Global Upstream Bioprocessing Market By Product Type (Bioreactors/Fermenters, Cell Culture Products, Filters, and Others), By Technology (Multi-use and Single-use), By Application (Media Preparation, Cell Culture, and Cell Separation), By Mode (In-house and Outsourced), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145627

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

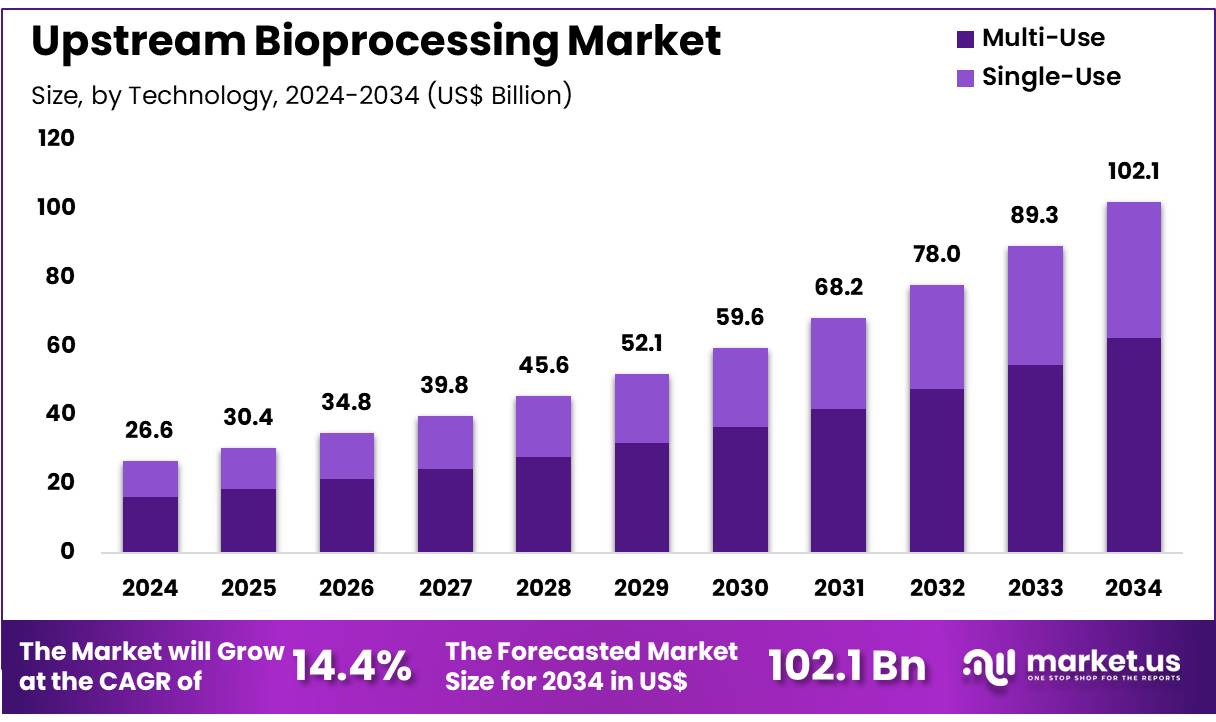

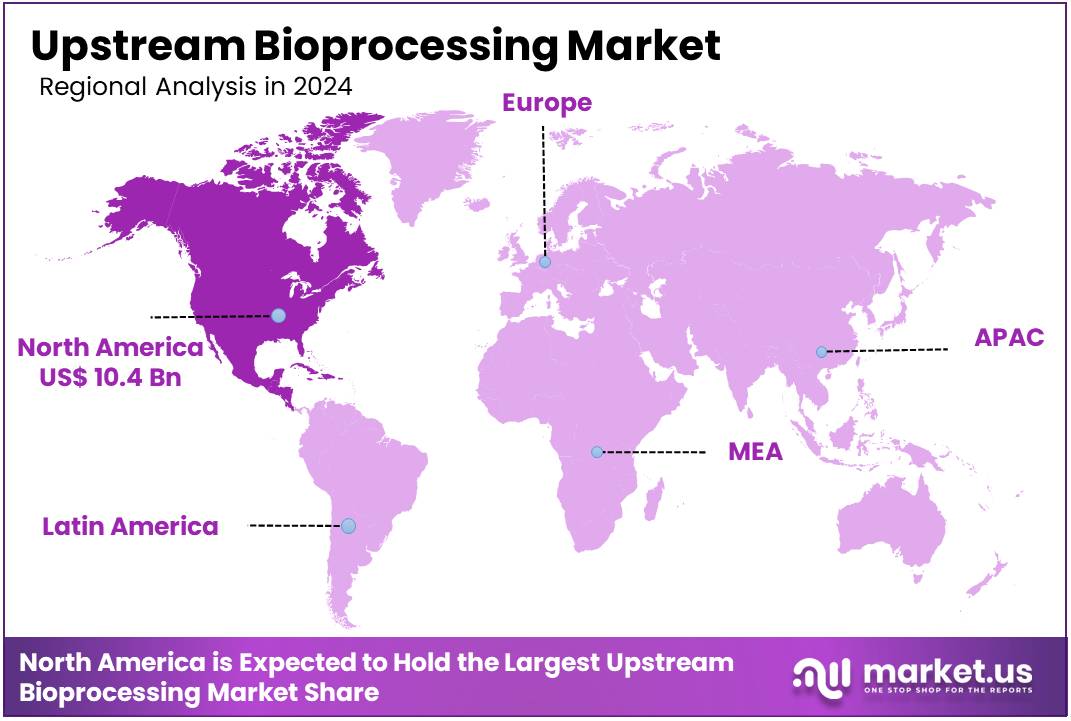

The Global Upstream Bioprocessing Market size is expected to be worth around US$ 102.1 billion by 2034 from US$ 26.6 billion in 2024, growing at a CAGR of 14.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.2% share with a revenue of US$ 10.4 Billion.

Increasing demand for biologics and biopharmaceuticals is driving significant growth in the upstream bioprocessing market. Upstream bioprocessing plays a crucial role in the production of vaccines, monoclonal antibodies, gene therapies, and other biologics, focusing on cell culture, fermentation, and media preparation. The rise in chronic diseases, an aging global population, and advancements in biotechnology fuel the need for efficient and scalable production systems.

Innovations such as single-use technologies, continuous bioprocessing, and the integration of automation are enhancing the efficiency and flexibility of upstream processes. In June 2023, the Public Investment Fund (PIF) launched Lifera, a Contract Development and Manufacturing Organization (CDMO) in Saudi Arabia.

The facility aims to accelerate local biomanufacturing, particularly for vaccines, insulin, plasma therapeutics, monoclonal antibodies, gene therapies, and small molecule drugs, strengthening healthcare self-sufficiency in the region. These trends highlight the growing emphasis on advancing bioprocessing technologies to meet the evolving demand for biopharmaceuticals while reducing production costs and improving yield.

Key Takeaways

- In 2024, the market for upstream bioprocessing generated a revenue of US$ 26.6 billion, with a CAGR of 14.4%, and is expected to reach US$ 102.1 billion by the year 2033.

- The product type segment is divided into bioreactors/fermenters, cell culture products, filters, and others, with bioreactors/fermenters taking the lead in 2024 with a market share of 53.5%.

- Considering technology, the market is divided into multi-use and single-use. Among these, multi-use held a significant share of 61.2%.

- Furthermore, concerning the application segment, the market is segregated into media preparation, cell culture, and cell separation. The cell culture sector stands out as the dominant player, holding the largest revenue share of 52.8% in the upstream bioprocessing market.

