Global Wound Care Market By Type (Advanced, Surgical, Traditional), By Application (Chronic Wound & Acute Wound), By End-User (Hospitals, Specialty Clinics, Home Healthcare, Trauma Centers, and Ambulatory Surgical Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 45728

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

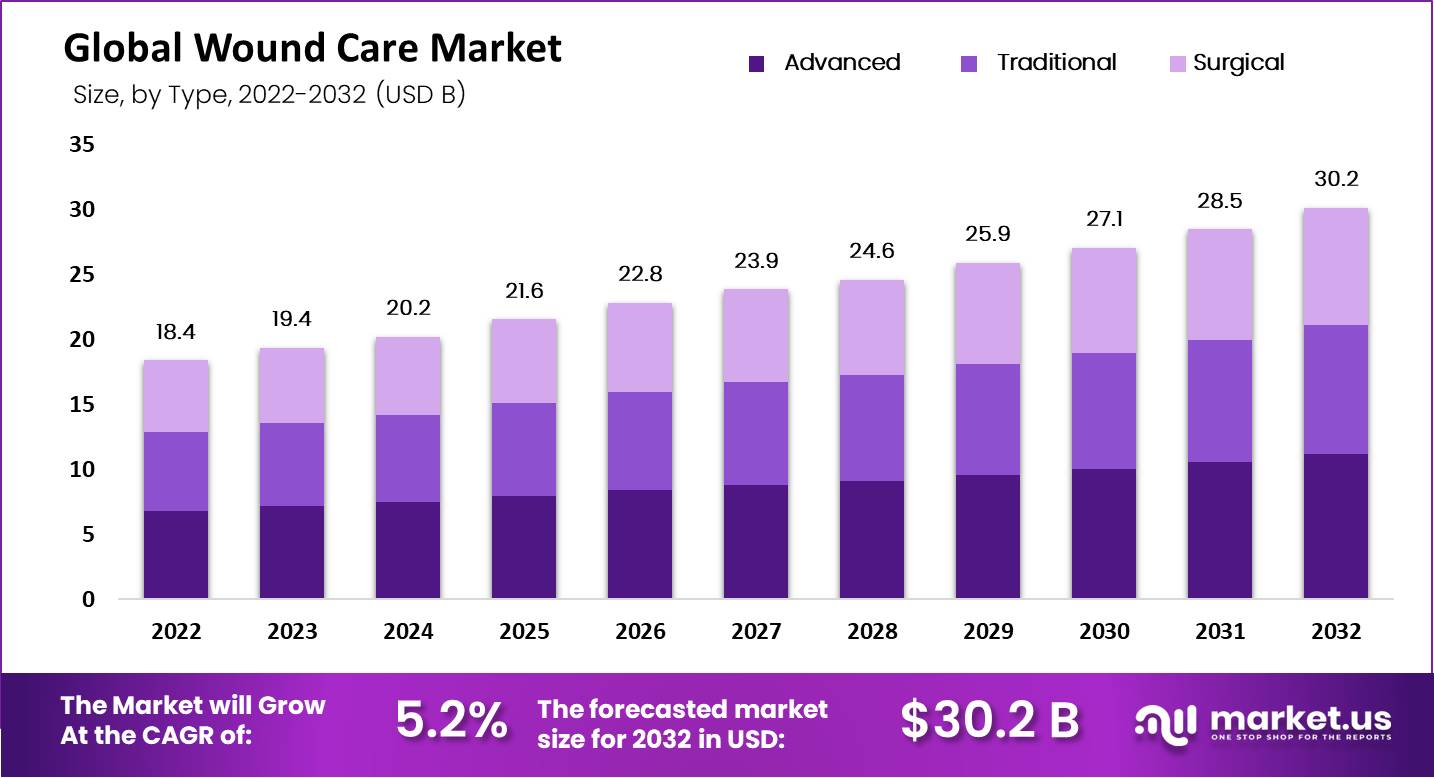

Global Wound Care Market size is expected to be worth around USD 30.2 Bn by 2032 from USD 18.4 Bn in 2022, growing at a CAGR of 5.2% during the forecast period from 2022 to 2032.

A wound is a disorder of the standard structure and function of skin and soft tissue planning an acute wound determines normal physiology, and healing is estimated to progress through the anticipated stages of wound healing. At the same time, a chronic wound is defined as one that is physiologically impaired. Wound care provides proper healing focusing on injury and damage to the skin and its underlying structure.

