Global Bio-Energy Market Size, Share, Trends Analysis Report By Type (Solid Biomass,Biogas,Renewable Waste, Others), By Feedstock (Agricultural waste, Wood waste, Solid waste, Others), By Technology (Gasification, Fast Pyrolysis, Fermentation, Others), By Application (Power generation, Heat generation,Transportation,Others),By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143230

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

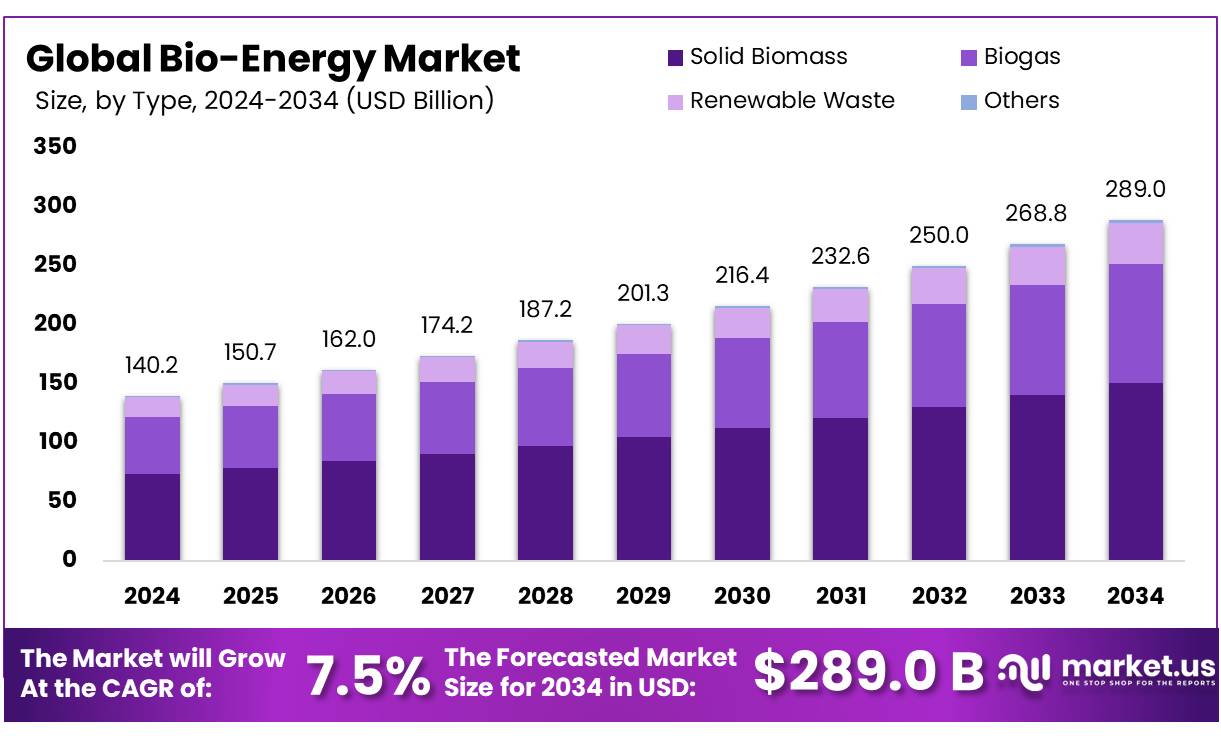

Global Bio-Energy Market Market size is expected to be worth around USD 289 Bn by 2034, from USD 140.2 Bn in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

Bioenergy is a form of renewable energy derived from organic materials, collectively known as biomass, which includes plant material, timber, agricultural waste, food waste, and even sewage. Bioenergy is produced by converting biomass into various energy forms such as heat, electricity, transportation fuels (biofuels), and bioproducts.

