Global Cell Culture Market Analysis By Product [Consumables (Sera (Fetal Bovine Serum, Other), Reagents (Albumin, Others), Media (Serum-free Media (CHO Media, HEK 293 Media, BHK Medium, Vero Medium, Other Serum-free Media), Classical Media (Stem Cell Culture Media, Chemically Defined Media, Specialty Media, Other Cell Culture Media), Instruments (Culture Systems, Incubators, Centrifuges, Cryostorage Equipment, Biosafety Equipment, Pipetting Instruments)]; By Application [Biopharmaceutical Production (Monoclonal Antibodies, Vaccines Production, Other Therapeutic Proteins), Drug Development, Diagnostics, Tissue Culture & Engineering, Cell & Gene Therapy, Toxicity Testing, Other Applications] By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 19074

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

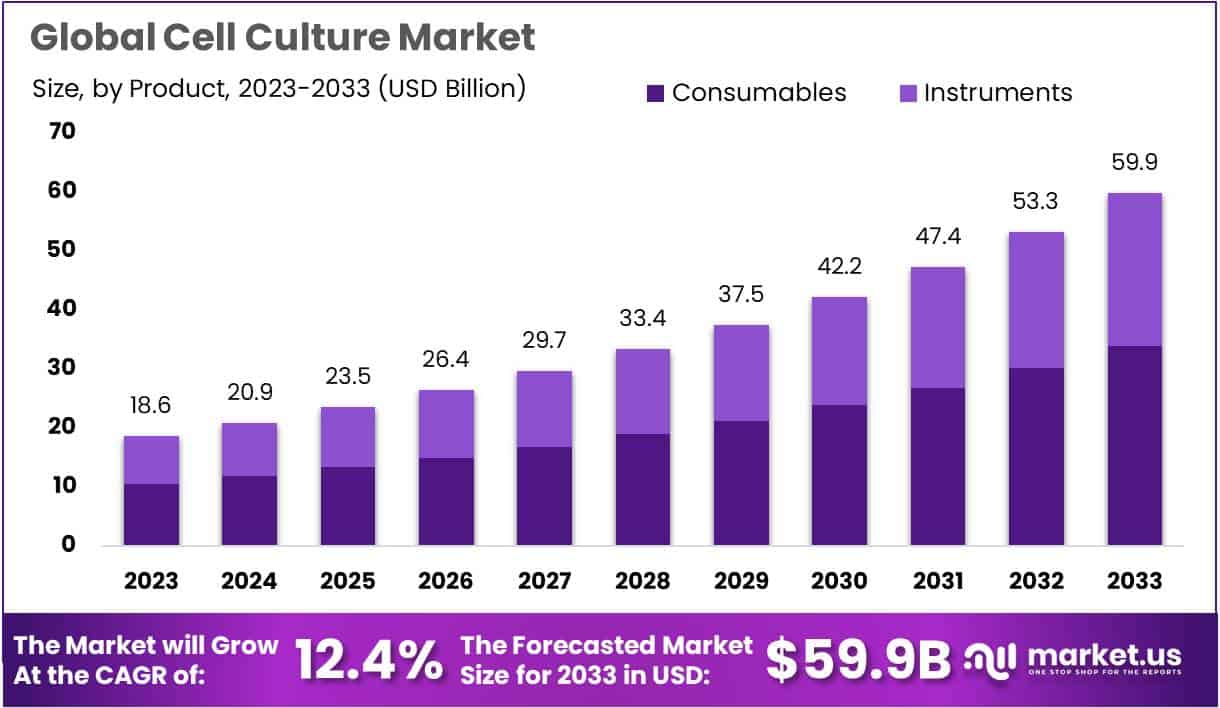

The Cell Culture Market Size is projected to reach approximately USD 59.9 billion by the year 2033, compared to USD 18.6 billion in 2023. This represents a remarkable Compound Annual Growth Rate (CAGR) of 12.4% over the forecast period spanning from 2024 to 2033.

Cell culture is a vital laboratory technique used for cultivating and maintaining cells outside the living organism for research and biotechnological purposes. This method involves growing diverse cell types, including primary cells and immortalized cell lines, in a controlled environment. The cells are nurtured in a specialized growth medium containing essential nutrients and supplements like amino acids and growth factors.

