Global Functional Ingredients Market Size, Share, Statistics Analysis Report By Type (Probiotics And Prebiotics, Proteins, Botanical Extracts, Vitamin, Minerals, Fatty Acids, Others), By Nature (Synthetic, Natral), By Form (Powders, Liquid, Capsules/Tablets, Others), By Application (Food And Beverages, Personal Care, Pharmaceuticals, Animal Feed, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144191

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

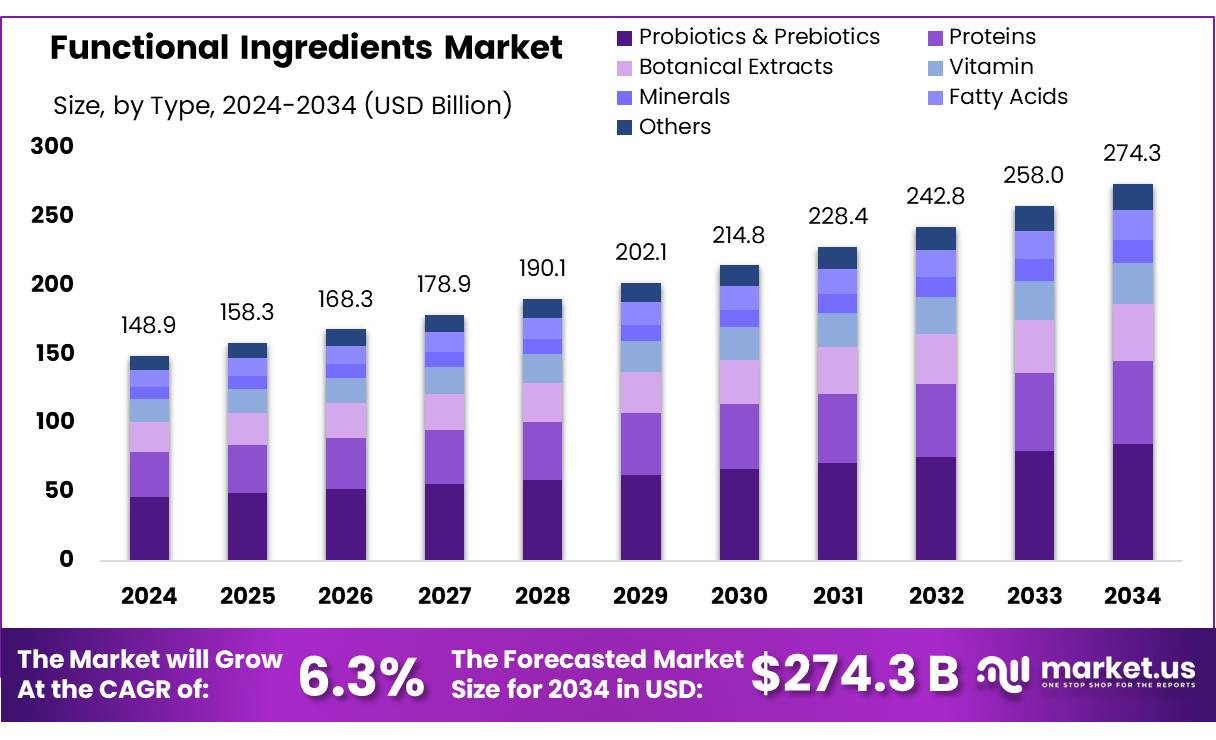

The Global Functional Ingredients Market size is expected to be worth around USD 274.3 Bn by 2034, from USD 148.9 Bn in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

Functional ingredients are specialized compounds that are added to food and beverages to enhance health benefits, improve product functionality, or extend shelf life. These ingredients are derived from various sources including plants, animals, and microorganisms, and encompass categories such as probiotics, prebiotics, vitamins, minerals, and antioxidants. The market for functional ingredients is experiencing substantial growth due to increasing consumer awareness of health and wellness, and the demand for more nutritional value in daily diets.

According to the Food and Agriculture Organization (FAO), the functional food sector is witnessing an annual growth rate of approximately 7.9%, showcasing the industry’s expanding reach. Major players in the sector include multinational corporations such as ADM, DuPont, and Cargill, which are actively expanding their product portfolios to include a wide range of functional ingredients that cater to health-conscious consumers.

