Diabetes Drugs Market By Drug Class (Insulin, DPP-4 Inhibitors, GLP-1 Receptor Agonists, SGLT2 Inhibitors, Other Drug Classes), By Application (Type 1 Diabetes, Type 2 Diabetes), By Route of Administration (Subcutaneous, Oral, Injectable), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Apr 2024

- Report ID: 118186

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

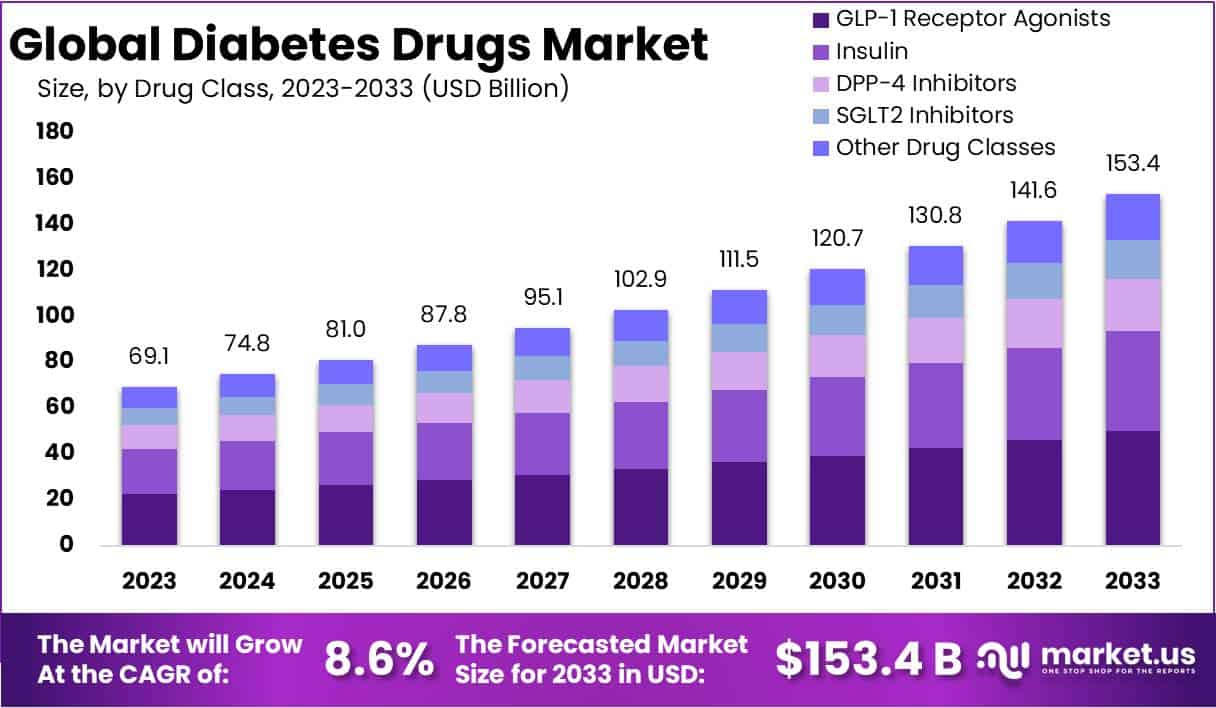

The Global Diabetes Drugs Market size is expected to be worth around USD 153.4 Billion by 2033, from USD 69.1 Billion in 2023, growing at a CAGR of 8.6% during the forecast period from 2024 to 2033.

The global diabetes drugs market is characterized by the considerable growth it has experienced over the recent years, which is attributed mostly to increasing prevalence of diabetes on a global scale. Diabetes is, in essence, a metabolic disorder, in which patient experiences chronically high blood sugar levels. The prevalence of diabetes is escalating on a global scale, which has spurred innovations in the field of diabetes treatment.

In addition to that, there have been various pharmaceutical interventions which have enabled patients to manage their disease. Insulin has been a go-to diabetes treatment due to its long lasting and rapid effects. Additionally, oral antidiabetic drugs assist in managing blood sugar levels, the examples of which are metformin, sulfonylureas, SGLT-2 inhibitors and GLP-1 receptor agonists.

