Global AI in Food Processing Market By Type of Food (Dairy, Meat and Poultry, Convenience Food and Snacks, Fruits and Vegetables, and Other Types), By Application (Food Sorting, Maintenance, Production and Packaging, Quality Control & Safety Compliance, Customer Engagement, Other application), By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: May 2025

- Report ID: 102164

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

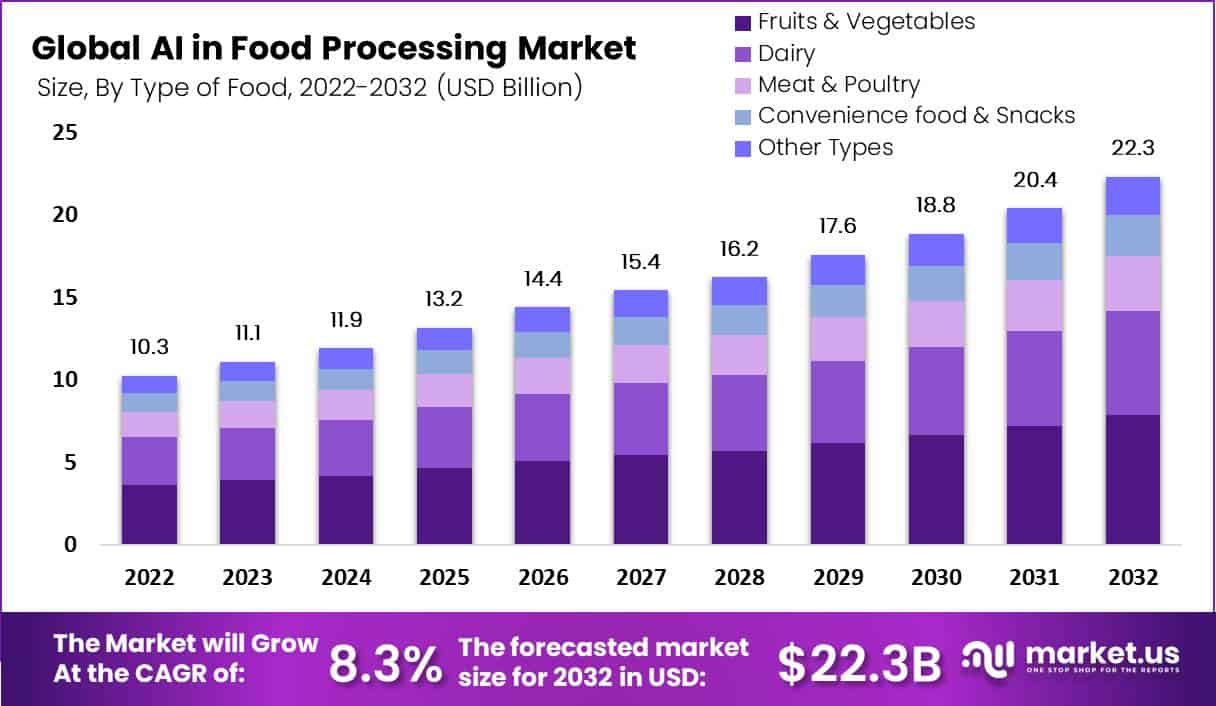

The Global AI in Food Processing Market size is expected to be worth around USD 22.3 Billion by 2032, from USD 11.1 Billion in 2023, growing at a CAGR of 8.3% during the forecast period from 2023 to 2032.

Artificial Intelligence (AI) in food processing refers to the application of advanced computational techniques to enhance various stages of food production. These techniques include machine learning, computer vision, and data analytics, which are employed to improve efficiency, quality, and safety in food manufacturing processes. For instance, AI systems can monitor production lines in real-time, detect anomalies, and predict maintenance needs, thereby reducing downtime and ensuring consistent product quality.

The AI in food processing market is experiencing significant growth, driven by the increasing demand for automation and precision in food production processes. Several factors are propelling the adoption of AI in food processing. The growing global population necessitates efficient and sustainable food production methods. AI enables manufacturers to optimize resource utilization, reduce energy consumption, and enhance yield.

