Global Sickle Cell Disease Treatment Market by Type (Hydroxyurea, Oxybryta, Adakveo, and others), By Application (Blood transfusion, Bone Marrow Transplants, and Pharmacotherapy and Others), By Route of Administration (Oral, Parenteral, and Others), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2032

- Published date: Oct 2023

- Report ID: 44935

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

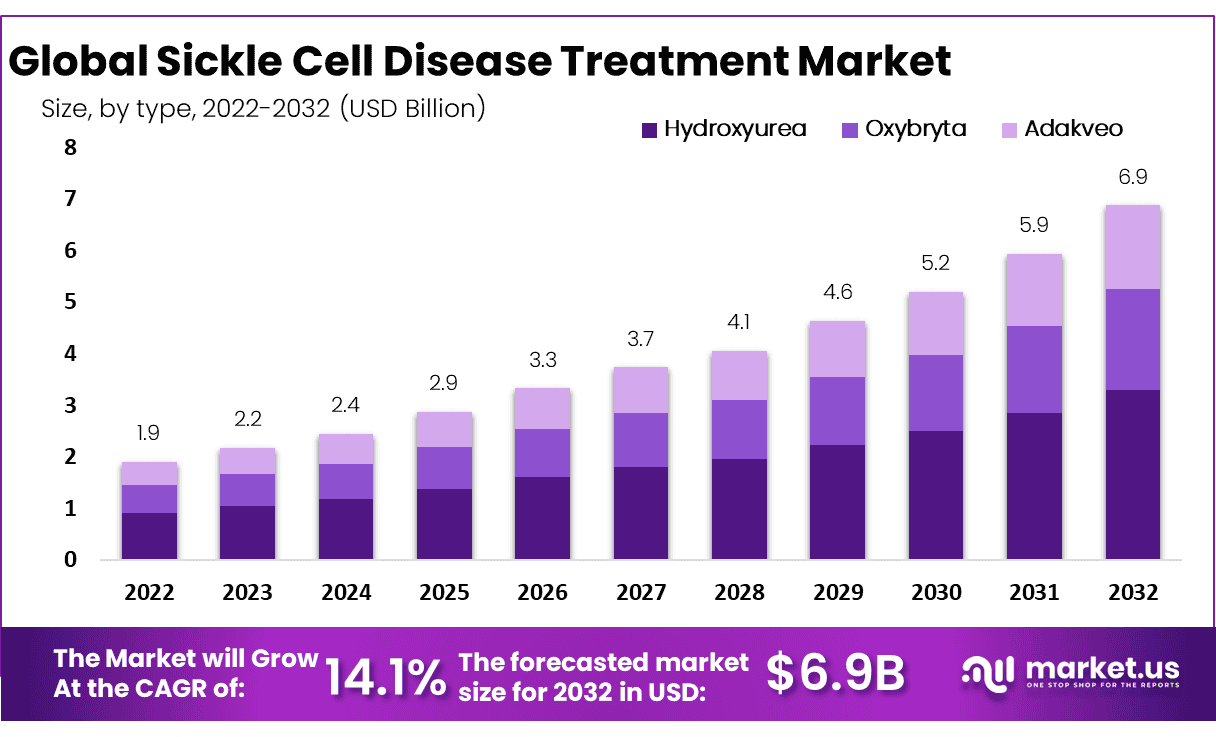

The Global Sickle Cell Disease Treatment Market size is expected to be worth around USD 6.9 Billion by 2032 from USD 2.2 Billion in 2023, growing at a CAGR of 14.10% during the forecast period from 2024 to 2032.

Sickle cell disease is a type of blood disease transferred from generation to generation. Hemoglobin deficiency is one of the symptoms of Sickle cell disease. It is an oxygen-carrying protein in red blood cells, but in SCD, it stops the oxygen supply to tissues. Sickle cell disease is currently treated by a blood transfusion and bone marrow transplant, which clinicians usually recommend. In the bone marrow transplant, the donor replaces diseased bone marrow with healthy bone marrow. Many other successful therapies, including blood transfusions and medications, are also used to cure patients to decrease disease and live longer.

