Global Machine Tools Market By Type (Metal Cutting(Machining Centers, Turning Machines, Grinding Machines, Milling Machines, Eroding machi), Metal Forming (Bending Machines, Presses, Punching Machines, Others)), By Technology (Computer Numerical Control (CNC), Conventional), By End-use (Automotive, Mechanical Engineering, Metal Working, Aerospace, Electrical industry, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 35729

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

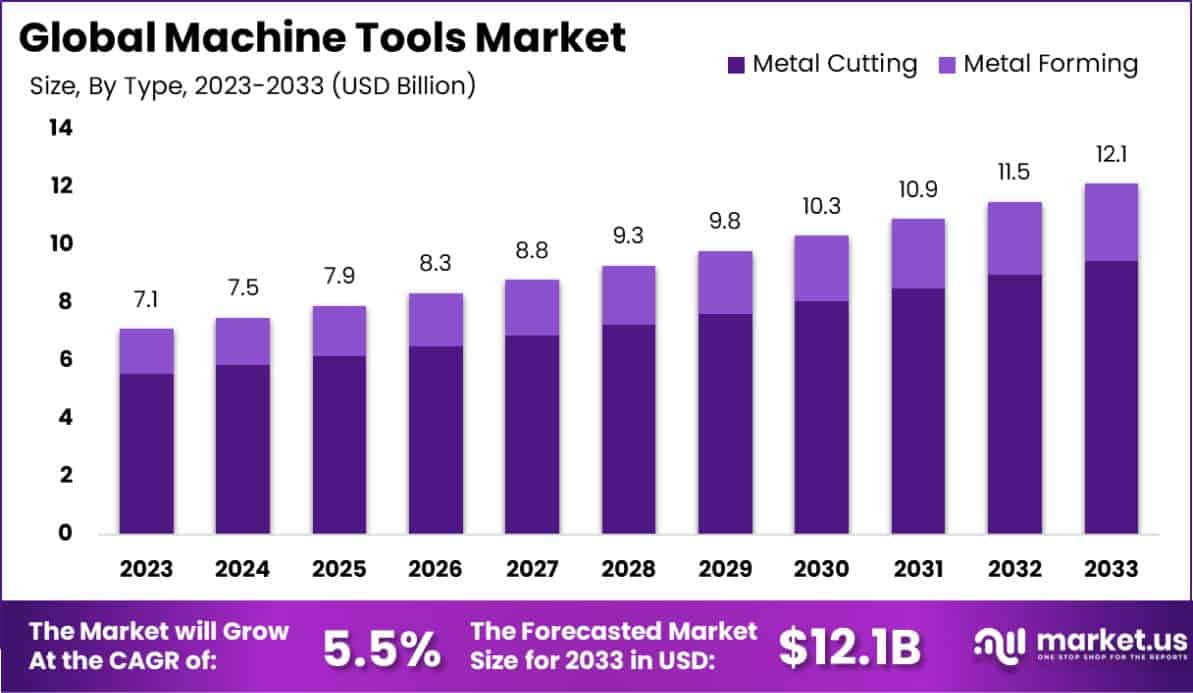

The Global Machine Tools Market size is expected to be worth around USD 12.1 Billion by 2033, from USD 7.1 Billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033. Asia Pacific dominated a 56.1% market share in 2023 and held USD 3.9 Billion revenue of the Machine Tools Market.

Machine tools are powered devices or machinery used in manufacturing to cut, shape, and form materials such as metal and wood. These tools range from lathes, grinders, and millers to drills and saws, essential for producing precision components in the engineering and manufacturing sectors.

Their efficiency and accuracy are critical in industrial settings, shaping the production capabilities and operational efficiencies of factories.

The machine tools market encompasses the global demand and supply of these devices, focusing on industry needs in sectors like automotive, aerospace, and smart manufacturing. Market dynamics are influenced by industrial expansions, technological innovations, and production requirements across various regions, reflecting the economic and manufacturing trends worldwide.

