Global Decentralized Finance (DeFi) Market Size, Share, Upcoming Investments Report By Component (Blockchain Technology, Decentralized Applications (dApps), Smart Contracts), By Application (Data & Analytics, Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Decentralized Exchanges, Prediction Industry, Stablecoins, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 135910

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Decentralized Finance (DeFi) Market size is expected to be worth around USD 616.1 Billion By 2033, from USD 21.3 billion in 2023, growing at a CAGR of 40% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 36% share, holding USD 7.6 Billion revenue.

Decentralized Finance, commonly known as DeFi, refers to an emerging financial technology based on secure distributed ledgers similar to those used by cryptocurrencies. The idea is to eliminate intermediaries such as banks and financial institutions by allowing people, merchants, and businesses to conduct transactions directly with one another. Essentially, DeFi leverages blockchain technology to manage financial transactions through software written in smart contracts.

The DeFi market encompasses various financial applications in cryptocurrency or blockchain geared toward disrupting financial intermediaries. DeFi platforms allow users to lend or borrow funds from others, speculate on price movements in a range of assets using derivatives, trade cryptocurrencies, insure against risks, and earn interest in savings-like accounts. DeFi uses a layered architecture and highly composable building blocks. Some experts believe this sector could lead to a paradigm shift in the way people think about financial services.

The major driving factors of the DeFi market include the quest for higher yields, increased transparency, and improved security compared to traditional financial systems. Investors are drawn to DeFi because of the potentially high returns on investment and lower barriers to entry in comparison to conventional markets. Additionally, the automation of smart contracts means that transactions can occur without human intervention, reducing costs and increasing efficiency.

Market demand in DeFi is largely driven by the increasing interest in alternative investments and the broader adoption of blockchain technology. As cryptocurrencies gain acceptance, both from retail and institutional investors, DeFi platforms that offer various financial services are seeing heightened demand. The flexibility to interact with global markets directly from a digital wallet allows for a seamless financial experience, attracting a diverse user base eager for decentralized financial solutions.

Based on data from Exploding Topics, the decentralized finance (DeFi) market is a powerhouse of innovation, with an impressive $52 billion of value currently locked. The blockchain industry, which underpins DeFi, is expanding rapidly. Global blockchain spending is projected to reach $19 billion by 2024, and the overall blockchain market is expected to skyrocket to over $1,076 billion by 2026.

Bitcoin continues to dominate the cryptocurrency landscape, with a staggering market cap of approximately $800 billion. Interestingly, the top three cryptocurrencies by value are all variations of Bitcoin, solidifying its central role in the digital economy.

According to Nansen, Ethereum remains the leader in DeFi, commanding over 58% of all DeFi liquidity. Its ecosystem is flourishing, with platforms like MetaMask—a popular non-custodial wallet—boasting over 30 million users, including 21 million monthly active users.

Switching to cryptocurrency exchanges, Uniswap leads the pack with a 7-day trading volume of $11.63 billion, according to Electro IQ. The United States plays a key role in the global DeFi ecosystem, ranking as the top adopter with an index score of 1.0 and accounting for 26.52% of Ethereum desktop traffic.

Emerging technologies like Big Data and AI are also transforming the financial technology (fintech) space. Around 87% of fintech companies leverage Big Data for technological innovation, while 82% use AI to enhance their operations. These trends showcase the seamless integration of advanced technologies in driving financial services forward.

Opportunities within the DeFi market are vast, as the sector is still in its infancy. There is potential for significant growth in areas such as decentralized exchanges, asset management platforms, and innovative lending protocols. Furthermore, as trust in traditional financial institutions fluctuates, DeFi stands ready to offer more resilient alternatives with its trustless setups. Enhancements in user experience and interoperability between different blockchain platforms could further propel the adoption of DeFi.

Technological advancements are continuously shaping the DeFi sector. The development of more scalable blockchain networks, improvements in smart contract technology, and the introduction of cross-chain bridges are notable enhancements improving the functionality and user appeal of DeFi services. Such advancements are critical in addressing the current limitations of DeFi, such as high gas fees, slow transaction speeds, and limited accessibility for non-technical users.