Introduction of continuous glucose monitoring systems and insulin pumps has also ushered in an era of advancements in diabetes technology. This has ultimately assisted in developing personalized and more effective solutions for diabetes management. Factors that drive market growth include increasing diabetes prevalence, sedentary lifestyles, aging population and unhealthy nutrition habits.

Furthermore, the market also experiences challenges such as pricing pressures, complex regulatory processes and a rapidly evolving landscape which create persisting demand for continuous innovation in drug development. Overall, the global diabetes drugs market is expected to undergo a period of unforeseen growth which is primarily driven by rising demand for effective solutions for diabetes management.

- According to the International Diabetes Federation, the diabetes population is expected to increase to 643 million by 2030 and reach 783 million by 2045.

- According to the American Diabetes Association’s Economic Costs of Diabetes in the U.S., the total estimated cost of diagnosed diabetes in 2022 amounted to $412.9 billion. This included $306.6 billion in direct medical costs and $106.3 billion in reduced productivity.

Key Takeaways

- The global diabetes drugs market generated a revenue of USD 69.1 billion in 2023, and is forecasted to exceed USD 153.4 billion., accompanied by a CAGR of 8.3%.

- In 2023, the GLP-1 receptor agonists segment led the market with a 32.6% market share.

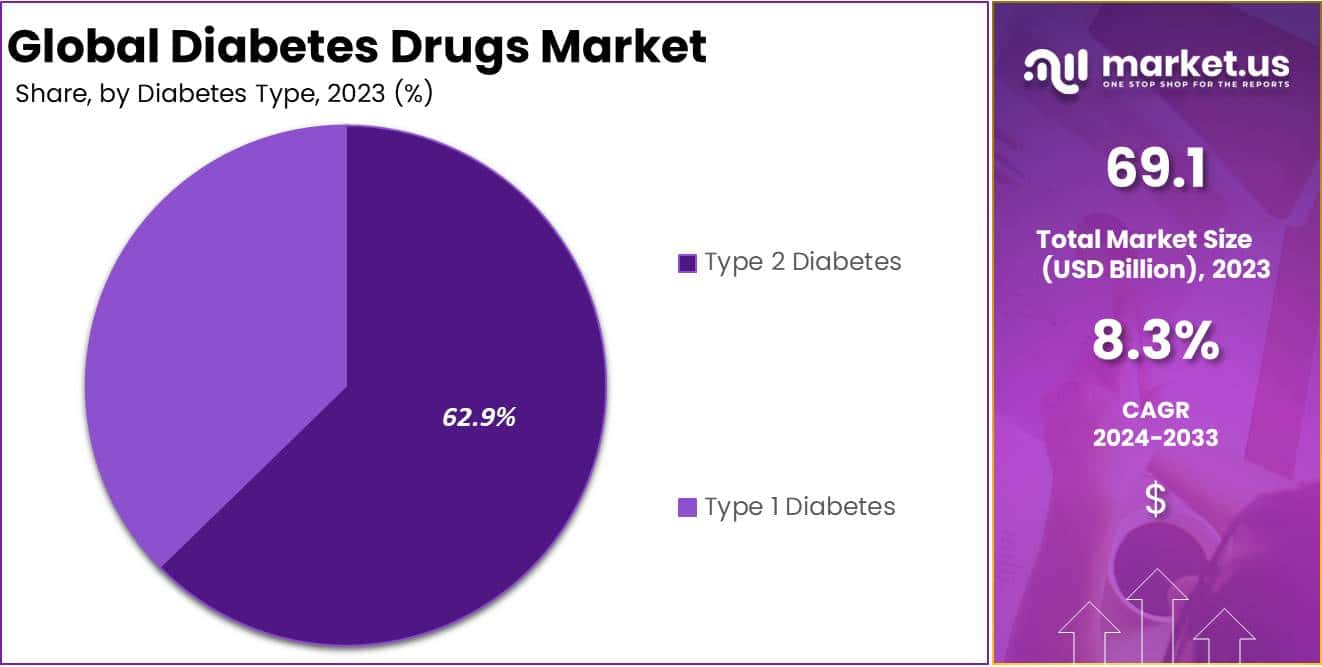

- The type 2 segment held the largest market share at 62.9% due to its higher global prevalence.

- Subcutaneous route of administration dominated with a 45.8% market share.

