Global Edible Animal Fat Market By Type (Butter, Lard, Tallow, Others), By Form (Liquid, Solid, Semi Solid), By Source (Cattle, Pig, Others), By Application (Non Food, Food) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136614

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

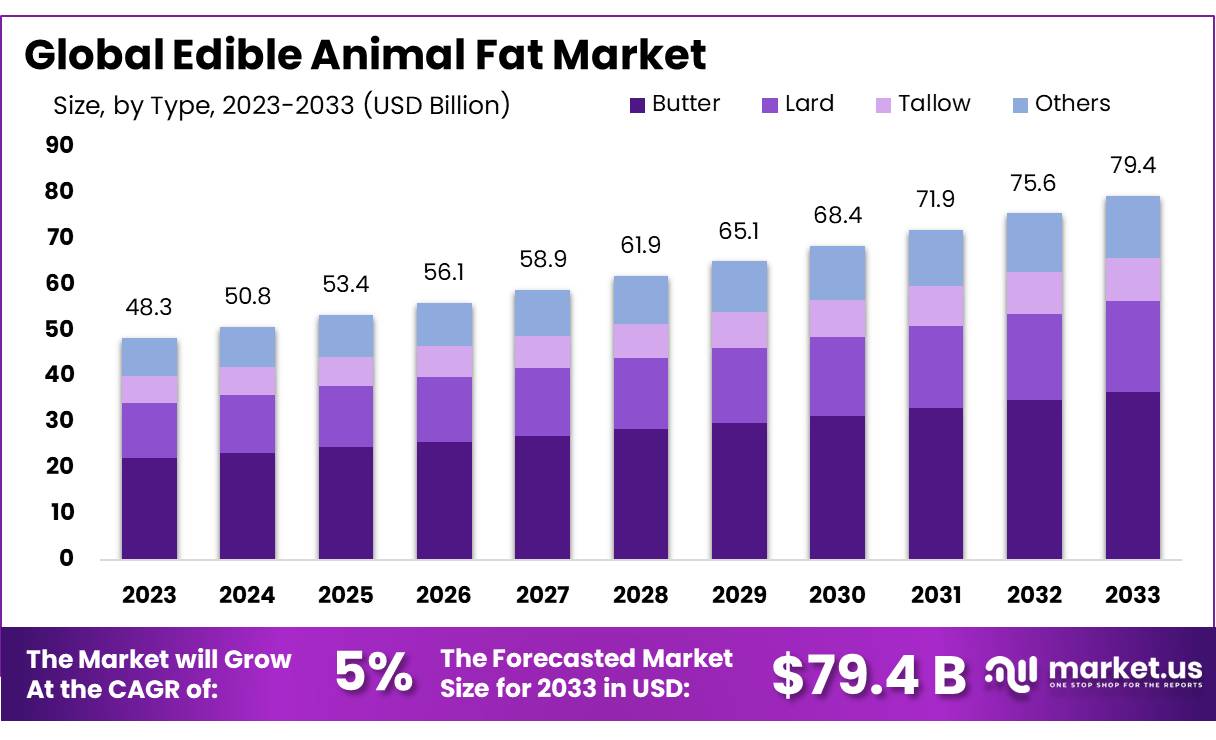

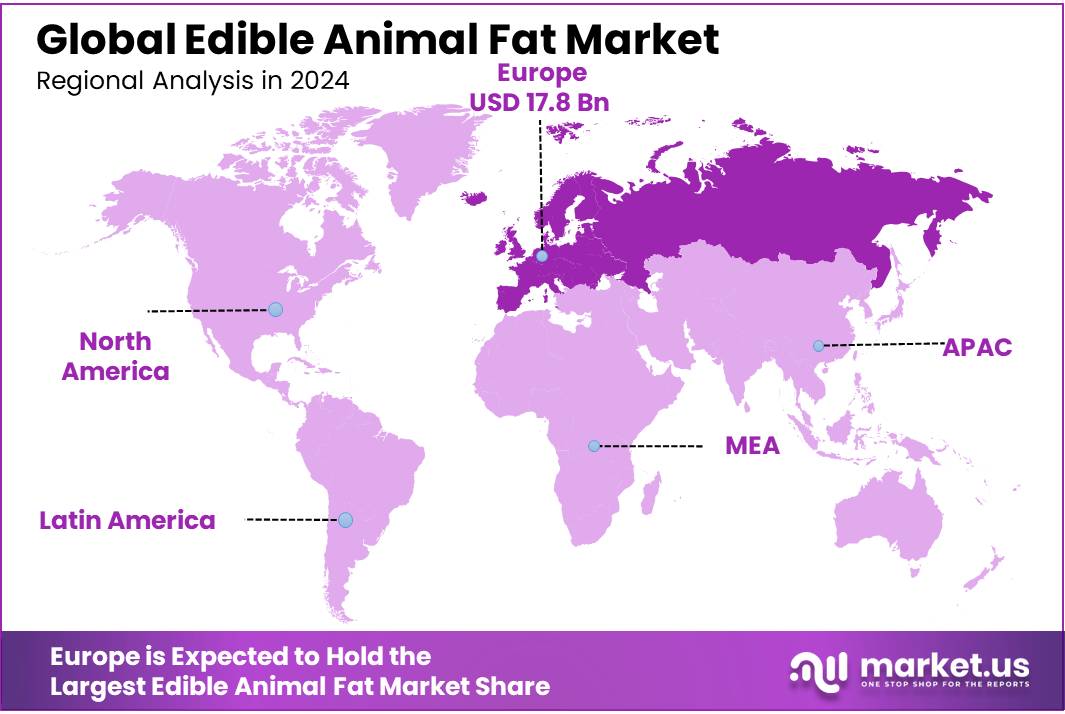

The Global Edible Animal Fat Market size is expected to be worth around USD 79.4 Bn by 2033, from USD 48.3 Bn in 2023, growing at a CAGR of 5.0% during the forecast period from 2024 to 2033. Europe stands out as the leading region in the global edible animal fat market, commanding a significant 36.9% market share and achieving a robust valuation of USD 17.8 billion.

The Global Edible Animal Fat Market is an integral component of the food and beverage industry, driven by its versatile applications in cooking, baking, and food processing. Edible animal fats, derived from sources such as pork, beef, poultry, and fish, are widely used for their flavor-enhancing properties and functional roles as shortening agents and stabilizers in food production. With growing global food consumption, the demand for animal fats has remained robust, particularly in regions where traditional diets rely heavily on animal-based products.

The edible animal fat production is characterized by a highly fragmented market structure, with a mix of large-scale processors and smaller, region-specific producers. The rendering industry plays a pivotal role in transforming animal by-products into valuable edible fats, ensuring sustainable utilization of resources. Technological advancements in rendering processes have enhanced the quality and safety of animal fats, meeting regulatory requirements and consumer expectations. Key end-use industries include bakery, confectionery, processed foods, and biodiesel production, further diversifying the demand base.