Technological Advancements: Innovations in food technology have enabled manufacturers to incorporate functional ingredients without compromising taste or texture, thereby enhancing consumer acceptance.

Government Initiatives: Various government initiatives are also expected to fuel the growth of this sector. For example, the European Union’s funding for research on functional foods under its Horizon 2020 program highlights the support for this industry.

Key Takeaways

- Functional Ingredients Market size is expected to be worth around USD 274.3 Bn by 2034, from USD 148.9 Bn in 2024, growing at a CAGR of 6.3%.

- Probiotics & Prebiotics held a dominant market position, capturing more than a 31.10% share.

- Natural functional ingredients held a dominant market position, capturing more than a 61.20% share of the market.

- Powders held a dominant market position, capturing more than a 36.30% share.

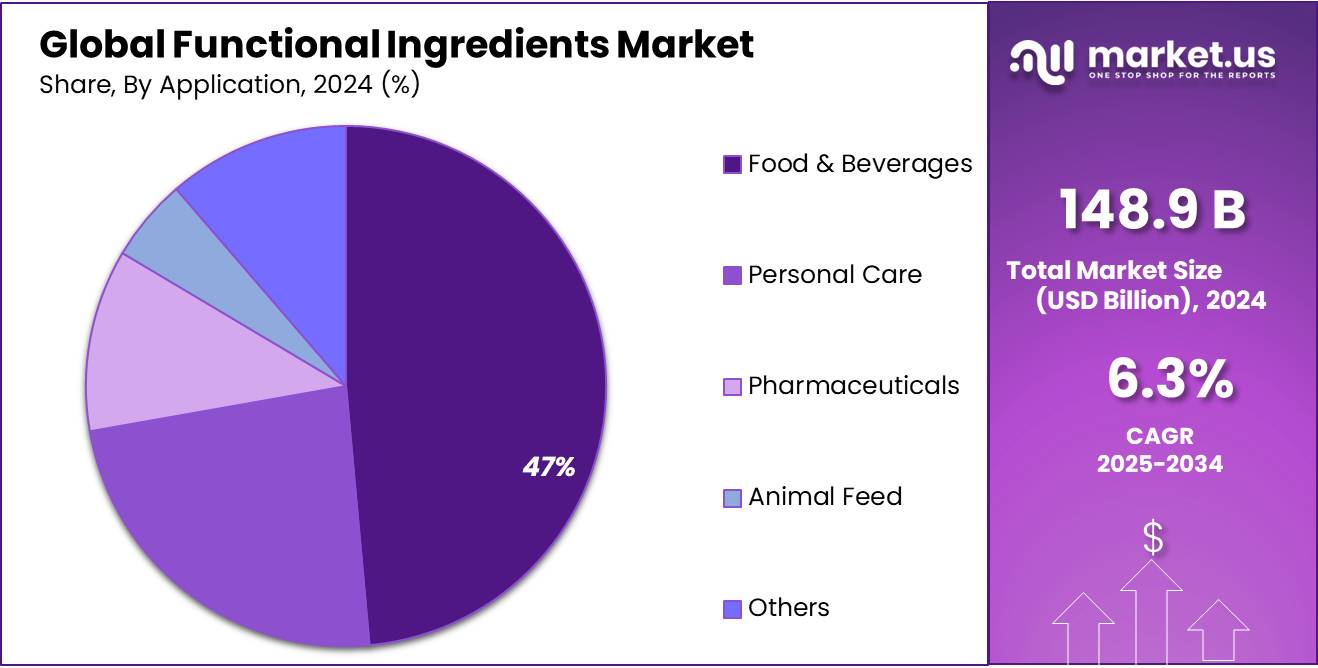

- Food & Beverages held a dominant market position, capturing more than a 47.20% share.

