Global Healthcare IT Market By Product Type (Healthcare Provider Solutions, Healthcare Payer Solutions, and HCIT Outsourcing Services), By Component (Software, Hardware, and Services), By Deployment Mode (On-premise and Cloud-based), By End-User (Healthcare Providers and Healthcare Payer), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: July 2024

- Report ID: 101978

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

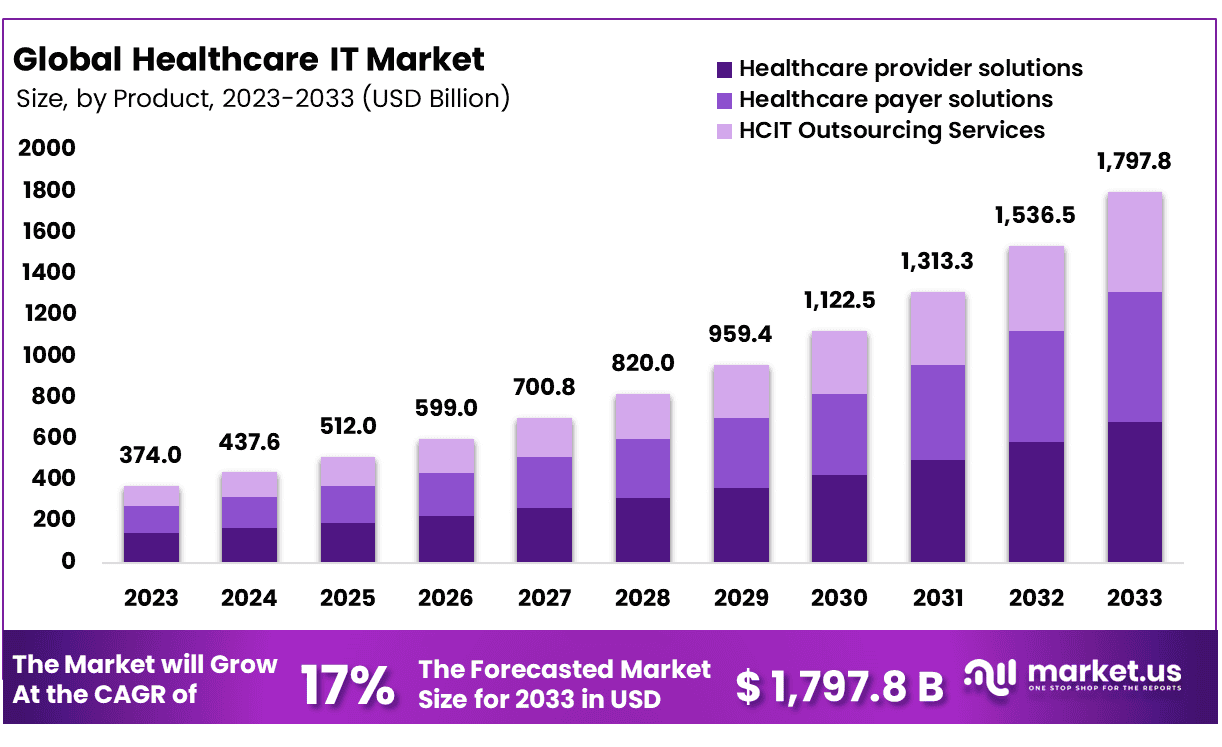

The Global Healthcare IT Market size is expected to be worth around USD 1797.8 Billion by 2033 from USD 374.0 Billion in 2023, growing at a CAGR of 17% during the forecast period from 2024 to 2033.

The Healthcare IT market is undergoing transformative growth, primarily driven by the widespread adoption of Electronic Health Records (EHR) and stringent government regulations focused on data security and interoperability. As of 2021, a remarkable 96% of non-federal acute care hospitals and 78% of office-based physicians in the U.S. have implemented certified EHR systems, showcasing a significant increase from 28% in 2011. This shift highlights the crucial role of EHRs in improving the accuracy and efficiency of patient care, indicating a broader global trend towards digital healthcare solutions.

