Global Champagne Market Size, Share, Statistics Analysis Report Product Type (Prestige Cuvee, Blanc De Noirs, Blanc De Blancs, Rose Champagne, Brut Champagne, Demi-Sec), Grape Variety (Pinot Noir, Pinot Meunier, Chardonnay, Others), Capacity (200 Ml, 375 Ml, 750 ML, 1500 Ml, Above 1500Ml), Distribution Channel (On-trade (Pubs, Bars And Cafe’s, Hotels And Restaurants, Others), Off-Trade (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Stores), Producers (Houses, Growers, Cooperatives), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 32325

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

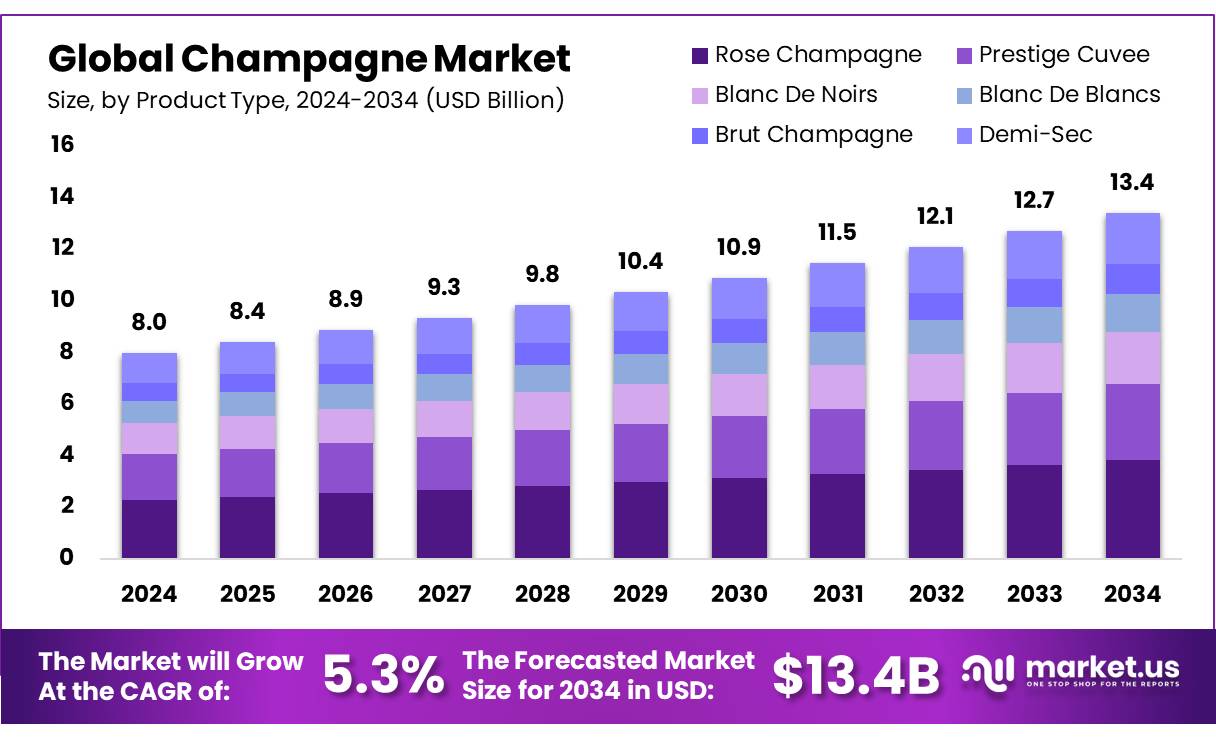

In 2024, the Global Champagne Market size is expected to be worth around USD 13.1 Billion by 2034, from USD 8.0 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

Champagne is a premium white or rosé sparkling wine produced in the Champagne region of France using the traditional method. It is made primarily from three grape varieties—Chardonnay, Pinot Noir, and Pinot Meunier and is exclusively produced in the Champagne region of France.

