Gobal Concentrated Milk Fat Market By Product (Organic, Conventional), By Form (Liquid, Dry), By Type (Anhydrous Milk Fat, Butteroil), By Fat Content (High (80% or above), Medium (40-79%), Low (less than 40%)), By Packaging (Drums, Barrels, Pail, Plastic Containers, Others), By Application (Bakery and Confectionery, Dairy Products, Nutraceuticals, Others), By Distribution Channel (Direct Sales/ B2B, Indirect Sales/ B2C) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137381

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

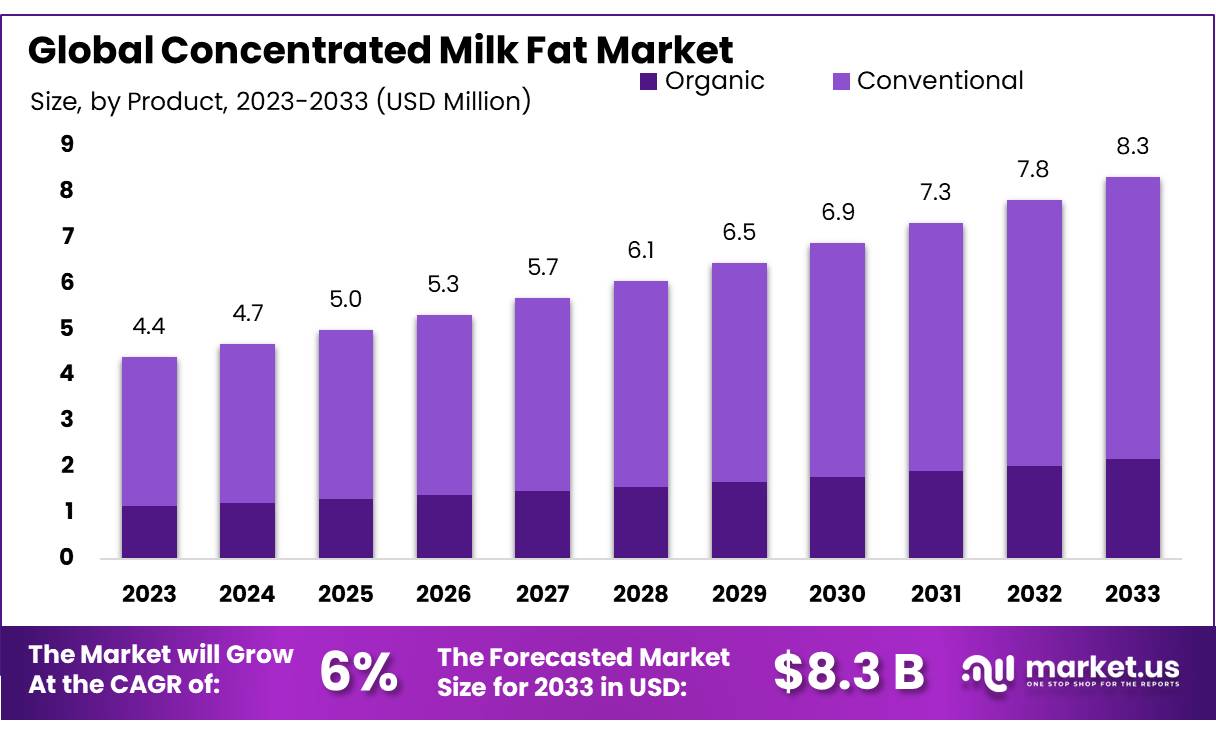

The Global Concentrated Milk Fat Market size is expected to be worth around USD 8.3 Bn by 2033, from USD 4.4 Bn in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

The Concentrated Milk Fat (CMF) Market is a critical segment of the dairy industry, serving as a key ingredient in the production of various dairy-based products such as cheese, butter, ice cream, and confectioneries. Concentrated milk fat, which includes products like anhydrous milk fat (AMF) and butter oil, is obtained by removing the water content from whole milk or cream.

Driving factors for the concentrated milk fat market include the increasing demand for dairy products, particularly in emerging economies where the middle class is growing, and there is rising awareness of Western food habits. The demand for high-quality dairy products such as premium ice creams, cheeses, and spreads is driving the market for CMF, as it enhances the texture and flavor of these products.

