Global Polycrystalline Silicon Market Size, Share, Segments Analysis By Purity Level (Electronic Grade, Solar Grade), By Application (Solar Photovoltaics, Monocrystalline Solar Panel, Multicrystalline Solar Panel, Electronics), By Manufacturing Technology (Siemens Process, Upgraded Metallurgical Grade (UMG) Process, Fluidized Bed Reactor (FBR) Process), By End User Industry (Solar Energy Industry, Electronics and Semiconductor Industry), By Distribution Channel (Direct Sales, Indirect Sales) , Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135198

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

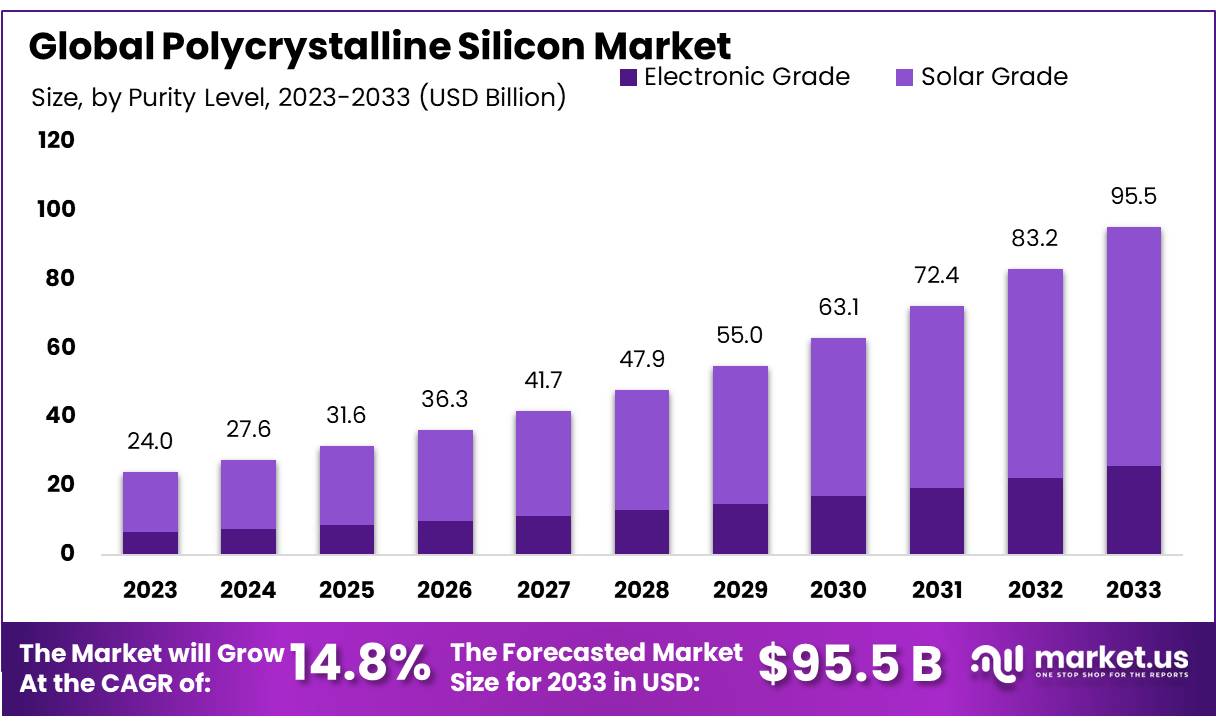

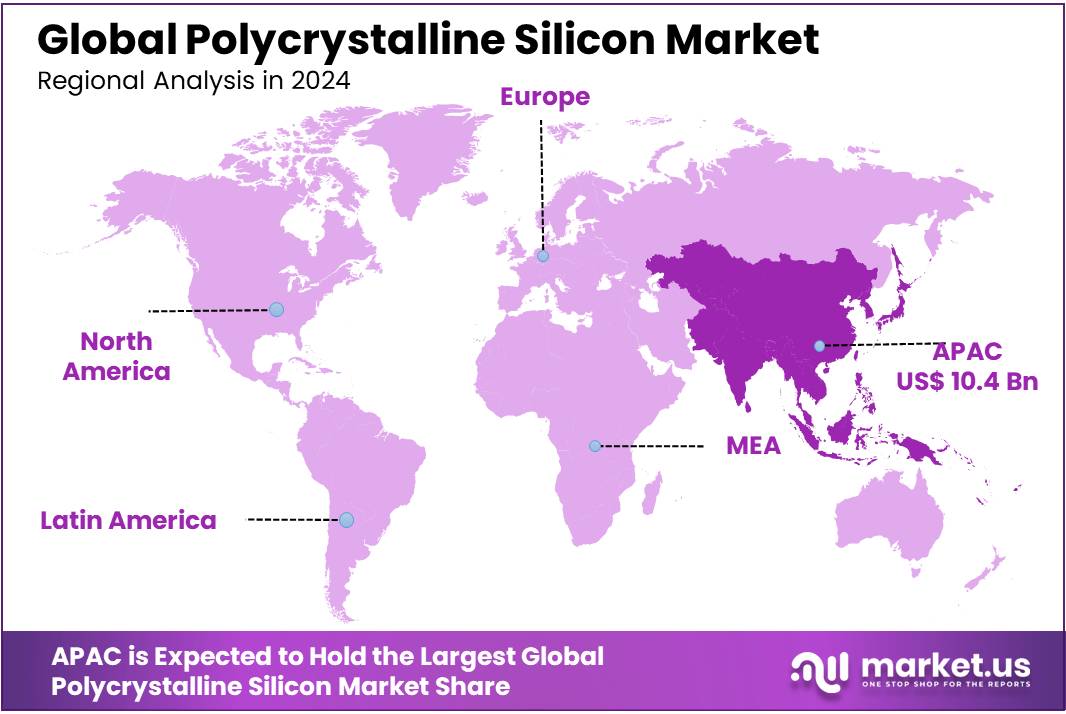

The Global Polycrystalline Silicon Market size is expected to be worth around USD 95.5 Bn by 2033, from USD 24.01 Bn in 2023, growing at a CAGR of 14.8% during the forecast period from 2024 to 2033. In 2023, the Asia Pacific (APAC) region dominated the global polycrystalline silicon market, accounting for 43.5% of the market share, valued at approximately USD 10.4 billion.

Polycrystalline Silicon (Poly-Si) refers to a material made up of small silicon crystals, typically used in the production of solar cells and semiconductors. Polycrystalline silicon is formed by melting high-purity silicon, and as the silicon cools, it crystallizes into multiple smaller crystals, unlike monocrystalline silicon, which consists of a single crystal.

In 2023, global production of polycrystalline silicon reached approximately 550,000 metric tons, with China maintaining its position as the dominant producer, accounting for over 75% of the global supply. The solar photovoltaic (PV) sector remains the largest consumer, using polycrystalline silicon in about 90% of the solar panels produced globally.