Besides blood transfusions and bone marrow transplants, a range of emerging therapies has been developed to better manage and potentially treat SCD. Hydroxyurea, a medication long used in cancer therapy, has been adapted for SCD treatment. It aids in reducing the frequency of pain crises and can decrease the need for blood transfusions by increasing fetal hemoglobin levels that are naturally present in newborns and inhibit sickling of the red cells.

Key Takeaways

- Market Size: Global Sickle Cell Disease Treatment Market size is expected to be worth around USD 6.9 Billion by 2032 from USD 2.2 Billion in 2023.

- Market Growth: The market growing at a CAGR of 14.10% during the forecast period from 2024 to 2032.

- Type Analysis: Hydroxyurea Segment Held Largest Share in Sickle Cell Disease Market.

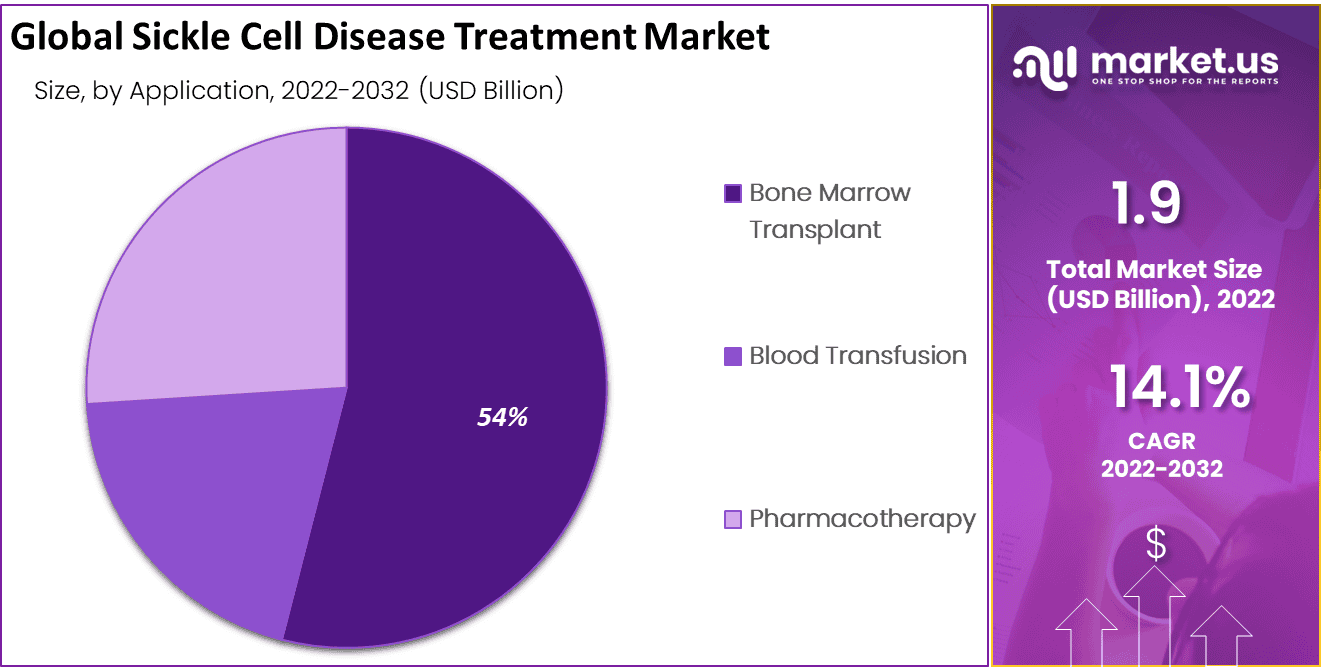

- Application Analysis: Bone Marrow Transplant Dominate the Market in the Application Segment.

- Route Administration: The Oral Segment Dominates the Market Shares in the Route Administration Segment.

- End-Use Analysis: Hospital Segment Lead Due to Increasing Prevalence of Patients Visits.