Additionally, the increasing consumer demand for high-quality, safe, and traceable food products compels companies to implement AI-driven quality control systems. These systems can detect defects and contaminants in real-time, ensuring compliance with safety standards and reducing the risk of product recalls.

The demand for AI technologies in food processing is on the rise, particularly in areas requiring precision and efficiency. For example, AI-powered robotics are increasingly used for automated sorting, packaging, and labeling, with over 55% of food processing companies integrating such technologies. Moreover, AI-based quality control systems have demonstrated a 40% reduction in contamination risks, highlighting their effectiveness in enhancing food safety.

Technological advancements are central to the increasing adoption of AI in food processing. Machine learning algorithms facilitate predictive maintenance by analyzing equipment data to foresee potential failures, thereby minimizing downtime. Computer vision technologies enable real-time inspection of products, ensuring consistency and quality.

Analyst Viewpoint

According to the University of Nottingham, equipment cleaning consumes nearly 30% of a food processing plant’s energy and water. They propose that their AI-based sensor technology could lead to annual savings of roughly $133 million, cutting cleaning time in half and contributing to significant reductions in energy and water consumption.

Investment opportunities in the AI food processing sector are abundant, particularly in developing intelligent automation systems and AI-powered quality control solutions. Companies specializing in robotics, machine learning, and computer vision stand to benefit from the growing demand for advanced technologies tailored to the food industry’s unique requirements.

Technological advancements continue to shape the AI in food processing landscape. Innovations such as AI-powered robotics with advanced sensory capabilities are revolutionizing tasks like food handling and packaging. For instance, robots equipped with soft, spatially aware hands can now perform delicate tasks traditionally reliant on human dexterity, enhancing efficiency and precision in food processing operations.

The regulatory environment plays a crucial role in the adoption of AI in food processing. Compliance with food safety standards and regulations is paramount, and AI technologies assist in meeting these requirements by providing accurate monitoring and documentation. Additionally, as regulatory bodies increasingly recognize the benefits of AI, guidelines are evolving to support its integration, fostering a conducive environment for technological advancement in the food industry.

Important Revelation

- Market Growth Projection: The AI in Food Processing Market is projected to grow from USD 11.1 Billion in 2022 to USD 22.3 Billion by 2032, with an expected CAGR of 8.3% from 2023 to 2032.

