Global Cassava Starch Market Size, Share, And Business Benefits By Type (Native, Modified), By Nature (Organic, Conventional), By Application (Food and Beverage (Bakery and Confectionery, Snacks and Cereals, Processed Food, Functional Food, Soups, Sauces, and Gravies, Beverages, Others), Pharmaceutical, Cosmetics and Personal Care, Paper, Textile and Adhesives, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150870

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

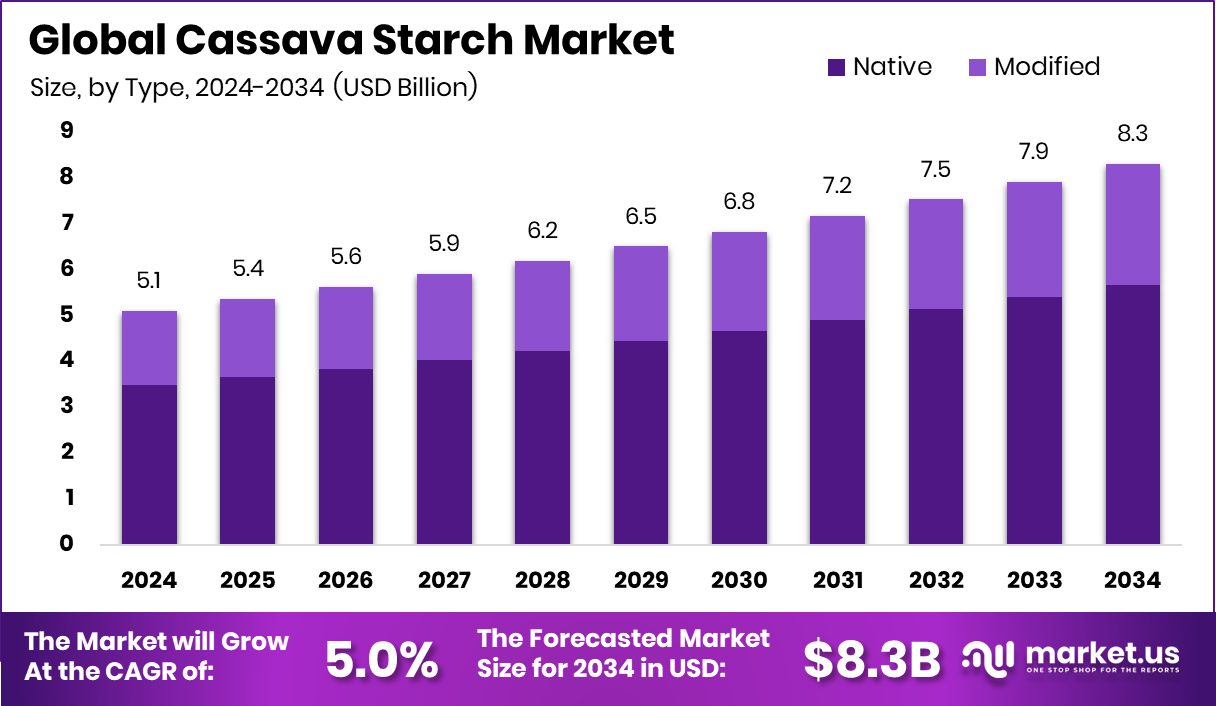

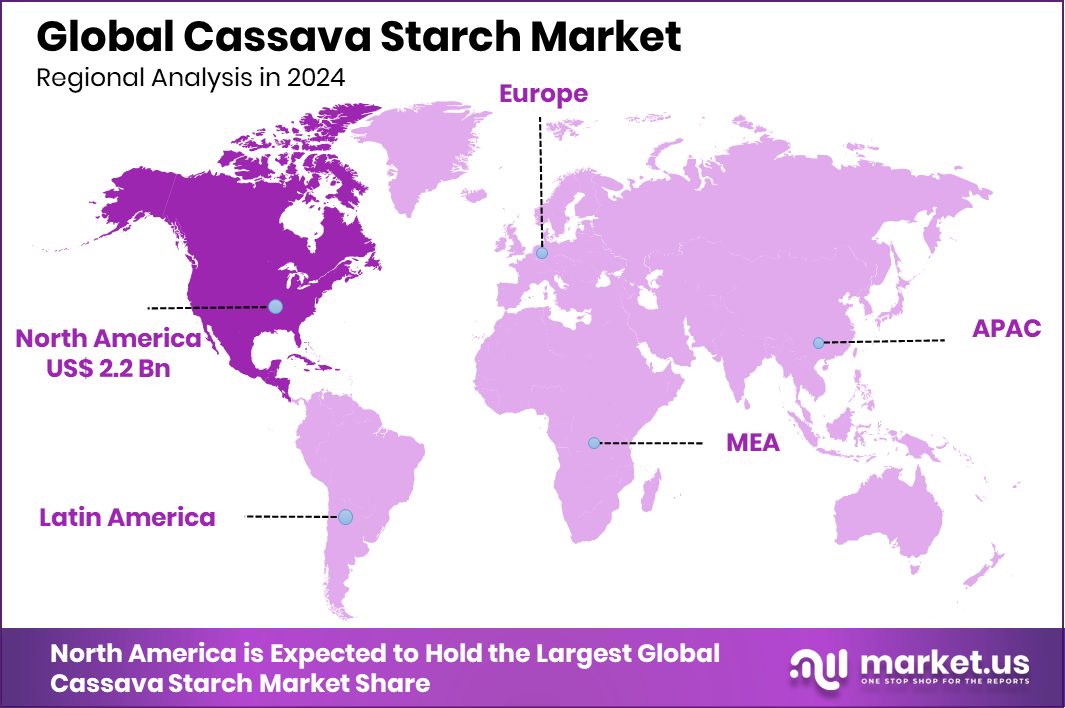

Global Cassava Starch Market is expected to be worth around USD 8.3 billion by 2034, up from USD 5.1 billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034. Strong demand for clean-label products drove North America’s USD 2.2 billion market.

Cassava starch is a natural carbohydrate extracted from the roots of the cassava plant, widely cultivated in tropical and subtropical regions. It is valued for its purity, neutral taste, and high level of viscosity, making it a versatile ingredient in food, textile, paper, and pharmaceutical industries. The starch is often used as a thickening, binding, or stabilizing agent and is a key component in gluten-free food products due to its smooth texture and digestibility.

The cassava starch market refers to the global trade and consumption of starch derived from cassava roots. This market serves a wide range of sectors, including food and beverage, cosmetics, pharmaceuticals, and industrial applications. With increasing awareness around clean-label and plant-based ingredients, cassava starch is gaining attention as a natural alternative to synthetic thickeners and modified starches.

A major factor driving growth in the cassava starch market is the rising demand for gluten-free and allergen-free food options. Consumers are becoming more health-conscious and turning to diets that exclude wheat and other grains, which makes cassava starch a preferred substitute. Its easy digestibility also adds to its appeal in the health and wellness sector.

The growing demand for biodegradable and sustainable materials is another contributing factor. Cassava starch is being explored for use in eco-friendly packaging, bioplastics, and other green solutions. Its biodegradable nature positions it as a viable alternative in industries seeking to reduce their environmental footprint.

Key Takeaways

- Global Cassava Starch Market is expected to be worth around USD 8.3 billion by 2034, up from USD 5.1 billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034.

- Native cassava starch holds a 68.3% share, dominating due to its wide industrial and culinary applications.