- The retail pharmacies segment secured the largest market share in 2023, accounting for 62.4% of sales, attributed to competitive pricing of diabetes drugs in retail channels.

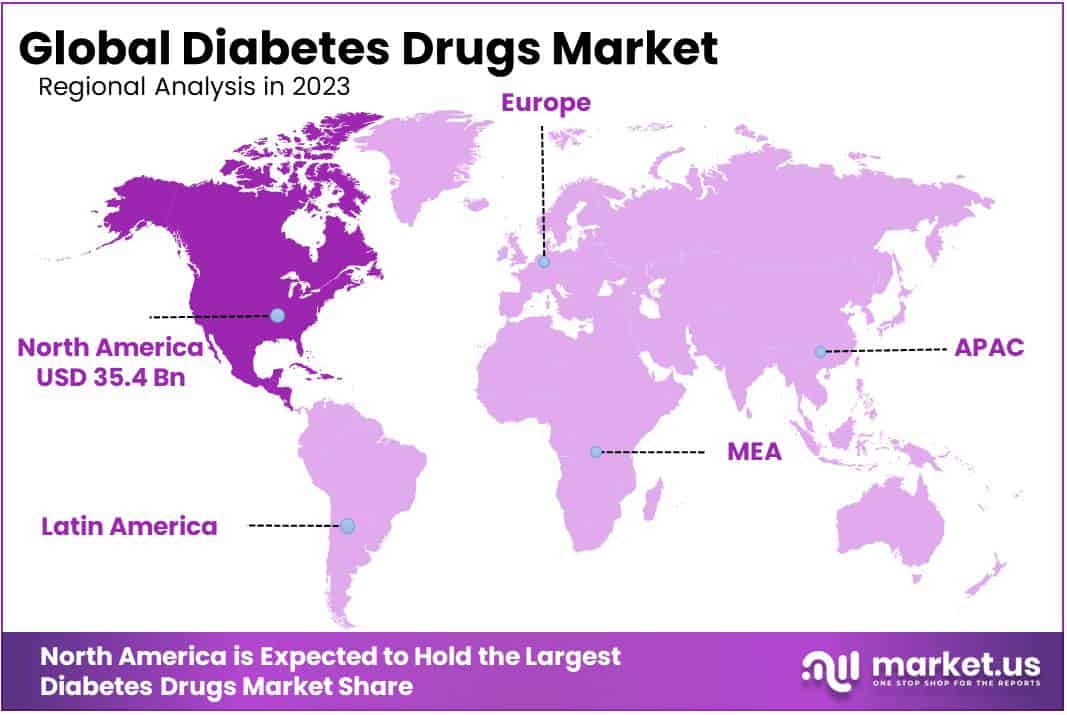

- In 2023, the North America market accounted for a significant market share of 51.3% in the diabetes drugs segment.

Drug Class Analysis

The global market for diabetes drugs is segmented into insulin, DPP-4 inhibitors, GLP-1 receptor agonists, SGLT-2 inhibitors and others, based on drug class. In 2023 the GLP-1 receptor segment generated the most revenue for the market and claimed a market share of 32.6%. This is attributed to increasing demand in developing and under developed countries, which, in turn, is attributed to the enhanced safety and effectiveness offered by the drugs.

This increasing demand encourages substantial R&D investments by established players. On the other hand, the insulin segment is expected to grow at an unmatched pace in the upcoming forecast period. The demand for insulin is fueled by increasing availability of generic versions of insulin worldwide coupled with its efficacy in managing the symptoms of type 1 and type 2 diabetes.

Diabetes Type Analysis

As far as diabetes type is concerned, the global diabetes drugs market is segmented into type 1 diabetes and type 2 diabetes. Among these, the type 2 diabetes segment claimed the largest Market share in 2023, amounting to 62.9%. This is credited to comparatively higher prevalence of the disease worldwide. According to an article by the World Health Organization, the majority of individuals with diabetes, 95% to be precise, are diagnosed with type 2 diabetes.

In addition to that the increasing clinical trials for type 2 diabetes medication overall are interpreted to further propel growth of the segment. On the other hand, type 1 segment is slated to experience considerable growth as the forecast period progresses. This is attributed to the increasing prevalence of the disease among children and young adults, especially in developing and under developed nations.