According to the Food and Agriculture Organization (FAO), global meat production exceeded 340 million metric tons in 2022, providing a significant raw material base for the animal fat industry. Moreover, the rising demand for natural and traditional cooking ingredients, particularly in Asia-Pacific and Latin America, has boosted the consumption of lard and tallow. The growing biofuel sector also contributes significantly to market demand, as animal fats serve as a sustainable feedstock for biodiesel production.

Prominent trends influencing the market include the shift toward healthier and sustainably sourced fats. With increasing consumer awareness about trans fats and artificial additives, edible animal fats are gaining favor due to their natural origin and lower processing requirements. Additionally, the emergence of value-added products, such as fortified animal fats enriched with vitamins and omega-3 fatty acids, caters to the health-conscious segment. The use of animal fats in specialty products, such as gourmet pastries and premium confectioneries, is another growth avenue.

Future growth opportunities are expected to emerge from technological innovations in rendering and refining processes, ensuring higher yield and improved fat quality. Expanding applications in non-food sectors, including cosmetics and pharmaceuticals, present additional growth potential. Developing regions such as Africa and Southeast Asia are anticipated to witness rapid market growth due to rising disposable incomes and changing dietary patterns.

Statistically, the global production of tallow and lard is estimated at over 25 million metric tons annually, with Europe and North America being major producers. The edible animal fat market is poised for steady growth, driven by its functional versatility, rising applications across industries, and the global focus on sustainability and resource optimization.

Key Takeaways

- Edible Animal Fat Market size is expected to be worth around USD 79.4 Bn by 2033, from USD 48.3 Bn in 2023, growing at a CAGR of 5.0%.

- Butter held a dominant market position, capturing more than a 46.1% share of the edible animal fat market.

- Solid edible animal fats held a dominant market position, capturing more than a 62.2% share.

