Global Solar Photovoltaic Glass Market Size, Share Analysis Report By Type (Photovoltaic Glass, Multifunctional Glass, AR Coated, Tempered, Others), By Grade of Transparency (Low Transparency, Medium Transparency, High Transparency), By Application (Curtain Walls, Facades, Skylights, Solar PV Panels, Glazing, Wind Shield, Others), By End Use (Solar Energy, Building and Construction, Automotive Industry, Infrastructure, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146278

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

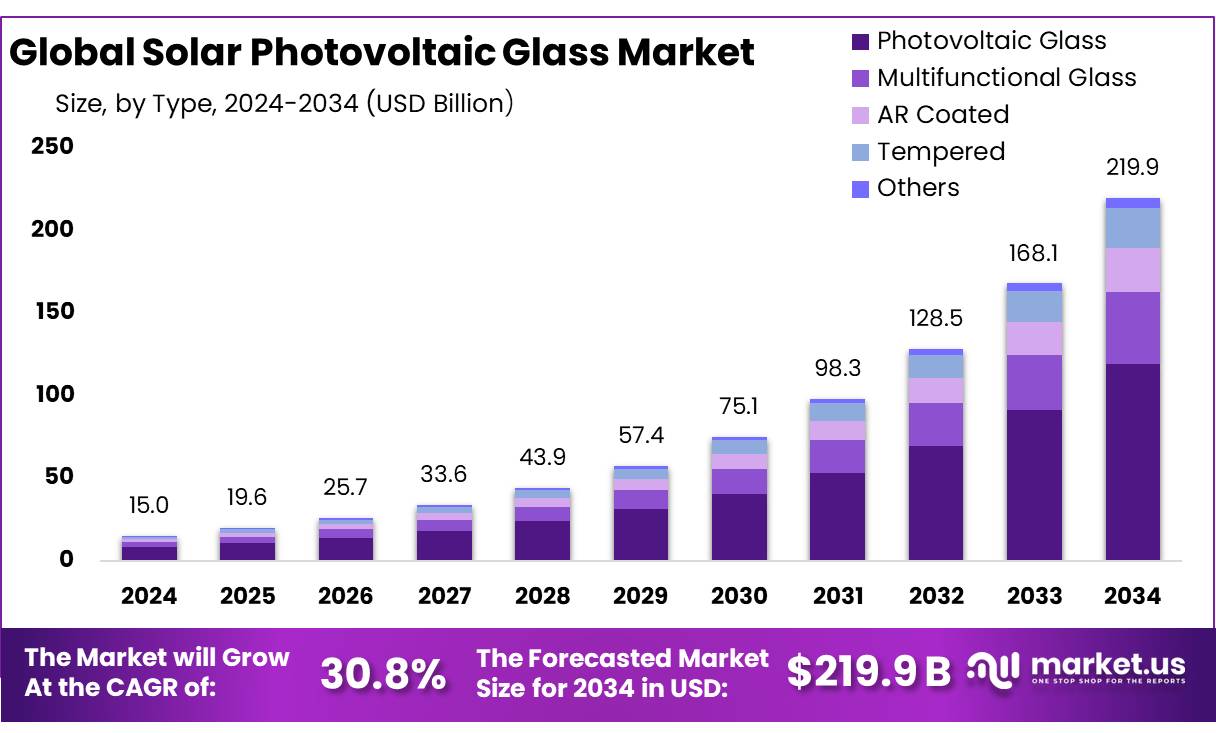

The Global Solar Photovoltaic Glass Market size is expected to be worth around USD 219.9 Bn by 2034, from USD 15.0 Bn in 2024, growing at a CAGR of 30.8% during the forecast period from 2025 to 2034.

The solar photovoltaic (PV) glass market has become a pivotal component in the global shift towards renewable energy. Solar PV glass is used as a component in solar panels to convert sunlight into electricity, demonstrating significant growth due to its efficiency and the increasing adoption of clean energy solutions.