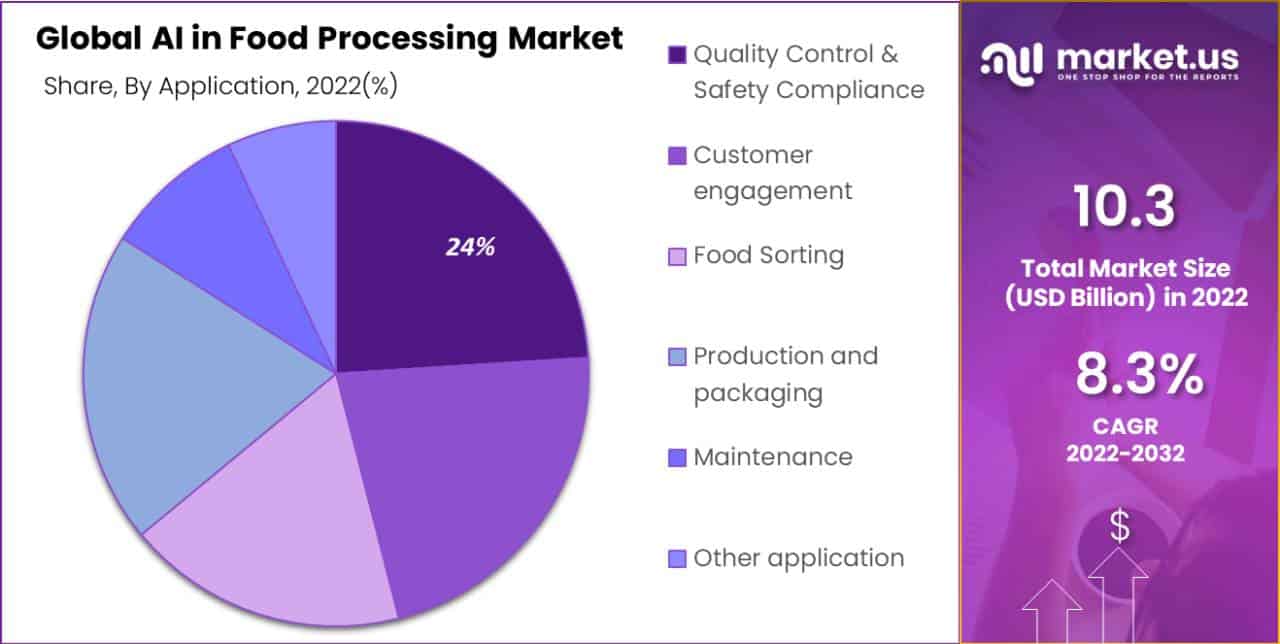

- Applications of AI in Food Processing: AI technology is employed in various aspects of food processing, including food sorting, maintenance, production and packaging, quality control, safety compliance, and customer engagement.

- Drivers of Market Growth: Improved quality, high profits, increased efficiency, and reduced operational costs are driving the adoption of AI in food processing. The integration of AI has enabled companies to streamline operations, optimize production, and minimize wastage.

- Challenges Faced: High installation and maintenance costs, vulnerability to cyberattacks, displacement of labor, and the requirement for skilled operators are some of the challenges hampering the widespread adoption of AI in food processing.

- Dominant Market Segments: The fruits and vegetables segment leads in the utilization of AI, followed by convenience food and snacks. Quality control and compliance remain the primary application for AI in food processing operations.

- Market Opportunities: Government initiatives and the growing demand for efficient solutions have created lucrative opportunities for AI integration in the food processing industry, allowing for improved product quality and reduced processing time.

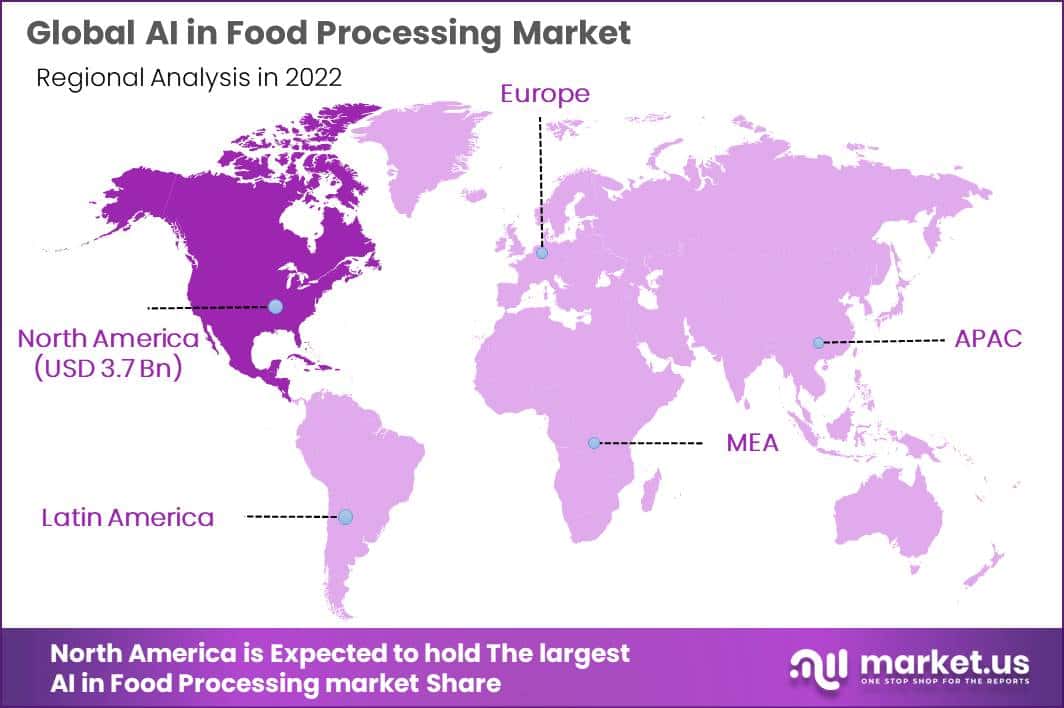

- Regional Dominance: North America currently dominates the global AI in Food Processing Market, accounting for a significant revenue share, attributed to the presence of major companies and well-developed food processing industries in the region.

