Global Wind Turbine Gearbox Market Size, Share, And Business Benefits By Type (Planetary Gearbox, Helical Gearbox, Hybrid Gearbox), By Capacity (Below 1.5 MW, 5 MW-3 MW, Above 3 MW), By End Use (Power Generation, Industrial, Commercial), By Location (Onshore , Offshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141497

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

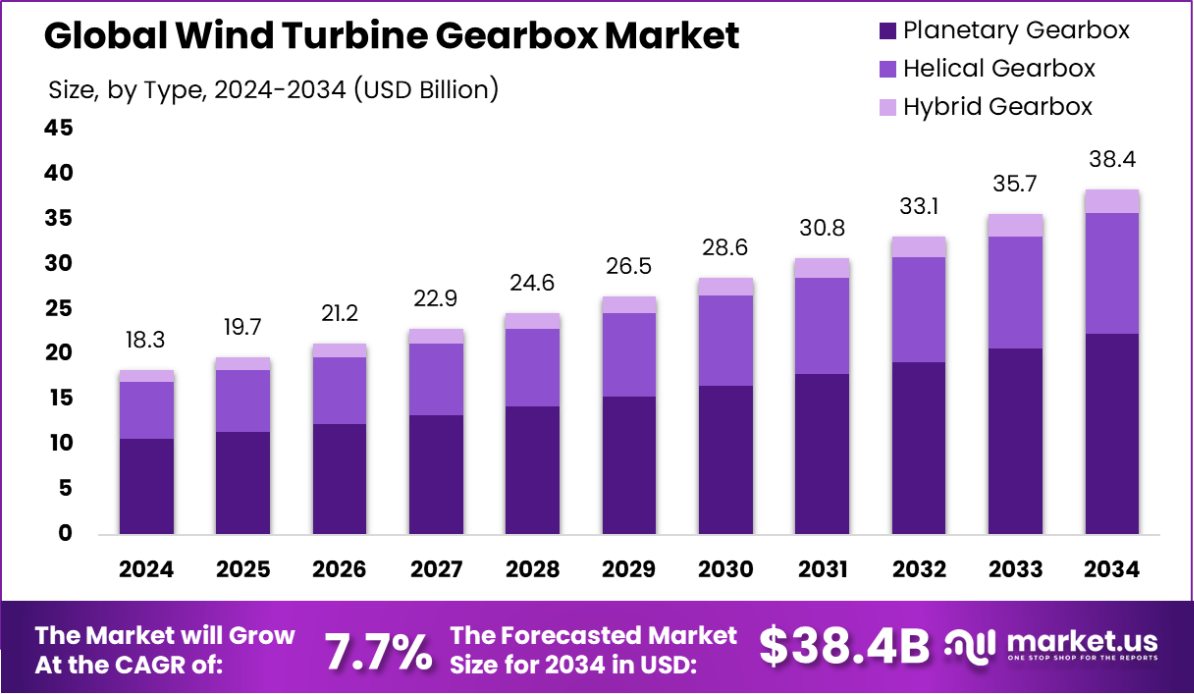

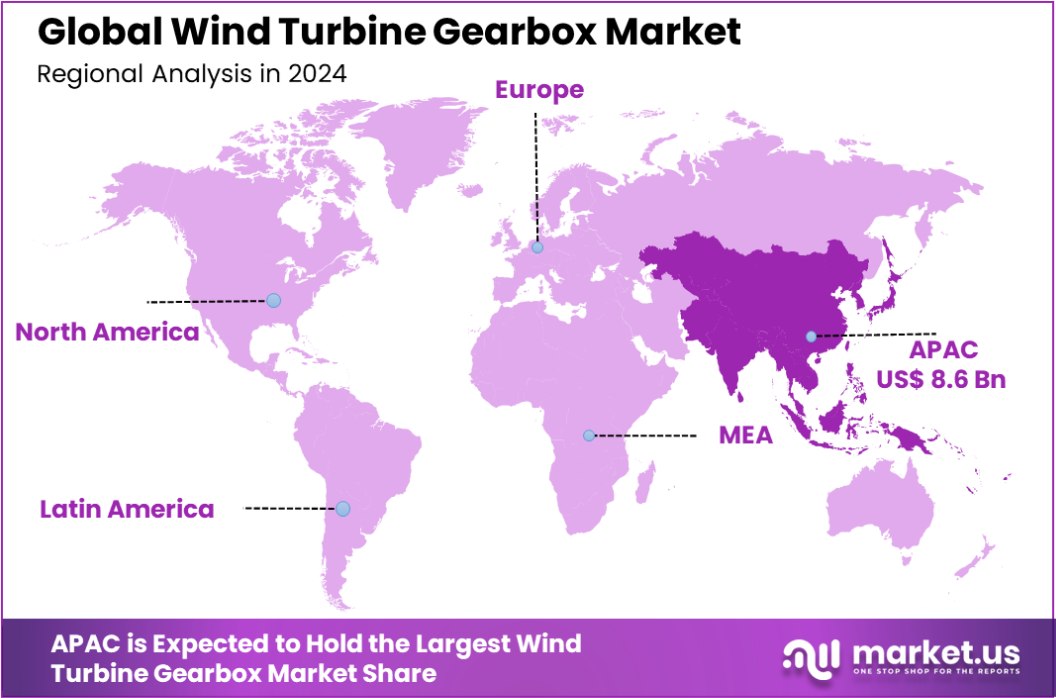

Global Wind Turbine Gearbox Market is expected to be worth around USD 38.4 billion by 2034, up from USD 18.3 billion in 2024, and grow at a CAGR of 7.7% from 2025 to 2034. With a market value of USD 8.6 billion, Asia-Pacific represents 47.1% of the global wind turbine gearbox market.

A wind turbine gearbox is a critical component in a wind turbine system that transmits mechanical energy from the turbine blades to the generator. It helps convert the low-speed, high-torque rotational energy produced by the blades into a higher-speed, lower-torque output necessary for electricity generation. The gearbox ensures that the generator operates at its optimal speed, enabling efficient power generation even under varying wind conditions.

The wind turbine gearbox market has experienced significant growth due to the increasing adoption of renewable energy sources worldwide. With governments investing in clean energy infrastructure and companies aiming to meet global sustainability targets, wind power is becoming an attractive energy solution. This demand is leading to a surge in the development and installation of wind turbines, further fueling the need for advanced gearboxes that can provide higher efficiency and durability in diverse environmental conditions.

