Global Wound Dressings Market By Product Type (Traditional Dressing (Gauze, Tape, Cotton, Bandages, and Others) and Advanced Dressing (Moist Dressing (Foam Dressing, Hydrogel Dressing, Hydrocolloid Dressing, Film Dressing, Collagen Dressing, Alginate Dressing, and Others), Antimicrobial Dressing (Silver Dressing and Non-silver Dressing), and Active Dressing (Biomaterials and Skin-substitute))), By Application (Chronic Wounds (Diabetic Foot Ulcers, Venous Leg Ulcers, Pressure Ulcers, and Others) and Acute Wounds (Surgical & Traumatic Wounds and Burns)), By End-user (Hospitals, Research & Manufacturing, Outpatient Facilities, and Home Healthcare), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 2025

- Report ID: 141486

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

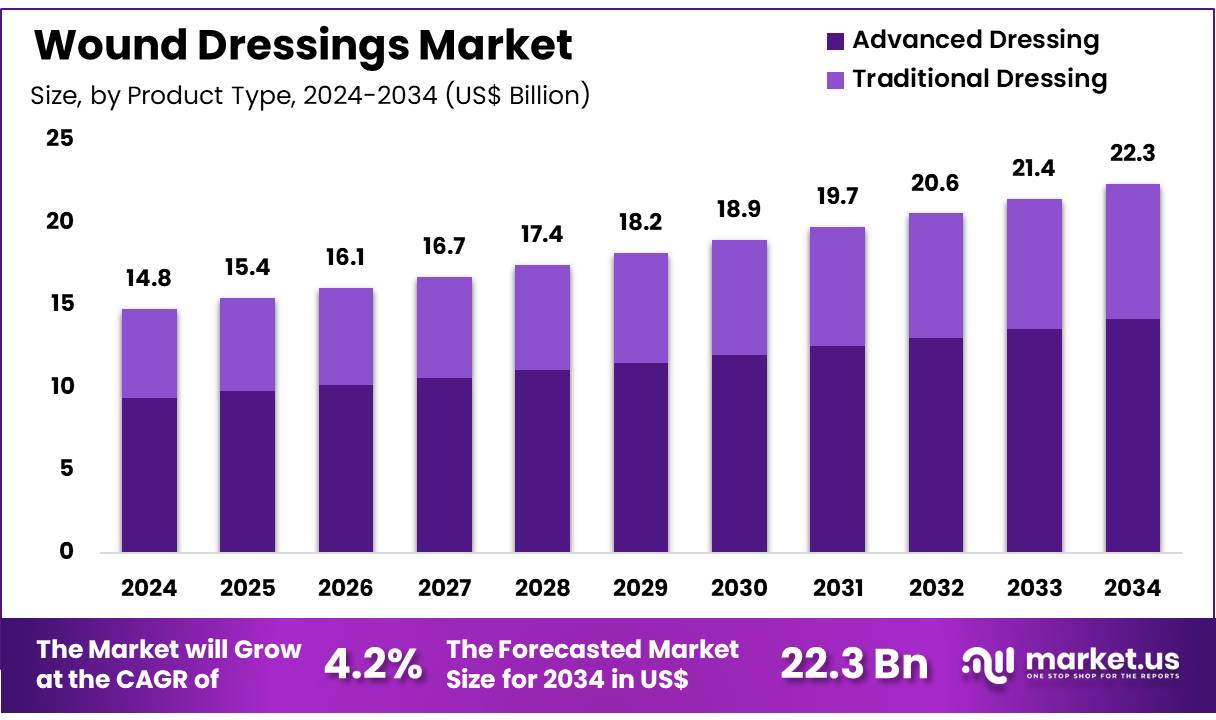

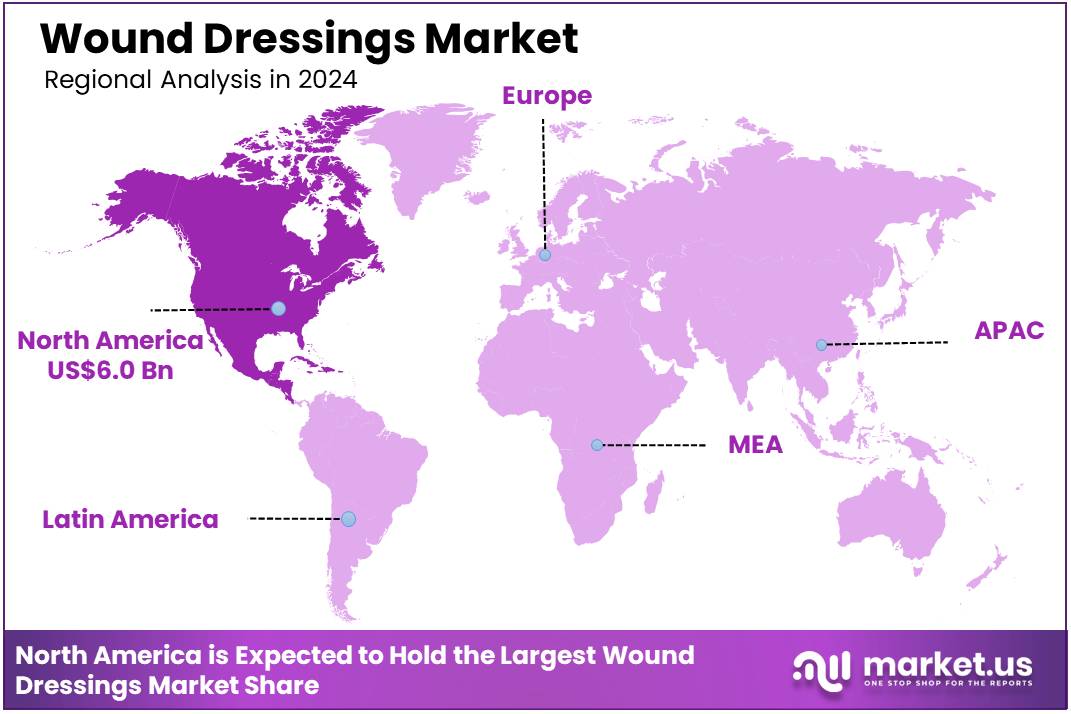

Global Wound dressings Market size is expected to be worth around US$ 22.3 billion by 2034 from US$ 14.8 billion in 2024, growing at a CAGR of 4.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.3% share with a revenue of US$ 6.0 Billion.

Growing demand for effective wound management solutions is driving the expansion of the wound dressings market, fueled by rising cases of chronic wounds, surgical site infections, and traumatic injuries. Advanced wound dressings, such as hydrocolloid, foam, and antimicrobial variants, are gaining traction due to their ability to enhance healing and prevent infections.

The increasing prevalence of diabetes and obesity-related complications, including diabetic foot ulcers and venous leg ulcers, is further boosting demand for specialized wound care products. According to a World Health Organization (WHO) report published in 2022, approximately 19.0% of Germany’s total population is classified as obese, significantly increasing the risk of venous leg ulcers, which require advanced dressings for effective healing.

Growing awareness of infection control in post-surgical wound care is also driving the adoption of antimicrobial and silver-infused dressings. The aging population, which is more prone to chronic wounds, is contributing to market expansion. Rising adoption of bioactive dressings incorporating growth factors and stem cell therapies is accelerating tissue regeneration.

The trend toward home healthcare is prompting the development of self-adhesive and breathable wound dressings for improved patient compliance. Increasing regulatory approvals and reimbursement policies are supporting the widespread use of advanced wound care products. With continuous innovations in smart wound dressings and sustainable materials, the market is poised for significant growth in the coming years.

Key Takeaways

- In 2024, the market for wound dressings generated a revenue of US$ 14.8 billion, with a CAGR of 4.2%, and is expected to reach US$ 22.3 billion by the year 2033.

- The product type segment is divided into traditional dressing and advanced dressing, with advanced dressing taking the lead in 2023 with a market share of 63.4%.