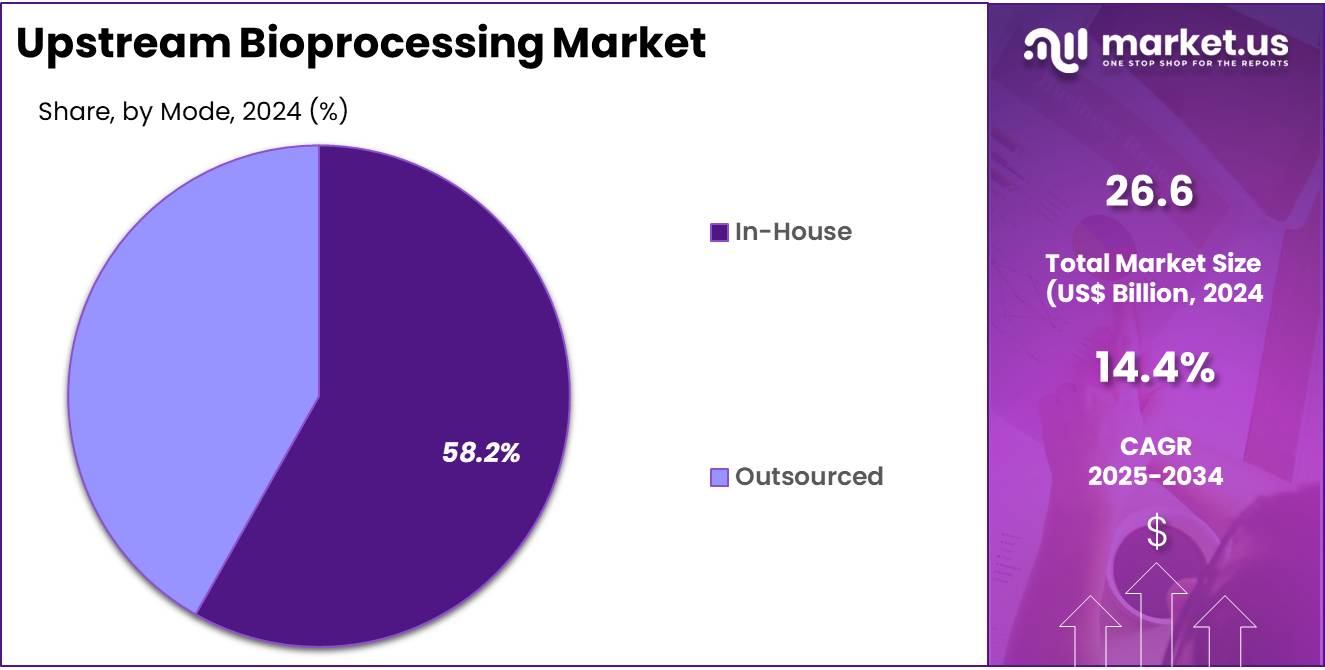

- The mode segment is segregated into in-house and outsourced, with the in-house segment leading the market, holding a revenue share of 58.2%.

- North America led the market by securing a market share of 38.2% in 2024.

Product Type Analysis

The bioreactors/fermenters segment led in 2024, claiming a market share of 53.5% as biopharmaceutical companies continue to increase production capacity and improve the efficiency of their bioprocesses. These bioreactors and fermenters, used for the large-scale cultivation of cells and microorganisms, are essential for the production of biopharmaceuticals, including vaccines, biologics, and therapeutic proteins.

The anticipated rise in demand for biologic drugs, especially monoclonal antibodies and cell-based therapies, is projected to drive growth in this segment. Additionally, advancements in bioreactor design, such as improvements in automation and process monitoring, are likely to further enhance their adoption across the industry.

Technology Analysis

The multi-use held a significant share of 61.2% as biopharmaceutical companies seek cost-effective solutions to meet growing production demands. Multi-use systems offer flexibility in manufacturing and are often preferred for processes that do not require high levels of contamination control.

The expected increase in production volumes and the expansion of clinical trials will likely drive the demand for multi-use systems, which offer a more sustainable and economically feasible option compared to single-use technologies. As the market for biopharmaceuticals expands globally, multi-use systems are expected to maintain their dominant share in the industry.

Application Analysis

The cell culture segment had a tremendous growth rate, with a revenue share of 52.8% as demand for cell-based therapies, vaccines, and biologics increases. Cell culture is essential for the propagation of cells that produce therapeutic proteins and other biopharmaceutical products.

The rising prevalence of chronic diseases, cancer, and genetic disorders is expected to increase the need for cell-based therapies, which will drive the demand for cell culture products. Additionally, advancements in cell culture technologies, including improvements in media formulations and the development of more efficient cell lines, will likely contribute to the growth of this segment.

Mode Analysis

The in-house segment grew at a substantial rate, generating a revenue portion of 58.2% as pharmaceutical and biotechnology companies increasingly prioritize control over their production processes. In-house manufacturing allows companies to maintain stringent quality control, ensure consistency, and protect proprietary technology.

The expected growth of personalized medicine and the demand for small-scale, high-quality production runs are anticipated to drive the preference for in-house bioprocessing. Furthermore, in-house bioprocessing provides companies with greater flexibility and the ability to scale production as needed, which is expected to be particularly valuable as the market for biopharmaceuticals continues to expand.

