Global Biscuits Market By Product Type (Sweet Biscuits, Savory, Crackers, Filled/Coated, Wafers), By Source (Wheat, Oats, Millets), By Flavor (Plain, Chocolate, Cheese, Fruit And Nut, Others), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Independent Bakeries, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139731

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

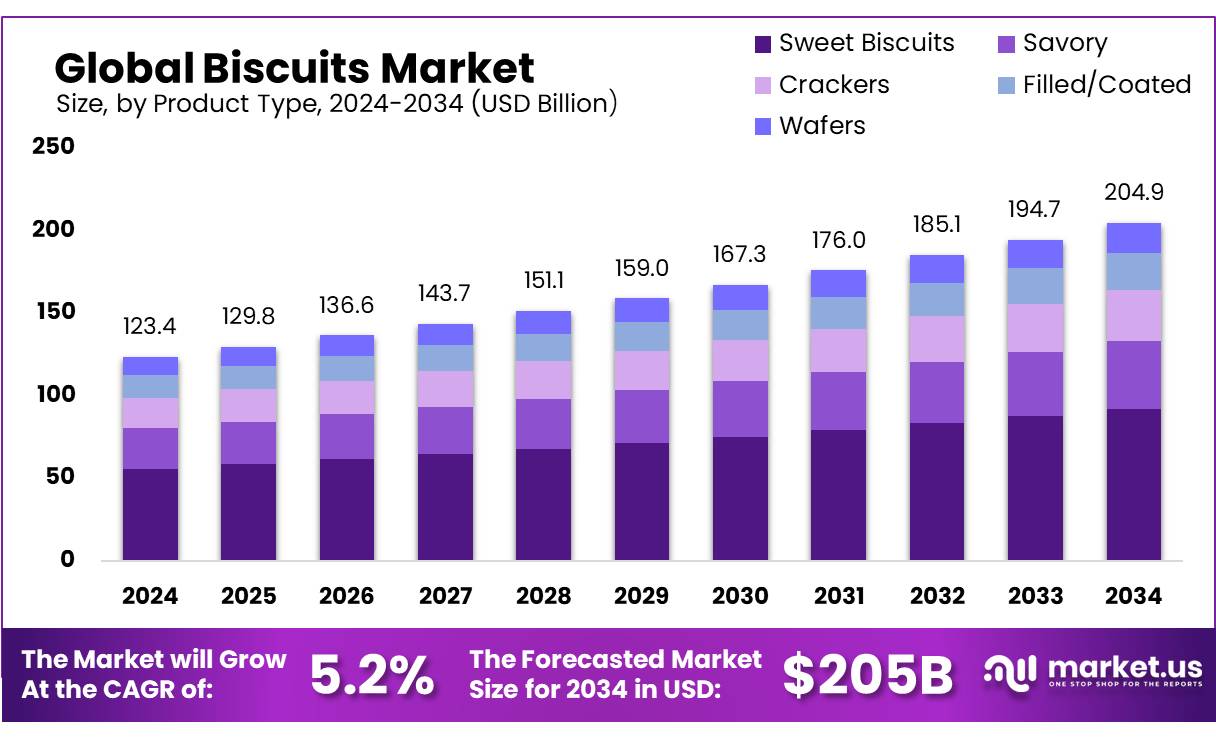

The Global Biscuits Market size is expected to be worth around USD 204.9 Bn by 2034, from USD 123.4 Bn in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

The global biscuits market has experienced significant growth over the past decade, driven by changing consumer preferences, rising disposable income, and increasing demand for convenient snack options. Biscuits, also known as cookies in certain regions, represent a crucial segment of the global baked goods industry. They are widely consumed due to their convenience, extended shelf life, and variety in taste and texture, catering to a wide demographic across all age groups.

