Digital Therapeutics Market By Product Type (Devices and Software), By Application (Diabetes, Obesity, Central Nervous System Disease, Gastrointestinal Disorder, Cardiovascular Disease, and Others), By Sales Channel (Business-to-Business (B2B) (Healthcare Provider, Employer, and Others) and Business-to-Consumer (B2C) (Caregiver and Patient)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 61023

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

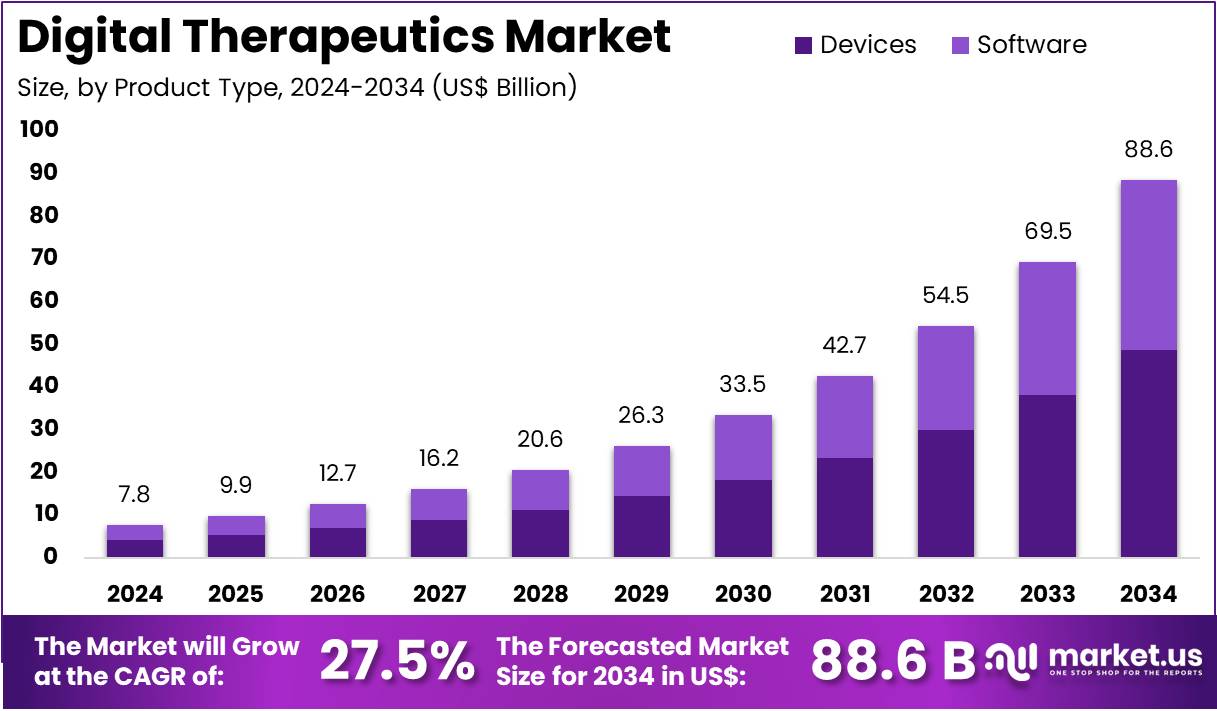

The Digital Therapeutics Market Size is expected to be worth around US$ 88.6 billion by 2034 from US$ 7.8 billion in 2024, growing at a CAGR of 27.5% during the forecast period 2025 to 2034.

Increasing adoption of technology in healthcare and the rising prevalence of chronic diseases are driving the rapid growth of the digital therapeutics (DTx) market. Digital therapeutics utilize evidence-based software and digital tools to prevent, manage, and treat medical conditions, offering an alternative or complement to traditional treatments. These solutions cater to a variety of therapeutic areas, including diabetes management, cardiovascular diseases, mental health, and addiction.