Trends in the market include the growing demand for anhydrous milk fat (AMF), which is seen as a superior ingredient for high-end food products. The trend toward clean-label and natural products is also influencing CMF production, with consumers increasingly seeking products with fewer additives and preservatives.

Furthermore, innovation in dairy processing and the expansion of the global trade in dairy products provide significant opportunities for companies involved in CMF production. The rising popularity of plant-based dairy alternatives and the need to cater to evolving consumer preferences will also drive innovation and create new market avenues for CMF.

The future growth opportunities for the concentrated milk fat market are promising, particularly in emerging markets such as Asia-Pacific and Latin America, where dairy consumption is growing rapidly due to rising incomes and changing dietary patterns. The expansion into these markets offers significant potential, with dairy consumption in Asia expected to increase by 15% over the next decade.

Key Takeaways

- Concentrated Milk Fat Market size is expected to be worth around USD 8.3 Bn by 2033, from USD 4.4 Bn in 2023, growing at a CAGR of 6.6%.

- conventional concentrated milk fat market held a dominant position, capturing more than 74.3% of the market share.

- dry form of concentrated milk fat held a dominant market position, capturing more than 64.4% of the market share.

- Anhydrous Milk Fat (AMF) held a dominant position in the concentrated milk fat market, capturing more than 59.2% of the share.

- High fat content category (80% or above) in the concentrated milk fat market held a dominant market position, capturing more than 58.4% share.

- Drums held a dominant market position in the packaging segment of the concentrated milk fat market, capturing more than 48.2% share.

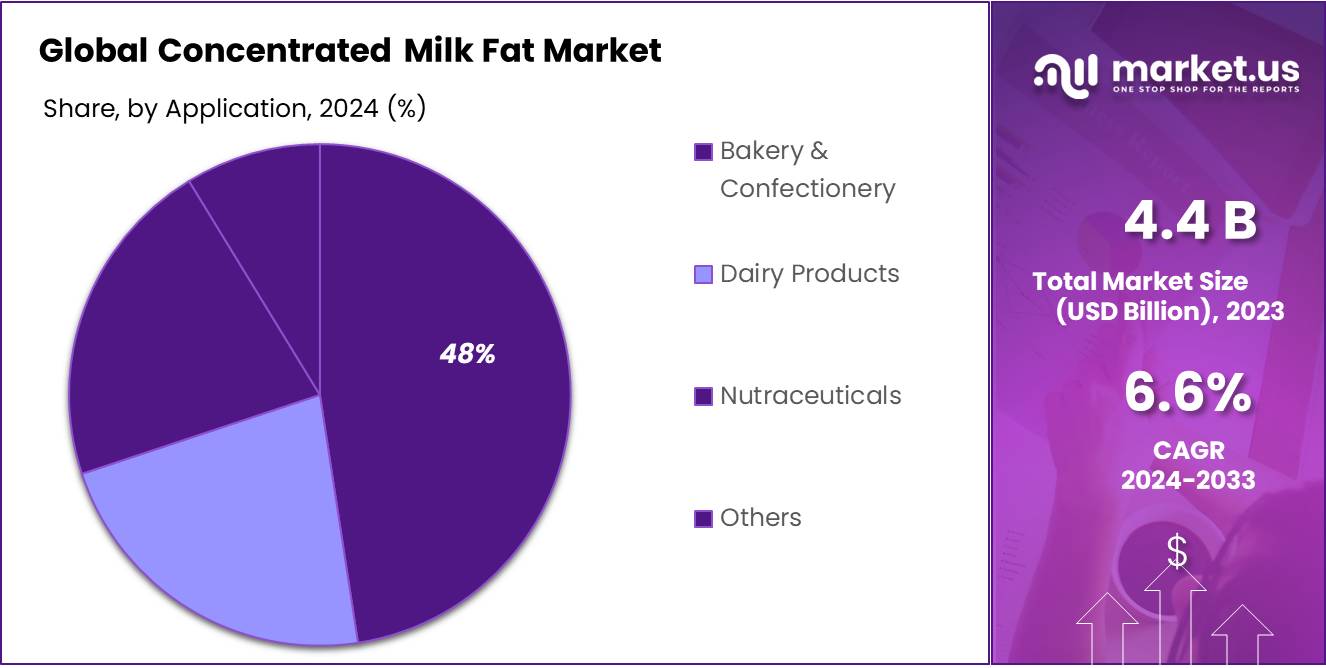

- Bakery and confectionery segment held a dominant position in the concentrated milk fat market, capturing more than 48.5% share.

