Global Distributed Control System Market Size, Share Analysis Report By Component (Hardware, Software, Services), By Application (Continuous Process, Batch Process), By End Use ( Chemicals, Metals and Mining, Oil and Gas, Pharmaceuticals, Power Generation, Pulp and Paper, Food and Beverages, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160598

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

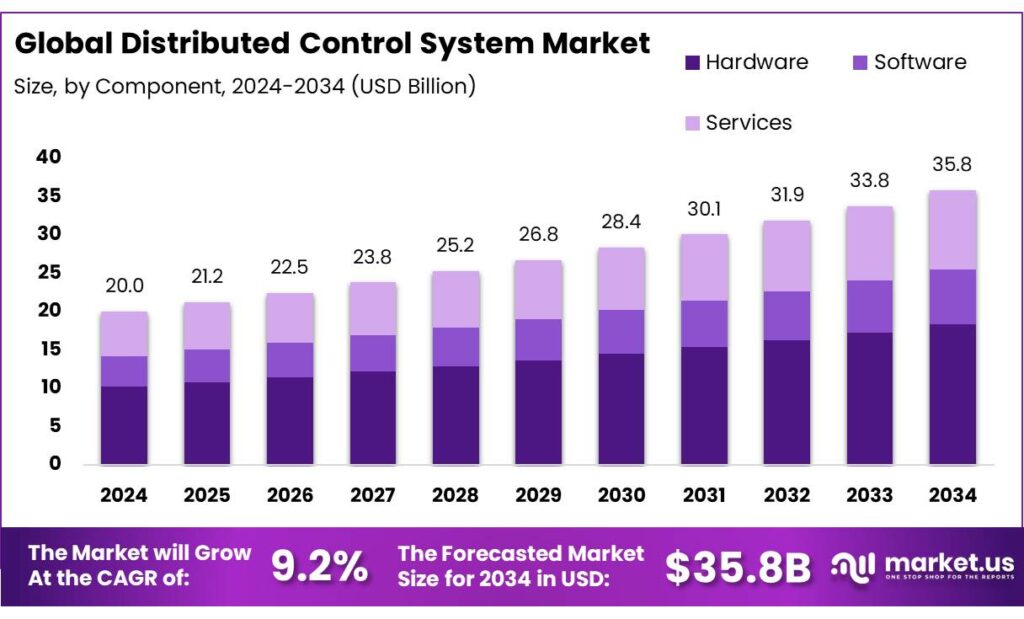

The Global Distributed Control System Market size is expected to be worth around USD 35.8 Billion by 2034, from USD 20 Billion in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034.

The Distributed Control System (DCS) market revolves around a digital automation technology that manages industrial processes through geographically distributed controllers connected via digital networks. This decentralized control architecture allows for high reliability and real-time monitoring across diverse industries such as power generation, oil and gas, chemicals, pharmaceuticals, and food processing.

For instance, In February 2024, Schneider Electric, Intel, and Red Hat introduced a Distributed Control Node (DCN) framework that uses a software-defined, plug-and-play system to simplify industrial automation, cut costs, and improve scalability and interoperability across sectors.

Key driving factors for the DCS market include the escalation of industrial automation and the push for operational efficiency across sectors. Integration with emerging technologies such as the Industrial Internet of Things (IIoT), artificial intelligence (AI), cloud computing, and advanced analytics substantially enhance the performance, predictive maintenance, and decision-making capabilities of DCS.

The rising global focus on clean and renewable energy sources requires robust process control systems to efficiently manage wind, solar, and other renewable power plants spread over wide geographical areas, thus fueling adoption. Additionally, governmental regulatory demands for environmental safety and energy efficiency support the transition to advanced DCS solutions.

The industrial scenario for DCS is driven by rapid digitalization of energy and process sectors and by large public investments in grid and generation modernization. Global adoption of digital control and monitoring has been amplified by the proliferation of connected devices, which reached an estimated 13 billion in 2023 – a development that has expanded telemetry, asset-level control and remote operations use cases for DCS platforms.

