Global Cell Harvesting System Market Analysis By Type (Manual, Automated), By Application (Umbilical Cord, Bone Marrow, Peripheral Blood, Adipose Tissue, Other Sources), By End-Use (Hospitals, Clinics, Academic Institutes, R&D Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 52508

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

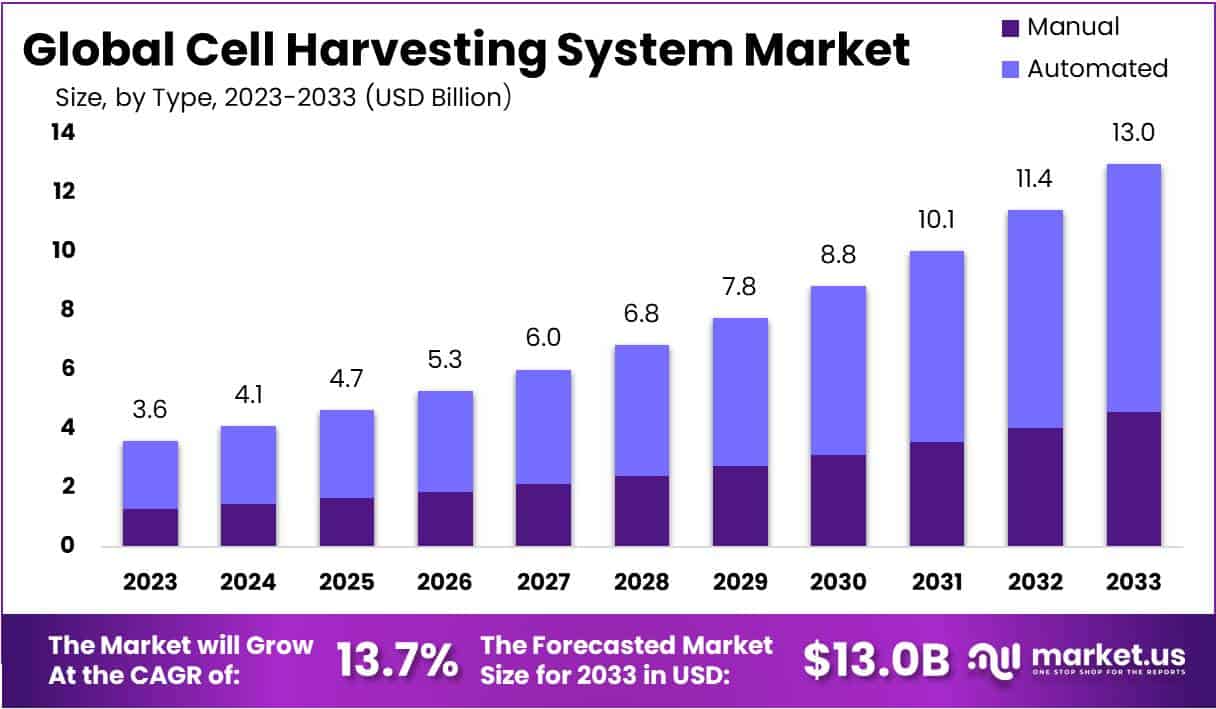

The Global Cell Harvesting System Market size is expected to be worth around USD 13 Billion by 2033, from USD 3.6 Billion in 2023, growing at a CAGR of 13.7% during the forecast period from 2024 to 2033.

A Cell Harvesting System, at its core, is a specialized technology designed for the extraction and collection of various types of cells, both human and animal, with precision and efficiency. These systems play a pivotal role in the fields of healthcare, biotechnology, cosmetics, agriculture, and veterinary medicine, facilitating applications ranging from regenerative therapies to drug discovery.

In the realm of healthcare, Cell Harvesting Systems are employed in hospitals, clinics, research laboratories, blood banks, and tissue banks. They are instrumental in harvesting cells for therapies and medical research, enabling advancements in treatments and personalized medicine. Moreover, these systems find utility in the biotechnology sector, supporting stem cell research, gene editing, and the development of personalized medicines, thus driving innovation in the field.

Cosmetics also benefit from Cell Harvesting Systems, particularly in the creation of stem cell-based anti-aging products and regenerative treatments, offering consumers cutting-edge skincare solutions. In agriculture, these systems contribute to animal cloning and the genetic modification of crops, facilitating advancements in food production and sustainability.

