Global Battery Material Market Size, Share Analysis Report By Material (Anode, Cathode, Electrolyte, Binder, Others), By Battery Type (Lithium-ion, Lead acid, Others), By End-user (Automotive, Consumer Electronics, Industrial, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146574

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

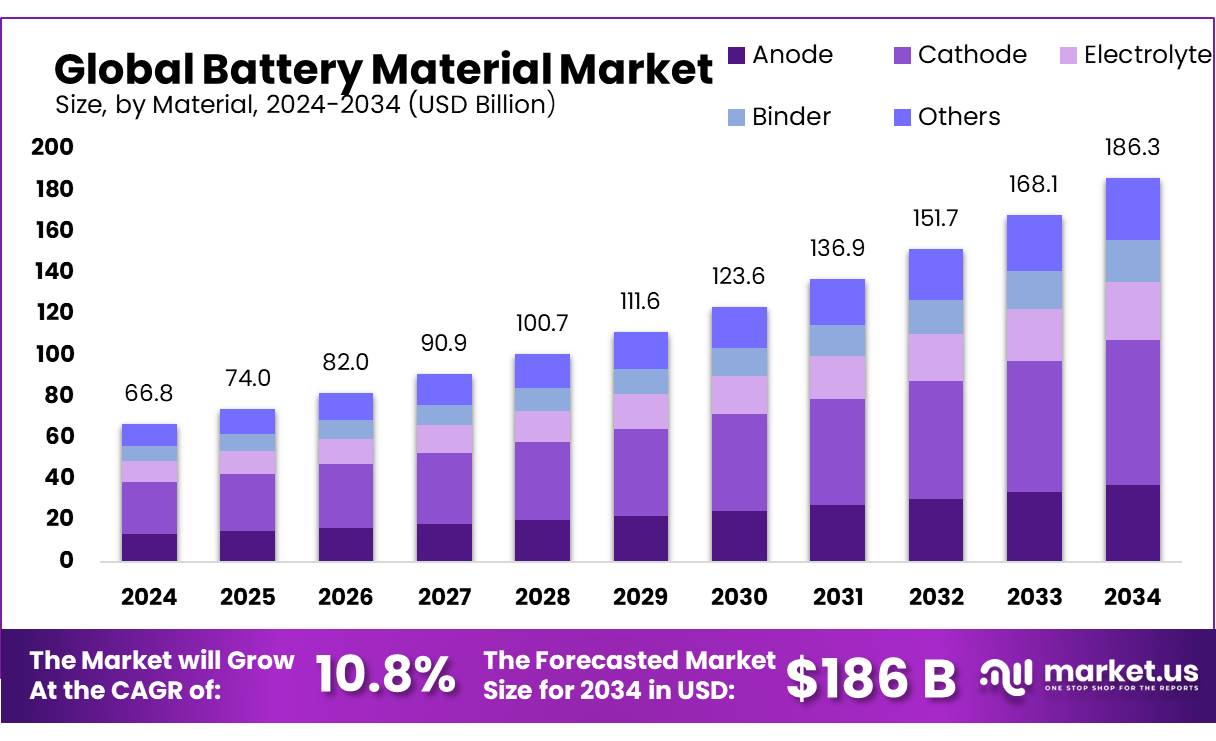

The Global Battery Material Market size is expected to be worth around USD 186.3 Bn by 2034, from USD 66.8 Bn in 2024, growing at a CAGR of 10.8% during the forecast period from 2025 to 2034.

The battery materials market is at the forefront of the global push towards electrification, influenced by the rising demand for electric vehicles (EVs), renewable energy integration, and portable electronic devices. As the core component of batteries, materials such as lithium, cobalt, nickel, and graphite, along with advanced cathodes and anodes, play critical roles in the functionality and efficiency of energy storage solutions.

The battery materials sector has continued to experience significant growth, driven by technological advancements and increasing investments in battery technology. This growth is catalyzed by the global transition towards sustainable energy practices, with governments and private sectors alike prioritizing innovations that enhance battery performance and sustainability. For instance, the U.S. Department of Energy announced in 2023 a funding initiative of USD 200 million aimed at advancing battery technology which underscores the commitment to supporting this critical industry.

The Indian government has implemented several initiatives to bolster the battery materials sector. The Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) Battery Storage, launched in 2021, allocates INR 18,100 crore (approximately USD 2.4 billion) to encourage domestic manufacturing of battery components.

