Global Packaged Soup Market By Product Type(Dried, Wet, Bottles, Canned), By Packaging(Bottles, Canned, Packets), By End-User(Commercial Sector, Household Sector), By Distribution Channels(Supermarket/Hypermarket, Convenience Store, Online Store, Foodservice, Others) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132019

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

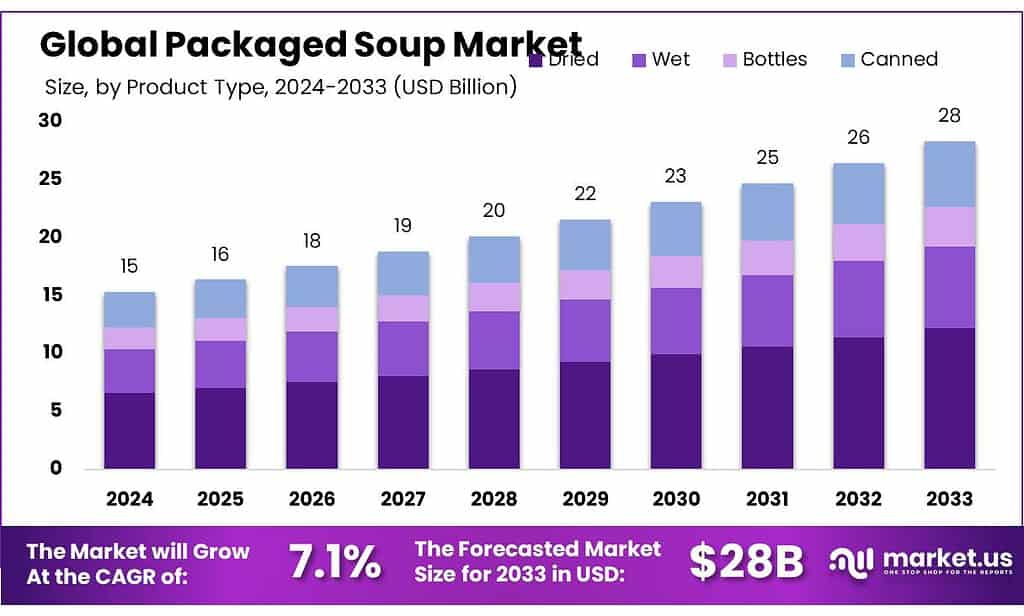

The Global Packaged Soup Market size is expected to be worth around USD 28 Bn by 2033, from USD 15 Bn in 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033.

Packaged soups represent a significant segment within the global food industry, primarily appealing to consumers seeking convenient, ready-to-eat meal solutions. These products are typically offered in various forms, including dry, condensed, or fully prepared options, and are packaged in cans, boxes, or flexible pouches to ensure they remain shelf-stable for extended periods. The diversity in flavors and types allows packaged soups to cater to a wide array of taste preferences and dietary needs, meeting the demands of a diverse global consumer base.

In response to the growing market demand, major industry players have significantly ramped up their investments in product innovation and expansion. For instance, in 2023, a prominent food company invested over $100 million to enhance its production capabilities, aiming to bolster supply to meet both existing and anticipated demand worldwide. This investment reflects a broader industry trend where companies are not only expanding their manufacturing capacities but also focusing on enhancing the quality and variety of their offerings.

Additionally, governmental initiatives, especially in regions like Europe, are increasingly influencing market dynamics. These initiatives often involve subsidies and regulatory support aimed at promoting healthier food options, which has enabled manufacturers to introduce low-sodium and preservative-free packaged soups. Such products align well with public health objectives that advocate for reduced sodium consumption and cleaner labels in processed foods.

The import-export dynamics of the packaged soup market also highlight a significant trend towards globalization of tastes and flavors. The U.S. and Europe are notable for their importation of exotic soup flavors from Asia, which is indicative of Western consumers’ growing appetites for diverse, international cuisines. The year-over-year export value of these specialty soups saw a 15% increase in 2023, underscoring the robust demand for unique culinary experiences among global consumers.