- Cattle held a dominant market position in the edible animal fat market, capturing more than a 52.2% share.

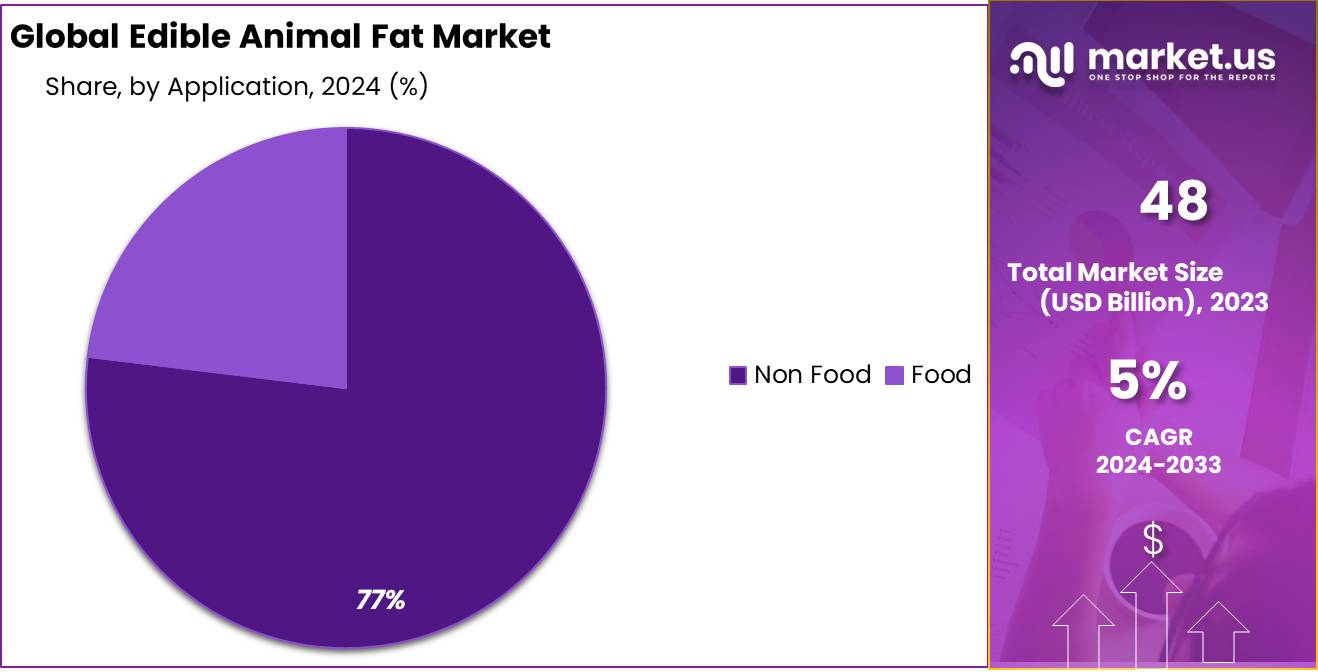

- Food held a dominant market position in the edible animal fat market, capturing more than 82.1% share.

- Europe leads the global market, holding a dominant share of 36.9%, with a valuation of USD 17.8 billion.

By Type

In 2023, Butter held a dominant market position, capturing more than a 46.1% share of the edible animal fat market. Butter’s widespread usage in cooking, baking, and food preparation across both households and the foodservice industry has made it the top choice for edible fats. The rise in demand for premium and specialty butters, such as organic or grass-fed varieties, further fueled its growth.

Lard followed as a significant player in the edible animal fat market in 2023. Lard, derived from pig fat, is a traditional fat used in various cuisines, especially in cooking and baking applications. It accounted for a notable portion of the market, as it remains a preferred fat in certain cultural food practices, such as in Latin American and Eastern European cooking. Despite competition from healthier alternatives, the use of lard in pastry making, especially for creating flaky textures, has kept its demand relatively stable.

Tallow, derived from beef or mutton fat, made up a smaller yet significant portion of the market in 2023. Although its use in cooking is not as widespread as butter or lard, tallow has gained attention due to its high smoke point and its use in specific culinary applications, such as deep frying and making certain traditional dishes.

By Form

In 2023, Solid edible animal fats held a dominant market position, capturing more than a 62.2% share. Solid fats, such as butter, lard, and tallow, are widely used in cooking and food processing due to their stable nature at room temperature and their versatility in a variety of applications, including frying, baking, and as ingredients in processed foods. The demand for solid fats is particularly high in the foodservice and baking industries, where they are valued for their ability to enhance flavor, texture, and consistency in products like pastries, cakes, and processed meats.

