Global Hydrocolloids Market Size, Share, And Business Benefits By Type (Gelatin, Xanthan gum, Carrageenan, Alginates, Agar, Pectin, Guar gum, Locust bean gum (LBG), Gum Arabic, Carboxymethyl cellulose (CMC), Microcrystalline cellulose (MCC)), By Function (Thickener, Stabilizers, Gelling Agents, Fat Replacers, Coating Materials, Others), By Application (Food and Beverage (Bakery and Confectionery, Meat and Poultry Products, Sauces and Dressings, Dairy Products, Others), Cosmetics and personal Care, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150719

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

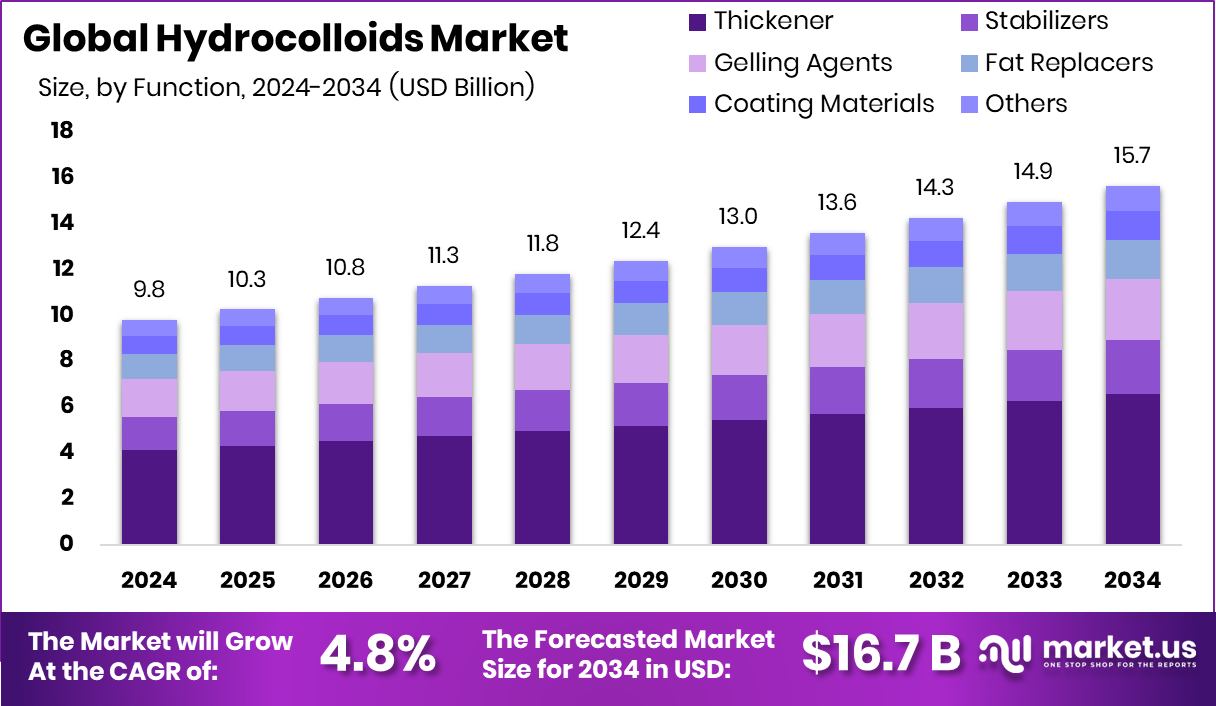

Global Hydrocolloids Market is expected to be worth around USD 15.7 billion by 2034, up from USD 9.8 billion in 2024, and grow at a CAGR of 4.8% from 2025 to 2034. Asia-Pacific’s 42.8% growth reflects strong demand for processed foods and clean-label ingredients today.

Hydrocolloids are substances that form gels when dispersed in water. They are typically polysaccharides or proteins that can thicken, stabilize, or emulsify food and non-food products. Commonly used in food processing, pharmaceuticals, cosmetics, and even textiles, hydrocolloids play a key role in enhancing texture, shelf life, and appearance.

The hydrocolloids market refers to the global demand, production, and trade of hydrocolloid-based products used across industries. It includes natural and modified hydrocolloids used in food and beverages, personal care, healthcare, and industrial applications. The market is shaped by factors such as dietary shifts, clean label demand, and product innovation in processed foods and functional health items.

One major growth factor for this market is the growing use of processed and convenience foods. Consumers increasingly seek products with better texture, mouthfeel, and longer shelf life, all of which hydrocolloids provide.

Demand for hydrocolloids is also driven by rising health awareness and plant-based diets. Many hydrocolloids are natural and allergen-free, fitting clean label trends and vegan formulations.

