Global Mobile Attribution Software Market Size, Share, Statistics Analysis Report By Component (Software, Services), By Deployment (On-Premises, Cloud), By Enterprise Size (SMEs, Large Enterprises), By End-User (BFSI, Healthcare, Retail & E-commerce, Media & Entertainment, IT & Telecom, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135637

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

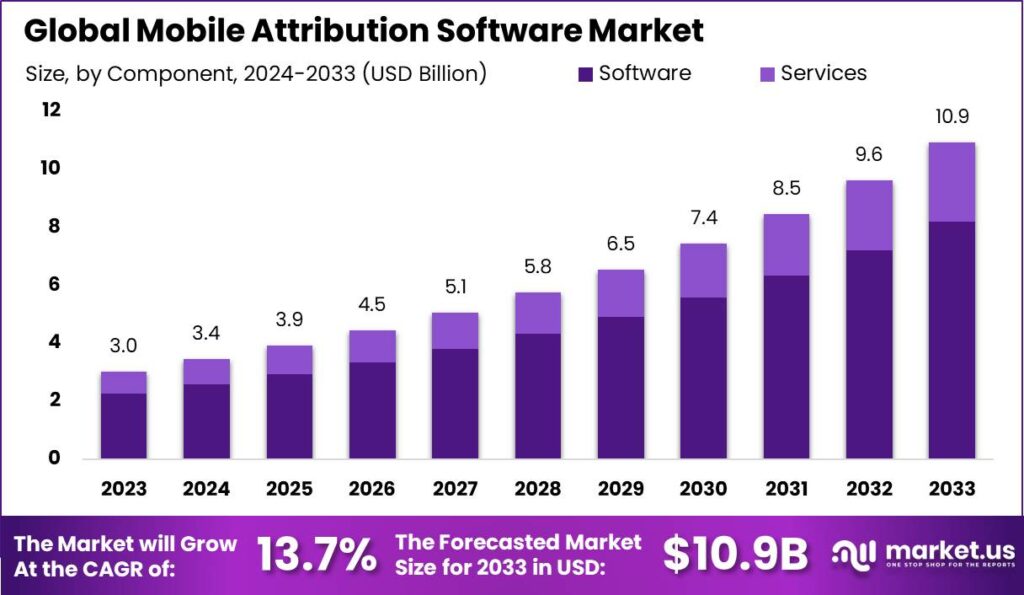

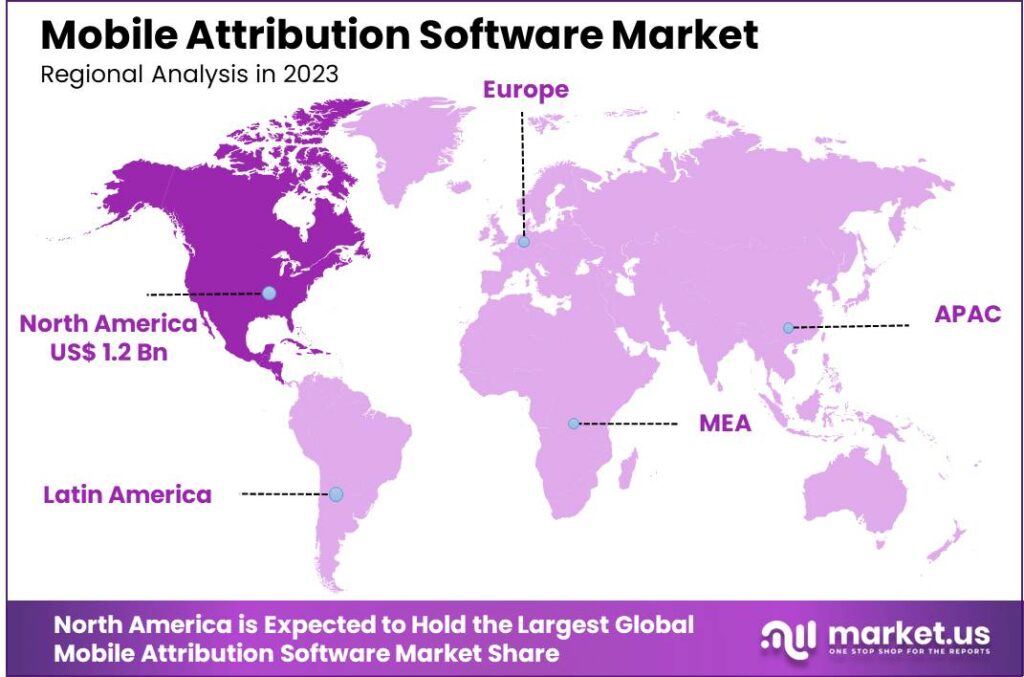

The Global Mobile Attribution Software Market size is expected to be worth around USD 10.9 Billion By 2033, from USD 3.03 Billion in 2023, growing at a CAGR of 13.70% during the forecast period from 2024 to 2033. In 2023, North America held a dominant position in the Mobile Attribution Software market, accounting for over 40% of the market share and generating approximately USD 1.2 billion in revenues.

