Global Advanced Wound Dressing Market By Product (Foam Dressings, Alginate Dressings, Film Dressings, Collagen Dressings, Other Products)By Application-Chronic Wounds(Pressure Ulcers, Diabetic Foot Ulcers, Venous Leg Ulcers, Other Applications), Acute Wounds, (Surgical & Traumatic Wounds, Burns) By End-User (Hospitals, Specialty Clinics, Nursing Homes, Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 18130

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

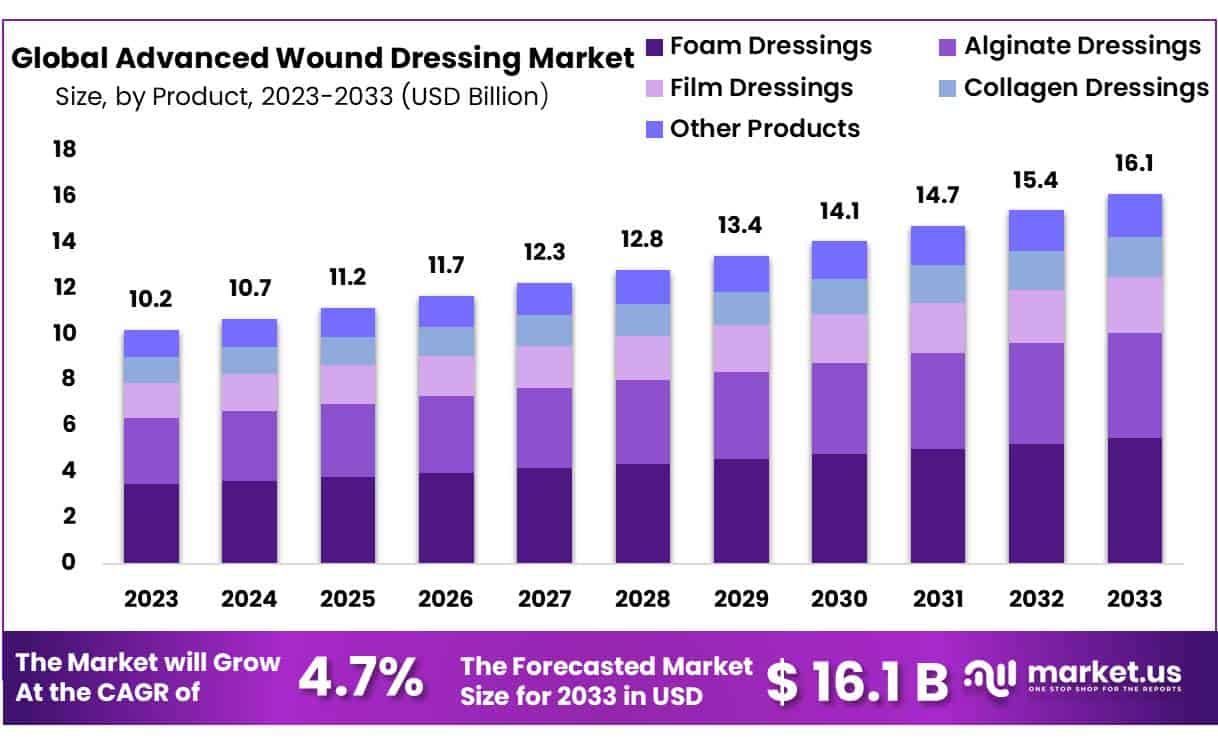

The Global Advanced Wound Dressing Market size is expected to be worth around USD 16.1 Billion by 2033 from USD 10.2 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

The advanced wound dressing market covers acute and chronic wounds alike, including lesions, burns and post-operative injuries. Advanced wound care solutions such as film and foam dressings, hydrogels, alginates and hydrocolloids play an essential role in maintaining optimal moisture levels within wound environments and expediting healing without impeding natural healing mechanisms.

This industry provides invaluable assistance for individuals suffering from chronic wounds by offering easily accessible and affordably priced products they can utilize at their convenience. With chronic wounds becoming more prevalent and surgical procedures increasing globally, coupled with technological advancements, the advanced wound care market is poised to meet both patients’ needs as well as healthcare provider’s requirements.

The advanced wound dressings market is driven by several key drivers. First and foremost is an increasing concern over hospital-acquired infections as well as pressure ulcers among an aging population, both contributing to driving demand in this market. Furthermore, awareness about how advanced wound dressings help accelerate the recovery process for chronic wounds serves as another driving factor for market expansion – healthcare providers and patients alike recognize its benefits to meet evolving healthcare landscape needs.