Route of Administration Analysis

When classified by route of administration the global market for diabetes drugs shows segments such as oral, subcutaneous and intravenous. Among these the subcutaneous segment maintained its strong hold on the market and commanded a market share of 45.8% in 2023. Insulin injections which are administrated subcutaneously assist in managing the symptoms of type 2 diabetes.

Additionally, the increasing use and demand for biosimilar and generic versions of insulin, in developing countries in particular, also drives the demand for the segment. Similarly, the oral route of administration is expected to experience increasing popularity during the forecast period. Additionally, future launches of oral diabetic medications, for example, GLP-1 and SGLT-2 inhibitors are predicted to accelerate the growth of the segment.

Distribution Channel Analysis

In terms of distribution channels, the global market for diabetes drugs is classified into hospital pharmacies, online pharmacies and retail pharmacies. Among these, the retail pharmacy segment generated the most revenue for the market in 2023 and secured a market share of 62.4%. the persisting dominance of the segment is attributed to diabetes drugs being easily available at competitive prices through retail channels.

Not only this but the prevalence of retail pharmacy is also escalating worldwide which has further supplemented market growth in recent years. On the other hand, the online pharmacy segment is predicted to experience accelerating growth during the forecast period. This is credited to extensive product portfolios offered by online pharmacy which continue expanding at an unrivaled rate.

By Drug Class

- GLP-1 Receptor Agonists

- Insulin

- DPP-4 Inhibitors

- SGLT2 Inhibitors

- Other Drug Classes

By Application

- Type 2 Diabetes

- Type 1 Diabetes

By Route of Administration

- Subcutaneous

- Oral

- Intravenous

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Market Drivers

Increasing Prevalence of Diabetes

One of the primary drivers of the diabetes drugs market is the rising prevalence of diabetes worldwide. The IDF Diabetes Atlas (2021) states that 10.5% of adults aged 20-79 have diabetes, and nearly half of them are unaware of their condition. The increasing prevalence of diabetes can be attributed to changing lifestyle habits such as unhealthy diets and lack of movement or exercise. Additionally, increasing prevalence of obesity and aging populations also exacerbate the problem.

Technological advancements

The global diabetes drugs market is benefited significantly due to rapidly advancing technology, which is led to continuous development of innovative medication and treatment. Furthermore, the introduction of SGLT-2 inhibitors and GLP-1 receptor agonists has provided patient with alternative treatment options to traditional solutions which include insulin therapy and antidiabetic drugs.

Additionally, the continuously evolving technological landscape has assisted in introduction of effective diabetes monitoring devices in the market. Such devices introduce convenience and efficacy in treatment regimen of patients which further enhances patient adherence to treatment.

Restraints

High Costs

The treatment of diabetes is expensive, which has proven to be a considerable restraint for the growth of the market. This restraint becomes particularly prominent in developing and underdeveloped nations, the residents of patients have limited access to healthcare. SGLT-2 inhibitors and GLP-1 receptor agonists are among the newer classes of drugs that while effective, can be expensive, which puts a financial burden on patients along with the healthcare systems.

Opportunities

The global diabetes drugs market presents several opportunities for growth, the most prominent of which is the development of novel therapeutic solutions that effectively target the unmet needs in diabetes management. Such treatments can offer benefits such as improved blood sugar control, reduced risk for cardiovascular conditions, and personalized treatment approaches. Advancements in biotechnology potentially offer breakthroughs in diabetes care, because of their extensive capabilities in targeting the underlying disease mechanisms and enhancing the efficiency of the treatment.

Additionally, the integration of novel technologies such as AI, machine learning and wearable devices in healthcare has enabled real-time monitoring, and feedback, along with data-driven insights, which will inevitably allow for optimized diabetes management. Patient centered approaches and preventive strategies also create collaborative opportunities for pharmaceutical companies and healthcare providers and payers, and assist in developing cost-effective diabetes care solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors such as inflation, government expenditure, and interest rates have a significant impact on the diabetes drugs market. Inflation has a negative influence on the production costs for pharmaceutical companies, which in turn, influences consumers and ultimately, drug sales. This can affect affordability and access to medication, which can prove to be particularly dire for patients from low- and middle-income countries.