This is largely due to the increasing demand for renewable energy and the cost-effectiveness of poly-Si-based panels. Following the solar industry, the electronics sector, especially semiconductors, is the second-largest consumer of polycrystalline silicon, as it is used in manufacturing electronic components and devices.

The market is also influenced by various government regulations and initiatives aimed at promoting the use of renewable energy. The Chinese government’s 14th Five-Year Plan (2021-2025) includes a commitment of USD 15 billion in subsidies for solar energy development, which directly impacts the demand for poly-Si.

Similarly, the European Union’s Green Deal sets a target to produce 40 GW of solar power by 2030, encouraging the increased production and consumption of polycrystalline silicon. These regulatory frameworks support both production and consumption, propelling growth in the solar energy market.

In terms of trade, the global imports of polycrystalline silicon were valued at USD 2.8 billion in 2023. The U.S. and Germany were the largest importers, reflecting strong demand for solar panels and electronic components in these regions. On the other hand, China, Japan, and South Korea are major exporters of polycrystalline silicon, with China leading exports at a value of USD 4.5 billion. This trade dynamic further highlights China’s key role in the global poly-Si market.

Private sector investments are also contributing to the growth of polycrystalline silicon production capacity. Trina Solar, a leading global solar panel manufacturer, invested USD 1.2 billion in expanding its polycrystalline silicon production facilities in 2023.

Key Takeaways

- Polycrystalline Silicon Market size is expected to be worth around USD 95.5 Bn by 2033, from USD 24.01 Bn in 2023, growing at a CAGR of 14.8%.

- Solar Grade held a dominant market position, capturing more than a 73.4% share.