The wound care market is the medical market focused on treating acute and chronic wounds and any other healing or repair of damaged human tissue, including injuries caused by therapeutics radiation and minor burns, but specifically excluding the burning market. Wound dressing helps to remove dead space and prevent bacterial growth by ensuring proper fluid balance, co-efficiency, and convenience for the patients and nursing staff.

The global wound care market has observed various technological advancements and developed as a standard solution to treat acute and chronic wounds.

Key Takeaways

- The global wound care market is growing at a CAGR of 5.2%.

- Wounds are classified as acute or chronic, with wound care focused on proper healing and injury repair.

- Advanced wound dressings are the most lucrative segment in the wound care market, driven by increasing burn cases and the aging population.

- Chronic wounds, such as diabetic foot ulcers and pressure ulcers, dominate the wound care market due to rising patient numbers and healthcare expenditure.

- Acute wounds, including traumatic injuries and burns, are expected to witness rapid growth, aided by surgical wound infection prevention and patient satisfaction.

- Hospitals are the leading end-users in the wound care market, with home healthcare projected to grow significantly due to an aging population and changing patient preferences.

- Technological advancements and product launches by companies like Conva Tech Group Plc. and Braun Melsungen AG drive market growth.

- Rising diabetes prevalence negatively affects wound healing, contributing to an increased demand for wound care products.

- The increased cost of wound care products and product recalls are restraining factors in the market.

- Growing economies with improved healthcare infrastructure present opportunities for market expansion, particularly in developing countries.

Type Analysis

Based on type, the market for wound care is segmented into advanced, traditional, and surgical wound dressing. Among these types, the advanced wound dressing segment is the most lucrative in the wound care market, anticipated to have the largest revenue share during the forecast period. One of the critical factors responsible for the dominance is the increase in the number of burn cases. For instance, as per the American Burn Association, individuals take medical treatments due to burning injuries in the United States. It was also reported that burn patients have the highest rates of infection complications.

Advanced wound care solutions are innovative products introduced for the welfare of people suffering from wound-related examinations such as diabetes and ulcers. Another primary driver of market expansion is the increasing geriatric population. For example, according to the United Nations Organization, the senior population numbered over and is anticipated to reach the forecast period. The advanced wound care market ensures high-level data integrity and accurate analysis. Active wound care products are most popularly used in advanced wound care therapy.

Since the elderly population is more susceptible to wounds, the market may expand during the forecast period. The increased prevalence of burn injuries and the increased number of surgical processes have considerably increased the use of advanced wound care market products. Advanced wound care solutions are innovative products. Thus growing incidence rate is anticipated to drive demand for traditional wound care products. Clinicians prescribe advanced wound care products for rapid wound healing. Advanced wound management products are mainly used to treat chronic and non-healing wounds.