Amid increasing regulatory demands, such as compliance with the Health Insurance Portability and Accountability Act (HIPAA) in the United States, there has been a substantial increase in IT investments within the healthcare sector. These regulations have catalyzed enhancements in cybersecurity measures across healthcare entities, contributing to a 40% growth in healthcare IT investment over the past five years.

Internationally, the U.S. marked a notable achievement in 2022 by exporting healthcare IT products valued at approximately $15 billion, a 25% increase from the previous year. This growth reflects the rising global demand for advanced healthcare IT solutions.

Government support for integrating IT in healthcare is also evident, with the European Union allocating around €500 million under its eHealth Action Plan to boost healthcare quality through technology over the next five years. Similarly, in 2023, the U.S. government committed $30 billion to enhance IT infrastructure within the healthcare sector, complemented by an additional $20 billion from private entities.

The market has seen significant strategic actions, such as IBM’s acquisition of Truven Health Analytics for $2.6 billion in March 2023 and Microsoft’s collaboration with Mayo Clinic in January 2024 to develop AI-driven diagnostic solutions. These initiatives reflect a strategic shift towards leveraging advanced technology to enhance healthcare delivery and efficiency.

These developments underscore a dynamic evolution in the Healthcare IT sector, marked by increased global engagement, investment, and innovation, aimed at fostering improved healthcare outcomes through advanced technological solutions.

Key Takeaways

- Market Overview: The global healthcare IT market is projected to reach USD 1,797.8 billion by 2033. The market is expected to grow at a CAGR of 17% from 2024 to 2033.

- Product Type Analysis: Healthcare provider solutions lead the market with a 38% revenue share.