Solar PV glass is distinguished by its transparency and the capability to withstand environmental conditions, providing optimal exposure to sunlight while protecting the photovoltaic cells underneath. In 2024, the global demand for solar PV glass surged, driven by substantial investments in solar energy projects. According to the International Energy Agency (IEA), solar power capacity additions worldwide are expected to grow by over 15% annually, propelled by decreasing costs and improved technologies.

The primary drivers of the solar PV glass market include governmental support for renewable energy, technological advancements, and increasing awareness of sustainable energy sources. Governments worldwide have been instrumental in this growth through incentives and subsidies to encourage solar installations. For instance, the U.S. government has extended the Investment Tax Credit (ITC) for solar energy, which provides a 26% tax credit for solar systems on residential and commercial properties through 2024.

Future Growth Opportunities Looking ahead, the solar PV glass market is poised for further expansion. One significant area of opportunity is the integration of solar PV installations in building materials, known as building-integrated photovoltaics (BIPV). The global BIPV market is anticipated to witness substantial growth, with predictions suggesting a market size exceeding USD 60 billion by 2026, as per data from governmental sources and industry analysts. This growth is facilitated by urbanization and the increasing incorporation of sustainable practices in architecture.

Key Takeaways

- Solar Photovoltaic Glass Market size is expected to be worth around USD 219.9 Bn by 2034, from USD 15.0 Bn in 2024, growing at a CAGR of 30.8%.

- Photovoltaic Glass solidified its market supremacy in the solar photovoltaic glass sector, securing a substantial 54.2% market share.

- Medium Transparency photovoltaic glass claimed a commanding market position by capturing over 56.4% of the market share.

- Curtain Walls in the solar photovoltaic glass market secured a leading position, accounting for a significant 58.7% market share.

