Global Cell Culture Vessels Market By Product Type (Bags, Flasks, Plates, Bottles, Dishes, and Tubes), By Usage (Single-use and Reusable), By Application (Research and Diagnostics), By End-use (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, CMOs & CROs), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 2025

- Report ID: 141966

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Usage Analysis

- End Use Analysis

- Key Segments Analysis

- Growing Demand for Biologics and Biopharmaceuticals

- Market Restraints

- Market Opportunities

- Impact of macroeconomic factors / Geopolitical factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

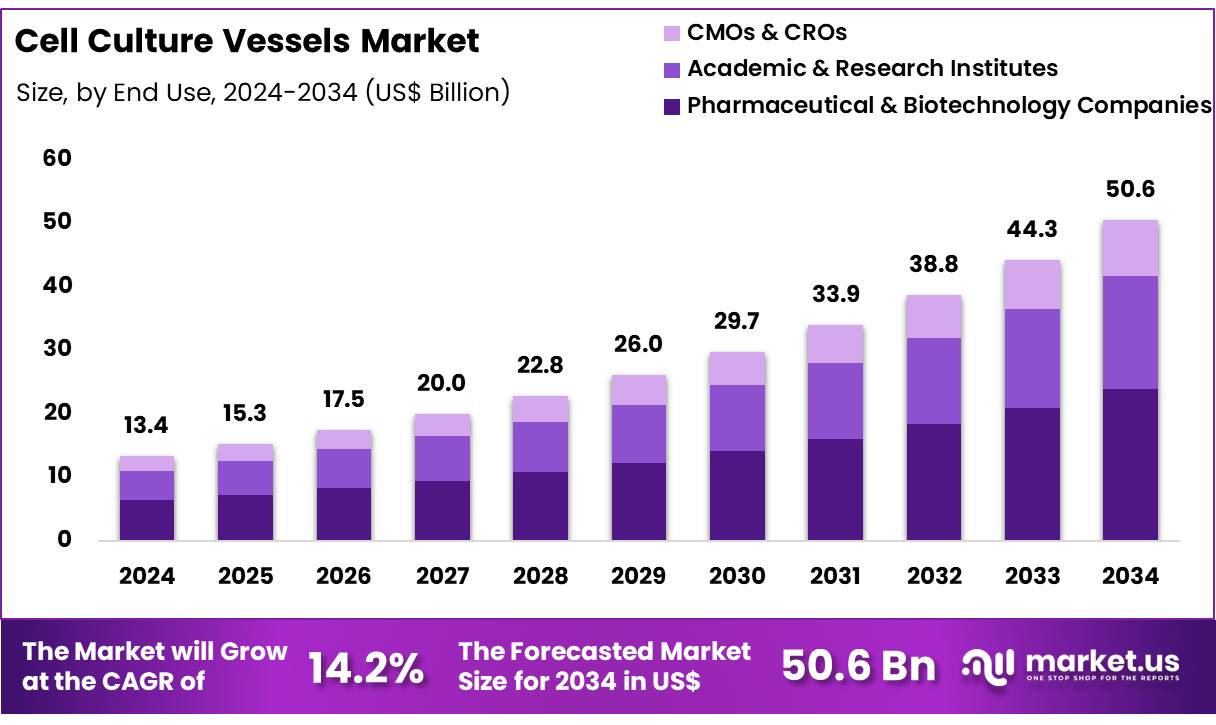

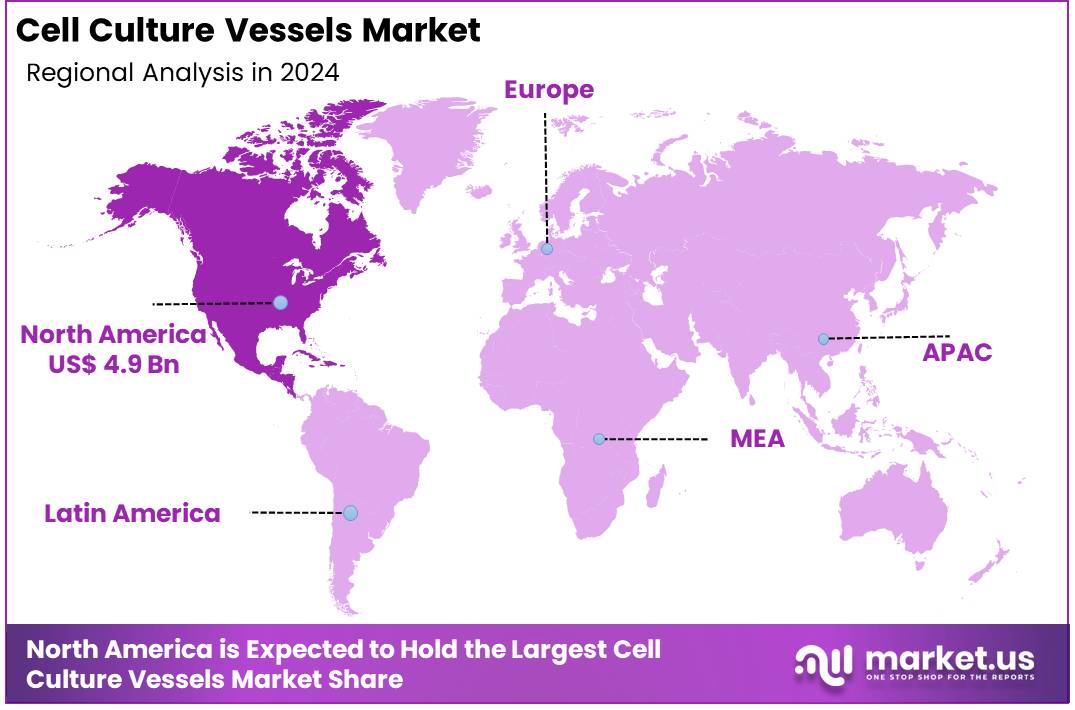

Global Cell Culture Vessels Market was valued at USD 13.4 billion in 2024 and is anticipated to register substantial growth of USD 50.6 billion by 2034, with 14.2% CAGR. In 2023, North America led the market, achieving over 37.3% share with a revenue of US$ 4.9 Billion.

The global cell culture vessels market is driven by the increasing demand for biopharmaceutical production, advancements in cell-based therapies, and the growing focus on personalized medicine. As the pharmaceutical and biotechnology industries expand, there is a rising need for efficient and scalable cell culture systems, which has fuelled the demand for various cell culture vessels, including flasks, bioreactors, and multi-well plates.

Additionally, the rise in research activities related to regenerative medicine and stem cell therapies has contributed to market growth. The adoption of advanced materials and technologies in vessel design, such as single-use and disposable vessels, further enhances productivity and reduces the risk of contamination, making them highly desirable in laboratory and industrial settings.

However, challenges like high production costs, limited awareness in developing regions, and regulatory complexities may restrain market growth. Despite these hurdles, the cell culture vessels market is expected to expand as new innovations and applications emerge in the life sciences industry.

Key Takeaways

- The cell culture vessels market was valued at USD 13.4 billion in 2024 and is anticipated to register substantial growth of USD 50.6 billion by 2034, with 14.2% CAGR.

- In 2024, the bags segment took the lead in the global market, securing 63.4% of the total revenue share.