Growth factors in the market include advancements in materials technology, which are making gearboxes more reliable and efficient. Moreover, the growing demand for large-scale offshore wind farms is pushing the need for robust, high-performance gearboxes that can withstand harsh environmental conditions. Demand for wind turbine gearboxes continues to rise, particularly in emerging markets where governments are promoting renewable energy policies.

Opportunities lie in the development of direct-drive wind turbines, which aim to reduce or eliminate the need for traditional gearboxes. Innovations like these offer potential cost savings, improved efficiency, and reduced maintenance, creating significant market potential for companies investing in R&D for next-generation turbine technologies.

In September 2024, Sany RE introduced its 919 wind turbine platform, featuring modular systems for gearboxes and other key components, designed for turbines ranging from 8.5 MW to 11 MW, with rotor diameters between 214 and 230 meters.

This expansion aligns with the growing demand in the wind turbine gearbox market, enhancing efficiency and scalability. Additionally, Sany RE tripled the size of its offshore nacelle facility in Taichung, Taiwan, to 90,000 square meters, boosting production of SG 14-222 DD offshore wind turbines.

Key Takeaways

- Global Wind Turbine Gearbox Market is expected to be worth around USD 38.4 billion by 2034, up from USD 18.3 billion in 2024, and grow at a CAGR of 7.7% from 2025 to 2034.

- The planetary gearbox type dominates the wind turbine gearbox market, accounting for 58.7% of total sales.

- In terms of capacity, wind turbines between 1.5 MW and 3 MW represent 48.5% of demand.

