Global White Spirits Market Size, Share, And Business Benefits By Type (Type 0, Type 1, Type 2, Type 3), By Flash Point (Low, Medium, High), By Application (Thinner and Solvent, Fuels, Cleaning Agent, Degreasing Agent, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147572

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

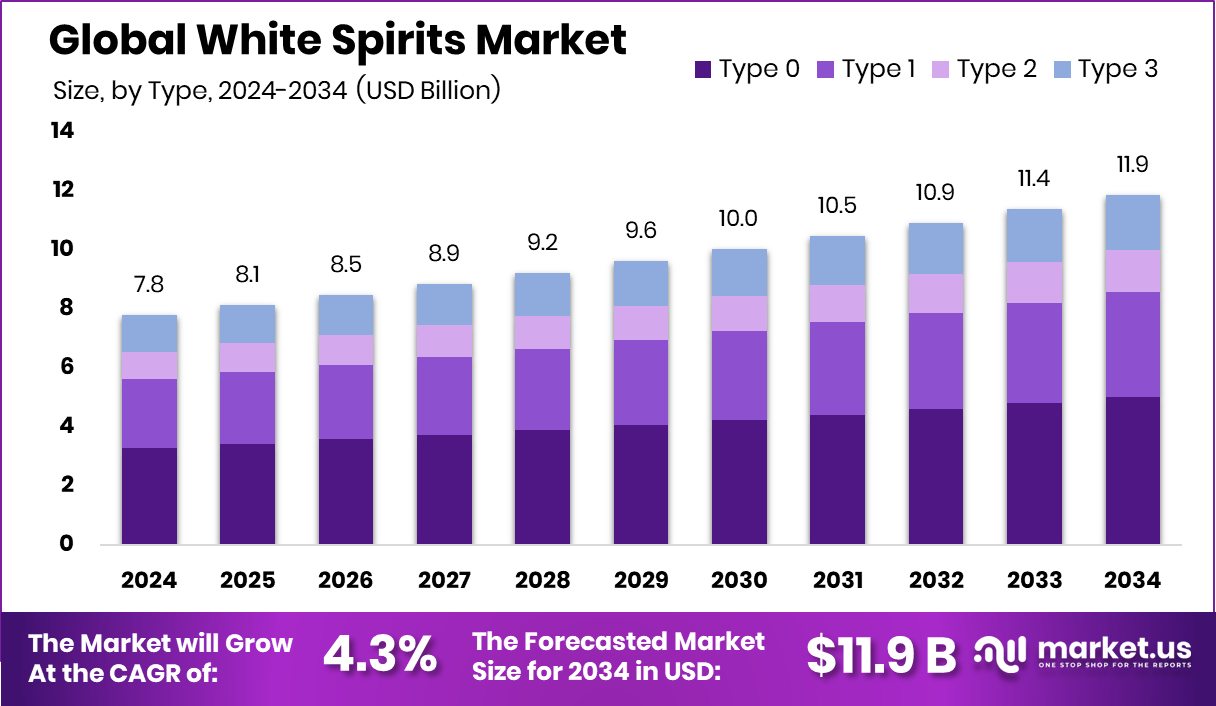

Global White Spirits Market is expected to be worth around USD 11.9 billion by 2034, up from USD 7.8 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034. With 37.4% market share, Asia-Pacific showed strong industrial usage of white spirits.

White spirits, also known as mineral spirits, are clear, petroleum-derived liquids commonly used as solvents. They are primarily applied in industries for thinning oil-based paints, cleaning paintbrushes, degreasing machinery, and in household products like varnishes and aerosols. Being less volatile than other petroleum distillates, white spirits offer effective cleaning power with reduced odor and slower evaporation.

The white spirits market includes the global production, consumption, and distribution of these solvents across industrial, commercial, and residential sectors. The market spans various grades like Type 1 (low flash), Type 2 (regular), and Type 3 (high flash), used by paint manufacturers, automotive workshops, cleaning services, and metalworking industries. Growth is supported by demand from construction, automotive, and furniture sectors, which rely heavily on solvent-based coatings.