It is known for its fine bubbles, refined complexity, and distinctive flavors of citrus, apple, toast, and almonds. Widely associated with luxury, celebration, and sophistication, Champagne is enjoyed across various occasions, from formal toasts and cocktails to food pairings with oysters, seafood, deviled eggs, fried chicken, and desserts such as fresh berries and soft cheeses.

The global Champagne market is driven by increasing consumer demand for high-quality, luxury alcoholic beverages, rising disposable incomes, and growing interest in premium wines, particularly in emerging markets. Widely available through supermarkets, liquor stores, wine retailers, and restaurants, Champagne continues to hold a dominant position in the sparkling wine category. Despite facing competition from alternatives such as Prosecco and Cava, its protected geographic origin and traditional production method have helped maintain its status as one of the most prestigious and sought-after wine options among both aristocratic and modern consumers.

Key Takeaways

- The global champagne market was valued at USD 8.0 billion in 2024.

- The global champagne market is projected to grow at a CAGR of 5.3 % and is estimated to reach USD 13.1 billion by 2034.

- Among product types, rose champagne accounted for the largest market share of 28.6%.

- Among grape varieties, Pinot Noir accounted for the majority of the market share at 46.5%.

- By capacity, 750 ML accounted for the largest market share of 67.4%.

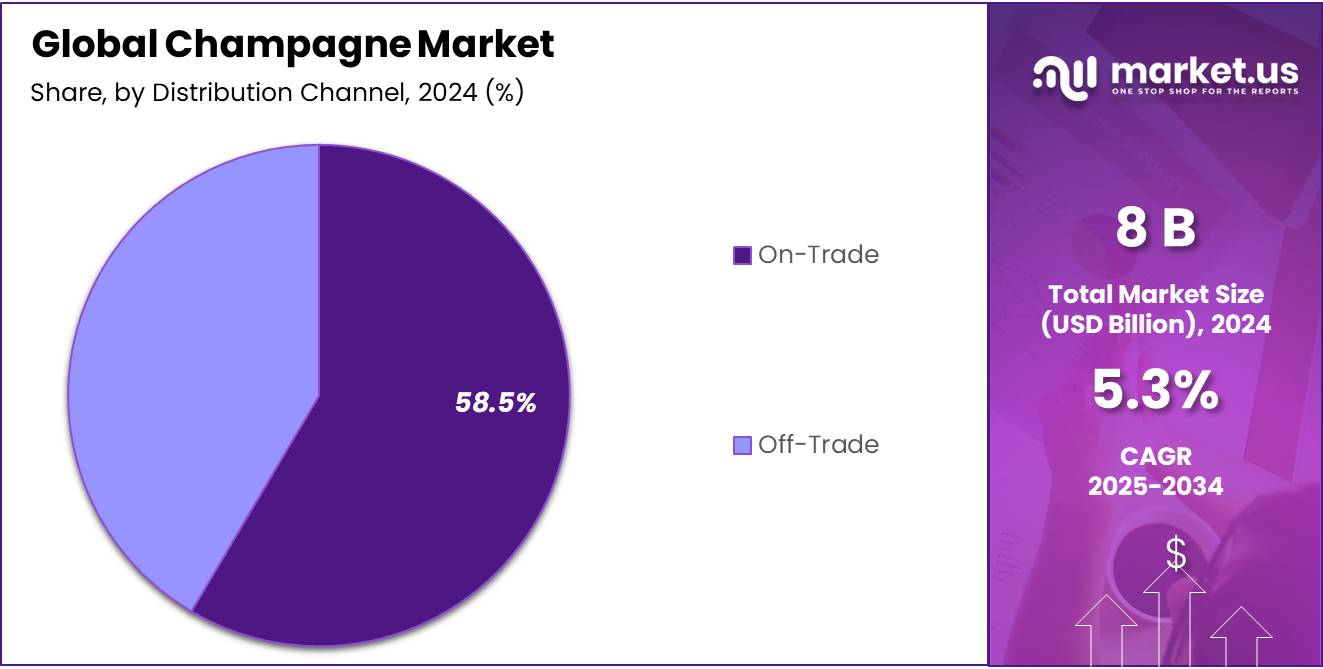

- By distribution channel, on-trade accounted for the majority of the market share at 58.5%.