- Major national programmes and funding streams have further underpinned DCS demand: for example, the U.S. Department of Energy announced a $38 million funding opportunity to accelerate grid modernization research in 2024, and ARPA-E allocated $88 million to selected grid modernization projects in FY2023 – investments that increase deployment of advanced automation and control systems in utilities and large industrial plants.

Key driving factors for DCS market growth include the integration of intermittent renewable generation, the need for resilience against extreme weather, and the drive to improve energy efficiency and emissions reporting.

National energy investment trends illustrate the scale of opportunity: capital spending in India’s energy sector reached approximately USD 68 billion in 2023, with nearly half directed to low-emission power generation – a financing environment that supports modern control system retrofits and greenfield DCS deployments. Additionally, national missions such as India’s National Green Hydrogen Mission were budgeted at INR 19,744 crore, creating future process-control requirements for hydrogen production and associated facilities.

Key Takeaways

- Distributed Control System Market size is expected to be worth around USD 35.8 Billion by 2034, from USD 20 Billion in 2024, growing at a CAGR of 9.2%.

- Hardware held a dominant market position, capturing more than a 51.2% share.

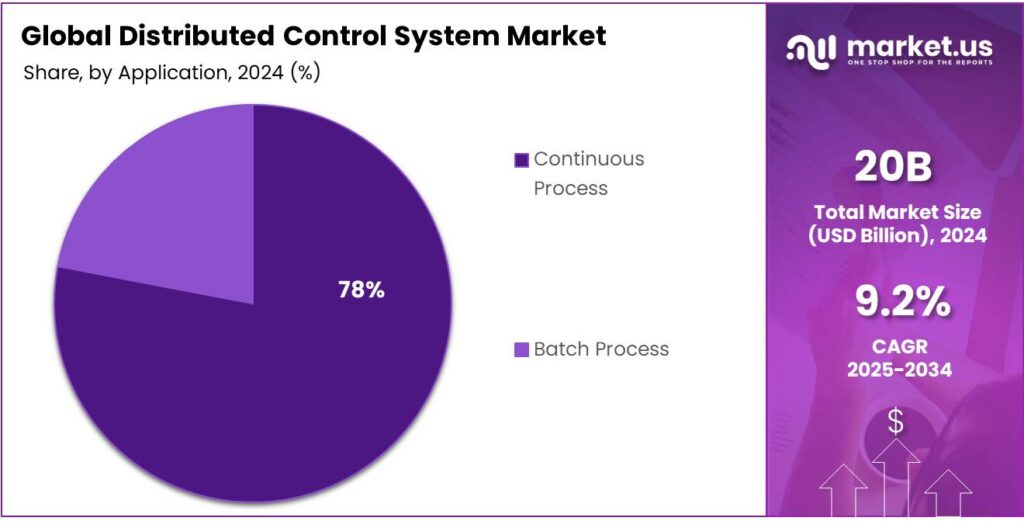

- Continuous process applications held a dominant market position, capturing more than a 78.4% share.

- Chemicals sector held a dominant market position, capturing more than a 31.3% share.

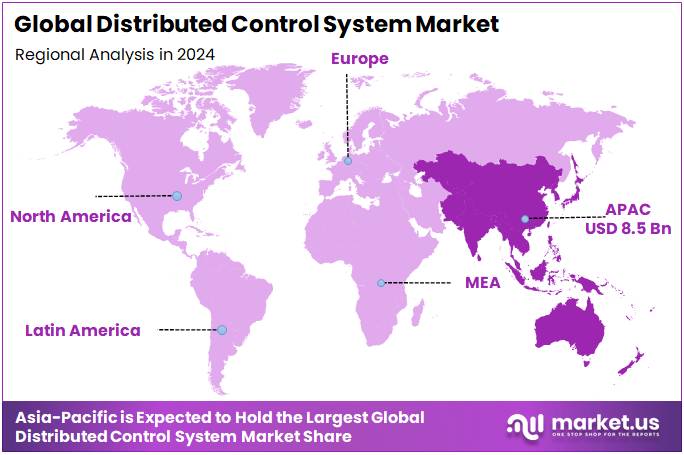

- Asia Pacific region accounted for a dominant 42.90% share of the distributed control system market, representing approximately USD 8.5 billion.