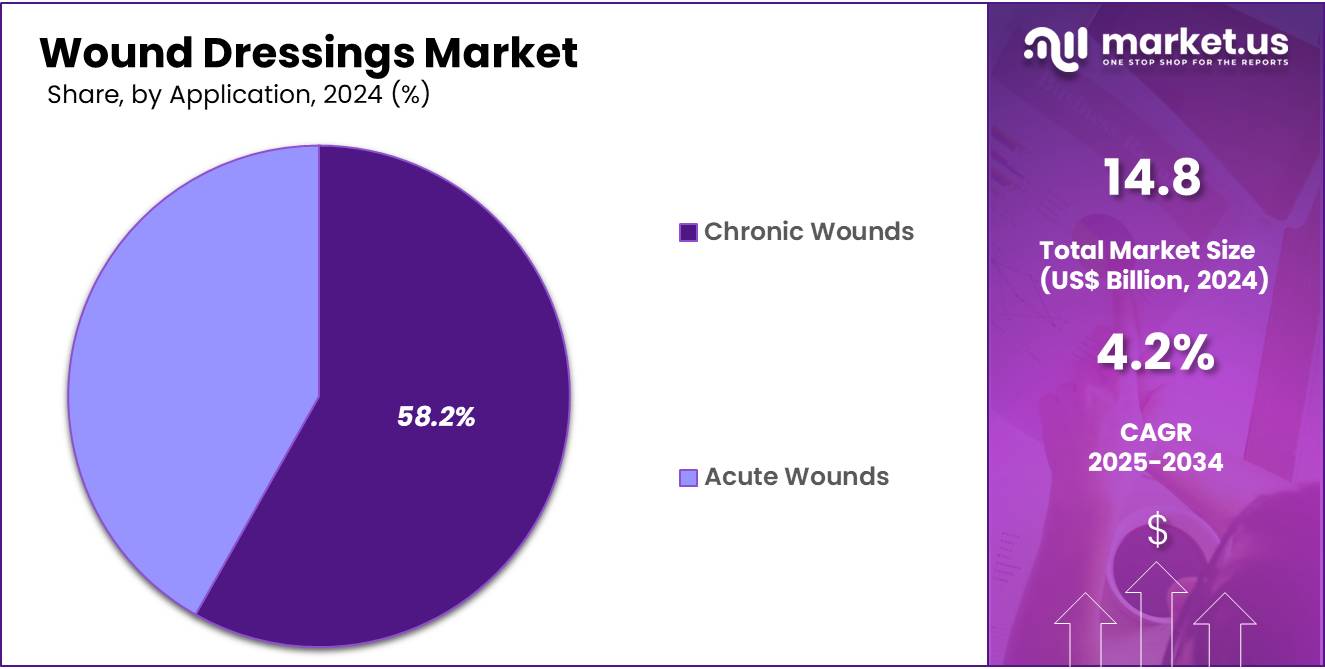

- Considering application, the market is divided into chronic wounds and acute wounds. Among these, chronic wounds held a significant share of 58.2%.

- Furthermore, concerning the end-use segment, the market is segregated into hospitals, research & manufacturing, outpatient facilities, and home healthcare. The hospitals sector stands out as the dominant player, holding the largest revenue share of 49.7% in the wound dressings market.

- North America led the market by securing a market share of 40.3% in 2024.

Product Type Analysis

The advanced dressing segment led in 2023, claiming a market share of 63.4% owing to the increasing demand for more effective treatments for various types of wounds. Advanced dressings, such as hydrocolloids, foams, and alginates, provide enhanced protection, promote faster healing, and reduce the risk of infection, making them ideal for managing chronic and complex wounds. The growing prevalence of chronic diseases like diabetes, which are known to cause non-healing wounds, is expected to further propel the adoption of advanced dressing products.

Additionally, technological advancements in wound care and a greater understanding of the importance of moist wound healing are anticipated to drive the demand for advanced dressings, positioning them as the preferred option for both patients and healthcare providers.

Application Analysis

The chronic wounds held a significant share of 58.2% due to the rising prevalence of chronic conditions such as diabetes, vascular diseases, and pressure ulcers. Chronic wounds, characterized by prolonged healing times, require specialized care, and advanced wound dressing products are projected to be in high demand to address these needs.