Industrialization and infrastructure development in emerging economies are key growth drivers. As urbanization increases, so does demand for paints, coatings, adhesives, and sealants, directly influencing the white spirits market. Additionally, the expanding automotive sector also boosts the use of metal cleaning and degreasing. Growth in manufacturing sectors using solvent-borne formulations continues to create consumption pockets globally.

White spirits remain preferred for their cleaning efficiency, compatibility with oil-based systems, and cost-effectiveness. In regions with limited regulatory pressure, they are widely used across industrial and household applications. High utility in cleaning machinery parts and thinning heavy-duty coatings ensures consistent demand from small workshops to large factories.

Key Takeaways

- Global White Spirits Market is expected to be worth around USD 11.9 billion by 2034, up from USD 7.8 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034.

- Type 1 white spirits hold 35.5% market share due to their wide applicability.

- Medium flash point white spirits cover 48.4% of the total global market share.

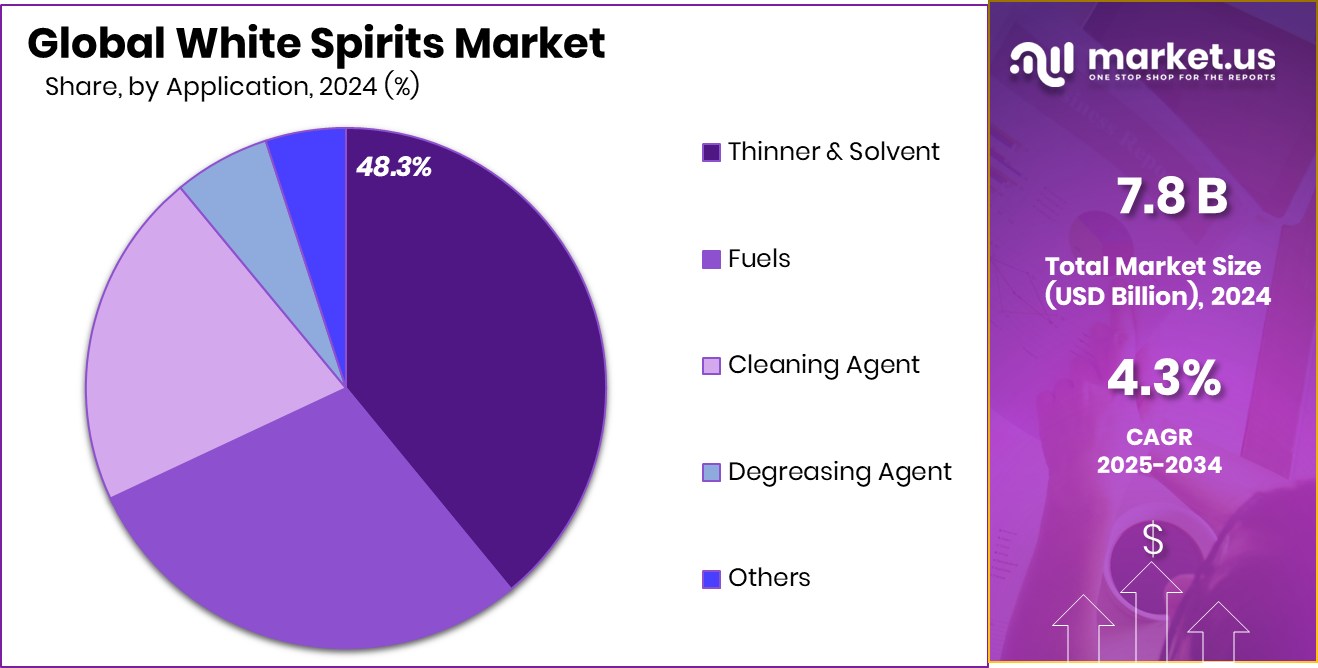

- Thinner and solvent use accounts for 48.3% in the white spirits market.

