Global Edible Cup Market By Material (Sugar, Chocolate, Cookies, Others), By Capacity (Up to 50 ml, 60 to 100 ml, Above 100 ml), By Application (Hot Beverages (Coffee, Tea, etc.), Cold Beverages (Smoothies, Juices, etc.), Food Items), By End Use (Industrial, Commercial, Institutional) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132919

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

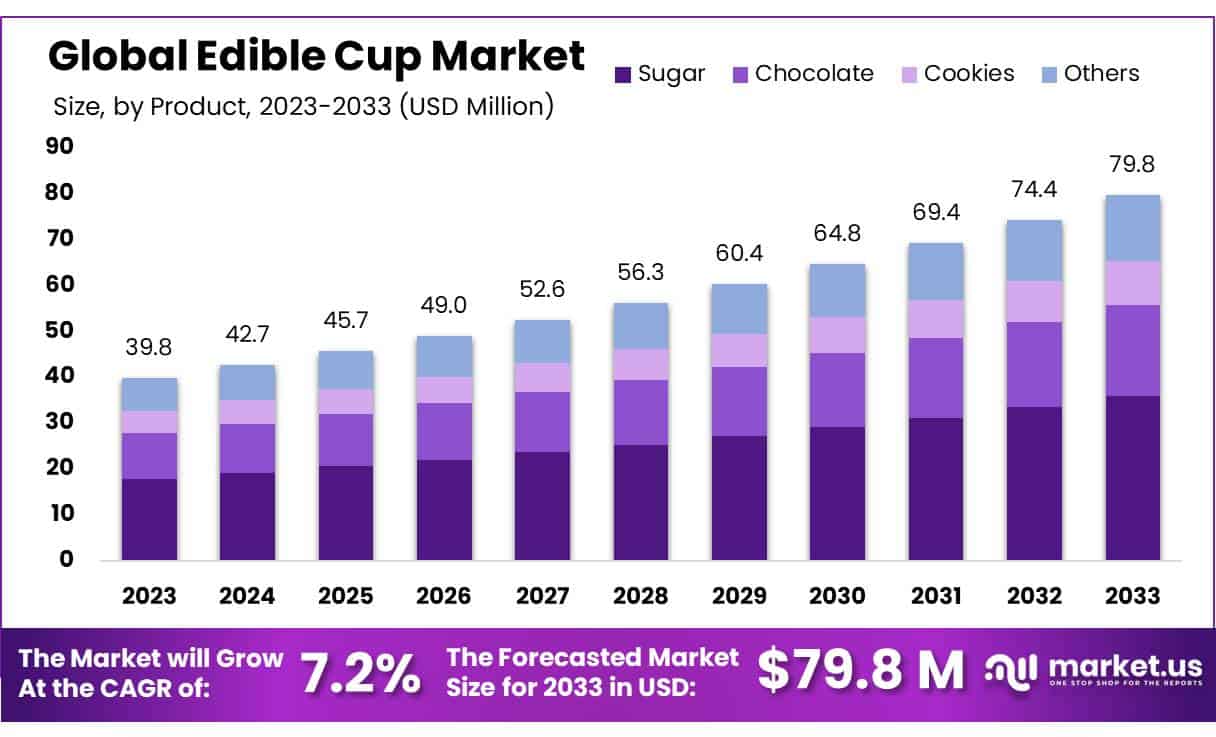

The Global Edible Cup Market size is expected to be worth around USD 79.8 Mn by 2033, from USD 39.8 Mn in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

Edible cups are an innovative form of sustainable packaging designed to be consumed along with the beverage or food they hold. Made from biodegradable and plant-based materials like wheat, rice, corn, or seaweed, they provide an eco-friendly alternative to traditional single-use plastic and paper cups.

These cups are engineered to handle both hot and cold liquids without losing their structure, ensuring usability throughout the consumption period. Their adoption is gaining momentum as consumers and businesses increasingly prioritize environmentally sustainable solutions.

Research shows that a 100-gram serving of such edible cups contains approximately 354 kcal, along with 74.2 grams of carbohydrates, 10.8 grams of protein, and 4.6 grams of dietary fiber. This combination makes edible cups not only a practical packaging solution but also a health-conscious choice, appealing to consumers seeking functional and eco-friendly products.