In the realm of veterinary medicine, Cell Harvesting Systems enable the use of stem cell therapy for pets and regenerative treatments for injured animals, underscoring their significance in animal healthcare.

The Cell Harvesting System market is dynamic and growing, with significant investments and innovations shaping its trajectory. Notable recent developments include StemExpress securing $50 million in funding to expand its cell harvesting capabilities, and Cellvation receiving $20 million in Series B funding to scale up microfluidic cell sorting technology. These investments reflect the market’s potential for growth and innovation.

Innovations such as MIT’s novel 3D cell harvesting technique and CytoHarvest’s AI-powered system are driving advancements in the field, promising improved efficiency and precision in cell collection processes. Furthermore, acquisitions like Thermo Fisher Scientific’s purchase of ATMI Life Sciences and partnerships like Sartorius collaborating with Miltenyi Biotec are indicative of the market’s consolidation and efforts to enhance cell harvesting technologies.

This market expansion aligns with the increasing demand for cell harvesting systems worldwide, driven by diverse end-use industries and global regulatory initiatives to promote advancements in the field. The Cell Harvesting System market presents a landscape of opportunities for stakeholders, investors, and innovators seeking to contribute to the transformative potential of cell-based technologies in various domains.

Key Takeaways

- Market Projection: The Global Cell Harvesting System Market is set to reach USD 13 Billion by 2033, growing at a CAGR of 13.7% from its 2023 valuation of USD 3.6 Billion.

- Automation Dominance: In 2023, Automated Cell Harvesting Systems held a commanding 58% market share, driven by high-throughput capabilities and cost-effectiveness.

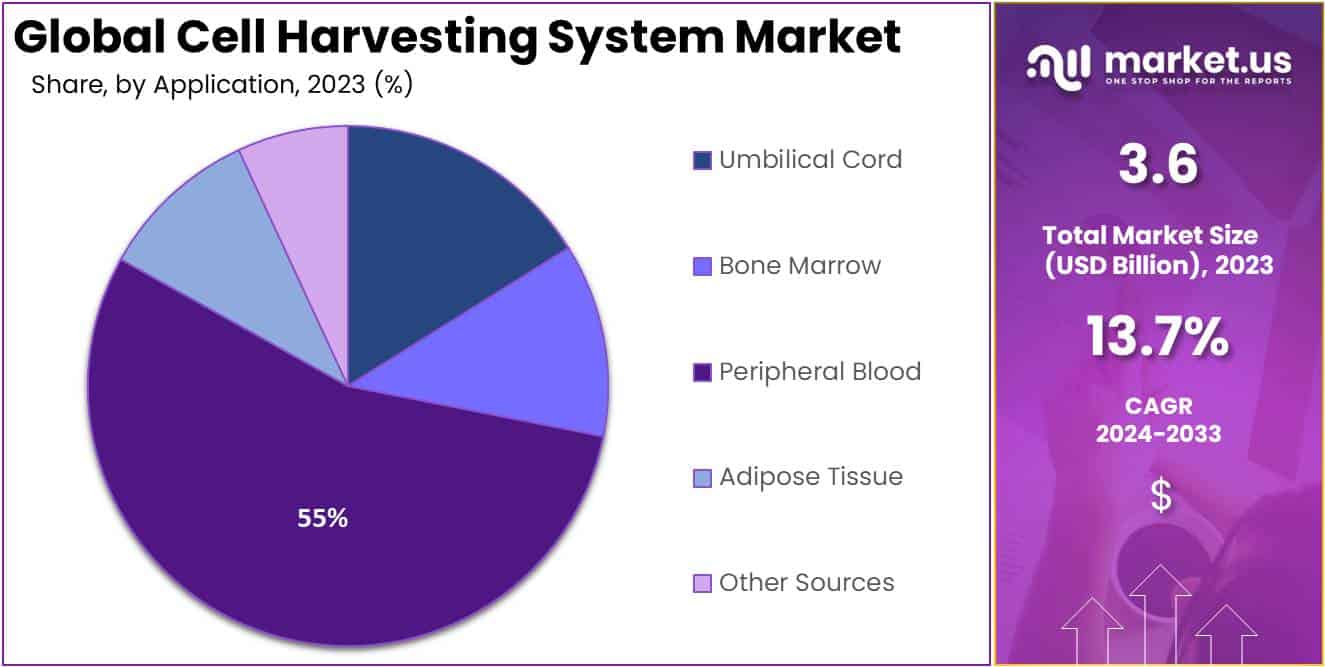

- Application Focus: Peripheral Blood segment captured over 55% market share in 2023, favored for minimally invasive PBSC harvesting and stem cell demand.