Key Takeaways

- Global Hydrocolloids Market is expected to be worth around USD 15.7 billion by 2034, up from USD 9.8 billion in 2024, and grow at a CAGR of 4.8% from 2025 to 2034.

- Gelatin holds a 24.6% share and is widely used for gelling and stabilizing across applications.

- Thickening dominates at 42.4%, as hydrocolloids enhance viscosity in sauces, dairy, and bakery products.

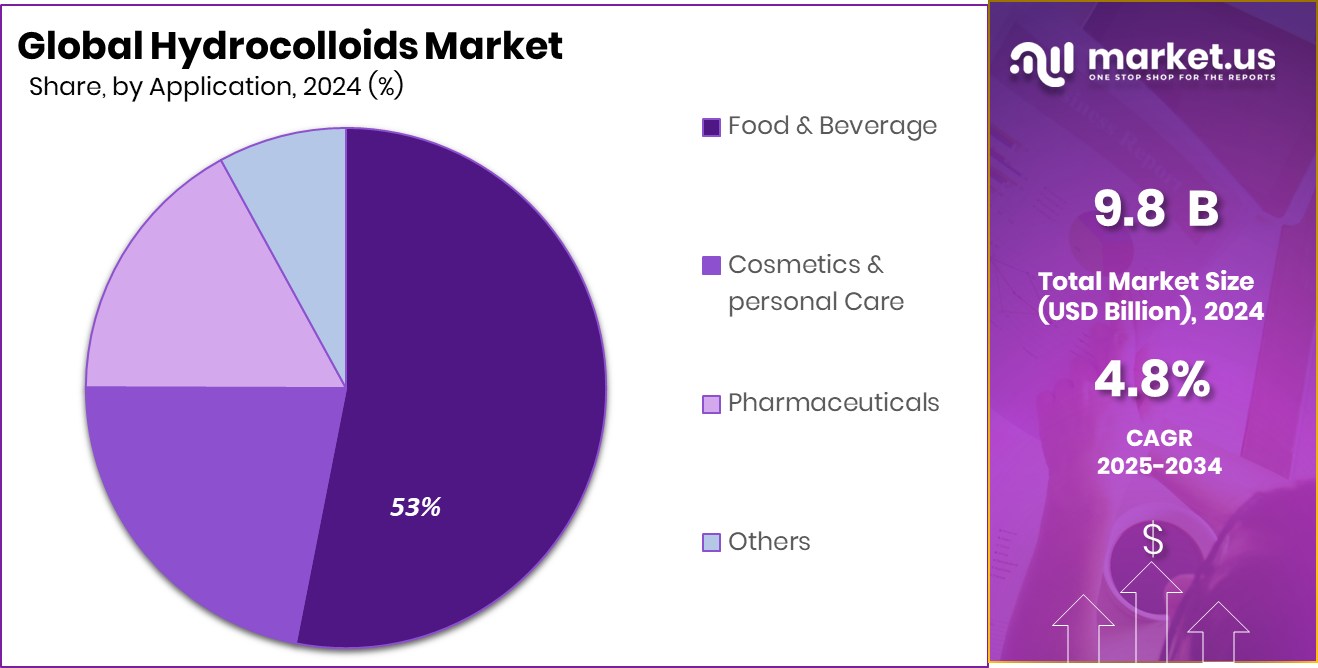

- The food and beverage sector leads with a 53.2% share, driven by the rising demand for texture improvement.

- The Asia-Pacific market size reached USD 4.1 billion due to rising food applications.

By Type Analysis

Gelatin holds a 24.6% share by type in the hydrocolloids market.

In 2024, Gelatin held a dominant market position in the By Type segment of the Hydrocolloids Market, with a 24.6% share. This dominance was primarily driven by its widespread application across the food, pharmaceutical, and personal care sectors.

Gelatin’s unique functional properties—such as gelling, thickening, and stabilizing—make it a preferred ingredient in applications ranging from confectionery and dairy products to capsule manufacturing in pharmaceuticals. Its ability to create a desirable texture and structure in food products, while also being digestible and protein-rich, has contributed to its steady demand.

Additionally, the growing interest in health-conscious and protein-enriched diets has indirectly supported gelatin usage, particularly in dietary supplements and functional foods. Its natural origin and clean-label perception also align well with consumer preference for familiar and minimally processed ingredients. Moreover, the pharmaceutical industry’s reliance on gelatin for softgel and hard capsule formulations continues to reinforce its market share.

In 2024, favorable consumer trends and stable raw material sourcing further strengthened its position. With no major shift reported away from gelatin, its 24.6% share illustrates the product’s mature and well-established presence in the hydrocolloids landscape, making it a dependable segment leader in both developed and developing regions.