The energy produced from biomass is considered carbon-neutral because to carbon dioxide released during its use is roughly equal to the amount absorbed by the plants during their growth. Bioenergy can be categorized into several types, including biofuels (such as ethanol, biodiesel, and cellulosic ethanol), biogas, biopower, bioproducts, and biomass heating. Each type is derived from organic materials and offers diverse energy solutions, contributing to the renewable energy landscape.

Bioenergy offers several advantages, making it an important renewable energy source. As a renewable resource, biomass can be renewed naturally through plant growth, making it more sustainable than fossil fuels. It also helps reduce greenhouse gas emissions by releasing carbon dioxide that was previously absorbed by plants, creating a closed carbon loop. Biomass utilizes waste from various industries, such as agriculture and food processing, contributing to waste reduction and environmental protection.

Key Takeaways

- The global bio-energy market was valued at US$ 140.2 Billion in 2024.

- The global bio-energy market is projected to grow at a CAGR of 7.5% and is estimated to reach US$ 289.0 Billion by 2034.

- Among types, solid biomass accounted for the largest market share of 52.2%.

- Among feedstock, wood waste accounted for the majority of the market share at 38.4%.

- By technology, gasification accounted for the largest market share of 38.5%.

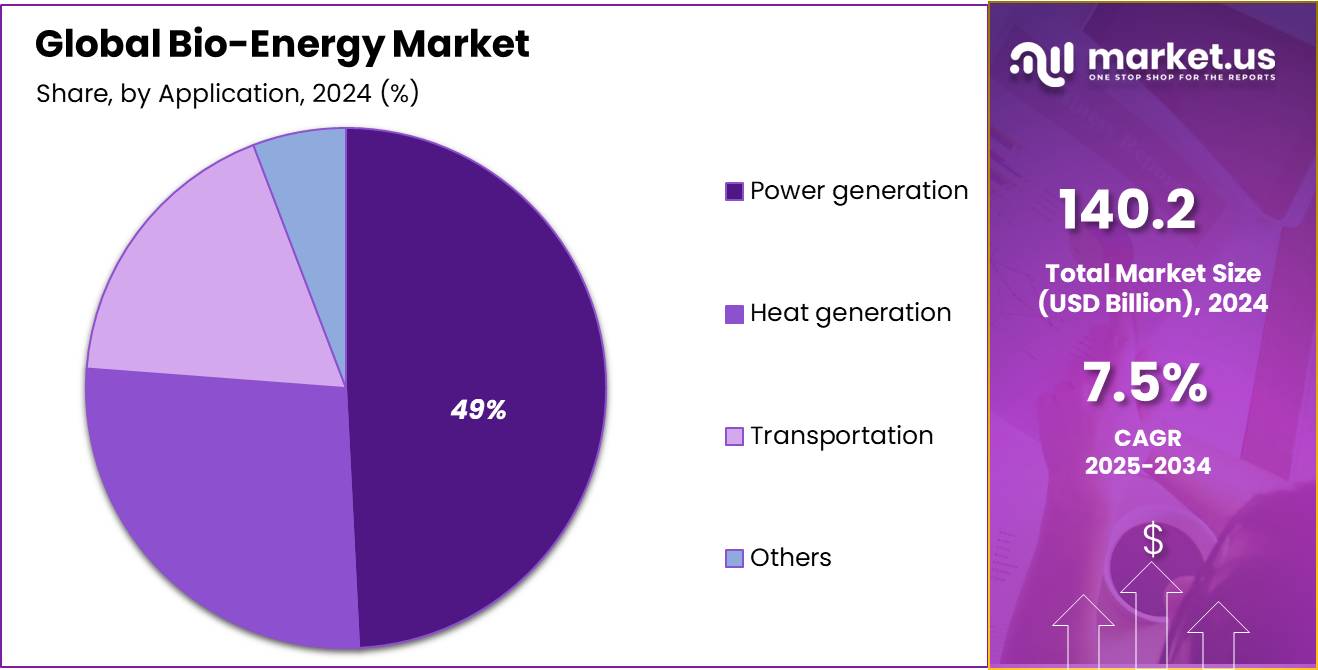

- By application, power generation accounted for the majority of the market share at 49.2%.