Driving factors for the battery materials market include the escalating adoption of EVs, spurred by government regulations aimed at reducing carbon emissions. Countries across the globe have set stringent emission standards and provide incentives for EV purchases, which in turn boost the demand for high-performance batteries. The European Union, for example, has implemented policies that require a significant reduction in automotive emissions, with proposals aiming for a 55% reduction by 2030 compared to 2021 levels.

The future growth opportunities in the battery materials market are substantial. The development of solid-state batteries offers a promising horizon. These batteries promise higher energy densities, faster charging times, and increased safety, potentially revolutionizing the market once they reach commercial viability. Furthermore, the need for sustainable and ethically sourced materials continues to drive research into alternative materials and recycling technologies. Initiatives like battery recycling programs are gaining traction, supported by policies that encourage circular economies within the battery industry.

Key Takeaways

- Battery Material Market size is expected to be worth around USD 186.3 Bn by 2034, from USD 66.8 Bn in 2024, growing at a CAGR of 10.8%.

- Cathodes within the battery materials market achieved a significant milestone, securing a dominant market share of 37.8%.

- Lithium-ion batteries secured a commanding position in the battery materials market, capturing an impressive 79.3% share.

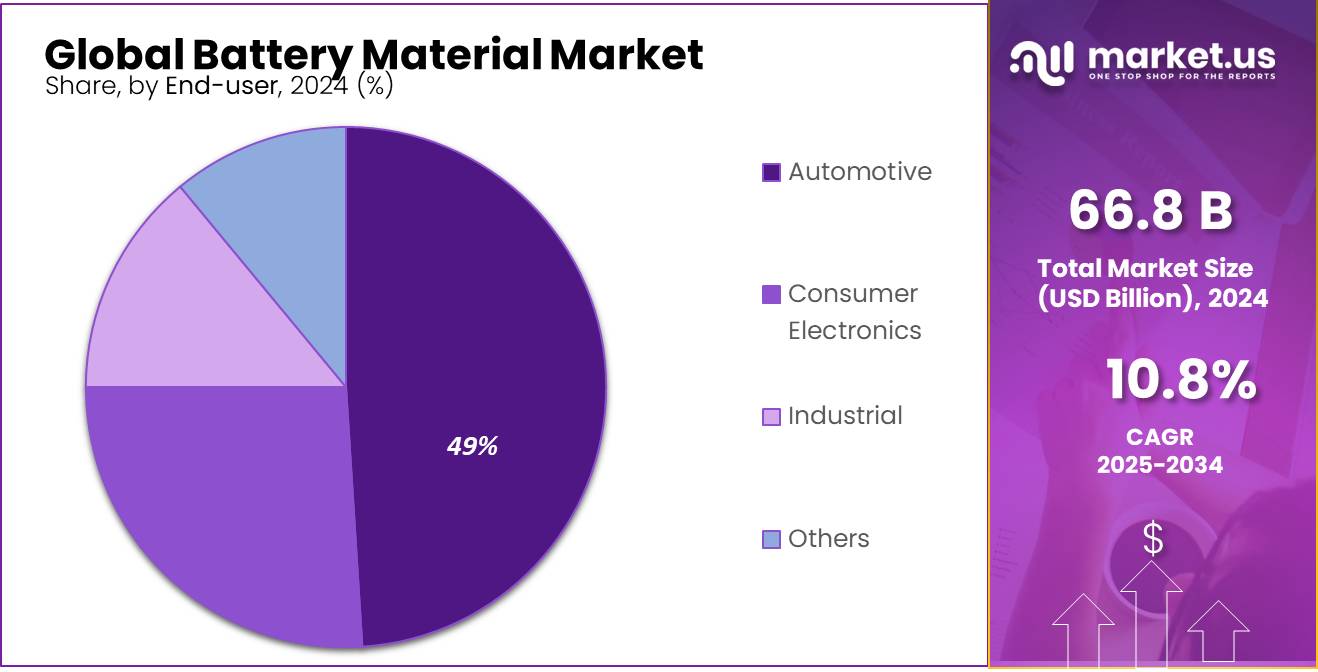

- Automotive sector carved out a significant niche in the battery materials market, holding a dominant 49.8% share.