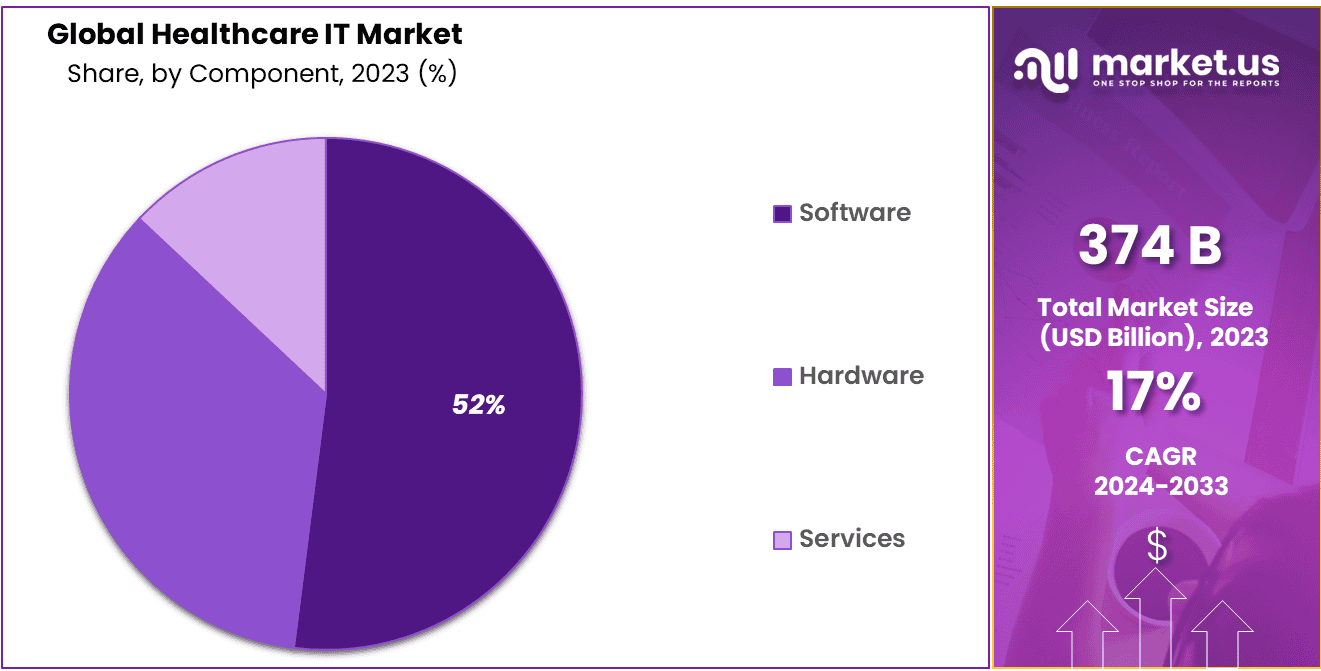

- Component Analysis: Healthcare IT services have the largest market share at 52%.

- End-User Analysis: Healthcare payers are set to generate the highest revenue.

- Opportunities: There is increasing demand for healthcare IT due to digitalization tools like telehealth and AI.

- Trends: Value-based payment models and Accountable Care Organizations (ACOs) drive partnerships and mergers.

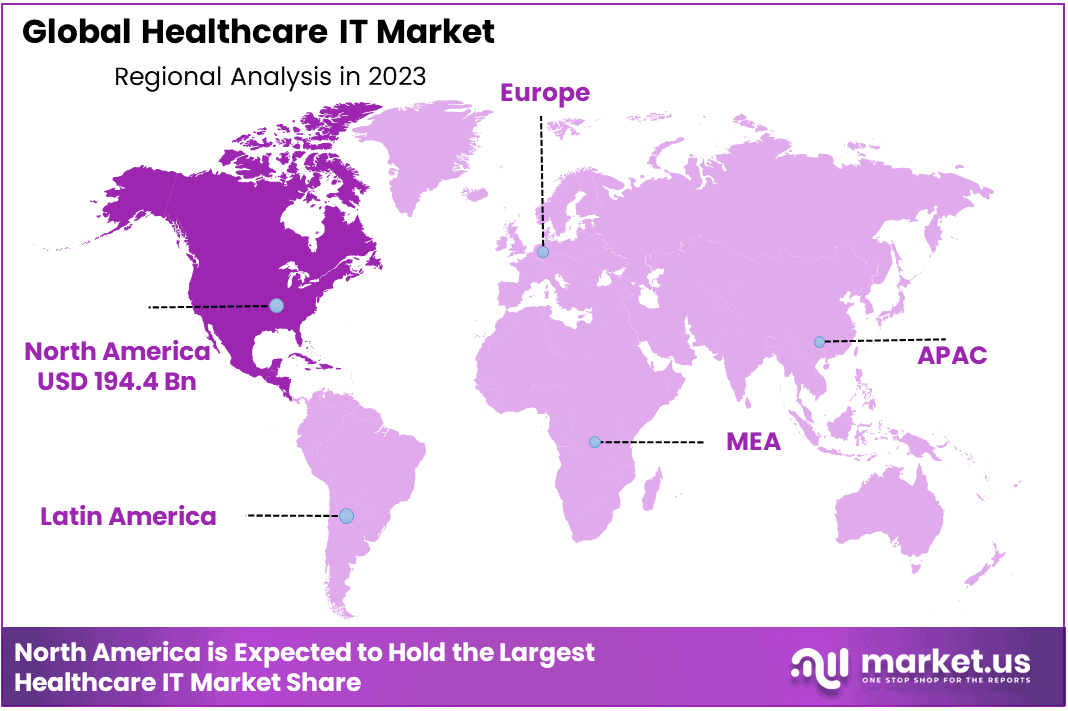

- Regional Analysis: North America leads the market with a 52% revenue share. Europe is expected to grow the fastest due to government support and AI adoption.

Product Type Analysis

Healthcare Provider Solutions Have Dominated the Segment

Healthcare provider solutions have dominated the market, capturing the highest revenue share of 38%. This dominance can be attributed to the increasing implementation of electronic health records (EHR) and other hospital information systems by healthcare providers.