Technological advancements in automation and precision engineering drive the growth of the machine tools market. Manufacturers are increasingly adopting CNC (Computer Numerical Control) machine tools to enhance production efficiency and accuracy, reducing labor costs and increasing output.

Demand for machine tools is propelled by the expanding automotive and aerospace industries. As these sectors require highly precise parts and components to meet safety and performance standards, the need for advanced machine tools continues to rise.

There’s a significant opportunity to develop eco-friendly and energy-efficient machine tools. As industries seek sustainable manufacturing practices, integrating green technologies and reducing energy consumption in machine tool operations opens new avenues for market expansion and innovation.

The machine tools market, pivotal to the precision manufacturing needs of diverse sectors such as automotive and aerospace, exhibits robust growth propelled by technological advancements and increasing automation. The Indian sector, characterized by a predominance of small and medium enterprises (SMEs), represents a microcosm of broader market dynamics. The Indian government’s endorsement of up to 100% FDI under the automatic route underscores a commitment to fostering a conducive environment for foreign investments, potentially catalyzing significant industrial advancements.

Moreover, with many manufacturers reporting annual turnovers in the range of ₹300 crore to ₹500 crore, the reliance on SMEs underscores a fragmented yet dynamic market structure. The strategic allocation of ₹100 crore by the Department of Heavy Industries, specifically aimed at invigorating the machine tool segment, is poised to enhance production capabilities and stimulate innovation.

This infusion is not merely a financial boost but a strategic move to elevate the domestic market on a global scale, ensuring that Indian manufacturers remain competitive and integral to the global supply chain in precision tooling. This landscape offers fertile ground for strategic investments and innovation, driving forward a sector crucial to the manufacturing prowess of the nation.

Key Takeaways

- The Global Machine Tools Market size is expected to be worth around USD 12.1 Billion by 2033, from USD 7.1 Billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

- In 2023, Metal Cutting held a dominant market position in the by-type segment of the Machine Tools Market, with a 78.1% share.