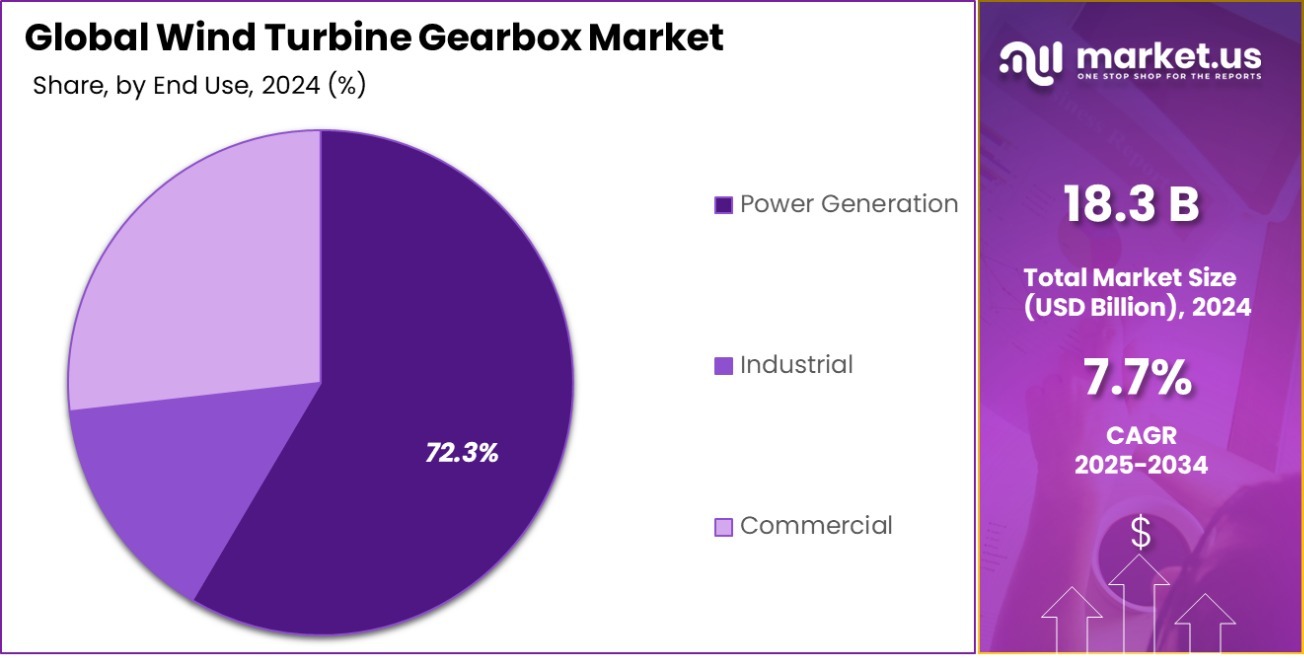

- Power generation remains the leading end-use sector for wind turbine gearboxes, holding a 72.3% share.

- Onshore wind farms are the primary location for wind turbine gearboxes, capturing 76.5% of market demand.

- The Asia-Pacific region’s market growth is driven by increasing investments, contributing USD 8.6 billion to the sector.

By Type Analysis

Planetary gearboxes dominate the market with a 58.7% share in wind turbines

In 2024, Planetary Gearbox held a dominant market position in the By Type segment of the Wind Turbine Gearbox Market, with a 58.7% share. The planetary gearbox is the most commonly used gearbox type in wind turbines due to its superior ability to handle high torque and its compact design, making it ideal for the efficiency needs of modern wind turbines.

The increasing demand for higher energy production from wind farms has driven the preference for planetary gearboxes, as they offer enhanced reliability and performance in harsh environmental conditions.

The robust growth of the wind energy sector, particularly in regions with a strong focus on renewable energy adoption, has further bolstered the demand for planetary gearboxes. These gearboxes provide a stable and efficient transmission of power from the turbine blades to the generator, which is crucial for optimal turbine performance.