- Among producers, houses accounted for the largest market share of 74.5%

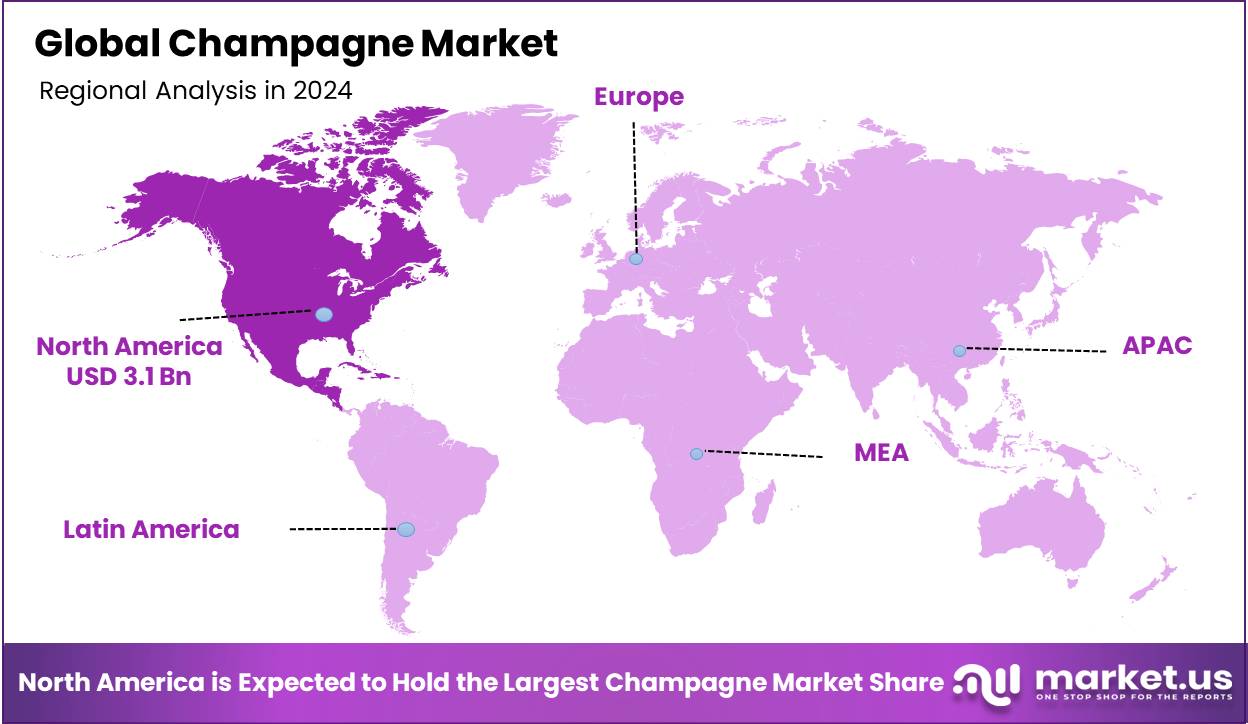

- North America is estimated as the largest market for champagne with a share of 39.4% of the market share.

Product Type Analysis

Rosé Champagne Leads with Strong Consumer Preference and Visual Appeal

The champagne market is segmented based on product type into prestige cuvee, blanc de noirs, blanc de Blancs, rose champagne, brut champagne, and demi-sec. Among them rose champagne segment held a significant revenue share of 28.6%. Due to its growing adoption among younger and lifestyle-conscious consumers. Their vibrant color, fruity flavor, and visual appearance make it a popular choice for celebrations and social events. The wine’s versatility with a combination of food pairings also enhances its demand across various occasions. Additionally, rising curiosity about Western culture, moderate consumption in emerging markets, and strong influence from social media trends have significantly contributed to its market growth.