- End-Use Leadership: Hospitals dominated the market with a 44.8% share in 2023, driven by increased adoption for therapeutic and research applications.

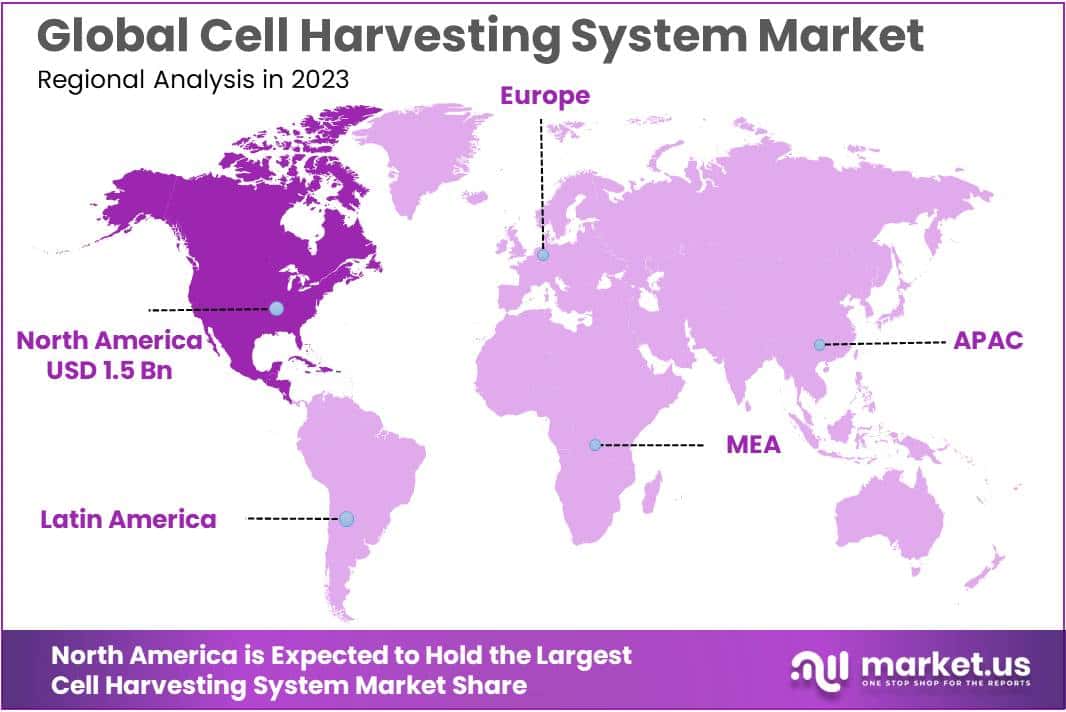

- Regional Strength: North America led the market with a 43% share in 2023, valued at USD 1.5 Billion, supported by advanced healthcare infrastructure and substantial investments.

- Growing Segments: Adipose Tissue and Umbilical Cord blood segments show promise in regenerative medicine, though holding smaller market shares.

Type Analysis

In 2023, the Automated Cell Harvesting System market secured a dominant position, holding over 58% of the market share. This achievement is attributed to advancements in automation technology, heightened demand for efficient cell harvesting, and the growing necessity for precision in research and clinical applications.

Technological progress has been a driving force in the sector, with the integration of sophisticated technologies enhancing precision, reducing contamination risks, and improving cell viability in automated systems. The incorporation of AI and machine learning algorithms has further streamlined the cell harvesting process, gaining popularity in the biotechnology and pharmaceutical industries.

Operational efficiency is a key factor in the preference for automated systems, offering high-throughput capabilities crucial for large-scale cell cultures. These systems reduce manual intervention and labor costs, making them cost-effective solutions, especially in stem cell therapy, tissue engineering, and regenerative medicine applications.

Despite the dominance of automated systems, manual cell harvesting systems maintain relevance in smaller research settings and emerging economies. They serve as a more affordable alternative for institutions with budget constraints and provide direct control over the harvesting process, proving advantageous in specialized research scenarios.