Mobile attribution software is a tool used by marketers to track the source of app installations and user engagement within mobile applications. This software helps in identifying which marketing campaigns, advertisement platforms, or digital strategies are effectively leading users to download and interact with an app. By collecting data on user activity and tracing it back to specific touchpoints along the customer journey, businesses can optimize their marketing efforts to achieve better results in user acquisition and retention.

The market for mobile attribution software is growing as businesses increasingly rely on mobile platforms to reach their customers. This market includes a variety of software solutions designed to provide precise analytics on app performance and user behavior. As the number of mobile users continues to rise globally, the demand for advanced attribution tools that can offer deeper insights into app engagement and conversion rates is also increasing.

One of the major drivers of the mobile attribution software market is the surge in mobile advertising spending. Companies are investing heavily in mobile ads to capture the attention of the vast number of smartphone users. This increase in investment necessitates effective tools for measuring the impact of these ads. Additionally, the growing complexity of user paths in the digital environment, with multiple devices and platforms involved, drives the need for robust mobile attribution solutions.

The demand in the mobile attribution software market is primarily fueled by the need for marketers to understand and optimize their mobile marketing campaigns. As digital marketing landscapes become more competitive and diverse, the ability to pinpoint the most effective channels and strategies becomes crucial. Businesses seek advanced attribution software that can not only track and report on basic metrics but also provide insights into user behavior and campaign performance across different platforms and devices.

There are significant opportunities in the mobile attribution software market related to the integration of artificial intelligence and machine learning technologies. These technologies can enhance the predictive capabilities of attribution tools, allowing for more accurate forecasting of campaign success and user behavior patterns. Additionally, there is an opportunity to expand these tools into emerging markets where mobile usage is skyrocketing, and digital marketing practices are just beginning to mature.

Technological advancements in the field of mobile attribution software include the development of real-time data processing capabilities and the integration of cross-platform tracking features. These advancements allow marketers to receive immediate feedback on their campaigns and adjust strategies swiftly to improve performance. Furthermore, improvements in data privacy and security features are crucial as businesses must comply with increasing regulations while handling user data.

Key Takeaways

- The Global Mobile Attribution Software Market size is expected to reach USD 10.9 billion by 2033, growing from USD 3.03 billion in 2023, with a CAGR of 13.70% during the forecast period from 2024 to 2033.

- In 2023, the Software segment held a dominant market position in the Mobile Attribution Software market, capturing more than a 75% share.

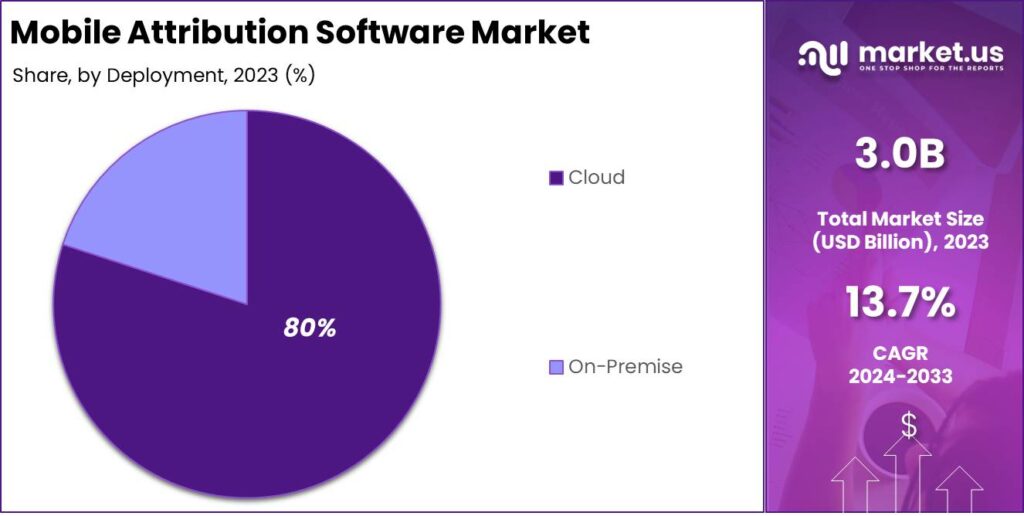

- The Cloud segment dominated the Mobile Attribution Software market in 2023, holding more than an 80% share.