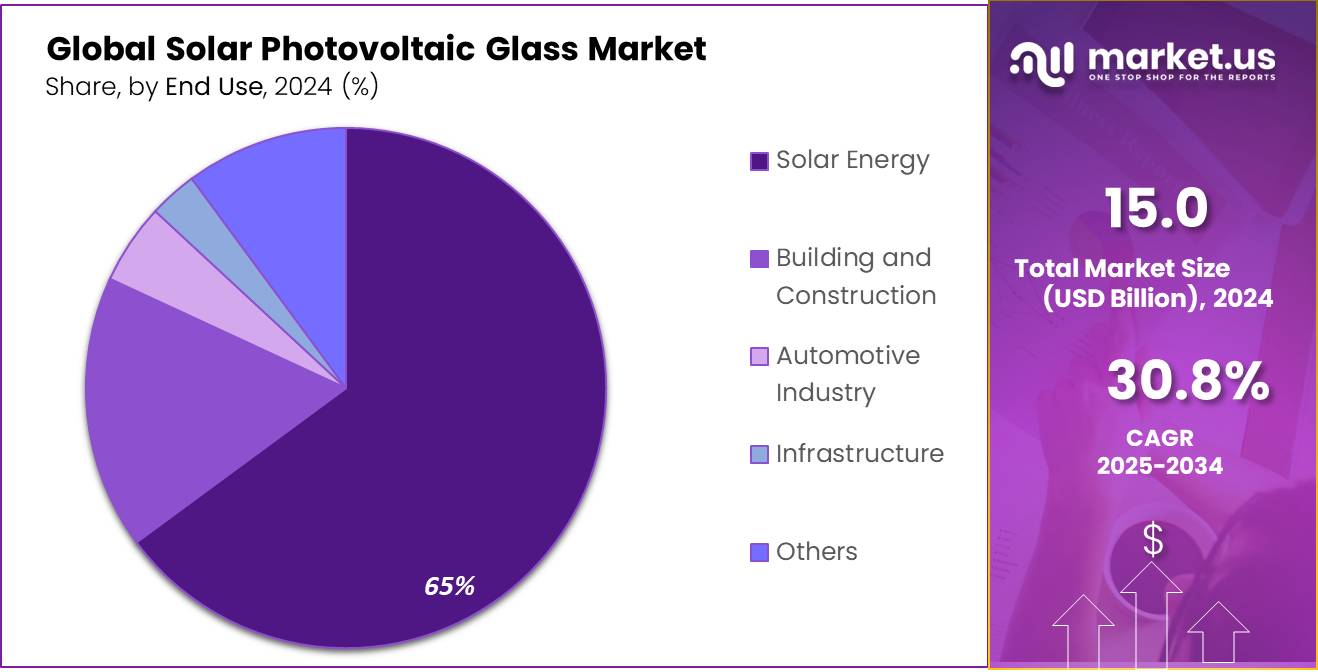

- Solar energy sector dramatically underscored its market leadership within the solar photovoltaic glass market, capturing an impressive 64.9% share.

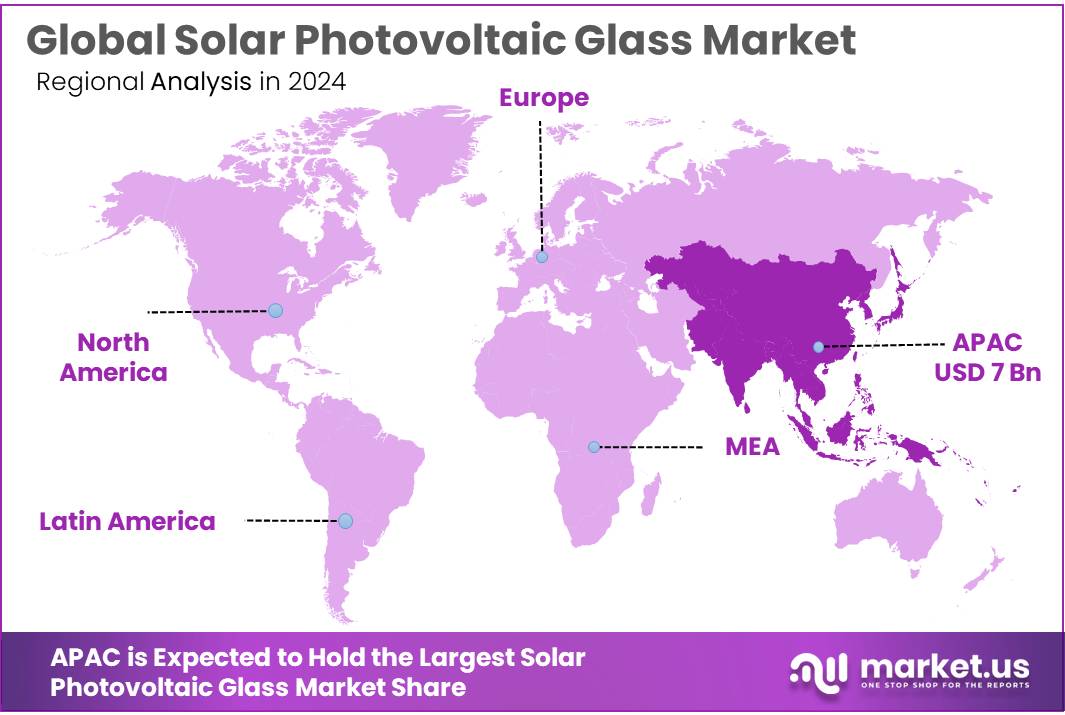

- Asia-Pacific (APAC) region continues to dominate the solar photovoltaic glass market, holding a commanding 46.7% market share, which equates to a market value of approximately USD 7 billion.

By Type

Photovoltaic Glass Continues to Lead with 54.2% Share Due to Rising Solar Adoption

In 2024, Photovoltaic Glass solidified its market supremacy in the solar photovoltaic glass sector, securing a substantial 54.2% market share. This dominance is attributed to the escalating global shift towards renewable energy sources, where photovoltaic glass plays a crucial role in enhancing the efficiency and durability of solar panels.

The increased demand for sustainable energy solutions, coupled with advancements in glass technology that improve light absorption and energy conversion rates, has significantly propelled the adoption of photovoltaic glass. This trend is expected to persist as more regions invest in clean energy infrastructures to meet their environmental targets and reduce carbon footprints, further cementing photovoltaic glass’s critical role in the renewable energy landscape.