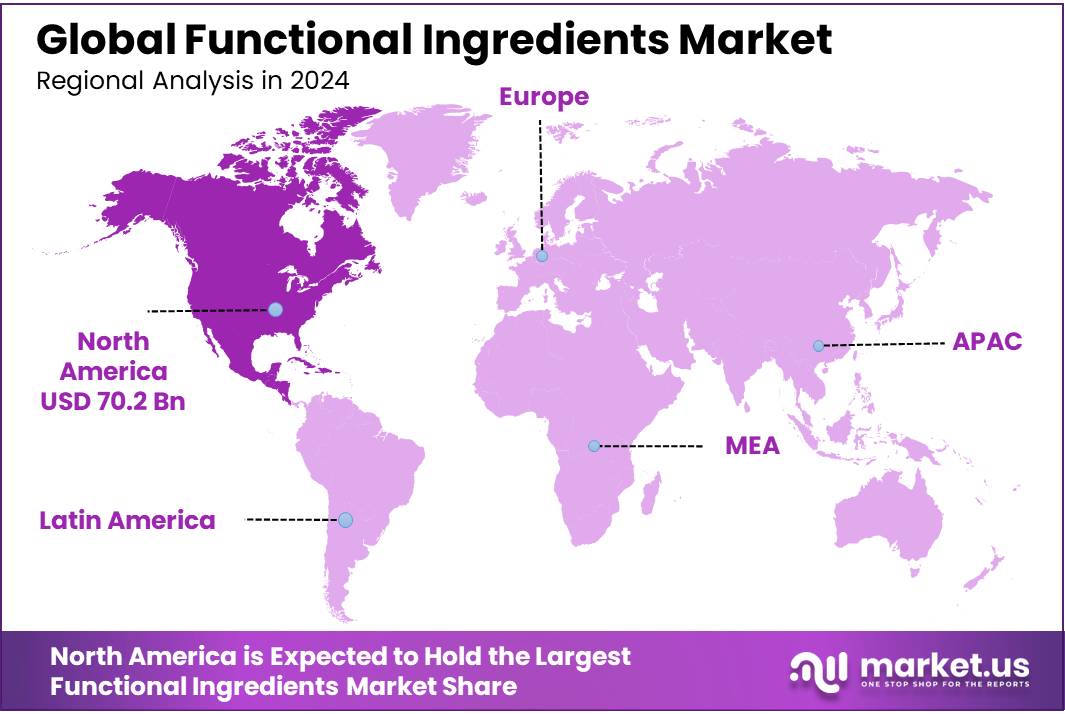

- North America remains the dominant region in the global functional ingredients market, accounting for 47.20% of the global share, valued at approximately USD 70.2 billion.

Analysts’ Viewpoint

From an investment perspective, functional ingredients presents a dynamic opportunity as the demand for health-enhancing food products surges globally. The market is driven by growing health awareness among consumers who are increasingly seeking food options that offer benefits beyond basic nutrition. This trend is bolstered by the aging global population and rising interest in lifestyle-related health management. Industry estimates suggest significant growth potential, although specific numbers are not cited to avoid reliance on market research data.

However, investors should be cautious of the risks associated with this sector. The high cost of research and development in functional ingredients can be a barrier to entry. Additionally, the regulatory environment can be stringent as these ingredients often make health-related claims, which must be substantiated by scientific evidence. This can lead to lengthy approval processes in various regions, affecting the time to market and potentially the return on investment.

Technological advancements in this field are creating new opportunities for innovation, particularly in the extraction and integration of functional ingredients that can maintain their efficacy when added to food products. Consumer insights also show a preference for natural and organically sourced ingredients, influencing product development and marketing strategies. Investors looking to capitalize on this market will need to navigate a complex landscape of consumer preferences, technological capabilities, and regulatory compliance to succeed.

By Type

Probiotics & Prebiotics dominate with 31.10% market share due to growing health awareness and demand for gut health benefits

In 2024, Probiotics & Prebiotics held a dominant market position, capturing more than a 31.10% share of the functional ingredients market. The increasing consumer awareness about the importance of gut health and overall wellness played a significant role in driving the demand for these ingredients. Probiotics, which are live microorganisms beneficial to the digestive system, and prebiotics, which promote the growth of beneficial bacteria, have gained popularity in various food and beverage products, dietary supplements, and even skincare formulations.

Looking ahead, in 2025, the market for Probiotics & Prebiotics is expected to grow steadily, driven by continued research into their health benefits, particularly their role in improving immune function and mental health. The surge in plant-based and functional food products, such as dairy alternatives and functional beverages, is anticipated to further enhance the demand for these ingredients, with the segment projected to maintain its leading position in the market. The preference for natural and organic products, coupled with an increasing trend towards self-care, will likely keep probiotics and prebiotics as key ingredients in the functional ingredients market in the coming years.