Research and development (R&D) are pivotal in sustaining growth and innovation within the packaged soup sector. Companies are dedicating a substantial portion of their revenues—typically between 3-5% annually—towards R&D activities. These investments are focused on developing new flavors and improving nutritional profiles to produce healthier product options that meet consumer expectations and regulatory standards.

Key Takeaways

- Packaged Soup Market size is expected to be worth around USD 28 Bn by 2033, from USD 15 Bn in 2023, growing at a CAGR of 7.1%.

- Dried segment of the packaged soups market held a dominant position, capturing more than a 43.1% share.

- Bottles held a dominant market position in the packaged soups sector, capturing more than a 27.1% share.

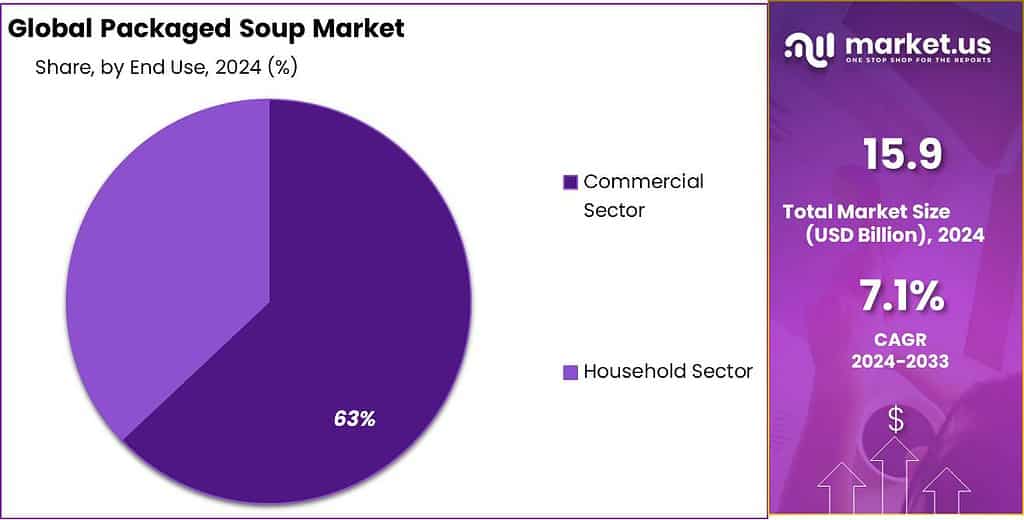

- Household Sector held a dominant market position in the packaged soups market, capturing more than a 63.2% share.

- Supermarkets/Hypermarkets held a dominant market position in the distribution of packaged soups, capturing more than a 42.1% share.