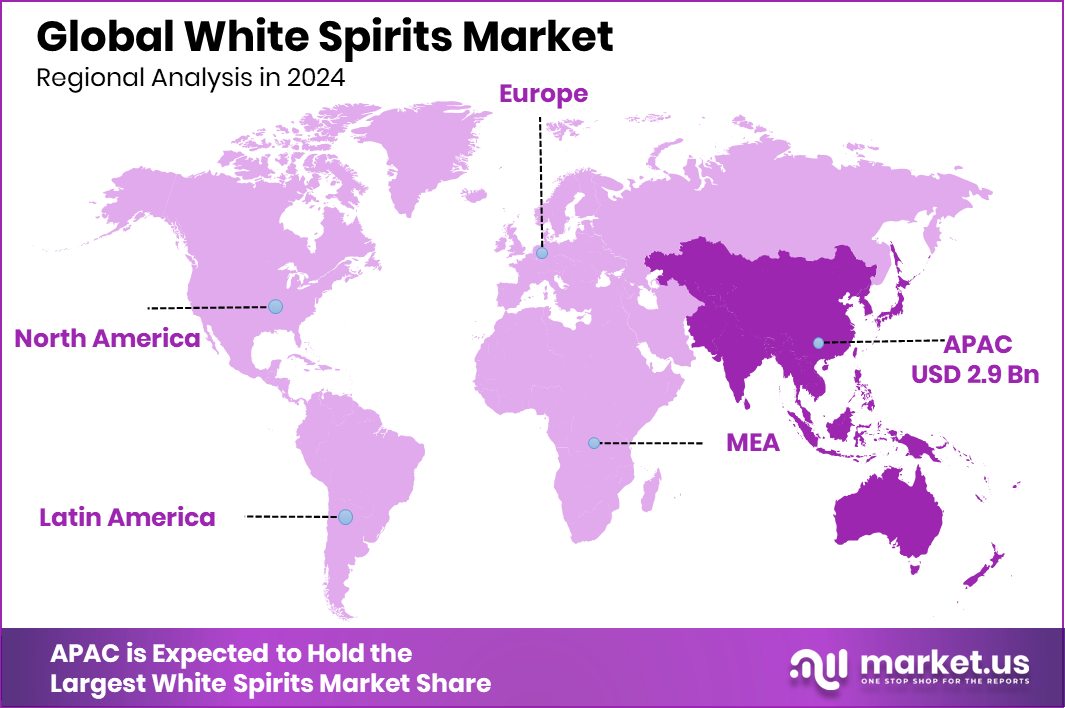

- In 2024, Asia-Pacific dominated demand for white spirits, reaching USD 2.9 Bn.

By Type Analysis

Type 1 holds 35.5% market share, widely used for general-purpose cleaning and thinning applications.

In 2024, Type 1 held a dominant market position in the By Type segment of the White Spirits Market, with a 35.5% share. This segment’s prominence reflects its widespread industrial acceptance, particularly for applications requiring moderate solvency strength and cost-efficiency.

Type 1 white spirit is extensively used in paint thinners, cleaning agents, and degreasing solutions due to its balanced properties, making it ideal for general-purpose use across multiple end-user industries. Its moderate volatility and compatibility with a range of coatings contribute to its continued preference over other types.

This 35.5% share indicates a stable demand pattern, particularly in sectors such as construction, automotive refinishing, and consumer household products. The segment’s dominance is also linked to consistent supply availability and regulatory acceptability in many global regions, where less toxic and moderately refined solvents are prioritized.

Additionally, industries have continued leveraging Type 1 white spirit for its favorable evaporation rate and flash point, which align with safety and application efficiency standards.

By Flash Point Analysis

Medium flash point white spirits dominate with 48.4%, offering balanced safety and effective solvent performance.

In 2024, Medium held a dominant market position in the By Flash Point segment of the White Spirits Market, with a 48.4% share. This strong market presence is largely attributed to the balanced safety and performance profile that medium flash point white spirits offer. These variants are neither too volatile nor too stable, making them ideal for a wide range of applications, particularly in paint formulations, industrial cleaning, and degreasing operations where controlled evaporation is essential.

The 48.4% market share reflects a clear preference among manufacturers and industrial users for solvents that meet safety regulations while maintaining effective solvency power. Medium flash point white spirits reduce fire hazards compared to low flash point variants, making them more acceptable in regulated environments and indoor applications. Their adaptability across temperature variations and processing conditions also adds to their market strength, especially in countries with varying climatic conditions.

