Global Testing, Inspection and Certification Market By Service Type (Testing, Inspection, and Certification), By Sourcing Type (In-House Sourcing, and Outsourced Sourcing), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Feb. 2025

- Report ID: 11870

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

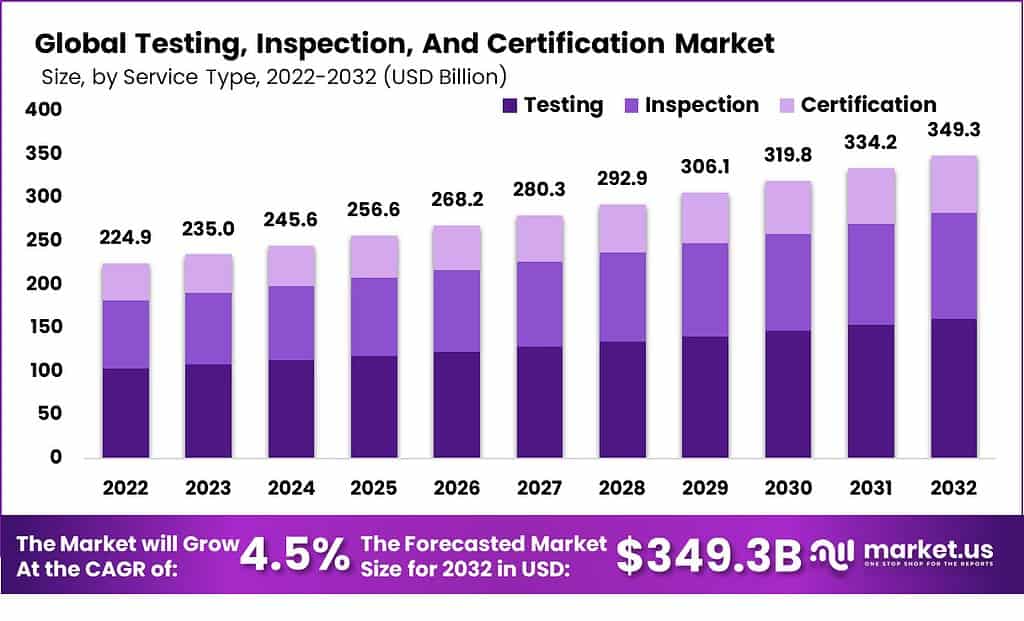

The Global Testing, Inspection and Certification Market size is expected to be worth around USD 349.3 Billion by 2033, from USD 235.0 Billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2023 to 2032.

Testing, inspection, and certification (TIC) are essential processes that ensure the quality, safety, and compliance of products, services, and systems across various industries. TIC services involve testing the products or systems to verify their performance, inspecting them to ensure compliance with regulatory standards, and providing certification to validate their quality and conformity. The TIC industry plays a crucial role in maintaining consumer confidence, facilitating trade, and promoting safety and sustainability.

The Testing, Inspection, and Certification (TIC) market is a crucial segment within the global service industry, providing essential services to ensure compliance with standards, regulations, and customer requirements across various sectors. This market encompasses a wide range of services, from conformity assessment and quality control to certification of systems, products, and processes.

The growth of the TIC market can be attributed to several factors, including the increasing complexity of standards and regulations, the globalization of trade, and the growing emphasis on quality, safety, and sustainability among consumers and industries alike.Key Takeaways

- In 2022, the Global Testing, Inspection, And Certification Market was valued at USD 224.9 Billion.

- The Market is estimated to register the highest CAGR of 4.5% between 2023 and 2032.

- The increasing emphasis on safety and quality across industries is propelling the growth of the Market.

- Continuously changing regulations are expected to have a negative impact on the Market.

- Trade disputes and geopolitical tensions can obstruct the growth of business.

- Based on Service Type, testing dominates the Market with a massive revenue share of 68.4%.

- Based on Sourcing Type, greater control and customization are driving the growth of in-house sourcing in the sourcing type segment of the Market.

- Based on Application, medical and life science leads the Market with a major revenue share of 22.6%.

- Growing environmental awareness and technological advancements are expected to create many lucrative opportunities over the forecast period.

- The trend of digital transformation is currently seen in the Market.

