Global Cell Counting Market By Product (Instruments, Consumables, and Accessories), By Application (Research, Industrial, Clinical, and Diagnostic), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 99879

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

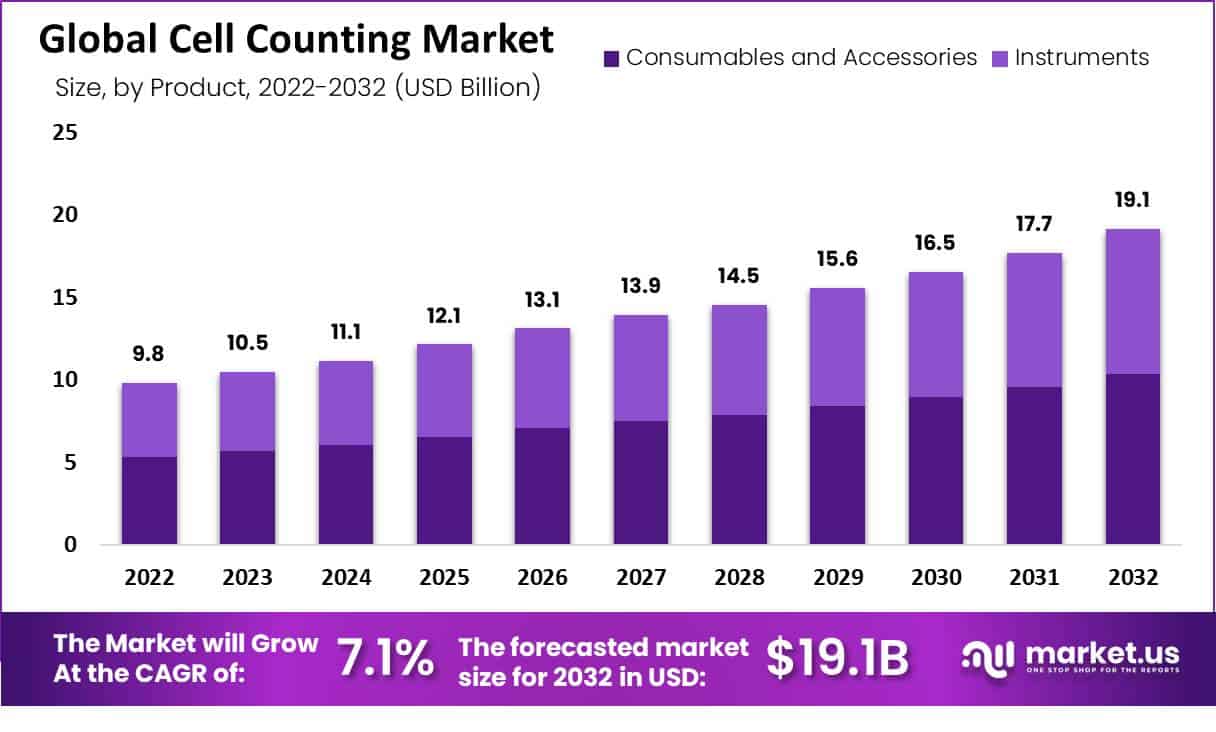

The global Cell Counting Market is valued at USD 9.8 Billion in 2022 and is expected to reach USD 19.1 Billion in 2032, with a CAGR of 7.1% from 2022 to 2032.

Cell counting is any of several techniques for the counting and similar qualifications of cells in the life sciences, including medical identification and treatment. Various processes in medicine and biology are required for the counting of cells. Cell counting used in monitoring cell health and production rate considering immortalization, transfection, and infection transformation of cells for following experiments and preparing for cell-based assays’ increasing requirement for biologics in treating chronic diseases is one of the factors contributing to the market growth.

Cell counting devices are gradually being accepted in various areas such as immunology and biology neuroscience cancer, which show lucrative growth opportunities for the market. Cell counting helps in circulating tumor identification and resolution of primary tumors and metastatic tumors, which are dangerous for disease monitoring and therapeutic targeting.

Key Takeaways

- The cell counting market is projected to reach over USD 19.1 billion by 2032.

- Focus on Point-of-Care Testing is a growing trend in the market.

- In 2022, the market was estimated at USD 9.8 billion.

- The market is expected to grow at a CAGR of 7.1% from 2022 to 2032.

- Cell counting is essential in applications like infectious disease diagnosis, neonatal care, and remote healthcare settings.