Additionally, advancements in material science and manufacturing techniques have improved the durability and efficiency of planetary gearboxes, contributing to their dominance in the market.

In comparison to other gearbox types, such as helical and parallel shaft gearboxes, planetary gearboxes remain the preferred choice due to their proven efficiency, cost-effectiveness, and ability to withstand the demanding operational conditions of wind turbines. This trend is expected to continue as the wind energy sector grows globally.

By Capacity Analysis

The 1.5 MW – 3 MW capacity segment holds a 48.5% market share

In 2024, 1.5 MW – 3 MW held a dominant market position in the By Capacity segment of the Wind Turbine Gearbox Market, with a 48.5% share. This capacity range is widely adopted in both onshore and offshore wind turbine installations due to its optimal balance between cost, efficiency, and power output. Wind turbines in this category are particularly favored for medium-scale wind farms, offering an ideal solution for regions with moderate wind conditions.

The 1.5 MW – 3 MW capacity range is seen as highly versatile, accommodating various applications across different geographic locations and providing a competitive advantage in terms of installation and operational costs. As the global demand for renewable energy continues to grow, wind turbines in this capacity range are expected to remain in high demand, driven by both government incentives and private investments in sustainable energy infrastructure.

The market share dominance of the 1.5 MW – 3 MW segment can also be attributed to ongoing technological advancements in gearbox design, which have improved the reliability and longevity of these turbines, even in challenging operational environments. Furthermore, the scalability of turbines within this capacity range allows for easy integration into wind farms of various sizes, further enhancing their market appeal.

By End-Use Analysis

Power generation accounts for the largest end-use, representing 72.3% of demand.

In 2024, Power Generation held a dominant market position in the By End Use segment of the Wind Turbine Gearbox Market, with a 72.3% share. This segment’s dominance is primarily driven by the increasing global shift toward renewable energy, with wind power being a key contributor to sustainable electricity generation. Wind turbines equipped with gearboxes play a crucial role in converting mechanical energy into electrical energy, making them essential for large-scale power generation.

The growing demand for clean energy, coupled with the expansion of wind farms worldwide, has significantly contributed to the power generation segment’s market share. Governments’ renewable energy targets and investments in offshore and onshore wind energy projects have further accelerated the demand for efficient wind turbine gearboxes.

The power generation sector’s market share is expected to continue expanding, driven by technological advancements in wind turbine design and improvements in gearbox performance. These advancements enhance the reliability and efficiency of wind turbines, ensuring they meet the increasing demand for renewable electricity.

Additionally, as countries strive to meet their carbon reduction goals, the role of wind energy in power generation will remain pivotal, further cementing the market dominance of gearboxes in the power generation segment.

By Location Analysis

Onshore wind turbines lead the market, capturing 76.5% of the location share.

In 2024, Onshore held a dominant market position in the By Location segment of the Wind Turbine Gearbox Market, with a 76.5% share. Onshore wind turbines have long been the preferred choice for wind energy installations due to their lower installation and operational costs compared to offshore wind farms.

The widespread availability of land for onshore wind farms, combined with favorable wind conditions in many regions, has driven the strong demand for onshore wind turbines equipped with high-performance gearboxes.

The growth in onshore wind projects is particularly prominent in countries with large areas of suitable land and a strong push for renewable energy adoption, such as the United States, China, and parts of Europe. The ability to install wind turbines in these areas has led to significant reductions in energy costs and enhanced the economic viability of onshore wind energy.

The market share of onshore wind turbines is expected to remain strong, with increasing investments in infrastructure and technology aimed at improving turbine efficiency and gearbox performance. Additionally, advancements in turbine design and operational efficiencies further support the continued growth of the onshore segment. As demand for clean, renewable energy continues to rise, the onshore wind turbine gearbox market is poised for sustained expansion.