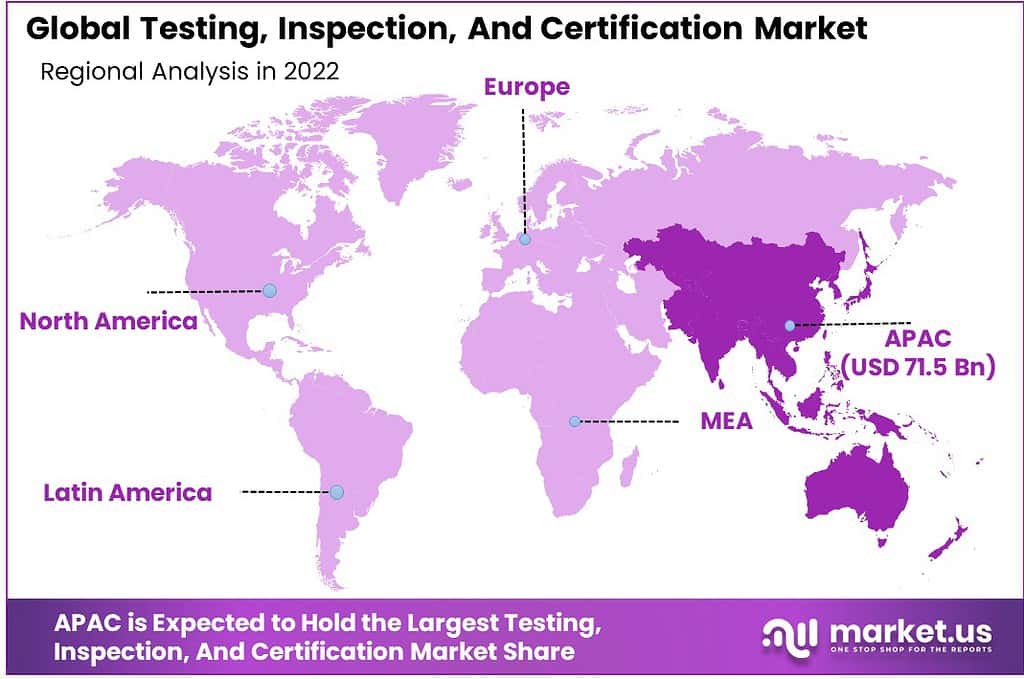

- Based on Region, Asia Pacific dominates the Market with a major revenue share of 31.8%.

- Some of the key players in the Market are Intertek Group plc, Applus+, Bureau Veritas SA, DEKRA SE, DNV GL, Element Materials Technology, and others.

By Service Type Analysis

Based on Service Type, the Market is classified into testing, inspection, and certification. Among these service types, testing holds the major revenue share of 68.4% to dominate the Market. This exponential growth of testing is due to its integral role in ensuring product quality and compliance with stringent standards.

In an increasingly competitive global landscape, businesses prioritize rigorous testing to validate the reliability and safety of their offerings. This is particularly crucial in industries like manufacturing, automotive, and healthcare.

Additionally, as consumer expectations rise, companies seek to build trust through comprehensive testing, thereby solidifying their market position. The demand for specialized testing services, driven by technological advancements and evolving regulations, further propels testing’s dominance in the Market, making it an indispensable component of quality assurance and risk mitigation strategies.