In India, government initiatives aimed at promoting sustainable practices are driving the adoption of edible packaging in the food and beverage industry. The edible cups market in the country is expected to grow at a compound annual growth rate (CAGR) of 8.0% during the forecast period, fueled by rising awareness and supportive regulatory frameworks.

Similarly, in Europe, stringent regulations on single-use plastics are compelling manufacturers to explore sustainable alternatives. The region holds a significant 23.5% share of the global edible cups market, reflecting its leadership in sustainability efforts. This trend is supported by growing consumer demand for eco-friendly products and the proactive stance of European governments in reducing plastic waste.

Key Takeaways

- Edible Cup Market size is expected to be worth around USD 79.8 Mn by 2033, from USD 39.8 Mn in 2023, growing at a CAGR of 7.2%.

- In 2023, Sugar held a dominant market position, capturing more than a 45.2% share.

- 60 to 100 ml segment held a dominant market position, capturing more than a 52.3% share.

- Hot Beverages (Coffee, Tea, etc.) held a dominant market position, capturing more than a 48.5% share.

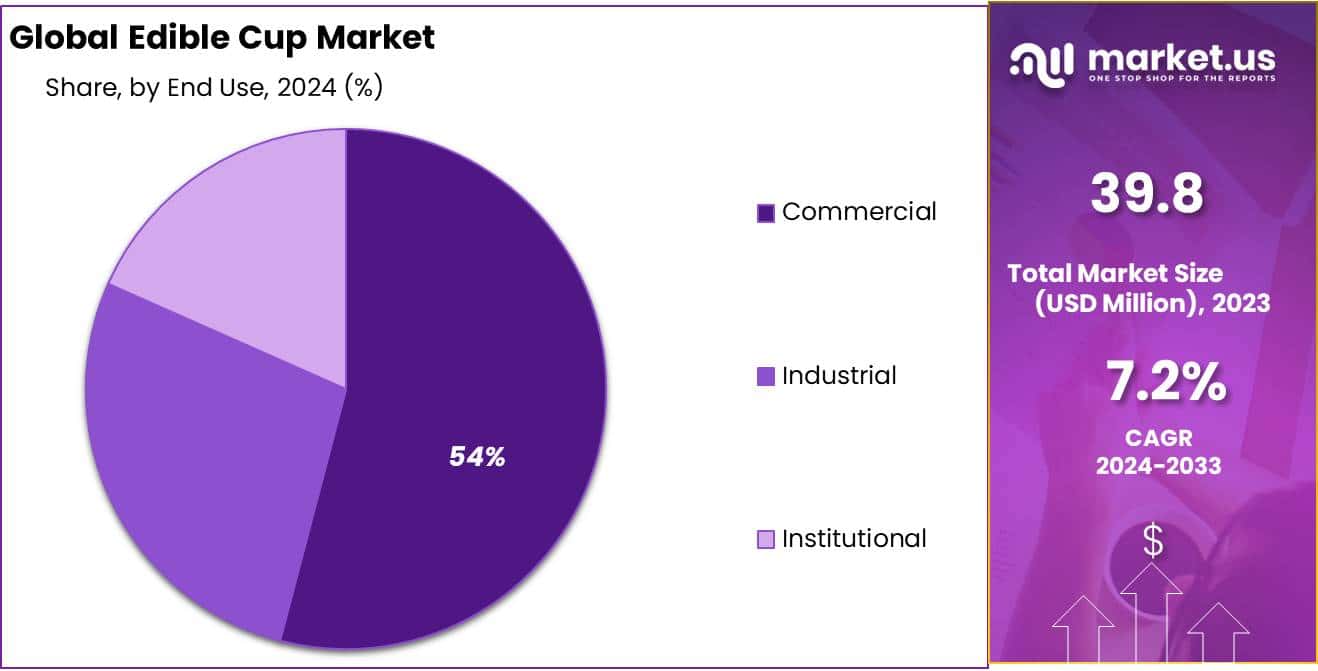

- Commercial held a dominant market position, capturing more than a 53.4% share.