- Solar Photovoltaics held a dominant market position, capturing more than a 58.2% share.

- Siemens Process held a dominant market position, capturing more than a 41.2% share.

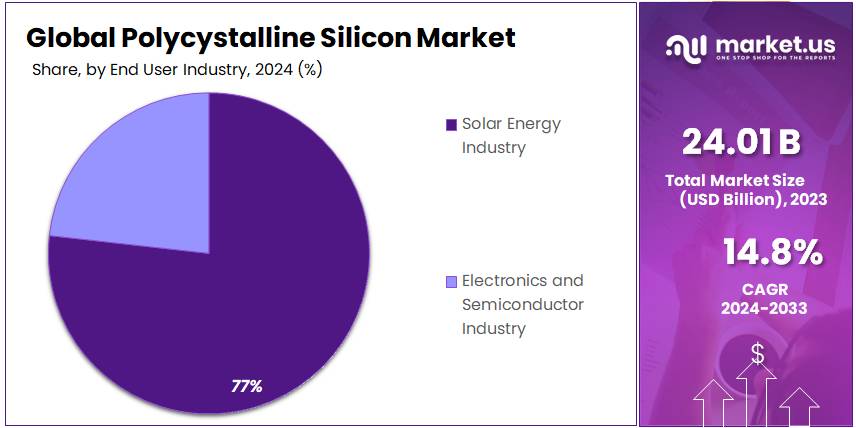

- Solar Energy Industry held a dominant market position, capturing more than a 76.1% share.

- Direct Sales held a dominant market position, capturing more than a 67.1% share of the global polycrystalline silicon market.

- Asia Pacific (APAC) region dominated the global polycrystalline silicon market, accounting for 43.5% of the market share, valued at approximately USD 10.4 billion.

By Purity Level

In 2023, Solar Grade held a dominant market position, capturing more than a 73.4% share of the global polycrystalline silicon market. This segment’s growth is driven by the increasing demand for solar energy. Solar Grade polycrystalline silicon is used to manufacture solar panels, which are a key component of the renewable energy sector. As solar energy adoption continues to rise, particularly in emerging markets, the demand for Solar Grade polycrystalline silicon is expected to remain strong.

On the other hand, Electronic Grade polycrystalline silicon, which is used in semiconductor applications, accounted for a smaller portion of the market. However, this segment is poised for steady growth as demand for electronics and advanced technologies like electric vehicles and IoT devices increases. Both segments are crucial for the ongoing transition toward cleaner energy and technological advancements.

By Application

In 2023, Solar Photovoltaics held a dominant market position, capturing more than a 58.2% share of the global polycrystalline silicon market. The growth of this segment is primarily driven by the increasing adoption of solar energy.

Solar Photovoltaics use polycrystalline silicon to convert sunlight into electricity, making it a key technology in the global shift towards renewable energy. With governments and businesses focusing on clean energy solutions, the demand for polycrystalline silicon in solar photovoltaics is expected to continue growing.

Monocrystalline Solar Panels, known for their higher efficiency, also represent a significant market segment. While they hold a smaller share compared to Solar Photovoltaics, the demand for monocrystalline panels is increasing due to their superior performance and energy output. As more consumers and businesses seek higher efficiency in their solar panel investments, this segment is expected to grow at a steady rate.

Multicrystalline Solar Panels, which offer a cost-effective alternative to monocrystalline panels, remain popular in price-sensitive markets. Though they have lower efficiency, they are still widely used in large-scale solar installations where cost is a key consideration.

The Electronics segment, which includes applications in semiconductors and microelectronics, holds a smaller but important share of the polycrystalline silicon market. As the demand for advanced electronics and technologies like electric vehicles and smart devices rises, this segment is anticipated to experience steady growth. Polycrystalline silicon is essential for the production of high-performance electronic components, ensuring a stable outlook for the segment.

By Manufacturing Technology

In 2023, Siemens Process held a dominant market position, capturing more than a 41.2% share of the global polycrystalline silicon market. This technology is widely used due to its high purity and efficiency in producing electronic-grade and solar-grade polycrystalline silicon.

The Siemens Process remains the preferred choice for large-scale production, particularly for the solar energy and electronics industries. As demand for solar panels and semiconductors continues to rise, this manufacturing method is expected to maintain its strong market presence.