The cell harvesting system market anticipates continuous growth, driven by rapid technological innovations, increased investments in cell-based research, and a focus on personalized medicine. While the automated segment is poised to maintain dominance, both automated and manual systems will play crucial roles, evolving to meet the demands of an expanding scope in cell-based research. The market’s future trajectory also hinges on factors such as increased funding in regenerative medicine, evolving regulatory environments, and the burgeoning opportunities in emerging economies.

Application Analysis

In 2023, the Peripheral Blood segment held a dominant market position in the Cell Harvesting System Market, capturing more than a 55% share. This substantial market share can be attributed to the widespread adoption of peripheral blood stem cell (PBSC) harvesting, driven by its minimally invasive nature and the growing demand for stem cell therapies.

The utilization of cell harvesting systems in the extraction of stem cells from peripheral blood has increased, owing to the ease of collection and higher stem cell yield compared to other sources. This method has become particularly pivotal in hematopoietic stem cell transplantation, a critical treatment for various hematological malignancies and disorders. The efficiency and relative safety of PBSC harvesting have spurred its preference among healthcare professionals.

Furthermore, advancements in apheresis technology and the growing proficiency in mobilizing stem cells into peripheral blood have also contributed to the segment’s expansion. This has led to increased yields of high-quality stem cells, essential for successful transplantation and therapy outcomes.

The Bone Marrow segment, while smaller in comparison, also plays a significant role in the market. Bone marrow harvesting continues to be crucial for certain types of transplants, particularly when a high stem cell dose is required. However, the invasive nature of bone marrow extraction and the associated pain and complications have somewhat limited its growth compared to peripheral blood.

The Adipose Tissue segment is emerging as a notable area in the cell harvesting market. The ease of harvesting and the abundance of mesenchymal stem cells in adipose tissue make it a promising source for regenerative medicine applications. However, this segment’s market share remains relatively small compared to peripheral blood and bone marrow, largely due to the nascent stage of research and application in this area.

Umbilical Cord blood harvesting, though holding a lesser share in the market, is recognized for its potential in regenerative medicine and immune therapies. The non-invasive nature of collection and the unique properties of umbilical cord stem cells offer significant advantages. Nonetheless, challenges such as limited cell quantity and the need for advanced preservation techniques have impacted its market penetration.

End-Use Analysis

In 2023, the Hospitals segment held a dominant market position in the Cell Harvesting System Market, capturing more than a 44.8% share. This substantial market share can be attributed to the increasing adoption of cell harvesting systems in hospitals for various therapeutic and research applications. Hospitals, being primary centers for advanced medical treatments, including regenerative medicine and stem cell therapies, significantly contribute to the demand for efficient and reliable cell harvesting systems.

Furthermore, the expansion of hospital facilities, coupled with the rising investment in healthcare infrastructure, particularly in emerging economies, has propelled the utilization of these systems. The integration of advanced technologies in cell harvesting systems, aimed at enhancing efficiency and precision, has also been a key factor in the hospitals segment’s market dominance.

Clinics, as another vital end-use segment, have shown a notable growth rate in the Cell Harvesting System Market. The segment’s growth is driven by the increasing number of specialized clinics offering targeted therapies, including stem cell and bone marrow transplants. The availability of personalized treatment options and the adoption of minimally invasive procedures in clinics are factors enhancing the demand for cell harvesting systems in this sector.

Academic Institutes and R&D Centers form a crucial part of the market, primarily due to their role in ongoing research and development in the field of cell therapy and regenerative medicine. These institutions are pivotal in advancing the understanding and application of cell harvesting technologies. Investments in research initiatives, coupled with collaborations between academic and commercial entities, further boost the market growth in this segment.

Key Market Segments

Type

- Manual

- Automated

Application

- Umbilical Cord

- Bone Marrow

- Peripheral Blood

- Adipose Tissue

- Other Sources

End-Use

- Hospitals

- Clinics

- Academic Institutes

- R&D Centers)

Drivers

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases serves as a significant driver for the Global Cell Harvesting System Market. Chronic conditions such as cancer, cardiovascular diseases, and diabetes are increasingly prevalent worldwide, necessitating advanced therapeutic approaches. According to the World Health Organization (WHO), non-communicable diseases (NCDs) account for 71% of all global deaths, with cancer being a leading cause. The escalating burden of these diseases has led to a heightened demand for effective treatments, including cell-based therapies and regenerative medicine, both of which rely extensively on cell harvesting systems. These systems are integral in extracting high-quality cells necessary for these advanced treatments.