- Key Players: Major companies driving advancements in AI technology for food processing include Rockwell Automation Inc., TOMRA, Key Technology Inc., Sight Machine Inc., Honeywell International Inc., ABB Ltd., and others.

Type of Food Analysis

In 2022, the Fruits and Vegetables segment held a dominant market position in the AI in Food Processing market, capturing a significant share. This segment’s prominence can be attributed to several factors that make it an attractive area for the application of AI technologies in food processing.

Fruits and vegetables are essential components of a healthy diet, and there is a growing emphasis on their consumption worldwide. However, the processing of fruits and vegetables poses unique challenges due to factors such as perishability, variable quality, and the need for precise handling. AI technologies offer solutions to address these challenges and optimize the processing of fruits and vegetables.

One of the key reasons for the dominance of the Fruits and Vegetables segment is the need for quality control and sorting. AI-powered computer vision systems can analyze images of fruits and vegetables in real-time, detecting defects, identifying ripeness, and sorting them based on various parameters such as size, color, and shape. This automated sorting process ensures consistent quality and reduces manual labor, making it an appealing solution for fruit and vegetable processors.

Moreover, AI algorithms can assist in optimizing processing parameters for fruits and vegetables. By analyzing data on factors such as temperature, humidity, and processing time, AI systems can determine the ideal conditions for preserving freshness, flavor, and nutritional content. This optimization leads to better product quality, longer shelf life, and reduced waste in the fruits and vegetables segment.

Additionally, the Fruits and Vegetables segment benefits from the increasing demand for convenience and ready-to-eat products. AI technologies can enable efficient processing and packaging of fruits and vegetables for the production of convenience foods, such as pre-cut salads, fruit cups, and vegetable snacks. By automating tasks like peeling, slicing, and packaging, AI helps meet consumer demand for convenient and healthy food options.

Application Analysis

In 2022, the Quality Control & Safety Compliance segment held a dominant market position in the AI in Food Processing market, capturing a significant share. This segment’s prominence can be attributed to the critical importance of ensuring food safety and compliance with regulatory standards in the food processing industry.

Quality control and safety compliance are paramount in food processing to protect consumers from potential health risks and maintain the reputation of food manufacturers. AI technologies offer advanced solutions to address the complexities and challenges associated with quality control and safety compliance.

One of the key reasons for the dominance of the Quality Control & Safety Compliance segment is the ability of AI to detect and prevent contaminants and quality defects in real-time. AI-powered systems equipped with computer vision can analyze images and videos to identify foreign objects, contaminants, and abnormalities in food products, ensuring that only safe and high-quality items reach the market. This real-time detection not only enhances consumer safety but also helps food manufacturers in maintaining compliance with stringent regulations and standards.

Furthermore, AI algorithms can analyze vast amounts of data to identify patterns and anomalies that indicate potential quality issues or deviations in food processing. By monitoring various parameters such as temperature, humidity, pH levels, and production metrics, AI systems can identify deviations from desired standards and trigger alerts or corrective actions, enabling proactive quality control and compliance management.

The Quality Control & Safety Compliance segment also benefits from the increasing use of AI in food traceability systems. With AI-powered data analytics, food manufacturers can track and trace products throughout the supply chain, from raw materials to the end consumer. This enhances transparency, facilitates rapid identification of potential issues or recalls, and ensures compliance with traceability regulations.

Key Market Segments

Type of Food

- Dairy

- Meat & Poultry

- Convenience food & Snacks

- Fruits & Vegetables

- Other Types

Application

- Food Sorting

- Maintenance

- Production and Packaging

- Quality Control & Safety Compliance

- Customer Engagement

- Other application

Driving Factor

Increasing Demand for Process Efficiency and Food Safety

Food manufacturers are under pressure to optimize their operations, reduce costs, and improve productivity. AI technologies offer solutions to enhance efficiency by automating repetitive tasks, optimizing production processes, and streamlining supply chain management.