- The Large Enterprises segment also held a dominant market position in 2023, capturing more than a 60% share in the Mobile Attribution Software market.

- The Retail & E-commerce segment held the largest share in the Mobile Attribution Software market in 2023, with more than a 31% share.

- In 2023, North America was the dominant region in the Mobile Attribution Software market, capturing more than 40% of the market share and generating revenues of approximately USD 1.2 billion.

Component Analysis

In 2023, the Software segment held a dominant market position in the Mobile Attribution Software market, capturing more than a 75% share. This dominance is primarily due to the essential role that software plays in providing core functionalities required for tracking and analyzing mobile user activities.

Attribution software serves as the backbone of mobile marketing strategies, enabling advertisers to gain precise insights into the effectiveness of their campaigns. The demand for these software solutions is driven by their ability to offer real-time data analysis, which is crucial for quick decision-making and strategy adjustments.

The lead of the Software segment is further bolstered by continuous innovations and enhancements in technology. As mobile ecosystems become more complex and integrated with emerging technologies such as artificial intelligence and machine learning, the software segment evolves to include these advanced capabilities.

Moreover, the integration capabilities of mobile attribution software with other marketing tools and platforms significantly contribute to its dominant market share. Companies prefer robust solutions that can seamlessly integrate with their existing marketing technology stacks, such as CRM systems, advertising platforms, and data management platforms.

Deployment Analysis

In 2023, the Cloud segment held a dominant position in the mobile attribution software market, capturing more than an 80% share. This dominance can be attributed to the numerous advantages offered by cloud-based solutions, including scalability, flexibility, and cost-effectiveness.

The preference for cloud-based mobile attribution software is further driven by its ability to seamlessly integrate with other data analytics and marketing platforms. This integration capability enables marketers to pull and analyze data from various sources, enhancing the comprehensiveness and accuracy of the attribution modeling.

Another factor contributing to the popularity of the cloud segment is the growing trend of remote work and the need for accessible, on-the-go marketing tools. Cloud-based mobile attribution platforms offer the flexibility to access critical data and insights from any location, which is highly valued in today’s mobile-centric business environment.

Furthermore, the ongoing innovations in cloud computing, such as improvements in data processing speeds and the integration of AI and machine learning technologies, are enhancing the capabilities of mobile attribution software. These advancements are making cloud-based solutions even more attractive by enabling more sophisticated and granular analysis of marketing data.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Mobile Attribution Software market, capturing more than a 60% share. This leadership can primarily be attributed to the extensive resources that large enterprises allocate toward advanced digital marketing strategies.

The predominant use of mobile attribution software by large enterprises is also driven by their need to manage vast arrays of advertising data across multiple platforms and geographies. The complexity of these operations often requires robust software solutions that can not only track but also analyze the effectiveness of mobile marketing campaigns on a large scale.

Furthermore, large enterprises tend to have more complex customer journeys and multiple touchpoints, making effective attribution a critical component of their marketing strategies. The ability to precisely attribute the success of specific campaigns to sales conversions is essential in justifying marketing budgets and strategies.

Finally, the competitive edge provided by mobile attribution software in terms of data-driven insights aligns closely with the strategic priorities of large enterprises. By leveraging these insights, large enterprises can maintain a significant advantage over smaller competitors, who may not have access to the same level of detailed analytics.

End-User Analysis

In 2023, the Retail & E-commerce segment held a dominant market position in the Mobile Attribution Software market, capturing more than a 31% share. This segment’s leadership is largely due to the critical role mobile devices play in the consumer shopping journey.

Retailers and e-commerce platforms increasingly rely on mobile attribution software to track and optimize the customer path from advertisement exposure to purchase, enhancing the effectiveness of their marketing efforts.

The proliferation of mobile shopping has made it essential for retail and e-commerce businesses to understand which marketing strategies are most effective at driving sales. Mobile attribution software provides these businesses with the tools necessary to analyze the performance of various marketing channels in real-time.

Moreover, the Retail & E-commerce sector benefits significantly from the granular level of data provided by mobile attribution software. This data includes user engagement metrics, conversion rates, and customer lifetime value insights, which are pivotal in crafting personalized marketing campaigns. Such targeted campaigns are known to increase customer retention and acquisition rates, thereby driving further growth in this segment.