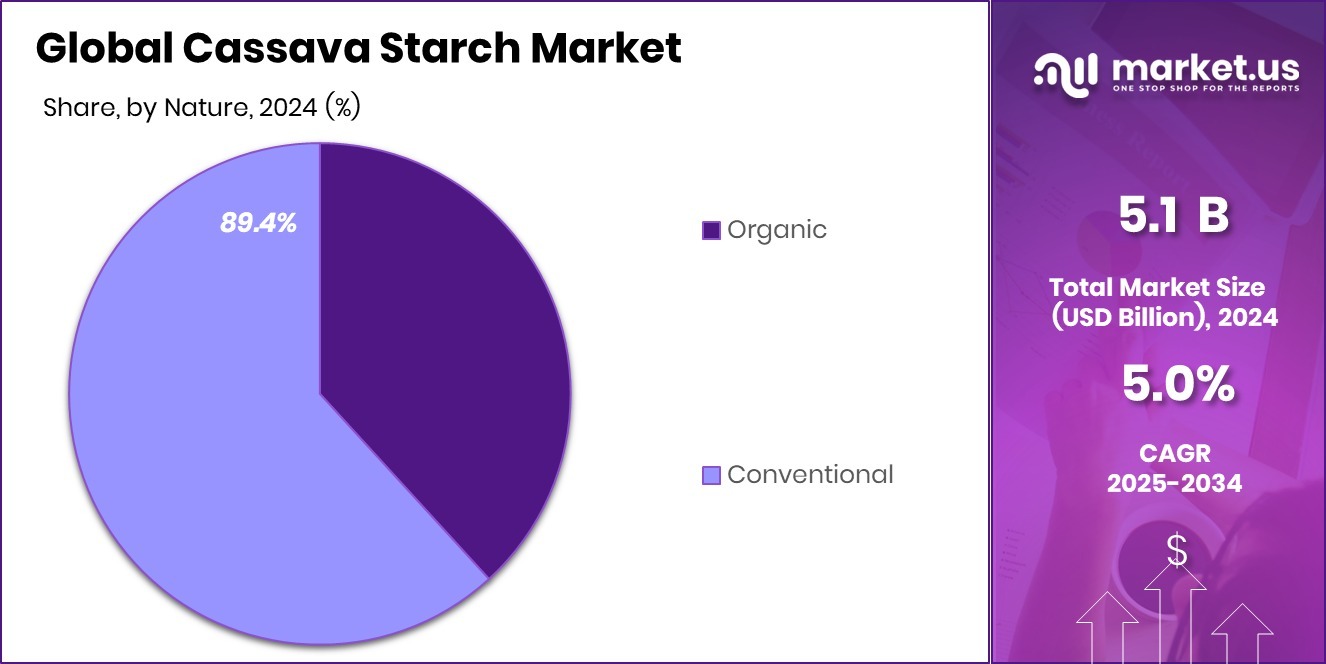

- Conventional cassava starch leads with 89.4%, driven by its affordability and established production methods.

- The food and beverage sector accounts for 39.1%, fueled by gluten-free demand and versatile uses.

- The market value in North America reached USD 2.2 billion in 2024.

By Type Analysis

Native cassava starch holds a 68.3% share in the cassava starch market.

In 2024, Native held a dominant market position in the By Type segment of the Cassava Starch Market, with a 68.3% share. This significant share reflects the continued preference for unmodified, natural forms of cassava starch across key end-use industries. Native cassava starch is widely favored due to its cost-effectiveness, functional versatility, and minimal processing requirements. It is commonly used in food and beverage formulations, especially in products targeting gluten-free and clean-label demands.

Industries such as paper and textiles also prefer native starch for its effective thickening and binding properties, without the need for chemical alterations. The ease of sourcing and processing native starch contributes to its widespread use, particularly in regions with established cassava cultivation. Additionally, increasing awareness of sustainable and biodegradable ingredients further supports the appeal of native cassava starch in industrial applications.

The 68.3% market share indicates robust consumption patterns and consistent demand, driven by both economic and environmental considerations. As industries continue to seek natural, adaptable starch options for diverse applications, native cassava starch remains a cornerstone product in the overall market landscape, securing its lead within the By Type segment for 2024.

By Nature Analysis

The cassava starch market is largely driven by conventional products at 89.4%.

In 2024, Conventional held a dominant market position in the By Nature segment of the Cassava Starch Market, with an 89.4% share. This overwhelming majority highlights the widespread adoption of conventionally produced cassava starch across both industrial and consumer applications. Conventional cassava starch benefits from well-established farming practices, easier scalability, and cost-effective production, making it the preferred choice for large-scale processing and export.

The high market share also reflects the dominance of conventional supply chains, particularly in regions where organic certification is either limited or not prioritized. Manufacturers across food processing, paper, textile, and pharmaceutical industries rely heavily on conventional starch due to its consistent quality, availability, and suitability for a wide range of formulations.