Liquid animal fats followed as a significant segment in 2023, though with a smaller share compared to solid fats. Liquid fats, such as those found in certain oils and fat-based products, are gaining popularity due to their applications in cooking and as a source of healthier fat alternatives, especially in the production of margarine and cooking oils.

Semi-Solid animal fats, such as partially hydrogenated oils and fats used in spreads, made up the remaining market share in 2023. Semi-solid fats have applications in both home kitchens and the food manufacturing sector. These fats are increasingly used in processed foods and snack products due to their balanced texture and longer shelf life.

By Source

In 2023, Cattle held a dominant market position in the edible animal fat market, capturing more than a 52.2% share. The primary source of fat from cattle, including tallow, is widely used in both food production and industrial applications.

Tallow, derived from beef fat, is highly valued for its stability at high temperatures, making it a preferred choice in cooking, frying, and food manufacturing. It is also a key ingredient in the production of various processed food items, such as snacks, confectionery, and fast food. In addition to culinary uses, tallow’s versatility extends to its use in the production of soaps, candles, and cosmetics, further driving its demand in the market.

Pig fat, primarily in the form of lard, also represents a significant share of the market. Lard, derived from pigs, is commonly used in traditional cooking and baking, particularly in pastries, pies, and processed meats. In 2023, pig-derived fats maintained a strong position, especially in regions with a long history of using lard in their culinary practices, such as in parts of Europe, North America, and Asia. The demand for lard has been stable, driven by both its culinary uses and the increasing popularity of lard-based products in certain niche markets.

By Application

In 2023, Food held a dominant market position in the edible animal fat market, capturing more than 82.1% share. Animal fats such as butter, lard, and tallow are essential ingredients in a wide range of food applications. Their use spans cooking, baking, frying, and as key components in processed foods like snacks, confectionery, and ready-to-eat meals.

The demand for food-grade animal fats has been driven by their ability to enhance flavor, texture, and shelf stability. Additionally, in many regions, animal fats are valued for their culinary traditions, making them an integral part of the food industry. As health and wellness trends evolve, certain animal fats, particularly those from cattle and pigs, continue to be favored for their rich taste and functional properties in various food products.

The Non-Food application segment accounted for a smaller share of the market in 2023 but still plays a crucial role. Non-food uses of animal fats primarily include their applications in the production of soaps, cosmetics, candles, and biodiesel. These fats are also used in certain pharmaceutical products. Despite the dominance of food applications, non-food uses have seen consistent demand due to the versatile nature of animal fats. However, the market for non-food applications is expected to grow more gradually compared to the food segment in the coming years, as sustainability concerns and the development of alternative materials increase.

Key Market Segments

By Type

- Butter

- Lard

- Tallow

- Others

By Form

- Liquid

- Solid

- Semi Solid

By Source

- Cattle

- Pig

- Others

By Application

- Non Food

- Food

Drivers

Rising Demand for Processed and Convenience Foods

One of the key driving factors for the edible animal fat market is the growing demand for processed and convenience foods, which rely heavily on animal fats like butter, lard, and tallow for flavor, texture, and preservation. As lifestyles become busier, there is an increasing preference for ready-to-eat meals, snacks, and fast food, which often use animal fats due to their functional properties.

In 2023, the global processed food market was valued at around USD 7 trillion, and this figure is expected to continue growing as urbanization, changing dietary habits, and the demand for convenience foods rise. Animal fats, especially tallow and lard, are favored for their stability, long shelf life, and ability to enhance flavors in products like pastries, snacks, and deep-fried items.

The dairy and bakery sectors are some of the largest consumers of animal fats, particularly butter, which is used in baking, cooking, and as a key ingredient in dairy-based products. Butter consumption in countries like the United States has increased by approximately 1.5% per year from 2020 to 2023, supported by consumer demand for premium, natural, and high-fat products.

In addition to processed foods, the foodservice industry also contributes significantly to the demand for animal fats. Restaurants, fast food chains, and catering services frequently use tallow and lard for frying and cooking due to their high smoking points and flavor-enhancing properties. The global market for fast food is expected to reach USD 800 billion by 2025, further increasing the consumption of edible animal fats in the industry.