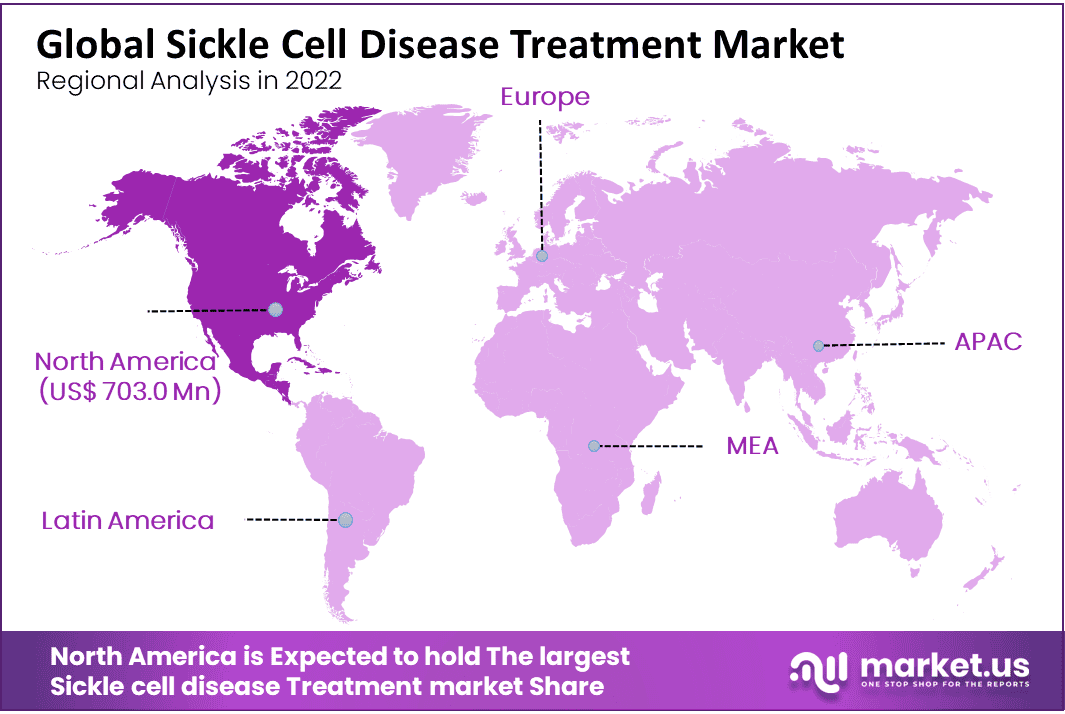

- Regional Analysis: North America Dominate the Largest Shares in the Sickle Cell Disease Market.

Type Analysis

Hydroxyurea Segment Held Largest Share in Sickle Cell Disease Market

Based on Product type, the segment is divided into adakveo, hydroxyurea, oxybryta, and others. Hydroxyurea is the most dominating sickle cell disease treatment market segment. Hydroxyurea drug used for sickle cell anemia offers therapeutic benefits over multiple actions, which helps to increase the growth of these segments in the market.

The adakveo segment is anticipated to show largest market growth throughout the forecast period. It is expected to increase in intake of Adakveo drug for the medication of vaso-occulsive crisis that occurred due to sickle cell disease, which is support to increase in demand for Adakveo during the projection period.

Application Analysis

Bone Marrow Transplant Dominate the Market in the Application Segment

Based on Application, the market is segmented into blood transfusion, bone marrow transplant, and pharmacotherapy. The Pharmacotherapy segment is further divided into hydroxyurea and branded drugs. The blood transfusion segment generated the highest CAGR during the projection period. Blood transfusion is the most effective treatment method to handle strokes. It is one of the severe symptoms of sickle cell disease. The rising number of stroke cases among sickle cell patients helps increase the demand for blood transfusion treatment.

These factors are responsible for dominating the market segment. However, the pharmacotherapy segment is estimated to grow at the fastest CAGR during the forecast period due to the introduction of new branded pharmacotherapy drugs and increasing government initiatives to launch new drugs. The presence of limited treatment options in the market is responsible for the growth of this segment.

The Government supports the research and development activities for sickle cell disease treatment through funding and descriptions such as fast track, orphan drugs, and priority review. These factors are expected to increase the introduction of new branded pharmacotherapy drugs and show significant growth for the pharmacotherapy segment.