Furthermore, the medium category aligns well with evolving safety norms and environmental guidelines, giving it a competitive edge over both low and high flash point alternatives. This segment’s dominance in 2024 suggests that end-users are prioritizing both functionality and safety compliance, reinforcing the medium flash point variant as the most balanced and widely applicable option in the White Spirits Market.

By Application Analysis

Thinner and solvent applications account for 48.3%, driving demand across paints, coatings, and industrial sectors.

In 2024, Thinner and Solvent held a dominant market position in the By Application segment of the White Spirits Market, with a 48.3% share. This significant market share highlights the widespread use of white spirits as thinning agents and solvents across industries such as paints, coatings, varnishes, and printing inks. Their role in adjusting viscosity and enhancing the spreadability of coatings makes them an essential component in both industrial and residential applications.

The 48.3% dominance is largely driven by consistent demand from the construction and automotive sectors, where white spirits are crucial for surface preparation and paint application. In paint manufacturing, white spirits serve as indispensable diluents, offering a balance between fast drying and optimal coverage. Their low cost, ease of use, and compatibility with a variety of formulations continue to fuel preference for this application.

Additionally, their function as solvents extends to cleaning and degreasing tasks, particularly in machinery maintenance and industrial equipment servicing. The dominance of the Thinner and Solvent application category underlines the ongoing reliance on white spirits for critical operational needs, where performance and cost-effectiveness are paramount.

Key Market Segments

By Type

- Type 0

- Type 1

- Type 2

- Type 3

By Flash Point

- Low

- Medium

- High

By Application

- Thinner and Solvent

- Fuels

- Cleaning Agent

- Degreasing Agent

- Others

Driving Factors

Growing Use in the Paints and Coatings Industry

One of the top driving factors for the White Spirits Market is its increasing use in the paints and coatings industry. White spirits are widely used as solvents and thinners in oil-based paints, varnishes, and wood preservatives. As construction and renovation activities rise globally, especially in developing regions, the demand for paints has gone up. This leads to higher consumption of white spirits.

They help adjust the thickness of paint, improve drying time, and enhance application smoothness. Also, they are commonly used for cleaning paint brushes and equipment. With construction, automotive refinishing, and industrial coatings continuing to expand, this segment’s reliance on white spirits is expected to keep growing steadily across major global markets.

Restraining Factors

Strict Environmental Laws Limit Market Growth Potential

A major restraining factor for the White Spirits Market is the implementation of strict environmental laws. White spirits are petroleum-based solvents that release volatile organic compounds (VOCs), which contribute to air pollution and smog. Due to these environmental and health concerns, many governments are enforcing stricter regulations on the use and production of such chemicals.

This has led to restrictions on usage, especially in developed regions like Europe and North America. Additionally, companies now face added compliance costs and may be required to shift towards greener alternatives. As awareness of sustainability grows and cleaner solvent options enter the market, demand for traditional white spirits could slow down, making environmental regulation a key limiting factor in future growth.

Growth Opportunity

Expanding Demand in the Asia-Pacific Construction Sector

One of the top growth opportunities for the White Spirits Market lies in the expanding construction sector within the Asia-Pacific region. Rapid urbanization, increasing population, and rising disposable incomes in countries like China and India have led to a surge in residential and commercial construction projects. White spirits are extensively used as solvents and thinners in paints and coatings, which are integral to construction activities.

The growth in infrastructure development, coupled with government initiatives promoting affordable housing, has further amplified the demand for paints and, consequently, white spirits. For instance, India’s Pradhan Mantri Awas Yojana aims to provide affordable housing, boosting the construction industry’s growth.

Latest Trends

Shift Towards Eco-Friendly White Spirit Solutions

A prominent trend in the White Spirits Market is the increasing shift towards eco-friendly and low-aromatic white spirit solutions. This change is driven by growing environmental concerns and stringent regulations on volatile organic compound (VOC) emissions.

Industries are now seeking alternatives that offer similar performance with reduced environmental impact. Low-aromatic white spirits, known for their lower toxicity and odor, are becoming the preferred choice in applications like paints, coatings, and cleaning agents.

This trend is further supported by advancements in refining technologies, enabling the production of purer and more sustainable white spirit variants. As awareness of environmental issues continues to rise, the demand for greener white spirit options is expected to grow, influencing manufacturers to innovate and adapt to these evolving market preferences.