Key Takeaways

- The Global Decentralized Finance (DeFi) Market is poised for remarkable growth, projected to expand from USD 21.3 billion in 2023 to an estimated USD 616.1 billion by 2033. This surge represents a robust CAGR of 40% over the decade from 2024 to 2033. Such significant growth underscores the increasing adoption and integration of DeFi services across various sectors.

- In 2023, North America emerged as a leading player in the DeFi landscape, accounting for over 36% of the global market. This translates to a revenue of approximately USD 7.6 billion, highlighting the region’s pivotal role in shaping the DeFi ecosystem.

- Within the market, Blockchain Technology continues to be a cornerstone of DeFi, dominating with a 42% market share.

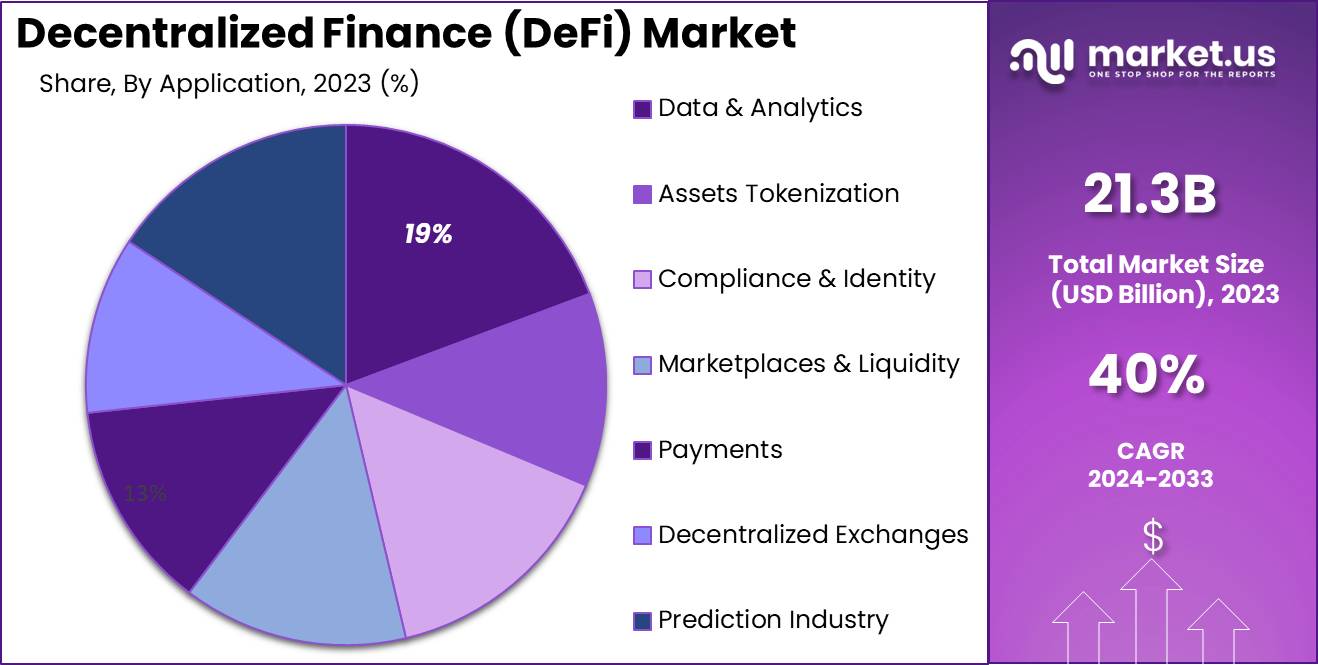

- Moreover, the Data & Analytics sector also claimed a significant stake in the DeFi market, holding more than 19.2% of the market share.