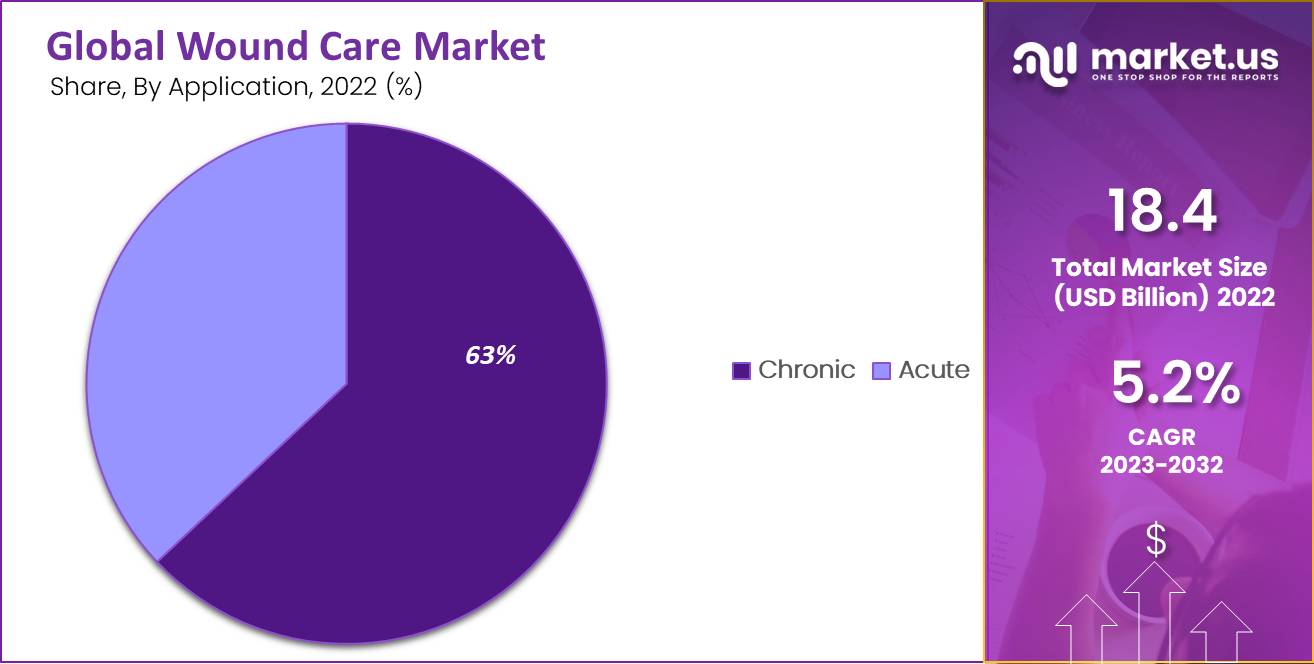

Application Analysis

On the basis of application, the market is segmented into chronic and acute wounds. The chronic wounds segment holds the dominating share market during the forecast period and is anticipated to witness a considerable growth rate. The dominance is attributed to the rise in the patient population suffering from diabetic foot ulcers, pressure ulcers, leg ulcers, and vascular ulcers and increasing expenditure on treating this condition. An increase in the number of the senior population, along with the rising prevalence of diabetic ulcers, venous pressure ulcers, arterial Ulcers, and other chronic

wounds, is anticipated to drive the market growth. A diabetic foot ulcer is a chronic wound that occurs in diabetic patients. The acute wound is predicted to witness the fastest revenue during the forecast period. The increase in traumatic wounds and burns cases is a significant factor determining the market growth. The multiple benefits of acute wounds include surgical wound infections, improved results, patient satisfaction, and decreased hospital stays.

Acute wound care products are most popular in advanced wound care therapy, as the products stimulate new tissue growth. These acute wound care products are used to treat complex burn injuries and diabetic wounds in patients. Acute wound care products are majorly used for treating acute wounds. Active wound care is further divided into skin substitutes and growth factors.

End-User Analysis

Based on the end user, the market includes hospitals, home healthcare, trauma centers, and clinics. The hospital section is the leading share due to the increase in the number of multispecialty hospitals with departments dictated to wound management, especially in emerging countries. The home healthcare segment is anticipated to grow at a larger CAGR during the forecast period. This is due to the growing incidence of chronic wounds among the geriatric population, the increasing change of patients towards home healthcare, and the increase in obesity and chronic conditions.

Key Market Segments

Based on Type

- Advanced

- Traditional

- Surgical

Based on Application

- Chronic

- Acute

Based on End-User

- Hospitals

- Clinics

- Home Healthcare

- Trauma Centers

- Ambulatory Surgical Centers

Drivers

Introduction of Technology Advance to Drive Market Growth

Increasing investment in research and development and launching advanced products by market players such as Covnva Tech Group Plc. Braun Melsungen AG. is anticipated to fuel the demand for these products, especially in developed countries. For example, in January, Conva Tech Group Plc. Introduced ConvaMax in the global market. The new ConvaMax was a super absorber wound dressing anticipated to be used to manage highly projecting wounds, including pressure ulcers.

Diabetic foot ulcers and leg ulcers. Key factors that determine the advanced wound care market growth include the increasing prevalence of diabetes. Therefore, aforementioned factors, the market for wound care is anticipated to impel growth during the forecast period. The rising senior population drives the market growth.

Increasing Incidence of Diabetes that Affects Wound Healing

Diabetes drives harmfully on wound healing. Over decades the prevalence of diabetes has increased widely, and acute and chronic wounds have risen significantly; the increasing geriatric population has led to increased surgical procedures. Due to increased obesity and other health conditions, the complexity of wounds has been improved for infections, ulcerations, and other chronic wounds.

Restraints

Rising cost of Wound Care Products

Increased focus on improving acute and chronic care products has improved the cost of wound care products, adversely impacting the market growth. Overall, the treatment of burn injuries and traumatic wounds has been enhanced in the last few years, restraining the market growth factors. The primary factor anticipated to impede the expansion of the global wound care market is the rising number of product recalls initiated by regulatory consultants such as the U.S. Food and Drug Administration. For instance, in November 2019, the Class 2 device 3M Durapore innovative surgical tape, which was produced by the healthcare company 3M, was recalled by the U.S. Food and Drug Administration due to the possibility of tape bond failure following prolonged exposure to high moisture clinical applications.