The Upgraded Metallurgical Grade (UMG) Process, which offers a more cost-effective alternative, is gaining traction. This process is primarily used to produce solar-grade polycrystalline silicon, and while it is less expensive, it typically requires further purification steps to meet the high standards needed for solar photovoltaics. As the cost pressures in the solar market grow, the UMG process is expected to see increased adoption, particularly in price-sensitive regions.

The Fluidized Bed Reactor (FBR) Process is a newer, innovative manufacturing method that focuses on reducing costs and improving efficiency. Though it currently holds a smaller share of the market, its potential for scalability and lower production costs makes it an attractive option for future growth. The FBR process is expected to become more relevant as demand for polycrystalline silicon rises, especially in the renewable energy sector.

By End User Industry

In 2023, the Solar Energy Industry held a dominant market position, capturing more than a 76.1% share of the global polycrystalline silicon market. The strong growth in this segment is driven by the rapid expansion of renewable energy projects worldwide.

Polycrystalline silicon is a key material used in the production of solar panels, and as more countries and businesses focus on clean energy, the demand for polycrystalline silicon in the solar energy sector is expected to continue to rise. The shift towards sustainable energy sources is a major factor fueling this growth.

The Electronics and Semiconductor Industry represents another significant segment of the polycrystalline silicon market, though it holds a smaller share compared to the solar energy sector. Polycrystalline silicon is used in semiconductors and other electronic components, which are critical for the production of consumer electronics, automotive technology, and industrial machinery.

As technology advances and the demand for more electronic devices increases, the need for high-quality polycrystalline silicon in the electronics and semiconductor industry is expected to grow steadily.

By Distribution Channel

In 2023, Direct Sales held a dominant market position, capturing more than a 67.1% share of the global polycrystalline silicon market. Direct sales offer manufacturers and suppliers the ability to establish closer relationships with their customers, providing more personalized service and direct access to product specifications.

This model is especially important in industries like solar energy and electronics, where customers often require tailored solutions and consistent quality. As demand for polycrystalline silicon in these sectors continues to grow, direct sales are expected to remain the preferred distribution method.

Indirect Sales, though accounting for a smaller market share, are also crucial in expanding the reach of polycrystalline silicon to various regions and customer segments. This distribution method includes wholesalers, distributors, and resellers who act as intermediaries between manufacturers and end customers.

Indirect sales allow for broader market penetration and ease of access to smaller or geographically distant buyers. As global demand increases, especially in emerging markets, the role of indirect sales is expected to grow, supporting the expansion of polycrystalline silicon into new markets and industries.

Key Market Segments

By Purity Level

- Electronic Grade

- Solar Grade

By Application

- Solar Photovoltaics

- Monocrystalline Solar Panel

- Multicrystalline Solar Panel

- Electronics

By Manufacturing Technology

- Siemens Process

- Upgraded Metallurgical Grade (UMG) Process

- Fluidized Bed Reactor (FBR) Process

By End User Industry

- Solar Energy Industry

- Electronics and Semiconductor Industry

By Distribution Channel

- Direct Sales

- Indirect Sales

Drivers

Increasing Adoption of Solar Energy

One of the major driving factors for the polycrystalline silicon market is the increasing global adoption of solar energy. As countries and organizations prioritize renewable energy, the demand for solar photovoltaic (PV) systems has surged, driving the need for polycrystalline silicon. Polycrystalline silicon is a key material used in manufacturing solar panels, and it plays a vital role in the transition toward sustainable energy solutions.

According to the International Renewable Energy Agency (IRENA), global solar PV capacity reached 1,093 GW by the end of 2022, growing from just 2.6 GW in 2000. In 2022 alone, over 180 GW of new solar capacity was added worldwide. This growth is largely attributed to government incentives and policies that promote solar energy as a viable alternative to fossil fuels.

For example, the United States’ Inflation Reduction Act (IRA), signed into law in 2022, includes $369 billion in energy security and climate change investments, with significant portions allocated for solar energy development. This has driven an acceleration in solar installations across both residential and commercial sectors.

Furthermore, the European Union has set ambitious renewable energy goals, aiming for a 40% share of renewable energy in its total energy consumption by 2030. This push is expected to significantly increase the demand for solar technologies and, consequently, polycrystalline silicon.