DTx products improve patient outcomes by providing personalized care, increasing adherence to prescribed therapies, and offering real-time monitoring through mobile apps and wearables. With advancements in artificial intelligence, machine learning, and data analytics, digital therapeutics platforms are becoming more effective and accessible. In mental health, for example, digital therapeutics have gained prominence in managing conditions like depression, anxiety, and post-traumatic stress disorder (PTSD) by providing cognitive behavioral therapy (CBT) through smartphones.

In May 2025, Scottish startup Eyesight Electronics introduced a groundbreaking treatment, AmblyoFix, for amblyopia (lazy eye), a condition affecting over 100 million people globally. This home-based therapy helped a patient, previously classified as legally blind, recover over 50 percent of their vision in just three months, demonstrating the potential of digital therapeutics in vision restoration.

The increasing shift towards remote healthcare and telemedicine further fuels the demand for digital therapeutics, as they offer convenient, cost-effective solutions for patients who may otherwise face barriers to accessing traditional care. As the healthcare industry continues to embrace technology, digital therapeutics will play an increasingly vital role in transforming how diseases are treated and managed.

Key Takeaways

- In 2024, the market for digital therapeutics generated a revenue of US$ 7.8 billion, with a CAGR of 27.5%, and is expected to reach US$ 88.6 billion by the year 2034.

- The product type segment is divided into devices and software, with devices taking the lead in 2023 with a market share of 55%.

- Considering application, the market is divided into diabetes, obesity, central nervous system disease, gastrointestinal disorder, cardiovascular disease, and others. Among these, diabetes held a significant share of 38%.

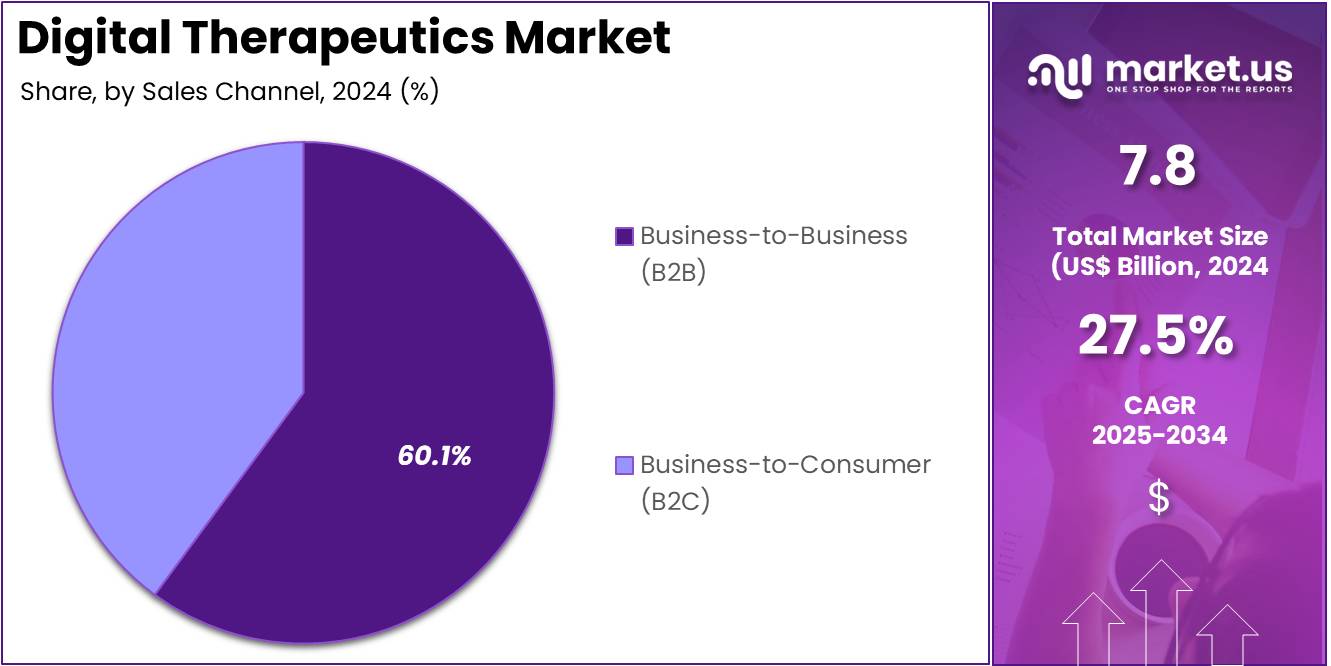

- Furthermore, concerning the sales channel segment, the market is segregated into business-to-business (B2B) and business-to-consumer (B2C). The business-to-business (B2B) sector stands out as the dominant player, holding the largest revenue share of 60.1% in the digital therapeutics market.