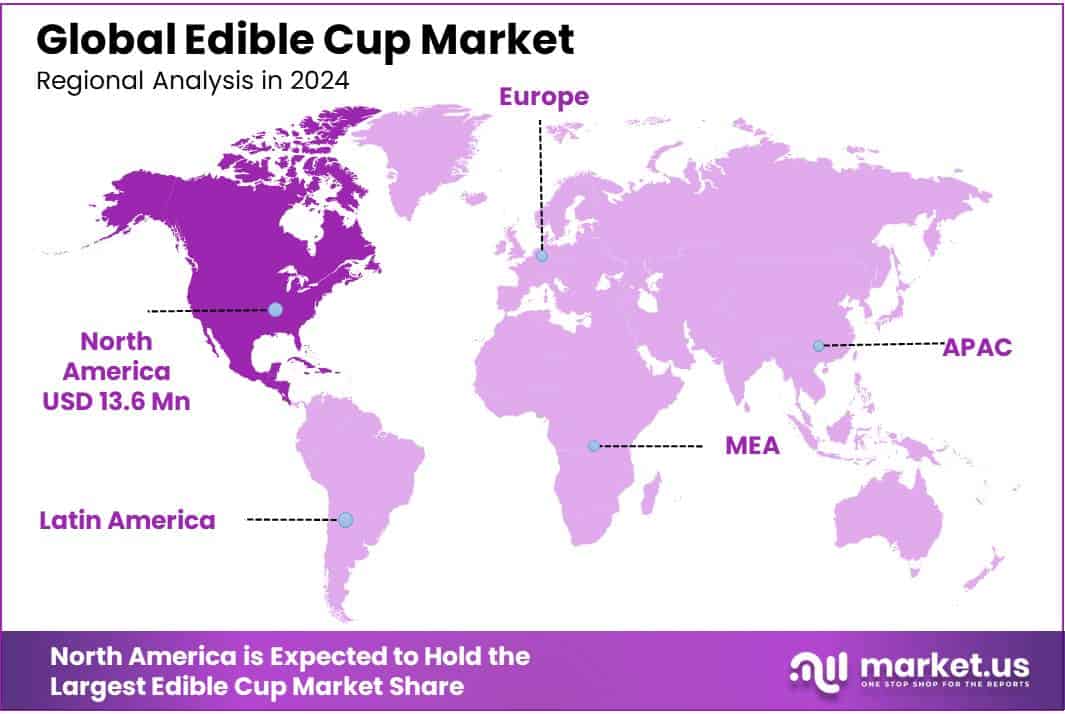

- North America, with a dominant share of 34% amounting to USD 13.6 million.

By Material

In 2023, Sugar held a dominant market position, capturing more than a 45.2% share. This segment benefits significantly from its versatility and cost-effectiveness, appealing broadly to manufacturers and consumers alike. Sugar-based edible cups are favored for their ability to complement a variety of beverages and desserts without altering the flavor profile.

The Chocolate segment also shows considerable market presence, appreciated for its rich flavor and appeal, particularly in luxury and specialty markets. Chocolate cups are often utilized in catering and event settings, providing an indulgent, no-waste option for dessert servings.

Cookies as an edible cup material have carved out a niche in the market. These cups offer a unique textural contrast to liquid contents, making them popular in cafes and casual dining venues. They are particularly favored for hot beverages like coffee or tea, where they serve a dual function as a snack and container.

By Capacity

In 2023, the 60 to 100 ml segment held a dominant market position, capturing more than a 52.3% share. This capacity range is highly favored for its practicality, perfectly suiting the serving sizes commonly preferred for espresso shots and small desserts. Its popularity is bolstered by its convenience for event catering and personal celebrations, where moderate portions are typically served.

The segment for cups up to 50 ml caters primarily to specialty uses, such as sampling and single-shot beverages. Although smaller in volume, this segment appeals to niche markets looking for unique serving solutions that reduce waste and enhance presentation, particularly in high-end cafes and tasting events.

Cups with a capacity above 100 ml serve a growing market segment interested in larger servings. These are suitable for full-size desserts, smoothies, or larger coffee drinks. This segment is gradually expanding, driven by the demand for more substantial and versatile edible containers that align with the casual dining and fast-casual restaurant sectors. Each capacity range addresses specific market needs, contributing to the diverse applications and growth of the edible cup industry.

By Application

In 2023, Hot Beverages (Coffee, Tea, etc.) held a dominant market position, capturing more than a 48.5% share. This segment benefits from the widespread cultural acceptance of hot drinks, which are consumed daily by a large segment of the global population. Edible cups used in this category enhance the consumer experience by adding an element of novelty and sustainability to the routine of coffee or tea consumption.