As the adoption of solar power continues to rise, the polycrystalline silicon market is expected to expand, with projections showing that the demand for solar panels will grow at a compound annual growth rate (CAGR) of 20% or more over the next decade.

Technological Advancements in Solar Panels

Technological improvements in solar panel efficiency and manufacturing processes are another key factor driving the demand for polycrystalline silicon. Advances in material science, such as innovations in polycrystalline silicon production techniques, have led to more cost-effective and efficient solar panels, making solar energy more accessible and economically viable.

In 2023, the average efficiency of polycrystalline silicon-based solar panels increased by approximately 2% over the past five years. Manufacturers are now producing panels that can achieve efficiency levels of 18% to 22% with polycrystalline silicon, compared to earlier models that were less efficient.

This increase in efficiency has made solar energy more attractive to consumers, businesses, and governments alike. In addition, the reduction in production costs, driven by better technology and larger-scale manufacturing, has also made solar panels more affordable.

Leading manufacturers such as First Solar and Canadian Solar have invested heavily in R&D to enhance the performance of solar panels. For instance, First Solar’s innovative Series 6 panels, which use cadmium telluride (CdTe) thin film technology, are highly efficient and cost-effective.

Meanwhile, manufacturers using polycrystalline silicon have made strides in improving their products, such as SunPower’s Maxeon solar cells, which use advanced materials for higher energy output. These improvements in technology contribute to the increased demand for polycrystalline silicon, which is crucial for producing the high-performance solar panels needed to meet global energy goals.

Government Policies and Incentives

Government policies and incentives play a critical role in boosting the demand for polycrystalline silicon, particularly in the solar energy sector. Many governments around the world have implemented renewable energy targets, subsidies, and tax incentives aimed at accelerating the transition to clean energy sources.

For example, in 2023, the U.S. Department of Energy’s Solar Energy Technologies Office (SETO) announced $15 million in funding to advance next-generation solar technologies, including those that improve polycrystalline silicon efficiency. The SETO’s funding supports the development of solar technologies that can lower costs, increase performance, and enhance the sustainability of solar energy.

Restraints

Fluctuating Raw Material Costs

A major restraining factor for the polycrystalline silicon market is the fluctuation in raw material costs. Polycrystalline silicon is produced from silicon metal, and price volatility in the cost of this raw material significantly impacts the overall production cost of polycrystalline silicon.

The cost of silicon metal has been subject to market dynamics, including supply chain disruptions, rising energy prices, and demand from various industries such as electronics, automotive, and construction.

For example, the price of silicon metal, a key raw material in the production of polycrystalline silicon, saw a sharp increase in 2021. According to data from the World Bank, silicon metal prices surged by more than 30% in 2021, reaching a peak of approximately $3,500 per metric ton.

Impact on Solar Energy Costs

Fluctuating raw material prices have a direct effect on the cost of solar panels, as polycrystalline silicon is a critical component in the manufacturing process. The rising cost of polycrystalline silicon affects the overall price of solar panels, making them more expensive for consumers. This price increase can dampen the growth of the solar energy sector, particularly in regions with limited subsidies or financial support for renewable energy projects.

For example, in 2022, the average cost of solar panels increased by 18% due to the rising prices of raw materials, including polycrystalline silicon. The Solar Energy Industries Association (SEIA) reported that supply chain disruptions and material price hikes led to delays in solar installations and raised costs for consumers. This impact is especially pronounced in markets that rely heavily on cost-effective solar energy solutions, such as developing countries where cost sensitivity is a key factor in the adoption of renewable energy.

Government initiatives aimed at promoting solar energy, such as tax incentives, subsidies, and renewable energy targets, help mitigate some of the effects of rising production costs. For example, in the U.S., the Inflation Reduction Act (IRA) introduced in 2022 allocates $369 billion for clean energy, including substantial funding for solar energy projects. While such initiatives can offset price increases, the rising cost of raw materials like silicon metal continues to pose a challenge to the affordability of solar panels.

Supply Chain Challenges

In addition to raw material cost fluctuations, the polycrystalline silicon market is also affected by ongoing supply chain disruptions. The COVID-19 pandemic and subsequent global logistics challenges have led to delays in the delivery of silicon metal and other materials needed for polycrystalline silicon production. These disruptions have caused manufacturing delays, reducing the supply of polycrystalline silicon in the market and increasing competition for available resources.