Key Market Segments

By Component

- Software

- Services

By Deployment

- On-Premises

- Cloud

By Enterprise Size

- SMEs

- Large Enterprises

By End-User

- BFSI

- Healthcare

- Retail & E-commerce

- Media & Entertainment

- IT & Telecom

- Others

Driver

The Surge in Mobile Device Utilization

The mobile attribution software market has been profoundly impacted by the increasing prevalence of smartphones. This widespread adoption compels companies to significantly invest in mobile marketing as a strategy to captivate potential customers effectively.

Mobile attribution software is pivotal for these companies as it enables the meticulous tracking and analysis of user interactions with mobile ads. This software provides crucial insights into the effectiveness of marketing campaigns and user behaviors, facilitating the optimization of strategies to enhance returns on investment. Thus, the escalation in the usage of mobile devices acts as a fundamental driver, propelling the growth of the mobile attribution software market.

Restraint

The Hurdle of Data Privacy

Data privacy concerns stand as a significant impediment within the mobile attribution software market. The enactment of rigorous regulations such as the California Consumer Privacy Act (CCPA) in the United States mandates that companies manage user data with heightened security and transparency. Failure to comply can lead to severe financial penalties and reputational damage.

These legal requirements force mobile attribution software providers to adopt stringent data protection measures, elevating operational costs and adding complexity. Moreover, as consumer awareness regarding data privacy grows, there is heightened scrutiny on how personal data is collected and utilized, potentially curtailing the extent of data available for marketing analysis.

Opportunity

Embracing AI and Machine Learning Innovations

Incorporating artificial intelligence (AI) and machine learning (ML) into mobile attribution software presents expansive growth opportunities. AI and ML technologies refine the precision of attribution models by analyzing large data sets to discern patterns and forecast user behaviors, thereby enhancing the targeting and personalization of marketing initiatives.

This leads to more effective user engagement and higher conversion rates. Additionally, AI-enhanced insights facilitate the real-time optimization of marketing campaigns, enabling businesses to swiftly adjust their strategies in response to evolving user preferences. The integration of these advanced technologies is poised to foster innovation and efficiency, granting a strategic edge to market pioneers.

Challenge

Navigating Cross-Device Attribution Complexities

The challenge of cross-device attribution remains a formidable barrier in the mobile attribution arena. Consumers frequently interact with brands across multiple devices, including smartphones, tablets, and desktops, complicating the ability to track and unify the customer journey.

This complexity is exacerbated by the varying identifiers across devices and the stringent privacy standards, which can lead to inaccuracies in campaign effectiveness metrics. Developing sophisticated solutions capable of accurately tracing cross-device paths, while complying with privacy laws, is crucial for enhancing the methodologies of mobile attribution.

Emerging Trends

Mobile attribution software is evolving rapidly to meet the changing needs of marketers and app developers. One significant trend is the integration of advanced analytics and machine learning. These technologies provide deeper insights into user behavior, enabling more precise attribution and campaign optimization.

Additionally, there is a growing emphasis on user privacy and data security. With increasing regulations and user awareness, attribution platforms are adopting privacy-centric approaches, such as aggregating data and minimizing the use of personal identifiers.

Another notable development is the shift towards multi-touch attribution models. Unlike traditional single-touch models, multi-touch attribution considers all user interactions across various channels, offering a more comprehensive understanding of the customer journey.

Furthermore, the rise of omnichannel marketing has led to the need for cross-platform attribution solutions. Modern attribution tools are now capable of tracking user engagement across different devices and platforms, ensuring consistent measurement and analysis.

Business Benefits

- Understanding Campaign Performance: By identifying which marketing efforts drive user engagement and revenue, businesses can optimize their strategies for better results.

- Enhancing User Engagement: Insights into user behavior enable the creation of more effective, targeted campaigns, leading to improved user engagement.

- Optimizing Budget Allocation: Accurate attribution data helps in making informed decisions about where to invest marketing budgets, maximizing return on investment.

- Increasing Revenue: By analyzing user behavior and interactions with ads, businesses can create more effective campaigns, leading to increased revenue.

- Detecting Fraudulent Activity: Mobile attribution plays a crucial role in identifying and preventing fraudulent activities, ensuring the integrity of marketing efforts.

Regional Analysis

In 2023, North America held a dominant market position in the Mobile Attribution Software market, capturing more than a 40% share and generating revenues of approximately USD 1.2 billion. This leadership is largely attributed to the region’s advanced digital infrastructure and the pervasive use of mobile devices, which has created a fertile ground for mobile marketing technologies.

The prominence of North America in this market is further supported by the presence of major tech companies and startups that specialize in advertising technology and mobile attribution. These companies continually innovate and improve their offerings, contributing to the robust ecosystem of mobile marketing technologies in the region.