- Direct sales/B2B (business-to-business) channel held a dominant position in the concentrated milk fat market, capturing more than 64.4% of the market share.

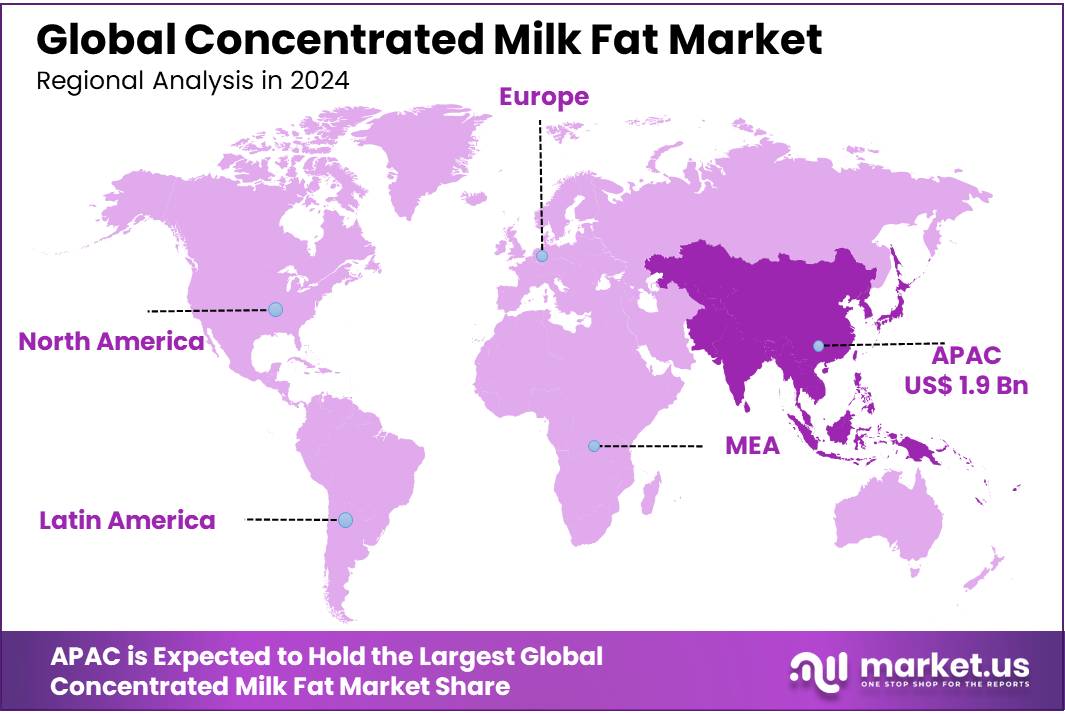

- Asia Pacific (APAC) region dominated the concentrated milk fat market, accounting for a substantial 43.2% market share, valued at USD 1.9 billion.

By Product

In 2023, the conventional concentrated milk fat market held a dominant position, capturing more than 74.3% of the market share. This segment’s dominance is largely attributed to its established presence in the food industry, where it is widely utilized due to its cost-effectiveness and broad consumer acceptance. Conventional concentrated milk fat is a staple in various culinary applications, ranging from baking to the production of confectionaries and dairy products, where it is prized for its ability to enhance flavor and texture.

The organic concentrated milk fat segment, though smaller, is experiencing rapid growth. This growth is driven by increasing consumer demand for organic and natural products, perceived as healthier and more environmentally friendly. Organic milk fat is produced under stringent conditions that forbid the use of synthetic hormones and pesticides, aligning with the global trend towards sustainable and ethical farming practices. As awareness and availability of organic dairy products increase, the market share of organic concentrated milk fat is expected to rise significantly, potentially altering the competitive landscape in 2024 and beyond.

By Form

In 2023, the dry form of concentrated milk fat held a dominant market position, capturing more than 64.4% of the market share. This form’s popularity is attributed to its versatility and stability, making it a preferred option for manufacturers in the food industry. Dry concentrated milk fat is particularly valued for its long shelf life and ease of storage and transportation, factors that are crucial in commercial food production settings. It is widely used in the manufacturing of baked goods, confectionery, and dairy products, where it contributes to enhanced texture and flavor stability under various processing conditions.