Key Market Segments

By Type

- Planetary Gearbox

- Helical Gearbox

- Hybrid Gearbox

By Capacity

- Below 1.5 MW

- 5 MW-3 MW

- Above 3 MW

By End Use

- Power Generation

- Industrial

- Commercial

By Location

- Onshore

- Offshore

Driving Factors

Growing Demand for Renewable Energy Sources

One of the key driving factors for the Wind Turbine Gearbox Market is the increasing global demand for renewable energy sources. As countries focus on reducing carbon emissions and achieving sustainability goals, the need for wind energy has surged. Wind turbines, equipped with efficient gearboxes, are crucial for converting mechanical energy into electricity in wind farms.

Governments around the world have implemented policies and incentives to promote clean energy, making wind power an attractive alternative to fossil fuels. This shift toward cleaner energy, driven by environmental concerns and energy security, has led to a significant rise in the installation of wind turbines, thereby boosting the demand for high-performance gearboxes in the market.

Restraining Factors

High Initial Investment and Maintenance Costs

A major restraining factor for the Wind Turbine Gearbox Market is the high initial investment and ongoing maintenance costs associated with wind turbine installations. While wind energy offers long-term benefits, the upfront capital required for both the turbines and the gearboxes can be substantial. This includes not only the purchase cost of the equipment but also the installation and infrastructure expenses.

Additionally, the maintenance of gearboxes is often complex and costly due to their critical role in ensuring turbine efficiency. Gearboxes in wind turbines are subject to harsh environmental conditions, which can lead to wear and tear, requiring frequent servicing or replacement. These high costs can deter potential investors, particularly in regions with less favorable wind conditions or smaller-scale projects.

Growth Opportunity

Technological Advancements in Gearbox Efficiency

A significant growth opportunity in the Wind Turbine Gearbox Market lies in technological advancements aimed at improving gearbox efficiency and durability. As wind turbine technology evolves, there is increasing focus on developing more reliable and cost-effective gearboxes that can withstand harsh conditions and operate at higher efficiency levels.

Innovations such as advanced materials, improved lubrication systems, and design modifications can enhance gearbox performance, reducing wear and tear and extending the lifespan of the turbines.

This presents an opportunity for gearbox manufacturers to introduce new solutions that minimize maintenance costs and improve energy output. As the demand for more efficient, lower-maintenance turbines rises, these advancements in gearbox technology are expected to drive market growth significantly.

Latest Trends

Shift Toward Direct Drive Wind Turbines

A notable trend in the Wind Turbine Gearbox Market is the shift toward direct drive wind turbines. These turbines eliminate the need for traditional gearboxes by using a direct connection between the turbine rotor and the generator. This design reduces mechanical complexity and the risk of gearbox failure, which in turn lowers maintenance costs and improves overall turbine reliability.

The trend is being driven by the desire to reduce operational costs and improve efficiency in wind power generation. As direct drive turbines gain traction, particularly in offshore wind projects where maintenance is more challenging, they are expected to significantly influence the market. This shift could reduce the demand for traditional gearboxes while opening up opportunities for alternative drivetrain solutions in the market.

Regional Analysis

Asia-Pacific holds a dominant market share of 47.1%, valued at USD 8.6 billion in total.

The Wind Turbine Gearbox Market is geographically diversified, with significant contributions from regions like Asia Pacific, North America, Europe, the Middle East & Africa, and Latin America. Asia Pacific leads the market, holding a dominant share of 47.1%, valued at USD 8.6 billion.

This region’s growth is driven by the rapid expansion of renewable energy projects, particularly in China and India, where wind power installations have surged in recent years. China, as the largest market, has heavily invested in wind turbine infrastructure, contributing to the region’s market share.

In North America, the market is witnessing steady growth, primarily fueled by the United States’ commitment to renewable energy sources. With an increasing number of wind farms being constructed across the Midwest and Southwest regions, the demand for efficient wind turbine gearboxes remains strong. Europe holds a significant portion of the market, supported by mature wind energy sectors in countries like Germany, Spain, and Denmark. The region’s focus on offshore wind farms boosts the demand for advanced gearboxes.