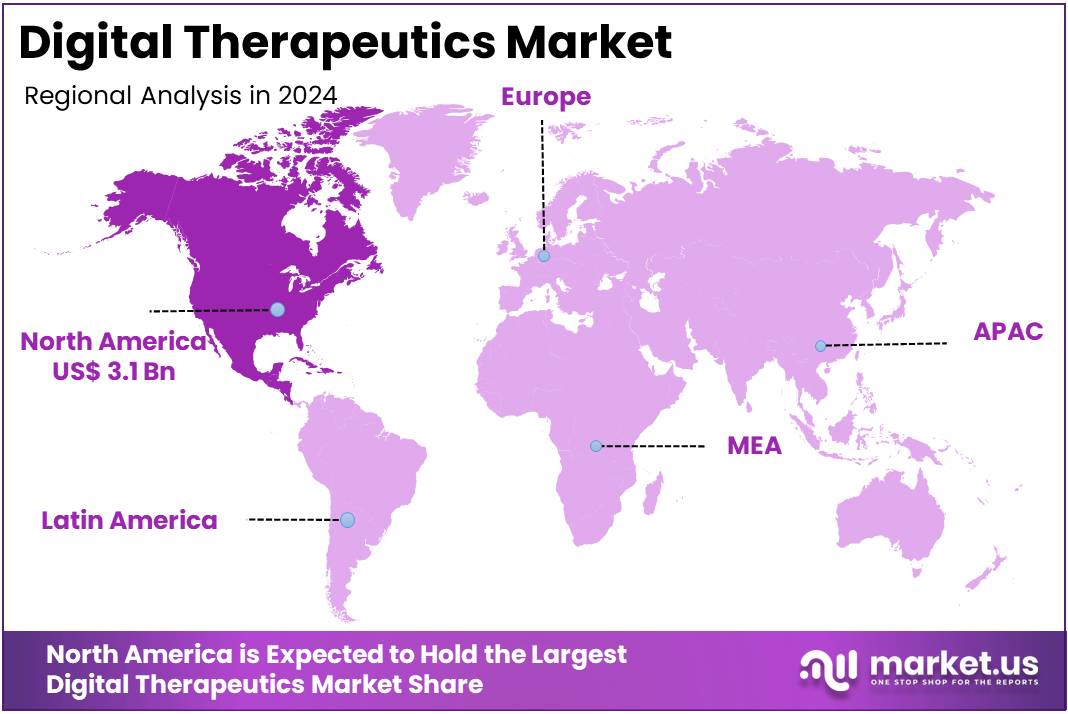

- North America led the market by securing a market share of 40.2% in 2023.

Product Type Analysis

Devices are expected to dominate the digital therapeutics market, comprising 55% of the market share. This segment is anticipated to experience significant growth as more healthcare providers and patients turn to digital solutions that include wearable devices, mobile health platforms, and therapeutic devices for managing chronic conditions. The adoption of devices in digital therapeutics is largely driven by their ability to monitor real-time health data, offer personalized treatment plans, and provide continuous therapeutic intervention without the need for frequent doctor visits.

The growing prevalence of chronic diseases, such as diabetes and cardiovascular disorders, is expected to contribute to the rising demand for these devices. Furthermore, advancements in sensor technology, AI, and connectivity are likely to improve device effectiveness and expand their use across various therapeutic areas. As consumers become more engaged in self-care and health management, digital therapeutic devices are projected to become increasingly integral to healthcare systems worldwide.