Cancer is a leading cause of death, making it a huge healthcare problem. According to WHO estimates, cancer is the leading cause worldwide of death and can be attributed almost to every 6 deaths. The WHO also reported that 75% of cancer-related deaths are usually in low-income countries.

Key Takeaways

- Market Size: Advanced Wound Dressing Market size is expected to be worth around USD 16.1 Billion by 2033 from USD 10.2 Billion in 2023.

- Market Growth: The market growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

- Product Analysis: In 2023, foam dressings had a dominant 34% market share for advanced wound dressing.

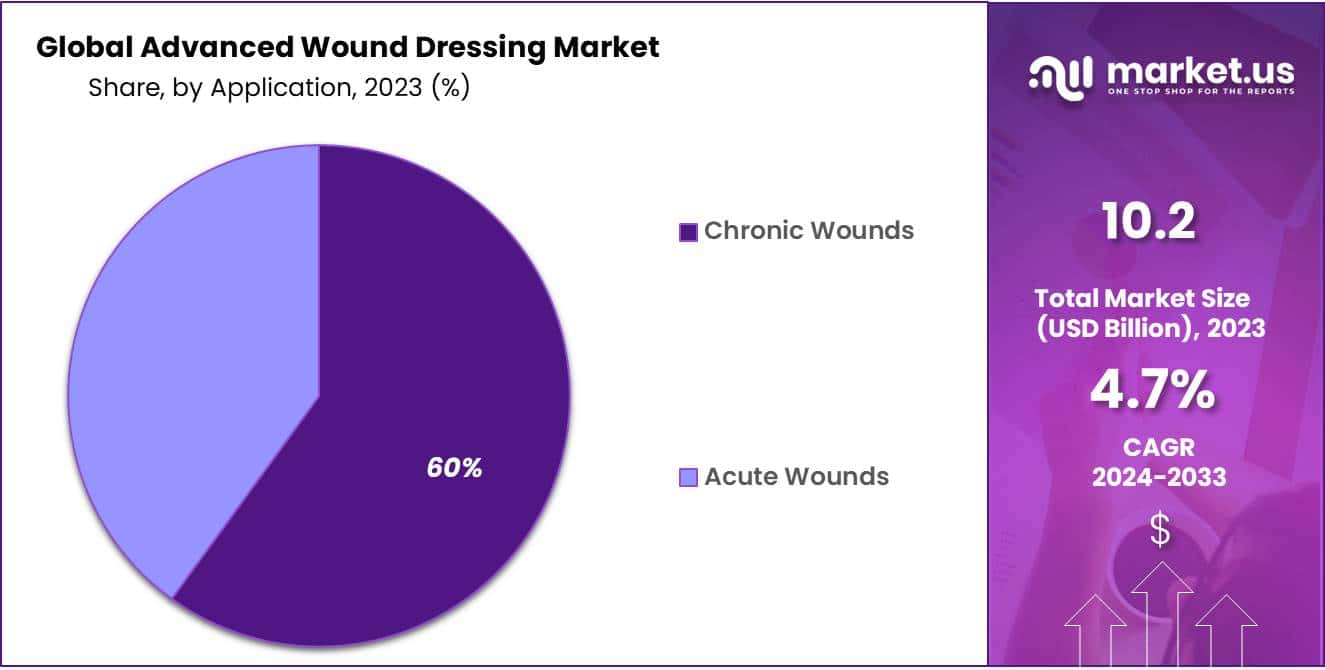

- Application Analysis: The Advanced Wound Dressing Market has seen dramatic growth over recent years, with chronic wounds accounting for 60% of its growth.

- End-Use Analysis: The hospital segment was the dominant market for advanced wound treatment and held by 41% high revenue share in 2023.