Grape Variety Analysis

Pinot Noir Dominates Due to Bold Flavor and Versatile Usage

Based on grape variety, the market is further divided into Pinot Noir, Pinot Meunier, Chardonnay, and Others. The predominance of the Pinot Noir, commanding a substantial 46.5% market share in 2024. Due to its ability to produce full-bodied, complex Champagnes with excellent aging potential. It is a key component in Blanc de Noirs and Rosé variants, both of which are increasingly popular. Pinot Noir adds structure and depth, making it a favorite among Champagne producers. Its adaptability across various vineyards and prominence in prestigious blends also contribute to its strong market position.

Capacity Analysis

750 mL Bottles Hold the Largest Market Share as the Standard Champagne Size

Among capacity, the champagne market is classified into 200 Ml, 375 Ml, 750 ML, 1500 Ml, and above 1500 Ml. Among these, 750 ML held a dominant position with a 68.4% share. Due to its status as the standard bottle size for Champagne globally. This size is widely preferred for both personal consumption and gifting, making it the most commercially popular option. Its ideal capacity balances affordability with portion size, catering to individual buyers, restaurants, and celebratory events alike. Additionally, it is the most commonly used size for marketing and branding efforts by Champagne producers, further reinforcing its market dominance.

Distribution Channel Analysis

On-Trade Segment Leads, Driven by Dining, Events, and Social Occasions

By distribution channel, the market is categorized into On-Trade and Off-Trade. The on-trade segment emerging as the dominant channel, holding 67.2% of the total market share. Due to its strong demand from hotels, restaurants, bars, and event venues. This growth is fueled by the increasing popularity of social dining, luxury experiences, and celebratory occasions where Champagne is a preferred beverage. The return of large-scale events, weddings, and tourism post-pandemic further boosted sales through on-trade channels. Additionally, premium branding and the personalized service offered in these venues enhance the appeal of consuming Champagne in social and upscale settings.

Producers Analysis

Champagne Houses Dominate the Market with Strong Branding and Global Reach

In terms of producers, the champagne market comprises houses, growers, and cooperatives. In 2024, houses led the market and accounted for a 74.5% share. Due to their strong global brand recognition, extensive distribution networks, and consistent product quality. These well-established producers, such as Moët & Chandon, Veuve Clicquot, and Dom Pérignon, invest heavily in marketing, export operations, and innovation. Their ability to produce Champagne at scale while maintaining prestige appeals to both luxury and mainstream consumers. Additionally, their presence in high-end retail and on-trade channels further reinforces their market leadership.

Key Market Segments

By Product Type

- Prestige Cuvee

- Blanc De Noirs

- Blanc De Blancs

- Rose Champagne

- Brut Champagne

- Demi-Sec

By Grape Variety

- Pinot Noir

- Pinot Meunier

- Chardonnay

- Others

By Capacity

- 200 Ml

- 375 Ml

- 750 ML

- 1500 Ml

- Above 1500Ml

By Distribution Channel

- On-trade

- Pubs, Bars & Cafe’s

- Hotels & Restaurants

- Others

- Off-trade

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

By Producers

- Houses

- Growers

- Cooperatives

Drivers

Growing Wine Culture Worldwide

The growing global wine culture is a major driver of the champagne market, as wine becomes more integrated into social lifestyles and luxury experiences. Champagne is increasingly seen as a prestigious drink tied to celebrations and elegance, particularly in regions with rising disposable incomes. As consumers embrace wine culture, they view champagne as a symbol of sophistication, fueling its demand across markets seeking premium and culturally rich beverages.

Additionally, the rising demand for moderate wine options, such as low-sugar, low-alcohol, and premium products, is further propelling champagne’s growth. In addition, the growing adoption of Western lifestyles among younger, female, and millennial consumers is fueling the rise of nightclubs and boosting food and drink consumption. The combination of food and drink experiences is also gaining popularity, with restaurants, hotels, and clubs adapting their menus and offerings to align with evolving consumer preferences and lifestyle trends.