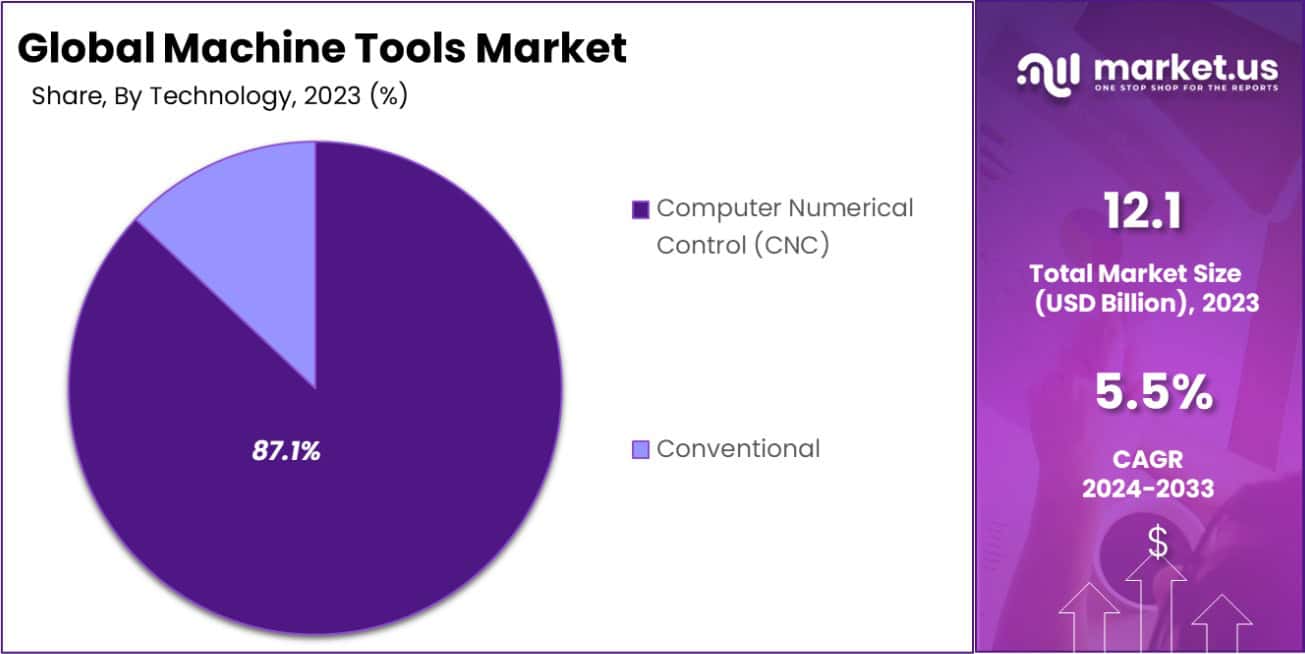

- In 2023, Computer Numerical Control (CNC) held a dominant market position in the By Technology segment of the Machine Tools Market, with an 87.1% share.

- In 2023, Automotive held a dominant market position in the end-use segment of the Machine Tools Market, with a 42.2% share.

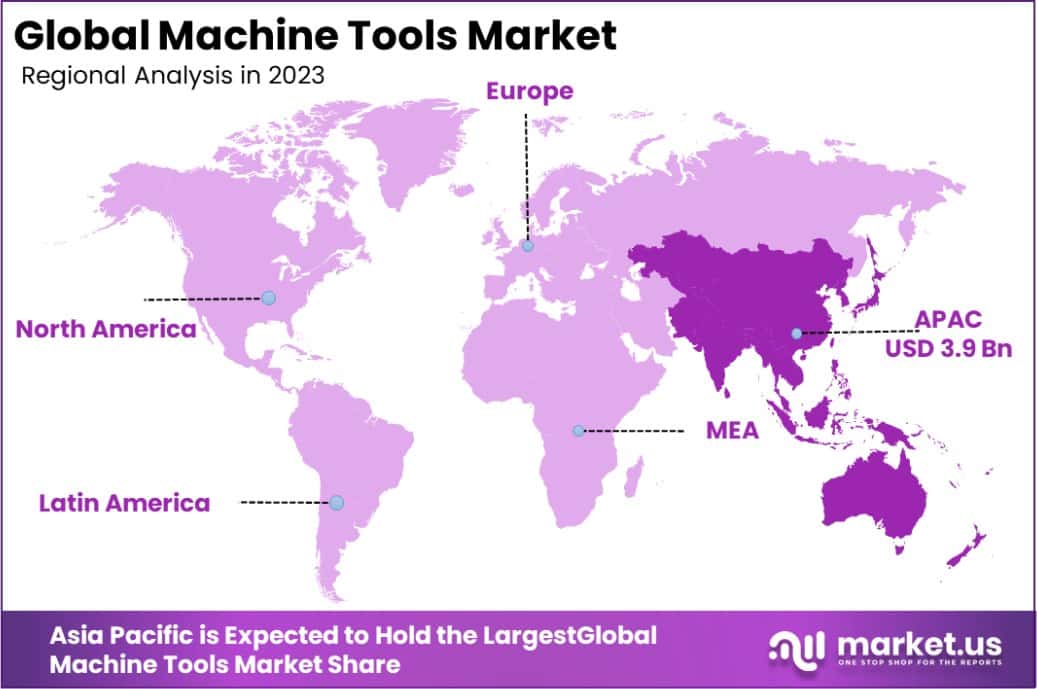

- Asia Pacific dominated a 56.1% market share in 2023 and held USD 3.9 Billion revenue of the Machine Tools Market.

By Type Analysis

In 2023, Metal Cutting held a dominant market position in the “By Type” segment of the Machine Tools Market, with a 78.1% share. This category encompasses various machine types, including Machining Centers, Turning Machines, Grinding Machines, Milling Machines, and Eroding Machines, among others.

Each subtype caters to specific manufacturing requirements, underscoring the essential nature of metal-cutting tools in precision engineering and manufacturing processes.

