Global Vaccines Market By Product Type (Subunit Vaccines (Recombinant vaccines, Conjugate Vaccines, and Toxoid vaccines), Viral vector vaccines, mRNA vaccines, Live Attenuated, and Inactivated), By Route of Administration (Oral, Parenteral, and Nasal), By Application (Viral Diseases (Hepatitis, Influenza, Rotavirus, and Others), Bacterial Vaccines (Meningococcal Diseases, Pneumococcal diseases, DPT, and Others), Cancer Vaccines, and Allergy Vaccines), By Distribution Channel (Hospital & Retail Pharmacies, Government Suppliers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 2025

- Report ID: 141433

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Route of Administration Analysis

- Application Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

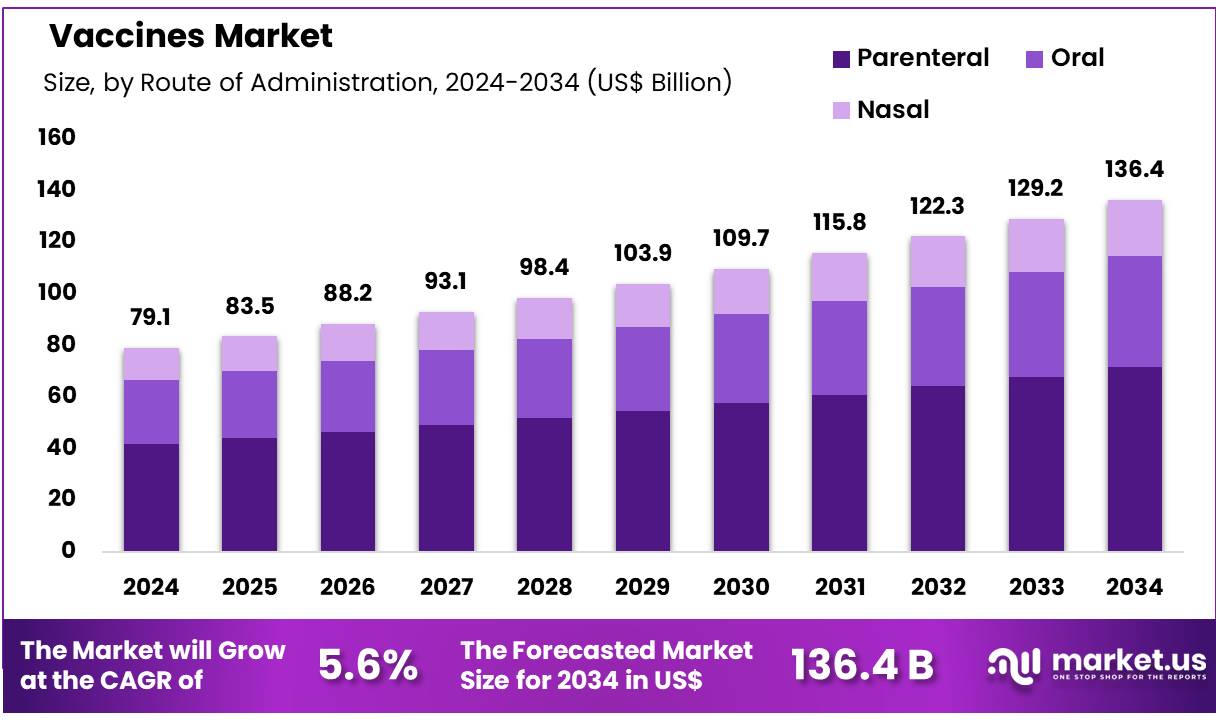

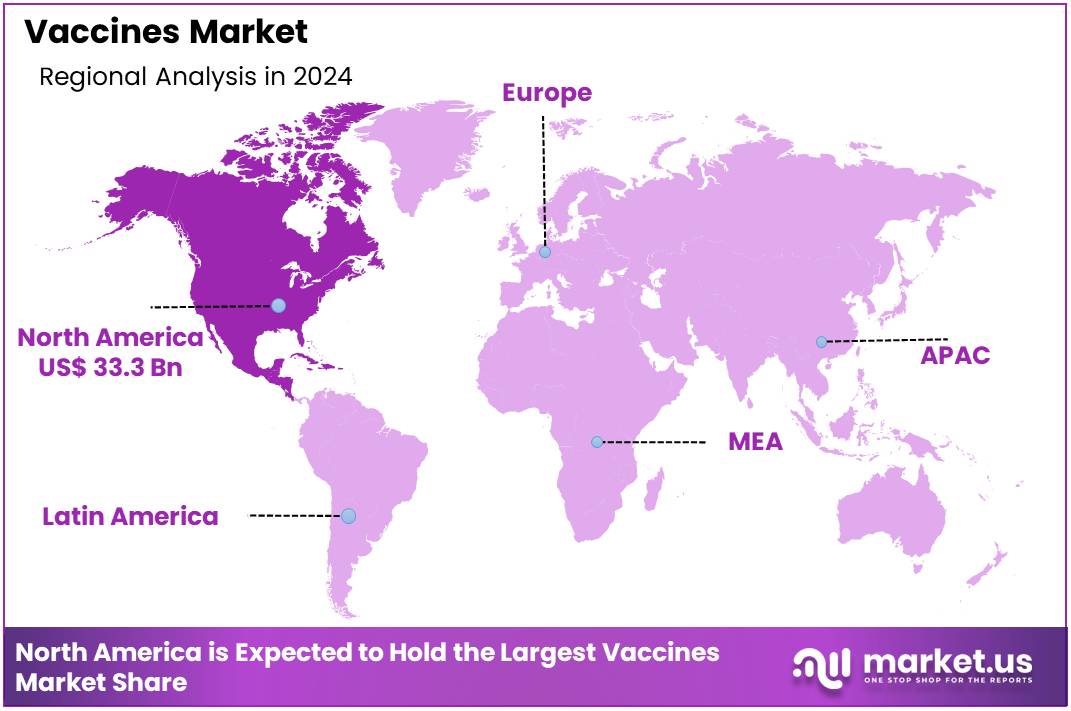

Global Vaccines Market size is expected to be worth around US$ 136.4 billion by 2034 from US$ 79.1 billion in 2024, growing at a CAGR of 5.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.1% share with a revenue of US$ 33.3 Billion.

Growing global health concerns and the increasing focus on disease prevention are driving the expansion of the vaccines market. Vaccines play a critical role in preventing infectious diseases, reducing healthcare burdens, and improving public health outcomes. The rising prevalence of both emerging and re-emerging infectious diseases, including COVID-19, influenza, and various strains of pneumonia, significantly boosts the demand for vaccines.

In September 2022, BD introduced an advanced glass prefillable syringe (PFS) developed in collaboration with pharmaceutical partners to address the growing complexities of vaccine production and improve manufacturing efficiency. This innovation highlights the trend of streamlining vaccine delivery and production processes to meet global demand. Recent trends also show increased investments in vaccine research and development, especially in areas like mRNA technology,

Key Takeaways

- In 2024, the market for Vaccines generated a revenue of US$ 79.1 billion, with a CAGR of 5.6%, and is expected to reach US$ 136.4 billion by the year 2033.

- The product type segment is divided into subunit vaccines, viral vector vaccines, mRNA vaccines, live attenuated, and inactivated, with mRNA vaccines taking the lead in 2023 with a market share of 38.4%.

- Considering route of administration, the market is divided into oral, parenteral, and nasal. Among these, parenteral held a significant share of 52.6%.

- Furthermore, concerning the application segment, the market is segregated into viral diseases, bacterial vaccines, cancer vaccines, and allergy vaccines. The viral diseases sector stands out as the dominant player, holding the largest revenue share of 44.2% in the Vaccines market.