According to the Semiconductor Industry Association (SIA), the global semiconductor market faced a shortfall of more than 3 million units in 2021, which led to increased competition for silicon-based components. This shortage further exacerbated supply chain challenges for polycrystalline silicon manufacturers, delaying production schedules and increasing costs.

Opportunity

Rising Global Demand for Renewable Energy

A significant growth opportunity for the polycrystalline silicon market lies in the rising global demand for renewable energy, particularly solar power. Governments worldwide are setting ambitious renewable energy targets, which are driving large-scale investments in solar energy infrastructure. Polycrystalline silicon, a key material in solar panel production, stands to benefit from this growing trend. Solar photovoltaics (PV) are a core technology in the shift toward cleaner, more sustainable energy sources, and as a result, the demand for polycrystalline silicon is expected to increase substantially.

According to the International Renewable Energy Agency (IRENA), global solar PV capacity reached 1,093 GW in 2022, an increase of over 20% from the previous year. The global solar market is expected to grow by 30% annually, with more than 500 GW of new solar capacity projected to be installed globally by 2025. In 2022 alone, over 180 GW of new solar capacity was added, and this figure is expected to rise in the coming years. Countries like China, India, the United States, and the European Union are driving this growth through strong government policies and incentives, including subsidies for solar energy projects, tax incentives, and renewable energy mandates.

For example, the European Union’s “Fit for 55” initiative, introduced in 2021, aims to reduce greenhouse gas emissions by 55% by 2030 and includes a strong emphasis on renewable energy adoption. This policy aims for renewable energy to make up 40% of the EU’s total energy mix by 2030, which will drive massive investments in solar power and, consequently, increase the demand for polycrystalline silicon.

Government Incentives and Policies for Solar Energy

Government policies and incentives also present a significant growth opportunity for the polycrystalline silicon market. Governments across the globe are actively promoting solar energy to combat climate change and reduce reliance on fossil fuels. This has led to increased demand for polycrystalline silicon, which is used in the production of solar panels.

In the United States, the Inflation Reduction Act (IRA) signed into law in 2022, allocated approximately $369 billion in energy and climate investments. This includes tax credits and subsidies for solar energy projects, which will likely boost the demand for solar panels and, in turn, the need for polycrystalline silicon. The U.S. government aims to install 30 GW of solar energy capacity annually by 2030, and the growing support for solar energy adoption is expected to have a positive effect on the polycrystalline silicon market.

Similarly, China, the world’s largest solar energy producer, has set ambitious goals to achieve carbon neutrality by 2060. The Chinese government has been investing heavily in renewable energy technologies, with solar energy being a primary focus.

In 2022, China added more than 50 GW of new solar PV capacity, and it is projected to continue expanding its solar energy infrastructure rapidly. This government-backed push for solar power presents a significant growth opportunity for polycrystalline silicon manufacturers as they seek to meet the increased demand for solar panels.

Technological Advancements and Efficiency Improvements

Technological advancements in the production of polycrystalline silicon and solar panels offer another growth opportunity. As the efficiency of solar panels improves and the cost of production decreases, the demand for polycrystalline silicon is likely to increase. Innovations such as bifacial solar panels, which capture sunlight on both sides of the panel, and improvements in the efficiency of polycrystalline silicon itself, make solar power an even more attractive energy source.

According to the U.S. Department of Energy, solar panel efficiencies have steadily increased over the years. The average efficiency of silicon-based solar cells has risen from 15-17% in the early 2000s to over 20% in 2022. This continuous improvement in solar panel efficiency reduces the cost per watt of energy produced and makes solar energy more competitive with traditional energy sources, which in turn drives demand for polycrystalline silicon.

Trends

Increased Efficiency in Solar Panels

One of the latest trends driving the polycrystalline silicon market is the continuous improvement in the efficiency of solar panels. As technology advances, polycrystalline silicon-based solar panels are becoming more efficient, enabling higher energy output and better performance.

This trend is driven by innovations in solar panel manufacturing techniques, such as improvements in silicon purity and the development of new cell structures. As the efficiency of solar panels increases, polycrystalline silicon is being utilized in more high-performance solar installations, both residential and commercial.

According to data from the International Energy Agency (IEA), global solar capacity is projected to increase by 30% annually, reaching over 1,500 GW by 2025. In parallel, solar panel efficiency has improved significantly over the years.

