Global Functional Flours Market Size, Share, And Industry Analysis Report By Source (Oats, Cereals, Rye, BuckWheat, Barley, Quinoa, Others), By Legumes (Pea, Lentil, Soybean, Others), By Application (Bakery and Confectionery, Savory Snacks, Soups and Sauces, Ready To Eat Products, Baby Food, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171808

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

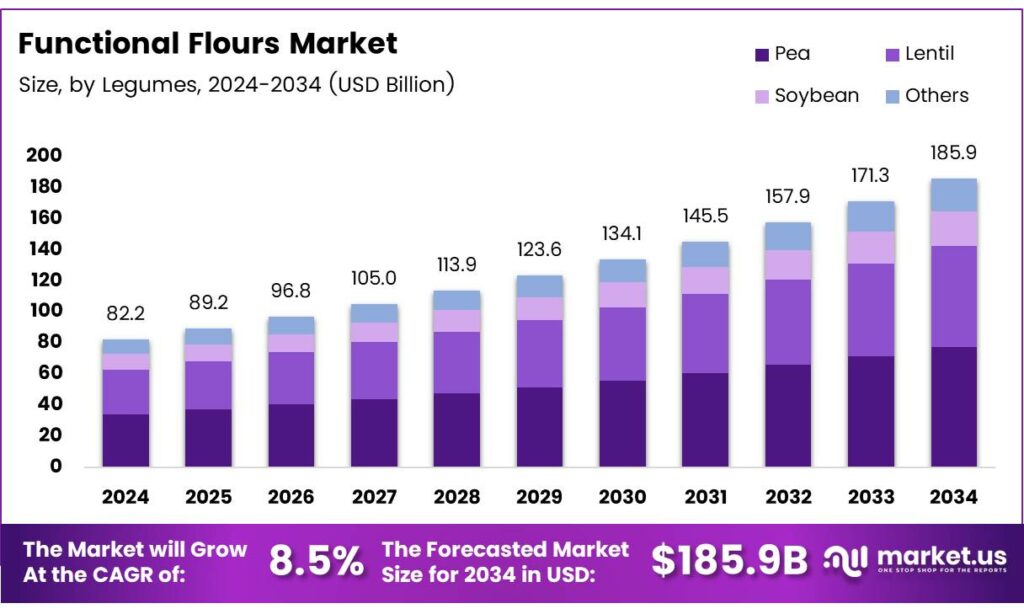

The Global Functional Flours Market size is expected to be worth around USD 185.9 billion by 2034, from USD 82.2 billion in 2024, growing at a CAGR of 8.5% during the forecast period from 2025 to 2034.

The Functional Flours Market represents a fast-developing segment within the global food ingredients landscape, driven by rising demand for clean-label, high-nutrition, and naturally processed flour solutions. These flours go beyond basic baking performance and deliver enhanced viscosity, stability, fiber enrichment, and better nutritional value across bakery, snacks, soups, sauces, and infant foods.

Functional flours continue gaining industry attention as food companies shift toward healthier, minimally processed ingredients. Rising consumer interest in gluten-free, high-protein, and high-fiber diet patterns boosts adoption across retail and industrial channels. Moreover, plant-based eating trends strengthen long-term growth prospects for flours made from pulses, ancient grains, and specialty cereals.

Toward the scientific side, gluten-free cereal flours continue evolving. Commercial gluten-free flours, seven flours: rice, oat, sorghum, foxtail millet, amaranth, quinoa, and buckwheat were evaluated for thermo-mechanical behavior and solvent retention capacity. Doughs were tested at water absorption levels WA1, providing 1.1 Nm consistency, and WA2 above 85% for full hydration.

- Additionally, contains high-quality proteins with balanced amino acids, including 11S globulin (37%), 2S albumin (35%), and 0.5–7% prolamine, while offering strong vitamin-E stability. Amaranth showed 50–60% albumins and globulins, high digestibility, and elevated methionine, cysteine, and lysine levels, supporting its premium positioning in functional flour innovation.