The increasing awareness of the benefits of modern wound care solutions, such as enhanced infection control, improved healing rates, and reduced hospital readmissions, will likely further drive this segment’s growth. Healthcare systems around the world are expected to invest more in effective wound care technologies, making chronic wound treatment a high priority in both hospital and outpatient settings.

End-user Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 49.7% owing to the increasing number of patients requiring specialized wound care treatments. Hospitals are expected to be the primary settings for the treatment of severe and chronic wounds, with advanced wound care products being integral to patient recovery. The rising incidence of chronic diseases and surgical procedures that result in complex wounds is projected to drive hospital demand for advanced dressings.

Additionally, hospitals are expected to invest more in wound care infrastructure and technologies to improve patient outcomes, reduce complications, and shorten recovery times, thereby fueling the growth of this segment. The growing emphasis on patient-centered care and improved healthcare standards will likely continue to push hospitals toward adopting advanced wound dressing solutions.

Key Market Segments

Product Type

- Traditional Dressing

- Gauze

- Tape

- Cotton

- Bandages

- Others

- Advanced Dressing

- Moist Dressing

-

-

- Foam Dressing

- Hydrogel Dressing

- Hydrocolloid Dressing

- Film Dressing

- Collagen Dressing

- Alginate Dressing

- Others

- Antimicrobial Dressing

- Silver Dressing

- Non-silver Dressing

- Active Dressing

- Biomaterials

- Skin-substitute

-

Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Pressure Ulcers

- Others

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

End-use

- Hospitals

- Research & Manufacturing

- Outpatient Facilities

- Home Healthcare

Drivers

Rising Occurrence of Road Accidents Driving the Wound Dressings Market

Increasing road accidents are anticipated to drive demand for wound dressings as the number of injuries requiring immediate medical care continues to grow. In June 2022, a report from the World Health Organization (WHO) estimated that approximately 1.3 million people lose their lives each year due to road accidents, with an additional 20 to 50 million individuals sustaining non-fatal injuries. These alarming figures highlight the ongoing need for enhanced road safety measures and advancements in medical response systems.

The high incidence of abrasions, lacerations, and deep wounds among accident victims has increased demand for specialized wound care products. Hydrocolloid and foam dressings are widely used in treating traumatic injuries due to their superior moisture retention and healing properties. The expanding emergency medical services sector is expected to boost the adoption of innovative wound management solutions.

Governments and healthcare agencies are implementing road safety initiatives, yet the rising vehicle population continues to contribute to accident-related injuries. With growing awareness of infection risks, healthcare providers are prioritizing antimicrobial wound dressings to reduce complications. The increasing integration of nanotechnology in wound dressings is enhancing healing efficiency and reducing treatment duration.

Technological advancements, such as bioengineered skin substitutes, are providing alternative solutions for severe wound management. Manufacturers are focusing on sustainable and biodegradable wound dressings to meet the demand for eco-friendly healthcare solutions. The rise in home healthcare services is increasing consumer preference for easy-to-use wound dressings, particularly among elderly patients.

Restraints

High Cost of Advanced Wound Dressings

Growing concerns over the affordability of advanced wound dressings are expected to limit market expansion, particularly in low-income regions. Many innovative wound care products, including bioactive dressings and antimicrobial solutions, come with high production costs, making them expensive for patients without comprehensive insurance coverage.

Traditional gauze and bandages remain widely used due to their affordability, slowing the adoption of advanced solutions. Limited reimbursement policies for specialized wound dressings create financial burdens for hospitals and patients, discouraging frequent use. Small healthcare facilities may lack the necessary resources to invest in high-end wound management technologies.

The development of advanced dressings involves extensive clinical trials and regulatory approvals, increasing overall costs and delaying product launches. In developing countries, the availability of cost-effective wound care alternatives often limits market penetration for premium wound dressing products. Despite technological advancements, pricing constraints remain a challenge in making advanced wound care accessible to a broader population.

Opportunities

Growing Demand for Advanced Wound Care Solutions as an Opportunity for the Wound Dressings Market

Rising demand for innovative wound care solutions is anticipated to create new opportunities in the wound dressings sector by addressing complex healing needs. A January 2023 report published by the National Center for Biotechnology Information (NCBI) indicated that around 6.5 million individuals in the United States are affected by chronic wounds, underscoring the growing demand for advanced wound care solutions and treatment innovations.