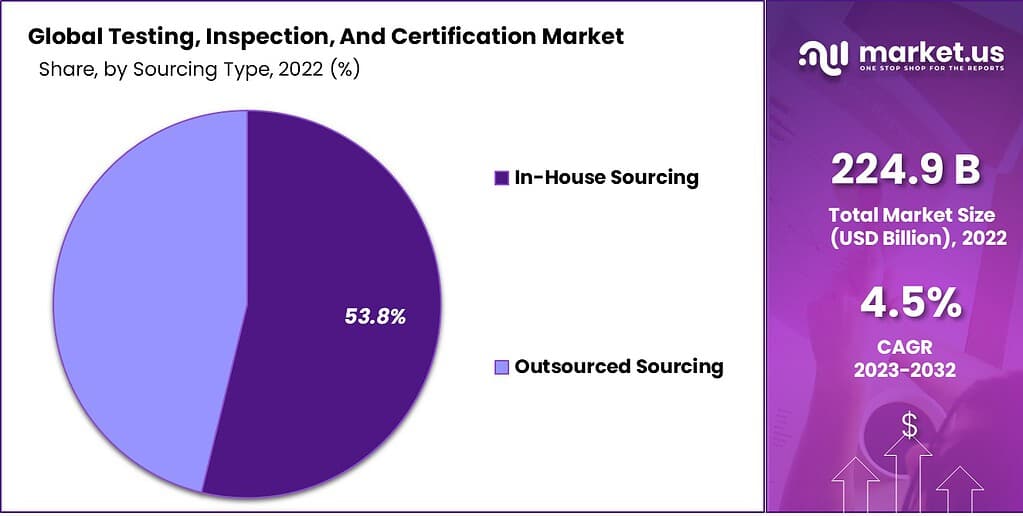

By Sourcing Type Analysis

Greater Control and Customization are Driving the Growth of In-House Sourcing in the Sourcing Type Segment of Market.

On the basis of sourcing type, the Market is divided into in-house sourcing and outsourced sourcing. From these sourcing types, in-house sourcing secured the major revenue share of 53.8% to lead the Market. This growth of in-house sourcing is owing to the greater control and customization it affords to businesses.

Companies prefer in-house sourcing as it allows them to tailor testing, inspection, and certification processes to their specific needs and standards. This level of autonomy ensures a direct focus on core business objectives and maintains confidentiality.

Moreover, in-house sourcing often proves cost-effective for large corporations with substantial resources and a continuous demand for services. While outsourced sourcing offers convenience and expertise, in-house control remains favored for its flexibility, alignment with corporate strategies, and ability to swiftly adapt to changing regulatory requirements.

By Application Analysis

Based on Application, the Market is classified into consumer goods and retail, medical and life science, agriculture and food, chemicals, construction and infrastructure, energy and power, and other applications. Out of these applications, medical and life science dominates the Market by holding a major revenue share of 22.6%. This supremacy is primarily attributed to the critical nature of testing, inspection, and certification within this industry.

Stringent regulations and standards for healthcare products and services necessitate extensive testing to ensure safety and quality. Additionally, the rising demand for healthcare services and pharmaceuticals, especially in the context of global health concerns, further boosts the prominence of medical and life science applications. The sector’s continuous innovation and evolving compliance requirements underscore the enduring demand for comprehensive testing and certification services, solidifying its leading position in the market.

Driving Factor

The Increasing Emphasis on Safety and Quality Across Industries is Propelling Growth

One of the primary drivers propelling the Market is the increasing emphasis on safety and quality across industries. As businesses worldwide face mounting regulatory pressures and heightened consumer expectations, they turn to TIC services to ensure compliance and uphold their brand reputation.

The drive for safety and quality spans sectors such as manufacturing, healthcare, and energy, where TIC plays a pivotal role in risk mitigation and adherence to stringent standards. Another key driver is globalization. In an era of extensive global trade, complex supply chains, and diverse regulations, TIC services become indispensable. Companies seek TIC partners to navigate international markets and ensure their products meet diverse regional requirements.

Moreover, technological advancements, such as the integration of digital solutions and data analytics into TIC processes, are enhancing efficiency and accuracy, further stimulating market growth. As industries evolve and embrace innovation, the TIC market is expected to continue its upward trajectory, offering essential support in safeguarding quality, safety, and compliance.

Restraining Factor

Continuously Changing Regulations are Expected to Have a Negative Impact on the Market.

The economic fluctuations and uncertainties can impact business investment decisions, leading to fluctuations in demand for TIC services. The competitive landscape within the TIC industry is intense, with numerous service providers competing for market share. This competition can exert downward pressure on pricing, affecting profit margins. Moreover, regulatory changes and geopolitical tensions can introduce uncertainty into the TIC market, as shifting regulations can necessitate adjustments to service offerings and strategies. The complexity of international standards and regional variations in regulations can also pose a challenge for TIC companies operating across borders.

Furthermore, the rapid pace of technological advancements can require substantial investments in updating equipment and skill sets within the TIC industry, which may strain resources. These restraints underscore the importance of strategic planning and adaptability for TIC firms in navigating the Market effectively.