The liquid form of concentrated milk fat, while holding a smaller share of the market, is prized for its immediate application in culinary and dairy product formulations. Liquid concentrated milk fat is often favored for its ease of blending and incorporation into recipes, making it ideal for use in sauces, creams, and as a butter fat substitute in various dishes. Despite its lower market share, the demand for liquid concentrated milk fat is expected to grow, driven by its functional advantages in specific food applications.

By Type

In 2023, Anhydrous Milk Fat (AMF) held a dominant position in the concentrated milk fat market, capturing more than 59.2% of the share. AMF is highly regarded for its purity and richness in flavor, which makes it a preferred choice in high-quality baking, confectionery, and premium dairy products. Its high-fat content, typically around 99.8%, and low moisture properties make it ideal for producing rich, creamy textures in products like ice cream and chocolate.

Butteroil, while similar to anhydrous milk fat, holds a smaller market share. It is also used extensively in the food industry, particularly in baking and dairy applications, but has a slightly lower fat content compared to AMF. The versatility of butteroil makes it a valuable ingredient in many culinary practices, though it does not command as large a market presence as AMF.

By Fat Content

In 2023, the high fat content category (80% or above) in the concentrated milk fat market held a dominant market position, capturing more than 58.4% share. This segment benefits from strong demand in premium dairy products and gourmet cooking applications where the high fat content is essential for rich flavor and texture. High-fat concentrated milk fat is particularly sought after in industries where superior quality and specific textural characteristics are required, such as in high-end bakery products, luxury confectioneries, and artisanal cheese manufacturing.

Medium fat content milk fat (40-79%) also plays a significant role in the market, catering to a segment that requires a balance between flavor richness and calorie content. This type is favored in applications where moderate fat content is sufficient to achieve the desired creaminess and taste without the heaviness of higher fat alternatives.

The low fat content category (less than 40%) occupies a niche market within the concentrated milk fat sector. Although it has the smallest share, there is a growing interest in low-fat milk fat products from health-conscious consumers and specific food sectors looking to reduce overall calorie content while still benefiting from the functional properties of milk fat.

By Packaging

In 2023, drums held a dominant market position in the packaging segment of the concentrated milk fat market, capturing more than 48.2% share. This preference is largely due to the practical advantages that drums offer for the storage and transportation of high-fat content products. Drums are highly effective in protecting the product from external contamination and are easy to handle, making them ideal for large-scale industrial use. They are particularly favored in the food industry for their durability and the protection they provide against light and air, which can degrade the quality of milk fat.

Barrels and pails also represent significant portions of the market, with barrels being preferred for their traditional use in the storage and aging of dairy products, adding a distinct flavor characteristic in some cases. Pails, on the other hand, are often used for their convenience in smaller-scale operations or in settings where the product needs to be frequently accessed and used quickly.

Plastic containers are gaining traction, especially in consumer-facing markets where smaller packaging sizes are required. These containers are valued for their light weight and lower cost, as well as their resealability, which is crucial for maintaining product freshness.

By Application

In 2023, the bakery and confectionery segment held a dominant position in the concentrated milk fat market, capturing more than 48.5% share. This segment’s prominence is driven by the critical role that concentrated milk fat plays in providing flavor, texture, and stability in baked goods and sweets. Concentrated milk fat is highly valued in this sector for its ability to enhance mouthfeel and extend the shelf life of products like pastries, cakes, and chocolate, making it a staple ingredient among bakers and confectioners.

The dairy products segment also holds a significant portion of the market, utilizing concentrated milk fat to enrich the creaminess and taste of products such as butter, cream, and cheese. This application benefits from the milk fat’s natural properties, which contribute to the sensory attributes that are key to consumer satisfaction in dairy products.

Nutraceuticals represent another important application, where concentrated milk fat is included for its nutritional benefits, particularly its high content of essential fatty acids and fat-soluble vitamins. This segment leverages the health aspects of milk fat, incorporating it into dietary supplements and functional foods aimed at health-conscious consumers.

By Distribution Channel

In 2023, the direct sales/B2B (business-to-business) channel held a dominant position in the concentrated milk fat market, capturing more than 64.4% of the market share. This dominance is largely due to the bulk nature of concentrated milk fat transactions, where large quantities are typically purchased by manufacturers of bakery and confectionery, dairy products, and other food items. Businesses in these sectors prefer direct purchasing from suppliers to reduce costs and ensure a steady supply of high-quality milk fat, essential for maintaining product consistency and quality.