- According to the Dietary Guidelines for Americans 2010, moderate alcohol consumption is defined as up to 1 drink per day for women and up to 2 drinks per day for men.

- According to the International Grape and Wine Organization, wine sales in China are projected to reach 462.4 billion yuan ($65.4 billion) by 2026, doubling the figures from 2021. The compound annual growth rate is expected to be 11.5% for still wine and 11.3% for sparkling wine, influenced by the growing adoption of Western lifestyles and habits, particularly among millennial and Gen Z consumers.

Furthermore, growing awareness of clean-label products and increasing curiosity about product origins are driving demand for transparency. Consumers prefer authentic, high-quality products from the Champagne-producing region and seek assurance of their authenticity. As wine is a major global beverage, governments have implemented regulations to protect champagne’s authenticity, ensuring consumer trust and safeguarding its reputation. These regulations help preserve brand loyalty, support local producers, and stabilize the market, boosting demand for premium wines.

- For instance, In the EU, Champagne is protected under Protected Designation of Origin (PDO) status, meaning only sparkling wine from the Champagne region of France, made using specific methods, can be legally sold as Champagne, ensuring quality and authenticity for consumers.

- For instance, Australia has agreed to phase out the use of the term “Champagne” for local products as part of its Free Trade Agreement with the EU, recognizing Champagne’s PDO status and aiming to protect its brand integrity in international markets.

Restraints

Impact of Anti-Alcohol Movement And Regulation

The global Champagne market is facing increasing challenges due to growing anti-alcohol movements and government regulations on grape farming, alcohol consumption, and production. Consumers in some regions are increasingly prioritizing religious culture alongside individual health and awareness regarding the impact of alcohol consumption on the body, limiting their market. In addition, various governments and public organizations promoting health campaigns emphasize the risks of alcohol consumption. This has led to declining demand, especially among younger, health-conscious consumers, further limiting Champagne’s market growth.

- For instance, the World Health Organization promotes anti-alcohol campaigns emphasizing that “there is no safe amount of alcohol”; this motto has increased consumer awareness, affecting overall alcohol consumption growth.

Furthermore, stringent government regulations and alcohol-related laws represent another significant factor restraining the growth of the global Champagne market, as regions such as Europe and the United States impose strict regulations on wine manufacturers and wine production.

- In the United States, regulations like the FDA’s Food Safety Modernization Act (FSMA) have expanded the scope of food safety standards to include alcoholic beverages, requiring wine manufacturers to adopt Good Manufacturing Practices (GMPs).

- In addition, European Champagne production is also controlled by the Appellation d’Origine Contrôlée (AOC). These regulations mandate specific practices, including the manual harvesting of grapes and a minimum aging period of three years on the lees for vintage Champagne.

These additional regulations have forced vineyards to invest in compliance measures, which can be costly and time-consuming, particularly for smaller operations.

Opportunity

Rising Demand Of Organic And Biodynamic Champagne

The rising demand for organic and biodynamic champagne is creating significant opportunities for the growth of the global champagne market. As consumers around the world become increasingly aware of the environmental impacts associated with traditional farming methods, there is a growing preference for wines that align with values of sustainability and eco-friendliness. Organic Champagne, produced without the use of synthetic pesticides or chemicals, and biodynamic Champagne, which incorporates holistic farming principles and follows lunar cycles, effectively cater to the rising consumer demand for healthier, natural products. This rising demand of consumer’s natural and organic ingredients consumption forces manufacturers and grape producers to adopt organic and biodynamic farming practices.

- In France, 36% of wine drinkers now regularly consume organic wine, a significant increase from previous years This shift reflects a broader trend across Europe and other major markets where organic wine is gaining ground as a regular choice rather than an occasional novelty.

- According to the Organic Trade Association, the U.S. has seen similar growth, with organic wine sales rising by nearly 10% annually over the past decade. This highlights risen demand for organic and biodynamic Champagne.

