Global Ayurvedic Food Market Size, Share Analysis Report By Type (Breakfast Porridge, Juices, Gummies, Jams, Cookies, Others), By Form (Liquid Form, Solid Form), By Distribution Channel (Supermarkets And Hypermarkets, Drug Stores, Online Retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169870

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

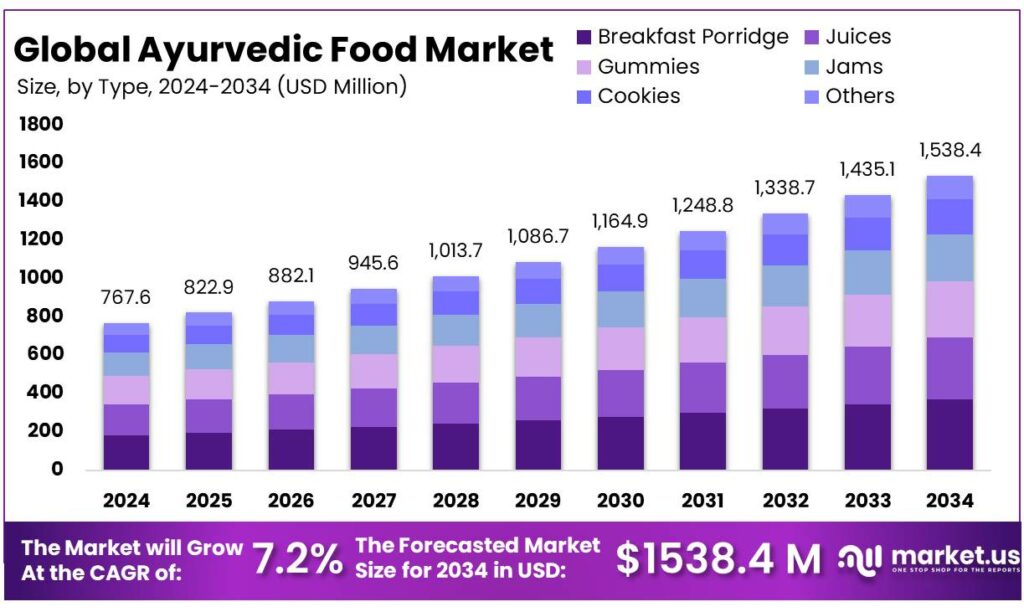

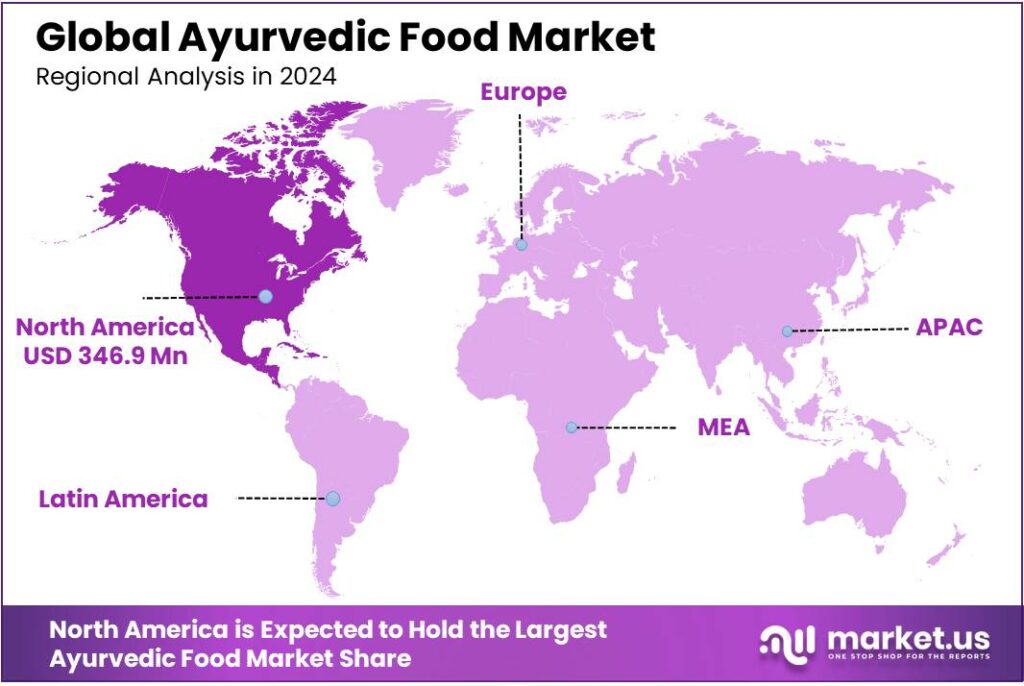

The Global Ayurvedic Food Market size is expected to be worth around USD 1538.4 Million by 2034, from USD 767.6 Million in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 45.2% share, holding USD 346.9 Million revenue.