Several factors are driving the growth of the biscuits market. One key driver is the increasing demand for convenient, on-the-go snacking solutions. Consumers are becoming busier, leading to a greater reliance on ready-to-eat foods like biscuits. The ongoing trend toward healthier snacks has further pushed the development of low-sugar, organic, and nutrient-enriched biscuit variants. Manufacturers are increasingly focusing on product innovation, incorporating functional ingredients such as fiber, protein, and vitamins to cater to the evolving preferences of consumers.

Rising disposable income, particularly in emerging economies, has enabled consumers to spend more on premium products, including gourmet and artisanal biscuits. This shift in consumer spending patterns is expected to continue contributing to the industry’s expansion. Furthermore, the increasing popularity of online retail platforms for food products has opened new distribution channels, creating opportunities for global players to expand their market reach.

Consumers are becoming more health-conscious, leading to a shift toward healthier variants such as whole grain, gluten-free, and low-sugar biscuits. As a result, biscuit manufacturers are increasingly focusing on offering functional ingredients like high fiber, reduced sugar, and organic options to meet evolving dietary preferences. Biscuits catering to specific dietary requirements, such as vegan, gluten-free, and keto biscuits, are expected to grow significantly, providing new avenues for market expansion.

Key Takeaways

- Biscuits Market size is expected to be worth around USD 204.9 Bn by 2034, from USD 123.4 Bn in 2024, growing at a CAGR of 5.2%.

- Sweet Biscuits continued to dominate the biscuits market, capturing more than a 45.3% share.

- Wheat continued to dominate the biscuits market, capturing more than a 57.1% share.