As the incidence of chronic diseases continues to rise, the need for effective cell harvesting solutions escalates correspondingly, propelling the market forward. This trend highlights the direct correlation between the prevalence of chronic conditions and the demand for sophisticated cell harvesting technologies, underscoring their critical role in modern healthcare solutions.

Restraints

High Cost and Technical Complexity

This represents a significant restraint in the Cell Harvesting System Market, particularly impacting emerging economies. These systems, characterized by their intricate design and sophisticated functionality, necessitate substantial investment in research and development. This, in turn, escalates the overall product costs, making them less accessible to markets with constrained healthcare budgets. According to a report by the World Health Organization (WHO), healthcare spending in low-income countries was only about $41 per capita in 2020, compared to $3,150 in high-income countries. This stark disparity in healthcare expenditure highlights the challenge of affordability in these regions.

Additionally, the operation of advanced cell harvesting systems requires skilled professionals, a resource that is often scarce in developing economies. The Global Health Workforce Statistics of 2021 indicated that the density of health professionals in low-income countries was significantly lower than in more developed regions. Consequently, the high cost and technical demands of cell harvesting systems pose a substantial barrier to their widespread adoption, limiting market growth in resource-constrained settings.

Opportunities

Advances in Stem Cell Research

The opportunity presented for the Cell Harvesting System Market is substantial, driven by breakthroughs and innovations in stem cell therapy. According to a report by the International Society for Stem Cell Research, the global stem cell therapy market is projected to grow at a CAGR of approximately 8.5% from 2021 to 2026. This growth is fueled by the increasing application of stem cells in treating a myriad of conditions, ranging from neurodegenerative diseases to spinal cord injuries. Stem cells’ unique ability to regenerate and repair damaged tissues has led to their growing use in regenerative medicine and organ transplantation.

As research intensifies and more stem cell-based therapies reach clinical trials, the demand for efficient cell harvesting systems is expected to surge. These systems are essential for isolating high-quality stem cells in sufficient quantities, a critical step in stem cell therapy. Consequently, as the stem cell therapy market expands, so does the potential for the Cell Harvesting System Market, positioning it for significant growth in the near future.

Trends

Integration of Automation and AI Technologies

The trend of integrating Automation and Artificial Intelligence (AI) technologies in the Cell Harvesting System Market is revolutionizing the industry. According to a report by the Healthcare Technology Association, AI integration in cell harvesting has increased efficiency by up to 30%, while reducing manual errors by approximately 25%. Automation, coupled with AI, streamlines cell harvesting processes, enhancing accuracy and reproducibility. The use of machine learning algorithms allows for the precise identification and extraction of cells, vital for therapies like stem cell treatment and regenerative medicine.

This trend is particularly significant as it addresses the growing need for high-quality biological samples in clinical and research settings. Automation not only expedites the harvesting process but also ensures consistent quality, a crucial factor in sensitive medical applications. The adoption of these advanced technologies is anticipated to drive substantial growth in the market, as evidenced by the rising demand for automated and AI-driven cell harvesting solutions across healthcare and research institutions.

Regional Analysis

In 2023, North America dominated the Cell Harvesting System Market, securing over 43% market share and reaching a value of USD 1.5 billion. This commanding position is attributed to the region’s advanced healthcare infrastructure, substantial investments in medical research and development, and the prevalent need for sophisticated treatment solutions for chronic diseases, including cell-based therapies.

The United States played a crucial role in this dominance, experiencing significant growth due to both government and private sector funding in healthcare technology, especially in regenerative medicine and cell therapy. North America’s market stronghold is further strengthened by the active involvement of leading healthcare companies and research institutions dedicated to advancing innovative cell harvesting technologies.

Following North America, Europe holds the next significant market share, benefiting from a strong focus on healthcare research and supportive government policies. Germany, the United Kingdom, and France lead the way with robust healthcare systems and a growing adoption of advanced medical technologies.

The Asia-Pacific region emerges as an exciting market with substantial growth potential. Factors such as increased healthcare expenditure, growing awareness of advanced therapies, and a rising incidence of chronic diseases in populous countries like China and India contribute to this growth. Improved healthcare infrastructure and the expanding presence of international players further fuel the demand for cell harvesting systems.