The Cold Beverages (Smoothies, Juices, etc.) segment also holds significant market appeal, particularly in the health and wellness industry. These edible cups are favored in settings where the emphasis is on organic and natural products. They offer a practical and eco-friendly solution that complements the clean-living ethos of their consumers, ideal for smoothies and fresh juices at health food cafes and outdoor events.

For Food Items, edible cups provide an innovative serving solution that turns ordinary meals into interactive experiences. This segment includes applications such as ice creams, snacks, and small bites, popular in both casual dining and luxury event catering.

The versatility of edible cups in food service helps reduce utensil waste and adds a creative twist to traditional dining setups, aligning with the increasing consumer preference for sustainability and novelty in food consumption. Each application leverages the unique properties of edible cups to enhance consumer enjoyment and market growth.

By End Use

In 2023, Commercial held a dominant market position, capturing more than a 53.4% share. This segment includes restaurants, cafes, and event caterers, where the demand for innovative and sustainable serving solutions is particularly strong. Edible cups in these settings enhance the customer experience by providing unique, waste-reducing alternatives to traditional serviceware.

The Industrial segment focuses on large-scale production capabilities for edible cups, supplying to commercial entities and institutional facilities. Although smaller in market share, this segment is vital for the development and distribution of edible cups, driven by advancements in food technology and production efficiencies.

Institutional use of edible cups, including schools, hospitals, and corporate environments, is growing as organizations seek to implement sustainable practices in their dining services. These settings value the dual benefits of convenience and reduced environmental impact, aligning with broader institutional goals for sustainability and health.

Key Market Segments

By Material

- Sugar

- Chocolate

- Cookies

- Others

By Capacity

- Up to 50 ml

- 60 to 100 ml

- Above 100 ml

By Application

- Hot Beverages (Coffee, Tea, etc.)

- Cold Beverages (Smoothies, Juices, etc.)

- Food Items

By End Use

- Industrial

- Commercial

- Institutional

Driving Factors

Environmental Sustainability Initiatives

One of the primary drivers propelling the growth of the edible cup market is the increasing global emphasis on environmental sustainability. Governments, consumers, and corporations are actively seeking alternatives to traditional single-use plastics to mitigate pollution and reduce ecological footprints.

Edible cups, being biodegradable and often made from natural ingredients, directly address these environmental concerns by providing a sustainable alternative to conventional disposable cups. This shift is supported by stricter regulations on plastic use in many regions, prompting businesses, especially in the food service industry, to adopt greener practices.

Consumer Demand for Innovative and Sustainable Products

The market for edible cups is further buoyed by a rising consumer preference for innovative products that align with personal health and environmental values. Edible cups, particularly those made from nutritious ingredients, cater to the health-conscious consumer while also providing a novel dining experience.

This trend is evident among younger demographics and trendsetters who are more open to trying new and unique products that differentiate from traditional offerings.

Technological Advancements in Food Production

Advances in food technology have significantly lowered barriers to the production of edible cups, making them more durable and versatile. This technological progress allows for the exploration of new flavors and materials, thereby expanding the market’s scope and potential applications.

The ability to customize these products for specific events or branding purposes also creates new marketing opportunities for businesses, enhancing consumer engagement and brand visibility.

Support from the Food and Beverage Industry

The adoption of edible cups within the food and beverage industry is crucial for market growth. As these products gain visibility, they are increasingly embraced for use with a variety of beverages and desserts, supported by collaborations and endorsements within the industry. This backing is vital for increasing consumer awareness and acceptance, helping to integrate edible cups into mainstream consumption patterns.

Restraining Factors

Limited Consumer Awareness and Adoption

One of the most significant challenges facing the growth of the edible cup market is limited consumer awareness and adoption. Many potential users remain unfamiliar with the concept of edible cups, and there is often a lack of understanding regarding their benefits and uses. This barrier is compounded by the novelty of the product and the need for targeted marketing strategies to educate consumers. Effective communication and educational campaigns are essential to increase consumer awareness and encourage adoption.

High Production and Retail Costs

Another critical restraining factor is the relatively high production costs associated with edible cups compared to traditional disposable options like plastic or paper cups. These increased costs can result in higher retail prices, potentially deterring cost-sensitive consumers and businesses from adopting this sustainable alternative. The complexity of manufacturing edible cups that meet both food safety standards and consumer expectations for taste and functionality adds to these costs, creating a price barrier for widespread adoption.