By Component Analysis

The hardware component dominates the distributed control system market by accounting for 51.2% of the share.

This leadership is driven by the importance of physical control devices such as controllers, sensors, and I/O modules that are essential for real-time process management. Robust hardware is critical to ensuring the reliability and precision of distributed control systems in demanding industrial settings.

The increasing adoption of advanced hardware, like modular controllers capable of handling complex and high-density control loops, is boosting this segment. Enhanced features such as universal I/O compatibility and redundant networking help reduce system downtime and improve maintenance efficiency, making hardware a favored choice among end users.

By Application Analysis

In 2024, The continuous process application segment takes a commanding lead with 78.4% share.

This segment includes industries like chemicals, power generation, and water treatment, where continuous and uninterrupted operation is crucial to production efficiency and safety. Distributed control systems are highly valued here for their ability to provide steady control and real-time monitoring that prevent downtime and production losses.

As industrial processes become more complex and operate around the clock, the demand for DCS solutions offering remote monitoring, predictive maintenance, and IoT integration grows stronger. These advancements allow plants to optimize performance and comply with strict regulations related to environmental protection and operational safety.

By End Use Analysis

In 2024, The chemicals industry contributes a significant 31.3% to the distributed control system market.

This sector demands high-level process control due to the hazardous and continuous nature of chemical manufacturing. Effective DCS deployment ensures safety, regulatory compliance, and enhanced operational efficiency in chemical plants.

Chemical manufacturing involves multiple input/output points and requires complex monitoring systems to maintain product quality and safeguard workers. The use of DCS allows companies to automate critical processes, reduce manual errors, and manage production flow efficiently, driving steady demand in this sector.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Application

- Continuous Process

- Batch Process

By End Use

- Chemicals

- Metals and Mining

- Oil & Gas

- Pharmaceuticals

- Power Generation

- Pulp & Paper

- Food & Beverages

- Others

Emerging Trends

Integration of Artificial Intelligence and IoT in Food Processing

The food processing industry in India is undergoing a significant transformation, driven by the integration of Artificial Intelligence (AI) and the Internet of Things (IoT). These technologies are enhancing operational efficiency, ensuring food safety, and enabling real-time monitoring of production processes.

According to the Indian Food Processing Industry report, the market for food processing technology is projected to grow to ₹2.5 lakh crore (approximately $30 billion) by 2024. This growth is attributed to the increasing adoption of automation and AI technologies in processing plants. Over 60% of food manufacturers in India are expected to adopt these technologies by 2025.

The government’s initiatives, such as the Pradhan Mantri Kisan Sampada Yojana (PMKSY) and the Production Linked Incentive (PLI) Scheme, are accelerating this shift. These programs provide financial support and incentives to food processing units, encouraging them to adopt modern technologies and improve their infrastructure.

For instance, the PLI Scheme for Food Processing aims to boost investment and infrastructure in the sector. With an outlay of ₹10,900 crore, the scheme targets generating employment opportunities for 250,000 individuals by 2026-27 and enhancing exports. It also focuses on raising food processing capacity, resulting in processed food output of ₹33,494 crore.

Drivers

Government Initiatives Fueling Automation in India’s Food Processing Sector

The Indian government’s proactive approach to modernizing the food processing industry has significantly accelerated the adoption of automation technologies, including Distributed Control Systems (DCS). This strategic push aims to enhance food safety, improve efficiency, and bolster the sector’s contribution to the national economy.