Regional Analysis

Asia-Pacific led the White Spirits Market with 37.4% share, valued at USD 2.9 Bn.

In 2024, Asia-Pacific emerged as the leading region in the White Spirits Market, holding a dominant 37.4% share valued at USD 2.9 billion. The region’s strong performance was driven by rising demand from construction, automotive refinishing, and industrial cleaning sectors, especially in countries like China and India.

Rapid urbanization and infrastructure development significantly boosted the use of paints and coatings, directly increasing the consumption of white spirits across multiple applications. In contrast, North America and Europe maintained stable demand supported by established industrial sectors, but faced regulatory challenges that limited aggressive market expansion.

The Middle East & Africa showed moderate growth, driven by oil-based industrial operations and ongoing construction activities in the Gulf states. Latin America, though smaller in market size, exhibited consistent consumption patterns, particularly in domestic paint industries.

Despite global presence, Asia-Pacific clearly stood out as the highest contributing region, with its 37.4% market share highlighting a strong preference for white spirits due to industrial scaling and low production costs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Diageo continued to assert its strong presence in the global white spirits market, leveraging its premium vodka brand Smirnoff and growth in gin variants like Tanqueray. The company focused on premiumization strategies and invested in sustainability-driven distilling processes, responding to rising demand for eco-conscious production. Diageo also expanded its market share in Asia and Latin America through regional marketing campaigns and new flavor innovations, enhancing consumer engagement and driving double-digit sales growth in select territories.

BACARDI maintained a competitive stance through its flagship product, BACARDI Superior rum, which held firm in the white spirits category. The brand’s modern positioning with youth-centric promotions and digital campaigns helped it retain consumer loyalty across North America and Europe. BACARDI emphasized cocktail culture and ready-to-drink (RTD) formats, contributing to revenue expansion. In 2024, the company launched new low-calorie and botanical rum variants to appeal to health-conscious drinkers, which helped broaden its audience and reinforce its brand equity in a saturated market.

Pernod Ricard demonstrated robust performance, especially through its key white spirit labels such as Absolut Vodka and Beefeater Gin. Absolut saw consistent growth in the U.S. and Europe through mixology campaigns and sustainability narratives. Pernod Ricard’s localized production efforts in India and South Africa also supported its volume growth, enabling stronger price positioning in emerging markets. The company’s digital transformation efforts, such as AI-enabled demand forecasting and direct-to-consumer platforms, streamlined supply chains, and improved retail efficiency across global markets.

Top Key Players in the Market

- Diageo

- BACARDI

- Pernod Ricard

- Suntory Global Spirits, Inc.

- Stock Spirits Group.

- Proximo Spirits,

- Alberta Distillers, LTD

- William Grant & Sons

- JACOB RIEGER & CO.

- Rémy Cointreau

Recent Developments

- In September 2024, Diageo India introduced the X Series under the McDowell’s & Co. brand. This new lineup includes Vodka, Dry Gin, Citron Rum, and Dark Rum, marking Diageo’s expansion into white spirits and dark rum. The launch aims to cater to the evolving preferences of Indian consumers, especially the younger demographic embracing cocktail culture and seeking diverse flavors.

- In September 2024, Bacardi and The Coca-Cola Company announced a collaboration to launch a ready-to-drink (RTD) cocktail combining BACARDÍ rum and Coca-Cola.

Report Scope

Report Features Description Market Value (2024) USD 7.8 Billion Forecast Revenue (2034) USD 11.9 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Type 0, Type 1, Type 2, Type 3), By Flash Point (Low, Medium, High), By Application (Thinner and Solvent, Fuels, Cleaning Agent, Degreasing Agent, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Diageo, BACARDI, Pernod Ricard, Suntory Global Spirits, Inc., Stock Spirits Group., Proximo Spirits, Alberta Distillers, LTD, William Grant & Sons, JACOB RIEGER & CO., Rémy Cointreau Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Diageo

- BACARDI

- Pernod Ricard

- Suntory Global Spirits, Inc.

- Stock Spirits Group.

- Proximo Spirits,

- Alberta Distillers, LTD

- William Grant & Sons

- JACOB RIEGER & CO.

- Rémy Cointreau