The increasing prevalence of diabetes and vascular diseases has contributed to a surge in chronic wound cases, including diabetic foot ulcers and pressure injuries. Hydrogel dressings and bioactive wound care products are gaining popularity due to their ability to accelerate healing while reducing infection risks.

The emergence of smart wound dressings, equipped with real-time monitoring capabilities, is improving wound assessment and treatment outcomes. Innovations in nanotechnology have led to the development of dressings with enhanced antimicrobial properties, further improving wound healing efficiency.

The introduction of skin-substitute dressings derived from human and animal tissues is transforming treatment options for severe wounds and burns. Growing investment in regenerative medicine is expanding the availability of biomaterial-based dressings for complex wound management. Telemedicine advancements are improving access to wound care consultations, increasing awareness and adoption of advanced dressings.

The expansion of home healthcare services is fueling demand for user-friendly wound dressings, particularly among elderly and immobile patients. Increased government initiatives to improve wound care management in hospitals and clinics are driving the adoption of next-generation dressings. The focus on sustainable wound care products is encouraging manufacturers to develop eco-friendly, biodegradable dressings to meet environmental standards.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly affect the wound dressings market. On the positive side, the growing prevalence of chronic diseases, such as diabetes, and an aging global population contribute to a higher demand for advanced wound care solutions. Economic growth, particularly in emerging markets, fosters increased healthcare investments, leading to expanded access to quality medical products. Additionally, advancements in healthcare infrastructure, especially in developing regions, offer significant opportunities for the wound dressings market.

However, economic downturns and tightening healthcare budgets can result in reduced spending on non-essential medical products, including premium wound care solutions. Geopolitical instability, such as trade disruptions or political tensions, can hinder the availability of raw materials and increase production costs, negatively impacting the market. Despite these challenges, the growing recognition of the importance of wound healing, coupled with innovations in dressings, continues to drive market growth, ensuring a positive outlook for the industry.

Latest Trends

Growing Awareness for Burn Injuries Driving the Wound Dressings Market

Increasing awareness of burn injuries is a recent trend driving the wound dressings market. High levels of global awareness about burn injuries, their devastating effects, and the importance of proper wound care have raised the demand for specialized treatment products. Rising public health initiatives, along with growing recognition of the need for effective burn management, are expected to drive market growth. The increasing incidence of burns, particularly in regions with inadequate healthcare infrastructure, further fuels the demand for advanced wound care solutions.

Additionally, healthcare providers and governments are likely to focus on improving access to appropriate treatment options for burn victims. As a result, the need for more advanced and efficient wound dressings is expected to increase. An October 2023 report from WHO highlighted that approximately 180,000 fatalities occur each year due to burn injuries worldwide.

Additionally, India alone experiences an alarming rate of burn cases, with nearly 1,000,000 individuals suffering from moderate to severe burns annually, which underscores the critical need for advanced wound management techniques, improved healthcare infrastructure, and widespread accessibility to high-quality burn treatment products, particularly in regions with a high incidence of such injuries.

Regional Analysis

North America is leading the Wound dressings Market

North America dominated the market with the highest revenue share of 40.3% owing to the increasing prevalence of chronic wounds and advancements in wound care technology. Data from the Centers for Disease Control and Prevention (CDC) in October 2022 reported that approximately 38.4 million people in the U.S. had been diagnosed with diabetes, accounting for 11.6% of the population.

This rising incidence contributed to a higher demand for advanced wound care solutions, particularly for diabetic foot ulcers and pressure injuries. Innovations in moisture-retentive dressings, antimicrobial formulations, and bioactive materials improved healing outcomes and reduced the risk of infection. The expansion of home healthcare services further drove demand, as patients sought convenient and effective treatment options.