Ayurvedic food sits at the intersection of traditional Indian medicine and modern functional nutrition. It includes herbal beverages, fortified staples, ghee-based preparations, spice blends and ready-to-eat products that are formulated according to Ayurveda’s principles of dosha balance and digestive health. Globally, Ayurveda benefits from the wider shift toward herbal and natural health: the World Health Organization estimates that 80% of the world’s population uses herbal medicine as part of primary healthcare, underlining a very large consumer base for plant-based food and wellness products.

- A government-commissioned study estimated the Indian Ayush industry at US$ 18.1 billion in 2020-21, with overall turnover growing about 17% between 2014 and 2020, despite pandemic disruption. Within this, the manufacturing segment expanded from under US$ 3 billion in 2014 to about US$ 23.3 billion projected for 2022, signalling rapid formalisation and scale-up of Ayurvedic and herbal processing capacities. Exports are also strengthening: India’s AYUSH and herbal product exports reached ₹5,907 crore in FY25, up from ₹5,580 crore in FY24, indicating rising global acceptance of Ayurveda-linked products, including food supplements and tonics.

A major driver for Ayurvedic food is the convergence with organic and clean-label food trends. APEDA reports that India produced about 3.6 million metric tonnes of certified organic products in FY24, spanning cereals, millets, fruits, spices, aromatic and medicinal plants and processed foods—key raw materials for Ayurvedic food manufacturers. The Ministry of Food Processing Industries further estimates the domestic organic ecosystem (including branded organic food and exports) at roughly ₹16,800 crore, of which exports contribute ₹5,520 crore and the organised domestic organic market about ₹3,340 crore, underlining a robust supply base for herb-rich and residue-free Ayurvedic formulations.

Regulation and policy support are also shaping the industrial landscape. The Food Safety and Standards Authority of India (FSSAI) regulates health supplements, nutraceuticals, foods for special dietary use, functional foods and novel foods under its 2016 regulations, providing a clear framework for Ayurvedic food, herbal drinks and fortified staples that make health claims.

- Future growth opportunities for Ayurvedic food are tightly linked to export ambitions and investment facilitation. A recent government communication notes that India aims to reach ₹20,000 crore in organic food exports by 2030, with shipments already rising from about US$ 213 million in 2012-13 to roughly US$ 665 million in 2024-25; Ayurvedic and herbal food brands can ride this export infrastructure for value-added offerings.

Key Takeaways

- Ayurvedic Food Market size is expected to be worth around USD 1538.4 Million by 2034, from USD 767.6 Million in 2024, growing at a CAGR of 7.2%.

- Breakfast Porridge held a dominant market position, capturing more than a 23.8% share.

- Solid Form held a dominant market position, capturing more than a 56.1% share.