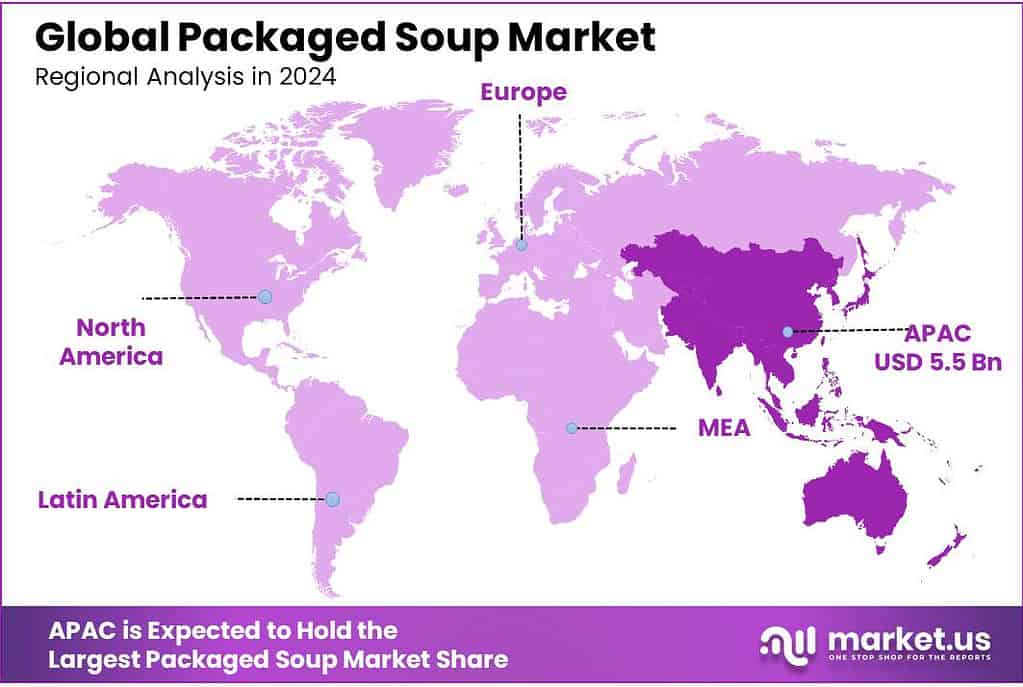

- Asia Pacific (APAC) currently dominates the global market, accounting for 36% of the market share with a valuation of USD 5.5 billion.

By Product Type

In 2023, dried soups secured the leading position in the packaged soups market with a 43.1% share.

In 2023, the dried segment of the packaged soups market held a dominant position, capturing more than a 43.1% share. This segment benefits significantly from its extended shelf life and convenience, appealing to consumers looking for quick and easy meal options that require minimal storage space and preparation effort. Dried soups are popular among campers, busy professionals, and families alike for their portability and ease of preparation, simply requiring the addition of hot water or broth.

The wet soup segment also plays a crucial role in the market, appreciated for its ready-to-eat convenience and closer resemblance to homemade soups in terms of texture and flavor. These products typically come in cans or pouches and are favored for their “heat-and-eat” simplicity, making them a go-to choice for those who prioritize time savings but want a more home-cooked feel from their meals.

Packaged soups in bottles, though less common, cater to a niche market segment interested in premium and often artisanal flavors. These soups tend to focus on organic and natural ingredients, targeting health-conscious consumers looking for transparency in ingredients and packaging.

By Packaging

In 2023, bottles held a dominant market position in the packaged soups sector, capturing more than a 27.1% share. This segment benefits significantly from consumer preferences for sustainable and aesthetically pleasing packaging options. Bottled soups often appeal to those seeking premium and organic choices, as the packaging aligns with a high-quality, health-conscious image.

Canned soups also represent a major segment, known for their convenience and long shelf life. They remain popular due to their cost-effectiveness and wide availability in various flavors and formulations, catering to a broad consumer base looking for ready-to-eat options.

By End-User

In 2023, the Household Sector held a dominant market position in the packaged soups market, capturing more than a 63.2% share. This sector’s significant market share is primarily due to the increasing demand for convenience foods that offer quick, easy meal solutions for busy families and individuals. Packaged soups in this category are favored for their ease of preparation and storage, making them a staple in many households for both daily meals and emergency food supplies.

Conversely, the Commercial Sector, which includes restaurants, cafeterias, and other food service establishments, also utilizes packaged soups but to a lesser extent. This sector leverages the benefits of packaged soups primarily for their consistency in quality and flavor, ease of use, and storage efficiency, allowing for quick service and reduced preparation times. Although substantial, the commercial sector’s reliance on packaged soups is not as extensive as in the household sector, reflecting the broader trend towards home consumption of these products.