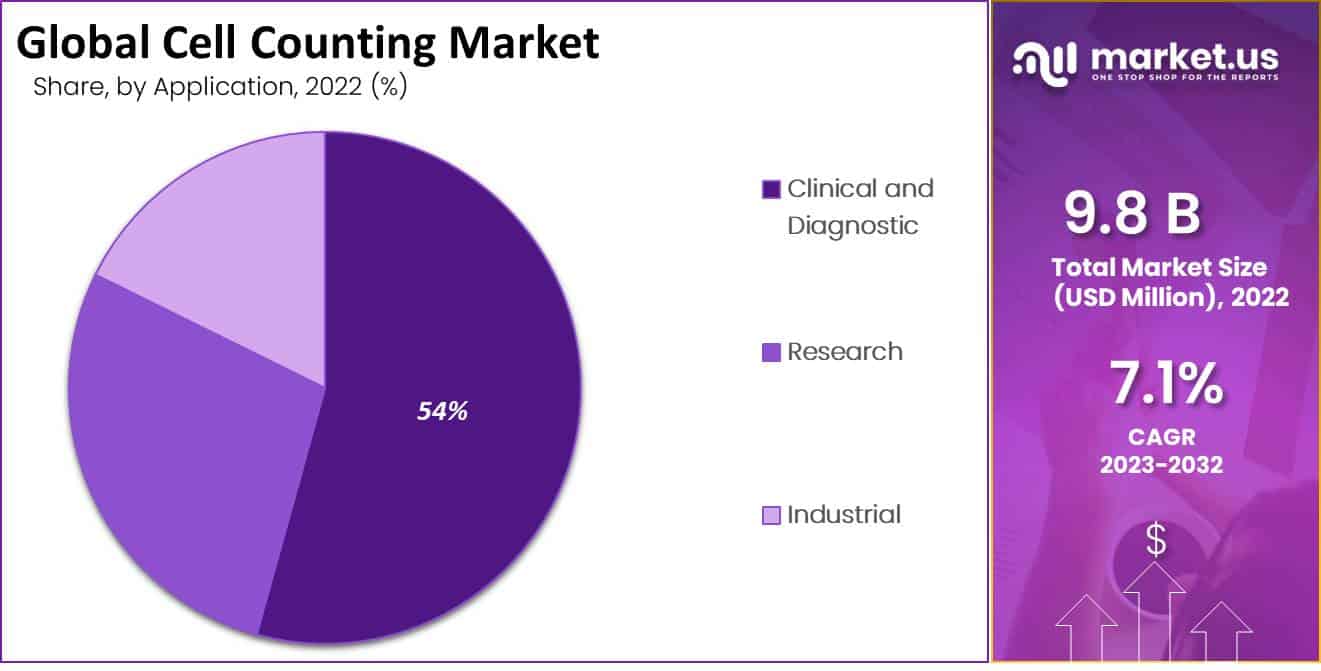

- Consumables and accessories accounted for 54% of revenue in 2022.

- Clinical and diagnostics is the dominant application segment.

- Hospitals and diagnostic laboratories are the largest end-users of cell counting technology.