Additionally, the infrastructure supporting conventional cassava cultivation and processing is more mature and accessible, enabling producers to meet growing global demand efficiently. With fewer regulatory hurdles and lower input costs compared to organic variants, conventional cassava starch remains the mainstay in commercial production and applications.

By Application Analysis

The food and beverage sector leads the cassava starch market applications with 39.1% share.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Cassava Starch Market, with a 39.1% share. This leading position underscores the critical role cassava starch plays as a functional ingredient in the global food industry. Widely used as a thickener, stabilizer, and texturizing agent, cassava starch is a preferred choice in a range of products including sauces, soups, bakery goods, and ready-to-eat meals.

Its neutral taste, high viscosity, and gluten-free nature make it highly adaptable for modern food formulations, especially those catering to health-conscious consumers and special dietary requirements. The strong presence of cassava starch in food and beverage applications is further supported by consistent demand for processed and convenience foods, where functional starches are essential for texture and shelf-life stability.

The 39.1% market share reflects the steady incorporation of cassava starch into everyday food items, both in household and commercial food preparation. As global consumption patterns shift toward clean-label and plant-based ingredients, food manufacturers continue to rely on cassava starch for its reliable performance and consumer-friendly profile.

Key Market Segments

By Type

- Native

- Modified

By Nature

- Organic

- Conventional

By Application

- Food and Beverage

- Bakery and Confectionery

- Snacks and Cereals

- Processed Food

- Functional Food

- Soups, Sauces, and Gravies

- Beverages

- Others

- Pharmaceutical

- Cosmetics and Personal Care

- Paper, Textile, and Adhesives

- Animal Feed

- Others

Driving Factors

Rising Demand for Gluten-Free and Clean Food

One of the top driving factors for the cassava starch market is the growing demand for gluten-free and clean-label food products. As more people become health-conscious or are diagnosed with gluten intolerance, they are actively seeking alternatives to wheat-based products. Cassava starch, being naturally gluten-free and easy to digest, fits perfectly into these diets.

It is used in a variety of baked goods, snacks, sauces, and ready-to-eat meals, offering the right texture and stability without artificial additives. Its neutral flavor also makes it versatile for many recipes. As food brands aim to offer simpler ingredient lists and more natural options, cassava starch is becoming a popular choice, supporting the steady growth of its market worldwide.

Restraining Factors

Limited Shelf Life and Storage Handling Issues

A key restraining factor for the cassava starch market is its limited shelf life and the challenges related to storage and transportation. Cassava starch, especially in its native form, is sensitive to moisture and temperature. If not stored properly in dry and cool conditions, it can clump, spoil, or lose its functional properties. In humid regions or during long-distance shipping, maintaining its quality becomes difficult without proper packaging and climate control.

This creates extra costs for producers and distributors, especially in developing countries with poor storage infrastructure. These challenges can discourage buyers, limit export opportunities, and slow down market growth, especially when compared to more stable starch options that are easier to store and transport over time.

Growth Opportunity

Eco-Friendly Packaging Boosts Cassava Starch Demand

A major growth opportunity for the cassava starch market lies in its use for making eco-friendly packaging materials. With rising concern about plastic pollution, industries and governments are actively looking for sustainable alternatives. Cassava starch can be used to create biodegradable films and packaging products that naturally break down without harming the environment.

This makes it a strong option for replacing single-use plastics in packaging for food, cosmetics, and other goods. As more companies aim to reduce their environmental footprint, the demand for starch-based packaging is expected to grow. This opens up new opportunities for cassava starch producers to innovate and expand into green packaging, especially in markets that are pushing for plastic bans and eco-friendly solutions.

Latest Trends

Use of Cassava Starch in Plant-Based Foods

One of the latest trends in the cassava starch market is its growing use in plant-based and vegan food products. As more people shift to plant-based diets for health, environmental, or ethical reasons, food producers are looking for natural ingredients that add texture, stability, and smoothness to their recipes. Cassava starch works well in dairy-free yogurts, plant-based cheeses, and meat alternatives because it helps bind ingredients and improve mouthfeel.