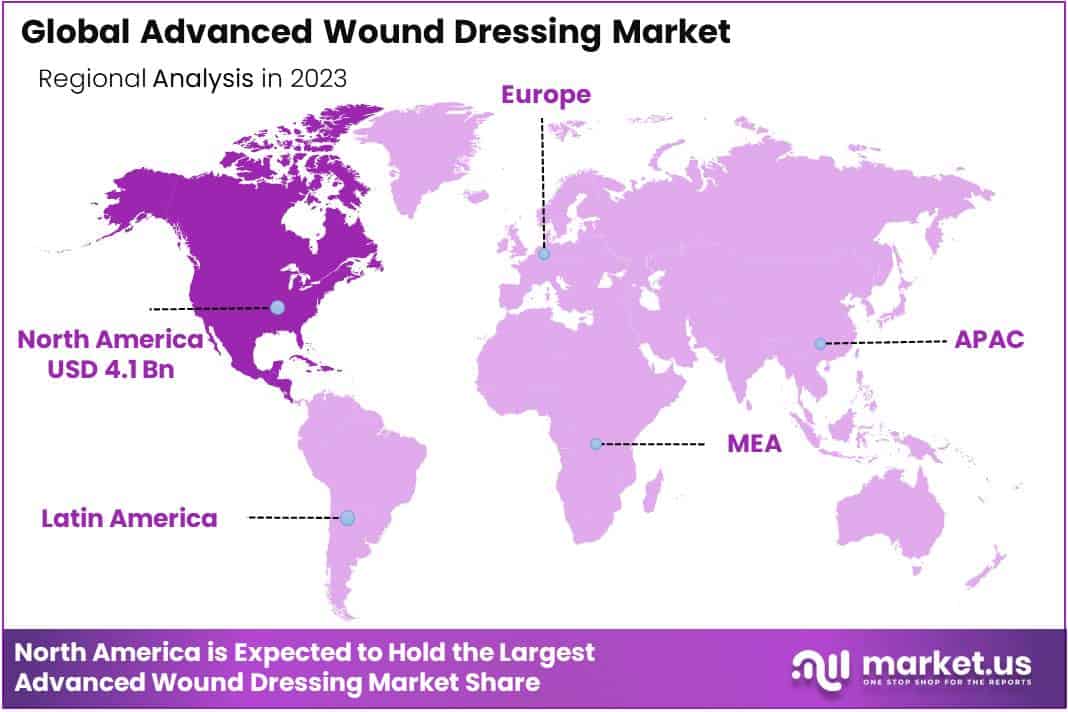

- Regional Analysis: North America held a 41% market share for advanced wound dressings in 2023.

- Market Drivers: Growth is driven by an increase in chronic wounds, diabetic ulcers, and surgical procedures.

- Technology Advancements: Innovative products such as antimicrobial dressings and foam dressings are gaining popularity.

- Aging Population: The rising elderly population globally is increasing the demand for advanced wound care products.

- Regulatory Environment: Strict regulatory standards ensure high-quality products but may also slow down product approvals.

- Market Challenges: High costs of advanced wound dressings and lack of awareness in developing regions hinder market growth.

Product Analysis

In 2023, foam dressings had a dominant 34% market share for advanced wound dressing. Over the forecast period, this segment will experience a substantial growth rate. Foam dressings are made of hydrophilic polyurethane, a highly absorbent substance. Foam dressings absorb water and help maintain the tissue’s integrity. Segment growth will be driven by increasing trauma cases and burns in America. The highest number of complications from infection has been reported in burn patients, according to the American Burn Association (ABA).

Foams are mainly used to treat and prevent exudation from burn injuries. Therefore, segment growth is expected to increase over the forecast period. The fastest-growing segment in hydrocolloid dressings is expected to be over the forecast period. Hydrocolloid dressings include gel-forming agents such as Carboxy Methylcellulose(CMC) and Gelatin. These materials are water-retentive and occlusive by nature.

These advanced dressings can be used to speed up healing times and are resistant to any type of bacterial infection. This dressing protects the wound from both internal and external factors. Over the forecast period, the segment is expected to grow due to the increasing incidence of diabetes in the world.

Application Analysis

The Advanced Wound Dressing Market has seen dramatic growth over recent years, with chronic wounds accounting for 60% of its growth. This indicates a pressing need for innovative solutions that address persistent wounds efficiently – particularly diabetic ulcers, pressure ulcers, and venous leg ulcers which present ongoing challenges that necessitate advanced dressing technologies capable of supporting effective healing processes.

Chronic wounds comprise the vast majority of this market; however acute injuries including surgical incisions and trauma injuries also require attention. As demand for advanced wound dressings for treating acute injuries increases due to their ability to speed healing time while mitigating infection risks and improving patient outcomes, more advanced dressings have become indispensable tools in treating them effectively.

Market growth is being propelled by technological innovations in wound care, including bioactive dressings, foam dressings, hydrocolloid dressings and film dressings that feature superior moisture management properties as well as exudate absorption capabilities and antimicrobial features – innovations that facilitate more rapid healing for more efficient wound recovery.