As consumers prioritize nutritional quality, ancient grains such as quinoa, amaranth, and buckwheat experience renewed demand. Functional flours from these sources help manufacturers create premium bakery mixes, dairy alternatives, and clean-label convenience foods. Their rich nutrient profiles make them ideal for fortification, allowing brands to differentiate in competitive categories like sports nutrition and functional beverages.

Key Takeaways

- The Global Functional Flours Market is valued at USD 82.2 billion in 2024 and is projected to reach USD 185.9 billion by 2034, at a CAGR of 8.5% from 2025 to 2034.

- Oats dominate the By Source segment with a leading share of 31.7% in 2024, supported by high fiber and health appeal.

- Pea flour leads the By Legumes segment with a substantial 39.5% market share due to its high protein content.

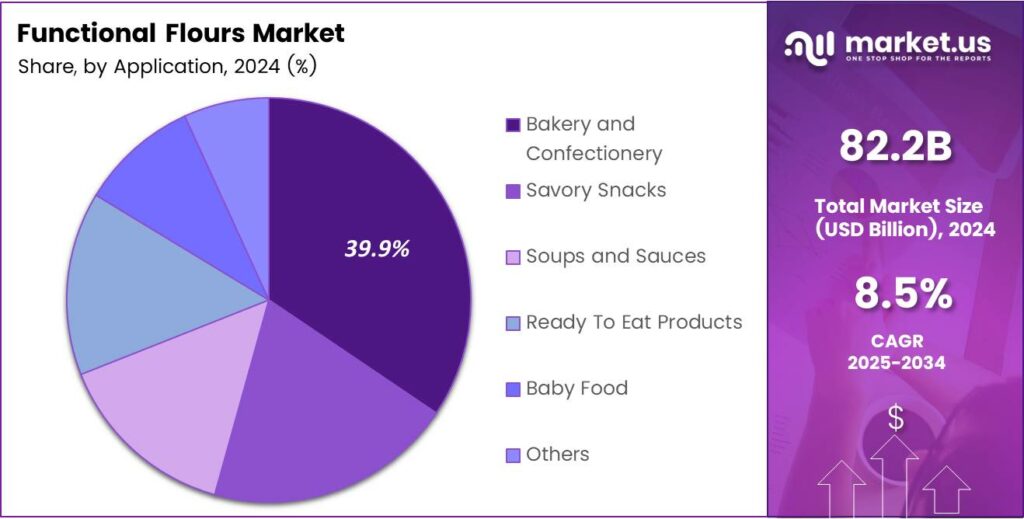

- Bakery and Confectionery is the top Application segment, accounting for a dominant 39.9% share in 2024.