Cultivation occurs within sterile culture vessels, such as Petri dishes and tissue culture flasks, where researchers adhere to strict aseptic techniques. Maintaining optimal conditions, including temperature, humidity, and CO2 concentration, is crucial to mimic the physiological environment. Regular subculturing ensures a continuous supply of healthy cells for experiments.

Cell culture plays a pivotal role in scientific research, offering insights into cell behavior, drug development, and disease modeling. Researchers carefully maintain sterility, using specialized vessels and growth mediums to support various cell types. Cultured cells thrive in controlled environments, with factors like temperature and CO2 concentration closely monitored.

Subculturing, a routine practice, ensures a constant supply of cells for experimentation. These meticulous methods are essential in advancing our understanding of cellular processes and developing treatments for various diseases, contributing significantly to the fields of biology and medicine.

Key Takeaways

- Cell Culture Market value stands at USD 18.6 billion in 2023, with a projected CAGR of 12.4% from 2024 to 2033.

- Market set to reach USD 59.9 billion by 2033, indicating substantial growth potential in the cell culture industry.

- Consumables dominate, holding 56.6% market share in 2023, vital for cell growth and maintenance in labs.

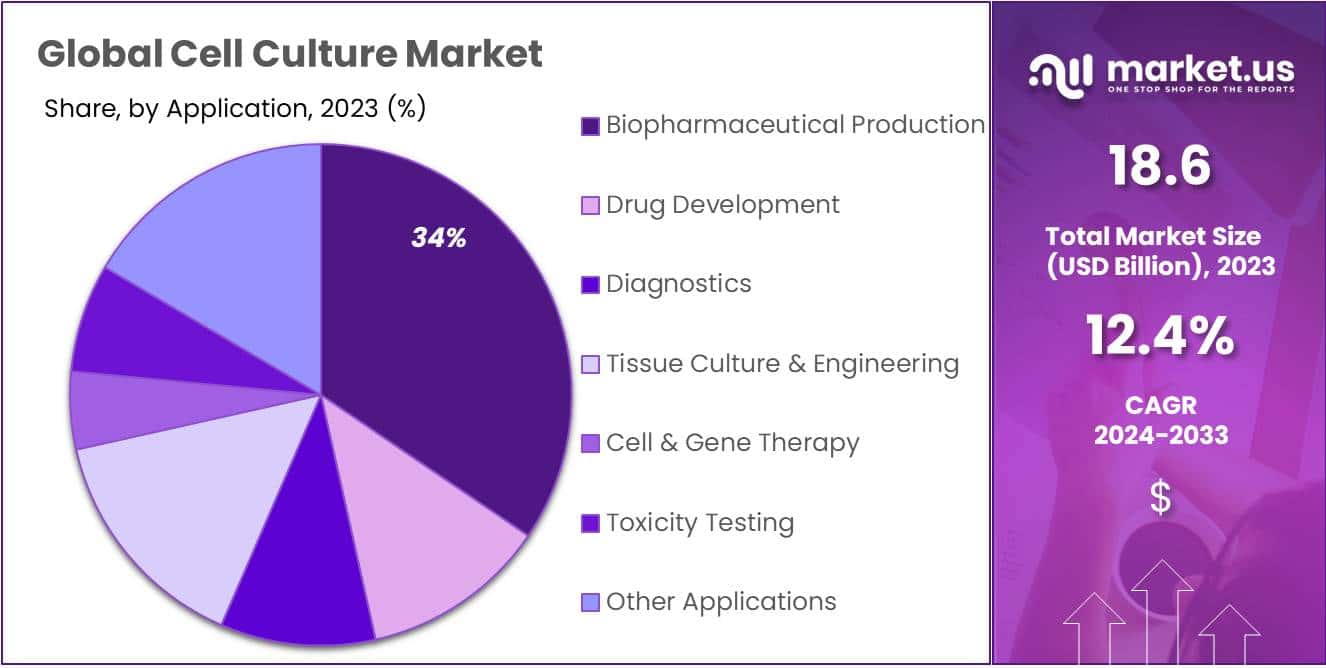

- Biopharmaceutical Production leads with a 34.5% market share in 2023, focused on vaccines and therapeutic proteins.

- Diverse applications include Drug Development, Diagnostics, Tissue Culture & Engineering, Cell & Gene Therapy, and Toxicity Testing.

- Market driven by factors like rising chronic diseases, investments, biologics growth, and technological advancements.

- High capital investment and technical challenges hinder market growth, posing obstacles for potential expansion.