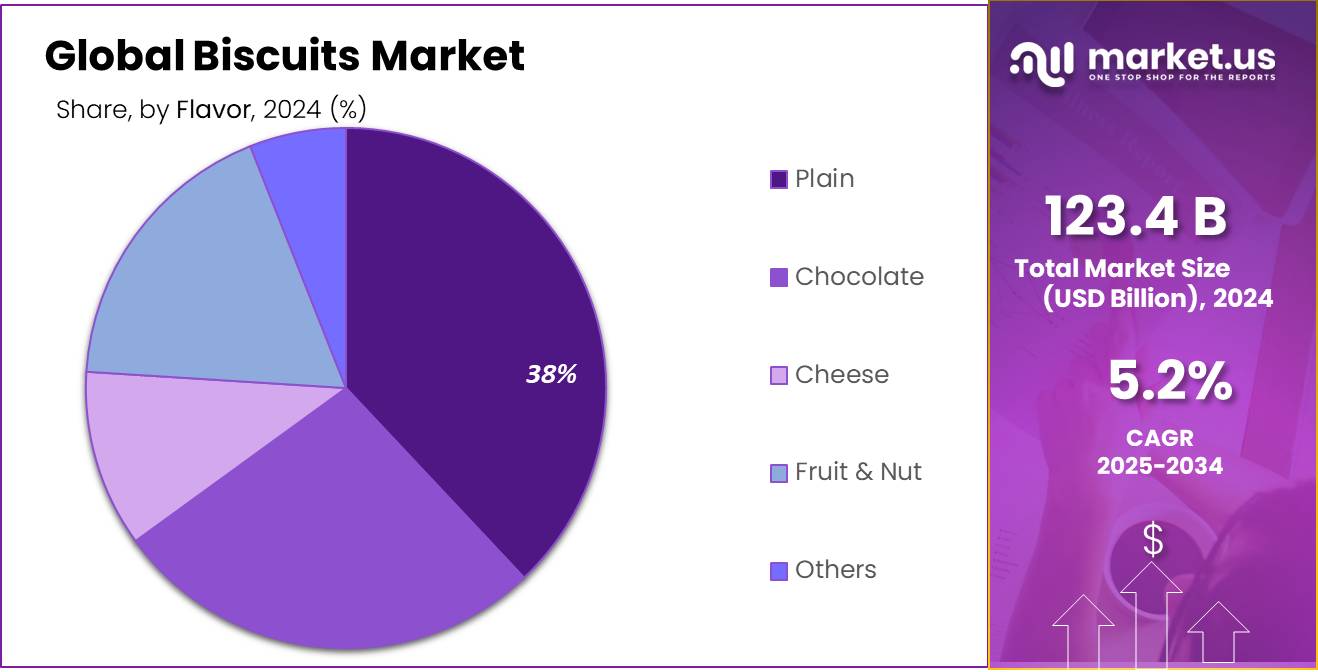

- Plain biscuits maintained a dominant position in the market, capturing more than a 38.3% share.

- Hypermarkets/Supermarkets continued to hold a dominant market position in the distribution of biscuits, capturing more than a 46.3% share.

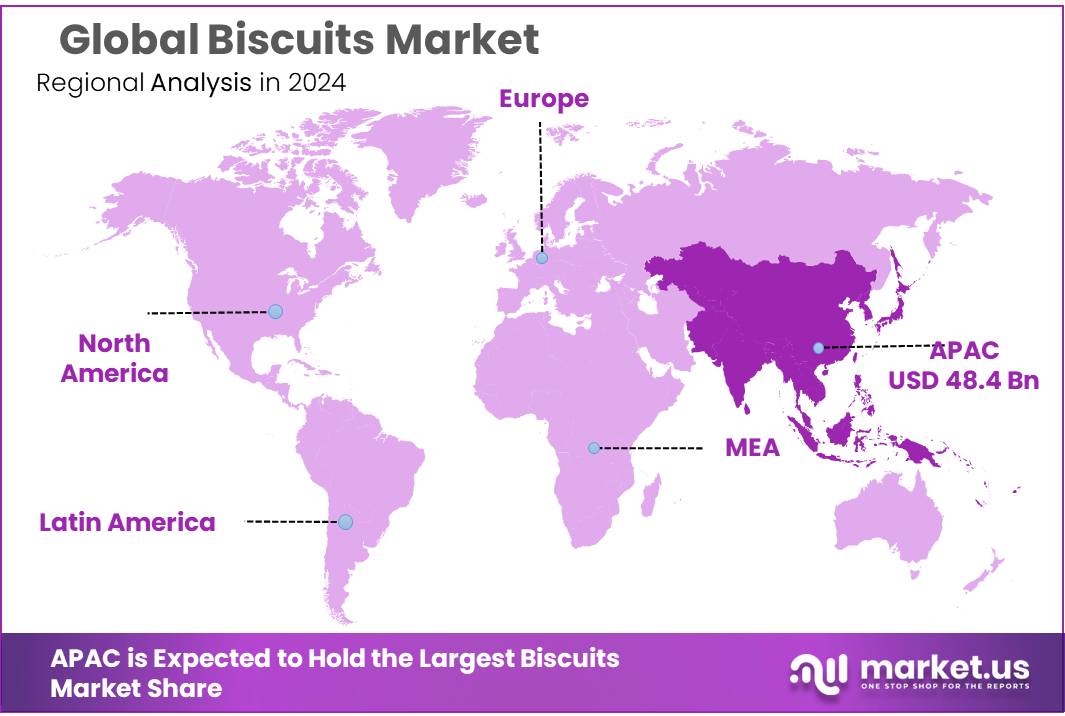

- Asia Pacific (APAC) region held a dominant position in the global biscuits market, capturing more than 39.3% of the market share, valued at approximately USD 48.4 billion.

By Product Type

In 2024, Sweet Biscuits continued to dominate the biscuits market, capturing more than a 45.3% share. This segment benefits from widespread consumer preference for sweet flavors, driving its significant market share. Sweet biscuits, which include varieties such as cookies and shortbreads, are popular both as snacks and dessert options, often paired with beverages like tea and coffee.