The market is poised for considerable growth due to several key factors. The demand for quality healthcare services and solutions is rising, driving the adoption of advanced technologies. Additionally, the integration of cloud technology in healthcare is becoming more prevalent, further boosting the market.

Electronic health records (EHR) systems have revolutionized the way healthcare providers manage patient data, offering streamlined processes and improved patient care. The shift towards digitalization in healthcare is a significant driver of market growth.

Moreover, healthcare providers are increasingly investing in hospital information systems to enhance operational efficiency and patient outcomes. These systems facilitate better data management and coordination among healthcare professionals, leading to improved service delivery.

The adoption of cloud technology in healthcare is another crucial factor contributing to market expansion. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness, making them an attractive choice for healthcare providers.

Component Analysis

The services segment in the healthcare IT market includes cybersecurity, network and hardware management, and on-site and cloud backups. This segment accounted for the largest market share, holding a significant 52%. The growth in this segment is driven by several factors. Healthcare IT services support hospitals, medical billing businesses, and physician groups. The introduction of online payment services also boosts the market’s revenue. Additionally, expanding financial responsibilities and the increasing prevalence of high-deductible health plans are fueling the demand for these services.

Healthcare IT services are becoming essential for efficient operations in the medical sector. Hospitals rely on these services for secure data management and streamlined workflows. Medical billing businesses benefit from enhanced accuracy and faster processing times. Physician groups use these services to improve patient care and administrative efficiency.

The growing need for cybersecurity in healthcare is a major factor driving market growth. As cyber threats increase, the demand for robust network and hardware management services rises. On-site and cloud backups provide vital data protection and recovery solutions, further contributing to the market’s expansion.

Deployment Mode Analysis

The on-premise segment accounted for 71.3% of the healthcare IT market. This growth is attributed to the reduced risk of data breaches. On-premise infrastructure is stored on-site, enhancing data security. Sensitive data is often kept on-premises for added protection.

On-premise software is managed by the customer. They oversee its availability, administration, and security. This software is more expensive than cloud-based options. The high cost is due to the significant capital expenditures for software licenses.

Additionally, on-premise software is considered more secure. The entire software instance remains within the organization’s premises. This control over the software environment adds a layer of security. It prevents unauthorized access and data breaches.

On-premise solutions offer advantages despite their higher cost. Organizations with sensitive data prefer on-premise software for its security benefits. This preference contributes to the segment’s significant market share.

End-User Analysis

The healthcare payer segment holds a significant share of the market, accounting for 63.2%. This segment’s rapid growth is driven by extensive partnerships between private payers and Medicaid or Medicare agencies. These collaborations aim to provide a robust and secure electronic health information infrastructure. This infrastructure benefits healthcare professionals, patients, and facilities by ensuring seamless data integration and access.

Private payers play a crucial role in propelling market growth. Their partnerships with public health agencies enhance the overall efficiency and security of health information systems. By integrating electronic health records (EHR) and other digital tools, these collaborations streamline healthcare delivery. This integration reduces administrative burdens and improves patient outcomes.

Additionally, the focus on secure data sharing and interoperability is paramount. These efforts ensure that healthcare providers have real-time access to critical patient information. As a result, decision-making processes are expedited, and care coordination is improved. The commitment to enhancing electronic health infrastructure underscores the market’s potential for sustained growth.

Key Market Segments

Based on Product Type

- Healthcare Provider Solutions

- Healthcare Payer Solutions

- HCIT Outsourcing Services

Based on Component

- Software

- Hardware

- Services

Based on the Deployment Mode

- Private Payer

- Public Payer

Based on End-User

- Healthcare Providers

- Hospitals

- Diagnostic and Imaging Centers

- Pharmacies

- Ambulatory Clinical Units

- Healthcare Payer

- On-premise

- Cloud-based

Drivers

Increasing Technological Advancements in Healthcare IT

Major healthcare technology companies are continuously evolving to meet the demands of modern clinical trials, enhancing both the scalability and efficiency of healthcare IT platforms. For example, Mednet has recently upgraded its eClinical platform with a significant focus on electronic patient-reported outcomes (ePRO).

