Global Large Wind Turbine Market Size, Share, And Business Benefits By Type (Horizontal-axis, Vertical-axis), By Capacity (Up to 5 MW, 5 to 10 MW, Above 10 MW), By Location (Onshore, Offshore), By End-use (Utility, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146340

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

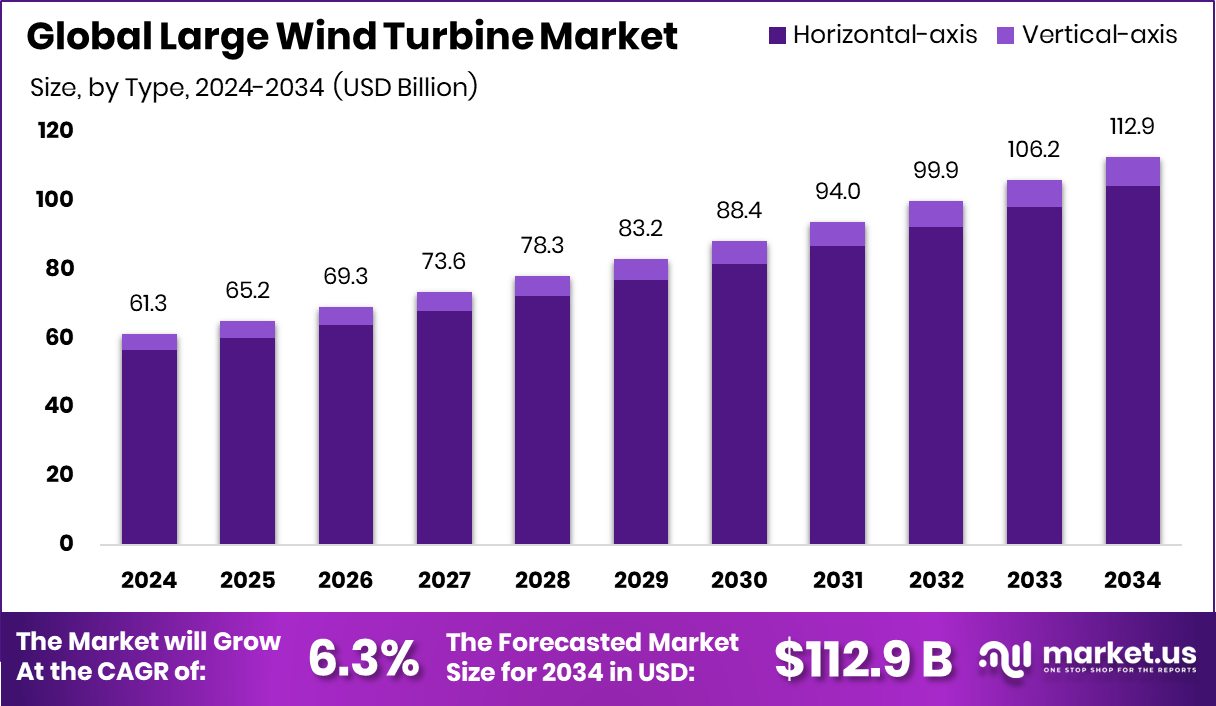

Global Large Wind Turbine Market is expected to be worth around USD 112.9 billion by 2034, up from USD 61.3 billion in 2024, and grow at a CAGR of 6.3% from 2025 to 2034. With 47.5% market share, Asia-Pacific dominates at a USD 29.1 billion valuation.

A large wind turbine refers to a type of windmill used primarily for generating electricity on a scale suitable for commercial electricity production. Unlike smaller models, large wind turbines feature blades that can span hundreds of feet in diameter, mounted on towers that also reach great heights. These turbines are typically installed in wind farms either onshore or offshore and are integral to utility-scale wind power generation projects.

The large wind turbine market encompasses the production, distribution, and installation of these giant turbines. It’s a sector that has seen significant growth due to the global shift toward renewable energy sources. The market includes everything from the manufacturing of turbine components like blades and generators to the services involved in planning, constructing, and maintaining wind farms.

One major growth factor for the large wind turbine market is the global push for clean energy to mitigate climate change. Governments worldwide are providing subsidies and incentives for renewable energy projects, which directly boosts the demand for large wind turbines. Additionally, technological advancements in turbine efficiency and the ability to harness wind energy at higher altitudes or offshore locations also contribute significantly to market growth.