The Savory biscuits segment also holds a key position in the market, appreciated for their crisp texture and variety of flavors. These biscuits are typically consumed as part of meals or as snacks, with flavors ranging from cheese and herb to spicy and mild. Savory biscuits are increasingly being marketed as healthier alternatives to more sugary snacks, which helps maintain their popularity among health-conscious consumers.

Crackers are another important category, known for their versatility. Often marketed as a healthier snacking option, crackers are popular in both plain and flavored varieties. They are frequently used as a base for cheeses and spreads or consumed on their own for their crisp, satisfying texture.

Filled/Coated biscuits represent a growing segment that includes biscuits with various fillings and coatings like chocolate, yogurt, or fruit. This category is particularly popular among younger consumers and is seeing growth through innovation in fillings and use of premium ingredients which cater to a more indulgent consumer segment.

By Source

In 2024, Wheat continued to dominate the biscuits market, capturing more than a 57.1% share. This dominance is attributed to wheat’s widespread availability and its foundational role in traditional biscuit recipes across the globe. Wheat biscuits are valued for their texture and flavor, which make them a preferred choice in both sweet and savory varieties. Their appeal is broad, ranging from everyday consumers to gourmet markets looking for classic tastes and textures.

Oats are another key source in the biscuits market, appreciated for their health benefits, including high fiber content and cholesterol-lowering properties. Oat-based biscuits have gained traction among health-conscious consumers, driving growth in this segment. Manufacturers are capitalizing on this trend by offering a range of oat biscuits, from simple, lightly sweetened options to those combined with nuts, fruits, and other wholesome ingredients to enhance their nutritional profile.

Millets, though smaller in market share compared to wheat and oats, are emerging as a significant source in the biscuit market due to their nutritional benefits and gluten-free properties. Millet-based biscuits appeal particularly to consumers with dietary restrictions or those seeking alternative grain options. The segment is seeing gradual growth as awareness of millet’s health benefits increases and as manufacturers continue to innovate with flavors and textures that cater to a health-oriented audience.

By Flavor

In 2024, Plain biscuits maintained a dominant position in the market, capturing more than a 38.3% share. This segment’s strength lies in its universal appeal and versatility, serving as a staple in many households for both snacking and culinary uses. Plain biscuits are often favored for their simplicity, which allows them to be paired with a variety of foods like cheese, jam, or used as a base for other flavors in recipes.

Chocolate-flavored biscuits also hold a significant market share, appealing to a wide range of consumers who prefer sweet and indulgent snacks. The popularity of chocolate biscuits is supported by continuous innovation in this segment, including the introduction of new chocolate blends and combinations with other flavors, which keeps consumer interest high.

Cheese biscuits cater to those who enjoy savory flavors, making up another important market segment. These are particularly popular as snacks and appetizers, often featured in party platters or consumed on their own. Manufacturers have been known to experiment with different types of cheeses and spices to diversify their offerings.

Fruit & Nut biscuits attract consumers looking for a healthier snacking option or those who prefer complex flavors. This segment benefits from the perception of being healthier, with biscuits often containing real fruit pieces, nuts, and seeds, which are marketed as a source of vitamins, fiber, and protein.

By Distribution Channel

In 2024, Hypermarkets/Supermarkets continued to hold a dominant market position in the distribution of biscuits, capturing more than a 46.3% share. This channel’s success is largely due to its convenience and the ability to offer a wide range of products under one roof, appealing to consumers looking for variety and accessibility in their shopping experience.

Specialty Stores also play a crucial role in the biscuits market, particularly for premium and artisanal products. These stores often cater to niche markets looking for organic, gluten-free, or gourmet biscuit options, providing a curated selection that differentiates them from larger retail formats.

Independent Bakeries represent a smaller but significant segment of the market, appreciated for their fresh and locally produced biscuits. These establishments attract consumers seeking handmade, unique flavors that differ from mass-produced brands, often using traditional baking methods and high-quality ingredients.