Key Market Segments

By Product Type

- Bioreactors/Fermenters

- Cell Culture Products

- Filters

- Others

By Technology

- Multi-use

- Single-use

By Application

- Media Preparation

- Cell Culture

- Cell Separation

By Mode

- In-house

- Outsourced

Drivers

Growing Demand for Biologics is Driving the Market

The increasing demand for biologics is significantly driving the market, as biologic drugs continue to dominate the pharmaceutical industry. According to the FDA’s 2023 Drug Approval Report, biologics accounted for 45% of novel drug approvals, up from 38% in 2021. Merck’s 2023 annual financial statements reported a 19% growth in their bioprocessing division, reflecting the expansion of biologics production capabilities.

Government health agencies also highlight that biologics now represent over 50% of the pharmaceutical pipelines among the top 20 global drugmakers. The NIH’s 2024 budget includes US$2.3 billion for advanced biomanufacturing initiatives, marking a 15% increase from 2022.

Additionally, clinical adoption of biologics continues to rise, with US hospitals administering 22% more biologic-based treatments in 2023 compared to 2021. This growing demand for biologic therapies is driving the expansion of biomanufacturing infrastructure and innovations in the production process.

Restraints

High Equipment Costs are Restraining the Market

The high cost of equipment, particularly in bioreactor systems, continues to restrain the growth of the biologics market. Leading manufacturers’ price lists show that single-use bioreactor systems range from US$75,000 to US$600,000, depending on their capacity. The American Hospital Association’s 2023 survey found that 60% of mid-sized biotech firms cited capital costs as their primary barrier to expansion.

In addition, US government data indicates that critical bioreactor components have experienced price increases of 18-22% since 2021, adding further financial strain on producers. Medicare reimbursement rates for biologics production have remained stagnant since 2022, which does not reflect the rising technology and material costs, exacerbating the challenge.

These financial pressures are particularly acute for startups, with 35% of them delaying equipment purchases in 2023, according to industry association data. These high capital and operational costs hinder the ability of smaller firms and startups to expand their biomanufacturing operations.

Opportunities

Continuous Bioprocessing Presents Growth Opportunities

The shift toward continuous bioprocessing technologies presents significant growth opportunities in the biologics manufacturing market. Thermo Fisher’s 2023 earnings report showed a 28% increase in revenue from continuous processing technologies, underscoring the growing adoption of these systems. The FDA’s 2024 guidance documents explicitly endorse continuous manufacturing for certain biologic products, recognizing its efficiency and scalability.

Clinical studies have shown that continuous bioprocessing systems can increase productivity by 30-40% compared to traditional batch processes, offering a more efficient and cost-effective solution. Major pharmaceutical companies have reported investing 25% more in continuous bioprocessing R&D in 2023 compared to 2021, reflecting a commitment to improving production capabilities.

Furthermore, regulatory agencies worldwide are streamlining approval pathways for continuously manufactured biologics, with 15 new approvals granted in 2023. As the industry increasingly adopts continuous bioprocessing, it is expected to drive further innovations and growth within the biologics manufacturing sector.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors are playing a significant role in shaping the biologics market, particularly in terms of production costs and supply chain dynamics. US government’s Bioeconomy Executive Order allocated US$1.8 billion in 2023 for domestic biomanufacturing infrastructure, providing a boost to the sector’s development.

In Asia-Pacific, particularly China, the biologics sector has seen strong growth, with an 18% increase in biomanufacturing in 2023. European reimbursement policies are increasingly favoring advanced manufacturing technologies, providing further incentives for growth in that region.

Despite ongoing supply chain challenges and economic pressures, the growing demand for biologic medicines and continued technological advancements in continuous and modular bioprocessing ensure that the market is positioned for long-term growth. The biologics sector remains resilient and well-supported by both government initiatives and industry investments, positioning it for continued expansion.

Latest Trends

Modular Facility Design is a Recent Trend

Modular facility design has emerged as a recent trend in the biologics manufacturing sector, offering flexibility and efficiency. GE Healthcare’s installation data shows that 40% more modular bioprocessing facilities were commissioned in 2023 compared to 2021.

Engineering estimates suggest that modular plants can be deployed 50% faster than traditional, fixed facilities, providing a quicker route to scaling up production capacity. Studies indicate that modular designs can also reduce contamination risks by up to 35%, enhancing the overall safety and quality of the manufacturing process.