The demand for large wind turbines is driven by the increasing need for sustainable energy solutions worldwide. As countries aim to reduce their carbon footprints, the shift from fossil fuels to wind energy is accelerating, creating a substantial market for large wind turbines. This demand is supported by improved grid integration technologies, making it easier to supply wind-generated electricity to consumers.

Key Takeaways

- Global Large Wind Turbine Market is expected to be worth around USD 112.9 billion by 2034, up from USD 61.3 billion in 2024, and grow at a CAGR of 6.3% from 2025 to 2034.

- Horizontal-axis turbines dominate the Large Wind Turbine Market with a 92.5% share.

- Turbines with a capacity of 5 to 10 MW hold 48.1% of the market.

- Onshore installations lead, comprising 73.4% of the Large Wind Turbine Market.

- The utility sector predominantly uses large wind turbines, holding a 67.9% market share.

- Asia-Pacific leads the market with a 47.5% share, valued at USD 29.1 billion.

By Type Analysis

Horizontal-axis turbines dominate the market with a 92.5% share.

In 2024, Horizontal-axis held a dominant market position in By Type segment of the Large Wind Turbine Market, with a 92.5% share. This dominance is largely attributed to its proven efficiency, advanced blade design, and widespread use in commercial utility-scale installations. Horizontal-axis wind turbines (HAWTs) are favored for their higher power output and consistent performance in areas with steady wind patterns, making them the preferred choice for large-scale energy projects.

The adoption of HAWTs is also driven by their compatibility with both onshore and offshore locations. Their design allows easier alignment with wind direction through yaw control systems, improving energy capture over time. Furthermore, horizontal-axis turbines are supported by a mature supply chain and infrastructure, which reduces overall maintenance and operation costs for project developers.

As energy utilities increasingly transition toward renewable sources, HAWTs are playing a key role in scaling up wind power generation capacity. Their technical benefits, coupled with strong government support for clean energy initiatives, have solidified their position in the global market. With technological advancements improving rotor diameter and turbine height, the horizontal-axis segment is expected to maintain its market leadership, especially in regions with high wind potential and grid connectivity.

By Capacity Analysis

Capacities between 5 to 10 MW hold a 48.1% market segment.

In 2024, 5 to 10 MW held a dominant market position in By Capacity segment of the Large Wind Turbine Market, with a 48.1% share. This capacity range is increasingly preferred due to its balanced combination of power output, cost-effectiveness, and deployment flexibility across both onshore and offshore wind farms. Turbines in the 5 to 10 MW range offer significantly higher energy yields compared to smaller units, making them suitable for large-scale renewable energy projects that aim to meet rising electricity demands.

The popularity of this segment is also driven by advancements in turbine design, including larger rotor diameters, improved blade efficiency, and better materials, all contributing to higher capacity factors. These turbines are often deployed in utility-scale wind farms where economies of scale further reduce the cost per megawatt, enhancing project viability and return on investment.

Moreover, many governments and energy developers favor this capacity range as it aligns with national decarbonization goals and grid integration requirements. The scalability and optimized performance of 5 to 10 MW turbines make them a reliable choice for wind-rich regions, especially in areas with limited land availability.

By Location Analysis

Onshore locations are preferred, comprising 73.4% of the market.

In 2024, Onshore held a dominant market position in By Location segment of the Large Wind Turbine Market, with a 73.4% share. This dominance is primarily driven by lower installation costs, easier accessibility, and faster construction timelines compared to offshore projects. Onshore wind farms continue to attract significant investments due to their established infrastructure and relatively simplified logistics for transporting turbine components and conducting maintenance operations.

The high market share also reflects the growing demand for renewable power generation in land-abundant regions, where governments are actively promoting clean energy development. Onshore wind installations are widely spread across countries with consistent wind profiles, making them a dependable source for utility-scale power generation.

Moreover, advancements in turbine efficiency have allowed onshore installations to capture more energy, even in moderate wind zones, enhancing their cost competitiveness. The regulatory approvals for onshore sites are also typically faster, contributing to higher project implementation rates. In 2024, the focus on reducing carbon emissions and increasing renewable energy capacity further accelerated onshore wind deployment.