Route Administration

The Oral Segment Dominates the Market Shares in the Route Administration Segment

Based on the route of administration, the market is divided into oral and parenteral. The oral segment accounted for the largest revenue in the market segment. Due to their easy absorbability and high patient compliance, oral drugs’ high adaption does not require any particular sterile conditions. For example, hydroxyurea is available in capsule and tablet forms, which is easily uptake by patients with sickle cell disease.

End-User Analysis

Hospital Segment Lead Due to Increasing Prevalence of Patients Visits

Based on end-user, the sickle cell disease treatment market is classified into Specialty clinics, hospitals, and others. The hospital segment shows a significant growth in the sickle cell disease treatment market due to the increasing frequency of Sickle cell disease as well as the increasing demand of hospitals for treating sickle cell diseases.

The Specialty clinics segment is anticipated to grow at a significant CAGR throughout the projection period. This segment also applies to the rising number of specialty clinics providing treatments and care for sickle cell diseases.

Key Market Segments

Based on Type

- Hydroxyurea

- Oxybryta

- Adakveo

- Others

Treatment Analysis

- Bone Marrow Transplant

- Blood Transfusion

- Pharmacotherapy

- Other Applications

Route Administration

- Oral Administration

- Parenteral Administration

End-User Analysis

- Hospitals

- Specialty Centers

- Others

Driving Factors

The Emergence of Advanced Treatment Modalities Contribute to Market Growth

Sickle cell disease majorly affects individuals throughout the world. The frequency of sickle cell disease has been rising at the fastest growth. The Vaso-occlusive Crisis is the painful complication of sickle cell disease in children and adults. It causes major acute pain to patients, including children and adults, who need to treat in emergency medical care.

Most industries focus on launching new drugs to treat painful complications and reduce the rate of these diseases. The increasing frequency of sickle cell disease treatments and the new advanced drugs for disease treatment is reducing the chances of Vaso-occlusive Crisis, and increasing the demand of patients helps to drive the market growth.

Sickle cell disease management involves only bone marrow transplantation and blood transfusion. The rising disease frequency and awareness increased the demand for other effective treatment options. The FDA and EMA also play a significant role by quickly approving these products. FDA provides approval for drugs for serious conditions to use at early as possible to the patients at a reasonable price to expect a clinical benefit for the patients. These factors are expected to drive the market growth.

Restraining Factors

The Less Availability of Treatment Options Limits the Growth of the Sickle Cell Disease Treatment Market

The Sickle cell disease of pharmacotherapy contains branded drugs and hydroxyurea. It is considered the first line of the disorder treatment and is suggested by many healthcare professionals. However, due to less availability of therapy options, different countries across the globe are responsible for the restraining factor. Also, blood transfusions for sickle cell disease depend on the donor’s availability.

If a donor is available, inappropriate screening and infection can occur during a blood transfusion. Private and public funding is less in African countries to improve the healthcare facilities and infrastructures for the patients suffering from the disease. During the forecast period, the lack of awareness about the disease population in emerging economies hampers the global market.

Growth Opportunities

Increasing Incentives Attract Pharmaceutical Companies to Invest in R&D, Driving Market Growth

The designation of sickle cell disease as an orphan disease in many regions provides regulatory benefits, such as market exclusivity and financial incentives, to companies developing treatments for this condition. These incentives attract pharmaceutical companies to invest in research and development, driving market growth. Moreover, Collaborations between pharmaceutical companies, research institutions, and non-profit organizations are fostering innovation and the development of new treatment options for sickle cell disease.

Partnerships can combine expertise, resources, and funding, accelerating the translation of research into clinical applications. In addition, the growing recognition of sickle cell disease as a global health concern has led to increased investment in emerging markets. Pharmaceutical companies are expanding their presence in developing regions, providing access to innovative treatments and driving market growth.

Trending Factors

Improvement in Research and Healthcare Facilities Drive the Market Growth

Gene therapy has emerged to cure different chronic or brain diseases. In the cases of gene therapy and hereditary diseases that target disease causes. The market players have moved their R&D and focus toward gene therapy with research development to improve the genetic mutation to treat the disease.