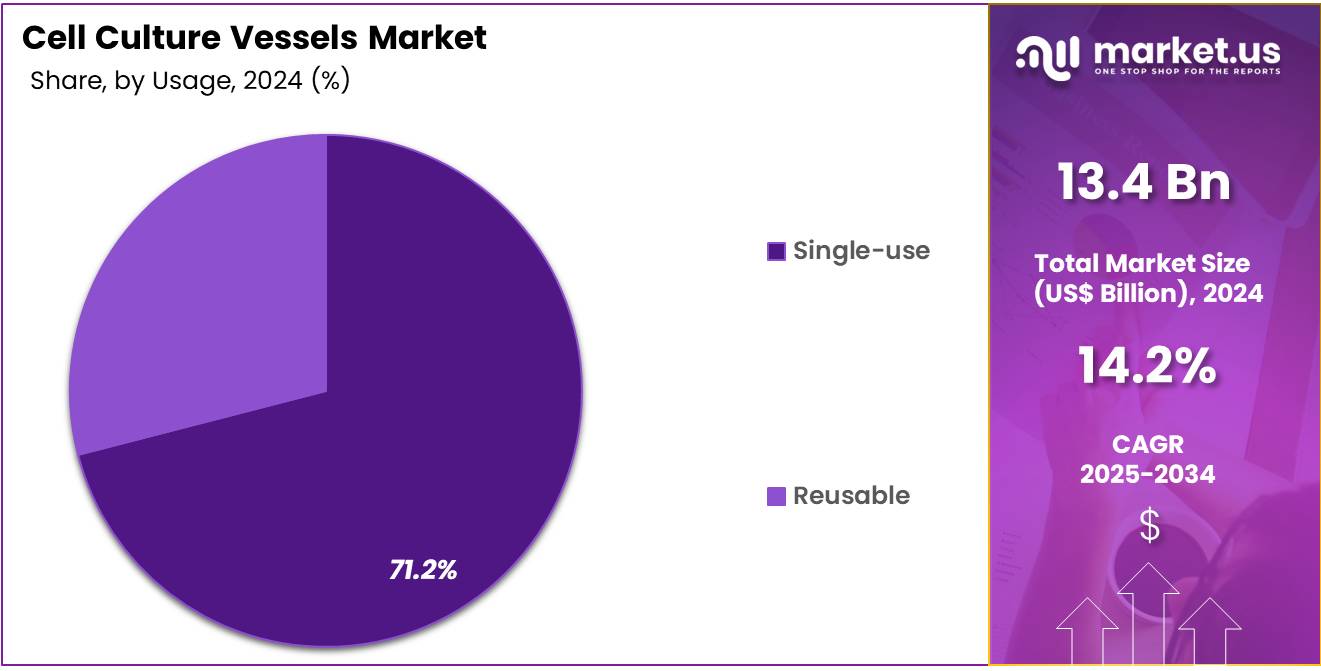

- The single-use segment took the lead in the global market, securing 44.3% of the total revenue share.

- The pharmaceutical & biotechnology companies segment took the lead in the global market, securing 47.3% of the total revenue share.

- North America took the lead in the global market, securing 37.3% of the total revenue share.

Product Type Analysis

Based on product type the market is fragmented into bags, flasks, plates, bottles, dishes, and tubes. Amongst these, bags segment dominated the cell culture vessels market capturing a significant market share of 63.4% in 2024. The bags segment has emerged as the dominant category in the cell culture vessels market due to several key factors. Primarily, single-use bags offer a range of advantages, such as cost-effectiveness, ease of use, and reduced risk of contamination, making them ideal for both research and industrial-scale applications.

These bags are widely used in the biopharmaceutical industry for the cultivation of cells and production of biologics, as they eliminate the need for cleaning and sterilization processes associated with traditional culture vessels. Additionally, the flexibility of bags allows for scalability, which is crucial in large-scale cell culture applications.

The adoption of disposable bags is also driven by the growing preference for closed, contamination-free systems in cell-based therapies and bioprocessing. Furthermore, advancements in bag design and material technology have improved their performance, increasing their attractiveness for laboratory and manufacturing environments. As a result, the bags segment continues to lead the cell culture vessels market.

Usage Analysis

The market is fragmented by usage into single-use and reusable. Single-use dominated the cell culture vessels market capturing a significant market share of 44.3% in 2024. The single-use segment has dominated the cell culture vessels market due to its significant advantages in biopharmaceutical production and research applications.

Single-use technologies, including disposable bags, bioreactors, and flasks, have become increasingly popular due to their cost-effectiveness, convenience, and ability to minimize the risk of cross-contamination between batches. These vessels eliminate the need for sterilization, cleaning, and maintenance, making them an attractive option for cell culture applications, especially in large-scale bio manufacturing.

Single-use systems also provide enhanced flexibility, enabling rapid scale-up of production processes and easier adaptation to varying production volumes. The rise of personalized medicine and cell-based therapies has further driven the demand for single-use vessels, as they are ideal for small-batch, custom production.

End Use Analysis

The market is fragmented by end use into pharmaceutical & biotechnology companies, academic & research institutes, and CMOs & CROs. Pharmaceutical & biotechnology companies dominated the cell culture vessels market capturing a significant market share of 67.6% in 2024. The research segment has dominated the cell culture vessels market due to its critical role in advancing scientific understanding, drug discovery, and development.

Cell culture vessels are essential tools in academic and commercial laboratories for a variety of research applications, including disease modeling, stem cell research, and genetic studies. Researchers use these vessels to cultivate cells in a controlled environment, which is crucial for experiments in biotechnology, pharmaceuticals, and regenerative medicine. The growing demand for high-quality and reproducible research outcomes has driven the preference for advanced cell culture vessels, such as multi-well plates, flasks, and bioreactors.