Opportunity

Growing Healthcare Market in Growing Economies

Over the past few years, developing countries significantly focused on developing wound care products to treat acute and chronic wounds. Improving the healthcare organization of countries will drive market growth.

Trends

Increasing Development of the Wound Care Market

Increased in the development of wound care markets. Several players are currently entering the market by focusing on dermal substitutes and cell-based therapies to growing demand for urgent effective wound management patients. Small companies’ high R and D capacity has increased the achievement of smaller and larger companies. Major players with solid financial positions tend to obtain this small player and use their inventiveness and technologies to develop advanced products.

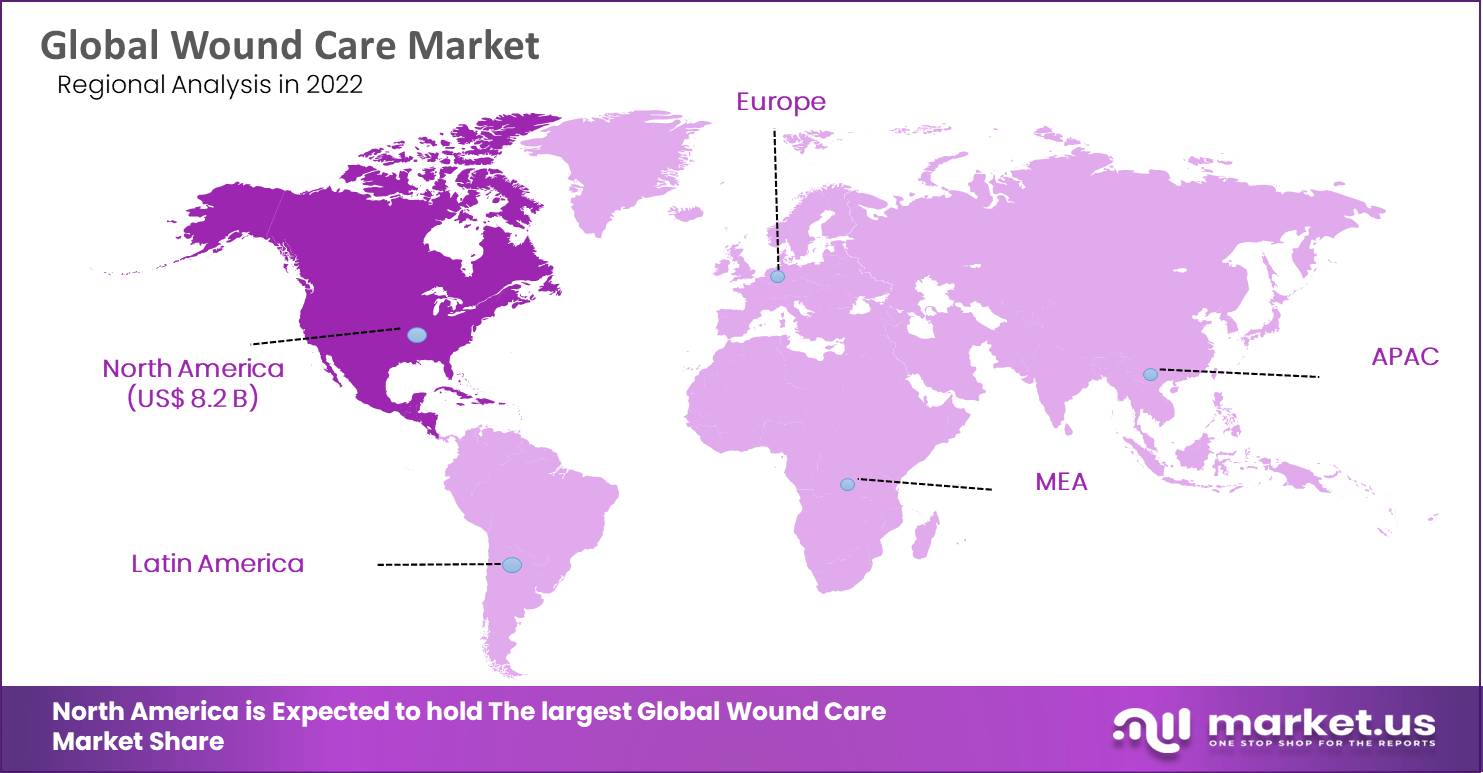

Regional Analysis

North America dominates the market with the majority of the revenue share, owing to the increasing healthcare sector

North America held the largest wound care market revenue share of 45% and is expected to see significant growth over the forecast period. Major market expansion drivers in this region include a large population base and an expanding patient pool in nations like the United States. Additionally, as the elderly population is more susceptible to wounds, the region’s demand for wound care and wound healing products will rise. For instance, the Administration for Community Living reports millions of people aged 65 and older.