However, initial capital requirements for modular facilities are still 20-25% higher than for conventional builds. Despite these premium costs, 65% of new biologics manufacturing projects now incorporate some modular elements, according to 2023 project filings. This trend demonstrates the increasing appeal of modular designs for companies looking to expand or adapt their production capabilities in a more flexible and cost-efficient manner.

Regional Analysis

North America is leading the Upstream Bioprocessing Market

North America dominated the market with the highest revenue share of 39.2% owing to verifiable industry developments. The FDA’s annual report documented the approval of 12 new biologic therapies in 2023, indicating sustained demand for bioprocessing technologies.

Government investment in biomanufacturing infrastructure reached US$2 billion in 2023, as confirmed by Department of Health and Human Services budget allocations. Production capacity increases were confirmed through corporate disclosures, with several major biotech firms reporting 15-20% expansions in their 2023 annual reports.

Academic institutions, including MIT and Stanford, established multiple new research centers focused on bioprocessing optimization, as evidenced by their press releases. The National Institute for Innovation in Manufacturing Biopharmaceuticals reported increased adoption of single-use systems, based on their annual technology survey. These developments collectively contributed to market growth across therapeutic areas, including monoclonal antibodies and cell therapies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR in the coming years. China’s National Development and Reform Commission published investment figures showing US$1.5 billion allocated to biomanufacturing in 2023. India’s Department of Biotechnology’s annual report confirmed capacity expansions in biopharmaceutical production during the same period.

South Korea’s Ministry of Food and Drug Safety released data showing increased biologic approvals in 2023. Singapore’s trade statistics recorded growth in bioprocessing equipment imports, reflecting rising demand for biomanufacturing technologies.

Corporate announcements from regional manufacturers detailed capacity expansion projects completed in 2023. These documented developments suggest continued growth potential for the region’s bioprocessing capabilities in the coming years, particularly in biologics and advanced cell therapies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the upstream bioprocessing market focus on product innovation, enhancing automation, and expanding their service offerings to drive growth. They invest in the development of more efficient cell culture systems, bioreactors, and media to improve productivity and reduce production costs. Companies also prioritize strategic partnerships with biopharma and biotechnology firms to optimize bioprocessing workflows and scale up production.

They expand their presence in emerging markets where biopharmaceutical production is growing rapidly, offering tailored solutions for local manufacturers. Additionally, regulatory compliance and continuous investment in R&D ensure companies stay competitive and meet the evolving needs of the industry.

Sartorius AG, headquartered in Goettingen, Germany, is a global leader in the bioprocessing market, providing products and solutions for both upstream and downstream biomanufacturing. The company offers a wide range of products, including bioreactors, cell culture media, and filtration systems, aimed at improving efficiency and scalability in biopharmaceutical production.

Sartorius focuses on continuous innovation, integrating automation and digitalization into its systems to streamline bioprocessing. With a strong global presence and a commitment to advancing biopharmaceutical manufacturing, Sartorius remains a key player in the upstream bioprocessing market.

Top Key Players

- Sartorius AG

- Merck KGaA

- Lonza

- Getinge

- Eppendorf AG

- Danaher

- Cytiva

- Corning Incorporated

Recent Developments

- In October 2023, Getinge completed the acquisition of Purity New England, Inc., a leading provider of single-use technologies for the bioprocessing industry. This acquisition enhances Getinge’s capabilities in supplying advanced, cost-effective solutions for biomanufacturers, strengthening its presence in the global biopharma market.

- In June 2023, Cytiva partnered with Culture Biosciences to advance upstream bioprocessing through innovative digital solutions. The collaboration introduces in-silico models and virtual monitoring to streamline the scaling of biomanufacturing processes, making production faster, more adaptable, and cost-efficient, especially in complex biologic therapies.

Report Scope

Report Features Description Market Value (2024) US$ 26.6 billion Forecast Revenue (2034) US$ 102.1 billion CAGR (2025-2034) 14.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bioreactors/Fermenters, Cell Culture Products, Filters, and Others), By Technology (Multi-use and Single-use), By Application (Media Preparation, Cell Culture, and Cell Separation), By Mode (In-house and Outsourced) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sartorius AG, Merck KGaA, Lonza, Getinge, Eppendorf AG, Danaher, Cytiva, and Corning Incorporated. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Upstream Bioprocessing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Upstream Bioprocessing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sartorius AG

- Merck KGaA

- Lonza

- Getinge

- Eppendorf AG

- Danaher

- Cytiva

- Corning Incorporated