By Distribution Channels

In 2023, Supermarkets/Hypermarkets held a dominant market position in the distribution of packaged soups, capturing more than a 42.1% share. This channel’s strength lies in its broad assortment of brands and types of packaged soups available, coupled with the convenience of one-stop shopping for consumers looking to combine their grocery purchases in a single location. Supermarkets and hypermarkets are preferred by customers who appreciate the ability to physically inspect products before purchasing and who often benefit from competitive pricing and promotional deals.

Convenience stores also play a crucial role, offering accessibility and speed for consumers needing quick meal solutions without the hassle of navigating larger supermarket layouts. These outlets are vital in urban areas where shoppers often stop for emergency pantry staples or quick meals.

Online stores have seen a significant increase in their market share, particularly driven by the growth of e-commerce and changing consumer shopping behaviors post-pandemic. This channel offers the convenience of home delivery and often provides access to a wider variety of products that might not be available in physical stores.

The Foodservice channel, which includes restaurants, cafeterias, and other catering services, utilizes packaged soups mainly for their ease of preparation and consistency, helping these establishments manage cost and waste more effectively while ensuring quick service.

Key Market Segments

By Product Type

- Dried

- Wet

- Bottles

- Canned

By Packaging

- Bottles

- Canned

- Packets

By End-User

- Commercial Sector

- Household Sector

By Distribution Channels

- Supermarket/Hypermarket

- Convenience Store

- Online Store

- Foodservice

- Others

Driving Factors

Rising Demand for Convenience Foods

The global market for packaged soups is primarily driven by the increasing consumer demand for convenience foods that are quick and easy to prepare. This trend is reinforced by the busy lifestyles of urban populations and the growing preference for ready-to-eat food products. The rise in demand is particularly noticeable in regions with rapid urbanization and lifestyle changes that favor quick meal solutions.

Health and Wellness Trends

Another significant driver is the shift towards health and wellness, which influences consumer choices towards soups that offer nutritional benefits without compromising on taste or quality. There is an increasing preference for soups with clean labels, natural ingredients, and functional benefits, such as low sodium and reduced sugar options, plant-based ingredients, and soups enriched with superfoods like turmeric and ginger. This shift is shaping product offerings across the market as manufacturers focus on creating healthier soup options to meet consumer demands.

Innovative Packaging and Product Offerings

The market is also witnessing innovations in product offerings and packaging solutions aimed at improving convenience, preserving taste, and extending shelf life. Advances in packaging technology have led to the development of microwavable soups and better packaging materials that enhance the appeal of packaged soups. The industry’s move towards sustainable packaging solutions that reduce environmental impact is also resonating with environmentally conscious consumers.

Expansion of Retail Channels

The expansion of retail channels, particularly through the growth of online grocery shopping and the wide availability of products in supermarkets and hypermarkets, is facilitating easier consumer access to a diverse range of packaged soup products. The availability of various flavors and types, from ethnic and international cuisines to diet-specific formulations, has helped attract a broader customer base, further driving market growth.

Restraining Factors

Impact on Ingredient Sourcing and Production

Recent events, notably the COVID-19 pandemic, have exposed vulnerabilities within the supply chains critical to the packaged soups industry. Disruptions have particularly impacted the sourcing of key ingredients and the consistent production of soups. These challenges arise from logistical delays, restrictions on international trade, and intermittent shutdowns of manufacturing facilities, all of which contribute to difficulties in maintaining a stable supply chain. Such disruptions can lead to shortages of products in the market and delayed deliveries to retailers, affecting overall market growth.

Resulting Cost Increases and Operational Delays

The instability in supply chains can also lead to increased costs. For manufacturers, the unpredictability of ingredient availability often results in higher prices due to scarcity and the need for urgent procurement methods. These increased costs may then be passed on to consumers, potentially reducing sales if the price point becomes too high. Furthermore, operational delays caused by supply chain issues can lead to inefficiencies, increased waste, particularly of perishable ingredients, and higher operational costs, all of which diminish profitability.