On the other hand, Metal Forming, which includes Bending Machines, Presses, Punching Machines, and other related equipment, also plays a critical role but commands a smaller portion of the market.

The disparity in market share between Metal Cutting and Metal Forming highlights the extensive application and dependency on cutting technologies in sectors such as automotive, aerospace, and electronics manufacturing, where precision and efficiency are paramount.

The significant dominance of Metal Cutting tools is driven by their critical role in producing intricate and finely detailed parts required in modern manufacturing. These tools enable manufacturers to achieve high levels of accuracy and surface finish, which are crucial for meeting the stringent quality standards demanded in many industrial applications.

The ongoing technological advancements in Metal Cutting tools, such as the integration of CNC technologies and automation, continue to enhance their appeal and utility across the manufacturing industry.

By Technology Analysis

In 2023, Computer Numerical Control (CNC) held a dominant market position in the “By Technology” segment of the Machine Tools Market, with an 87.1% share, contrasting sharply with Conventional tools.

The overwhelming preference for CNC technology stems from its superior precision, efficiency, and automation capabilities, which are essential in modern manufacturing environments. CNC machine tools enhance productivity by automating complex, repetitive tasks and significantly reducing the margin of error compared to conventional tools.

The robust market share of CNC machine tools reflects their integration across critical industries such as automotive, aerospace, and electronics, where precision engineering is paramount.

These sectors rely on CNC technology to produce parts with high precision and excellent repeatability, driving demand for these advanced tools. The shift towards automation and smart manufacturing technologies further fuels the adoption of CNC systems, aligning with industry 4.0 initiatives.

Conventional machine tools, while still used for specific applications requiring lower cost or less precision, have seen a decline in market presence due to the growing need for higher productivity and tighter quality control.

As industries continue to innovate and seek efficiency enhancements, CNC technology’s market dominance is likely to strengthen, reinforcing its essential role in the global machine tools landscape.

By End-use Analysis

In 2023, the Automotive sector held a dominant market position in the “By End-use” segment of the Machine Tools Market, with a 42.2% share. This significant proportion underscores the critical role of machine tools in automotive manufacturing, where precision, efficiency, and innovation are crucial for producing various components ranging from engines to small intricate parts.

The reliance on advanced machining processes, especially CNC technologies, facilitates the automotive industry’s demand for high-quality and high-volume production capabilities.

Following the Automotive sector, other important segments include Mechanical Engineering, metalworking, Aerospace, and the Electrical industry, each utilizing machine tools for specialized production needs. While these sectors collectively contribute to the market, their shares do not approach the dominance exhibited by the Automotive industry.

The Aerospace and Mechanical Engineering sectors increasingly integrate advanced machine tools to handle complex materials and designs, requiring high precision levels. Metalworking and the Electrical industry also benefit from these advancements, adapting to evolving market demands and technological innovations.

The varied application across these sectors illustrates the machine tools market’s diversified nature, driven primarily by the Automotive industry’s ongoing growth and modernization efforts.

Key Market Segments

By Type

- Metal Cutting

- Machining Centers

- Turning Machines

- Grinding Machines

- Milling Machines

- Eroding machines

- Others

- Metal Forming

- Bending Machines

- Presses

- Punching Machines

- Others

By Technology

- Computer Numerical Control (CNC)

- Conventional

By End-use

- Automotive

- Mechanical Engineering

- Metal Working

- Aerospace

- Electrical industry

- Others

Drivers

Machine Tools Market Growth Drivers

The Machine Tools Market is experiencing significant growth driven by several key factors. Increased automation in industries like automotive and aerospace is a major driver, as companies strive to enhance precision and efficiency in production processes.

The integration of advanced technologies such as Computer Numerical Control (CNC) systems has revolutionized manufacturing, offering higher productivity and reduced human error. Additionally, the global push towards modernizing manufacturing facilities and adopting the latest technologies supports the expansion of the machine tools market.

Economic growth in emerging markets also presents opportunities for market expansion as new manufacturing hubs develop. This growth is further supported by government initiatives and investments in infrastructure, encouraging the adoption of advanced machine tools to meet increasing production demands and standards.