A notable initiative is the Pradhan Mantri Kisan Sampada Yojana (PMKSY), which seeks to establish modern infrastructure along the food processing value chain, from farm to retail outlet. Under this scheme, financial support ranging from 35% to 75% of the project cost is provided, facilitating the establishment of Mega Food Parks, Integrated Cold Chain and Value Addition Infrastructure, and Agro Processing Clusters. As of 2023-24, over 41 Mega Food Parks and more than 800 projects have been approved under various sub-schemes, with an annual budget allocation of approximately ₹1,500 crores

Additionally, the Production Linked Incentive (PLI) Scheme for Food Processing aims to stimulate significant investment in food processing to enhance manufacturing and exports. This initiative focuses on ready-to-cook/ready-to-eat foods, marine products, fruits, and vegetables, among other innovative and organic products by small and medium enterprises (SMEs)

These government-backed programs have created a conducive environment for the integration of advanced automation systems, including DCS, in food processing units. By providing financial incentives and infrastructural support, the government has enabled food manufacturers to invest in state-of-the-art technologies that enhance production efficiency, ensure consistent product quality, and comply with stringent food safety regulations.

Restraints

High Initial Investment and Integration Challenges in India’s Food Processing Sector

Implementing Distributed Control Systems (DCS) in India’s food processing industry faces significant hurdles, primarily due to the substantial initial investment required and the complexities associated with integrating these advanced systems into existing operations.

The cost of setting up a DCS can be prohibitive, especially for small and medium-sized enterprises (SMEs) that constitute a significant portion of the food processing sector. These businesses often operate on tight margins and may lack the financial resources to invest in sophisticated automation technologies. The initial capital expenditure includes expenses for hardware, software, installation, and training, which can be a substantial burden for SMEs.

Moreover, integrating DCS into existing production lines poses technical challenges. Many food processing units in India still operate with legacy systems that are not compatible with modern DCS technologies. Upgrading these systems requires careful planning to ensure compatibility and minimize disruptions to ongoing operations. The process of retrofitting old equipment with new DCS components can be time-consuming and may lead to temporary halts in production, affecting overall efficiency and profitability.

Additionally, the lack of skilled personnel proficient in operating and maintaining DCS adds another layer of complexity. Training existing staff or hiring new employees with the necessary expertise involves additional costs and time. This shortage of skilled labor can delay the implementation of DCS and hinder the realization of its benefits.

Opportunity

Government Initiatives Accelerating Automation in India’s Food Processing Sector

The Indian government’s strategic initiatives are significantly propelling the adoption of automation technologies, including Distributed Control Systems (DCS), in the food processing industry. These efforts aim to modernize the sector, enhance productivity, and improve food safety standards.

A key initiative is the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme, launched in June 2020. This scheme provides financial assistance to micro food processing units to help them modernize their operations. Under this program, micro-units receive a 35% capital subsidy on project costs, up to a maximum of ₹10 lakh, and support for branding and marketing. As of July 2025, Gujarat has onboarded 675 beneficiaries—the highest in the country—demonstrating the scheme’s success in facilitating the adoption of modern technologies in food processing.

Additionally, the Production Linked Incentive (PLI) Scheme for Food Processing Industries aims to boost investment and infrastructure in the sector. With an outlay of ₹10,900 crore (approximately USD 1.31 billion), the scheme targets generating employment opportunities for 250,000 individuals by 2026-27 and enhancing exports. It also focuses on raising food processing capacity, resulting in processed food output of ₹33,494 crore.

These government-backed programs are creating a conducive environment for the integration of advanced automation systems, including DCS, in food processing units. By providing financial incentives and infrastructural support, the government is enabling food manufacturers to invest in state-of-the-art technologies that enhance production efficiency, ensure consistent product quality, and comply with stringent food safety regulations.

Regional Insights

Asia Pacific leads with 42.90% share (USD 8.5 bn) driven by large manufacturing base and energy transition investment

The region’s leadership stems from its large manufacturing base spanning chemicals, power, automotive, and pharmaceuticals industries. Investments in energy transition projects and industrial digitalization further boost DCS adoption.