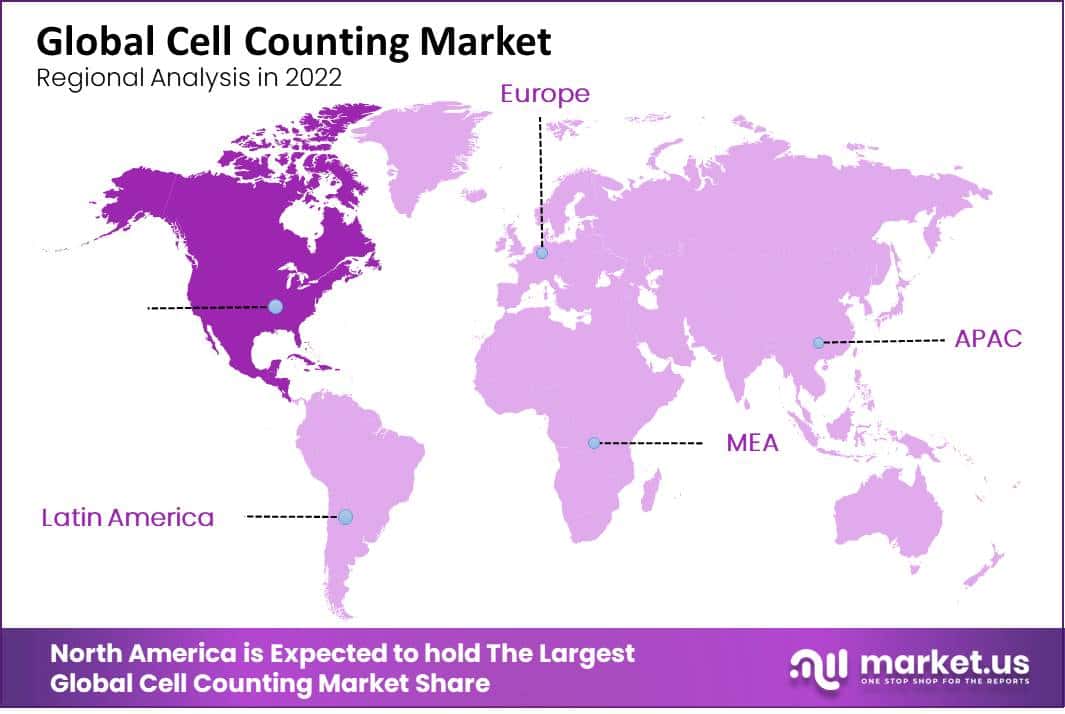

- In 2022, North America had the highest revenue share at 35%.

- Europe held a revenue share of 25% in 2022.

- Cell counting equipment is increasingly used in areas like immunology, biology neuroscience, and cancer research.

- Factors affecting market growth include technological developments, government investments, and the prevalence of infectious diseases.

- The market is driven by research activities and cell-based research, including stem cell therapies.

- Key players in the market include Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer.

Product Analysis

Consumables and Accessories Segment to Witness Significant Growth

Based on product, the global cell counting market is segmented into instruments, consumables, and accessories. Consumables and accessories used with this device include media, sera, reagents, assay kits, microplate accessories, and other consumables. The consumables and accessories segment accounted for the largest market share at 54%. During the forecast period, due to their high usage of volume. However, the launch of new products drives segment growth. For example, In December eNuvio propelled a 3D cell culture microplate that is reusable.

This new plate allows scientists to develop embryoid bodies, the initial stage for growing larger organoids or spheroids from stem cells. Media, sera, and reagents are part of cell culture and have applications in biopharmaceuticals, cancer research, and regenerative medicine development. The reagents segment held the largest revenue share during the forecast period. The spectrophotometers segment will have a leading share in the global market. The spectrophotometry process in cell counting has become an approved choice to identify cell concentration, causing an increase in the demand for spectrophotometers.

Application Analysis

The clinical and Diagnostics Segment Dominates the Market Growth During the Forecast Period

Based on application, the global cell counting market is divided into industrial, research, clinical, and diagnostic. The Clinical and diagnostic segment registers the highest market share of 54.3% during the forecast period. This exponential segment growth can be recognized by the extensive and growing applications of cell counting in clinical diagnostics.

For example, cell counting products are extensively used in cancer research to determine intra-tumor heterogeneity, estimate cancer progression, and others. The stem cell research segment is expected to expand at the highest CAGR during the forecast period.

The exponential growth results from the increasing need for mass production of human stem cells for research applications. In addition, stem cells are highly imperative in cancer therapy, regenerative medicines, and transplantation.

End-User Analysis

The Hospitals and Diagnostic Laboratories Segment to Significant the Market

Based on end-user, the global cell counting market is divided into hospitals and diagnostic laboratories, research institutes, and pharmaceutical and biotechnology companies. The Hospitals and diagnostic laboratories segment dominates the market share growth due to the considerate number of patients visiting these facilities with different health conditions.

On the other hand, the pharmaceutical and biotechnology companies segment is expected to grow exponentially during the forecast period. Cell counting is a significant characteristic of examining the strength of any biological product. These devices determine the number of cells in a particular culture solution. Which further added to the bioreactors to achieve the anticipated products.

Key Market Segments

By Product

- Instruments

- Spectrophotometers

- Hematology Analyzers

- Cell Counters

- Flow Cytometers

- Microscopes

- Consumables and Accessories

- Media, Sera, and Reagents

- Assay Kits

- Microplates

- Accessories

- Other Consumables

By Application

- Research

- Cancer

- Immunology

- Neurology

- Stem Cell

- Other Research

- Industrial

- Clinical and Diagnostic

By End-User

- Hospitals & Diagnostic Laboratories

- Research Institutes

- Pharmaceutical & Biotechnology Companies

Drivers

The Significant Factors Driving the Growth of the Market Due to Increasing Incidence of Cancer and AIDS

Factors increasing the cell counting market boost cell counting in diagnosing and treating life-threatening diseases such as cancer and an extensive range of cell counting applications. First, the rising dominance of infectious Thus increasing cases of infectious diseases is anticipated to grow the demand in the cell counting market ultimately.

Cell counting facilities the determination of intratumor heterogeneity, an essential stage in responsible cancer development in the patient’s body. Cell counting helps determine the plasma concentration, red blood cells, platelets, and white blood cells. These vigorously promote cell counting in numerous treatments, research activities, and medical procedures, leading to a growing demand for cell counting devices and methods.