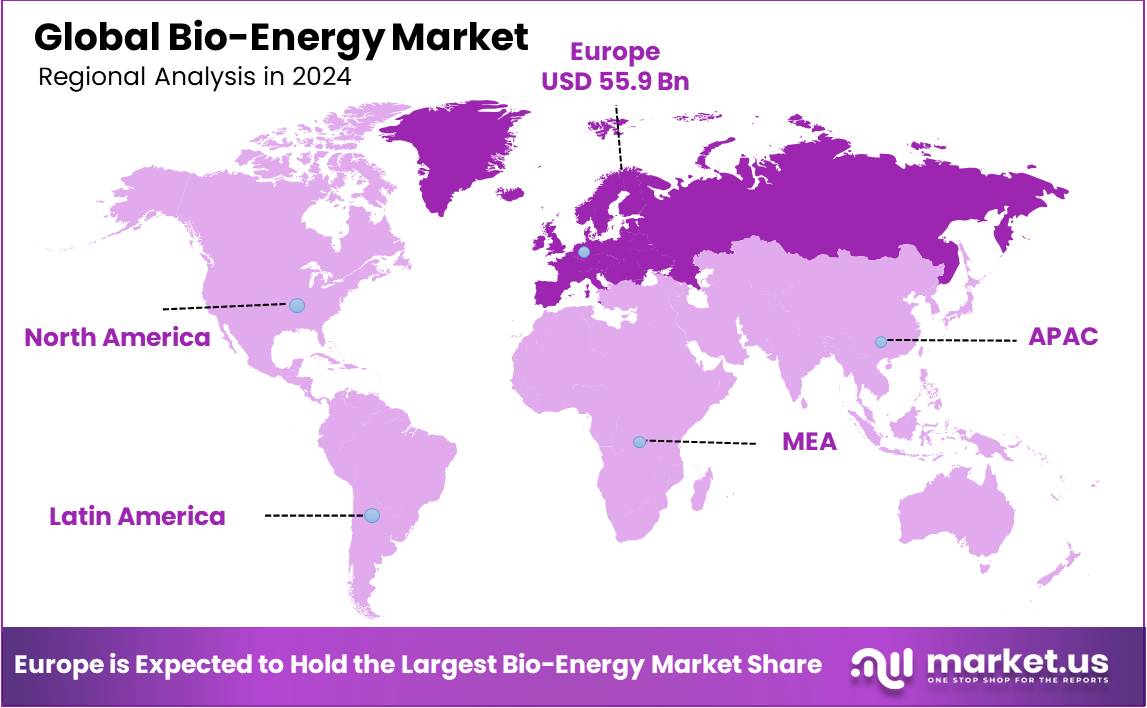

- Europe is estimated as the largest market for Bio-Energy with a share of 39.9% of the market share.

Type Analysis

The bio-energy market is segmented based on type into solid biomass, biogas, renewable waste, and others. In 2024, the solid biomass segment held a significant revenue share of 52.2%. Due to its widespread availability, versatility, and cost-effectiveness as a renewable energy source. Solid biomass, which includes materials like wood pellets, agricultural residues, and organic waste, is a highly efficient feedstock for generating electricity, heating, and biofuels.

Furthermore, demand for solid biomass has surged because it can be sourced locally, reducing dependence on fossil fuels and promoting energy security. Additionally, technological advancements in biomass conversion, such as efficient combustion and gasification systems, have made it an attractive option for large-scale power generation. The growing focus on reducing greenhouse gas emissions, coupled with government policies that incentivize renewable energy adoption, further drives the dominance of solid biomass in the bio-energy market.