- Emerging opportunities include stem cell therapies, genetic disorder treatments, and growth in Asian biotech sectors.

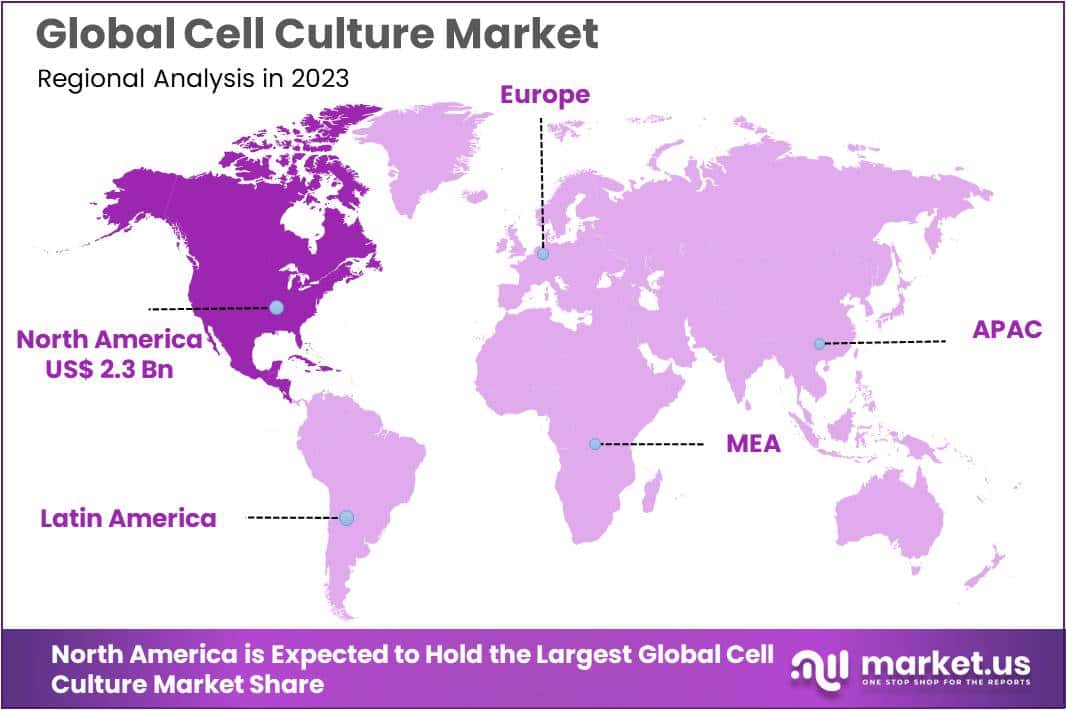

- North America leads with 36.7% market share in 2023, driven by research, biopharmaceutical industry, and technological breakthroughs.

- Major players include Sartorius AG, Danaher, Merck KGaA, Thermo Fisher Scientific Inc., and Corning Inc., among others.

Product Analysis

In 2023, Consumables held a dominant market position, capturing more than a 56.6% share. Consumables in the cell culture market are crucial components for maintaining and growing cells in a laboratory setting. These essential items include Sera, Reagents, and Media.

Sera, which accounted for a significant portion of this segment, are vital for providing necessary nutrients and growth factors to support cell growth. Reagents, on the other hand, are essential for various laboratory procedures and maintaining cell health. Media, the third component of Consumables, is used to create an environment suitable for cell proliferation.

Moving on to the Instruments segment, it plays a pivotal role in the cell culture process. Culture Systems, such as bioreactors and culture dishes, facilitate the controlled growth of cells. Incubators are used to maintain optimal temperature and conditions for cell cultures. Centrifuges help in cell separation and isolation, while Cryostorage Equipment ensures the preservation of cell lines for future use.

Biosafety Equipment is another important category within the Instruments segment, as it ensures a safe working environment by preventing contamination and protecting researchers. Pipetting Instruments, such as pipettes and dispensers, are indispensable tools for precise liquid handling during cell culture procedures.

The Cell Culture market is driven by a combination of Consumables and Instruments, each playing a unique role in supporting research and production activities. Consumables are the foundation, providing the necessary elements for cell growth, while Instruments offer the infrastructure needed for maintaining and managing cell cultures. Together, these segments form the backbone of the cell culture market, supporting advancements in biotechnology, pharmaceuticals, and scientific research.