Government expenditure also influential in healthcare funding and access to diabetes medication. Increased government expenditure cannot only spread awareness among diabetes patients but increases accessibility of diabetes meditation. Furthermore, the interest rates also have a considerable impact on the diabetes drugs market, particularly in terms of investment and financing for established players. High interest rates affect the investment abilities of pharmaceutical companies, while low interest rates stimulate investment and innovation which ultimately leads to the development of novel therapeutic solutions.

Latest Trends

Shift Towards Personalized Medicine

The latest trends observed in the market underscore a prominent shift towards personalized medicine, digital integration in healthcare, and novel therapeutic approaches. The increasing adoption of precision medicine in diabetes care has resulted in careful curation of highly effective and individualized patient profiles which has ultimately assisted in improving the quality of medical care delivered.

Furthermore, digital health technology such as wearables and tele medicine platforms are increasingly being integrated into health care systems which has allowed for remote increased patient engagement and effective data driven decision making. Another prominent trend is the development of innovative therapies, the examples of which include, GLP-1 receptor agonists, biosimilar insulin and SGLT-2 inhibitors.

The increasing emphasis on holistic approaches has led to development of collaborative care. Overall these trends underline a paradigm shift towards personalized technology enabled and comprehensive approaches to diabetes management which are sure to lead to optimized patient outcomes and enhanced patient satisfaction.

Regional Analysis

North America is leading the Diabetes Drugs Market

In 2023, the North America segment of the global diabetes drugs market secured a market share of 51.3%, with predictions to maintain its dominance during the forecast period as well. This is owed to the ever-increasing diabetes incidence in the region and enhanced investments in research and development by both private and government sectors. Furthermore, the awareness regarding innovative anti-diabetic medications has been on the rise, which, coupled with the frequent launches and favorable reimbursement policies is expected to drive market growth in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia pacific diabetes drugs market is poised for considerable growth as the forecast period progresses. This potential for growth is primarily attributed to growing incidence for diabetes. The substantial burden of diabetes fuels the demand for diabetes care, which is expected to ultimately contribute to the high Compound Annual Growth Rate (CAGR) during the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global diabetes drugs market is characterized by its fragmented and highly competitive nature with the established players vying for market share on a global scale. Leading pharmaceutical companies dominating the market include Novo Nordisk, Sanofi, Eli Lilly, Merck & Co., AstraZeneca, and Boehringer Ingelheim. These established players have cemented their presence in the market with the help of impressive product portfolios, innovative drug development pipelines, and strategic partnerships. These key players continuously invest in research marketing strategies and product innovation in order to not only maintain but also expand their market share.

Top Key Players in Diabetes Drugs Market

- Novo Nordisk

- Glaxosmithkline

- Sanofi

- Merck & Co.,

- Eli Lilly and Company

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International GmbH

- Novartis AG

- Bayer AG

- Other Key Players

Recent Developments

- In February 2023, Merck & Co., a prominent pharmaceutical company based in the United States, identified nitrosamine contaminants and their source in three popular diabetes medications containing sitagliptin as the active ingredient. Nitrosamine impurities are of concern due to their potential to cause cancer.

- In August 2023, Critical Path Institute (C-Path) revealed that Sanofi, a renowned player in immunology and diabetes care on a global scale, become a member of its Type 1 Diabetes Consortium (T1DC). Sanofi’s inclusion in T1DC reflects its dedication to advancing innovation and enhancing the well-being of individuals affected by diabetes.

Report Scope

Report Features Description Market Value (2023) USD 69.1 billion Forecast Revenue (2033) USD 153.4 billion CAGR (2024-2033) 8.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class – Insulin, DPP-4 Inhibitors, GLP-1 Receptor Agonists, SGLT2 Inhibitors, Other Drug Classes; By Application – Type 1 Diabetes, Type 2 Diabetes; By Route of Administration – Oral, Injectable; By Distribution Channel – Hospital Pharmacies, Retail Pharmacies, Online Pharmacies Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novo Nordisk, Glaxosmithkline, Sanofi, Merck & Co., Eli Lilly and Company, AstraZeneca, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Novartis AG, Bayer AG, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novo Nordisk

- Glaxosmithkline

- Sanofi

- Merck & Co.,

- Eli Lilly and Company

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International GmbH

- Novartis AG

- Bayer AG

- Other Key Players