North America DeFi Market Size

In 2023, North America maintained a dominant position in the Decentralized Finance (DeFi) market, capturing over 36% of the market share with revenues amounting to approximately USD 7.6 billion. This dominance is largely attributed to the concentration of major DeFi players such as Compound Labs, Inc., and Uniswap, as well as a highly developed cryptocurrency infrastructure in this region.

The region’s lead in the DeFi market can also be credited to its advanced technological landscape and the rapid adoption of blockchain technologies across various sectors. North America’s robust financial markets and the presence of a tech-savvy population have facilitated the growth and acceptance of DeFi services, further propelled by the region’s openness to innovative financial solutions.

This environment has encouraged significant investments and the implementation of DeFi applications, especially in areas such as peer-to-peer payments, lending, and trading, which rely heavily on the benefits provided by blockchain technology such as transparency, security, and efficiency. Furthermore, the regulatory landscape in North America, while still evolving, has started to provide clearer guidelines and frameworks that support the growth of DeFi.

These regulatory efforts are aimed at balancing the need for innovation in the financial sector with consumer protection, which has helped gain investor confidence and facilitated the mainstream adoption of DeFi platforms. The proactive approach to addressing security and compliance issues, alongside initiatives to enhance the interoperability of DeFi platforms, also contributes to the robust growth of the market in this region.

Overall, North America’s leading position in the global DeFi market is bolstered by a combination of technological advancement, strategic innovations by key market players, and a progressively accommodating regulatory environment that together drive the adoption and expansion of decentralized financial services.

Component Analysis

In 2023, the Blockchain Technology segment held a dominant position within the Decentralized Finance (DeFi) market, capturing more than a 42% share. This significant market presence can be attributed to the foundational role that blockchain plays in the DeFi ecosystem. As the underlying technology, blockchain ensures transparency, security, and immutability of financial transactions, which are pivotal in gaining user trust and facilitating widespread adoption.

Blockchain’s intrinsic features, such as decentralization, resistance to censorship, and absence of a central point of failure, enhance its appeal in the DeFi sector. These characteristics mitigate risks associated with traditional centralized financial systems, such as fraud and mismanagement, and provide a robust platform for developing decentralized applications (dApps) and smart contracts.

The rise in blockchain adoption is further driven by its scalability solutions and advancements in network protocols, which have significantly improved transaction speeds and reduced costs, thereby attracting a broader user base and increasing transaction volumes. The growth of the Blockchain Technology segment is also reinforced by regulatory clarity in several key markets, which has encouraged substantial investments from both institutional and retail investors.

Moreover, strategic collaborations between blockchain firms and traditional financial institutions aiming to leverage blockchain’s potential to enhance their operational efficiencies and service offerings have been pivotal. These partnerships not only validate the utility of blockchain but also promote its integration into mainstream financial services.

Furthermore, continuous innovations in blockchain technology, such as the development of more environmentally sustainable consensus algorithms and enhanced privacy features, are expected to drive its adoption further. As blockchain technology continues to evolve, it is anticipated to unlock new possibilities within the DeFi space, potentially leading to a greater market share in the upcoming years.

Application Analysis

In 2023, the Data & Analytics segment held a dominant market position within the Decentralized Finance (DeFi) market, capturing more than a 19.2% share. This substantial market share is largely due to the critical role data plays in the operational integrity and strategic decision-making processes within the DeFi ecosystem.

Enhanced data analysis tools and services are imperative for providing actionable insights, improving transparency, and ensuring security across decentralized platforms. The increasing complexity and volume of transactions on the blockchain necessitate robust data & analytics solutions that can process and analyze data in real-time.

These solutions empower users and organizations with the ability to monitor transaction flows and token dynamics, thereby aiding in risk assessment and management. This capability is essential in a landscape where financial activities are spread across multiple blockchains and require constant vigilance against fraud and anomalies.

Moreover, the integration of artificial intelligence and machine learning technologies with data analytics is transforming how market trends are forecasted and risks are managed in the DeFi space. These technological advancements enhance predictive capabilities, enabling proactive management of assets and liquidity. This has not only increased the efficacy of DeFi applications but also bolstered trust and security, drawing more users and investments into the sector.