Shelf Life and Distribution Challenges

Edible cups often have a shorter shelf life than their non-edible counterparts, which poses significant challenges for distribution and inventory management. This limitation can lead to increased waste and logistical complications, making it difficult for retailers and food service providers to manage stocks effectively. Ensuring the freshness and quality of edible cups while minimizing waste requires efficient supply chain solutions, which can be both costly and complex to implement.

Regulatory and Compliance Issues

Navigating the stringent regulatory landscape associated with food products is another substantial hurdle. Edible cups must comply with various food safety regulations, which can vary significantly by region. Meeting these standards involves rigorous testing and quality control processes, which can delay product launches and increase overall costs. Additionally, manufacturers must ensure that their products are consistently safe to consume, further complicating production and quality assurance efforts.

Growth Opportunity

Expansion into New Regional Markets

One of the most significant growth opportunities for the edible cup market lies in its expansion into new geographic regions. As consumer awareness of sustainability increases globally, regions like Asia-Pacific and the Middle East are expected to offer new avenues for market penetration due to their rising disposable incomes and urbanization trends. For instance, the market in India is projected to grow significantly, driven by government initiatives to reduce plastic waste and a booming food and beverage sector seeking innovative, eco-friendly solutions.

Increased Consumer Demand for Sustainable Options

There’s a growing consumer preference for sustainable and eco-friendly products, which directly benefits the edible cup market. As more people become aware of the environmental impact of single-use plastics, the demand for alternatives like edible cups is expected to rise. This shift in consumer behavior is particularly notable in North America and Europe, where sustainability is a major concern, and regulatory support for green products is strong.

Technological Advancements in Product Development

Technological advancements offer another growth opportunity for the edible cup market. Innovations in food production technology have made it possible to enhance the durability, functionality, and aesthetic appeal of edible cups, making them more attractive to both consumers and businesses. As technology continues to evolve, it enables the creation of edible cups that can cater to a wider range of beverages and food items, potentially increasing market reach and consumer acceptance.

Strategic Collaborations and Marketing

Engaging in strategic collaborations with food and beverage companies, event organizers, and retail sectors can significantly boost the visibility and adoption of edible cups. Additionally, leveraging social media and digital marketing to raise consumer awareness and showcase the practicality and environmental benefits of edible cups can attract a broader audience. Such marketing strategies are essential in educating consumers and promoting the widespread adoption of edible cups as a viable alternative to traditional disposable cups

Latest Trends

Rising Popularity of Wafer-Based and Bread-Based Edible Cups

A major trend in the edible cup market is the increasing popularity of wafer-based cups. These cups are prized for their crisp texture and versatility, capable of holding both hot and cold beverages, making them a favorite among consumers for various culinary uses. Bread-based cups are also gaining traction, noted for their eco-friendliness and biodegradability. These cups are designed to hold beverages effectively without leakage and are compostable, aligning with growing environmental sustainability efforts

Integration with Social Media and Visual Marketing

The visual appeal of edible cups has become a key factor in their market success. Particularly in the United States, where social media culture heavily influences consumer choices, the vibrant and Instagram-worthy presentation of edible cups enhances their appeal. Businesses are leveraging these attributes to engage with environmentally conscious customers, promoting edible cups as both a practical and aesthetically pleasing option

Government Initiatives Promoting Sustainable Practices

Government regulations and initiatives promoting sustainable and eco-friendly packaging solutions continue to drive the adoption of edible cups. These efforts are particularly evident in markets like India, where there is a strong push towards reducing plastic waste. Such regulatory support is encouraging businesses to explore and adopt edible cups as a viable alternative to traditional single-use plastics

Regional Analysis

North America, with a dominant share of 34% amounting to USD 13.6 million, leads the global market. This region’s market is bolstered by a strong awareness of environmental issues and a high adoption rate of sustainable products. The U.S. and Canada are significant contributors, driven by proactive governmental policies encouraging the use of eco-friendly materials and a robust foodservice sector that increasingly integrates sustainable practices.

Europe follows closely, characterized by stringent EU regulations on single-use plastics which enhance the market’s growth potential. The region’s commitment to sustainability and the high visibility of environmental conservation efforts contribute to the growing demand for edible cups, especially in countries like Germany, the UK, and France. Europe’s focus on innovative and sustainable packaging solutions makes it a critical market for edible cups.