By Grade of Transparency

Medium Transparency Leads with 56.4% Share, Favored for Balanced Performance

In 2024, Medium Transparency photovoltaic glass claimed a commanding market position by capturing over 56.4% of the market share. This segment’s popularity is largely driven by its ability to offer a balance between light transmission and energy efficiency, making it particularly appealing for residential and commercial solar applications.

Medium transparency glass provides sufficient natural light penetration while maintaining high energy capture, which is essential for maximizing the efficiency of photovoltaic systems without compromising on aesthetic and environmental considerations. The increasing incorporation of solar energy solutions in architectural designs and urban planning further supports the continued dominance of this segment, reflecting a growing preference for sustainable and energy-efficient building materials.

By Application

Curtain Walls Command 58.7% Share, Boosted by Aesthetic and Energy Gains

In 2024, Curtain Walls in the solar photovoltaic glass market secured a leading position, accounting for a significant 58.7% market share. This dominance is primarily driven by the increasing integration of solar energy solutions in modern architecture. Curtain walls made of photovoltaic glass not only enhance the aesthetic appeal of buildings but also contribute to their energy efficiency.

These glass walls enable buildings to produce their own power, reducing reliance on external energy sources and significantly cutting energy costs. The trend towards more sustainable and energy-efficient building practices is likely to continue propelling the demand for photovoltaic curtain walls, as businesses and homeowners increasingly prioritize green building standards and energy independence.

By End Use

Solar Energy Tops with 64.9% Share, Fueled by Global Shift to Renewable Sources

In 2024, the Solar energy sector dramatically underscored its market leadership within the solar photovoltaic glass market, capturing an impressive 64.9% share. This dominant position is chiefly attributed to the global drive towards sustainable energy sources, with solar energy at the forefront of this transition. Photovoltaic glass plays a pivotal role in this context, enhancing the efficiency of solar panels which are integral to residential, commercial, and industrial energy systems.

As governments and corporations intensify their commitments to reduce carbon footprints and promote green energy, the demand for solar photovoltaic glass in solar energy applications is expected to surge, maintaining its majority stake in the market. This trend reflects the broader societal shift towards energy sustainability and the increasing viability of solar technologies.

Key Market Segments

By Type

- Photovoltaic Glass

- Multifunctional Glass

- AR Coated

- Tempered

- Others

By Grade of Transparency

- Low Transparency

- Medium Transparency

- High Transparency

By Application

- Curtain Walls

- Facades

- Skylights

- Solar PV Panels

- Glazing

- Wind Shield

- Others

By End Use

- Solar Energy

- Building and Construction

- Automotive Industry

- Infrastructure

- Others

Drivers

Government Incentives Propel Growth in Solar Photovoltaic Glass Market

One of the primary driving factors for the growth of the solar photovoltaic glass market is the significant support from various government initiatives worldwide. Governments across the globe are increasingly promoting the adoption of solar energy through financial incentives such as grants, tax benefits, and favorable tariffs. For instance, the United States’ Department of Energy has launched multiple programs aimed at supporting solar technology adoption. Notably, the Solar Energy Technologies Office (SETO) funds projects that enhance the affordability, reliability, and domestic benefit of solar technologies on the grid.

Moreover, the European Union has set ambitious targets to reduce greenhouse gas emissions, with a strategic plan to increase the share of renewable energy in its total energy mix. This includes substantial funding for solar energy projects under the Horizon 2020 program, which is the EU’s largest research and innovation program with nearly €80 billion in funding available over 7 years (2014 to 2020).

These government-led incentives are crucial in lowering the capital costs associated with solar installations, making solar energy more accessible and appealing to both public and private sectors. As more entities opt for solar solutions to power their operations, the demand for solar photovoltaic glass, known for its ability to enhance the efficiency and durability of solar panels, has witnessed a significant uptick.