By End-use Analysis

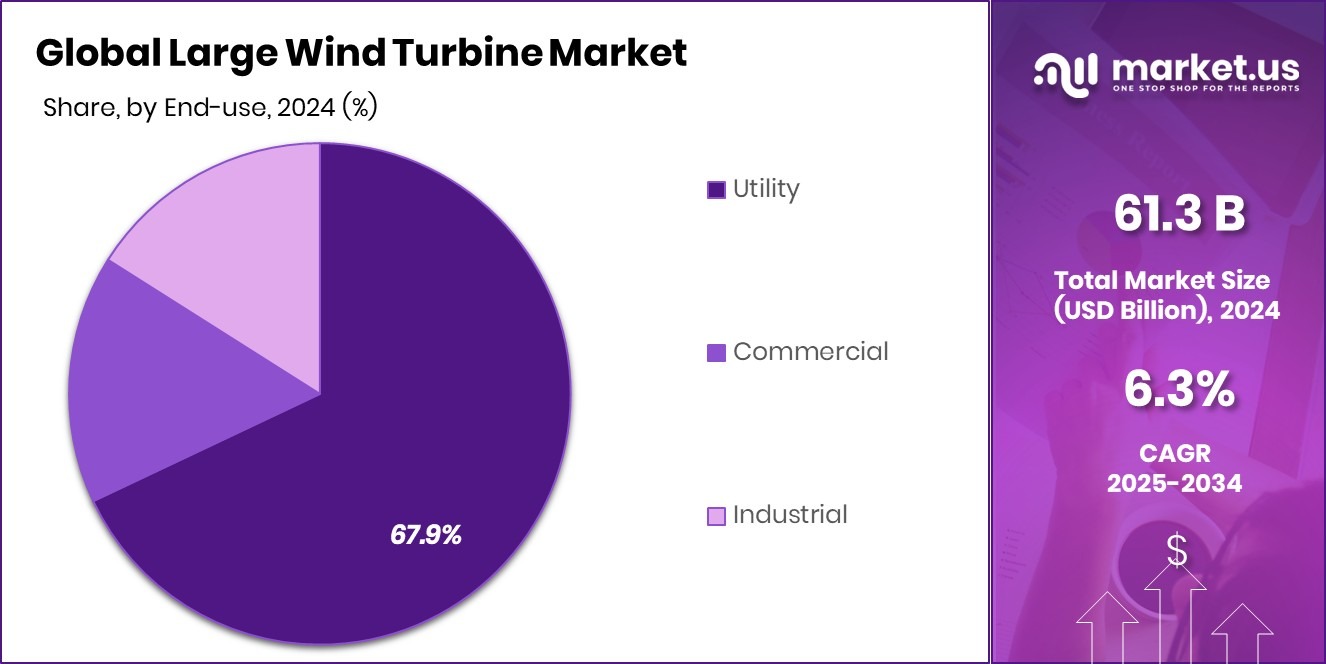

Utility end-users lead, utilizing 67.9% of large wind turbines.

In 2024, Utility held a dominant market position in By End-use segment of the Large Wind Turbine Market, with a 67.9% share. This leading position is supported by the increasing demand for large-scale renewable energy generation by public and private utility companies. Utility-scale wind farms benefit from economies of scale, which help in lowering the cost of electricity generation per unit and improving grid integration efficiency.

Governments across multiple regions have set ambitious renewable energy targets, encouraging utilities to invest in large wind projects. The consistent performance, high capacity factor, and improved reliability of large wind turbines make them ideal for utilities looking to diversify their energy portfolio and reduce dependency on fossil fuels.

Additionally, the availability of financing and favorable power purchase agreements (PPAs) supports utility-led wind projects. These projects are typically long-term, capital-intensive, and designed to serve regional or national grids, which aligns perfectly with the capabilities of large wind turbines.

Key Market Segments

By Type

- Horizontal-axis

- Vertical-axis

By Capacity

- Up to 5 MW

- 5 to 10 MW

- Above 10 MW

By Location

- Onshore

- Offshore

By End-use

- Utility

- Commercial

- Industrial

Driving Factors

Rising Demand for Clean Energy Boosts Growth

One of the biggest reasons behind the growth of the large wind turbine market is the increasing demand for clean and renewable energy. Countries around the world are focusing more on reducing pollution and cutting down their carbon emissions. Wind energy, especially from large wind turbines, is one of the cleanest and cheapest sources of power.

Many governments are also offering support in the form of tax benefits, subsidies, and easier rules for wind energy projects. This is making it attractive for companies and investors to build larger wind farms.