The Online distribution channel has seen substantial growth, driven by the convenience of home delivery and the increasing penetration of e-commerce platforms. Consumers are turning to online shopping for its ease of access to a broad range of products, from everyday snacks to luxury biscuits, often with the added benefit of consumer reviews and competitive pricing.

Key Market Segments

By Product Type

- Sweet Biscuits

- Savory

- Crackers

- Filled/Coated

- Wafers

By Source

- Wheat

- Oats

- Millets

By Flavor

- Plain

- Chocolate

- Cheese

- Fruit & Nut

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Independent Bakeries

- Online

- Others

Drivers

Health-Conscious Consumer Trends

One of the major driving factors in the biscuits market is the growing trend of health-conscious consumption. As consumers become more aware of the nutritional aspects of their diets, there’s a noticeable shift towards healthier biscuit options. This includes an increase in demand for biscuits made from whole grains, reduced sugar, and functional ingredients that offer added health benefits such as fiber, protein, and reduced allergens.

For instance, leading food organizations have reported a surge in consumer demand for options that not only satisfy hunger but also contribute to a healthier lifestyle. This has led to innovations in biscuit formulations, with key players introducing products featuring alternative grains like oats and millets, which are perceived as healthier than traditional wheat-based biscuits.

Moreover, government initiatives around the world are also playing a crucial role in this trend. For example, the European Commission and the U.S. Food and Drug Administration (FDA) have implemented guidelines and regulations that encourage food manufacturers to reduce the sugar and fat content in their products. These regulations are designed to combat rising health issues such as obesity and diabetes, which in turn drives biscuit manufacturers to adjust their product portfolios to include healthier options.

This shift is not only seen in western markets but also increasingly in emerging economies, where urbanization and rising incomes are enabling consumers to make more health-conscious food choices. The result is a global increase in the demand for biscuits that offer nutritional benefits without compromising on taste, propelling the growth of the health-focused segment of the biscuit market.

Restraints

Rising Raw Material Costs

A significant restraining factor in the biscuits market is the rising cost of raw materials. The prices of key ingredients, such as wheat, sugar, and fats, have been increasing due to several factors including climate change, supply chain disruptions, and inflationary pressures. These rising costs directly impact biscuit manufacturers, as raw materials make up a large portion of their production expenses. For instance, wheat prices have seen a sharp rise in recent years.

According to the Food and Agriculture Organization (FAO), global wheat prices surged by approximately 30% from 2020 to 2022 due to adverse weather conditions and supply chain constraints.

This increase in raw material costs forces manufacturers to either absorb the higher costs, which can reduce profitability, or pass the costs on to consumers in the form of higher retail prices. The latter option can lead to reduced demand, especially in price-sensitive markets where consumers are looking for affordable snack options. In fact, a report from the U.S. Department of Agriculture (USDA) indicated that rising food prices, including for ingredients used in biscuits, have caused consumer spending to shift towards cheaper alternatives.

Additionally, government regulations aimed at promoting healthier eating habits have also contributed to cost pressures. Many governments are encouraging food manufacturers to reduce sugar and fat content, which often requires investment in new formulations, healthier ingredients, and more sophisticated production processes. These changes, while beneficial for public health, can increase production costs.

Opportunity

Rising Demand for Healthier Biscuits

A major growth opportunity in the biscuits market lies in the increasing consumer demand for healthier options. As more people become health-conscious and aware of the importance of balanced diets, there is a growing shift towards biscuits that offer nutritional benefits without compromising on taste. Biscuits made from whole grains, lower sugar, and added functional ingredients like fiber, protein, and vitamins are becoming popular.

For example, according to the World Health Organization (WHO), the global prevalence of obesity and related health issues has been rising steadily, pushing many consumers to seek out healthier snacks, including biscuits. This has spurred innovation within the biscuits sector, with manufacturers increasingly introducing low-sugar, gluten-free, and high-fiber products.