Application Analysis

Diabetes is expected to be the largest application segment in the digital therapeutics market, holding 38% of the market share. Digital therapeutics for diabetes management, including devices and software, have proven highly effective in improving patient outcomes by providing personalized management solutions, including continuous glucose monitoring, insulin management, and lifestyle interventions. The growing prevalence of type 2 diabetes globally, driven by rising obesity rates and sedentary lifestyles, is expected to fuel the demand for digital therapeutics in this space.

Additionally, digital therapeutics offer a more engaging and interactive way for patients to track their health, leading to better adherence to treatment plans and improved disease control. The increasing integration of AI, machine learning, and real-time data analytics in digital health solutions is expected to further enhance the effectiveness of diabetes management tools. As healthcare systems shift toward value-based care, the demand for digital therapeutics in managing diabetes is likely to continue to grow, offering more accessible, cost-effective solutions for patients and healthcare providers alike.

Sales Channel Analysis

Business-to-Business (B2B) is projected to be the largest sales channel in the digital therapeutics market, comprising 60.1% of the market share. The B2B segment is expected to grow significantly as healthcare providers, insurers, pharmaceutical companies, and other businesses partner with digital therapeutics companies to integrate these solutions into clinical practice, health plans, and wellness programs. The rising adoption of digital therapeutics by healthcare organizations for managing chronic diseases and improving patient outcomes will drive growth in this segment.

Additionally, partnerships between technology companies and healthcare providers are expected to lead to the development of integrated solutions that combine digital therapeutics with traditional healthcare services. The push for cost-effective healthcare and the emphasis on remote patient monitoring and disease management are projected to fuel the growth of the B2B sales channel. As the demand for digital health solutions increases, B2B partnerships will remain critical in scaling these technologies to reach a broader patient population, making it a dominant force in the digital therapeutics market.

Key Market Segments

By Product Type

- Devices

- Software

By Application

- Diabetes

- Obesity

- Central Nervous System Disease

- Gastrointestinal Disorder

- Cardiovascular Disease

- Others

By Sales Channel

- Business-to-Business (B2B)

- Healthcare Provider

- Employer

- Others

- Business-to-Consumer (B2C)

- Caregiver

- Patient

Drivers

Increasing Prevalence of Chronic Diseases is Driving the Market

The escalating global prevalence of chronic diseases, such as diabetes, cardiovascular conditions, respiratory disorders, and mental health issues, serves as a fundamental driver for the digital therapeutics market. These conditions often require continuous management, behavioral modification, and ongoing support that traditional healthcare models struggle to provide effectively or consistently.

Digital therapeutics (DTx) offer scalable, evidence-based interventions delivered through software programs, directly addressing these long-term management needs. The Centers for Disease Control and Prevention (CDC) reported that approximately 6 in 10 Americans live with at least 1 chronic disease, and 4 in 10 adults have two or more chronic diseases, based on 2022 data. This widespread and continuously growing burden of chronic conditions necessitates innovative, accessible, and cost-effective solutions for disease management, directly fueling the expansion and adoption of digital therapeutics as a vital component of integrated care.

Restraints

Lack of Clear and Consistent Reimbursement Pathways is Restraining the Market

A major restraint in the digital therapeutics market stems from the lack of clearly defined, consistent reimbursement pathways. Despite evidence showing their clinical effectiveness and potential to reduce healthcare costs, many digital therapeutics face difficulty gaining widespread adoption. The core issue lies in the financial uncertainty surrounding how payers—both government-funded programs and private insurers—will cover these treatments.

Unlike traditional medical interventions that follow standardized coding and billing frameworks, digital therapeutics often fall outside these norms. This discrepancy makes it difficult for providers to justify their use, especially when there is no guaranteed reimbursement. As a result, promising innovations in digital health frequently encounter barriers to integration within routine clinical practice.

The regulatory environment further complicates adoption, as digital therapeutics typically occupy a gray area between wellness tools and medical interventions. While there have been efforts to support integration—such as the addition of new Current Procedural Terminology (CPT) codes by the U.S. Centers for Medicare & Medicaid Services (CMS) in January 2024—these updates primarily focus on the services associated with prescribing and interpreting digital health data. Coverage for the digital therapeutic products themselves remains limited. This partial support, though a step forward, does not resolve the broader concern of financial coverage and thus continues to limit market traction and scalability.