Its clean, neutral taste also blends easily with other ingredients without affecting flavor. This trend is pushing innovation in food manufacturing, where cassava starch is being used in creative ways to meet consumer demands for tasty, plant-based options that are free from common allergens and artificial additives.

Regional Analysis

In 2024, North America held a 44.9% share of the cassava starch market.

In 2024, North America dominated the global cassava starch market with a commanding 44.9% share, valued at USD 2.2 billion. This strong position reflects the region’s growing demand for clean-label, gluten-free, and plant-based food products, where cassava starch serves as a preferred functional ingredient.

Well-developed food processing industries and increased consumer awareness around healthy eating habits continue to drive usage in both industrial and retail sectors. Europe also represents a steady market for cassava starch, supported by rising interest in sustainable packaging and allergen-free food alternatives.

In Asia Pacific, while not the dominant region, cassava starch consumption remains significant due to the presence of large cassava-producing countries and a high demand for traditional food products incorporating native starch.

The Middle East & Africa and Latin America are emerging markets, showing gradual growth driven by the expansion of the food and beverage sectors and increasing awareness of natural starch alternatives. Although these regions hold smaller shares, they present long-term potential for market players.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as AGRANA Starch, Aryan International, and Cargill Incorporated played pivotal roles in shaping the global cassava starch market. Each of these companies contributed uniquely to the industry through product innovation, market presence, and strategic positioning.

AGRANA Starch maintained its influence through strong integration across the starch supply chain, with a focus on maintaining product quality and application versatility. Its continued emphasis on sustainable processing and specialty starch offerings helped address the increasing global demand for clean-label and functional food ingredients. AGRANA’s ability to cater to both food and industrial applications strengthened its relevance across multiple markets.

Aryan International stood out by focusing on natural and organic sourcing practices, appealing particularly to health-conscious and eco-aware consumers. Its positioning aligned well with the rising trend of gluten-free and chemical-free food products. Aryan’s niche approach allowed it to establish a competitive edge in segments where transparency and ingredient purity are major consumer priorities.

Cargill, Incorporated, continued to demonstrate its market leadership through its expansive distribution network and deep R&D capabilities. By leveraging its global reach and technical expertise, Cargill remained a key supplier of cassava starch across various end-use industries, including food, beverage, and packaging.

Top Key Players in the Market

- AGRANA Starch

- Aryan International

- Cargill, Incorporated

- Chorchaiwat Industry Company Limited

- Ekta International

- Ingredion

- Psaltry International Limited

- SPAC Starch Products Ltd.

- Tate & Lyle

- Thai Foods Product International Co., Ltd.

- The Dutch Agricultural Development & Trading Company BV

Recent Developments

- In June 2025, AGRANA Starch and Ingredion Germany GmbH received approval to form a joint venture at their starch plant in Țăndărei, Romania. Ingredion acquired a 49% stake in the facility, and together they plan to invest €35 million to expand production capacity.

- In June 2024, Tate & Lyle announced plans to buy CP Kelco, a leading producer of pectin and specialty gums, for US$ $1.8 billion—key to expanding their ingredient portfolio.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 8.3 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Native, Modified), By Nature (Organic, Conventional), By Application (Food and Beverage (Bakery and Confectionery, Snacks and Cereals, Processed Food, Functional Food, Soups, Sauces, and Gravies, Beverages, Others), Pharmaceutical, Cosmetics and Personal Care, Paper, Textile and Adhesives, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AGRANA Starch, Aryan International, Cargill, Incorporated, Chorchaiwat Industry Company Limited, Ekta International, Ingredion, Psaltry International Limited, SPAC Starch Products Ltd., Tate & Lyle, Thai Foods Product International Co., Ltd., The Dutch Agricultural Development & Trading Company BV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AGRANA Starch

- Aryan International

- Cargill, Incorporated

- Chorchaiwat Industry Company Limited

- Ekta International

- Ingredion

- Psaltry International Limited

- SPAC Starch Products Ltd.

- Tate & Lyle

- Thai Foods Product International Co., Ltd.

- The Dutch Agricultural Development & Trading Company BV