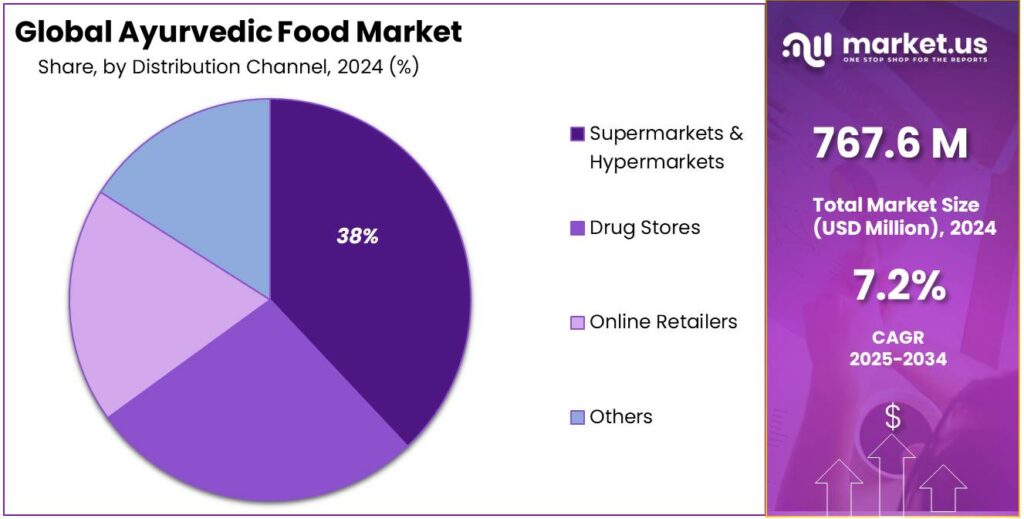

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 37.9% share.

- North American region emerged as the dominating market for Ayurvedic food products, holding a 45.2% share and accounting for an estimated market value of 346.9 Mn.

By Type Analysis

Breakfast Porridge leads the category with a 23.8% share, driven by rising demand for natural morning meals.

In 2024, Breakfast Porridge held a dominant market position, capturing more than a 23.8% share as consumer preference shifted toward nutrient-rich and herbal morning foods. The growth of this segment was supported by increasing adoption of traditional Ayurvedic ingredients such as millets, herbs, and botanical extracts in daily diets. In 2025, steady demand continued as households increasingly chose fortified Ayurvedic porridge for digestive balance and energy support. The segment’s expansion has been driven by clean-label formulations, rising health awareness, and growing acceptance of Ayurveda-based functional foods in routine breakfast habits.

By Form Analysis

Solid Form leads the market with 56.1% as consumers prefer convenient and stable Ayurvedic food formats.

In 2024, Solid Form held a dominant market position, capturing more than a 56.1% share as demand increased for easy-to-use Ayurvedic products such as bars, mixes, porridges, and herbal solids. The segment’s strength was supported by longer shelf life, convenient handling, and wider retail availability. By 2025, consistent adoption was observed across both urban and semi-urban consumers, as solid Ayurvedic foods were increasingly used for daily wellness routines. The growth of this form has been driven by strong preference for natural ingredients, on-the-go consumption, and trust in traditional solid formulations.

By Distribution Channel Analysis

Supermarkets & Hypermarkets lead with 37.9% due to wide reach and strong shelf presence.

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 37.9% share as consumers increasingly preferred the convenience, product variety, and visible placement offered by large-format retailers. The channel benefited from consistent in-store promotions, trusted private-label options, and reliable supply chains that made Ayurvedic food products easier to discover and purchase.

By 2025, the channel’s influence remained evident as urban and peri-urban shoppers continued to rely on supermarkets for routine grocery trips and one-stop purchases of herbal and fortified Ayurvedic items. The sustained preference for this distribution route has been driven by enhanced merchandising, regular stock availability, and the ability to support larger pack sizes and family purchases.

Key Market Segments

By Type

- Breakfast Porridge

- Juices

- Gummies

- Jams

- Cookies

- Others

By Form

- Liquid Form

- Solid Form

By Distribution Channel

- Supermarkets & Hypermarkets

- Drug Stores

- Online Retailers

- Others

Emerging Trends

Ayurvedic Everyday Foods Moving into Modern Convenience

One clear, very current trend in Ayurvedic food is how it is quietly moving from “occasionally taken as a tonic” to “something you can drink or eat every day, on the go.” A big push behind this is the global conversation on what a healthy plate should look like. The World Health Organization now advises adults to eat at least 400 g of fruits and vegetables per day as part of a diet rich in whole grains, legumes and nuts to reduce the risk of noncommunicable diseases.

The ingredient supply chain is also changing in a way that favours Ayurvedic convenience foods. APEDA reports that India produced about 3.6 million metric tonnes of certified organic products in FY 2023-24, covering cereals, millets, pulses, oilseeds, spices, tea and many other crops. In the same year, India exported around 2.61 lakh MT of organic food worth roughly US$ 494.8 million. For an Ayurvedic food manufacturer, this means it is becoming easier to source organic turmeric, ginger, cinnamon, grains and seeds and to sell a drink or snack that is both “Ayurvedic” and “organic” in one shot.