This new module is designed to streamline patient identification and survey administration, thereby improving the user experience for clinical staff and participants. The updated ePRO capabilities are essential for supporting remote clinical trial participation, which has become increasingly crucial in the current healthcare landscape.

Moreover, Mednet’s initiative includes several other features aimed at optimizing the clinical trial process. Enhanced functionalities like lab normal configurations and simplified file management systems are integrated to reduce administrative burdens and enhance operational efficiency. Such advancements are vital in the rapidly evolving field of clinical research, where technology plays a crucial role in the seamless execution of studies

Restraints

Problems with Data Invasion and Privacy

Data invasion and privacy concerns remain significant issues in the consulting services market. Frequent data breaches compromise personal information, with 45% of Americans affected in the past five years. Consequently, 64% of consumers blame companies for such breaches rather than hackers.

The risk of hacking and data theft reduces the adoption of consulting solutions, hindering market growth. Privacy professionals report that 63% of organizations lack sufficient resources to meet privacy goals, which further exacerbates the issue. Companies must implement robust privacy measures to build trust and comply with evolving regulations like GDPR and CCPA to mitigate these risks.

Opportunities

Increasing Demand for Information Technology

The rising demand for information technology is boosting the global healthcare IT market. Digitalization tools like telehealth services and artificial intelligence are driving this growth. These technologies streamline workflows, enhance systems, reduce service costs, and improve patient outcomes.

For instance, according to the World Health Organization (WHO), the use of telehealth increased by 70% during the COVID-19 pandemic, highlighting its effectiveness in healthcare. This surge in digital health solutions is a key factor in market expansion.

Increasing Rate of Government Initiatives

Government initiatives worldwide are significantly impacting the digital health market. For example, the Indian Prime Minister launched the Pradhan Mantri Digital Health Mission to digitalize healthcare practices nationwide. This initiative allows patients to access, store, and share health records digitally.

Similarly, the U.S. government invested over $36 billion in health information technology as part of the HITECH Act, improving healthcare delivery and patient care. These efforts by governments are crucial drivers of the digital health market’s growth, fostering a more integrated and efficient healthcare system.

Trends

Value-Based Payment Models and Accountable Care Organizations (ACOs) Promoting Trends

Value-based payment models and ACOs are driving industry trends toward joint ventures, partnerships, and payer-provider mergers. This shift aims to address fragmented healthcare delivery, promote care coordination, and emphasize patient-centered care. For example, CVS Health completed its acquisition of Aetna. The goal is to build healthier communities and transform the health experience by offering affordable, local care. This approach centers on making healthcare more accessible and customer-focused.

Value-based reimbursement benefits all stakeholders in the healthcare industry, including providers, payers, and patients. According to the Centers for Medicare & Medicaid Services (CMS), value-based care models can lead to significant cost savings and improved health outcomes.

Healthcare providers are incentivized to offer high-quality care at lower costs, which means patients receive superior care at better value. This alignment of incentives among providers, patients, and payers encourages the delivery of high-quality, coordinated care. As a result, the healthcare system becomes more efficient and effective, enhancing the overall patient experience.

Regional Analysis

North America Leads the Global Healthcare IT Market

North America holds the largest revenue share in the global healthcare IT market, accounting for 52%. This region is expected to see the fastest growth over the forecast period. Factors driving this growth include improved internet connectivity, widespread smartphone use, high digital literacy, and advanced healthcare IT solutions. The presence of key players and infrastructure advancements also contribute. The North American healthcare industry is quickly adopting IT services to enhance patient care and reduce costs, further boosting market growth.

Europe is expected to report the fastest growth rate during the forecast period. The region benefits from the presence of prominent market players and increased adoption of artificial intelligence. Significant government support and investment in healthcare IT are also key factors. For example, the European Commission has invested heavily in digital health initiatives to improve healthcare outcomes. This combination of factors is driving the rapid expansion of the healthcare IT market in Europe.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global healthcare IT market is dominated by medium and large-sized companies. These players contribute significantly to market revenue. Major companies are focusing on mergers, acquisitions, technological collaborations, and partnerships. These strategies help them expand their product portfolios and business footprint, providing a competitive edge.