Application Analysis

In 2023, Biopharmaceutical Production held a dominant market position, capturing more than a 34.5% share. The application segment revolves around the cultivation of cells for manufacturing biopharmaceutical products such as vaccines, monoclonal antibodies, and therapeutic proteins. The robust demand for innovative biopharmaceuticals is driving the growth of this segment, as it plays a pivotal role in meeting healthcare needs.

Drug Development, another vital segment, constituted a substantial portion of the cell culture market, accounting for a significant share. This segment focuses on using cell cultures to develop and test new drugs. It aids pharmaceutical companies in screening potential drug candidates and evaluating their efficacy and safety, expediting the drug development process.

Diagnostics, as a key application of cell culture, played a crucial role in disease detection and monitoring. By utilizing cell cultures, diagnostic laboratories can grow and analyze pathogens or cells to identify diseases and assess patient health. This segment has been steadily expanding due to the increasing need for accurate and timely disease diagnosis.

Tissue Culture and engineering, a segment in the cell culture market, revolves around the cultivation and manipulation of cells for regenerative medicine and tissue engineering applications. It holds promise in repairing or replacing damaged tissues and organs, making it a growing area of interest for medical research and treatment.

Cell & Gene Therapy, a rapidly evolving segment, has gained traction in recent years. It involves the modification and cultivation of cells to develop therapies for various diseases, including genetic disorders and certain types of cancer. The growing interest in personalized medicine and breakthroughs in gene editing technologies have propelled the expansion of this segment.

Toxicity Testing is another crucial application of cell culture techniques. It is widely used in assessing the safety and potential toxic effects of new compounds, including pharmaceuticals, chemicals, and cosmetics. This segment is gaining importance in regulatory compliance and product development.

Furthermore, there are Other Applications in the cell culture market, including academic research and food production. These applications, while diverse, contribute to the overall growth of the market by creating opportunities for cell culture technology utilization beyond the core segments.

Key Market Segments

Product

- Consumables

- Sera

- Fetal Bovine Serum

- Other

- Reagents

- Albumin

- Others

- Media

- Serum-free Media

- CHO Media

- HEK 293 Media

- BHK Medium

- Vero Medium

- Other Serum-free Media

- Classical Media

- Stem Cell Culture Media

- Chemically Defined Media

- Specialty Media

- Other Cell Culture Media

- Serum-free Media

- Sera

- Instruments

- Culture Systems

- Incubators

- Centrifuges

- Cryostorage Equipment

- Biosafety Equipment

- Pipetting Instruments

Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Drug Development

- Diagnostics

- Tissue Culture & Engineering

- Cell & Gene Therapy

- Toxicity Testing

- Other Applications

Drivers

Rising prevalence of chronic diseases and cancer is increasing demand for new and advanced therapies like cell-based therapies, driving growth of the cell culture market. Cell cultures are used extensively in research for development of new drugs and therapies.

Increasing investments by pharmaceutical and biotechnology companies in research and development of new drugs and gene therapies using cell culture techniques is propelling market growth. Cell cultures enable drug toxicity testing.

Growth of the biologics and biosimilars market globally has led to increased production capacities and growing adoption of single-use technologies in bioprocessing. This drives the growth of the cell culture market.

Advances in cell culture technologies like 3D cell cultures and genetically engineered cells provide better in vivo environments for drug development and testing. This is boosting adoption of cell cultures.

Restraints

High capital investment required for cell culture equipment and facilities may restrain market growth to some extent. Maintenance of aseptic conditions also adds to costs.

Technical challenges associated with cell dissociation reagents required for passaging cells can hamper market growth. Reagents can affect cell viability and phenotype.

Risk of contamination due to microbes or cross-contamination is a key restraining factor. This can compromise cell viability and lead to loss of valuable cell lines.

Lack of trained and skilled personnel required for precise and controlled processes in cell culture technology may restrict adoption, especially in developing regions.

Opportunities

Increasing research in stem cell therapies and tissue engineering offers significant growth opportunities to cell culture technology providers. Stem cells have ability to differentiate into specialized cells.

Rising incidence of genetic disorders is expected to drive demand for cell-based gene therapies made possible by cell culture techniques like CRISPR. This offers lucrative growth opportunities.

Emerging economies like China, India, and Brazil with growing biotechnology sectors, present great market opportunities. Increasing investments in biomedical research in these regions is driving market growth.

Growing focus on 3D cell culture adoption in cancer research for modeling tumors presents future growth potential. 3D cultures mimic in vivo environments better.