Key Segments Analysis

Product Type

- Bags

- Instruments

- Consumables & Reagents

- Software

Usage

- Single-use

- Genome Assembly

- Microbial Strain Typing

- Others

Application

- Research

- Diagnostics

By End-use

- Pharmaceutical & Biotechnology Companies

- Biotechnology & Pharmaceutical Companies

- Hospitals & Clinical Laboratories

Growing Demand for Biologics and Biopharmaceuticals

The rise in the development of biologic drugs, such as monoclonal antibodies, vaccines, and gene therapies, has significantly increased the need for efficient and scalable cell culture systems. These biologics are crucial in treating a wide range of conditions, including cancer, autoimmune diseases, and genetic disorders. As the biopharmaceutical industry expands, the demand for cell culture vessels, including bioreactors, flasks, and bags, has grown correspondingly, as these vessels are essential for the cultivation of cells used in the production of biologics.

The shift towards biologics, driven by their effectiveness and the growing number of patients seeking personalized medicine, has pushed for more advanced and scalable cell culture technologies. In particular, single-use bioreactors and disposable vessels have gained significant traction, as they allow for more flexible, cost-effective, and contamination-free production processes.

The ability to rapidly scale up or down in production with minimal risk of cross-contamination and reduced operational costs is driving the adoption of single-use technologies in cell culture. Furthermore, the global focus on improving healthcare outcomes and accelerating the development of life-saving treatments has further increased the reliance on cell culture vessels, making this sector a key growth driver in the market.

Market Restraints

High Cost of Advanced Cell Culture Systems

The high cost of advanced cell culture systems is restraining the growth of market. While innovations such as single-use bioreactors, disposable bags, and other high-performance vessels offer significant advantages in terms of scalability, flexibility, and contamination prevention, they come with a substantial price tag.

These systems, especially in large-scale biopharmaceutical manufacturing, require significant capital investment, as well as ongoing operational costs for procurement and replacement of single-use components. The high cost of these vessels can be a barrier, particularly for small and mid-sized research laboratories or biotech companies with limited budgets.

Market Opportunities

Growing Adoption of Personalized Medicine and Cell-Based Therapies

The growing adoption of personalized medicine and cell-based therapies is creating new growth opportunity for cell culture vessels market. Personalized medicine, which tailors treatment to individual genetic profiles, is gaining momentum as advancements in genomics and biotechnology enable more targeted therapies. This shift is driving an increased demand for cell culture vessels, as researchers and biopharmaceutical companies require high-quality, scalable systems to develop and produce patient-specific treatments.

Cell-based therapies, including stem cell therapies, CAR-T cell therapies, and tissue regeneration treatments, also require highly controlled environments for cell growth and manipulation, which creates a substantial opportunity for cell culture vessels. These therapies involve complex cell culturing processes that need specialized vessels for optimal cell growth, differentiation, and scaling. The expanding pipeline of cell-based therapies in clinical trials presents a major growth driver for the cell culture vessels market.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors can significantly impact the cell culture vessels market, influencing both supply and demand dynamics. On the macroeconomic front, economic conditions such as inflation, recession, or fluctuations in exchange rates can affect the purchasing power of both companies and research institutions.

For example, during economic downturns, funding for research and development may decrease, leading to reduced investments in advanced cell culture systems. Smaller biotech firms and research laboratories in emerging markets, in particular, might face budget constraints, limiting their ability to adopt high-cost cell culture vessels.

Additionally, global supply chain disruptions, such as those caused by inflation or logistic challenges, could lead to delays or increased costs in the production of cell culture vessels, impacting market accessibility. Geopolitical factors, including trade tensions, regulatory changes, and political instability, can also influence the market. For instance, tariffs on raw materials used in the manufacturing of cell culture vessels could increase production costs, which might be passed on to consumers.

Latest Trends

The cell culture vessels market is experiencing several key trends that are shaping its growth and innovation. One of the most notable trends is the increasing adoption of single-use technologies. Single-use bioreactors, bags, and flasks have become preferred options due to their ability to minimize the risk of cross-contamination, reduce cleaning and sterilization requirements, and enhance scalability for biopharmaceutical production.

These vessels are particularly beneficial for the production of biologics and cell-based therapies, aligning with the growing demand for personalized medicine. Another important trend is the rise of automated and high-throughput cell culture systems.

Automation in cell culture allows for improved efficiency, reproducibility, and scalability, enabling laboratories and manufacturing facilities to process large volumes of cell cultures with minimal manual intervention. This trend is driven by the increasing need for cost-effective and rapid production methods in the biopharmaceutical industry.