Long-term Brand and Customer Impact

Persistent supply chain issues not only affect immediate production and distribution but can also harm brand reputation. Companies often face challenges in fulfilling orders on time, which can frustrate retailers and consumers, leading to a loss of trust and potentially long-term damage to customer relationships. In severe cases, consistent supply chain problems can lead to permanent loss of sales as consumers and retailers turn to more reliable competitors.

Growth Opportunity

E-Commerce Expansion

The rapid expansion of e-commerce presents a significant growth opportunity for the packaged soups market. As consumers increasingly turn to online shopping for convenience, there’s a clear trend towards purchasing food items, including packaged soups, through digital platforms. The ease of ordering online coupled with the wide array of choices and the ability to easily compare products and prices helps drive the demand in this segment. The growth of direct-to-consumer (DTC) sales channels is particularly transformative, allowing soup manufacturers to engage directly with consumers and personalize marketing strategies.

Health and Wellness Focus

Another key driver is the rising consumer interest in health and wellness, which influences purchasing decisions towards soups that are perceived as healthier. Packaged soup producers are responding by creating products with clean labels, natural ingredients, and functional benefits.

These include low-sodium and reduced-sugar options, as well as soups that incorporate superfoods and offer specific health benefits like enhanced immune support or improved gut health. This shift is not only in response to consumer demand but also aligns with broader public health objectives.

Innovative Product Offerings

Manufacturers are continuously innovating to cater to the evolving consumer palette. This includes the introduction of a variety of new flavors and soup types that cater to both traditional preferences and exotic tastes. The availability of international and gourmet flavors is helping to attract a broader consumer base, providing an experience that was once limited to restaurants. Additionally, the market is seeing an increase in plant-based and organic soup options, catering to the growing segment of consumers looking for vegetarian and vegan meal options

Latest Trends

Health and Wellness Driven Innovations

The growing consumer focus on health and wellness is shaping major trends within the packaged soups market. More and more consumers are opting for soups that promote health benefits, which has led manufacturers to innovate by introducing products with low sodium, reduced sugar, and no preservatives. The trend extends to offering more plant-based and clean-label options that cater to dietary preferences like vegan and gluten-free. This shift is not only a response to consumer demand but also aligns with broader public health goals of improving diet quality across populations.

Convenience and Premiumization

Convenience continues to drive innovations in product offerings and packaging. Microwavable soups and ready-to-drink formats are gaining popularity because they fit well with the hectic lifestyles of urban consumers who demand quick and easy meal solutions. Additionally, there is a noticeable shift toward premiumization within the sector. Gourmet and exotic flavors are being developed to replicate restaurant-quality meals, offering consumers a luxurious dining experience at home. This includes the use of high-quality, niche ingredients and fusion flavors that cater to the adventurous palates of modern consumers.

Technological Advancements and E-commerce Growth

Advancements in technology are playing a pivotal role in reshaping the packaged soups market. The integration of blockchain and IoT for better supply chain management and product tracking is enhancing operational efficiencies and transparency. Moreover, the rapid expansion of e-commerce has transformed distribution channels, making it easier for consumers to access a wide variety of soup products online with the convenience of home delivery. This trend is further supported by the growth of direct-to-consumer platforms, which allow brands to engage directly with customers and personalize marketing strategies.

Regional Analysis

Asia Pacific (APAC) currently dominates the global market, accounting for 36% of the market share with a valuation of USD 5.5 billion. This region’s significant growth is driven by increasing urbanization, a burgeoning middle class, and rising disposable incomes, which have boosted demand for convenient and quick meal solutions. The popularity of local flavors and the integration of traditional soups into packaged formats also play a crucial role in the market’s expansion.

North America follows closely, characterized by a high demand for health-conscious products like low-sodium and organic soups. The region’s well-established retail infrastructure and the high penetration of e-commerce platforms further facilitate consumer access to a variety of packaged soup products, enhancing the market’s growth prospects.