Feedstock Analysis

Based on feedstock, the market is further divided into agricultural waste, wood waste, solid waste, and others. The predominance of Wood Waste, commanding a substantial 38.4 % market share in 2024. It can be attributed to its wide availability, cost-effectiveness, and efficient conversion into energy. Wood waste, which includes residues from timber production, sawmills, and furniture manufacturing, is a readily accessible and renewable resource that can be effectively utilized for bioenergy production.

Additionally, wood waste is highly efficient in bioenergy conversion processes such as combustion, gasification, and pelletization, making it a preferred feedstock for power generation and heating. Its low cost, coupled with the ability to use existing infrastructure for collection and processing, further supports its dominance in the market. The increasing demand for sustainable, carbon-neutral energy sources and government incentives for renewable energy projects have also contributed to the strong market share of wood waste in the bio-energy sector.

Technology Analysis

Based on Technology, the market is further divided into Gasification, Fast Pyrolysis, Fermentation, and Others. The predominance of the Gasification, commanding a substantial 35.5% market share in 2024. This can be attributed to its efficiency and versatility in converting a wide range of feedstocks, including biomass, agricultural residues, and even waste materials, into valuable energy products. Gasification produces syngas, a clean, high-energy gas that can be used for electricity generation, heating, or as a precursor for biofuels, making it a preferred technology for large-scale energy production.

Additionally, gasification offers several advantages, including higher energy conversion efficiency compared to traditional combustion, lower emissions, and the ability to produce both power and heat from the same process.

Moreover, advancements in gasification technologies, along with growing investments and supportive government policies, have made it an attractive solution for meeting the increasing global demand for sustainable, renewable energy. Its substantial market share reflects the growing trend towards cleaner and more efficient energy solutions in the bio-energy sector.

Application Analysis

Based on application, the market is further divided into power generation, heat generation, transportation, and others. The predominance of power generation will command a substantial 49.2% market share in 2024. Due to their increasing global demand for renewable energy sources to replace fossil fuels and reduce carbon emissions. Biomass and biogas, used in power plants, provide a reliable, scalable source of electricity, helping to meet the growing energy needs while supporting sustainability goals.

Furthermore, bioenergy for power generation is particularly attractive due to its ability to provide baseload power, unlike intermittent renewable sources like solar and wind. Technological advancements in biomass conversion methods, such as gasification and combustion, have improved efficiency and reduced costs, making it a viable alternative to traditional power generation.

Additionally, government policies promoting renewable energy and carbon reduction have further boosted investment in bio-energy for power generation, solidifying its dominance in the market. Supportive government policies, technological advancements, and the need for energy security further boost the adoption of bioenergy in power generation. The carbon-neutral nature of biomass energy, combined with its ability to provide consistent, locally sourced electricity, has made it a key player in the transition toward sustainable energy systems worldwide.

Key Market Segments

By Type

- Solid Biomass

- Biogas

- Renewable Waste

- Others

By Feedstock

- Agricultural waste

- Wood waste

- Solid waste

- Others

By Technology

- Gasification

- Fast Pyrolysis

- Fermentation

- Others

By Application

- Power generation

- Heat generation

- Transportation

- Others

Drivers

Increasing Adoption of Biogas and Biofuels in Transportation and Industrial Sector

The increasing adoption of biogas and biofuels, especially in the transportation and industrial sectors, is significantly driving the growth of the global bioenergy market. Bioenergy plays a crucial role in achieving global climate goals, particularly the Paris Agreement’s target of limiting global warming to under 2°C. Bioethanol, biodiesel, and biogas are key alternatives to fossil fuels, offering lower-carbon solutions that are vital for decarbonizing sectors such as transportation, aviation, and shipping.

These biofuels help reduce dependence on petroleum-based fuels, contributing significantly to global efforts to mitigate climate change. As biofuels such as bioethanol (derived from sugarcane, maize, and other cereals) and biodiesel (produced from vegetable oils and animal fats) become more widely used, the industrial sectors gradually reduce their dependence on petroleum-based fuels. This widespread use of biofuels helps reduce global greenhouse gas emissions, contributing to long-term climate change mitigation goals.