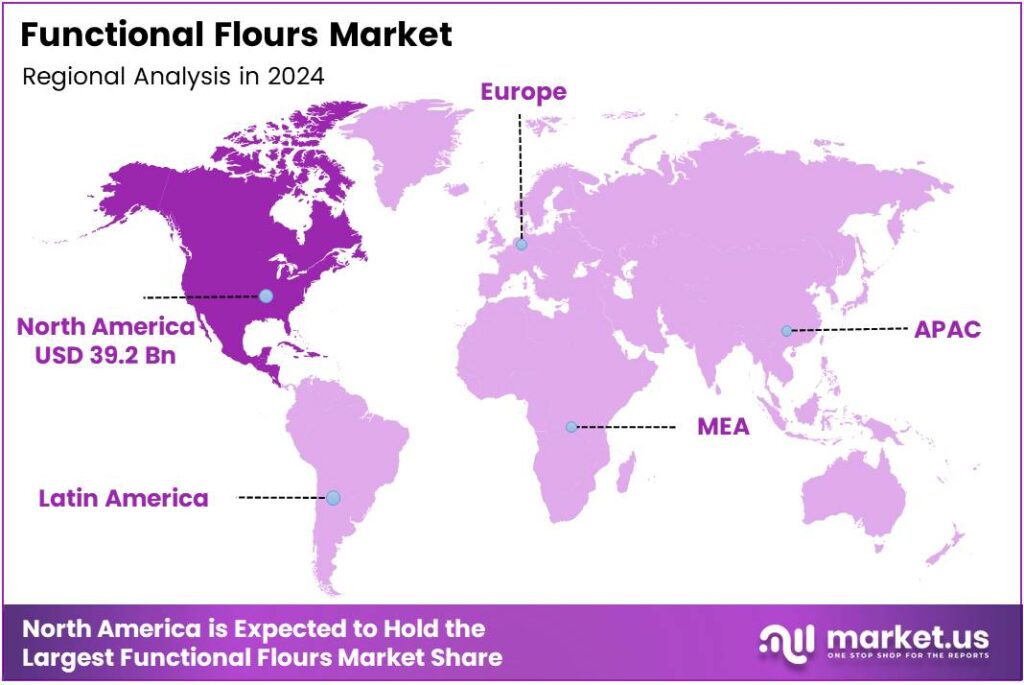

- North America holds the leading regional share of 47.8%, valued at USD 39.2 billion in 2024.

By Source Analysis

Oats dominate the segment with a 31.7% share due to their strong nutritional profile and wide use in healthy foods.

In 2024, Oats held a dominant market position in the By Source Analysis segment of the Functional Flours Market, with a 31.7% share. Their strong fiber content and clean-label appeal continue to boost demand. Brands increasingly use oat flour to enhance texture while keeping recipes natural and allergen-friendly.

Cereals maintained steady traction as manufacturers expanded product offerings in breakfast items, bakery mixes, and fortified snacks. Their versatility supports different processing techniques, allowing producers to design affordable and nutrient-enriched flour blends for mass consumption. Growing interest in whole-grain diets further supports cereal-based flour expansion worldwide.

Rye gained attention as consumers showed interest in rich-flavored bakery products. Its dense texture and digestive benefits encourage niche producers to adopt rye flour in rustic breads, crackers, and wellness-focused baked items. Growth continues as premium craft bakeries promote rye-based alternatives for customers seeking deeper flavors and better satiety.

Buckwheat advanced as gluten-free demand rose across key markets. Its natural amino-acid balance makes it attractive for specialty foods, especially in markets where gluten avoidance is growing. Companies explore buckwheat for pancakes, noodles, and functional snack bases that provide an earthy taste and strong nutritional density.

By Legumes Analysis

Pea flour leads the category with a 39.5% share because of its protein density and clean-label suitability.

In 2024, Pea held a dominant market position in the By Legumes Analysis segment of the Functional Flours Market, with a 39.5% share. Its high protein and neutral flavor help manufacturers improve nutritional labels. Pea flour is rising in bakery mixes, plant-based foods, and performance-oriented nutrition formats.

Lentil flour expanded steadily as consumers sought iron-rich and fiber-dense ingredients. Its mild taste suits bakery items, snacks, and baby food blends. Producers value its emulsifying properties, which support stable dough structures. Growth continues as lentil-based products attract families looking for natural nutrient enhancement.

Soybean flour remained vital due to its strong protein quality and affordability. It helps improve browning and moisture retention in baked goods. Many manufacturers rely on soybean flour to offer cost-effective enrichment across diverse recipes, including savory snacks and ready-to-eat foods, driving stable adoption.

By Application Analysis

Bakery and Confectionery dominates with a 39.9% share due to strong consumption of healthier baked goods.

In 2024, Bakery and Confectionery held a dominant market position in the By Application Analysis segment of the Functional Flours Market, with a 39.9% share. Demand for fiber-rich breads, cookies, and pastries fuels growth. Food brands increasingly choose functional flours to improve texture and nutrition in mainstream bakery products.

Savory Snacks adopted functional flours to enhance crispiness and reduce oil absorption. Manufacturers explore corn-free and allergen-friendly formulas to target new consumer groups. The shift toward cleaner ingredient labels continues shaping innovation, especially as younger buyers prioritize healthier and high-protein snack choices.

Soups and Sauces used functional flours for thickening, stability, and shelf-life benefits. These flours help create smooth textures without artificial additives. Producers adopt oat, barley, and legume-based options to meet natural ingredient expectations while maintaining consistent viscosity during both cooking and packaging processes.

Ready-to-Eat Products increasingly incorporate functional flours to support convenient nutrition. Their binding and hydration properties help maintain freshness in meal kits and instant foods. As quick-meal adoption rises globally, producers rely on diverse flour types to enhance structure, taste, and nutritional claims.