Ongoing discussions within healthcare policy circles highlight the urgency of addressing reimbursement gaps. Without a standardized and favorable framework, manufacturers face uncertainty in generating sustainable revenue models, and healthcare providers lack incentives to prescribe these treatments. The absence of financial clarity discourages innovation and investment in the sector, slowing the pace of technological advancement. As digital therapeutics continue to prove their value in managing chronic diseases and mental health conditions, the development of uniform reimbursement mechanisms will be critical to unlocking broader market growth and improving patient access.

Opportunities

Growing Clinical Evidence and Regulatory Clarity Create Growth Opportunities

The accumulation of robust clinical evidence demonstrating the efficacy and safety of digital therapeutics, coupled with increasing regulatory clarity from health authorities, presents significant growth opportunities. As more digital therapeutic products undergo rigorous clinical trials and receive regulatory clearances, healthcare providers gain confidence in their clinical utility and effectiveness.

For instance, the U.S. Food and Drug Administration (FDA) has actively provided regulatory pathways for Software as a Medical Device (SaMD), which includes many digital therapeutics. According to FDA data compiled up to August 7, 2024, the agency had authorized 950 AI or machine learning-enabled medical devices since 1995, many of which are SaMD that underpin digital therapeutics.

Crucially, 107 of these authorizations occurred in 2024 alone, indicating a rapid acceleration in regulatory approvals for innovative digital health solutions. This growing body of evidence and clearer regulatory frameworks validate digital therapeutics as legitimate and effective medical interventions, encouraging broader adoption by clinicians, patients, and payers. The consistent stream of new clearances underscores a maturing regulatory environment that facilitates market entry for novel digital health solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors play a critical role in shaping the growth trajectory of the digital therapeutics market. These factors influence healthcare budgets, investment flows, and consumer access to advanced technologies. During times of economic expansion and fiscal stability, healthcare systems typically have increased flexibility to invest in innovative digital solutions. Such technologies, while often requiring high initial capital outlays, offer long-term benefits in patient care and operational efficiency.

In contrast, economic downturns or inflationary pressures can tighten healthcare budgets, thereby slowing the pace of digital adoption. The International Monetary Fund’s (IMF) October 2024 Global Financial Stability Report noted that although immediate financial risks remain contained, rising vulnerabilities could pose future challenges to health technology investments.

In addition to macroeconomic forces, geopolitical dynamics further affect the digital therapeutics landscape. Trade policies that influence the import and export of digital software components or impose tariffs can raise the cost of production and hinder cross-border innovation. Moreover, inadequate intellectual property protections may discourage investment in digital health development, particularly in regions with weak enforcement. Political instability, sanctions, or trade disputes may also disrupt global supply chains that are essential for producing connected therapeutic devices. These disruptions introduce uncertainty into international market expansion strategies and can delay the deployment of digital solutions across healthcare systems, especially in low- and middle-income countries.

Despite these challenges, the global demand for cost-effective, scalable, and clinically validated solutions to manage chronic diseases continues to support the digital therapeutics market. Healthcare providers and governments alike recognize the potential of these tools to address long-term public health challenges, particularly as traditional care delivery models face mounting pressure. Even in volatile economic or political climates, the sector remains resilient, driven by the urgent need for technology-enabled health interventions. As such, investment in research, regulatory advancements, and public-private partnerships is expected to persist, ensuring ongoing innovation and broader adoption of digital therapeutics in the years ahead.

Current U.S. tariff policies may indirectly affect the digital therapeutics market, primarily by influencing the cost of essential hardware, software components, and related infrastructure. Although digital therapeutics are largely software-driven, they often depend on imported devices such as smart wearables, tablets, and computing servers. According to the U.S. Census Bureau’s 2024 report on international trade, imports of capital goods rose by US$ 103.3 billion, which includes computers and accessories. Additionally, imports of consumer goods—including pharmaceutical preparations—increased by US$ 48.4 billion, underscoring a strong dependence on global supply chains. Any new tariffs applied to these technology inputs may raise the production and implementation costs of digital therapeutic solutions.