As DeFi continues to mature, the demand for sophisticated data & analytics services is expected to grow, driven by the need for greater compliance with emerging regulations and the pursuit of more refined investment strategies. This ongoing development underscores the pivotal role of data & analytics in the scalability and sustainability of the decentralized finance market.

Key Market Segments

By Component

- Blockchain Technology

- Decentralized Applications (dApps)

- Smart Contracts

By Application

- Data & Analytics

- Assets Tokenization

- Compliance & Identity

- Marketplaces & Liquidity

- Payments

- Decentralized Exchanges

- Prediction Industry

- Stablecoins

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Elimination of Intermediaries

One of the primary drivers of the Decentralized Finance (DeFi) market is the elimination of traditional financial intermediaries like banks and payment processors. By leveraging blockchain technology, DeFi enables direct peer-to-peer financial transactions, reducing or even eliminating transaction fees and processing times. This not only simplifies financial operations but also makes them faster and more cost-effective.

The accessibility and efficiency of DeFi platforms attract a broad user base, thereby enhancing the overall market growth. The user-friendly nature of these platforms, where anyone with an internet connection can engage in financial services just by downloading an application, further drives their adoption and contributes to the expansive growth of the DeFi market.

Restraint

Security Vulnerabilities

Security remains a significant restraint in the growth of the DeFi market. The very features that make DeFi appealing, such as open-source code and the automated execution of contracts, also expose it to various security risks.

Smart contract vulnerabilities are particularly concerning as they can be exploited to cause considerable financial losses. Despite ongoing improvements in security practices and auditing standards, the persistent threat of hacks and frauds continues to undermine trust in DeFi platforms and hampers wider adoption.

Opportunity

Integration with NFTs and Web3

The convergence of DeFi with non-fungible tokens (NFTs) and Web3 technologies presents substantial growth opportunities. NFTs are used within DeFi platforms to collateralize digital assets, allowing users to secure loans against digital art, collectibles, or virtual real estate, which opens up new avenues for both investment and lending.

Moreover, the integration of DeFi services into the Web3 infrastructure supports the creation of more dynamic, user-centric financial products and services that leverage the decentralized nature of blockchain. This integration is poised to drive innovation and attract new investments into the DeFi sector.

Challenge

Regulatory Uncertainty

Regulatory uncertainty is a pervasive challenge in the DeFi space. The lack of clear legal frameworks and standards for the operation of DeFi platforms creates a challenging environment for both users and developers. Without definitive regulations, there is a heightened risk of non-compliance with existing financial laws, which can lead to penalties or restrictions on operations.

This regulatory ambiguity not only affects the trust and stability of DeFi platforms but also deters significant institutional investments and the broader adoption of DeFi technologies. Establishing clear regulations is essential to foster a secure and thriving ecosystem for DeFi to flourish.

Growth Factors of the DeFi Market

The Decentralized Finance (DeFi) market is experiencing robust growth, driven by several key factors that promise to reshape the landscape of finance. One significant growth factor is the global shift towards blockchain technology, which underpins the entire DeFi ecosystem.

Blockchain’s inherent characteristics – decentralization, transparency, and security – are vital in facilitating trustless financial transactions without traditional intermediaries like banks. This technology not only simplifies financial processes but also dramatically reduces costs and transaction times, making financial services more accessible worldwide, especially in underserved regions.

Furthermore, the rise of smart contracts has been instrumental in DeFi’s growth. These self-executing contracts with the terms of the agreement directly written into code automate and secure transactions on the blockchain, ensuring that all parties fulfill their obligations without the need for a central authority.

This automation is crucial for creating efficient, trustless systems that can operate at a global scale. As blockchain technology continues to advance, with developments in scalability and security, the capabilities and reach of DeFi platforms are expected to expand significantly.