Additionally, AI-powered systems can enhance food safety by providing real-time monitoring, quality control, and traceability throughout the production and distribution process. With the growing emphasis on operational efficiency and food safety, the demand for AI in food processing is expected to continue rising.

Restraining Factor

High Initial Investment Costs

Implementing AI technologies requires significant upfront investments in hardware, software, and infrastructure. Additionally, there may be costs associated with training personnel and integrating AI systems into existing processes. These high costs can pose a barrier, particularly for small and medium-sized food processing companies with limited resources.

However, as the technology advances and becomes more accessible, and as the benefits of AI adoption become more evident, the initial investment costs are expected to decrease, making it more feasible for a wider range of companies to adopt AI in their food processing operations.

Opportunity

Expansion into Emerging Markets

Emerging markets, characterized by rapid urbanization and a growing middle class, are witnessing increased demand for processed and packaged food products. These markets often face challenges related to food safety, supply chain efficiency, and quality control. AI technologies can address these challenges by enabling efficient production, quality control, and traceability.

Moreover, AI can help optimize supply chain logistics, reduce waste, and ensure timely delivery of food products to meet the growing consumer demand. By expanding into emerging markets, AI providers can tap into new revenue streams and establish themselves as key players in the global food processing industry.

Challenge

Data Privacy and Security Concerns

AI systems rely on vast amounts of data, including sensitive information such as production data, quality control metrics, and consumer preferences. Ensuring the privacy and security of this data is crucial to maintain consumer trust and comply with data protection regulations. Food processing companies need to implement robust data privacy measures, such as encryption, secure storage, and access controls, to safeguard sensitive information.

Additionally, they must establish clear data governance policies and protocols to address issues related to data ownership, consent, and sharing. Overcoming these challenges and building trust in data privacy and security will be essential for the successful integration of AI in food processing.

Trending Factors

The Product Customization Trend is Driving the Growth of the AI in Food Processing Market.

The ongoing trend of product customization is driving the growth of AI in food processing market. The introduction of AI in food processing has allowed customers to review and customize their products according to their needs and desire.

Many companies offer the AI chatbot to assist and help customers with ordering food products according to their needs and also customize it with the suggestions from the chatbot. This is attracting more customers to customize their products and also boosting the growth of AI technology in the food processing industry.

Regional Analysis

North America Dominates the Global AI in Food Processing Market with Major Share in the Market.

North America leads the AI in food processing market by accounting for a major revenue share of 36.4%. This regional dominance can be attributed to several factors that contribute to the advancement and adoption of AI technologies in the food processing industry.

One of the key reasons for North America’s dominance is the presence of a robust technological infrastructure and a well-established food processing sector. The region is home to several leading technology companies and research institutions that drive innovation in AI. This technological prowess enables North American companies to develop and deploy cutting-edge AI solutions tailored to the specific needs of the food processing industry.

Furthermore, North America places a strong emphasis on food safety and quality control. The region has stringent regulatory frameworks and standards in place to ensure the safety and integrity of food products. AI technologies offer advanced solutions for real-time monitoring, quality control, and traceability, aligning with the region’s focus on food safety. The ability of AI to enhance compliance with these regulations and standards has contributed to its widespread adoption in the North American food processing industry.

Additionally, the region has a high level of automation and digitalization across various industries, including food processing. This culture of embracing technological advancements, coupled with the availability of skilled professionals in the field of AI, has fostered the rapid integration of AI technologies in food processing operations.

Moreover, North America has a strong consumer demand for processed and packaged food products. The region’s busy lifestyles and preference for convenience have led to an increased need for efficient food processing techniques. AI technologies enable automation, optimization, and customization of food processing, meeting the demands of North American consumers for high-quality and convenient food products.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Key Player Analysis in the AI in Food Processing market involves a comprehensive examination of companies leading the charge in integrating artificial intelligence technologies within the food processing industry. These players are instrumental in shaping the market through innovation, strategic partnerships, and expansion of AI applications in food safety, quality control, supply chain optimization, and beyond.