For example, in 2022, the efficiency of polycrystalline silicon solar panels reached approximately 18% to 20%, compared to around 15% in the early 2000s. As manufacturers focus on improving the performance of their solar products, polycrystalline silicon remains a key material, contributing to better energy conversion rates and lower costs per watt of solar energy.

In addition to advancements in efficiency, companies are focusing on reducing the overall cost of solar power through improved manufacturing processes. For example, the cost of solar PV modules has decreased by 89% from 2010 to 2020, making solar energy more affordable for consumers worldwide.

Integration of Advanced Manufacturing Technologies

Another trend shaping the polycrystalline silicon market is the integration of advanced manufacturing technologies aimed at reducing production costs and improving quality. New manufacturing methods, such as the Fluidized Bed Reactor (FBR) and upgraded metallurgical grade (UMG) processes, are helping reduce the cost of producing polycrystalline silicon.

The development of more efficient production processes is particularly important as the solar energy industry strives to scale up production to meet global demand. For instance, China, the world’s largest producer of polycrystalline silicon, is implementing the FBR process in some of its plants.

This process allows for the production of high-purity polycrystalline silicon at a much lower cost compared to traditional methods. By reducing the energy consumption and raw material waste, the FBR process is expected to significantly lower the overall production costs of polycrystalline silicon, making solar panels more accessible to a wider range of consumers.

Additionally, ongoing improvements in automation, artificial intelligence (AI), and machine learning are also enhancing the manufacturing efficiency of polycrystalline silicon. These technologies help optimize production lines, improve quality control, and reduce labor costs, which further contribute to cost reductions in the solar panel industry.

Growing Investments in Solar Infrastructure

Investments in solar infrastructure are at an all-time high, further fueling the demand for polycrystalline silicon. Governments around the world are committing to aggressive renewable energy goals, and private companies are also increasing their investment in solar energy technologies.

For instance, in the United States, the Inflation Reduction Act (IRA) passed in 2022, allocates $369 billion to energy security and clean energy investments, with a significant portion directed toward renewable energy, including solar. The funding is expected to accelerate the development and deployment of solar energy projects, increasing the demand for polycrystalline silicon.

The European Union is also prioritizing solar energy. Under its “Green Deal” and “Fit for 55” initiative, the EU aims to achieve a 40% share of renewable energy in its total energy mix by 2030, with solar energy being a major contributor.

The EU’s focus on expanding solar capacity, combined with similar efforts from other regions, is expected to drive up the demand for solar panels and, by extension, polycrystalline silicon. According to the European Commission, the EU plans to install 320 GW of additional solar capacity by 2030, further boosting demand for materials like polycrystalline silicon.

Regional Analysis

In 2023, the Asia Pacific (APAC) region dominated the global polycrystalline silicon market, accounting for 43.5% of the market share, valued at approximately USD 10.4 billion. The dominance of APAC is driven by strong solar energy investments, particularly in countries like China, India, and Japan, which are among the largest producers and consumers of polycrystalline silicon.

China, the world’s leading producer of solar panels, significantly influences the global demand for polycrystalline silicon. The country’s ambitious renewable energy targets, which aim to install 1,200 GW of solar power capacity by 2030, directly contribute to this high demand. Additionally, India’s focus on increasing its solar capacity to 500 GW by 2030 adds to the growth potential in the region.

In North America, the polycrystalline silicon market is also expanding, driven by increasing solar energy adoption and government initiatives. The United States has introduced policies like the Inflation Reduction Act (2022), which allocates significant funding for solar energy projects, spurring demand for polycrystalline silicon. In 2022, North America’s share of the global market was estimated at around 18%, with a growing trend toward green energy initiatives in both residential and commercial sectors.

Europe, with its emphasis on renewable energy through initiatives like the European Green Deal, accounted for around 15% of the market in 2023. The European Union’s aggressive solar energy targets, aiming for 40% renewable energy by 2030, also support the region’s growth in polycrystalline silicon demand.

The Middle East & Africa and Latin America are smaller markets but are expected to grow steadily, with increasing investments in solar energy projects, particularly in regions with abundant sunlight like the Middle East and parts of Latin America.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The polycrystalline silicon market is highly competitive, with key players across the globe focused on improving production capabilities, expanding market reach, and advancing technology to meet growing demand, particularly from the solar energy sector.