Furthermore, North America’s stringent regulatory environment regarding data privacy, led by initiatives such as the California Consumer Privacy Act (CCPA), compels companies to adopt reliable and compliant mobile attribution platforms. These platforms not only ensure compliance with regulations but also provide marketers with the tools necessary to leverage data responsibly and effectively.

The combination of technological leadership, a strong regulatory framework, and significant investment in digital marketing positions North America as a continuing leader in the Mobile Attribution Software market. As businesses increasingly focus on data-driven decision-making, the demand for mobile attribution software in North America is expected to remain robust, supporting sustained growth in this sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Mobile Attribution Software market is characterized by the presence of several influential players, with AppsFlyer, Branch Metrics, and Adjust standing out as key participants.

AppsFlyer holds a prominent position within the market due to its robust mobile attribution and marketing analytics platform. Catering to a wide array of industries including retail, gaming, travel, and finance, AppsFlyer offers solutions that allow companies to optimize their mobile marketing campaigns through precise data analysis and real-time insights.

Branch Metrics is another significant player, known for its deep linking technology that enhances mobile user experiences and improves campaign performance. Branch Metrics provides a unified platform that resolves the complexity of linking and attribution across various channels and platforms, ensuring a cohesive user experience.

Adjust distinguishes itself through its comprehensive suite of tools designed to measure and analyze the performance of mobile marketing efforts across different platforms. Adjust’s platform offers features such as fraud prevention, audience segmentation, and automated campaign optimization, making it an all-encompassing solution for mobile marketers.

Top Key Players in the Market

- AppsFlyer

- Branch Metrics

- Adjust

- Kochava

- Singular

- Tune

- Adobe (Marketo Engage)

- Airbridge

- Funnel

- Tenjin

- Other Key Players

Top Opportunities Awaiting for Players

In the evolving landscape of the mobile attribution software market, significant opportunities are presenting themselves to key players.

- Expansion in Emerging Markets: With increasing digitalization globally, especially in Asia-Pacific and Latin America, there’s a heightened demand for mobile attribution solutions. These regions show a robust increase in mobile device usage and app downloads, creating a fertile ground for mobile attribution software providers to expand their customer base.

- Integration with Multi-Channel Marketing Tools: As businesses aim to provide a seamless customer experience across all touchpoints, there’s a growing need for mobile attribution platforms that can integrate with other marketing tools. This capability allows for a comprehensive view of customer behaviors and enhances the effectiveness of marketing campaigns.

- Advanced Analytics and Machine Learning Capabilities: There’s a notable trend towards the adoption of advanced analytics and AI in mobile attribution software. Providers who can offer predictive analytics and machine learning insights give marketers the edge in understanding consumer behavior patterns and optimizing their marketing strategies accordingly.

- Compliance and Data Privacy: With increasing scrutiny on data privacy globally, opportunities arise for mobile attribution providers to differentiate by offering robust privacy features and compliance with regulations like GDPR and CCPA. This not only helps in gaining trust among users but also positions the company as a leader in responsible data management.

- Tailored Solutions for Specific Industries: As different sectors such as e-commerce, gaming, and finance have unique needs, there is an opportunity for mobile attribution companies to specialize their offerings. By providing customized solutions tailored to specific industry requirements, companies can enhance their market positioning and attractiveness to those particular segments.

Recent Developments

- In November 2023, AppsFlyer acquired DevtoDev, a data analytics firm specializing in gaming and app development. This acquisition aims to enhance AppsFlyer’s analytics capabilities for mobile developers.

- In September 2024, Kochava’s open beta allows select advertisers to access new attribution match types for Meta and TikTok for Business. By introducing engaged view and engaged click in the attribution waterfall, marketers can now gain more precise data across diverse video and interactive ad formats.

Report Scope

Report Features Description Market Value (2023) USD 3.0 Bn Forecast Revenue (2033) USD 10.9 Bn CAGR (2024-2033) 13.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Deployment (On-Premises, Cloud), By Enterprise Size (SMEs, Large Enterprises), By End-User (BFSI, Healthcare, Retail & E-commerce, Media & Entertainment, IT & Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AppsFlyer, Branch Metrics, Adjust, Kochava, Singular, Tune, Adobe (Marketo Engage), Airbridge, Funnel, Tenjin, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Attribution Software MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Mobile Attribution Software MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AppsFlyer

- Branch Metrics

- Adjust

- Kochava

- Singular

- Tune

- Adobe (Marketo Engage)

- Airbridge

- Funnel

- Tenjin

- Other Key Players