Such cost increases could have several downstream effects. Higher expenses for hardware and software may lead to elevated operational costs for developers and healthcare providers. This, in turn, could result in increased prices for digital therapeutics subscriptions or services, limiting access for some users. Moreover, companies facing tighter profit margins due to tariff-related cost hikes may slow down research and development activities. Innovation could be delayed as firms prioritize resource allocation to core operations rather than pursuing new features or improvements. Consequently, U.S. tariff policies could shape not only the affordability but also the pace of digital innovation in this evolving healthcare segment.

On the other hand, there may be long-term benefits if tariff pressure drives domestic manufacturing and development of digital therapeutics technologies. A strategic shift toward local production of medical software platforms and hardware may support a more resilient and secure supply chain. This could reduce U.S. dependence on potentially unstable international sources and create opportunities for job growth and innovation within the country. However, this transition may involve higher initial investment and regulatory compliance costs. Despite these challenges, enhanced domestic capacity could position the U.S. as a global leader in digital health infrastructure and self-sustained therapeutic innovation.

Latest Trends

Increasing Integration of Artificial Intelligence (AI) and Personalization is a Recent Trend

A prominent recent trend in the digital therapeutics market is the increasing integration of Artificial Intelligence (AI) and machine learning to deliver highly personalized and adaptive therapeutic interventions. AI algorithms analyze patient data, including behavioral patterns, physiological responses, and progress indicators, to tailor treatment plans, provide real-time feedback, and optimize engagement. This allows for a more dynamic and individualized therapeutic experience, improving adherence and outcomes.

The Ministry of Health and Family Welfare (MoHFW) in India, for example, highlighted in a March 2025 press release that AI is transforming public health. They specifically noted that an AI solution integrated into the national telemedicine platform, eSanjeevani, aided 12 million consultations with AI-recommended diagnoses since its deployment.

Such AI-powered clinical decision support systems and personalized engagement tools are becoming integral to digital therapeutics, enhancing their efficacy and user experience. This rapid adoption of AI in healthcare, particularly for personalized interventions and decision support, is making these therapeutic programs more intelligent, responsive, and ultimately more effective for managing a wide range of health conditions.

Regional Analysis

North America is leading the Digital Therapeutics Market

North America dominated the market with the highest revenue share of 40.2% owing to increasing recognition of these software-driven interventions as effective, scalable solutions for various health conditions, alongside growing regulatory clarity and expanding reimbursement pathways. The rising prevalence of chronic diseases and mental health disorders continues to fuel demand for innovative treatment options.

For example, in the United States, about one in five adults aged 18 and older experienced symptoms of anxiety (18.2%) or depression (21.4%) in the past two weeks in 2022, as reported by the CDC, highlighting a substantial population in need of accessible care, which digital solutions can address. The U.S. Food and Drug Administration (FDA) has actively cleared and approved a growing number of digital therapeutic products, with various Software as a Medical Device (SaMD) solutions receiving clearances for conditions ranging from migraine to ADHD, indicating a maturing regulatory landscape.

Companies are increasingly integrating these solutions into broader healthcare offerings; for instance, Teladoc Health’s BetterHelp segment, a significant player in the digital mental health space, reported US$1.04 billion in revenue for the full year 2024, demonstrating substantial adoption. Furthermore, companies like DarioHealth, specializing in chronic condition management platforms, saw their full-year 2024 revenue increase by 32.9% to US$27.0 million from US$20.4 million in 2023, largely driven by their business-to-business-to-consumer (B2B2C) channel with employers and health plans.

Reimbursement policies are also evolving, with the Centers for Medicare & Medicaid Services (CMS) continuing to update telehealth policies, indicating a move towards broader coverage for digital health services. These factors collectively illustrate a robust market expansion as digital therapies become more integrated into mainstream clinical practice.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the digital therapeutics market. The rise in healthcare spending, widespread smartphone use, and increasing chronic disease rates are key drivers. Governments in the region are also actively promoting digital health. These combined factors create strong demand for scalable health solutions. Many countries in Asia still face gaps in equitable healthcare access, making digital technologies vital. As a result, digital therapeutics are gaining momentum as a practical and affordable solution for better disease management.