Restraints

High Initial Investment Costs Deter Widespread Adoption of Solar Photovoltaic Glass

One significant restraining factor affecting the growth of the solar photovoltaic glass market is the high initial investment required for solar installations. Despite the long-term savings and environmental benefits of solar energy, the upfront costs associated with purchasing and installing solar photovoltaic systems can be prohibitive for many potential users, particularly in less developed regions.

The cost of solar photovoltaic glass, which is integral to the efficiency of solar panels, adds a considerable amount to the overall expenses. These costs stem from the sophisticated manufacturing processes required to produce high-quality, durable photovoltaic glass that can withstand environmental pressures and provide long-term reliability.

For example, while the price of solar panels has decreased significantly over the past decade, the cost for an average residential solar installation can still range between $15,000 and $25,000 in the United States after federal tax credits. This figure can vary widely depending on the size of the installation and the specific technologies used, including the type of photovoltaic glass. Such substantial initial costs can deter homeowners and small businesses from adopting solar technology, especially in areas without substantial government subsidies or financing options.

Opportunity

Expanding Urban Landscapes Offer Growth Avenues for Solar Photovoltaic Glass

The rapid expansion of urban environments presents a major growth opportunity for the solar photovoltaic glass market. As cities worldwide continue to grow, so does the demand for innovative and sustainable building materials. Solar photovoltaic glass is uniquely positioned to meet this demand, offering benefits like energy savings, reduced carbon emissions, and enhanced building aesthetics.

Increasingly, urban planners and architects are integrating solar photovoltaic glass into the design and construction of new buildings as part of a broader push towards sustainable urban development. This integration is often supported by local and national government initiatives encouraging renewable energy installations and green building practices. For instance, the European Commission has endorsed the use of renewable energy technologies in urban areas through policies that support the energy performance of buildings and reduce urban carbon footprints.

Furthermore, the global push for smart cities, which leverage technology to create more efficient and sustainable urban environments, also includes the adoption of integrated solar energy solutions. Solar photovoltaic glass can play a crucial role in these initiatives by providing an active building material that not only supports the structure’s energy needs but also contributes to the aesthetic and functional value of urban landscapes.

Trends

Integration of BIPV Technology Drives Innovation in Solar Photovoltaic Glass Market

A major trend shaping the solar photovoltaic glass market is the increasing integration of Building-Integrated Photovoltaics (BIPV). As architects and builders seek more aesthetically pleasing and functional ways to incorporate renewable energy solutions into new buildings and renovations, BIPV technology has emerged as a key innovator. BIPV products replace conventional building materials in parts of the building envelope such as the roof, skylights, or facades with photovoltaic materials that generate electricity while providing structural integrity.

This trend is gaining traction, driven by a global emphasis on sustainability and energy efficiency within the building sector. For instance, the European Union, under its Green Deal, has set ambitious targets to reduce greenhouse gas emissions by 55% by 2030. Part of this initiative encourages the adoption of BIPV systems in residential and commercial buildings to contribute to these targets significantly.

BIPV technology not only enhances a building’s energy self-sufficiency but also integrates seamlessly into its design, offering significant architectural flexibility. The latest advancements in solar photovoltaic glass have resulted in products that are indistinguishable from traditional glazing, yet capable of producing clean energy. This integration has opened new avenues for architects and designers to embed solar energy generation directly into the aesthetic and functional aspects of their projects without compromising on style or design integrity.

Regional Analysis

The Asia-Pacific (APAC) region continues to dominate the solar photovoltaic glass market, holding a commanding 46.7% market share, which equates to a market value of approximately USD 7 billion. This substantial market presence is largely driven by the rapid expansion of solar energy installations across several APAC countries, which are increasingly investing in renewable energy to meet their growing power needs while addressing environmental concerns.

China leads within the region, not only as the largest producer of photovoltaic glass but also as the largest consumer, driven by governmental policies aimed at boosting renewable energy capacity and reducing reliance on coal. The Chinese government has implemented several initiatives, such as feed-in tariffs and subsidies for solar developments, which have significantly propelled the market forward.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AGC Glass Europe stands as a pioneer in the production of high-performance glass products, including solar photovoltaic glass. Leveraging advanced technology, AGC focuses on creating energy-efficient glass that maximizes solar energy conversion. Their commitment to sustainability is evident in their eco-friendly production methods, which significantly reduce the environmental footprint of their manufacturing processes. AGC Glass Europe’s strategic position in the market is strengthened by its expansive distribution network across the continent, catering to a diverse range of industries seeking green building solutions.