Vertex Pharmaceuticals and CRISPR Therapeutics conducted clinical trials on CRISPR-Cas9 gene therapy CTX001, but currently, it is in phase 3 clinical trials and is expected to be over in 2024. The positive clinical studies on CTX001 recommend that the pipeline applicant can become a hit drug in the market. These factors are estimated the significant growth of the global sickle cell disease treatment market in the coming years.

Regional Analysis

North America Dominate the Largest Shares in the Sickle Cell Disease Market

North America generates the highest revenue in the global market shares. The market is dominating due to offering Sickle cell disease treatments and increasing collaboration to improve the treatment of the disease. Europe is also estimated to have a significant market share and is expected to grow considerably during the forecast period. The market growth in Europe is increased due to government funding policies, increasing frequency of diseased patients, and major market key players prioritizing this region’s expansion.

All countries are expected to grow significantly in the forecast period due to increased market growth in the region, which is expected to increase the frequency of sickle cell disease in Africa, the Middle East, and South America by improving disposable income. The increased awareness of sickle cell disease and a strong pipeline of branded drugs are expected to drive market growth in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on various strategic policies to develop their respective businesses in foreign markets. Several Sickle cell disease market companies are expanding their operations and R&D facilities. Furthermore, sickle cell disease market businesses are developing new products and portfolio expansion strategies through investments, mergers, and acquisitions.

In addition, several key players are now focusing on different marketing strategies, such as spreading awareness about natural ingredients, which is boosting the target products’ growth.

Market Key Players

With the presence of many local and regional players, the market for sickle cell disease treatment is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. Companies have gained various expansion strategies, such as partnerships and product launches, to stay on top of the market.

Listed below are some of the most prominent Sickle Cell Disease Treatment market players

- Agios Pharmaceuticals

- Bristol-Myers Squibb

- CRISPR Therapeutics

- Editas Medicine

- Emmaus Life Sciences Inc.

- Medunic USA Inc.

- Novo Nordisk

- Vifor Pharma

- Other key Players

Recent Developments

- Bristol-Myers Squibb (September 2024): Bristol-Myers Squibb initiated a new clinical trial for their investigational sickle cell disease therapy. The study aims to evaluate the efficacy of a novel therapeutic that targets the underlying causes of the disease, addressing the need for more comprehensive treatments. This follows promising preclinical data reported earlier this year.

- CRISPR Therapeutics (October 2024): CRISPR Therapeutics announced significant progress in its CRISPR-Cas9 gene-editing therapy for sickle cell disease. The company is currently conducting pivotal trials and expects regulatory submission by mid-2025. Early data shows potential for long-term relief from vaso-occlusive crises.

- Agios Pharmaceuticals (December 2023): Agios Pharmaceuticals reported positive results from the Phase 2 RISE UP study of mitapivat for sickle cell disease. The treatment showed a significant increase in hemoglobin levels and a reduction in pain crises. Agios is now advancing to the Phase 3 trial, with U.S. regulatory approval expected by 2026.

Report Scope

Report Features Description Market Value (2023) USD 2.2 Billion Forecast Revenue (2032) USD 6.9 Billion CAGR (2023-2032) 14.1% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Hydroxyurea, Oxybryta, Adakveo, and others); By Application (Blood transfusion, Bone Marrow Transplants, and Pharmacotherapy, and Others); By Route of Administration (Oral, Parenteral, and Others); By End-User Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Agios Pharmaceuticals, Bristol-Myers Squibb, CRISPR Therapeutics, Editas Medicine, Emmaus Life Sciences, Inc., Medunic USA Inc., Novo Nordisk, Vifor Pharma, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sickle Cell Disease Treatment MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Sickle Cell Disease Treatment MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Agios Pharmaceuticals

- Bristol-Myers Squibb

- CRISPR Therapeutics

- Editas Medicine

- Emmaus Life Sciences Inc.

- Medunic USA Inc.

- Novo Nordisk

- Vifor Pharma

- Other key Players