The increasing consumption of comfort foods and traditional recipes, many of which rely on animal fats, is also helping drive the market. With a growing preference for rich, indulgent food experiences, especially in Western and Asian markets, the demand for fats such as butter and lard remains robust. In particular, countries like China and India are witnessing rising consumption of processed meats and dairy products, contributing to a growth in the use of animal fats in the food industry.

Restraints

Health Concerns and Shift Towards Healthier Alternatives

A significant restraining factor for the edible animal fat market is the growing health concerns associated with the consumption of saturated fats, which has led to a shift towards healthier alternatives. High intake of animal fats, especially those rich in saturated fats such as butter and lard, has been linked to an increased risk of cardiovascular diseases, obesity, and other health issues. As public awareness of these health risks rises, consumers and food manufacturers are increasingly opting for plant-based oils and fats, such as olive oil, avocado oil, and coconut oil, which are perceived as healthier options.

The World Health Organization (WHO) recommends that saturated fats should make up no more than 10% of total energy intake, and it highlights the importance of reducing the consumption of processed foods high in animal fats. This recommendation has led to a shift in consumer behavior, especially in developed regions like North America and Europe, where health-consciousness is higher. In fact, in 2023, sales of plant-based oils grew by 6.5% globally, further undermining the demand for traditional animal fats.

Moreover, various governments and health organizations are promoting policies and campaigns that encourage the reduction of saturated fat consumption. In the United States, the Dietary Guidelines for Americans recommend lowering the intake of saturated fats, particularly in favor of healthier unsaturated fats. This has influenced both consumers and food producers to move away from animal fats in favor of healthier alternatives, limiting the growth potential of the edible animal fat market.

The ongoing trend towards health-conscious eating is also reinforced by the rising popularity of plant-based diets and flexitarianism. In 2023, the global market for plant-based food products was valued at USD 21 billion, and this trend is expected to continue growing as more consumers adopt plant-based or low-saturated-fat diets. As a result, the demand for animal fats in food production has been constrained, posing a challenge for market growth in the coming years.

Opportunity

Growing Popularity of Clean Label and Natural Animal Fats

A key growth opportunity for the edible animal fat market lies in the rising popularity of clean label and natural food products. Consumers are becoming increasingly health-conscious and are seeking more transparent, natural, and minimally processed ingredients in their food. As part of this trend, there is a growing demand for animal fats that are sourced sustainably and produced with minimal processing, aligning with the broader clean label movement.

In particular, grass-fed butter and organic lard are gaining traction among health-conscious consumers. These products are often marketed as being free from antibiotics, hormones, and other chemicals, which appeals to consumers who prioritize organic and ethically sourced ingredients. The shift towards these natural, minimally processed animal fats presents an opportunity for producers to cater to this growing demand, especially in developed markets such as North America and Europe.

The rise in demand for clean label products also aligns with initiatives from organizations like the FDA and the European Food Safety Authority (EFSA), which have been encouraging transparency in food labeling. In 2024, we can expect an even greater focus on natural and responsibly sourced ingredients, which will likely drive further growth in the edible animal fat market, particularly for premium, clean-label fat products.

Trends

Increased Demand for Grass-Fed and Sustainable Animal Fats

One of the major trends in the edible animal fat market is the rising demand for grass-fed and sustainably sourced animal fats. As consumers become more environmentally and health-conscious, there is a growing preference for products that are perceived as more natural, ethical, and better for personal well-being. Grass-fed animal fats, particularly from cattle, are being increasingly favored due to their higher levels of beneficial nutrients like omega-3 fatty acids, which are seen as healthier compared to conventional grain-fed animal fats.

In response to this trend, several companies in the food industry are prioritizing sustainable practices and are focusing on sourcing fats from animals raised on natural pastures without the use of antibiotics or hormones.

Additionally, organizations like the Food and Agriculture Organization (FAO) have emphasized the need for more sustainable food production systems, encouraging the shift towards ethical and sustainable sourcing practices in the meat and fat industries. These factors are expected to drive continued growth in demand for grass-fed animal fats, as consumers increasingly prioritize sustainability and health benefits.

The trend toward sustainable and grass-fed animal fats also aligns with broader consumer demand for clean label products, where minimal processing and natural ingredients are highly valued. This trend is especially noticeable in regions like North America and Europe, where consumer demand for transparency and ethical sourcing is growing at a rapid pace.