Herbs and spices are at the heart of this trend. A study based on FAO data notes that India is the world’s largest producer of ginger and turmeric, with about 35.2% share in global ginger and an impressive 78% share in global turmeric production. These are not just flavourings; they are functional ingredients in Ayurveda. When a company bottles a turmeric-ginger immunity drink or launches a “digestive spice buttermilk” in a tetra pack, it is using this spice leadership to answer a very modern demand: something warm, familiar and easy to consume between two online meetings.

Regulation is also catching up with this new reality. The Food Safety and Standards Authority of India notified the Food Safety and Standards (Ayurveda Aahara) Regulations, 2022, creating a specific category for foods prepared according to recipes and processes from authoritative Ayurvedic texts. In August 2025, the government went a step further and released the first definitive list of Ayurveda Aahara products, aimed at giving “unprecedented clarity and confidence” to businesses and consumers.

Drivers

Preventive Wellness and Trust in Traditional Diets

One strong driving force behind Ayurvedic food is the way people are turning to preventive health. Around the world, noncommunicable diseases such as heart disease, diabetes and cancer cause about 41 million deaths every year, equal to roughly 74% of all deaths globally. Families see this every day in rising blood sugar, blood pressure and weight issues at a younger age. As treatment costs go up, many households start looking at food first, not medicines, to protect health.

At the same time, trust in traditional systems like Ayurveda is very deep. The World Health Organization notes that more than 80% of the world’s population in over 170 countries uses some form of traditional medicine, including Ayurveda, for health needs. This means the cultural base for Ayurvedic food is already large; people are not starting from zero. When a consumer sees chyawanprash, herbal ghee, turmeric drinks or dosha-balancing meals, these do not feel “new age” – they feel familiar and safe.

- Government policy is reinforcing this shift. According to a reply in the Indian Parliament, the Ayush manufacturing sector grew from about US$ 2.85 billion in 2014 to US$ 18.1 billion in 2020, a six-fold jump in seven years, with overall industry growth of 17% between 2014 and 2020. Such rapid scaling is not possible without rising demand for food-like health products – tonics, herbal jams, immunity drinks, spiced ghees and fortified staples based on Ayurvedic principles.

On the demand side, the organic and “free-from” movement is clearly global. A recent release from India’s Ministry of Commerce notes that the global organic market rose from US$ 112 billion in 2019 to about US$ 147.49 billion in 2023. Ayurvedic food fits naturally inside this trend because it combines organic or minimally processed ingredients with a clear health story – improved digestion, better immunity, balanced energy, and stress support – without synthetic additives.

Restraints

Safety and Quality Concerns as a Major Restraining Factor

One of the biggest brakes on the Ayurvedic food industry today is simple: many consumers are not fully sure the products are safe and consistently controlled for quality. This hesitation is especially strong outside India, but even Indian buyers are becoming more cautious as they hear about contamination or mis-labelling incidents in herbal and traditional products.

- The World Health Organization estimates that unsafe food makes about 600 million people sick each year and causes around 420,000 deaths, with an economic loss of about US$ 110 billion in low- and middle-income countries. When people already know that food safety is fragile, they become even more sensitive to anything that feels “unregulated” or “traditional but untested,” including Ayurvedic foods and supplements.

Several scientific and public-health bodies have flagged contamination problems in Ayurvedic preparations, especially those sold online or outside formal regulatory systems. A recent communication from the Minnesota Department of Health reported that roughly 1 in 5 Ayurvedic medications bought online contained lead, mercury or arsenic, levels high enough to raise concern about metal toxicity. Earlier clinical research also found that about 20% of sampled Ayurvedic herbal medicines contained potentially harmful levels of these metals.

Opportunity

Exporting Ayurveda-Inspired Foods to a Health-Conscious World

One of the biggest growth openings for Ayurvedic food lies in taking India’s traditional recipes into the global organic and health-food aisles. The world is already leaning toward natural wellness. The World Health Organization estimates that around 80% of the world’s population uses some form of traditional medicine, including Ayurveda, and 170 of 194 member states report its use. That means hundreds of millions of people are at least open to the idea of turmeric tonics, herbal ghees, immunity drinks and dosha-friendly meals, if they are offered in a safe, modern format.

On the food side, the organic movement gives a strong runway. A global review of the organic sector notes that the organic food market has expanded more than nine-fold in the last 23 years, reaching about €141 billion in 2022, with health, food safety and environmental concerns as key purchase reasons. Ayurvedic food fits naturally inside this space: many classical preparations are based on whole grains, pulses, spices, herbs and natural fats that can easily be certified organic and marketed as clean-label products.