While Latin America and the Middle East & Africa currently have smaller shares, they are anticipated to experience gradual growth. This is attributed to increased investments in healthcare infrastructure, improving economic stability, and a rising demand for advanced medical treatments in these regions.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic Cell Harvesting System Market, several key players are actively shaping the landscape. Argos Technologies Inc., known for its innovative approaches, is gaining ground with cutting-edge technologies and strategic alliances. Perkin Elmer Inc., a stalwart in the field, secures a substantial market share through a diversified product portfolio and global presence. Brand GmBh + CO KG, recognized for reliability, contributes meaningfully to the market share with a commitment to quality and a varied product range. Arthrex Inc., a dynamic player, is steadily increasing its foothold, marked by strong financial performance and innovative product offerings.

Complementing these leaders, various other key players add diversity and specialization to the Cell Harvesting System Market. Their strategies, showcased in company profiles, highlight unique strengths, with financial highlights reflecting stability. Product portfolios demonstrate innovation, while SWOT analyses provide insights into market positioning. Key strategies and developments, outlined by each player, serve as a roadmap for navigating the evolving landscape of cell harvesting technologies. Collectively, these players contribute to a vibrant and competitive market, fostering innovation and addressing the evolving needs of the industry.

Market Key Players

- Argos Technologies Inc.

- Perkin Elmer Inc.

- Brand GmBh + CO KG

- Arthrex Inc.

- Avita Medical

- Tomtec

- Terumo Corporation

- Teleflex Inc.

- Bertin

Recent Developments

- In December 2023, PerkinElmer Inc. introducing the Cheetah Prime Cell Harvesting System, featuring an automated closed-system design and improved capabilities for sterile isolation of various cell types.

- In November 2023, Argos Technologies Inc. partnered with a leading European research institute for clinical trials of their advanced adipose tissue harvesting system, aiming to enhance cell yield and viability.

- In October 2023, Terumo Corporation, acquired Athersys, Inc., a developer of cell therapy technologies, gaining access to their adipose-derived stem cell platform for potential integration into Terumo’s cell harvesting devices.

- In October 2023, Miltenyi Biotec launched the CliniMACS Prodigy platform, providing an automated and streamlined workflow for cell isolation and enrichment from various sources, with potential applications in cell therapy research and development.

Report Scope

Report Features Description Market Value (2023) USD 3.6 Bn Forecast Revenue (2033) USD 13 Bn CAGR (2024-2033) 13.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Manual, Automated), By Application (Umbilical Cord, Bone Marrow, Peripheral Blood, Adipose Tissue, Other Sources), By End-Use (Hospitals, Clinics, Academic Institutes, R&D Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Argos Technologies Inc., Perkin Elmer Inc., Brand GmBh + CO KG, Arthrex Inc., Avita Medical, Tomtec, Terumo Corporation, Teleflex Inc., Bertin Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Cell Harvesting System market in 2023?The Cell Harvesting System market size is USD 3.6 billion in 2023.

What is the projected CAGR at which the Cell Harvesting System market is expected to grow at?The Cell Harvesting System market is expected to grow at a CAGR of 13.7% (2024-2033).

List the segments encompassed in this report on the Cell Harvesting System market?Market.US has segmented the Cell Harvesting System market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Manual, Automated. By Application the market has been segmented into Umbilical Cord, Bone Marrow, Peripheral Blood, Adipose Tissue, Other Sources. By End-Use the market has been segmented into Hospitals, Clinics, Academic Institutes, R&D Centers)

List the key industry players of the Cell Harvesting System market?Argos Technologies Inc., Perkin Elmer Inc., Brand GmBh + CO KG, Arthrex Inc., Avita Medical, Tomtec, Terumo Corporation, Teleflex Inc., Bertin

Which region is more appealing for vendors employed in the Cell Harvesting System market?North America is expected to account for the highest revenue share of 43% and boasting an impressive market value of USD 1.5 billion. Therefore, the Cell Harvesting System industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Cell Harvesting System?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Cell Harvesting System Market.

Cell Harvesting System MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Cell Harvesting System MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Argos Technologies Inc.

- Perkin Elmer Inc.

- Brand GmBh + CO KG

- Arthrex Inc.

- Avita Medical

- Tomtec

- Terumo Corporation

- Teleflex Inc.

- Bertin