Asia Silicon, a leading producer of polycrystalline silicon, has maintained a significant presence in the Asia Pacific region, contributing to the region’s dominance in the market. Similarly, China-based GCL-TECH and Tongwei Group Co., Ltd. are major players, capitalizing on the country’s rapid expansion in solar energy production. Tongwei Group, for instance, is recognized as one of the largest solar cell manufacturers globally, which strengthens its demand for polycrystalline silicon.

Other major players include Hanwha Chemical Co. Ltd., a key manufacturer of high-purity silicon, and Hemlock Semiconductor Corporation, which is a prominent supplier of polysilicon products to the global semiconductor and solar industries.

Wacker Chemie AG, a German multinational, continues to be a strong player, known for its advanced silicon production technologies. OCI Company Ltd. and Mitsubishi Materials Corporation are also vital contributors, with strong operations in Asia, particularly in the production of electronic-grade and solar-grade polycrystalline silicon.

Emerging companies like Qatar Solar Technologies and REC Silicon ASA are expanding their portfolios in response to the global shift toward renewable energy. These companies are leveraging government incentives and regional growth in solar energy installations to increase their market share.

With technological advancements and expanding manufacturing capacities, these key players are expected to remain critical in driving the market forward, especially in fast-growing regions like Asia and North America.

Top Key Players in the Market

- Asia Silicon

- CSG Holdings Co. Ltd.

- Dago New Energy Co. Ltd

- GCL-TECH

- Hanwha Chemical Co. Ltd

- Hemlock Semiconductor Corporation

- High-Purity Silicon America Corporation

- Mitsubishi Materials Corporation

- OCI COMPANY Ltd.

- Osaka Titanium Technologies Co. Ltd.

- Qatar Solar Technologies

- REC Silicon ASA

- Sichuan Yongxiang Co. Ltd (Tongwei)

- TBEA Co. Ltd

- Tokuyama Corporation

- Tongwei Group Co., Ltd

- Wacker Chemie AG

- Xinte Energy Co., Ltd.

Recent Developments

In 2024, Asia Silicon is projected to expand its capacity to 80,000 metric tons as part of its strategy to meet the rising global demand for renewable energy.

In 2024, CSG Holdings plans to expand its production capacity to 50,000 metric tons in response to increasing demand for solar-grade silicon.

Report Scope

Report Features Description Market Value (2023) USD 24.0 Bn Forecast Revenue (2033) USD 95.5 Bn CAGR (2024-2033) 14.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity Level (Electronic Grade, Solar Grade), By Application (Solar Photovoltaics, Monocrystalline Solar Panel, Multicrystalline Solar Panel, Electronics), By Manufacturing Technology (Siemens Process, Upgraded Metallurgical Grade (UMG) Process, Fluidized Bed Reactor (FBR) Process), By End User Industry (Solar Energy Industry, Electronics and Semiconductor Industry), By Distribution Channel (Direct Sales, Indirect Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Asia Silicon, CSG Holdings Co. Ltd., Dago New Energy Co. Ltd, GCL-TECH, Hanwha Chemical Co. Ltd, Hemlock Semiconductor Corporation, High-Purity Silicon America Corporation, Mitsubishi Materials Corporation, OCI COMPANY Ltd., Osaka Titanium Technologies Co. Ltd., Qatar Solar Technologies, REC Silicon ASA, Sichuan Yongxiang Co. Ltd (Tongwei), TBEA Co. Ltd, Tokuyama Corporation, Tongwei Group Co., Ltd, Wacker Chemie AG, Xinte Energy Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polycrystalline Silicon MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Polycrystalline Silicon MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Asia Silicon

- CSG Holdings Co. Ltd.

- Dago New Energy Co. Ltd

- GCL-TECH

- Hanwha Chemical Co. Ltd

- Hemlock Semiconductor Corporation

- High-Purity Silicon America Corporation

- Mitsubishi Materials Corporation

- OCI COMPANY Ltd.

- Osaka Titanium Technologies Co. Ltd.

- Qatar Solar Technologies

- REC Silicon ASA

- Sichuan Yongxiang Co. Ltd (Tongwei)

- TBEA Co. Ltd

- Tokuyama Corporation

- Tongwei Group Co., Ltd

- Wacker Chemie AG

- Xinte Energy Co., Ltd.