China’s digital health market reached US$18.08 billion in revenue in 2024. This includes various digital therapeutic platforms and applications. The market is expected to grow at a CAGR of 23.6% from 2025 to 2030. This growth is supported by government-led initiatives promoting digital care and health IT infrastructure. In India, the Ayushman Bharat Digital Mission, launched in 2021, is enabling broad digital health adoption. By January 2025, over 730 million ABHA IDs were created, supporting future use of digital therapeutic systems.

Japan is also accelerating its digital health framework. The Ministry of Health, Labour and Welfare launched the “Medical DX Promotion Plan” in 2022. A budget of approximately US$400 million (JPY 61.7 billion) was allocated to support digital tools. This includes digital therapeutics and AI-driven diagnostics. These strategic moves across major Asia Pacific markets show strong policy alignment. Combined with a tech-savvy population, the region is positioned for rapid growth in digital therapy adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the digital therapeutics market employ various strategies to drive growth, including expanding their product portfolios through the development of novel therapies and research tools targeting chronic diseases and mental health conditions. They focus on enhancing the efficacy and safety profiles of their offerings by investing in research and development.

Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new therapies into clinical practices. Companies also aim to strengthen their market presence by establishing manufacturing facilities and distribution networks in key regions, ensuring timely and efficient delivery of products to support the growing demand for digital health solutions. Additionally, players engage in mergers and acquisitions to broaden their capabilities and market reach.

Omada Health, Inc. is a prominent player in the digital therapeutics market. Headquartered in San Francisco, California, Omada Health specializes in providing digital health programs for chronic disease prevention and management, including diabetes, hypertension, and behavioral health. The company offers personalized coaching, digital tools, and connected devices to support users in making sustainable health behavior changes.

Omada Health partners with employers, health plans, and other organizations to deliver its programs to a broad population, aiming to improve health outcomes and reduce healthcare costs. Through its evidence-based approach and scalable solutions, Omada Health continues to contribute to the advancement of digital therapeutics.

Top Key Players in the Digital Therapeutics Market

- PreveCeutical Medical Inc

- Mango Health

- HYGIEIA

- GAIA AG

- Fitbit LLC

- Click Therapeutics, Inc

- CANARY HEALTH

- BigHealth

Recent Developments

- In April 2025: Click Therapeutics, Inc., a pioneer in prescription medical treatments, unveiled a new brand identity and website to reflect the company’s evolution and future vision for medicine. This rebranding follows a year of major achievements, including the FDA clearance of the first prescription digital therapeutic for the adjunctive treatment of major depressive disorder symptoms, positioning Click as a leader in digital therapeutics and software-enhanced drug therapies.

- In May 2025: PreveCeutical Medical Inc., a health sciences company focused on preventive and curative therapies, announced that its subsidiary, BioGene Therapeutics Inc., has launched a new website. BioGene, a Texas-based life sciences company, is dedicated to advancing innovative therapies in metabolic health and gene-based treatments, further expanding PreveCeutical’s role in the development of next-generation healthcare solutions.

Report Scope

Report Features Description Market Value (2024) US$ 7.8 billion Forecast Revenue (2034) US$ 88.6 billion CAGR (2025-2034) 27.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Devices and Software), By Application (Diabetes, Obesity, Central Nervous System Disease, Gastrointestinal Disorder, Cardiovascular Disease, and Others), By Sales Channel (Business-to-Business (B2B) (Healthcare Provider, Employer, and Others) and Business-to-Consumer (B2C) (Caregiver and Patient)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PreveCeutical Medical Inc, Mango Health, HYGIEIA, GAIA AG, Fitbit LLC, Click Therapeutics, Inc, CANARY HEALTH, BigHealth Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Therapeutics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Therapeutics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- PreveCeutical Medical Inc

- Mango Health

- HYGIEIA

- GAIA AG

- Fitbit LLC

- Click Therapeutics, Inc

- CANARY HEALTH

- BigHealth