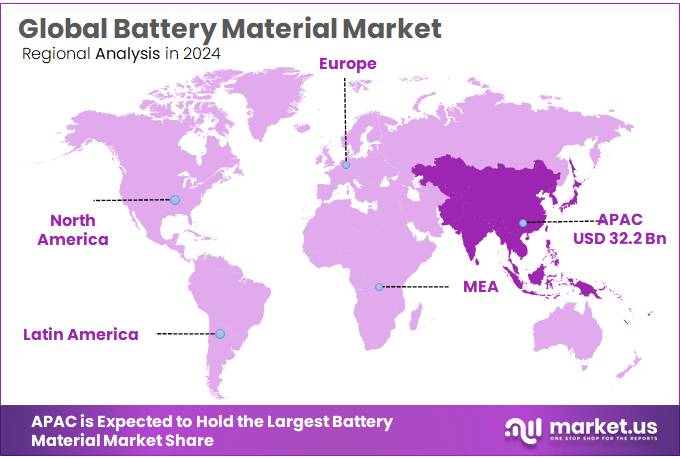

- Asia-Pacific (APAC) region holds a commanding position in the global battery materials market, capturing a dominant 48.3% market share and generating revenues worth USD 32.2 billion.

By Material

Cathodes Lead with 37.8% Share Owing to High Efficiency and Durability

In 2024, the segment for cathodes within the battery materials market achieved a significant milestone, securing a dominant market share of 37.8%. This substantial portion reflects the pivotal role cathodes play in battery composition, primarily due to their impact on the overall performance, efficiency, and life span of batteries.

The cathode materials are crucial as they directly influence the energy density and stability of batteries, making them essential for high-demand applications across various industries including automotive, consumer electronics, and renewable energy storage systems. Their dominance in the market is further supported by ongoing advancements in material science, which strive to enhance the capability and durability of cathode materials to meet the rising energy requirements of modern technology.

By Battery Type

Lithium-ion Batteries Command 79.3% Market Share Due to Superior Performance

In 2024, lithium-ion batteries secured a commanding position in the battery materials market, capturing an impressive 79.3% share. This dominance is largely attributed to their superior energy density, longer life cycles, and consistent performance across a range of applications. Lithium-ion batteries are the preferred choice in sectors such as electric vehicles, portable electronics, and renewable energy systems, where efficiency and reliability are paramount. Their widespread adoption is supported by ongoing technological advancements that continue to enhance their performance and reduce costs, ensuring they remain at the forefront of the battery technology landscape.

By End-user

Automotive Sector Dominates with 49.8% Share Due to High Demand for EVs

In 2024, the automotive sector carved out a significant niche in the battery materials market, holding a dominant 49.8% share. This substantial market presence is largely fueled by the accelerating shift towards electric vehicles (EVs), driven by global efforts to reduce carbon emissions and enhance fuel efficiency. The automotive industry’s demand for high-performance batteries underscores the critical role of advanced battery materials in meeting the energy requirements of modern vehicles. This trend is expected to persist as advancements in battery technology continue to evolve, further cementing the automotive sector’s position as a key end-user in the battery materials market.

Key Market Segments

By Material

- Anode

- Lithium

- Cobalt

- Lead

- Carbon

- Graphite

- Magnesium

- Others

- Cathode

- Magnesium Dioxide

- Lithium Magnesium Oxide

- Lead Dioxide

- Lithium Cobalt Oxide

- Nickel Magnesium Cobalt

- Nickel Cobalt Aluminum

- Others

- Electrolyte

- Ammonium Chloride

- Zinc Carbon

- Alkali Metal Hydroxide

- Sulfuric Acid

- Others

- Binder

- Others

By Battery Type

- Lithium-ion

- Lead acid

- Others

By End-user

- Automotive

- Consumer Electronics

- Industrial

- Others

Drivers

Government Push for Electric Vehicles Fuels Demand for Advanced Battery Materials

A significant driving factor for the growth of the battery materials market is the global push by governments to increase the adoption of electric vehicles (EVs) as part of their efforts to combat climate change and reduce dependency on fossil fuels. Initiatives such as tax incentives, subsidies for EV buyers, and investments in EV infrastructure are pivotal in promoting the use of electric vehicles. For instance, the U.S. Department of Energy has allocated substantial funds towards battery innovation to enhance the energy density and reduce the cost of EV batteries.

Furthermore, the European Union’s stringent emissions regulations have compelled automakers to expedite the development and deployment of electric vehicles, thereby boosting the demand for high-performance battery materials. The EU’s Green Deal aims to achieve climate neutrality by 2050, which includes proposals to lower the emissions from new cars by 55% in 2030 compared to 2021 levels. This regulatory framework has led to increased research and development in battery technologies, focusing on improving efficiency and reducing environmental impact.

Additionally, countries like China are leading in both the production and adoption of electric vehicles. The Chinese government has been supporting the EV industry through financial incentives and has established ambitious targets for electric vehicle sales, aiming for EVs to constitute 40% of all automobile sales by 2030. Such policies not only drive the demand for batteries but also for the innovative materials necessary to enhance battery performance, longevity, and safety.