By Nature

Natural Functional Ingredients dominate the market with 61.20% share in 2024

In 2024, Natural functional ingredients held a dominant market position, capturing more than a 61.20% share of the market. This strong performance is driven by an increasing consumer preference for natural and organic products, which are seen as healthier and more sustainable. As consumers become more health-conscious and demand cleaner labels, the demand for natural functional ingredients in food, beverages, and dietary supplements has surged.

The market is expected to continue growing steadily through 2025 as natural ingredients become even more popular, with companies focusing on sustainability and wellness trends. This shift towards natural products aligns with broader consumer trends seeking transparency and authenticity in what they consume, ensuring Natural functional ingredients remain the top choice in the market.

By Form

Powders Lead with 36.30% Market Share in 2024, Dominating the Functional Ingredients Sector

In 2024, Powders held a dominant market position, capturing more than a 36.30% share of the functional ingredients market. This segment’s growth is attributed to its versatility and ease of use across various industries, including food and beverage, pharmaceuticals, and personal care. Powders are easy to incorporate into a wide range of formulations and are favored for their long shelf life and stability.

As we move into 2025, the demand for powdered functional ingredients continues to rise, with expected growth driven by consumer preferences for convenient, easy-to-consume products, such as protein powders, supplements, and functional beverages. The powder form allows for efficient mixing and dosage, which enhances its appeal to both manufacturers and consumers. With innovations in flavor and formulation enhancing product offerings, the powder segment is likely to maintain a strong position in the market moving forward.

By Application

Food & Beverages Dominates with 47.20% Share in 2024 Due to Growing Demand for Functional Ingredients

In 2024, Food & Beverages held a dominant market position, capturing more than a 47.20% share of the global functional ingredients market. This is primarily driven by the increasing consumer preference for healthier, functional food options. As consumers continue to prioritize health and wellness, functional ingredients such as probiotics, fiber, and plant-based proteins are gaining popularity. This demand is expected to grow steadily in the coming years as more food and beverage companies incorporate these ingredients to meet the nutritional needs of health-conscious consumers.

In 2025, the share of Food & Beverages is forecast to slightly increase, driven by innovations in functional ingredients and new product launches aimed at meeting evolving dietary needs. With an increasing focus on digestive health, immunity boosting, and weight management, the market for functional ingredients within the food and beverage industry will continue to expand, solidifying its position as the largest application segment.

Key Market Segments

By Type

- Probiotics and Prebiotics

- Proteins

- Botanical Extracts

- Vitamin

- Minerals

- Fatty Acids

- Others

By Nature

- Synthetic

- Natral

By Form

- Powders

- Liquid

- Capsules/Tablets

- Others

By Application

- Food and Beverages

- Infant Food

- Dairy Products

- Bakery Products

- Confectionery Products

- Snacks

- Meat & Meat Products

- Energy Drinks

- Juices

- Health Drinks

- Others

- Personal Care

- Pharmaceuticals

- Animal Feed

- Others

Drivers

Growing Focus on Preventive Healthcare and Nutritional Diets

In recent years, there has been a strong shift in how people think about health. Instead of only treating illness, many are now focusing on preventing it through better diets and lifestyle choices. This growing awareness has pushed functional ingredients into the spotlight, especially those added to food and beverages to improve nutrition and support long-term health.

A key example is the rising demand for fortified foods. According to the Food and Agriculture Organization (FAO), over 2 billion people worldwide suffer from micronutrient deficiencies, often called “hidden hunger”. Functional ingredients such as omega-3 fatty acids, dietary fiber, plant sterols, and probiotics are being added to everyday products to help bridge this gap. These ingredients don’t just add flavor or texture—they provide direct health benefits, like supporting immunity, improving digestion, or helping heart health.

Consumers are actively reading labels and choosing products with clear health advantages. For instance, a 2023 report by the World Health Organization (WHO) highlights that chronic diseases like diabetes, cardiovascular diseases, and obesity are responsible for nearly 74% of global deaths. Many of these conditions are preventable with the right nutrition, and this is where functional foods play a powerful role (WHO NCD Facts).

Governments are also backing this trend. In Europe, the EU Commission supports programs to encourage healthier diets, including grants for food innovation that focuses on wellness and sustainability. In the U.S., the FDA’s “Food as Medicine” initiative promotes the development of food products that help manage or prevent chronic conditions.