Governments around the world are also playing a role in this trend. Many countries, including the United States and those in the European Union, have introduced initiatives to reduce sugar and salt content in packaged foods to combat health issues such as diabetes and heart disease. These initiatives are influencing manufacturers to reformulate their products to meet new guidelines while catering to the growing demand for healthier alternatives.

For instance, the U.S. Food and Drug Administration (FDA) has provided clear guidelines on how much sugar should be in snack foods, pushing companies to innovate in order to meet these standards.

The rising preference for healthier biscuits offers a significant growth opportunity for brands to expand their product lines and capture a larger share of the market. By focusing on health-conscious ingredients and responding to government regulations, biscuit manufacturers can not only meet consumer demand but also contribute to the fight against global health issues.

Trends

Increased Focus on Sustainable Packaging

One of the latest trends in the biscuits market is the growing shift toward sustainable packaging. As environmental concerns continue to rise, consumers and manufacturers alike are increasingly prioritizing eco-friendly options. This shift is driven by both consumer demand for environmentally responsible products and by global initiatives aimed at reducing plastic waste and promoting recycling.

The global food industry is under increasing pressure to adopt sustainable packaging solutions. According to the Ellen MacArthur Foundation, approximately 46% of global plastic waste comes from packaging, with food packaging being a significant contributor. As a result, governments and regulatory bodies are tightening regulations around plastic use.

In response to these regulations, many biscuit manufacturers have begun exploring packaging made from biodegradable materials, such as plant-based plastics, and have moved toward using paper or cardboard for biscuit packaging. This trend is not just about reducing environmental impact; it also aligns with consumer preferences. A 2023 survey by the Food Marketing Institute found that 70% of consumers are more likely to purchase a product with sustainable packaging, reflecting growing consumer awareness of environmental issues.

This trend toward sustainable packaging presents a major growth opportunity for the biscuits market, as brands that embrace eco-friendly practices can differentiate themselves in an increasingly competitive market. By adopting recyclable or biodegradable packaging, biscuit companies not only reduce their environmental footprint but also cater to a more environmentally conscious consumer base. This trend is expected to continue gaining momentum as the demand for sustainable practices in the food industry increases.

Regional Analysis

In 2024, the Asia Pacific (APAC) region held a dominant position in the global biscuits market, capturing more than 39.3% of the market share, valued at approximately USD 48.4 billion. This dominance is driven by the region’s large population base, rising disposable incomes, and a growing preference for convenient snack foods. Countries like China, India, and Japan are key contributors, with increasing urbanization and evolving consumer tastes further fueling the demand for biscuits in various forms, from traditional types to healthier, more innovative options.

Europe follows closely behind, with a strong focus on premium and healthier biscuit varieties. The region’s biscuits market is supported by stringent regulations that promote healthier snacks and eco-friendly packaging, aligning with increasing consumer awareness about nutrition and sustainability. Countries such as the UK, Germany, and France are major markets within Europe, where demand for biscuits continues to grow steadily, particularly in the health-conscious and organic segments.

North America, while smaller in market share compared to APAC and Europe, remains an important player. The United States is the largest market in this region, with strong demand for both traditional biscuits and new, innovative products, such as gluten-free and low-sugar biscuits, in response to the growing health trend.

The Middle East & Africa and Latin America represent emerging markets, experiencing moderate growth. In the Middle East & Africa, the demand for biscuits is driven by a rising middle class and increased urbanization, while Latin America shows potential due to rising disposable incomes and changing snacking habits. Together, these regions are expected to contribute to the overall growth of the global biscuits market in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The biscuits market is highly competitive, with several key players holding substantial market shares across different regions. Bahlsen GmbH & Co. KG, a renowned German manufacturer, is a major player in the premium biscuits segment, with a focus on high-quality, innovative products. The company has strengthened its position through a wide product portfolio and continuous expansion into international markets. Britannia Industries, one of India’s largest biscuit manufacturers, has also carved a strong market presence, driven by its popular brands like Good Day and Tiger. Its expansion into healthier biscuit options and strategic pricing has helped it maintain its leadership in India and grow its footprint in global markets.