The indirect sales/B2C (business-to-consumer) channel, while smaller, caters primarily to small businesses, specialty food shops, and individual consumers looking for premium ingredients for home cooking or small-scale commercial use. This segment benefits from the growing trend of gourmet cooking at home and the increasing consumer interest in high-quality, professional-grade ingredients.

Key Market Segments

By Product

- Organic

- Conventional

By Form

- Liquid

- Dry

By Type

- Anhydrous Milk Fat

- Butteroil

By Fat Content

- High (80% or above)

- Medium (40-79%)

- Low (less than 40%)

By Packaging

- Drums

- Barrels

- Pail

- Plastic Containers

- Others

By Application

- Bakery & Confectionery

- Dairy Products

- Nutraceuticals

- Others

By Distribution Channel

- Direct Sales/ B2B

- Indirect Sales/ B2C

Drivers

Increasing Demand for High-Fat Dairy Products as a Key Driver in the Concentrated Milk Fat Market

One major driving factor for the concentrated milk fat market is the rising consumer preference for high-fat dairy products. Over recent years, there has been a significant shift in consumer perception regarding dietary fats. Research and public health advice that once demonized saturated fats are increasingly recognizing the benefits of natural fats in dairy for overall health, which has led to increased consumption of high-fat dairy products.

This change is reflected in the sales figures and market demand observed by food industry analysts. For example, whole milk and full-fat dairy product sales have seen a resurgence as consumers seek out richer flavors and more satisfying dietary options. This trend is supported by studies suggesting that full-fat dairy may be more effective in promoting satiety and weight management compared to lower-fat alternatives. The demand for high-fat dairy extends beyond milk to include products like cheese, yogurt, and butter, all of which require concentrated milk fat as a key ingredient.

Government guidelines and nutritional policies are also adapting to these new perspectives. For instance, the Dietary Guidelines for Americans have shifted focus in recent editions, placing less emphasis on reducing fat intake and more on encouraging healthy food choices across all food groups. These guidelines influence both consumer behavior and food industry practices, supporting the market for concentrated milk fat.

Moreover, the growth of the gourmet food industry and the artisanal production of dairy products have further propelled the demand for high-quality concentrated milk fat. Consumers are increasingly willing to pay a premium for products that are perceived as superior in taste and nutritional value, which often feature concentrated milk fat as a central component.

The popularity of keto and other high-fat, low-carbohydrate diets has also played a significant role in boosting the market. These diets promote the consumption of high levels of fats, which has led to increased use of concentrated milk fat in home cooking and manufactured food products tailored to these dietary preferences.

Restraints

Health Concerns Related to Saturated Fats as a Major Restraint in the Concentrated Milk Fat Market

A significant restraining factor for the growth of the concentrated milk fat market is the persistent health concerns related to the intake of saturated fats, which are prevalent in high-fat dairy products. Despite shifting perspectives on dietary fats, many health organizations and a substantial portion of the consumer base continue to express concerns over the potential risks associated with high saturated fat intake, such as heart disease and cholesterol issues.

For years, guidelines issued by influential bodies such as the World Health Organization (WHO) and the American Heart Association (AHA) have recommended limiting saturated fat consumption to reduce the risk of heart disease. The AHA advises that saturated fats should account for no more than 5% to 6% of total daily calories. This ongoing recommendation influences consumer choices, particularly among those at risk of cardiovascular diseases or monitoring their cholesterol levels.

The impact of these health concerns is evident in market dynamics where, despite the growing popularity of high-fat diets, a significant segment of the market remains cautious about incorporating high-fat dairy products into their regular diet. This caution is reflected in the purchasing behaviors of health-conscious consumers who opt for low-fat or fat-free alternatives, believing them to contribute to a healthier lifestyle.

Moreover, the rise of plant-based diets has also introduced alternatives to animal-derived fats, providing consumers with options that they perceive as healthier and more ethical. The availability of these alternatives is expanding, driven by innovations in food technology and supported by marketing that emphasizes their health and environmental benefits.