Restraint

Challenges in the Machine Tools Market

Despite robust growth, the Machine Tools Market faces significant restraints. One major challenge is the high cost of advanced machine tools, such as CNC machines, which can be a barrier for small and medium-sized enterprises (SMEs) with limited budgets.

These costs include not only the initial purchase but also maintenance and the skilled labor required to operate such sophisticated machinery. Additionally, the market is impacted by economic fluctuations which can lead to reduced investment in new machinery during downturns.

Global supply chain issues, exacerbated by international conflicts and trade disputes, also pose challenges by causing delays and increasing costs for components and materials essential for manufacturing machine tools. These factors collectively dampen market growth and pose hurdles to widespread adoption across all sectors.

Opportunities

Expanding Opportunities in the Machine Tools Market

The Machine Tools Market presents numerous growth opportunities, especially in emerging markets and through technological advancements. As countries develop and industrialize, there is an increasing demand for machine tools to support new factories and expand manufacturing capabilities.

Technological innovations, such as the integration of IoT (Internet of Things) and AI (Artificial Intelligence) with machine tools, open new avenues for efficiency and precision, catering to industries requiring high standards, like aerospace and automotive. Additionally, the shift towards sustainable manufacturing practices offers potential for the development of energy-efficient and environmentally friendly machine tools, aligning with global sustainability goals.

These advancements not only enhance production processes but also create new market segments and customer bases, driving further expansion in the global machine tools landscape.

Challenges

Challenges Facing the Machine Tools Market

The Machine Tools Market faces several challenges that could impede its growth. A significant hurdle is the rapid pace of technological change, which requires continuous investment in new machinery and training to stay competitive.

This can be particularly challenging for small and medium-sized enterprises (SMEs) with limited financial resources. Additionally, the dependency on global supply chains exposes manufacturers to risks such as supply disruptions and fluctuating material costs, influenced by geopolitical tensions and international trade policies.

The stringent regulatory environment in various countries also adds layers of complexity, requiring compliance with numerous safety and environmental regulations. These challenges require companies to be adaptive and strategic in their operations to navigate the volatile landscape of the machine tools market.

Growth Factors

Key Growth Factors for Machine Tools

The Machine Tools Market is propelled by several growth factors that enhance its expansion globally. A primary factor is the increasing adoption of automation and precision engineering across key industries such as automotive, aerospace, and electronics. This trend is driven by the need for high-quality, complex parts with tight tolerances, which modern machine tools can produce efficiently.

Another significant growth driver is the ongoing industrialization in emerging economies, where the demand for manufacturing capabilities is rising rapidly. Furthermore, technological advancements like Computer Numerical Control (CNC) and the integration of smart technologies such as IoT and AI into machine tools are revolutionizing manufacturing processes.

These innovations enable greater productivity and flexibility, making machine tools more indispensable than ever in today’s fast-paced production environments.

Emerging Trends

Emerging Trends in the Machine Tools Market

The Machine Tools Market is witnessing several emerging trends that are shaping its future landscape. A prominent trend is the increasing integration of digital technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning.

These technologies enhance machine tool operations by improving precision, reducing downtime, and facilitating predictive maintenance. Additionally, there is a growing shift towards sustainable manufacturing practices, prompting the development of energy-efficient and eco-friendly machine tools.

Another significant trend is the adoption of additive manufacturing or 3D printing, which complements traditional machine tool processes by allowing for more complex designs and rapid prototyping. These trends not only drive innovation within the market but also create competitive advantages for manufacturers who adapt quickly to these technological advancements.

Regional Analysis

In the Machine Tools Market, regional dynamics significantly influence growth patterns and opportunities. Asia Pacific stands out as the dominant region, holding a substantial 56.1% market share with a valuation of USD 3.9 billion.

This prominence is driven by rapid industrialization, particularly in countries like China, Japan, and South Korea, which are heavily investing in automotive and electronics manufacturing sectors, intensifying demand for machine tools.