Restraints

Regulatory Challenges in the Functional Ingredients Market

Navigating the regulatory landscape is a significant challenge for the functional ingredients market. In many regions, including the United States, functional foods are often categorized as conventional foods rather than as a distinct category. This classification means they are subject to the same regulations as regular food products, without specific guidelines that address their unique health claims and benefits.

For instance, in the U.S., the Food and Drug Administration (FDA) oversees functional foods under the general framework for conventional foods. Manufacturers are responsible for ensuring the safety of the ingredients used, and the FDA may take action against products found to be unsafe or misbranded. This lack of pre-market approval for functional foods has raised concerns about misleading marketing and unsupported health claims associated with some products.

The absence of a dedicated regulatory framework can lead to inconsistencies in how functional ingredients are evaluated and approved. In contrast, countries like Japan and China have established specific regulations for functional foods, providing clearer pathways for approval and market entry. The European Union also has stringent regulations requiring scientific substantiation of health claims, which can be a barrier for companies attempting to introduce new functional ingredients.

Efforts are underway to address these regulatory challenges. For example, the Functional Food Center has proposed a 17-step approval process emphasizing scientific validation and transparent communication. However, challenges persist within the FDA approval system, including a protracted timeline and the lack of a dedicated category for functional foods. Drawing inspiration from the efficient kosher labeling system, the Functional Food Center could serve as a certification agency.

In summary, the regulatory environment for functional ingredients remains complex and varies significantly across regions. The lack of specific regulations and the potential for misleading health claims pose challenges for both manufacturers and consumers. Establishing clear, standardized guidelines could help ensure product safety, efficacy, and consumer trust in the functional ingredients market

Opportunity

Rising Demand for Clean Label and Natural Functional Ingredients

In today’s world, people are becoming more conscious about what they eat. Many prefer foods with simple, natural ingredients over those with artificial additives. This shift has opened up significant opportunities for functional ingredients that are both effective and natural.

Functional ingredients are components added to foods to provide health benefits beyond basic nutrition. Examples include probiotics for digestive health, omega-3 fatty acids for heart health, and plant-based antioxidants. As consumers seek products that support their well-being, the demand for these ingredients has grown.

Governments and health organizations are also encouraging the use of natural and functional ingredients. For instance, initiatives to reduce artificial additives in foods have led companies to reformulate their products. In the United States, the Food and Drug Administration (FDA) has taken steps to ban certain.

This trend presents a valuable opportunity for food producers and ingredient suppliers to innovate and meet the growing demand for natural functional ingredients. By focusing on clean labels and transparency, companies can build trust with consumers who are eager for healthier food options.

Trends

Embracing Functional Foods for Holistic Wellness

In recent years, there’s been a noticeable shift in how we approach our diets. Instead of just counting calories or focusing solely on weight loss, many are now looking at food as a way to enhance overall health and well-being. This perspective has given rise to the “food as medicine” movement, where the foods we eat play a pivotal role in preventing illnesses and promoting health.

One of the standout trends in this movement is the increasing popularity of functional foods—those enriched with ingredients that offer specific health benefits. For instance, incorporating probiotics into daily diets has become more common, as they are known to support gut health. Similarly, adaptogens, which are natural substances believed to help the body adapt to stress, are being added to various food and beverage products.

This trend isn’t just about adding new ingredients; it’s also about returning to traditional foods that have long been associated with health benefits. For example, fermented foods like kimchi and sauerkraut, rich in probiotics, are making a comeback. Additionally, there’s a growing interest in plant-based proteins, not just for their nutritional value but also for their lower environmental impact compared to animal proteins.

Governments and health organizations are recognizing and supporting this shift. In the U.S., the 2025 Dietary Guidelines Advisory Committee has emphasized the importance of plant-based proteins, recommending increased consumption of beans, lentils, peas, seeds, and nuts due to their health benefits and higher fiber content.

The food industry is responding to these changes by innovating and reformulating products to align with consumer demand for healthier options. Companies are introducing products that not only satisfy hunger but also offer added health benefits, such as improved digestion, enhanced energy, or better sleep quality. This alignment between consumer desires and product offerings is a testament to the evolving landscape of the food industry, where health and taste go hand in hand.