Additionally, it is anticipated that the availability of skilled professionals in this region and the rising number of road accidents will drive demand for wound care products in North America. Over the forecast period, the market in Asia-Pacific is projected to hold the largest share. This is because the region is experiencing an increased chronic disease prevalence due to a changing lifestyle.

For instance, as of December, the Down to Earth organization estimates that millions of Indians between the ages of 20 and 79 will have diabetes. In addition, it is anticipated that the number will reach millions. Additionally, there is an increase in medical tourism in this region, which is increasing the number of surgeries carried out. Asia-Pacific is estimated to grow at the fastest rate over the forecast period as a result of the factors as mentioned above.

Key Regions

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Numerous large and small manufacturers are present in the market, making it highly fragmented. Due to the multiple market players, competitive rivalry is anticipated to grow over the forecast period in the wound care market. In addition, significant players collaborate with one another to expand their product lines, launch new products, and join forces in mergers and acquisitions.

For example, Smith and Nephew introduced the novel PICO 14 NPWT system in March, which lasts up to 14 days. The company increased the variety of its products thanks to this product launch. Introducing innovative treatments for wounds and expanding sales channels are key strategies adopted by leading players to maintain their dominant position in the market.

Similarly, the company paid approximately a million for Southlake Medical Supplies in September. The business gained a stronger foothold in the American market due to this. As a result, the market is expected to grow during the forecast period thanks to various strategies implemented by major players. The following are some of the major manufacturers in the wound care market.

The primary key market players include Smith & Nephew Plc, 3M Company, B Braun Melsungen AG, Johnson & Johnson, Coloplast A/S, Medtronic Plc, Baxter International Inc., Investor AB, Derma Science Inc. Cardinal Health, BSN Medical GmbH, MiMedx Group, Inc. and Paul Hartman AG.

Market Key Players

- Smith & Nephew Plc.

- 3M Company

- Medtronic Plc.

- Coloplast A/S

- Cardinal Health

- PAUL HARTMAN AG

- Molnlycke Health Care AB

- Johnson & Johnson Services

- Conva Tech, Inc.

- B Braun Melsungen AG

- Bactiguard AB

- Paul Heartman AG

- MiMedx Group, Inc.

- Investor AB

- Baxter International Inc.

- Derma Science Inc.

- BSN Medical GmbH

- Other Key Players

Recent Developments

- April 2021- 3 M Company launched 3 M Spunlace Extended Wear Adhesive tapes. It has a longer wear time, providing user compliance and health and economic benefits.

- May 2021- Smith and Nephew launched ARIA Home PT, a remote physical therapy product, as a part of ARIA suit solutions.

Report Scope

Report Features Description Market Value (2022) US$ 18.4 Bn Forecast Revenue (2032) US$ 30.2 Bn CAGR (2023-2032) 5.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Advanced, Traditional, Surgical, Negative Pressure); By Application (Chronic and Acute); By End-User (Hospitals, Clinics, Home Healthcare, and Trauma Centres) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Smith& Nephew, 3M, Medtronic, Coloplast A/S, Conva Tech, Inc., Bactiguard AB, Johnson& Johnson, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How much is the Global Wound Care Market worth?Global Wound Care Market market size is Expected to Reach USD 30.2 Bn by 2032.

What was the Market Segmentation of the Wound Care Market?By Type -– Advanced, Traditional, SurgicalNegative Pressure; By Application -– Chronic and Acute; and By End-User – Hospitals, Clinics, Home Healthcare, and Trauma Centres

Who are the major players operating in the Wound Care Market?Smith& Nephew, 3M, Medtronic, Coloplast A/S, Conva Tech, Inc., Bactiguard AB, Johnson& Johnson, and Other Key Players.

Which region will lead the Global Wound Care Market?North America is estimated to be the fastest-growing region during the forthcoming years.

-

-

- Smith & Nephew Plc.

- 3M Company

- Medtronic Plc.

- Coloplast A/S

- Cardinal Health

- PAUL HARTMAN AG

- Molnlycke Health Care AB

- Johnson & Johnson Services

- Conva Tech, Inc.

- B Braun Melsungen AG

- Bactiguard AB

- Paul Heartman AG

- MiMedx Group, Inc.

- Investor AB

- Baxter International Inc.

- Derma Science Inc.

- BSN Medical GmbH

- Other Key Players