Key Market Segments

By Source

- Oats

- Cereals

- Rye

- BuckWheat

- Barley

- Quinoa

- Others

By Legumes

- Pea

- Lentil

- Soybean

- Others

By Application

- Bakery and Confectionery

- Savory Snacks

- Soups and Sauces

- Ready To Eat Products

- Baby Food

- Others

Emerging Trends

Growing Shift Toward Plant-Based Nutrition Fuels Product Innovation

A major trending factor in the functional flours market is the rising shift toward plant-based diets. Consumers are looking for natural, plant-derived ingredients in everyday foods, and functional flours fit perfectly into this trend. They help manufacturers replace artificial thickeners and emulsifiers with natural alternatives.

- Functional flours made from pulses, seeds, and legumes offer 20–28% protein content, making them ideal for snacks, bakery items, and fortified foods. According to the UN FAO, global pulse production crossed 96 million tonnes, driven by rising demand for plant-based protein ingredients.

Plant-based bakery, snacks, and beverages increasingly use functional flours to improve structure and stability. This has led to a surge in innovation, with companies exploring ancient grains, legumes, and specialty seeds to create new flour blends with enhanced properties.

Drivers

Rising Demand for Clean-Label and Healthy Food Drives Market Growth

Growing consumer interest in clean-label foods is becoming a strong driver for functional flours. People now prefer products with simple ingredients, and functional flours support this demand naturally. Manufacturers rely on these flours to improve texture, nutrition, and stability without artificial additives.

- This shift is especially visible in bakery and snacks, where clean-label claims attract buyers. As more consumers read ingredient lists closely, brands use functional flours to maintain product quality while keeping labels simple. The FAO reports that global dietary fiber intake still averages only 20 g/day, far below the recommended 25–30 g/day for adults, prompting manufacturers to use fiber-dense flours like chickpea, lentil, and millet flour to address these needs.

Functional flours also help food producers respond to rising interest in high-fiber and nutrient-rich diets. They enhance product value by improving thickness, shelf life, and overall sensory experience. With nutrition-focused eating becoming a daily priority, the demand for functional flours grows steadily.

Restraints

Higher Production Costs Limit Large-Scale Market Expansion

One major restraint for the functional flours market is the high cost of processing and manufacturing. Producing functional flours requires advanced techniques like heat treatment, enzymatic modification, and specialty milling, which increase overall production expenses. Smaller manufacturers often struggle to invest in such technologies.

- These higher costs also affect pricing, making functional flours more expensive than regular flours. Food companies operating on tight budgets may hesitate to switch, especially when producing large volumes. The USDA reported that over 40% of wheat-producing areas in the U.S. experienced drought, reducing yields and altering flour absorption properties.

Functional flour production depends on consistent grain quality, but weather variations and crop shortages can disrupt availability. This forces manufacturers to pay more for raw materials, further increasing costs and reducing margin flexibility. Additionally, maintaining product consistency across batches requires strict quality control.

Growth Factors

Expanding Gluten-Free and Allergen-Free Product Demand Creates New Opportunities

The rapid rise of gluten-free and allergen-free foods offers strong growth potential for the functional flours market. Many consumers are adopting gluten-free diets due to health preferences, lifestyle choices, or intolerance. Functional flours made from sorghum, quinoa, rice, or buckwheat offer natural solutions for these needs.

Food brands see major opportunities in using these flours to create better textures in gluten-free bakery, snacks, and ready-to-eat meals. Unlike standard gluten-free options, functional flours provide improved structure and mouthfeel, helping companies deliver higher-quality products that stand out on shelves.

The clean-label and plant-based movement further strengthens these opportunities. By launching new functional flour blends tailored for specific performance needs such as high viscosity, improved binding, or enhanced nutrition, companies can tap into new premium segments. Gluten-free and allergen-free categories remain key growth engines for the market.

Regional Analysis

North America Dominates the Functional Flours Market with a Market Share of 47.8%, Valued at USD 39.2 Billion

North America leads the Functional Flours Market due to its strong demand for clean-label, gluten-free, and protein-enriched food products. Consumers in the region continue shifting toward healthier bakery, snacks, and ready-to-eat items, driving wider adoption of specialty flours. The region’s structured food regulations and rapid product innovation further support market expansion, making its share of 47.8% and value of USD 39.2 billion a reflection of consistent demand.