Trends

Consumables segment accounts for largest market share due to recurrent use of supplies like media and reagents in cell culture processes. Technological advances in supplementing media are key trends.

Shift towards automation and adoption of robotic liquid handling systems for cell culture to improve output and efficiency while limiting errors is a key trend.

Increasing use of single-use bioprocess technologies like pre-sterilized bags, bioreactors, connectors, tubing sets etc. due to benefits like lower risk of contamination.

Rising preference for serum-free and animal-component free media to overcome challenges with serum-containing media is an important trend influencing market growth.

Regional Analysis

In 2023, the North American Cell Culture Market is leading in the region with a current value of 2.3 billion dollars, and commanding the largest revenue share at 36.7%. It continues to lead the way in the realm of cell culture applications and innovative instrumentation. Moreover, the North American market is witnessing a surge in investments within the media sector, a move designed to bolster the entire cell culture industry, particularly as there is a growing preference for animal-free media. This region’s remarkable growth is primarily attributed to the advent of technological breakthroughs in the field of cell culture equipment and instruments.

The United States, with its prominent healthcare and life science sector, was among the earliest adopters of cell culture techniques. Consequently, it boasts a significant market share. The U.S. cell-culture market is primarily driven by ongoing research and the expanding biopharmaceutical industry.

A multitude of biotherapeutics currently in clinical development rely on various cell lines, including mammalian and transgenic cells. This has spurred the development of innovative solutions to cater to the evolving consumer demands.

For instance, in 2022, Mammoth Biosciences inked a collaboration agreement with Bayer to advance in-vivo gene editing therapies through Mammoth’s CRISPR technology. Collaborative initiatives of this nature are fuelling market demand.

Germany has emerged as a prominent player in stem cell research, particularly in the regenerative medicine field. Together with France and the UK, it is anticipated to dominate the cell culture market. Germany’s market in this field is on an upswing due to the substantial volume of stem cell and cell culture research in the realm of oncology. Moreover, the advancement of cell culture testing equipment and techniques is bolstering this market’s growth.

In a similar vein, Medigene and BioNTech joined forces in 2022 to develop TCR-based immunotherapy for cancer, with the collaboration slated to span three years. These collaborative endeavors are instrumental in driving the German market, even though ethical concerns surrounding embryonic stem cell research and the trend towards outsourcing clinical research to developing nations may constrain the country’s adoption and demand.

India’s cell culture market, on the other hand, is experiencing significant momentum, propelled by ongoing advancements and the development of regenerative medicine. The rising incidence of chronic and genetic diseases, combined with India’s rapidly expanding healthcare sector, increased medical expenditure, and augmented research and development investments in healthcare, has resulted in substantial unmet medical needs.

Government initiatives in line with the burgeoning drug development trend in the industry are serving as a catalyst for the Indian market. In 2022, the Union Health Ministry in India amended the New Drugs & Clinical Trials regulations to encompass cell-culture-derived products within the definition of new drugs. These government-driven initiatives are poised to play a pivotal role in driving the market’s growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic realm of the cell culture market, several key players stand out for their substantial contributions and market influence. Sartorius AG, a leading figure in this domain, is renowned for its premium cell culture media and equipment, offering a comprehensive array of solutions for diverse applications. Danaher, another prominent entity, has carved a niche in life sciences, offering innovative tools and technologies for research. Its strategic acquisitions have bolstered its presence in the cell culture sector. Merck KGaA, a globally recognized name, is known for its comprehensive product range encompassing media, sera, and equipment, underpinned by an unwavering commitment to quality and innovation.

Thermo Fisher Scientific, Inc., boasts a diverse product portfolio that covers a wide spectrum of cell culture solutions, including media, reagents, and instruments. The company’s global presence and robust research support further bolster its position. Corning Inc. specializes in the manufacturing of laboratory products, particularly cell culture vessels and surfaces, offering innovative solutions for cell culture and research, underpinned by its expertise in materials science. Avantor, Inc., is another notable player that contributes significantly to the cell culture market, offering a range of products, including media, reagents, and consumables, with a focus on research and biopharmaceutical applications.

Cell Culture Market Key Players Are

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Corning Inc.

- Avantor Inc.