Top Market Leaders

- Rockwell Automation Inc.

- Key Technology Inc.

- Sight Machine Inc.

- Honeywell International Inc.

- Raytec Vision SpA

- ABB ltd.

- Sesotec GmbH

- Martec of Whitell Ltd.

- Bratney Companies

- Agco Corporation

- TOMRA

- Other Key Players

Recent Developments

1. Rockwell Automation Inc.:

- January 2023: Partnershipt with Microsoft Azure: Integrates Azure cloud services with Rockwell’s FactoryTalk InnovationSuite, offering AI-powered analytics and machine learning capabilities for food processing operations.

- June 2023: Acquisition of Odospace: Gains expertise in AI-powered anomaly detection and predictive maintenance solutions for food processing machinery.

2. Key Technology Inc.:

- March 2023: Launches SPECTRAL SORT X: High-performance sorting system: Utilizes deep learning AI algorithms for advanced defect detection and product identification, ensuring food quality and safety.

- October 2023: Collaboration with Bosch Rexroth: Integrates Key Technology’s sorting systems with Bosch Rexroth’s robotics and automation solutions for enhanced food processing automation.

3. Sight Machine Inc.:

- April 2023: Secures $40 million Series D funding: Expands development of its AI-powered industrial analytics platform for food and beverage manufacturing, focusing on optimizing production processes and reducing waste.

- November 2023: Deployment at major dairy producer: Implements its AI platform for predictive maintenance and process optimization, resulting in improved production efficiency and reduced downtime.

Report Scope

Report Features Description Market Value (2023) US$ 11.1 Bn Forecast Revenue (2032) US$ 22.3 Bn CAGR (2023-2032) 8.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Food – Dairy, Meat and Poultry, Convenience Food and Snacks, Fruits and Vegetables, and Other Types; By Application – Maintenance, Food Sorting, Production, and packaging, Customer engagement, Quality Control & Safety Compliance, and Other application. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Rockwell Automation Inc., TOMRA, Key Technology Inc., Sight Machine Inc., Honeywell International Inc., Martec of Whitell Ltd., ABB Ltd., Raytec Vision SpA, Sesotec GmbH, Agco Corporation, Bratney Companies, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the Global Food Processing Market?The Global Food Processing Market was valued at US$ 10.3 Billion in 2022 and is projected to reach US$ 22.3 Billion by 2032.

How is artificial intelligence (AI) technology utilized in food processing?AI technology is used in food processing for purposes such as food sorting, quality checking, packaging, machine maintenance, and problem-solving during processing.

Which segment in the food processing market utilizes AI the most?The fruits and vegetables segment leads the market in AI utilization due to the increasing demand for sorting and quality evaluation equipment.

What are the primary applications of AI in food processing?AI is used for maintenance, food sorting, quality control and compliance, customer engagement, and other applications.

What opportunities are created by AI in the food processing market?Government initiatives, rising demand for efficient solutions, and the ability of AI to improve quality and reduce processing time create lucrative opportunities for market players in the food processing industry.

What are the different types of food analyzed in the AI in Food Processing Market?The AI in Food Processing Market analyzes various types of food, including dairy, meat and poultry, convenience food and snacks, fruits and vegetables, and other types.

Name some of the prominent players in the AI in Food Processing Market.Prominent players in the AI in Food Processing Market include Rockwell Automation Inc., TOMRA, Key Technology Inc., Sight Machine Inc., Honeywell International Inc., Martec of Whitell Ltd., ABB Ltd., Raytec Vision SpA, Sesotec GmbH, Agco Corporation, Bratney Companies, and other key players.

AI in Food Processing MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Food Processing MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Rockwell Automation Inc.

- Key Technology Inc.

- Sight Machine Inc.

- Honeywell International Inc.

- Raytec Vision SpA

- ABB ltd.

- Sesotec GmbH

- Martec of Whitell Ltd.

- Bratney Companies

- Agco Corporation

- TOMRA