Furthermore, growing government regulations and policies promoting the production of organic and biodynamic Champagne are encouraging wineries to adopt more sustainable practices. As governments from wine-producing regions such as the United States and France increasingly prioritize soil health, water conservation, and the reduction of chemical inputs, farmers in these regions are shifting toward traditional and environmentally friendly farming methods. This trend toward sustainably cultivated Champagne is expected to drive innovation, attract environmentally conscious consumers, and significantly expand the market for organic and biodynamic Champagne in the upcoming years.

- According to reports published by Comité Champagne, a 20 percent decrease in carbon emissions per bottle and a 50 percent decrease through their zero herbicide target. Highlights the importance of sustainable practices within the Champagne industry.

Trends

Increasing Popularity of Grower Champagne

Grower champagne is emerging as a significant trend within the global champagne market, as its production method is different from the traditional Champagne. Unlike major champagne houses, grower champagnes are produced by winegrowers who cultivate, harvest, and vinify their grapes, allowing for greater control over the entire winemaking process and resulting in wines that reflect the unique characteristics of their vineyard sites. These wines are typically labeled with the designation “RM” (Récoltant Manipulant), highlighting their direct connection to the terroir and reflecting the unique characteristics of specific vineyard sites. This production approach aligns with growing consumer interest in handcrafted, small-batch, and artisanal champagne options that offer distinct and authentic flavor profiles.

The increasing popularity of grower champagne is also being driven by rising demand for clean-labeled products, as consumers seek greater transparency regarding the origin and production of their beverages. This trend is particularly pronounced among younger and urban consumers, who are leading the shift toward artisanal and locally sourced alcohol products. The appeal of craft and independently produced champagnes is contributing to more frequent consumption and fostering market expansion at a global level. These evolving preferences are creating a favorable environment for the rise of grower champagne, positioning it as a dynamic and influential segment within the broader Champagne industry.

- In 2021, grower champagne imports remained relatively stable at 5-10%, LVMH reported a significant 32% sales increase, highlighting that grower champagne represents a growing trend in the Champagne industry.

Geopolitical Impact Analysis

U.S. Tariffs on European Wines Disrupt Champagne Trade and Market Growth

The champagne market is experiencing significant disruptions due to recent geopolitical developments, especially the imposition of tariffs on imports from key manufacturing regions including Europe. The U.S. government implemented broad tariff measures, imposing the 200% tariff on wines, champagnes, and other alcoholic beverages imported from the European Union, these tariffs, were proposed by President Donald Trump in response to retaliatory 50% tariffs from the EU on American whiskey.

These impositions of tariffs have caused significant concern among French Champagne producers and European wine exporters, as France is a major producer of champagne. Facing the risk of financial losses and market disruptions, due to the U.S. is a major export market for Champagne and European wines.

- According to the French Federation of Wine and Spirits Exporters (FEVS), there is a 20% reduction in U.S. sales due to the tariffs.

The threat of US tariffs has created significant uncertainty for European wine producers and retailers, businesses affected by prices, sales, and overall business stability. At the global level, these tariffs may force European producers to seek alternative markets, this disruption is expected to alter global trade flows and could negatively impact wine industries in other countries, as European producers compete for limited demand these affect the overall champagne market growth.

- According to the French Federation of Wine Leading European drinks giants came under pressure. Shares in Pernod Ricard fell almost 4% and Rémy Cointreau declined 3.5%. LVMH, owner of Moët & Chandon, slipped 1.4%. These declines reflect investor concerns over the potential impact of President Trump’s tariffs on European wines.

Regional Analysis

North America Held the Largest Share of the Global Champagne Market

In 2024, North America dominated the global Champagne market, accounting for 39.4% of the total market share, The growing consumer demand for high-quality, luxury alcoholic beverages, supported by rising disposable incomes and a strong cultural emphasis on celebrating special occasions, has significantly contributed to the increased consumption of premium products such as Champagne.

However, evolving consumer trends such as the shift toward health-conscious choices, a preference for lower-calorie and lower-alcohol-by-volume (ABV) options, and the rise of moderate drinking habits are further enhancing Champagne’s appeal. Its unique flavor profile and refined taste position it as a favorable choice among consumers seeking a balance between indulgence and wellness.