The broader AYUSH ecosystem is also scaling fast, which indirectly supports demand for Ayurvedic food. A government-linked study cited by the Ministry of Ayush shows that the Indian AYUSH industry’s turnover rose from about US$ 2.85 billion in 2014 to US$ 18.1 billion in 2020, a roughly six-fold jump and about 17% overall growth during that period. Another government communication notes that global herbal markets were around US$ 657.5 billion in 2020, underscoring how large the natural-health space. As AYUSH brands grow, many will look beyond tablets and syrups toward food formats that are easier to adopt in daily life.

Regional Insights

North America leads with 45.2% and a market value of 346.9 Mn.

In 2024, the North American region emerged as the dominating market for Ayurvedic food products, holding a 45.2% share and accounting for an estimated market value of 346.9 Mn. This leadership can be attributed to elevated consumer interest in preventive health, broad adoption of plant-based dietary choices, and robust distribution through supermarkets, specialty retailers, and digital channels. Urban populations in major metropolitan areas exhibited notably higher per-capita consumption of Ayurvedic porridge, herbal mixes, and fortified solid formulations, which supported steady revenue generation across retail and online platforms.

Regulatory frameworks that favor clear ingredient labeling and substantiated claims were observed to facilitate consumer trust, thereby aiding mainstream acceptance. Investment in product development and clean-label positioning by manufacturers was reflected in improved shelf visibility and promotional activity, which in turn reinforced sales. Cross-border trade of botanical inputs and private-label offerings further enhanced supply chain resilience and product availability.

Retailers and distributors were noted to expand shelf space for Ayurvedic ranges, supported by targeted promotions and in-store education. While emerging markets displayed rising interest, North America’s combination of high consumer awareness, established retail networks, and a sizable addressable market consolidated its role as the leading region in the Ayurvedic food sector for the period under review.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dabur’s diversified FMCG portfolio continues to underpin its Ayurvedic food presence; the company reported consolidated revenue of ₹12,563 crore for FY 2024–25, with the food portfolio contributing materially to overall sales and margins. Ongoing investment in R&D and distribution has supported shelf expansion and product innovation across herbal and fortified food lines.

Organic India reported that ayurvedic medicines and related herbal products comprised about 67% of its revenues in FY2024, reflecting strong demand for organic and Ayurvedic food ranges; the firm’s public financials and rating notes show steady expansion of packaged food and herbal supplement lines. Product diversification and clean-label positioning supported sales growth.

Arya Vaidya Pharmacy (AVP): The Arya Vaidya Pharmacy (Coimbatore) reported revenues in the order of tens of crores (reported ~₹90.4 crore for FY2024 in corporate databases), reflecting a focused presence in Ayurvedic formulations and value-added food supplements. Improved operating margins and targeted product development have supported revenue resilience.

Top Key Players Outlook

- Dabur

- Organic India

- Kottakkal Arya Vaidya Sala

- Arya Vaidya Pharmacy (AVP)

- Ayurveda Rasashala

- Others

Recent Industry Developments

By 2025, The Arya Vaidya Pharmacy affirmed its commitment to holistic health by expanding its product line to include formulations for infants and adults, alongside its classical Ayurvedic medicines and wellness foods. AVP operates through a wide distribution network spanning over 1,000 outlets and reaching more than 100,000 stores nationwide, facilitating broad access to its products.

Dabur reported steady scale in the Ayurvedic food space, supported by its broad natural-health portfolio and extensive retail reach. In FY 2024–25, consolidated revenue was ₹12,563.1 crore, with an operating profit of ₹2,317 crore and profit after tax of approximately ₹1,768 crore, reflecting continued investment in product innovation and channel expansion.

Report Scope

Report Features Description Market Value (2024) USD 767.6 Mn Forecast Revenue (2034) USD 1538.4 Mn CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Breakfast Porridge, Juices, Gummies, Jams, Cookies, Others), By Form (Liquid Form, Solid Form), By Distribution Channel (Supermarkets And Hypermarkets, Drug Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dabur, Organic India, Kottakkal Arya Vaidya Sala, Arya Vaidya Pharmacy (AVP), Ayurveda Rasashala, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dabur

- Organic India

- Kottakkal Arya Vaidya Sala

- Arya Vaidya Pharmacy (AVP)

- Ayurveda Rasashala

- Others