Emerging Trends in the DeFi Market

Emerging trends within the DeFi sector include the increasing integration of DeFi with other cutting-edge technologies such as non-fungible tokens (NFTs) and the broader Web3.0 infrastructure. NFTs, which represent ownership of unique digital items, are being used as collateral in DeFi lending platforms, expanding the types of assets that can be financialized in the digital realm.

Additionally, the rise of decentralized autonomous organizations (DAOs) highlights a shift towards more community-driven governance models in finance, where stakeholders make decisions collectively rather than relying on a central authority.

Another prominent trend is the growing focus on financial inclusivity. DeFi is particularly well-suited to bridge the gap for unbanked populations by providing them with access to financial services without the need for traditional bank accounts or financial history. This potential for massive scale adoption is one of the most transformative aspects of DeFi, promising to bring millions into the formal economy and spur new economic growth and opportunities.

Business Benefits of DeFi

The business benefits of adopting DeFi are profound and varied. For one, companies operating in the DeFi space can significantly lower their operational costs by eliminating the need for intermediaries and reducing transaction fees. The automation provided by smart contracts and the efficiency of blockchain transactions lead to faster service delivery and reduced chances of fraud or errors.

DeFi also offers businesses the ability to tap into new markets and customer bases, especially in regions that are currently underserved by traditional financial institutions. By providing more democratic access to capital and financial services, DeFi platforms can serve as powerful tools for economic development and empowerment.

Moreover, the transparency and security of blockchain ensure that all transactions are traceable and immutable, which enhances the accountability and reliability of financial operations. This transparency is crucial for gaining user trust and can help companies comply with regulatory requirements more effectively as the regulatory landscape around blockchain and DeFi evolves.

Key Player Analysis

The Decentralized Finance (DeFi) market has experienced significant growth, with numerous players striving to secure a competitive position. This dynamic space has attracted diverse participants, including blockchain startups, financial institutions, and tech companies, all eager to tap into its vast potential. To gain market share, these entities have adopted various strategies tailored to the unique demands of this evolving market.

Key strategies include building user-centric platforms, leveraging innovative blockchain technologies, and forging strategic partnerships. For instance, over 70% of blockchain startups prioritize enhancing user experience to attract and retain users. Meanwhile, traditional financial institutions have increasingly embraced DeFi by integrating decentralized solutions into their operations, reflecting a growing interest in bridging the gap between traditional and decentralized financial ecosystems.

Top Key Players in the Market

- MakerDAO

- Compound

- Aave

- Uniswap

- Synthetix

- SushiSwap

- Yearn.finance

- Curve Finance

- Balancer

- Chainlink

- Other Key Players

Recent Developments

- In May 2024, ConsenSys, a leading name in blockchain and decentralized technology, launched an innovative R&D hub dedicated to advancing decentralized finance (DeFi) applications. This strategic initiative is set to reshape the global financial landscape by addressing the core challenges of adoption, functionality, and scalability within the DeFi space.

- In June 2023, Compound Labs, Inc. secured $4 million in equity funding to further its mission of creating regulated financial products tailored for blockchain technology. This strategic investment highlights the growing interest of investors in blockchain-based financial services. By focusing on compliance and regulation, Compound Labs aims to bridge the gap between traditional finance and decentralized technologies.

Report Scope

Report Features Description Market Value (2023) USD 21.3 Bn Forecast Revenue (2033) USD 616.1 Bn CAGR (2024-2033) 40% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Blockchain Technology, Decentralized Applications (dApps), Smart Contracts), By Application (Data & Analytics, Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Decentralized Exchanges, Prediction Industry, Stablecoins, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape MakerDAO, Compound, Aave, Uniswap, Synthetix, SushiSwap, Yearn.finance, Curve Finance, Balancer, Chainlink, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Decentralized Finance (DeFi) MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Decentralized Finance (DeFi) MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- MakerDAO

- Compound

- Aave

- Uniswap

- Synthetix

- SushiSwap

- Yearn.finance

- Curve Finance

- Balancer

- Chainlink

- Other Key Players