On the international stage, Mondelēz International and Nestlé SA are dominant players in the biscuits sector, with brands such as Oreo and KitKat, respectively. Both companies focus on diversifying their product offerings to cater to health-conscious consumers by introducing low-sugar, gluten-free, and plant-based options. Kellogg Co. and The Kraft Heinz Company are also significant contributors, with their vast distribution networks and iconic brands such as Kellogg’s Digestives and Kraft Biscuits. These global food giants leverage strong brand recognition, innovative product lines, and extensive marketing strategies to capture a large share of the market.

The biscuits market is highly competitive, with several key players holding substantial market shares across different regions. Bahlsen GmbH & Co. KG, a renowned German manufacturer, is a major player in the premium biscuits segment, with a focus on high-quality, innovative products. The company has strengthened its position through a wide product portfolio and continuous expansion into international markets. Britannia Industries, one of India’s largest biscuit manufacturers, has also carved a strong market presence, driven by its popular brands like Good Day and Tiger. Its expansion into healthier biscuit options and strategic pricing has helped it maintain its leadership in India and grow its footprint in global markets.

Top Key Players

- Bahlsen GmbH & Co. KG

- Britannia Industries

- Burton’s Biscuit Company

- Campbell Soup Company

- Cornu AG

- Dali Food Group Co, Ltd.

- Ferrero

- ITC LIMITED

- Kellogg Co.

- Kraft Foods Group, Inc.

- Lotus Bakeries Corporate

- Mondelēz International

- Nestle SA

- Parle Products Pvt Ltd

- The Hershey Company

- The Kraft Heinz Company

- Ulker Biskuvi Sanayi A.S.

- United Biscuits Company

- Walkers Shortbread Ltd

- Yildiz Holding Inc.

Recent Developments

In 2024 Bahlsen GmbH & Co. KG, the company is expected to continue building on its legacy of over 130 years in the biscuit industry, with an estimated revenue of around €500 million.

In 2024 Britannia Industries, the company is projected to generate a revenue of around ₹14,000 crore, driven by its diverse product portfolio and strong market presence.

Report Scope

Report Features Description Market Value (2024) USD 123.4 Bn Forecast Revenue (2034) USD 204.9 Bn CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sweet Biscuits, Savory, Crackers, Filled/Coated, Wafers), By Source (Wheat, Oats, Millets), By Flavor (Plain, Chocolate, Cheese, Fruit And Nut, Others), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Independent Bakeries, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bahlsen GmbH & Co. KG, Britannia Industries, Burton’s Biscuit Company, Campbell Soup Company, Cornu AG, Dali Food Group Co, Ltd., Ferrero, ITC LIMITED, Kellogg Co., Kraft Foods Group, Inc., Lotus Bakeries Corporate, Mondelēz International, Nestle SA, Parle Products Pvt Ltd, The Hershey Company, The Kraft Heinz Company, Ulker Biskuvi Sanayi A.S., United Biscuits Company, Walkers Shortbread Ltd, Yildiz Holding Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bahlsen GmbH & Co. KG

- Britannia Industries

- Burton's Biscuit Company

- Campbell Soup Company

- Cornu AG

- Dali Food Group Co, Ltd.

- Ferrero

- ITC LIMITED

- Kellogg Co.

- Kraft Foods Group, Inc.

- Lotus Bakeries Corporate

- Mondelēz International

- Nestle SA

- Parle Products Pvt Ltd

- The Hershey Company

- The Kraft Heinz Company

- Ulker Biskuvi Sanayi A.S.

- United Biscuits Company

- Walkers Shortbread Ltd

- Yildiz Holding Inc.