Regional Analysis

Europe leads the global market, holding a dominant share of 36.9%, with a valuation of USD 17.8 billion. The region’s prominence is attributed to its well-established food processing industry and the high demand for edible animal fats in bakery, confectionery, and culinary applications. Countries such as Germany, France, and Italy are key contributors, driven by strong consumption patterns and a robust export market for processed foods.

North America follows as a significant market due to the widespread use of animal fats in food manufacturing and biodiesel production. The U.S. and Canada are major players, supported by high meat production rates and technological advancements in fat extraction and processing techniques.

Asia Pacific (APAC) is experiencing rapid growth, fueled by rising demand for processed and convenience foods, coupled with increasing meat consumption. Countries like China, India, and Japan are key growth hubs, benefiting from expanding urban populations and evolving dietary preferences.

Latin America and the Middle East & Africa (MEA) are emerging markets, with growth driven by increasing industrial applications of animal fats in products like biodiesel, lubricants, and soaps. Brazil and South Africa stand out in these regions, supported by growing meat processing industries and export activities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Edible Animal Fat Market is characterized by the presence of several prominent players driving innovation, efficiency, and expansion in the industry. Key companies such as Archer-Daniels Midland Company, Bunge Limited, Cargill, Incorporated, and Darling Ingredients lead the market with their extensive product portfolios and robust global networks. These organizations focus on integrating sustainable practices and advanced processing technologies to meet the increasing demand for edible animal fats across various applications, including food, biodiesel, and industrial uses.

Other notable players include Boyer Valley Company, LLC. (The Lauridsen Group), Coast Packing Company, Leo Group Ltd., and Sanimax, which emphasize regional dominance through strategic partnerships, acquisitions, and product diversification. Companies like PIERMEN B.V., Ten Kate Vetten B.V., and Hubberts Industries are pivotal in enhancing market dynamics with tailored fat and tallow blends catering to the specific requirements of bakery, confectionery, and industrial applications.

The market landscape also benefits from specialized firms such as Sonac (Darling Ingredients Inc.), York Foods, and COLYER FEHR GROUP, which focus on niche product offerings and high-quality standards. Together, these players ensure a competitive environment, pushing the market forward through innovation and adherence to regulatory standards while addressing growing consumer demand for sustainable and versatile animal fat solutions.

Top Key Players

- Archer-Daniels Midland Company

- Boyer Valley Company, LLC. (The Lauridsen Group)

- Bunge Limited

- Cargill, Incorporated

- Coast Packing Company

- COLYER FEHR GROUP

- Darling Ingredients

- Fats & tallow blends

- Hubberts Industries

- Leo Group Ltd.

- PIERMEN B.V

- Sanimax

- SARIA A S GmbH and Co. KG

- Sonac (Darling Ingredients Inc.)

- Ten Kate Vetten B.V.

- York Foods

- Bunge Limited

Recent Developments

In 2023, ADM reported annual sales nearing $100 billion, with its Nutrition division—encompassing edible animal fats—contributing significantly to this revenue.

Cargill, Incorporated, a major player in the edible animal fat market, reported a 10% decrease in annual revenue, dropping from $177 billion in 2023 to $160 billion in 2024.

Report Scope

Report Features Description Market Value (2023) USD 48.3 Bn Forecast Revenue (2033) USD 79.4 Bn CAGR (2024-2033) 5.0% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Butter, Lard, Tallow, Others), By Form (Liquid, Solid, Semi Solid), By Source (Cattle, Pig, Others), By Application (Non Food, Food) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Archer-Daniels Midland Company, Boyer Valley Company, LLC. (The Lauridsen Group), Bunge Limited, Cargill, Incorporated, Coast Packing Company, COLYER FEHR GROUP, Darling Ingredients, Fats & tallow blends, Hubberts Industries, Leo Group Ltd., PIERMEN B.V, Sanimax, SARIA A S GmbH and Co. KG, Sonac (Darling Ingredients Inc.), Ten Kate Vetten B.V., York Foods, Bunge Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer-Daniels Midland Company

- Boyer Valley Company, LLC. (The Lauridsen Group)

- Bunge Limited

- Cargill, Incorporated

- Coast Packing Company

- COLYER FEHR GROUP

- Darling Ingredients

- Fats & tallow blends

- Hubberts Industries

- Leo Group Ltd.

- PIERMEN B.V

- Sanimax

- SARIA A S GmbH and Co. KG

- Sonac (Darling Ingredients Inc.)

- Ten Kate Vetten B.V.

- York Foods

- Bunge Limited