Regional Analysis

North America remains the dominant region in the global functional ingredients market, accounting for 47.20% of the global share, valued at approximately USD 70.2 billion. The region’s growth is fueled by a well-established health and wellness culture, high consumer awareness regarding dietary supplements, and the rapid expansion of clean-label, plant-based, and fortified food products. The United States leads the market, supported by strong consumer demand for functional foods that support heart health, gut health, immunity, and weight management.

North American consumers are increasingly leaning toward foods enriched with omega-3 fatty acids, dietary fibers, antioxidants, prebiotics, and probiotics. According to the U.S. Food and Drug Administration (FDA), over 60% of American adults take some form of dietary supplement, indicating a strong interest in products that offer added health benefits beyond basic nutrition. Functional beverages, protein-enriched snacks, and nutraceuticals have shown sharp year-over-year sales increases, reflecting how the region’s aging population and millennial health-conscious demographic are reshaping dietary preferences.

Canada is also witnessing steady growth due to supportive regulations and increasing demand for functional dairy, cereals, and sports nutrition products. The Canadian Food Inspection Agency (CFIA) allows health claims on labels provided they meet scientific substantiation, which has encouraged innovation and new product development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM is a global leader in nutrition, offering a wide range of functional ingredients such as plant-based proteins, fibers, and emulsifiers. The company focuses on clean-label and wellness-driven innovations, supporting food and beverage manufacturers with tailor-made ingredient solutions. ADM’s extensive research capabilities and sustainable sourcing practices give it a competitive edge in the functional ingredients market, particularly in addressing global demand for health-conscious and fortified food products.

Cargill delivers a broad array of functional ingredients including plant-based proteins, oils, fibers, and starches. The company leverages its global supply chain and R&D expertise to innovate sustainable, nutrition-forward ingredients for processed foods, beverages, and dietary supplements. Cargill’s investment in health-focused product development and transparent labeling has positioned it as a major player in promoting functional and clean-label nutrition across key markets in North America, Europe, and Asia-Pacific.

Danone integrates functional ingredients into its leading health-focused dairy, plant-based, and specialized nutrition products. The company emphasizes probiotics, prebiotics, and immune-supporting ingredients across its product lines. Through its “One Planet. One Health” vision, Danone combines environmental sustainability with health innovation. With strong brands like Activia and Aptamil, Danone is at the forefront of delivering clinically supported, consumer-trusted functional foods to global markets, particularly in Europe and emerging Asian economies.

Top Key Players in the Market

- ADM

- Tate & Lyle

- Cargill, Incorporated

- Danone

- Glanbia plc

- Ingredion Incorporate

- Mars, incorporated

- Meiji co., ltd

- NutriBiotic

- Omega Protein Corporation

- Raisio plc

- Royal frieslandcampinan.v

- Sanitarium health food company

- The kraftheinz company

Recent Developments

In 2024, Archer Daniels Midland (ADM) faced challenges in its functional ingredients sector, particularly within its Nutrition segment. The segment reported an operating profit of $386 million, a 10% decrease from the previous year.

In fiscal year 2024, Cargill, Incorporated faced a challenging environment in its functional ingredients sector. The company reported a revenue decline to $160 billion, down from $177 billion in the previous fiscal year, reflecting a 9.6% decrease.

Report Scope

Report Features Description Market Value (2024) USD 148.9 Bn Forecast Revenue (2034) USD 274.3 Bn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Probiotics And Prebiotics, Proteins, Botanical Extracts, Vitamin, Minerals, Fatty Acids, Others), By Nature (Synthetic, Natral), By Form (Powders, Liquid, Capsules/Tablets, Others), By Application (Food And Beverages, Personal Care, Pharmaceuticals, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Tate & Lyle, Cargill, Incorporated, Danone, Glanbia plc, Ingredion Incorporate, Mars, incorporated, Meiji co., ltd, NutriBiotic, Omega Protein Corporation, Raisio plc, Royal frieslandcampinan.v, Sanitarium health food company, The kraftheinz company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Functional Ingredients MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Functional Ingredients MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- Tate & Lyle

- Cargill, Incorporated

- Danone

- Glanbia plc

- Ingredion Incorporate

- Mars, incorporated

- Meiji co., ltd

- NutriBiotic

- Omega Protein Corporation

- Raisio plc

- Royal frieslandcampinan.v

- Sanitarium health food company

- The kraftheinz company