Europe shows steady growth supported by rising interest in sustainable ingredients, artisanal bakery culture, and plant-based food adoption. Consumers are increasingly choosing functional blends offering fiber enrichment and digestive health benefits. Strong food safety standards and higher purchasing power also encourage innovation in premium flour variants and fortified formulations across the region.

Asia Pacific is emerging as one of the fastest-growing regions due to expanding urban populations and rising demand for packaged foods. Local diets incorporating rice, millet, sorghum, and pulse-based flours further support market growth. Government programs encouraging food processing modernization strengthen regional production capabilities, accelerating the adoption of health-focused flour ingredients.

The U.S. remains a key contributor within North America, driven by consumer preference for organic, high-fiber, and gluten-free foods. Innovation in bakery, snacks, baby food, and sports nutrition supports strong market expansion. High awareness of ingredient quality and transparent labeling continues to shape demand for functional, nutrient-enhanced flour types.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Cargill, Inc. continues to shape the functional flours landscape by leveraging its scale in grain origination, processing, and food ingredient customization. Its strength lies in helping food brands reformulate for cleaner labels, better texture, and consistent performance across bakery, snacks, and convenience foods, especially where gluten-free and multi-grain blends need tight quality control.

Archer Daniels Midland Company stands out for its integrated approach—linking agricultural sourcing with ingredient solutions that target protein enrichment, fiber fortification, and sensory improvement. ADM’s value to buyers is reliability at volume, along with application support that shortens product development cycles for manufacturers moving toward healthier positioning without sacrificing taste.

Associated British Foods plc, the competitive edge in functional flours is tied to strong milling and ingredient capabilities that serve both retail and industrial channels. In 2024, its focus aligns with practical functionality—improving dough handling, shelf stability, and product consistency—supporting bakery and prepared food producers facing rising quality expectations and tight cost management.

Ingredion Incorporated is viewed as a formulation-driven player, helping customers use functional flours to deliver specific outcomes such as viscosity control, moisture management, and texture enhancement. Its role is especially relevant for “better-for-you” launches, where brands must balance nutrition claims with eating quality, and where ingredient performance must stay stable across different production lines and regions.

Top Key Players in the Market

- Cargill, Inc.

- Archer Daniels Midland Company

- Associated British Foods plc

- Ingredion Incorporated

- Bunge Limited

- Parrish and Heimbecker Limited

- Südzucker AG

- The Scoular Company

- GEMEF Industries

- The Caremoli Group

Recent Developments

- In 2024, Cargill has focused on innovations in functional ingredients and starches that support healthier bakery products, aligning with the functional flours sector through nutritional enhancements and label-friendly solutions. Cargill introduced SimPure Bright, a new line of functional label-friendly starches designed for bakery applications.

- In 2024, ADM has advanced in nutrition solutions and regenerative practices that enhance functional flours, with emphasis on gut health, fortification, and consumer trends in bakery and ingredients. ADM released an eBook on baked goods for gut-conscious consumers, noting that U.S. adults experience digestive discomfort monthly and seeking solutions through functional bakery mixes.

Report Scope

Report Features Description Market Value (2024) USD 82.2 Billion Forecast Revenue (2034) USD 185.9 Billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Oats, Cereals, Rye, BuckWheat, Barley, Quinoa, Others), By Legumes (Pea, Lentil, Soybean, Others), By Application (Bakery and Confectionery, Savory Snacks, Soups and Sauces, Ready To Eat Products, Baby Food, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cargill, Inc., Archer Daniels Midland Company, Associated British Foods plc, Ingredion Incorporated, Bunge Limited, Parrish and Heimbecker Limited, Südzucker AG, The Scoular Company, GEMEF Industries, The Caremoli Group Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Functional Flours MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Functional Flours MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill, Inc.

- Archer Daniels Midland Company

- Associated British Foods plc

- Ingredion Incorporated

- Bunge Limited

- Parrish and Heimbecker Limited

- Südzucker AG

- The Scoular Company

- GEMEF Industries

- The Caremoli Group