Asia Pacific is identified as the fastest-growing region due to its rising middle class, increasing urbanization, and expanding food and beverage industry. Countries like China, India, and Japan are seeing increased consumer interest in sustainable dining options, supported by government initiatives aimed at reducing plastic waste. The market in Asia Pacific benefits from both increased consumer spending power and heightened environmental awareness.

The Middle East & Africa and Latin America are emerging markets with untapped potential. These regions show a gradual increase in consumer awareness about sustainability, though growth is moderated by economic variability and less stringent regulatory frameworks compared to North America and Europe. However, increasing urbanization and the influence of global trends are expected to drive future market expansion in these areas.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Amcor Ltd. and Berry Global Group, Inc. are prominent players, renowned for their extensive experience and broad product portfolios in sustainable packaging solutions. These companies are pivotal in driving advancements and adoption of new technologies in the market. Huhtamäki Oyj and Sonoco Products Company also contribute significantly, leveraging their global presence and expertise in eco-friendly packaging to meet the rising demand for sustainable options.

Bakeys and The Edible Cup Company specialize in unique and innovative edible cup solutions, focusing on market niches that appeal to eco-conscious consumers. Bakeys, for instance, is known for its edible cutlery made from sorghum, offering a compostable alternative to traditional plastic. Eco Cup and MoChill reflect the trend towards bespoke and consumer-friendly products that cater to specific dietary and environmental preferences.

AR Packaging Group AB and Constantia Flexibles Group GmbH are pivotal in enhancing the edible cups’ market reach through strategic partnerships and expansion into new geographical markets. The industry is also witnessing a surge in creative solutions from entities like Wiki Eats and Scoff Paper, which are introducing visually appealing and functional designs to captivate a broader audience. These players collectively drive the industry forward by balancing innovation with practical solutions to sustainability challenges in the foodservice and packaging sectors.

Top Key Players in the Market

- Amcor Ltd.

- AR Packaging Group AB

- Bakeys

- Bemis Company, Inc.

- Berry Global Group, Inc.

- CCL Industries Inc

- Constantia Flexibles Group GmbH

- DS Smith Plc

- Eco Cup

- Forn De Sant Francesc

- Huhtamäki Oyj

- MoChill

- Mondi Group

- Muuse

- Ooh La La

- Papamania

- Scoff Paper

- Sealed Air Corporation

- Sonoco Products Company

- The Edible Cup Company

- The Good Side

- Wiki Eats

Recent Developments

In 2023, Amcor, along with other major industry participants like Constantia Flexibles Group GmbH and Berry Global Group, Inc., has been actively involved in developing and distributing innovative edible cup solutions aimed at reducing plastic waste and enhancing consumer convenience.

In 2023, Bakeys, an Indian company based in Hyderabad, has distinguished itself in the edible cups sector by focusing on eco-friendly alternatives to disposable utensils.

Report Scope

Report Features Description Market Value (2023) USD 39.8 Mn Forecast Revenue (2033) USD 79.8 Mn CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Sugar, Chocolate, Cookies, Others), By Capacity (Up to 50 ml, 60 to 100 ml, Above 100 ml), By Application (Hot Beverages (Coffee, Tea, etc.), Cold Beverages (Smoothies, Juices, etc.), Food Items), By End Use (Industrial, Commercial, Institutional) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor Ltd., AR Packaging Group AB, Bakeys, Bemis Company, Inc., Berry Global Group, Inc., CCL Industries Inc, Constantia Flexibles Group GmbH, DS Smith Plc, Eco Cup, Forn De Sant Francesc, Huhtamäki Oyj, MoChill, Mondi Group, Muuse, Ooh La La, Papamania, Scoff Paper, Sealed Air Corporation, Sonoco Products Company, The Edible Cup Company, The Good Side, Wiki Eats Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amcor Ltd.

- AR Packaging Group AB

- Bakeys

- Bemis Company, Inc.

- Berry Global Group, Inc.

- CCL Industries Inc

- Constantia Flexibles Group GmbH

- DS Smith Plc

- Eco Cup

- Forn De Sant Francesc

- Huhtamäki Oyj

- MoChill

- Mondi Group

- Muuse

- Ooh La La

- Papamania

- Scoff Paper

- Sealed Air Corporation

- Sonoco Products Company

- The Edible Cup Company

- The Good Side

- Wiki Eats