Restraining Factors

High Installation Cost Slows Market Expansion Globally

A major challenge for the large wind turbine market is the high cost of installation. Setting up a large wind turbine needs a lot of money, land, and skilled labor. The cost of transporting turbine parts, especially to remote or offshore areas, adds even more to the expense.

Not all regions have the right infrastructure or budget to support such large projects. Smaller energy companies and developing countries often face difficulties in affording these systems.

Additionally, delays in project approvals and land acquisition problems can also increase the overall costs. These financial and logistical barriers make it hard for some markets to adopt large wind turbines, slowing down overall growth despite rising energy demand.

Growth Opportunity

Expanding Offshore Projects in Deepwater Wind Zones

One of the biggest growth opportunities for the large wind turbine market is the rising number of offshore wind energy projects, especially in deepwater zones. These locations have stronger and more consistent wind speeds, which help produce more electricity.

With floating wind turbine technology improving, companies can now install turbines far from the shore, where traditional fixed-foundation models were not possible.

Many countries, including the U.S., U.K., and Japan, are now planning or approving new deep-sea wind farms. This shift is creating a huge demand for large, powerful turbines that can withstand ocean conditions and generate high output

Latest Trends

Taller Turbines Capture More Consistent Wind Energy

One of the latest trends in the Large Wind Turbine Market is the shift toward building taller turbines. As turbine towers become higher, they can reach stronger and more consistent wind speeds found at greater altitudes. This means turbines can now generate more electricity with the same or even fewer blades.

Taller turbines are especially useful in areas with lower ground-level wind speeds, expanding wind power to new regions. With better technology and stronger materials, building these tall structures has become more practical and cost-effective.

This trend helps boost overall efficiency, reduce energy costs, and support the global move toward clean and renewable energy, especially in offshore and remote onshore areas

Regional Analysis

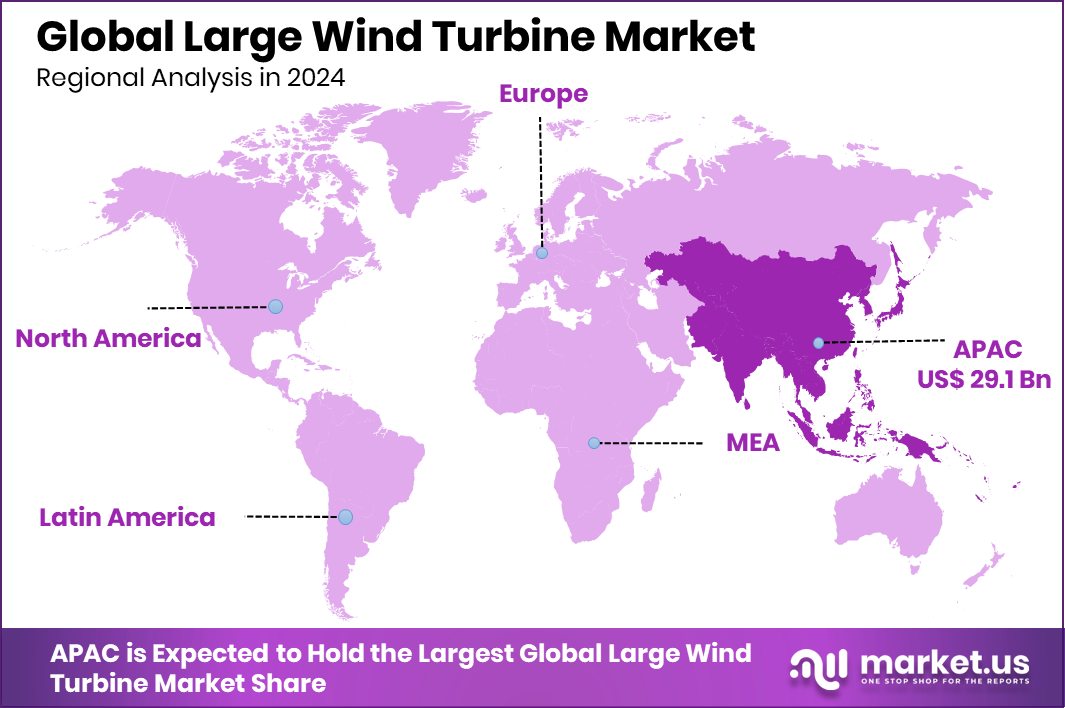

In Asia-Pacific, the Large Wind Turbine Market captured 47.5%, reaching USD 29.1 billion.