Geopolitical Impact Analysis

Trade Disputes and Geopolitical Tensions can Obstruct the Growth of the Market.

Geopolitical tensions and trade disputes can introduce uncertainty and volatility, affecting the global flow of goods and services. These uncertainties can impact the demand for TIC services, especially in industries closely tied to international trade. Changes in government policies and regulations, driven by geopolitical considerations, can also impact the TIC market. Shifts in import/export requirements, tariffs, and sanctions can necessitate adjustments in TIC practices and compliance standards. Companies operating in multiple regions must navigate this complex geopolitical landscape to ensure their products meet varying regulatory standards.

Moreover, geopolitical instability in certain regions can disrupt supply chains, potentially leading to increased demand for TIC services to ensure product quality and safety. Overall, geopolitical factors have a substantial impact on the Market, highlighting the importance of monitoring global political developments for TIC firms.

Growth Opportunity

Growing Environmental Awareness and Technological Advancements are Expected to Create Many Lucrative Opportunities over the Forecast Period.

The growing awareness of environmental sustainability and corporate social responsibility is creating a demand for TIC services that verify adherence to green and ethical standards. As organizations strive to demonstrate their commitment to sustainability, TIC plays a vital role in certifying eco-friendly practices and products. The rapid advancement of technology, including the Internet of Things (IoT) and artificial intelligence (AI), offers the TIC industry opportunities to innovate and enhance testing and inspection processes. These technologies enable real-time monitoring and data analysis, improving efficiency and accuracy in TIC procedures.

Moreover, the globalization of markets and supply chains continues to expand, necessitating TIC services to ensure product quality and compliance with diverse international regulations. As businesses seek to penetrate new markets, they rely on TIC firms to facilitate market entry and maintain product integrity.

Latest Trends

The Trend of Digital Transformation is Currently Seen in the Market.

A prominent trend in the Market is the increasing integration of digital technologies. TIC firms are leveraging advanced data analytics, artificial intelligence, and automation to streamline their processes, enhance the accuracy of inspections, and reduce turnaround times. This digital transformation not only boosts operational efficiency but also provides clients with real-time insights and data-driven decision-making capabilities.

Another notable trend is the rising demand for specialized TIC services. As industries become more complex and regulated, there is a growing need for niche TIC expertise. This includes areas such as cybersecurity testing, food safety certification, and sustainability assessments, reflecting evolving consumer preferences and regulatory requirements.

Furthermore, sustainability and ESG (Environmental, Social, and Governance) considerations are shaping the TIC landscape. Businesses are seeking TIC services to validate their sustainability claims and ensure compliance with environmental and social standards. As sustainability gains importance, TIC firms that offer comprehensive ESG assessments are poised for significant growth in the coming years.

Key Market Segments

Service Type

- Testing

- Inspection

- Certification

Sourcing Type

- In-House Sourcing

- Outsourced Sourcing

Application

- Consumer Goods and Retail

- Medical and Life Science

- Agriculture and Food

- Chemicals

- Construction and Infrastructure

- Energy and Power

- Other Applications

Regional Analysis

The Asia Pacific region leads the Market by holding a major revenue share of 31.8%. This dominance can be attributed to the region’s rapid industrialization and economic growth that have led to increased production and trade, necessitating extensive TIC services to ensure product quality and safety.

Asia Pacific is home to diverse regulatory environments, both domestically and internationally, prompting a high demand for conformity assessments and compliance checks. Moreover, the burgeoning technology sector in countries like China and India is driving the adoption of advanced TIC solutions, further bolstering the region’s prominence in the global TIC market.

After Asia Pacific, the Europe region is expected to grow at the fastest CAGR during the forecast period. The growth of the European region is expected to be driven by Europe’s commitment to environmental sustainability and corporate responsibility.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

In this Market, key players have distinct market shares. SGS SA currently leads with a significant share, leveraging a global presence and a diverse service portfolio. Intertek Group plc follows closely, excelling in specialized TIC services and strong industry partnerships. ALS Limited is notable for its expertise in digital TIC solutions and commitment to sustainability.