These government initiatives underscore the critical role that policy frameworks play in shaping market dynamics and driving the demand for advanced battery materials. As these policies continue to evolve, they will likely remain a key driver for the battery materials market, supporting the global transition towards sustainable energy solutions.

Restraints

Supply Chain Vulnerabilities Hinder Battery Material Market Growth

One of the main restraining factors impacting the battery materials market is the vulnerability of the supply chain for critical raw materials. The production of batteries, especially lithium-ion batteries, relies heavily on materials such as lithium, cobalt, and nickel, which are often sourced from a limited number of countries. For example, over 60% of the world’s cobalt, a crucial component for battery cathodes, is mined in the Democratic Republic of Congo (DRC). This concentration raises significant risks related to political instability, regulatory changes, and potential disruptions due to conflicts or health crises in the region.

Moreover, the extraction processes of these materials pose environmental and ethical challenges, leading to stricter regulations by governments and increased scrutiny by non-governmental organizations (NGOs). For instance, the European Union has implemented regulations that aim to ensure responsible sourcing of minerals, particularly those associated with conflict areas and human rights abuses. Such regulations can complicate supply chains and increase costs for battery manufacturers, impacting the overall market growth.

Additionally, the rapid growth in demand for electric vehicles and energy storage systems has led to concerns about the long-term availability of these critical minerals. Although recycling initiatives and technological advancements in battery composition are underway, the transition is not immediate and is dependent on developing effective recycling technologies and alternative material solutions.

To address these challenges, governments and industry leaders are investing in research and development to find sustainable alternatives to traditional battery materials. For instance, the U.S. Department of Energy has funded projects aimed at reducing the reliance on rare earth elements and developing new materials that can provide the same or better performance as current technologies.

Opportunity

Renewable Energy Integration Presents Expansive Opportunities for Battery Materials

The integration of renewable energy sources with grid systems presents a substantial growth opportunity for the battery materials market. As the world increasingly shifts towards sustainable energy solutions, the need for efficient energy storage solutions escalates. Batteries, particularly those used in large-scale energy storage systems, are crucial for stabilizing renewable energy supply, which tends to be intermittent due to its dependency on weather conditions.

Governments around the globe are bolstering their support for renewable energy technologies through various incentives and regulatory frameworks. For example, the European Union’s Green Deal and the United States’ Green New Deal outline significant investments in renewable energy, which include enhancements to grid storage capacities. Such policies directly contribute to the growth of the battery market, as effective energy storage is essential to the broad adoption of solar and wind energy.

Additionally, technological advancements in battery materials are enhancing the efficiency and reducing the cost of batteries. Innovations such as solid-state batteries and improvements in lithium-ion technologies are making energy storage more reliable and economically viable. These advancements are crucial for enabling the consistent integration of renewable energy sources into the grid.

Furthermore, the expansion of electric vehicle (EV) markets globally boosts demand for high-performance batteries, which, in turn, drives the development of new and improved battery materials. As EVs become more mainstream, the synergies between renewable energy and electric transportation systems grow stronger, creating a cycle of increasing demand for more sophisticated energy storage solutions.

Trends

Solid-State Batteries: Pioneering a Revolution in Energy Storage

One of the most significant trends in the battery materials market is the development and anticipated commercialization of solid-state batteries. This emerging technology is poised to transform the landscape of energy storage with its potential to offer higher energy densities and improved safety compared to conventional lithium-ion batteries. Solid-state batteries replace the liquid electrolyte with a solid counterpart, which can significantly enhance the battery’s thermal stability and reduce risks associated with leakage and volatility.

The interest in solid-state technology has been spurred by the increasing demands of the electric vehicle (EV) industry, which requires more efficient, safer, and longer-lasting batteries. Major automotive companies and battery manufacturers are investing heavily in the research and development of solid-state batteries. For instance, Toyota has announced its plan to commercialize solid-state battery technology for electric vehicles by the mid-2020s, aiming to provide batteries that can be charged in under 10 minutes with a higher range per charge.

Furthermore, government bodies are recognizing the potential of this technology and are providing support through funding and partnerships. The U.S. Department of Energy, for example, has funded multiple projects under its Advanced Research Projects Agency-Energy (ARPA-E) to innovate and lower the costs of solid-state battery technologies. These initiatives are critical in overcoming the current barriers to entry for solid-state batteries, such as high material costs and manufacturing scalability.

The transition to solid-state batteries could also see an increased demand for new types of battery materials, such as advanced ceramics and glassy electrolytes, which are essential components of solid-state systems. This shift is expected to drive significant changes in supply chains and production techniques within the battery materials industry.