Regional Analysis

North America has emerged as a dominant force in the cell culture vessels market, driven by a combination of advanced research infrastructure, robust biopharmaceutical industries, and significant investments in healthcare innovation. The United States, in particular, is a global leader in biotechnology and pharmaceuticals, with numerous prominent biopharmaceutical companies and research institutions that heavily rely on cell culture vessels for drug development, biologics production, and cellular therapies.

The demand for high-quality, scalable cell culture systems is further fuelled by the increasing focus on personalized medicine, gene therapies, and stem cell-based treatments, all of which require sophisticated cell culture tools.

Additionally, North America benefits from strong government support for research and development, particularly through organizations such as the National Institutes of Health (NIH) and the U.S. Food and Drug Administration (FDA), which promote advancements in biomedical research and regulatory frameworks. The growing emphasis on regenerative medicine and the production of biologics has created a favorable environment for cell culture vessel adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global cell culture vessels market is highly competitive, driven by technological advancements, increasing demand for biopharmaceutical research, and the growing need for cell-based therapies. Key players in the market are focused on innovation, product expansion, and strategic collaborations to gain a competitive edge.

Leading companies such as Corning Inc., Thermo Fisher Scientific, Merck KGaA, Greiner Bio-One, and Sartorius AG dominate the industry with their extensive portfolios of cell culture flasks, plates, and bioreactors. The market is witnessing a surge in demand for advanced vessels with enhanced surface coatings, automation compatibility, and optimized designs for high-throughput applications.

Additionally, rising investments in regenerative medicine, stem cell research, and biologics production are fuelling market expansion. Emerging players and start-ups are focusing on sustainable and cost-effective solutions, including biodegradable and reusable culture vessels, to cater to the rising preference for eco-friendly laboratory practices.

Thermo Fisher Scientific Inc. is a global leader in scientific research solutions, providing a wide range of products and services for life sciences, healthcare, and industrial applications. The company offers laboratory equipment, analytical instruments, reagents, and software solutions to support research, diagnostics, and pharmaceutical manufacturing.

Merck KGaA, headquartered in Darmstadt, Germany, is a leading global science and technology company specializing in healthcare, life sciences, and performance materials. Merck is one of the oldest pharmaceutical and chemical companies, known for its innovations in drug development, biopharmaceutical production, and laboratory research solutions.

Top Key Players

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Greiner Bio-One International GmbH

- STEMCELL Technologies

- Corning Incorporated

- Wilson Wolf

- DWK Life Sciences

- Danaher

- Sartorius Stedim Biotech

- Cell Culture Company, LLC

- VWR International, LLC.

Recent Developments

- In April 2024, Fujifilm Corporation announced a USD 1.2 billion investment to expand its cell culture CDMO business, bringing the total investment in its Fujifilm Diosynth Biotechnologies facility in Holly Springs, North Carolina, to over USD 3.2 billion.

- In March 2024, Novartis revealed plans to invest €500 million ($556.26 million) each in its Kundl and Schaftenau sites to enhance the continuous production of biopharmaceuticals in Austria. This strategic expansion aims to strengthen cell culture technology, further driving the demand for cell culture vessels.

Report Scope

Report Features Description Market Value (2024) US$ 13.4 billion Forecast Revenue (2034) US$ 50.6 billion CAGR (2025-2034) 14.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bags, Instruments, Consumables & Reagents, and Software), By Usage (Single-use, Genome Assembly, Microbial Strain Typing, and Others), By Application (Research and Diagnostics), By End-use (Pharmaceutical & Biotechnology Companies, Biotechnology & Pharmaceutical Companies, and Hospitals & Clinical Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Merck KGaA, Greiner Bio-One International GmbH, STEMCELL Technologies, Corning Incorporated, Wilson Wolf, DWK Life Sciences, Danaher, Sartorius Stedim Biotech, Cell Culture Company, LLC, and VWR International, LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cell Culture Vessels MarketPublished date: Mar 2025add_shopping_cartBuy Now get_appDownload Sample

Cell Culture Vessels MarketPublished date: Mar 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Greiner Bio-One International GmbH

- STEMCELL Technologies

- Corning Incorporated

- Wilson Wolf

- DWK Life Sciences

- Danaher

- Sartorius Stedim Biotech

- Cell Culture Company, LLC

- VWR International, LLC.