Government funding for chronic disease management and increased insurance coverage for advanced wound care products supported market growth. Additionally, collaborations between medical device companies and research institutions accelerated the development of next-generation dressings with enhanced healing properties, reinforcing North America’s position as a leader in wound care advancements.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising cases of diabetes and an aging population. Expanding healthcare infrastructure in countries like China, India, and Japan is expected to improve access to modern wound management technologies. Government initiatives promoting chronic disease management and increased healthcare spending are likely to support market expansion.

Growing awareness of the importance of early intervention and proper wound care is anticipated to drive demand for innovative treatment solutions. Collaborations between global medical device firms and regional manufacturers are projected to enhance product availability and affordability.

The increasing adoption of hydrocolloid, foam, and collagen-based dressings is expected to improve treatment outcomes, particularly for chronic wounds. Additionally, the rise of medical tourism, especially in countries offering cost-effective yet advanced healthcare services, is likely to contribute to market growth across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the wound dressings market focus on developing advanced materials such as hydrocolloids, foams, and antimicrobial dressings to enhance healing and infection control. Companies invest in research and development to introduce bioactive and smart dressings that promote faster tissue regeneration and moisture balance.

Strategic partnerships with healthcare providers and distributors help expand product reach and improve accessibility. Geographic expansion into regions with increasing demand for chronic wound care solutions supports further market growth. Many players also emphasize cost-effective and eco-friendly materials to align with sustainability initiatives and healthcare affordability.

Smith & Nephew is a leading company in this market, offering innovative wound management solutions such as ALLEVYN foam dressings, designed for optimal healing. The company focuses on continuous product innovation and strong collaborations with healthcare professionals to improve patient outcomes. Smith & Nephew’s commitment to quality and advanced wound care technology establishes it as a key player in the industry.

Top Key Players

- URGO

- Smith+Nephew

- Mölnlycke Health Care AB

- Johnson & Johnson

- JeNaCell

- Healthium Medtech

- Convatec Group PLC

- 3M

Recent Developments

- In June 2023, JeNaCell, a company specializing in advanced wound care solutions, introduced its innovative epicite balancing wound dressing to the German market; this dressing, which is specifically designed for the effective management of chronic wounds characterized by low to moderate levels of exudation, has been tailored to address a wide range of conditions, including diabetic foot ulcers, venous leg ulcers, arterial leg ulcers, and soft tissue lesions, making it an essential addition to modern wound care protocols that aim to enhance patient recovery outcomes while minimizing the risk of complications.

- In January 2023, Convatec Group PLC introduced Convafoam, an advanced foam dressing in the U.S. market. This innovative wound care solution is designed to cater to both patients and healthcare professionals by offering versatility in wound management. Its adaptability allows it to be used across different wound types and healing stages, simplifying the dressing selection process for enhanced skin protection and recovery.

- In October 2022, Healthium Medtech launched Theruptor Novo, a specialized wound dressing line aimed at managing chronic wounds. Developed for conditions such as diabetic foot ulcers and leg ulcers, the product provides an advanced healing environment, promoting effective treatment for patients suffering from persistent sores.

Report Scope

Report Features Description Market Value (2024) US$ 14.8 billion Forecast Revenue (2034) US$ 22.3 billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Traditional Dressing (Gauze, Tape, Cotton, Bandages, and Others) and Advanced Dressing (Moist Dressing (Foam Dressing, Hydrogel Dressing, Hydrocolloid Dressing, Film Dressing, Collagen Dressing, Alginate Dressing, and Others), Antimicrobial Dressing (Silver Dressing and Non-silver Dressing), and Active Dressing (Biomaterials and Skin-substitute))), By Application (Chronic Wounds (Diabetic Foot Ulcers, Venous Leg Ulcers, Pressure Ulcers, and Others) and Acute Wounds (Surgical & Traumatic Wounds and Burns)), By End-user (Hospitals, Research & Manufacturing, Outpatient Facilities, and Home Healthcare) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape URGO, Smith+Nephew, Mölnlycke Health Care AB, Johnson & Johnson, JeNaCell, Healthium Medtech, Convatec Group PLC, and 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- URGO

- Smith+Nephew

- Mölnlycke Health Care AB

- Johnson & Johnson

- JeNaCell

- Healthium Medtech

- Convatec Group PLC

- 3M