Regional Analysis

APAC Dominates Battery Materials Market with 48.3% Share and $32.2 Billion in Revenue

The Asia-Pacific (APAC) region holds a commanding position in the global battery materials market, capturing a dominant 48.3% market share and generating revenues worth USD 32.2 billion. This substantial market presence can be attributed to several factors that are unique to the region. APAC benefits from the presence of major economies such as China, Japan, South Korea, and India, which are not only large consumers but also key producers of battery materials and technology.

China, in particular, is a global leader in the production and export of battery materials, driven by its vast industrial base and aggressive governmental policies supporting the battery and electric vehicle (EV) industries. The Chinese government has implemented numerous initiatives and subsidies to boost the production of lithium-ion batteries, aiming to meet the internal demand from its burgeoning EV market as well as to furnish the global market.

Similarly, Japan and South Korea are renowned for their technological advancements in battery materials, particularly in the development of high-capacity, safe, and durable lithium-ion batteries. These countries host some of the world’s leading electronic manufacturers and battery developers, such as Panasonic and LG Chem, who are at the forefront of battery technology innovation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Asahi Kasei, a diversified Japanese conglomerate, has carved a niche in the battery materials market through its advanced materials division. The company focuses on producing separator films for lithium-ion batteries, a critical component that enhances battery safety and efficiency. Their commitment to innovation and quality has positioned them as key suppliers in the rapidly growing electric vehicle and energy storage sectors. Asahi Kasei continues to expand its global footprint, investing in technology to meet the increasing demand for high-performance battery components.

BASF SE, the German chemical giant, is pivotal in the battery materials sector, particularly known for its development of cathode materials for lithium-ion batteries. Their products are crucial for improving battery life, capacity, and performance. BASF is committed to sustainability and has been actively expanding its production capacity to support the global shift towards electric mobility. The company’s strategic investments in research and development aim to further enhance the efficiency and environmental footprint of their battery materials.

Hitachi Chemical, recently rebranded as Showa Denko Materials, is an influential player in the battery materials industry, known for its high-performance materials for lithium-ion batteries. Their offerings include anode and cathode materials, which are essential for increasing the energy density and durability of batteries. Hitachi Chemical’s focus on R&D and its integrated supply chain enable it to provide innovative solutions that meet the advanced requirements of the automotive and electronics industries.

Top Key Players in the Market

- Asahi Kasei

- BASF SE

- Hitachi Chemical Co., Ltd.

- Johnson Matthey

- Kureha Corporation

- Mitsubishi Chemical Holdings

NEI Corporation - NICHIA CORPORATION

- Posco

- Shanghai Shanshan Tech Co., Ltd.

- Sumitomo Corporation

- Targray Technology International

- TCI Chemicals (India) Pvt. Ltd.

- Toray Industries

- Umicore Cobalt & Specialty Materials (CSM)

Recent Developments

In 2024, Asahi Kasei’s commitment to enhancing the safety and performance of batteries is evident as they continue to invest in research and development to push the boundaries of their material technologies.

In 2024, BASF has focused on advancing its portfolio of high-energy cathode materials which are essential for manufacturing powerful lithium-ion batteries. These cathode materials are designed to improve the performance and extend the lifespan of batteries, crucial for applications in electric vehicles and renewable energy storage systems.

Report Scope

Report Features Description Market Value (2024) USD 66.8 Bn Forecast Revenue (2034) USD 186.3 Bn CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Anode, Cathode, Electrolyte, Binder, Others), By Battery Type (Lithium-ion, Lead acid, Others), By End-user (Automotive, Consumer Electronics, Industrial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Asahi Kasei, BASF SE, Hitachi Chemical Co., Ltd., Johnson Matthey, Kureha Corporation, Mitsubishi Chemical Holdings, NEI Corporation, NICHIA CORPORATION, Posco, Shanghai Shanshan Tech Co., Ltd., Sumitomo Corporation, Targray Technology International, TCI Chemicals (India) Pvt. Ltd., Toray Industries, Umicore Cobalt & Specialty Materials (CSM) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Asahi Kasei

- BASF SE

- Hitachi Chemical Co., Ltd.

- Johnson Matthey

- Kureha Corporation

- Mitsubishi Chemical Holdings NEI Corporation

- NICHIA CORPORATION

- Posco

- Shanghai Shanshan Tech Co., Ltd.

- Sumitomo Corporation

- Targray Technology International

- TCI Chemicals (India) Pvt. Ltd.

- Toray Industries

- Umicore Cobalt & Specialty Materials (CSM)