In 2024, Asia-Pacific held a dominant position in the Large Wind Turbine Market, accounting for 47.5% of the global share, with a market value of USD 29.1 billion. The region’s leadership is attributed to increasing renewable energy projects, supportive government initiatives, and high wind potential across countries like China, India, and Australia.

In contrast, North America continues to witness steady growth, driven by expanding wind installations in the U.S. and Canada. Europe remains a key contributor as well, supported by strong regulatory frameworks and sustainability targets set by the European Union. The Middle East & Africa are an emerging region for large wind turbines, gradually adopting wind energy to diversify power sources.

Meanwhile, Latin America is seeing slow yet consistent progress, with Brazil and Chile exploring large-scale wind projects. Despite varying levels of adoption, all regions are aligning with clean energy goals. However, Asia-Pacific leads in both volume and value, establishing itself as the center of investment and growth in the global large wind turbine industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Vestas maintained its position as a leading player in the Large Wind Turbine Market through consistent global deployment and a robust order book. The company focused on expanding its turbine capacity offerings, especially in the 5 MW+ segment, to meet increasing demand from utility-scale projects. Its technological upgrades and focus on operational efficiency played a key role in securing contracts across Asia-Pacific and Europe.

Siemens Gamesa Renewable Energy, S.A. continued to strengthen its offshore and onshore presence. The company emphasized the rollout of its high-capacity turbines above 10 MW, especially targeting offshore wind farms. With a focus on sustainability and integrated digital platforms, Siemens Gamesa remained a preferred choice in long-term wind energy partnerships across Europe and North America.

Suzlon Energy Limited, based in India, contributed significantly to domestic onshore installations in 2024. The company concentrated on cost-effective turbine solutions tailored for medium wind speed sites, especially in rural and semi-urban locations. Suzlon also focused on repowering older wind farms, improving their efficiency without full infrastructure replacement.

Sinovel Wind Group Co., Ltd., one of China’s prominent players, continued to support large-scale government-backed wind installations. In 2024, the company focused on delivering turbines tailored to China’s inland and coastal wind zones. Sinovel also expanded its R&D efforts, developing newer models for higher hub heights and low-speed conditions.

Top Key Players in the Market

- Vestas

- Siemens Gamesa Renewable Energy, S.A.

- Suzlon Energy Limited

- Sinovel Wind Group Co., Ltd.

- General Electric Company

- Nordex SE

- ENERCON GmbH

- Xinjiang Goldwind Science & Technology Co., Ltd.

- Vergnet

- Envision Group

- VENSYS Energy AG

- Zhejiang Yunda Wind Power Co., Ltd.

- MingYang Smart Energy

- SANY Group

- Other Key Players

Recent Developments

- In April 2025, GE Vernova opened a new customer experience center at its Pensacola, Florida, nacelle manufacturing facility, part of a $70 million investment to enhance wind turbine production.

- In January 2025, Suzlon and Torrent Power achieved a 1 GW milestone with a new 486 MW order. They will install 162 S144 turbines (3 MW each) in Gujarat, supporting India’s renewable energy goals.

Report Scope

Report Features Description Market Value (2024) USD 61.3 Billion Forecast Revenue (2034) USD 112.9 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Horizontal-axis, Vertical-axis), By Capacity (Up to 5 MW, 5 to 10 MW, Above 10 MW), By Location (Onshore, Offshore), By End-use (Utility, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Vestas, Siemens Gamesa Renewable Energy, S.A., Suzlon Energy Limited, Sinovel Wind Group Co., Ltd., General Electric Company, Nordex SE, ENERCON GmbH, Xinjiang Goldwind Science & Technology Co., Ltd., Vergnet, Envision Group, VENSYS Energy AG, Zhejiang Yunda Wind Power Co., Ltd., MingYang Smart Energy, SANY Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Large Wind Turbine MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Large Wind Turbine MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vestas

- Siemens Gamesa Renewable Energy, S.A.

- Suzlon Energy Limited

- Sinovel Wind Group Co., Ltd.

- General Electric Company

- Nordex SE

- ENERCON GmbH

- Xinjiang Goldwind Science & Technology Co., Ltd.

- Vergnet

- Envision Group

- VENSYS Energy AG

- Zhejiang Yunda Wind Power Co., Ltd.

- MingYang Smart Energy

- SANY Group

- Other Key Players