For example, in 2020, Mednet, a healthcare information technology company, launched software with extended electronic patient reported outcomes (ePRO) capabilities. This advancement enhances their service offerings and strengthens their market position.

Other notable players in the healthcare IT market include Allscripts Healthcare Solutions and Philips Healthcare. These companies, along with Mednet, continue to innovate and drive market growth.

The healthcare IT sector is highly competitive. Companies are constantly seeking ways to improve their technology and services. This dynamic environment encourages continuous improvement and expansion. As a result, the healthcare IT market is expected to see sustained growth and development.

By focusing on strategic initiatives, these companies aim to maintain their leadership positions and continue contributing to the healthcare IT market’s expansion.

Market Key Players

- GE Healthcare Technologies Inc.

- Koninklijke Philips N.V.

- eClinicalWorks

- Carestream Health

- McKesson Corporation

- Agfa Healthcare

- Oracle Corporation

- Advantech Co., Ltd.

- Other Key Players

Recent Developments

- In November 2023: eClinicalWorks introduced a new telehealth platform. This platform integrates seamlessly with their existing EHR systems. It enhances remote patient monitoring capabilities, improving healthcare delivery.

- In August 2023: Carestream Health launched a new medical imaging system. This system uses AI to enhance diagnostic accuracy and efficiency. It marks a significant step in Carestream’s innovation strategy.

- June 2023: Philips launched a new AI-powered diagnostic solution. This solution aims to improve radiology workflows and patient outcomes. It demonstrates Philips’ commitment to enhancing healthcare delivery through technology advancements.

Report Scope

Report Features Description Market Value (2023) USD 374.0 Billion Forecast Revenue (2033) USD 1,797.8 Billion CAGR (2023-2033) 17% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Healthcare Provider Solutions, Healthcare Payer Solutions, and HCIT Outsourcing Services; By Component- Software, Hardware, and Services; By Deployment Mode- On-premise and Cloud-based; and End-User- Healthcare Providers and Healthcare Payer. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape GE Healthcare Technologies Inc., Koninklijke Philips N.V., eClinicalWorks, Carestream Health, McKesson Corporation, Agfa Healthcare, Oracle Corporation, Advantech Co. Ltd., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Healthcare IT market in 2023?The Healthcare IT market size is USD 374 Billion in 2023.

What is the projected CAGR at which the Healthcare IT market is expected to grow at?The Healthcare IT market is expected to grow at a CAGR of 17% (2024-2033).

List the segments encompassed in this report on the Healthcare IT market?Market.US has segmented the Healthcare IT market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type the market has been segmented into Healthcare Provider Solutions, Healthcare Payer Solutions, and HCIT Outsourcing Services. By Component the market has been segmented into Software, Hardware, and Services. By Deployment Mode the market has been segmented into On-premise and Cloud-based. End-User the market has been segmented into Healthcare Providers and Healthcare Payer.

List the key industry players of the Healthcare IT market?GE Healthcare Technologies Inc., Koninklijke Philips N.V., eClinicalWorks, Carestream Health, McKesson Corporation, Agfa Healthcare, Oracle Corporation, Advantech Co. Ltd., and Other Key Players.

Which region is more appealing for vendors employed in the Healthcare IT market?North America is expected to account for the highest revenue share with 52%, and boasting an impressive market value of USD 194.4 Billion. Therefore, the Healthcare IT industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Healthcare IT?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Healthcare IT Market.

-

-

- GE Healthcare Technologies Inc.

- Koninklijke Philips N.V.

- eClinicalWorks

- Carestream Health

- McKesson Corporation

- Agfa Healthcare

- Oracle Corporation

- Advantech Co., Ltd.

- Other Key Players