End-Use Analysis

The hospital segment was the dominant market for advanced wound treatment and held by 41% high revenue share in 2023. The main drivers of growth are the rising incidences of diabetic leg ulcers and venous ulcers. The segment is also being driven by an increase in the number of surgical wounds. For healing SSI injuries, advanced wound dressings are used. These factors could increase segment growth in the future.

Homecare will see the greatest growth in the future. The majority of surgeries require a long recovery period that requires frequent dressing changes. The demand for advanced wound treatment products in at-home healthcare is growing. Homecare is preferred by patients with chronic wounds, as well as the elderly and bariatric populations.

Key Market Segments

Product

- Foam Dressings

- Alginate Dressings

- Film Dressings

- Collagen Dressings

- Other Products

Application

- Chronic Wounds

- Pressure Ulcers

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Other Applications

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

End-User

- Hospitals

- Specialty Clinics

- Nursing Homes

- Other End-Users

Driver

Rising Incidence of Chronic Diseases

The growing incidence of chronic diseases like diabetes, obesity and vascular disorders is a primary driver for growth of the advanced wound dressing market. Such diseases frequently result in chronic wounds including diabetic ulcers, pressure ulcers and venous leg ulcers – creating demand for advanced wound care products such as advanced wound dressings to manage these chronic wounds effectively and treat these ailments effectively – furthering market expansion. As healthcare providers seek solutions to effectively manage and treat such ailments using advanced wound dressing products thus driving market expansion.

Antimicrobial resistance, sedentary lifestyles, alcohol consumption and smoking all play a part in driving chronic disease globally, contributing to its increasing prevalence. Diabetes, cancer and autoimmune disorders have become more frequent. According to the Centers for Disease Control and Prevention’s 2017 National Diabetes Statistic Report over 100 Million US residents had diabetes or prediabetes while Diabetes caused nearly 1.6 Million deaths globally during 2016.

Technological Advancements in Wound Care

Innovation and advances in wound care technology are driving adoption of advanced wound dressings. Manufacturers have introduced novel materials and formulations offering superior healing properties such as enhanced moisture management, antimicrobial efficacy and bioactivity.

Furthermore, advanced wound dressings with features such as sustained release of therapeutic agents or tailored exudate management capabilities are quickly gaining favor among healthcare professionals and widespread adoption by consumers alike. Smart technologies incorporating sensors or connectivity further propelling market growth, providing remote monitoring solutions as well as tailored wound care solutions tailored specifically for their individual users.

Trend

Shift towards Value-Based Healthcare

There has been an emerging shift toward value-based healthcare models focused on improving patient outcomes while decreasing overall healthcare costs. Advanced wound dressings play a significant role in expediting faster wound healing, mitigating complications, and decreasing hospital readmissions; healthcare providers increasingly recognize the value of investing in advanced wound care products that provide improved clinical results as well as long-term cost savings; consequently there has been an uptick in evidence-based wound care practices with integrated advanced dressings into comprehensive wound management protocols.

Rising Demand for Active Wound Care Products

There has been an increased interest in active wound care products that not only offer protection but actively aid healing as well. Products like hydrogels, foams and alginates containing bioactive ingredients or growth factors to promote tissue regeneration are rapidly growing in demand compared to traditional dressings as they create optimal conditions for healing while also targeting specific wound characteristics more effectively.

As such, adoption of such active wound care products continues to expand both within hospital environments as well as at home settings, propelling market expansion for this segment.

Restraint

High Cost of Advanced Wound Dressings

One of the primary barriers limiting market growth is their high costs. Advanced products often come with higher price tags due to their advanced materials and innovative features, creating financial difficulties for healthcare facilities in resource-limited settings or regions with tight healthcare budgets.

Advanced wound dressings’ high cost may prevent their widespread adoption in developing nations where affordability is an issue. Healthcare providers might opt for less-expensive options instead, diminishing market potential for advanced wound care products.

Reimbursement Challenges

Reimbursement policies and coverage for advanced wound dressings vary significantly among healthcare systems and payers, creating barriers to market growth. In some regions, reimbursement may only partially cover the costs of advanced wound care products, creating financial barriers for both patients and healthcare providers alike.

Furthermore, complex reimbursement processes with stringent approval criteria may further hinder their adoption by healthcare stakeholders in those markets with restrictive reimbursement policies. As healthcare stakeholders grapple with reimbursement hurdles, market penetration and adoption could suffer significantly as healthcare stakeholders navigate these difficulties – particularly where reimbursement policies restrict market development or adoption may decrease significantly.