Latin America and the Middle East & Africa represent emerging markets, with increasing governmental support and investments in wind energy projects. However, these regions currently contribute a smaller share compared to Asia Pacific and Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Wind Turbine Gearbox Market is experiencing significant growth, driven by technological innovations, increased demand for renewable energy, and the global push for sustainability. Key players such as Ansys, Bosch Rexroth, Clarke Energy, Crown Holdings, Dana Brevini SpA, and General Electric (GE) are strategically positioned to capitalize on these trends.

Ansys, known for its advanced simulation software, plays a crucial role in the design and optimization of wind turbine gearboxes. Its solutions allow manufacturers to improve gearbox efficiency, durability, and performance through virtual testing, thus reducing development costs and time to market. This technological advantage is pivotal in an increasingly competitive market.

Bosch Rexroth, a leading manufacturer of drive and control technologies, continues to innovate in gearbox solutions. Its strong presence in industrial automation and renewable energy applications positions it as a key player, offering high-efficiency, robust gearboxes suited for both onshore and offshore wind turbines.

Clarke Energy, while primarily known for energy solutions, is also making strides in renewable energy systems, particularly with integrated gearbox technologies for wind turbines. Their expertise in energy-efficient solutions helps drive the adoption of wind energy systems globally.

Crown Holdings and Dana Brevini SpA are significant players offering high-quality gearboxes with advanced mechanical systems designed to improve wind turbine reliability and reduce maintenance. Their global reach and strong supplier networks help cater to the growing demand for efficient wind turbine components.

General Electric (GE) remains a dominant force in the market, known for its state-of-the-art wind turbine technology and comprehensive gearbox solutions. GE’s focus on innovation and reliability makes it a leader in the wind energy sector, reinforcing its market position in the gearbox market for 2024.

Top Key Players in the Market

- Ansys

- Bosch Rexroth

- Clarke Energy

- Crown Holdings

- Dana Brevini SpA

- General Electric

- Ishibashi Manufacturing Co. Ltd.

- ME Production A/S

- Moventas Gear Oy

- Nordex

- Renk AG

- Robert Bosch

- Senvion

- Siemens Gamesa Renewable Energy SA

- Simec Atlantis Energy

- Sungrow

- Vestas

- Voith GmbH & Co. KGaA

- Winergy Group

- ZF Friedrichshafen AG

Recent Developments

- In November 2024, Winergy introduced a compact gearbox design for medium-sized onshore wind turbines, offering improved power density and easier installation.

- In April 2024, Vestas launched a new predictive maintenance system for its wind turbine gearboxes, using AI and IoT technologies to reduce downtime and extend operational periods.

Report Scope

Report Features Description Market Value (2024) USD 18.3 Billion Forecast Revenue (2034) USD 38.4 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Planetary Gearbox, Helical Gearbox, Hybrid Gearbox), By Capacity (Below 1.5 MW, 5 MW-3 MW, Above 3 MW), By End Use (Power Generation, Industrial, Commercial), By Location (Onshore , Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ansys, Bosch Rexroth, Clarke Energy, Crown Holdings, Dana Brevini SpA, General Electric, Ishibashi Manufacturing Co. Ltd., ME Production A/S, Moventas Gear Oy, Nordex, Renk AG, Robert Bosch, Senvion, Siemens Gamesa Renewable Energy SA, Simec Atlantis Energy, Sungrow, Vestas, Voith GmbH & Co. KGaA, Winergy Group , ZF Friedrichshafen AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wind Turbine Gearbox MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Wind Turbine Gearbox MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ansys

- Bosch Rexroth

- Clarke Energy

- Crown Holdings

- Dana Brevini SpA

- General Electric

- Ishibashi Manufacturing Co. Ltd.

- ME Production A/S

- Moventas Gear Oy

- Nordex

- Renk AG

- Robert Bosch

- Senvion

- Siemens Gamesa Renewable Energy SA

- Simec Atlantis Energy

- Sungrow

- Vestas

- Voith GmbH & Co. KGaA

- Winergy Group

- ZF Friedrichshafen AG