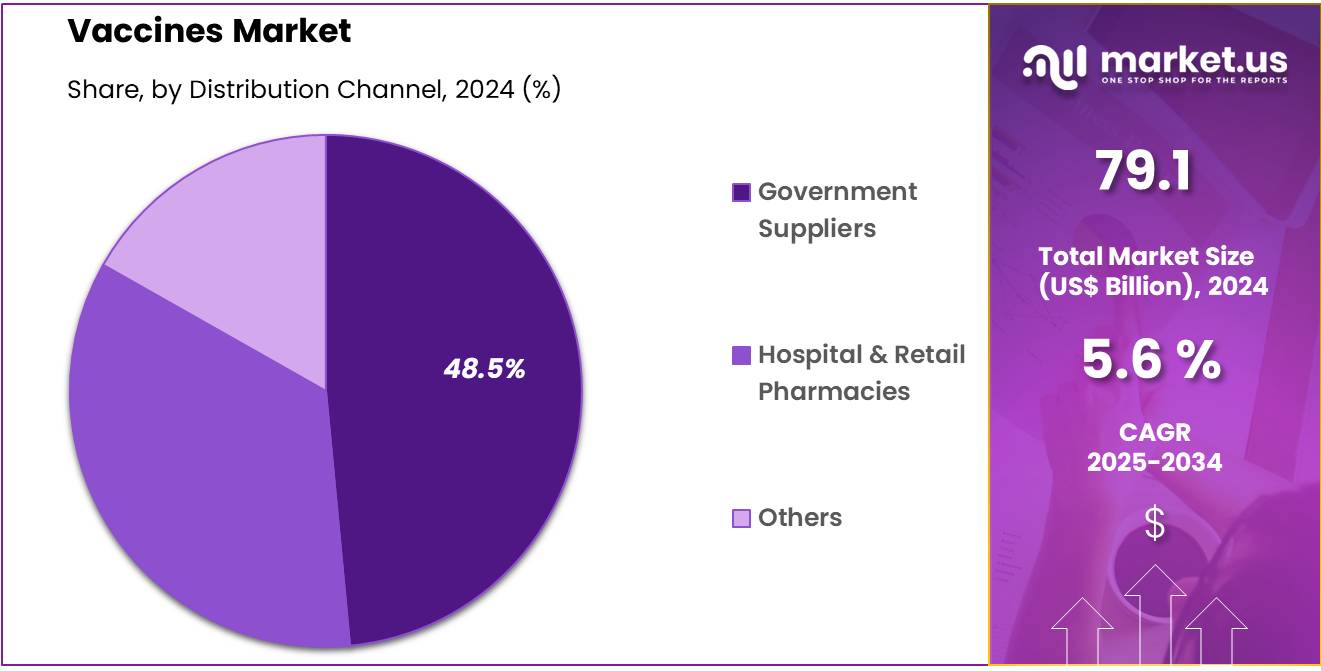

- The distribution channel segment is segregated into hospital & retail pharmacies, government suppliers, and others, with the government suppliers segment leading the market, holding a revenue share of 48.5%.

- North America led the market by securing a market share of 42.1% in 2024.

Product Type Analysis

The mRNA vaccines segment led in 2023, claiming a market share of 38.4% owing to the success of mRNA-based vaccines in the fight against infectious diseases, such as COVID-19. The rapid development and high efficacy of mRNA vaccines in providing immunity have increased their demand and paved the way for their application in other infectious diseases, including influenza and Zika virus.

With advancements in mRNA technology, these vaccines are anticipated to become a major platform for developing new vaccines due to their ability to be produced quickly and efficiently. Additionally, mRNA vaccines offer high specificity and adaptability, which are expected to drive further growth in this segment as pharmaceutical companies explore their potential for broader vaccine applications.

Route of Administration Analysis

The parenteral held a significant share of 52.6% due to the widespread use of injectable vaccines. Parenteral administration, especially through intramuscular or subcutaneous injections, is expected to remain the preferred method for vaccines, as it ensures better absorption and long-lasting immunity. The growing prevalence of infectious diseases and the need for booster shots, along with the ongoing pandemic preparedness efforts, is likely to boost the demand for injectable vaccines.

Additionally, advances in needle-free injection technologies are anticipated to enhance the appeal of parenteral vaccines, further driving growth in this segment.

Application Analysis

The viral diseases segment had a tremendous growth rate, with a revenue share of 44.2% as global vaccination programs intensify to address emerging viral threats. Increasing incidences of viral infections such as influenza, hepatitis, and human papillomavirus (HPV) are expected to drive the demand for vaccines in this segment.

Additionally, rapid advancements in vaccine development technology and the growing recognition of the importance of vaccination for public health are expected to further support the growth of this segment. The development of universal vaccines targeting multiple strains of viruses is likely to propel the viral diseases segment in the coming years.

Distribution Channel Analysis

The government suppliers segment grew at a substantial rate, generating a revenue portion of 48.5% as governments around the world continue to expand immunization programs and invest in vaccination campaigns. Government suppliers play a crucial role in ensuring the availability of vaccines for large populations, especially in developing countries where access to vaccines is often limited.

Increased funding for vaccination programs, especially in the wake of the COVID-19 pandemic, is expected to drive the growth of this segment. Furthermore, the increasing adoption of vaccines in routine immunization schedules, as well as the global push for pandemic preparedness, is projected to boost the demand for government-supplied vaccines in various countries.

Key Market Segments

Product Type

- Subunit Vaccines

- Recombinant vaccines

- Conjugate Vaccines

- Toxoid vaccines

- Viral vector vaccines

- mRNA vaccines

- Live Attenuated

- Inactivated

Route of Administration

- Oral

- Parenteral

- Nasal

Application

- Viral Diseases

- Hepatitis

- Influenza

- Rotavirus

- Others

- Bacterial Vaccines

- Meningococcal Diseases

- Pneumococcal diseases

- DPT

- Others

- Cancer Vaccines

- Allergy Vaccines

Distribution Channel

- Hospital & Retail Pharmacies

- Government Suppliers

- Others

Drivers

Rapid Development of New Vaccines Driving the Vaccines Market

Rising advancements in vaccine development are expected to drive the vaccines market by improving accessibility and accelerating immunization efforts. In March 2023, the Serum Institute of India outlined plans to expand its vaccine portfolio beyond COVID-19 by shifting focus toward malaria and dengue vaccines. The company repurposed its existing manufacturing infrastructure to accommodate the production of these vaccines, with the potential to scale output to 4 billion doses annually.