Rapid industrialization, government initiatives aimed at sustainable energy, and modernization programs are key drivers in APAC. Countries like China, India, Japan, and South Korea are investing heavily in smart factories and grid modernization, enhancing the need for flexible and energy-efficient control systems across the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB has retained its leadership in the global DCS market through its flagship platforms ABB Ability System 800xA and Symphony Plus. It holds around 19.2% of the market (based on earlier data) and has been ranked #1 by ARC Advisory for DCS leadership for many years. Its strengths lie in multi-industry domain knowledge (oil & gas, chemicals, mining etc.), substantial investment in R&D, modular automation offerings, remote monitoring, and analytics for predictive maintenance.

Emerson is known for its DeltaV DCS system, which supports scalable architectures, advanced process control (including model-predictive control), modular design and strong compliance with standards like ISA-88 and ISA-95. Its solutions are used across refining, power generation, chemicals, life sciences etc., emphasising integration, diagnostics, optimization and cybersecurity. Emerson’s approach reduces engineering time and supports both new and existing installations by simplifying hardware/software configuration.

Honeywell’s Experion PKS remains a central DCS offering, with innovation lately focused on its HIVE architecture (Highly Integrated Virtual Environment) and Release R530. The company emphasizes flexibility (modular IO, controller virtualization), support for emissions monitoring, remote gateway operations, and alignment with energy transition trends. The system aims to reduce hardware footprint, improve lifecycle costs, and strengthen cybersecurity and resilience.

Top Key Players Outlook

- ABB

- Azbil Corporation

- Emerson Electric Co

- General Electric Company

- Honeywell International Inc.

- Valmet

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- NovaTech, LLC

- OMRON Corporation

- Rockwell Automation

- Schneider Electric

- Siemens

- Toshiba International Corporation

- Yokogawa Electric Corporation

Recent Industry Developments

- In October 2024, ABB released Freelance 2024 DCS with faster data transfer, stronger security, and improved connectivity. It integrates PROFINET, NAMUR Open Architecture, Ethernet APL, and Module Type Packages to support scalability, interoperability, and easier technology adoption. The system helps plant managers streamline operations, increase flexibility, and address skill gaps through an intuitive interface.

- In September 2024, Honeywell partnered with USA BioEnergy to deploy its Experion PKS DCS and safety systems at the Bon Wier biorefinery in Texas. The technology will support the conversion of wood waste into sustainable aviation fuel, improving operational efficiency, reducing downtime, and helping meet emission-reduction goals.

- In February 2024, LyondellBasell chose Emerson to upgrade control systems at its Wesseling facility in Germany. The butadiene and ethylene cracker units will run on Emerson’s DeltaV DCS and DeltaV Live software, supported by AMS Device Manager and MIMIC simulation for operator training.

- In February 2024, BASF selected ABB to supply the Distributed Control System for its first European greenfield Ethernet-APL project. Performance tests were completed in March 2023 using ABB Ability System 800xA in realistic production settings.

Report Scope

Report Features Description Market Value (2024) USD 20.0 Bn Forecast Revenue (2034) USD 35.8 Bn CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Application (Continuous Process, Batch Process), By End Use (Chemicals, Metals and Mining, Oil and Gas, Pharmaceuticals, Power Generation, Pulp and Paper, Food and Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Azbil Corporation, Emerson Electric Co, General Electric Company, Honeywell International Inc., Valmet, MITSUBISHI HEAVY INDUSTRIES, LTD., NovaTech, LLC, OMRON Corporation, Rockwell Automation, Schneider Electric, Siemens, Toshiba International Corporation, Yokogawa Electric Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Distributed Control System MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Distributed Control System MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Azbil Corporation

- Emerson Electric Co

- General Electric Company

- Honeywell International Inc.

- Valmet

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- NovaTech, LLC

- OMRON Corporation

- Rockwell Automation

- Schneider Electric

- Siemens

- Toshiba International Corporation

- Yokogawa Electric Corporation