- For instance, According to a report by the International Energy Agency, biofuel demand is set to grow by 38 billion liters from 2023 to 2028, marking a 30% increase from the previous five years. Overall, total biofuel demand is expected to rise by 23%, reaching 200 billion liters by 2028, reflecting a global shift towards cleaner, more sustainable energy alternatives.

Furthermore, biofuels, particularly ethanol and biodiesel, continue to dominate the transportation fuel market, accounting for over 90% of renewable energy used in the sector. The rising demand for sustainable energy sources, supported by blending mandates, carbon reduction goals, and low-carbon fuel standards (LCFS), is increasing the market share of biofuels. Emerging economies such as Brazil, Indonesia, and India, are experiencing rapid biofuel market growth due to favorable government policies and abundant feedstock resources. As a result, biofuels such as ethanol and biodiesel are becoming vital components in decarbonizing the transportation sector, which accounts for a significant portion of global carbon dioxide emissions.

- For instance, reports published by Indian chemical news state that, the Indian government has amended provisions under the Pradhan Mantri JI-VAN Yojana to support advanced biofuel projects using lignocellulosic biomass, extending the implementation timeline to 2028-29 and prioritizing new technologies. This initiative aims to enhance ethanol production, promote environmental sustainability, and contribute to India’s energy security.

Restraints

Limited Feedstock Supply And Awareness

The limited feedstock supply is an important restraint factor for the global bioenergy market’s growth. As bioenergy has significant potential in many industrial sectors, its versatility is often limited by the availability of sustainable biomass feedstocks, such as agricultural residues, forestry by-products, and dedicated energy crops.

These feedstocks are not always abundant or consistently available, and their production can be influenced by factors like land competition, weather patterns, and environmental concerns. Additionally, biomass harvesting practices can sometimes raise concerns over deforestation, land degradation, and biodiversity loss. These challenges limit the long-term reliability and sustainability of bioenergy production, preventing it from meeting growing global demand.

Furthermore, lack of awareness about bioenergy’s potential is another important factor limiting the market growth. As the bioenergy concept grows still many policymakers, businesses, and consumers are unaware of the bioenergy applications and their role in achieving climate goals. This lack of knowledge can result in insufficient investment in bioenergy infrastructure, steady adoption of bioenergy technologies, and limited research into innovative biofuel production methods. Without increased awareness and education about the benefits and feasibility of bioenergy, the sector will struggle to unlock its full potential and contribute to global energy and climate goals effectively.

Opportunity

Integration of Bioenergy with Carbon Capture Technologies

The integration of Bioenergy with Carbon Capture and Storage (BECCS) presents a significant opportunity for the global bioenergy market. Incorporating biomass energy generation with carbon capture helps to mitigate climate change and offers an attractive solution to meet global energy demands. BECCS isolates and stores CO2 emissions produced during biomass conversion, resulting in negative emissions that help reverse climate impact. This dual-benefit approach not only meets growing energy needs but also supports decarbonization objectives, positioning BECCS as a crucial driver in the shift toward a low-carbon economy. The growing demand for cleaner energy and stronger environmental policies will accelerate investments and technological advancements in BECCS, enhancing its potential as a scalable and sustainable solution for the future.

Furthermore, the BECCS drives the growth of the bioenergy market by attracting investments in carbon capture technologies and encouraging the development of new feedstocks. It also opens up business opportunities in carbon capture, transportation, and storage, further diversifying the sector. As BECCS technologies continue to advance, markets for biofuels like bioethanol and waste-to-energy solutions become more appealing. With BECCS playing a key role in helping industries meet net-zero emissions targets, its potential benefits extend across sectors like power generation and cement production.