In terms of regulatory impacts, governments and health organizations worldwide continue to campaign about the risks of high saturated fat intake, reinforcing these cautionary stances through public health initiatives and nutritional education programs. These efforts aim to inform consumer choices and encourage food manufacturers to reformulate products to contain lower levels of saturated fats.

Opportunity

Expansion in Emerging Markets as a Growth Opportunity for Concentrated Milk Fat

One of the most significant growth opportunities for the concentrated milk fat market lies in the expansion into emerging markets, particularly in regions like Asia, Africa, and Latin America. These regions are witnessing rapid urbanization, rising disposable incomes, and a growing middle class, all of which contribute to an increased demand for dairy and bakery products that utilize concentrated milk fat.

As economies in these regions grow, there is a noticeable shift in dietary patterns towards more Western-style diets, which often include higher-fat dairy products. This shift is supported by a growing awareness of the nutritional benefits provided by dairy fats, such as essential fatty acids and fat-soluble vitamins crucial for human health. For instance, concentrated milk fat is rich in vitamins A, D, E, and K and provides a concentrated source of energy, making it an attractive ingredient for food manufacturers looking to cater to the nutritional needs and preferences of these emerging market consumers.

Furthermore, government initiatives in these regions often aim to improve nutritional standards and encourage the consumption of higher-quality food products. These initiatives can include support for dairy farming and investments in food processing infrastructure, which can directly benefit the concentrated milk fat industry by expanding the supply chain and distribution networks necessary for market growth.

The dairy sector in many of these countries is also undergoing modernization, with investments in technology and processes to improve the quality and output of dairy products. This modernization often includes the adoption of Western technologies and practices, which can integrate the use of concentrated milk fat in traditional and new dairy products alike.

Additionally, the expansion of retail and distribution networks in these regions provides greater access to a variety of food products, including those containing concentrated milk fat. Supermarkets and hypermarkets are expanding, along with online grocery sales, which further facilitates the penetration of high-fat dairy products into the market.

Trends

Integration of Concentrated Milk Fat in Functional and Nutraceutical Foods

A significant trend shaping the concentrated milk fat market is its increasing integration into functional and nutraceutical foods. This trend is driven by growing consumer awareness and demand for food products that not only satisfy hunger but also provide health benefits. Concentrated milk fat, with its high levels of essential fatty acids and fat-soluble vitamins, is being recognized as a valuable ingredient for enhancing the nutritional profile of foods.

As consumers become more health-conscious, they are turning towards products that support health beyond basic nutrition. Foods enhanced with concentrated milk fat are being marketed for their potential benefits in improving heart health, enhancing bone strength, and supporting immune functions. This is largely due to the natural content of vitamins A, D, E, and K in milk fat, which are essential for various bodily functions.

The trend is supported by numerous studies and health experts who advocate for the inclusion of healthy fats in daily diets. This shift is also reflected in the dietary guidelines of several countries, which now emphasize the importance of fat quality over simply minimizing fat intake. These guidelines often promote the consumption of natural animal fats in moderation, recognizing their role in a balanced diet.

Moreover, the food industry is responding to this demand by developing new products that incorporate concentrated milk fat in innovative ways. For example, dairy-based spreads and creams that are fortified with additional nutrients and aimed at health-conscious demographics are becoming more popular. The versatility of concentrated milk fat makes it ideal for such applications, allowing it to be easily incorporated into a wide range of products.

Additionally, the global rise in the popularity of ketogenic and other high-fat, low-carbohydrate diets has further propelled the use of concentrated milk fat in consumer food products. These diets highlight the importance of high-quality fat sources, and concentrated milk fat is increasingly featured in diet plans and recipes targeted at followers of these diets.

Regional Analysis

In 2023, the Asia Pacific (APAC) region dominated the concentrated milk fat market, accounting for a substantial 43.2% market share, valued at USD 1.9 billion. This significant market presence is largely driven by rapid urbanization, growing middle-class populations, and increasing westernization of diets, particularly in countries like China and India. These factors have led to heightened demand for dairy-rich products, including those that utilize concentrated milk fat for enhanced flavor and texture.

In North America, the market is well-established, with a strong emphasis on innovation in dairy products and a robust food processing industry that integrates concentrated milk fat in various applications, from bakery goods to nutraceuticals. The region’s focus on health-conscious food options also supports the demand for high-quality dairy fats.