Additionally, the increasing popularity of occasional drinking and the integration of wine consumption with food experiences have reinforced Champagne’s image as a symbol of luxury and status. This perception continues to attract both traditional and modern consumers. Moreover, the expansion of e-commerce channels and the growing influence of celebrity lifestyles are playing a significant role in shaping consumer preferences and fueling demand for Champagne within the broader alcoholic beverage market.

- For instance, in 2023, the United States remained the largest export market for Champagne, with around 27 million bottles shipped, valued at approximately €810 million ($885 million), reflecting strong consumer demand and growing acceptance of premium alcoholic beverages.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players in the Champagne Market Dominate The Market Through Strategic Innovation, Premium Positioning, And Global Reach.

In 2024 global champagne market dominated by key players like LVMH, Laurent-Perrier, Taittinger, Nicolas Feuillatte, and Piper-Heidsieck, along with smaller but significant producers like Moët Hennessy, and Canard-Duchene. Each leverages its unique strengths to navigate evolving consumer preferences and market dynamics.

LVMH – LVMH dominates the Champagne market through its ownership of prestigious brands like Moët & Chandon, Dom Pérignon, and Veuve Clicquot. The company leverages a strong global distribution network, premium branding, and strategic marketing to maintain its leadership. Its continued innovation, product diversification, and expansion into emerging segments, such as non-alcoholic sparkling wines, further strengthen its market position.

Laurent-Perrier- dominates the champagne market through its heritage-driven innovation, premium product portfolio, and strong global distribution, positioning itself as a leading independent house known for quality, elegance, and consistency.

Major Players in the Industry

- Champagne Nicolas Feuillatte

- Laurent-Perrier

- Lanson-BCC

- LVMH

- Pernod Ricard

- Piper-Heidsieck

- Champagne Pommery

- Taittinger

- Thiénot Bordeaux-Champagnes

- Veuve Clicquot Ponsardin

- Cook’s California Champagne

- Korbel California Champagne

- Champagne Lanson

- Canard-Duchêne

- Moët Hennessy

- Other Key Players

Recent Development

- In October 2024- Moët Hennessy made a strategic minority investment in French Bloom, a luxury non-alcoholic sparkling wine brand, to diversify its portfolio and tap into the growing demand for alcohol-free beverages, particularly among health-conscious and younger consumers. This move aligns with the company’s broader strategy to address declining revenues in the traditional sparkling wine segment and strengthen its position in the evolving no- and low-alcohol market.

Report Scope

Report Features Description Market Value (2024) USD 8 Bn Forecast Revenue (2034) USD 13 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product Type (Prestige Cuvee, Blanc De Noirs, Blanc De Blancs, Rose Champagne, Brut Champagne, Demi-Sec), Grape Variety (Pinot Noir, Pinot Meunier, Chardonnay, Others), Capacity (200 Ml, 375 Ml, 750 ML, 1500 Ml, Above 1500Ml), Distribution Channel (On-trade (Pubs, Bars & Cafe’s., Hotels & Restaurants, Others, off-trade (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Stores), Producers (Houses, Growers, Cooperatives), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Champagne Nicolas Feuillatte, Laurent-Perrier, Lanson-BCC, LVMH, Pernod Ricard, Piper-Heidsieck, Champagne Pommery, Taittinger, Thiénot Bordeaux-Champagnes, Veuve Clicquot Ponsardin, Cook’s California Champagne, Korbel California Champagne, Champagne Lanson, Canard-Duchêne, Moët Hennessy, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Champagne Nicolas Feuillatte

- Laurent-Perrier

- Lanson-BCC

- LVMH

- Pernod Ricard

- Piper-Heidsieck

- Champagne Pommery

- Taittinger

- Thiénot Bordeaux-Champagnes

- Veuve Clicquot Ponsardin

- Cook's California Champagne

- Korbel California Champagne

- Champagne Lanson

- Canard-Duchêne

- Moët Hennessy

- Other Key Players