- For instance, Infinium has announced the next phase of its carbon capture and storage (CCS) pilot program, with a new pilot plant being relocated to its Parc Adfer facility in North Wales. This marks the first CCS pilot in the HyNet industrial cluster and aims to advance decarbonization efforts in the region. The project supports the UK’s net-zero ambitions by exploring scalable carbon capture technologies for energy from waste facilities.

Trends

Utilizing Bioenergy for Sustainable District Heating Solutions

The global push for sustainable district heating solutions is accelerating the growth of the bioenergy market, especially in the field of biomass-based district heating (BioDH). This growth is driven by the need to reduce greenhouse gas emissions and transition to cleaner energy sources. Biomass heating systems, which utilize locally sourced renewable resources like wood chips, agricultural residues, and waste materials, offer a flexible and cost-effective solution for decarbonizing heating infrastructure.

By integrating with various heat sources such as waste heat recovery, geothermal energy, and solar thermal, BioDH systems provide an adaptable approach, especially in colder regions where reliable heating is essential. Technological innovations in gasification, smart grid integration, and low-temperature district heating networks are further enhancing the efficiency and emissions performance of biomass systems, making them an increasingly attractive option for consumers and businesses.

Geopolitical Impact Analysis

Geopolitical risks disrupt the bioenergy market by affecting supply chains, investment, and energy security.

Geopolitical risks have a significant influence on the global bioenergy market, affecting everything from supply chains to policy decisions and market stability. These risks include factors such as trade disputes, military conflicts, territorial disagreements, and sanctions, which can disrupt the flow of resources, investments, and technological advancements within the bioenergy sector. Bioenergy, as a renewable energy source, is increasingly seen as a strategic asset in the global push for cleaner energy, but its growth is susceptible to the broader geopolitical climate.

For instance, disruptions in key regions where bioenergy feedstocks are produced, such as agricultural products, wood, or waste biomass, can lead to supply shortages or price volatility, directly impacting the bioenergy market’s growth trajectory.

Furthermore, trade disputes and sanctions affect the key countries involved in bioenergy production or technology development and can limit the global bioenergy trade, innovation, and investment. This can also limit the ability of countries to access necessary feedstocks or advanced technologies, slowing the global adoption of bioenergy solutions. On the other hand, geopolitical tensions may encourage some nations to prioritize energy security, accelerating their investments in renewable energy sources, including bioenergy, and reducing dependence on fossil fuels or unstable energy imports. This shift in focus can create new opportunities for growth in the bioenergy market, particularly in regions seeking to diversify their energy supply.

Regional Analysis

In 2024, Europe dominated the global Bio-Energy market, accounting for 39.9% of the total market share, Driven by Strong government policies, advanced technology, and a wide variety of biomass resources. The European Union has introduced policies like the Renewable Energy Directive and the European Green Deal to promote bioenergy production and help meet climate targets. Countries like Sweden, Finland, and Germany also provide support through subsidies and incentives, boosting bioenergy growth and solidifying Europe’s role as a key player in the industry.

Moreover, Europe has also made significant technological progress, moving beyond traditional biomass like firewood to more advanced systems such as biogas, biomass gasification, and biofuels. Countries like Germany and Denmark have invested heavily in these technologies, ensuring biomass is used in the most efficient and eco-friendly ways. This ongoing innovation has allowed Europe to stay ahead in the global bioenergy market, ensuring it remains a sustainable and competitive force.

Furthermore, European bioenergy market is further supported by an abundant supply of diverse biomass feedstocks, including wood, agricultural residues, and waste biomass. As demand for bioenergy grows, the region is expected to shift towards using more agricultural biomass and waste streams, reducing its reliance on wood. This shift not only enhances sustainability but also ensures that bioenergy contributes to rural economic development by utilizing local biomass resources. Europe’s commitment to sustainable sourcing of biomass ensures that bioenergy remains an environmentally responsible energy solution.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the bioenergy market focus on expanding renewable portfolios, securing feedstocks, and investing in advanced technologies.