Continuous innovations in mRNA technology are expediting vaccine development for infectious diseases. Global health organizations are collaborating with pharmaceutical companies to enhance research in next-generation vaccines. The expansion of recombinant and vector-based vaccine platforms is improving efficacy and safety profiles. Governments are implementing regulatory frameworks to streamline vaccine approvals and distribution.

Biopharmaceutical companies are focusing on universal vaccines that provide broader protection against multiple variants. Increased funding for vaccine research is supporting novel formulations and delivery mechanisms. The development of combination vaccines is reducing the number of doses required for immunization.

Advancements in thermostable vaccine formulations are improving storage and transportation logistics. Digital tracking systems for vaccination programs are enhancing monitoring and compliance rates. The growing emphasis on pandemic preparedness is anticipated to sustain long-term growth in the vaccines market.

Restraints

High Production Costs Are Restraining the Vaccines Market

Increasing production expenses are limiting the growth of the vaccines market by making large-scale manufacturing complex and expensive. Developing a new vaccine requires extensive preclinical and clinical trials, adding to research costs and delaying commercialization. The need for high-quality raw materials, adjuvants, and bioreactors contributes to elevated production costs.

Stringent regulatory guidelines demand multiple stages of safety and efficacy testing, increasing overall investment requirements. Cold chain logistics for vaccine storage and transportation add further financial strain, particularly for developing nations with limited infrastructure. Biopharmaceutical companies must allocate significant resources to scale up production while ensuring quality control.

The cost of maintaining sterile manufacturing environments and specialized workforce training also raises operational expenses. Addressing cost-related challenges through process optimization, public-private partnerships, and funding initiatives is necessary to improve vaccine accessibility worldwide.

Opportunities

Growing Investments in R&D Activities as an Opportunity for the Vaccines Market

Increasing funding for vaccine research is anticipated to create new opportunities in the vaccines market by accelerating innovation and development. Moderna, known for its expertise in mRNA technology, significantly increased its research and development investment to USD 4.8 billion in 2023, marking a 47% rise from the previous year.

This surge in funding highlights the company’s commitment to advancing vaccine innovation and pipeline expansion. Rising investments in next-generation vaccines are driving the development of long-lasting immunization solutions. Research institutions and pharmaceutical companies are collaborating to explore novel vaccine platforms for emerging infectious diseases. AI-driven drug discovery is enhancing the speed and precision of vaccine candidate selection.

Governments and global health organizations are allocating funds to combat antimicrobial resistance through vaccine innovation. The expansion of personalized vaccine research is paving the way for individualized immunization strategies. Increased funding for rapid-response vaccine development is strengthening pandemic preparedness measures. Strategic investments in biotechnology and genomics are likely to shape the future of vaccine production and disease prevention.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors greatly influence the vaccines market. On the positive side, increasing healthcare budgets and government investments in immunization programs around the world provide a strong foundation for market growth. The growing focus on global health security, especially after the COVID-19 pandemic, has further pushed governments to invest in vaccines for both prevention and outbreak control.

Emerging markets also present new growth opportunities as vaccination programs expand. However, economic downturns and political instability in certain regions can disrupt vaccination programs, limiting access to immunization. Trade restrictions, varying regulatory requirements across countries, and fluctuating manufacturing costs could also pose challenges to vaccine distribution and affordability.

Despite these challenges, global initiatives to improve access to life-saving vaccines, advancements in production technologies, and increasing public-private partnerships provide a positive outlook for the market’s future growth.

Latest Trends

Increasing Use of Latest Technology in Vaccine Development Driving the Market:

Increasing use of the latest technology in vaccine development is a key trend driving the vaccines market. High demand for faster, more effective vaccines, especially in response to emerging infectious diseases, has led to the adoption of innovative technologies such as mRNA and viral vector platforms. These advancements are expected to accelerate the development of vaccines with enhanced efficacy and quicker production timelines.

The rise of novel technologies is likely to improve the scalability of vaccine production, enabling more efficient global distribution. Rising interest in personalized medicine and the potential for targeted vaccines further drives the adoption of cutting-edge technologies.