Europe shows a strong preference for premium, organic, and non-GMO soups, reflecting the region’s stringent food safety regulations and the consumers’ focus on health and wellness. The market in Europe is also supported by numerous initiatives promoting sustainable packaging and ethically sourced ingredients, aligning with the broader consumer trends towards environmental stewardship.

Latin America and the Middle East & Africa (MEA), while smaller in comparison, are expected to experience rapid growth. In Latin America, increasing urbanization and the westernization of diets contribute to the market expansion, whereas in the MEA, the growing expatriate population and the rising standards of living are key growth drivers. These regions are witnessing an increase in consumer demand for international soup flavors and convenient meal options, which are expected to propel market growth in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The packaged soups market is characterized by a diverse array of key players who significantly contribute to the industry’s dynamics through innovation, strategic marketing, and broad geographic presence. Campbell Soup Company, Nestlé S.A., and Unilever PLC are among the giants in the sector, known for their extensive product lines and strong brand equity. These companies have a robust global distribution network that ensures their products are available worldwide, catering to a wide range of consumer tastes and preferences.

Conagra Brands Inc., General Mills Inc., and The Kraft Heinz Company also play crucial roles in the market with their focus on continuous product innovation and marketing strategies that resonate with changing consumer demands, such as healthier options and convenient meal solutions. These players have been instrumental in driving growth by introducing organic and natural soup offerings, aligning with global health trends.

Smaller specialized companies like Baxters Food Group Limited, Blount Fine Foods, and Kettle Cuisine LLC focus on niche markets, offering gourmet and premium products that target specific consumer segments looking for high-quality, artisanal food experiences. Meanwhile, Ajinomoto Co. Inc. and Ottogi Corporation lead in delivering regional flavors that cater to local preferences, particularly in Asian markets. Together, these companies contribute to a highly competitive market landscape, pushing for innovation in flavors, packaging, and product accessibility, meeting the global consumer demand for variety and convenience in soup products.

Top Key Players in the Market

- Ajinomoto Co.Inc.

- B&G Foods Inc.

- Baxters Food Group Limited

- Blount Fine Foods

- Ottogi Corporation

- Premier Foods Group Limited

- Campbell Soup Company

- Conagra Brands Inc.

- General Mills Inc.

- Kettle Cuisine LLC

- Nestle S. A.

- The Hain Celestial Group

- The Kraft Heinz Company

- Unilever PLC

Recent Developments

In 2023, Ajinomoto Co., Inc. continued to expand its presence in the packaged soups sector, leveraging its established capabilities in flavor and seasoning technologies.

In 2023 Baxters Food Group capitalizes on the growing trend towards convenient, healthy eating by expanding their range of packaged soups that cater to various dietary preferences, including options that are gluten-free, vegetarian, and low in sodium.

Report Scope

Report Features Description Market Value (2023) USD 15 Bn Forecast Revenue (2033) USD 28 Bn CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Dried, Wet, Bottles, Canned), By Packaging(Bottles, Canned, Packets), By End-User(Commercial Sector, Household Sector), By Distribution Channels(Supermarket/Hypermarket, Convenience Store, Online Store, Foodservice, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ajinomoto Co.Inc., B&G Foods Inc., Baxters Food Group Limited, Blount Fine Foods, Ottogi Corporation, Premier Foods Group Limited, Campbell Soup Company, Conagra Brands Inc., General Mills Inc., Kettle Cuisine LLC, Nestle S. A., The Hain Celestial Group, The Kraft Heinz Company, Unilever PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ajinomoto Co.Inc.

- B&G Foods Inc.

- Baxters Food Group Limited

- Blount Fine Foods

- Ottogi Corporation

- Premier Foods Group Limited

- Campbell Soup Company

- Conagra Brands Inc.

- General Mills Inc.

- Kettle Cuisine LLC

- Nestle S. A.

- The Hain Celestial Group

- The Kraft Heinz Company

- Unilever PLC