Emerging players, especially in the Asia Pacific region, are gaining traction. This competitive landscape ensures continuous industry innovation and diversification. Some of the key players in the Market are Intertek Group plc, Applus+, Bureau Veritas SA, DEKRA SE, DNV GL, Element Materials Technology, Eurofins Scientific, ALS Limited, MISTRAS Group Inc., SGS SA, TÜV NORD GROUP, UL LLC, DNV GL, Socotec Group, BSI Group, and Other Key Players.

Top Key Players in the Testing, Inspection, And Certification Market

- Intertek Group plc

- Applus+

- Bureau Veritas SA

- DEKRA SE

- DNV GL

- Element Materials Technology

- Eurofins Scientific

- ALS Limited

- MISTRAS Group Inc.

- SGS SA

- TÜV NORD GROUP

- UL LLC

- DNV GL

- Socotec Group

- BSI Group

- Other Key Players

Recent Developments

- On April 3, 2023, Intertek revealed its strategic acquisition of Controle Analitico, a prominent testing firm based in Brazil. This strategic move aims to strengthen Intertek’s footprint in the environmental testing sector, positioning it for growth and expanded influence in this market segment.

- In June 2023, Intertek further fortified its proficiency in corrosion and materials testing at the Manchester Centre of Excellence. This center specializes in delivering advanced corrosion consultancy and a wide range of comprehensive testing services, cementing Intertek’s commitment to excellence in this field.

Report Scope

Report Features Description Market Value (2023) USD 235.0 Bn Forecast Revenue (2032) USD 349.3 Bn CAGR (2023-2032) 4.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type – Testing, Inspection, and Certification; By Sourcing Type – In-House Sourcing and Outsourced Sourcing; By Application – Consumer Goods and Retail, Medical and Life Science, Agriculture and Food, Chemicals, Construction and Infrastructure, Energy and Power, and Other Applications. Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Intertek Group plc, Applus+, Bureau Veritas SA, DEKRA SE, DNV GL, Element Materials Technology, Eurofins Scientific, ALS Limited, MISTRAS Group Inc., SGS SA, TÜV NORD GROUP, UL LLC, DNV GL, Socotec Group, BSI Group, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Testing, Inspection and Certification Market?Testing, Inspection and Certification (TIC) market refers to organizations offering testing and inspection services designed to verify products that adhere to certain standards or regulations as well as safeguard consumer health and the environment. TIC testing services help organizations ensure products conform to certain specifications or protect both health and the environment by offering these services at cost.

How big is the testing inspection certification market?The Global Testing, Inspection and Certification Market size was estimated at USD 224.9 billion in 2022 and expected to reach around USD 349.3 billion by 2032, poised to grow at a compound annual growth rate (CAGR) of 4.5% during the forecast period 2023 to 2032.

What are the trends in the TIC market?Some of the key trends in the TIC market include:

- The increasing globalization of trade: As globalization increases, businesses must ensure their products and services comply with local market requirements before exporting overseas.

- Growth of emerging economies: : Emerging economies are expanding quickly and this has caused new demand for TIC services to surge.

- New technologies: Emergent technologies such as artificial intelligence and Internet of Things have opened up numerous avenues for TIC providers to expand their businesses.

How much does TIC cost?Costs associated with TIC services depend upon numerous variables, including service type, complexity of assessment process and location of provider - though on average these can be relatively affordable options.

Who are the major players in the TIC market?The major players in the TIC market include: Intertek Group plc, Applus+, Bureau Veritas SA, DEKRA SE, DNV GL, Element Materials Technology, Eurofins Scientific, ALS Limited, MISTRAS Group Inc., SGS SA, TÜV NORD GROUP, UL LLC, DNV GL, Socotec Group, BSI Group, and Other Key Players.

Testing, Inspection and Certification MarketPublished date: Feb. 2025add_shopping_cartBuy Now get_appDownload Sample

Testing, Inspection and Certification MarketPublished date: Feb. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Intertek Group plc

- Applus+

- Bureau Veritas SA

- DEKRA SE

- DNV GL

- Element Materials Technology

- Eurofins Scientific

- ALS Limited

- MISTRAS Group Inc.

- SGS SA

- TÜV NORD GROUP

- UL LLC

- DNV GL

- Socotec Group

- BSI Group

- Other Key Players