In February 2024, scientists at the University at Buffalo, U.S., developed a novel recombinant flu vaccine leveraging Nano-liposome technology, showing potential for improved immune response and vaccine efficacy. As the integration of advanced technology continues to evolve, the market is anticipated to experience substantial growth, meeting the increasing global demand for safer, more effective vaccines.

Regional Analysis

North America is leading the Vaccines Market

North America dominated the market with the highest revenue share of 42.1% owing to rising demand for immunization programs and advancements in vaccine technology. Merck & Co., Inc.’s FDA approval in June 2022 for PCV15 (Vaxneuvance), designed to prevent pneumococcal disease in children, reinforced the region’s focus on expanding pediatric immunization coverage. The increasing prevalence of infectious diseases, along with growing awareness of preventive healthcare, encouraged higher vaccination rates across various age groups.

Government-led initiatives and funding for routine and seasonal immunization programs further strengthened market expansion. The rapid development of mRNA-based formulations and next-generation vaccine platforms enhanced efficacy and production efficiency. Private-sector investments in research and development contributed to the introduction of improved immunization solutions targeting both common and emerging pathogens.

The presence of well-established pharmaceutical companies, alongside collaborations with biotechnology firms, accelerated innovation and streamlined distribution networks. Additionally, the adoption of digital healthcare solutions improved patient engagement, facilitating higher compliance with recommended vaccination schedules.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing investment in immunization programs and the development of novel formulations. Maxvax Biotechnology’s successful Series C funding of USD 82.5 million in July 2024 demonstrated the region’s commitment to advancing immunization solutions. Expanding healthcare infrastructure in countries like China, India, and Japan is likely to improve accessibility and distribution.

Government initiatives promoting large-scale vaccination drives for both pediatric and adult populations are anticipated to support market expansion. Collaborations between global pharmaceutical firms and regional biotech companies are expected to accelerate innovation and regulatory approvals. Rising awareness of the benefits of immunization, particularly in preventing respiratory and vector-borne diseases, is projected to increase demand.

The introduction of AI-driven research tools and next-generation manufacturing techniques is likely to enhance vaccine production efficiency. Additionally, growing public-private partnerships focused on reducing vaccine hesitancy and improving outreach are anticipated to further strengthen market growth across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the vaccines market focus on advancing research and development to create innovative formulations for emerging infectious diseases and chronic conditions. Companies invest in mRNA technology, recombinant platforms, and adjuvant systems to improve efficacy and accelerate production timelines.

Strategic partnerships with governments and global health organizations help expand immunization programs and ensure widespread access. Geographic expansion into regions with increasing healthcare investments supports further market growth. Many players also emphasize sustainability by developing eco-friendly packaging and optimizing cold chain logistics for better distribution.

Moderna is a leading company in this market, known for its groundbreaking mRNA-based vaccines, including its COVID-19 formulation. The company prioritizes innovation by expanding its pipeline to target respiratory viruses, cancer, and rare diseases. Moderna’s commitment to cutting-edge science and global healthcare solutions positions it as a key player in vaccine development.

Top Key Players

Recent Developments

- By March 2024, Dr. Reddy’s Laboratories (DRL) will assume responsibility for distributing and promoting Sanofi’s vaccine range in India. This collaboration is expected to enhance access to a variety of pediatric and adult immunization options within the country.

- In May 2024, Novavax and Sanofi entered into a licensing agreement to co-commercialize a COVID-19 vaccine and jointly develop a combination vaccine targeting both COVID-19 and influenza. This alliance reflects the pharmaceutical industry’s efforts to expand vaccine offerings and strengthen global market presence.

Report Scope

Report Features Description Market Value (2024) US$ 79.1 billion Forecast Revenue (2034) US$ 136.4 billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Subunit Vaccines (Recombinant vaccines, Conjugate Vaccines, and Toxoid vaccines), Viral vector vaccines, mRNA vaccines, Live Attenuated, and Inactivated), By Route of Administration (Oral, Parenteral, and Nasal), By Application (Viral Diseases (Hepatitis, Influenza, Rotavirus, and Others), Bacterial Vaccines (Meningococcal Diseases, Pneumococcal diseases, DPT, and Others), Cancer Vaccines, and Allergy Vaccines), By Distribution Channel (Hospital & Retail Pharmacies, Government Suppliers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novavax, Dr. Reddy’s Laboratories, Sanofi, GSK Plc, Pfizer, Moderna, Sinovac, and AstraZeneca. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novavax

- Reddy’s Laboratories

- Sanofi

- GSK Plc

- Pfizer

- Moderna

- Sinovac

- AstraZeneca