- BD

- Eppendorf SE

- Bio-Techne

- PromoCell GmbH

- Other Key Companies

Recent Developments

- In July 2023, Thermo Fisher Scientific made big news by announcing their plan to buy PeproTech for a hefty $1.35 billion. This acquisition, set to happen in the latter part of 2023, will help Thermo Fisher expand its range of products and services for growing cells in labs. These include stuff like special liquids, reagents, and equipment. PeproTech is known for its proteins and antibodies, which are important for drug discovery, vaccine work, and making regenerative medicines.

- In June 2023, Corning launched a new product line called Corning VelveTouch 3D Microcarriers. These little things are meant to make it easier for scientists to grow cells in a stable and repeatable way. They’re made from a special kind of gel coated with a friendly material for cells to stick to. Plus, they’re small and all the same size, which makes them handy for working with cells in lab dishes.

- In May 2023, Sartorius decided to buy Taitron Laboratories for $240 million. The deal should be done in the latter part of 2023. This move is all about expanding Sartorius’ offerings for cell growing. They’re into things like special liquids, reagents, and equipment. Taitron Labs makes stuff for cell work in drug discovery, vaccines, and regenerative medicine.

- In April 2023, Merck and MilliporeSigma teamed up to make cell culture work even better. They’re going to work together on creating new tools and services to help scientists do cell culture work more efficiently and consistently. Both companies are big names in this field, and their partnership aims to create cool new technologies for researchers worldwide.

Report Scope

Report Features Description Market Value (2023) USD 18.6 Bn Forecast Revenue (2033) USD 59.9 Bn CAGR (2024-2033) 12.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product [Consumables (Sera (Fetal Bovine Serum, Other), Reagents (Albumin, Others), Media( Serum-free Media (CHO Media, HEK 293 Media, BHK Medium, Vero Medium, Other Serum-free Media), Classical Media (Stem Cell Culture Media, Chemically Defined Media, Specialty Media, Other Cell Culture Media), Instruments (Culture Systems, Incubators, Centrifuges, Cryostorage Equipment, Biosafety Equipment, Pipetting Instruments)];

Application [Biopharmaceutical Production (Monoclonal Antibodies, Vaccines Production, Other Therapeutic Proteins), Drug Development, Diagnostics, Tissue Culture & Engineering, Cell & Gene Therapy, Toxicity Testing, Other Applications]Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sartorius AG, Danaher, Merck KGaA, Thermo Fisher Scientific Inc., Corning Inc., Avantor Inc., BD, Eppendorf SE, Bio-Techne, PromoCell GmbH, Other Key Companies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Cell Culture market in 2023?The Cell Culture market size is USD 18.6 billion in 2023.

What is the projected CAGR at which the Cell Culture market is expected to grow at?The Cell Culture market is expected to grow at a CAGR of 12.4% (2024-2033).

List the segments encompassed in this report on the Cell Culture market?Market.US has segmented the Cell Culture market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product [Consumables (Sera (Fetal Bovine Serum, Other), Reagents (Albumin, Others), Media( Serum-free Media (CHO Media, HEK 293 Media, BHK Medium, Vero Medium, Other Serum-free Media), Classical Media (Stem Cell Culture Media, Chemically Defined Media, Specialty Media, Other Cell Culture Media), Instruments (Culture Systems, Incubators, Centrifuges, Cryostorage Equipment, Biosafety Equipment, Pipetting Instruments)], By Application [Biopharmaceutical Production (Monoclonal Antibodies, Vaccines Production, Other Therapeutic Proteins), Drug Development, Diagnostics, Tissue Culture & Engineering, Cell & Gene Therapy, Toxicity Testing, Other Applications].

List the key industry players of the Cell Culture market?Sartorius AG, Danaher, Merck KGaA, Thermo Fisher Scientific Inc., Corning Inc., Avantor Inc., BD, Eppendorf SE, Bio-Techne, PromoCell GmbH, Other Key Companies.

Which region is more appealing for vendors employed in the Cell Culture market?North America accounted for the highest revenue share of 36.7%. Therefore, the Cell Culture industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Cell Culture?U.S., Canada, Germany, UK, China, Japan, Brazil, South Africa, are key areas of operation for Cell Culture Market.

Which segment accounts for the greatest market share in the Cell Culture industry?With respect to the Cell Culture industry, vendors can expect to leverage greater prospective business opportunities through the media segment, as this area of interest accounts for the largest market share.

-

-

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Corning Inc.

- Avantor Inc.

- BD

- Eppendorf SE

- Bio-Techne

- PromoCell GmbH

- Other Key Companies