Key players in the global bioenergy market are focusing on expanding their renewable energy portfolios by investing in innovative technologies, such as advanced biomass conversion processes and integrated bioenergy solutions. They are also forging strategic partnerships with governments and stakeholders to capitalize on policy incentives and subsidies that promote bioenergy adoption. Additionally, many players are focusing on securing sustainable feedstock sources, optimizing supply chains, and improving production efficiency to reduce costs and enhance profitability.

Another significant strategy includes expanding their market presence in emerging regions with abundant biomass resources, while also diversifying their offerings to include both biofuels and biomass-based heat and power solutions. Lastly, they are investing in R&D to advance the development of next-generation bioenergy technologies, such as algae-based biofuels and waste-to-energy solutions.

The following are some of the major players in the industry

- ADM

- Ameresco, Inc.

- BABCOCK & WILCOX ENTERPRISES, INC.

- BP PLC

- Drax Group

- Enerkem

- Enexor Energy

- EnviTec Biogas AG

- Enviva

- FORTUM

- Green Plains Inc.

- HITACHI ZOSEN CORPORATION

- Lignetics

- MWV Energie AG

- ORSTED A/S

- Pacific BioEnergy Corp

- POET

- Royal Dutch Shell Plc

- Others

Recent Development

- In March 2025- St1 Biokraft, a leading biomethane producer in the Nordic region, has acquired Södra Hallands Kraft Biogas AB, including its production facility in Hov, Sweden. This acquisition increases St1 Biokraft’s production capacity by 25 GWh and is part of its ambition to reach 3 TWh of production by 2030.

- In September 2024 – Gensol Engineering, in partnership with Matrix Gas & Renewables, has secured a ₹164 crore contract to develop India’s first bio-hydrogen project, which will convert 25 tons of bio-waste into 1 ton of hydrogen daily. The project aligns with India’s National Green Hydrogen Mission and is set to be completed within 18 months.

- In January 2025– VTTI has launched VIDA Bioenergy, a fully-owned subsidiary dedicated to converting biomass into renewable energy. Led by CEO Lars Boetje, VIDA Bioenergy will operate independently to focus on providing clean energy solutions such as biomethane, biogenic CO2, and organic fertiliser, supporting decarbonisation efforts in buildings, heavy transport, and industrial heat. This move aligns with VTTI’s commitment to sustainability and innovation in the bioenergy sector.

- In November 2024 – Nufarm has formed strategic R&D partnerships to expand its bioenergy platform, focusing on sustainable oils and biofuels. By advancing Biomass Oil trait technology, the company aims to produce high-biomass crops for biofuel production and other consumer goods.

Report Scope

Report Features Description Market Value (2024) US$ 140.2 Bn Forecast Revenue (2034) US$ 289 Bn CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Solid Biomass, Biogas, Renewable Waste, Others), By Feedstock (Agricultural waste, Wood waste, Solid waste, Others), By Technology (Gasification, Fast Pyrolysis, Fermentation, Others), By Application (Power generation, Heat generation,Transportation, Others), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape ADM, Ameresco, Inc. , BABCOCK & WILCOX ENTERPRISES, INC.,BP PLC, Drax Group , Enerkem ,Enexor Energy , EnviTec Biogas AG , Enviva , FORTUM,Green Plains Inc. , HITACHI ZOSEN CORPORATION, Lignetics , MWV Energie AG , ORSTED A/S, Pacific BioEnergy Corp , POET , Royal Dutch Shell Plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

- ADM

- Ameresco, Inc.

- BABCOCK & WILCOX ENTERPRISES, INC.

- BP PLC

- Drax Group

- Enerkem

- Enexor Energy

- EnviTec Biogas AG

- Enviva

- FORTUM

- Green Plains Inc.

- HITACHI ZOSEN CORPORATION

- Lignetics

- MWV Energie AG

- ORSTED A/S

- Pacific BioEnergy Corp

- POET

- Royal Dutch Shell Plc

- Others