Europe follows closely, with its market driven by a preference for traditional dairy products and stringent quality standards that favor premium milk fat products. The region’s stringent regulatory environment ensures high-quality standards, making European concentrated milk fat products highly sought after in both local and international markets.

The Middle East & Africa (MEA) and Latin America are experiencing gradual growth in this market. In MEA, increasing disposable incomes and urbanization contribute to the growing demand for dairy products, while in Latin America, a shift towards more processed and high-value dairy items is starting to take root, influencing the use of concentrated milk fat in traditional cuisines.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Among these key players, Fonterra Co-operative Group Limited and Lactalis Ingredients stand out due to their global presence and extensive product offerings that cater to both B2B and consumer markets. Fonterra, based in New Zealand, is one of the largest dairy exporters in the world and is renowned for its high-quality dairy ingredients, including concentrated milk fat, which are crucial for numerous food manufacturing processes. Lactalis, a leading dairy player from France, also commands significant respect in the market for its diversified dairy products, particularly in Europe and North America.

California Dairies, Inc., Darigold, and Royal FrieslandCampina N.V. are also notable for their influential roles in the concentrated milk fat market. California Dairies and Darigold, both based in the United States, are pivotal in supplying concentrated milk fat across North America, known for their commitment to quality and sustainability. Royal FrieslandCampina offers a broad range of dairy products including concentrated milk fat, known for their innovation and quality, serving a global market from their base in the Netherlands.

These companies, along with others like Eurial Ingredients & Nutrition, Grassland Dairy Products, and Hoogwegt, which operate across various continents, contribute to the robust competitive landscape of the concentrated milk fat market. Their operations are crucial in meeting the rising global demand for dairy-based fat products, driven by both direct consumption and industrial food production needs.

Top Key Players

- Asha Ram & Sons Pvt. Ltd.

- California Dairies, Inc.

- Darigold

- Eurial Ingredients & Nutrition

- Fonterra Co-operative Group Limited

- G&R Food

- Gloria Argentina SA

- Grassland Dairy products

- Hoogwegt

- Interfood Holding BV

- JLS Foods International

- Lactalis Ingredients

- Nestlé SA

- Pine River Dairy

- Polmlek Group

- Royal Friesland

- Campina N.V.

- Royal VIVBuisman

- UGA Group

- Vitusa Corp

Recent Developments

Briess Malt & Ingredients, a leading supplier in the malted milk sector, has been instrumental in shaping the market’s growth trajectory.

California Dairies strategic initiatives, including the acquisition of DairyAmerica in January 2023, have enhanced its capabilities in providing premium dairy ingredients, thereby strengthening its position in the competitive landscape.

Report Scope

Report Features Description Market Value (2023) USD 4.4 Bn Forecast Revenue (2033) USD 8.3 Bn CAGR (2024-2033) 6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Organic, Conventional), By Form (Liquid, Dry), By Type (Anhydrous Milk Fat, Butteroil), By Fat Content (High (80% or above), Medium (40-79%), Low (less than 40%)), By Packaging (Drums, Barrels, Pail, Plastic Containers, Others), By Application (Bakery and Confectionery, Dairy Products, Nutraceuticals, Others), By Distribution Channel (Direct Sales/ B2B, Indirect Sales/ B2C) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Asha Ram & Sons Pvt. Ltd., California Dairies, Inc., Darigold, Eurial Ingredients & Nutrition, Fonterra Co-operative Group Limited, G&R Food, Gloria Argentina SA, Grassland Dairy products, Hoogwegt, Interfood Holding BV, JLS Foods International, Lactalis Ingredients, Nestlé SA, Pine River Dairy, Polmlek Group, Royal Friesland, Campina N.V., Royal VIVBuisman, UGA Group, Vitusa Corp Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Concentrated Milk Fat MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Concentrated Milk Fat MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Asha Ram & Sons Pvt. Ltd.

- California Dairies, Inc.

- Darigold

- Eurial Ingredients & Nutrition

- Fonterra Co-operative Group Limited

- G&R Food

- Gloria Argentina SA

- Grassland Dairy products

- Hoogwegt

- Interfood Holding BV

- JLS Foods International

- Lactalis Ingredients

- Nestlé SA

- Pine River Dairy

- Polmlek Group

- Royal Friesland

- Campina N.V.

- Royal VIVBuisman

- UGA Group

- Vitusa Corp