Restraints

High-Cost Technologies, Lack of Awareness, and Lack of Professionals

The growth of the global cell counting market is hindered by the high cost of complicated cell counting technologies, hematology analyzer recalls, and the absence of experienced professionals. The high price of cell counting products limits the market from growing its ultimate potential.

Opportunity

Growing the growth of cell therapies for Blood-Related Issues, Rising Government Support, and Increasing Number of Collaborations

Government procedures boost the growth of cell therapies, in which cell counting plays a dangerous part, increasing the market’s growth in the future. The cell counting market has profited from associations, research institutes, and several organizations to enhance R&D activities in the coming years.

However, the rising incidence of chronic blood-related illnesses adds to the expansion of this market. In addition, numerous microorganisms and infectious disorders destroy our immune systems, reducing T-cell counts.

Trends

Developments of Innovative Products Fuel Market Growth

Various companies in the hearing aid market are in the process of continuously developing innovative products. The importance and efficiency of cell counting equipment will lead to increased demand for these devices, which is anticipated to propel market growth over the upcoming years.

Regional Analysis

North America Region Accounted Significant Revenue Share of the Global Cell Counting Market

North America accounted for a significant cell-counting market revenue share of 35% due to the rising focus on cancer and biomedical research. The increasing dominance of chronic diseases such as blood and cardiovascular diseases is one of the main factors projected to fuel the acceptance of these devices.

Asia-Pacific is anticipated to grow exponentially during the forecast period and is attributed to the local presence of specific clinical research and biopharmaceutical companies across the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Various prominent key players in the global cell counting market concentrate on expanding through product invention and technological advancements. In addition, companies are aiming the huge potential developing regions to achieve inorganic growth. Some primary key players in the market include Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., PerkinElmer, Inc., Danaher Corporation, and others.

Market Key Players

The following are some of the major players in the global cell counting market industry

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- Bio Tek Instruments

- GE Healthcare Technologies, Inc.

- DeNovix Inc.

- Merck KGaA

- Becton Dickinson and Company

- Logos Biosystems Inc.

- Nexcelom Bioscience LLC

- Olympus Corporation

- Tecan Trading AG

- Beckman Coulter Inc.

- Sysmex Corporation

- Other Key Players

Recent Development

- March 2022– Mindray propelled the novel BC-700 Series, a revolutionary hematology analyzer series incorporating CBC and erythrocytes sedimentation rate testes.

- May 2021- PerkinElmer pronounced the development of its Cell biology capabilities by obtaining Nexcelom Bioscience. The achievement gives PerkinElmer access to Nexcelom Biosciences’ cell counting product and drives its QC/QA capacity.

- December 2020- Danaher acquired the Biopharma business of life sciences, recognized as a separate working company from Danaher’s Life Science section.

Report Scope

Report Features Description Market Value (2022) USD 9.8 Bn Forecast Revenue (2032) USD 19.1Bn CAGR (2023-2032) 7.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product- (Instruments, Consumables, and Accessories); By Application-Research, Clinical Diagnostic; By End-User-Hospitals, Diagnostic Laboratories, Research Institutes, and Pharmaceutical Biotechnology Companies Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., PerkinElmer, Inc., Danaher Corporation, Bio-Rad Laboratories, Inc., Merck KGaA, Olympus Corporation, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How much is the Global Cell Counting Market worth?Global Cell Counting Market market size is Expected to Reach USD 19.1 Bn by 2032.

What was the Market Segmentation of the Cell Counting Market?By Product- (Instruments, Consumables, and Accessories); By Application-Research, Clinical Diagnostic; By End-User-Hospitals, Diagnostic Laboratories, Research Institutes, and Pharmaceutical Biotechnology Companies

What is the CAGR of Cell Counting Market?The Cell Counting Marketis growing at a CAGR of 7.1% during the forecast period 2022 to 2032.

Who are the major players operating in the Cell Counting Market?Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., PerkinElmer, Inc., Danaher Corporation, Bio-Rad Laboratories, Inc., Merck KGaA, Olympus Corporation, and Other Key Players

Which region will lead the Global Cell Counting Market?North America is estimated to be the fastest-growing region during the forthcoming years.

-

-

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- Bio Tek Instruments

- GE Healthcare Technologies, Inc.

- DeNovix Inc.

- Merck KGaA

- Becton Dickinson and Company

- Logos Biosystems Inc.

- Nexcelom Bioscience LLC

- Olympus Corporation

- Tecan Trading AG

- Beckman Coulter Inc.

- Sysmex Corporation

- Other Key Players