Opportunities

Growing Aging Population

The global aging population presents an unparalleled opportunity for the advanced wound dressing market. Aging brings increased susceptibility to chronic conditions, impaired wound healing and age-related comorbidities; leading to an increase in chronic wounds among elderly individuals.

As population age worldwide, so will demand for tailored advanced wound care solutions addressing unique needs for this demographic; healthcare providers recognize the necessity of offering such care specialized solutions, giving manufacturers ample room to create products specifically aimed at this age bracket and expand market presence within this segment.

Expanding Homecare Settings

Homecare settings offer an attractive opportunity for the advanced wound dressing market. Telemedicine, remote monitoring, and patient-centric care models have opened the door for managing chronic wounds at home in an increasingly popular trend. Advanced wound dressings that are easy to apply, require little upkeep, and provide long-term protection are increasingly sought-after in homecare settings.

Manufacturers have an opportunity to develop innovative homecare products that address patients and caregivers seeking convenient wound care solutions outside traditional healthcare facilities. As homecare continues its rise in prominence within healthcare landscape, homecare-specific advanced wound dressings may become even more in demand and drive market expansion in this segment.

Regional Analysis

North America held a 41% market share for advanced wound dressings in 2023 and this dominance is projected to expand substantially over time. This surge is driven by various factors including road accidents and sports-related injuries increasing rapidly as well as key industry players operating within this region. Furthermore, North America benefits from an established healthcare infrastructure and skilled workforce which add significantly to market projections for growth.

North America saw the United States emerge with the highest share of the advanced wound dressing market in 2023. This success can be attributed to several factors, including an extensive healthcare infrastructure, rising awareness about advanced wound care products, and innovation-driven market players; additionally, an increase in orthopedic procedures due to sports-related injuries provides further impetus to market expansion efforts. These factors position North America – specifically the US – as key drivers of growth within advanced wound dressing market.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Players Analysis

Players in the market use various strategies to create revenue streams, including complementary acquisitions, new developments, assuring product quality assurance and mergers and acquisitions. Effective supply chain systems management also enhances market growth opportunities. Major market players expand their businesses across different geographical areas through mergers and acquisitions, product development initiatives, and the launch of new products.

Revenue generation for this sector occurs via product releases, expansion into emerging markets, and acquisitions at both established and new locations. Through these strategies, revenue is effectively driven forward and sustained for sustained growth.

Market Key Players

- 3M

- Coloplast Corp.

- Medline Industries

- Smith & Nephew

- ConvaTec Group PLC

- Derma Sciences

- Ethicon

- Baxter International

- Molnlycke Heath Care AB

- Medtronic Plc.

- Other Key Players

Recent Developments

- 3M: Collaborated with Avita Medical to develop a novel negative pressure wound therapy system, this system is designed to be smaller, quieter, and more portable than traditional options, making it ideal for home care settings.

- Coloplast Corp.: Received FDA clearance for its Brava® Ostomy System, this new system features a unique seal that conforms to the body’s curves, helping to prevent leaks and improve comfort for ostomy patients.

- Smith & Nephew: Received FDA clearance for its PICO Negative Pressure Wound Therapy System, this new system is designed to be smaller, lighter, and quieter than traditional options, making it ideal for outpatient use.

- ConvaTec Group PLC: Launched AQUACEL® EXTRA Contact Layer with Hydrocolloid Technology, this new dressing is designed to be highly absorbent and provide a moist wound healing environment.

Report Scope

Report Features Description Market Value (2023) USD 10.2 Billion Forecast Revenue (2033) USD 16.1 Billion CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product-(Foam Dressings, Alginate Dressings, Film Dressings, Collagen Dressings, Other Products)By Application -Chronic Wounds(Pressure Ulcers, Diabetic Foot Ulcers, Venous Leg Ulcers, Other Applications), Acute Wounds, (Surgical & Traumatic Wounds, Burns) By End-User-(Hospitals, Specialty Clinics, Nursing Homes, Other End-Users) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape 3M, Coloplast Corp., Medline Industries, Smith & Nephew, ConvaTec Group PLC, Derma Sciences, Ethicon, Baxter International, Molnlycke Heath Care AB, Medtronic Plc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Advanced Wound Dressing MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Advanced Wound Dressing MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Coloplast Corp.

- Medline Industries

- Smith & Nephew

- ConvaTec Group PLC

- Derma Sciences

- Ethicon

- Baxter International

- Molnlycke Heath Care AB

- Medtronic Plc.

- Other Key Players