Nippon Sheet Glass Co., Ltd., a key player in the global market, specializes in the production of glass and glazing solutions in three major sectors: Architectural, Automotive, and Technical Glass. Their photovoltaic glass segment is renowned for its innovative, high-quality products that enhance the efficiency of solar energy systems. Nippon Sheet Glass focuses on sustainable practices and continuous improvement in their manufacturing processes to meet the increasing demand for renewable energy solutions, particularly in Asia and Europe.

Taiwan Glass Industry Corporation, one of Asia’s leading glass manufacturers, excels in producing a wide range of glass products, including solar photovoltaic glass. Their commitment to innovation is showcased in their state-of-the-art production facilities, which produce high-transparency and high-efficiency photovoltaic glass, catering to the booming solar energy sector. Taiwan Glass has strategically positioned itself to leverage the rapid growth of solar installations in the region, emphasizing sustainability and energy efficiency.

Top Key Players

- AGC Glass Europe.

- Nippon Sheet Glass Co., Ltd.

- Taiwan Glass Industry Corporation

- Xinyi Solar Holdings Limited

- Sisecam

- Guardian Glass

- Saint-Gobain

- Borosil Limited

- China-Henan Huamei Chemical Co., Ltd.,

- Interfloat Corporation

- Guangdong Golden Glass Technologies Ltd.,

- Hecker Glastechnik GmbH & Co. KG

- ENF Ltd.,

- Emmvee Toughened Glass Private Limited

- Euroglas GmbH

Recent Developments

In 2024, Nippon Sheet Glass has focused on innovations that improve the efficiency and longevity of solar panels. Their commitment to environmental sustainability is evident in their production processes, which are designed to minimize carbon emissions and reduce environmental impact.

In 2024, AGC Glass Europe continued to assert its dominance in the solar photovoltaic glass market, driven by its commitment to innovation and sustainability. As a leading manufacturer of glass and glass-related products, AGC Glass Europe has tailored its offerings to meet the growing demand for renewable energy solutions across the continent.

Report Scope

Report Features Description Market Value (2024) USD 15.0 Bn Forecast Revenue (2034) USD 219.9 Bn CAGR (2025-2034) 30.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Photovoltaic Glass, Multifunctional Glass, AR Coated, Tempered, Others), By Grade of Transparency (Low Transparency, Medium Transparency, High Transparency), By Application (Curtain Walls, Facades, Skylights, Solar PV Panels, Glazing, Wind Shield, Others), By End Use (Solar Energy, Building and Construction, Automotive Industry, Infrastructure, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AGC Glass Europe, Nippon Sheet Glass Co. Ltd., Taiwan Glass Industry Corporation, Xinyi Solar Holdings Limited, Sisecam, Guardian Glass, Saint-Gobain, Borosil Limited, China-Henan Huamei Chemical Co. Ltd., Interfloat Corporation, Guangdong Golden Glass Technologies Ltd., Hecker Glastechnik GmbH & Co. KG, ENF Ltd., Emmvee Toughened Glass Private Limited, Euroglas GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solar Photovoltaic Glass MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Solar Photovoltaic Glass MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AGC Glass Europe.

- Nippon Sheet Glass Co., Ltd.

- Taiwan Glass Industry Corporation

- Xinyi Solar Holdings Limited

- Sisecam

- Guardian Glass

- Saint-Gobain

- Borosil Limited

- China-Henan Huamei Chemical Co., Ltd.,

- Interfloat Corporation

- Guangdong Golden Glass Technologies Ltd.,

- Hecker Glastechnik GmbH & Co. KG

- ENF Ltd.,

- Emmvee Toughened Glass Private Limited

- Euroglas GmbH