By Function Analysis

Thickener function dominates with a 42.4% share, supporting texture and stability in products.

In 2024, Thickener held a dominant market position in the By Function segment of the Hydrocolloids Market, with a 42.4% share. This leadership can be attributed to the extensive use of hydrocolloids as thickeners in a wide range of food and beverage applications, including sauces, soups, dressings, dairy, and bakery products.

Their ability to enhance viscosity without altering flavor, along with their compatibility with both hot and cold systems, has made thickeners the most relied-upon function of hydrocolloids across manufacturing setups.

The 42.4% share also reflects the growing consumer preference for foods with consistent texture and mouthfeel. As manufacturers aim to meet expectations for quality and stability in processed products, thickeners offer a dependable solution. The demand has also risen with the increased consumption of ready-to-eat meals and packaged food, where texture control is crucial.

Furthermore, thickeners are instrumental in achieving uniform consistency in formulations, which is especially vital in high-throughput production environments. In 2024, the prominence of this functional category reinforced its central role in the hydrocolloids value chain, making thickening agents a cornerstone of formulation strategies across various product lines and geographies.

By Application Analysis

Food and beverage applications lead with 53.2%, driven by demand for processed foods.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Hydrocolloids Market, with a 53.2% share. This significant lead reflects the widespread use of hydrocolloids in enhancing the texture, stability, and shelf life of food and drink products.

The 53.2% market share also underscores the sector’s growing demand for clean-label, natural additives that can deliver multiple functional benefits without synthetic ingredients. In packaged foods, hydrocolloids are used as thickening, gelling, emulsifying, and stabilizing agents, allowing manufacturers to create visually appealing and consumer-friendly products.

Additionally, hydrocolloids align with current consumer trends favoring plant-based and gluten-free alternatives, both of which heavily rely on these ingredients to replicate texture and mouthfeel. In 2024, this dominance by the food and beverage application illustrates how hydrocolloids have become an indispensable part of modern food formulation, holding the largest share of the application landscape.

Key Market Segments

By Type

- Gelatin

- Xanthan gum

- Carrageenan

- Alginates

- Agar

- Pectin

- Guar gum

- Locust bean gum (LBG)

- Gum Arabic

- Carboxymethyl cellulose (CMC)

- Microcrystalline cellulose (MCC)

By Function

- Thickener

- Stabilizers

- Gelling Agents

- Fat Replacers

- Coating Materials

- Others

By Application

- Food and Beverage

- Bakery and Confectionery

- Meat and Poultry Products

- Sauces and Dressings

- Dairy Products

- Others

- Cosmetics and Personal Care

- Pharmaceuticals

- Others

Driving Factors

Rising Demand for Processed Foods and Beverages

One of the biggest factors driving the hydrocolloids market is the growing demand for processed foods and beverages. As more people around the world seek convenient, ready-to-eat meals, the need for ingredients that improve texture, thickness, and shelf life has increased. Hydrocolloids help maintain the quality and feel of products like sauces, soups, dairy items, and baked goods. They make food smoother, more stable, and more enjoyable to eat.

With busier lifestyles and changing eating habits, especially in urban areas, processed food sales are climbing. This directly supports the use of hydrocolloids in the food industry. As food manufacturers innovate new products, hydrocolloids remain a key ingredient, boosting overall market growth year after year.

Restraining Factors

Fluctuating Raw Material Prices Affecting Stability

A major challenge for the hydrocolloids market is the unstable cost of raw materials. Many hydrocolloids are sourced from natural ingredients like seaweed, plants, and animal by-products. These sources are often affected by environmental changes, seasonal availability, and supply chain disruptions.

For example, poor harvests or climate issues can reduce availability and raise prices. When raw material prices go up, production costs for manufacturers increase too. This makes it harder to maintain steady pricing for end products, especially in competitive markets. Such uncertainty creates problems for food producers and other industries that rely on hydrocolloids.

Growth Opportunity

Growing Use in Health and Wellness Products

A strong growth opportunity for the hydrocolloids market lies in the rising demand for health and wellness products. Consumers are becoming more health-conscious and prefer clean-label, low-fat, and functional foods. Hydrocolloids help create these products by improving texture, stability, and shelf life without the need for artificial additives.

Additionally, hydrocolloids are gaining traction in pharmaceuticals and personal care products, such as capsules, gels, and skin treatments. As wellness trends continue to expand globally, especially among younger consumers, the demand for hydrocolloid-based solutions is expected to rise steadily, opening new opportunities in both food and non-food sectors.