North America and Europe also represent key markets, characterized by advanced manufacturing technologies and significant investments in aerospace and defense industries. However, their market shares are less compared to Asia Pacific due to slower industrial growth rates and matured market conditions.

In contrast, the Middle East & Africa, and Latin America are emerging as potential growth areas. These regions are witnessing increasing investments in infrastructure development and industrialization, albeit from a smaller base.

The expansion of manufacturing capabilities in these regions is expected to drive the demand for machine tools, although they currently hold smaller portions of the global market. The overall global landscape sees Asia Pacific not only leading in market share but also setting the pace for technology adoption and market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Machine Tools Market for 2023, key players such as DMG MORI, Doosan Machine Tools Co. Ltd., and CHIRON Group SE have demonstrated strategic positioning and innovation that set them apart in a competitive landscape.

DMG MORI stands as a frontrunner, renowned for its high-precision machine tools and advanced technological integrations, including automation and digitalization solutions. The company’s strong focus on research and development has allowed it to offer industry-leading CNC and additive manufacturing technologies.

DMG MORI’s commitment to sustainability, with initiatives aimed at reducing energy consumption across its product line, further strengthens its market position and aligns with global trends toward environmentally responsible manufacturing practices.

Doosan Machine Tools Co. Ltd. has carved out a significant presence, particularly in heavy industries and large-scale manufacturing sectors, with its robust and durable machinery. Doosan’s strategic expansions in emerging markets and ongoing investments in enhancing machine efficiency and operator convenience underscore its approach to meeting diverse global demands.

The company’s focus on customer-centric innovation and service excellence ensures high reliability and performance, appealing to a broad industrial customer base.

CHIRON Group SE specializes in speed and precision, with a strong portfolio geared towards high-speed machining centers. CHIRON’s advancements in modular machine design allow for extensive customization, catering to specialized manufacturing needs in the automotive and aerospace sectors.

The group’s proactive strategy in integrating IoT and real-time data analytics into its operations positions it as a pioneer in smart manufacturing solutions.

Together, these companies are not just participants but leading drivers in the Machine Tools Market, each bringing unique strengths to address the evolving challenges and opportunities within the industry. Their collective progress in 2023 indicates a robust trajectory toward innovation and market leadership.

Top Key Players in the Market

- DMG MORI

- Doosan Machine Tools Co. Ltd.

- CHIRON Group SE

- Hyundai Wia Corp.

- Georg Fischer Ltd.

- JTEKT Corporation

- Okuma Corporation

- Makino

- Komatsu Ltd.

- Other Key Players

Recent Developments

- In May 2023, CHIRON Group SE: Introduced a new line of high-speed milling machines, specifically designed to meet the stringent demands of the aerospace sector.

- In March 2023, Doosan Machine Tools Co. Ltd.: Secured a $50 million investment to expand its production facilities in North America, aiming to double its output capacity.

- In January 2023, DMG MORI: Launched the new ECO Mill series, featuring enhanced energy efficiency and improved digital integration for smarter manufacturing.

Report Scope

Report Features Description Market Value (2023) USD 7.1 Billion Forecast Revenue (2033) USD 12.1 Billion CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Metal Cutting(Machining Centers, Turning Machines, Grinding Machines, Milling Machines, Eroding machi), Metal Forming(Bending Machines, Presses, Punching Machines, Others)), By Technology(Computer Numerical Control (CNC), Conventional), By End-use (Automotive, Mechanical Engineering, Metal Working, Aerospace, Electrical industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DMG MORI, Doosan Machine Tools Co. Ltd., CHIRON Group SE, Hyundai Wia Corp., Georg Fischer Ltd., JTEKT Corporation, Okuma Corporation, Makino, Komatsu Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DMG MORI

- Doosan Machine Tools Co. Ltd.

- CHIRON Group SE

- Hyundai Wia Corp.

- Georg Fischer Ltd.

- JTEKT Corporation

- Okuma Corporation

- Makino

- Komatsu Ltd.

- Other Key Players