Latest Trends

Shift Toward Clean‑Label and Plant‑Based Hydrocolloids

A key trend in the hydrocolloids market is the move toward clean‑label and plant‑based ingredients. Consumers nowadays prefer simple, natural foods without artificial additives, which has driven manufacturers to choose hydrocolloids sourced from plants, like agar, pectin, and guar gum, over synthetic counterparts.

These plant-based options are seen as healthier and more transparent, fitting perfectly with wellness-focused packaging labels. This shift is especially noticeable in plant-based dairy, meat alternatives, and vegan desserts, where hydrocolloids help recreate desirable textures and mouthfeel. Beyond food, clean‑label hydrocolloids are appearing in cosmetics and supplements, too.

Regional Analysis

In 2024, Asia-Pacific led the hydrocolloids market with a 42.8% share.

In 2024, Asia-Pacific emerged as the dominating region in the global hydrocolloids market, accounting for 42.8% of the total market share, valued at USD 4.1 billion. This leadership is largely supported by the region’s expanding food processing sector, growing urban population, and increasing demand for functional ingredients in countries like China, India, and Southeast Asia.

North America also maintained a strong position, supported by the well-established food and pharmaceutical industries, where hydrocolloids are widely utilized for gelling and thickening purposes. Europe followed with stable growth, owing to the demand for clean-label and plant-based ingredients across Germany, France, and the UK.

In contrast, the Middle East & Africa and Latin America regions held relatively smaller shares. However, rising food innovation, urbanization, and packaged food consumption are gradually increasing the importance of hydrocolloids in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DuPont maintained its position through a broad portfolio of hydrocolloid solutions that span food, pharmaceutical, and industrial applications. With established expertise in ingredient research and a strong R&D pipeline, DuPont focused on enhancing functionality—such as improved gel strength and heat stability—while aligning with clean‑label demands. The company’s investments in production efficiency and sustainable sourcing bolstered its reputation among large-scale manufacturers seeking reliability and consistency.

Palsgaard, renowned for its texturizer technologies, continued to leverage dairy and bakery sector partnerships. Its strength lies in tailored hydrocolloid blends that simplify formulation processes and ensure consistent mouthfeel. In 2024, Palsgaard emphasized transparency and traceability throughout its supply chain, responding to growing consumer preference for ethically sourced ingredients.

Nexira took a distinctive path by specializing in natural, plant‑based hydrocolloids primarily for functional foods and nutraceuticals. The company’s product line, centered around acacia gum and botanical fibers, aligned squarely with wellness and digestive‑health trends. Nexira’s focus on organic certification, allergen‑free composition, and clean‑label positioning appealed to health‑conscious brands.

Top Key Players in the Market

- DuPont

- Palsgaard

- Nexira

- Ingredion, Incorporated

- Kerry

- BASF

- Ashland

- CP Kelco U.S. Inc.

- Tate & Lyle Plc

- Cargill, Incorporated

- The Archer Daniels Midland Company (ADM)

- DSM N.V.

Recent Developments

- In May 2025, DuPont introduced its AmberChrom™ TQ1 chromatography resin, designed specifically for purifying oligonucleotides and peptides in biopharma applications. This agarose‑based resin delivers higher loading capacity and throughput while operating under lower pressure, helping drug developers achieve purer yields and faster processes.

- In July 2024, Nexira introduced its naltive™ range at the IFT event in Chicago. This new lineup includes key plant-based hydrocolloids like locust bean gum, tara gum, and guar gum. These gently processed ingredients are designed to improve texture in food products, especially plant-based alternatives, while demonstrating sustainability and prebiotic benefits.

Report Scope

Report Features Description Market Value (2024) USD 9.8 Billion Forecast Revenue (2034) USD 15.7 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Gelatin, Xanthan gum, Carrageenan, Alginates, Agar, Pectin, Guar gum, Locust bean gum (LBG), Gum Arabic, Carboxymethyl cellulose (CMC), Microcrystalline cellulose (MCC)), By Function (Thickener, Stabilizers, Gelling Agents, Fat Replacers, Coating Materials, Others), By Application (Food and Beverage (Bakery and Confectionery, Meat and Poultry Products, Sauces and Dressings, Dairy Products, Others), Cosmetics and personal Care, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DuPont, Palsgaard, Nexira, Ingredion, Incorporated, Kerry, BASF, Ashland, CP Kelco U.S. Inc., Tate & Lyle Plc, Cargill, Incorporated, The Archer Daniels Midland Company (ADM), DSM N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DuPont

- Palsgaard

- Nexira

- Ingredion, Incorporated

- Kerry

- BASF

- Ashland

- CP Kelco U.S. Inc.

- Tate & Lyle Plc

- Cargill, Incorporated

- The Archer Daniels Midland Company (ADM)

- DSM N.V.