Global Human Antihistamine Drug Market Analysis By Drug Type (First-Generation Antihistamines, Second-Generation Antihistamines), By Type (Prescription-based, Over-the-counter (OTC)), By Indication (Urticaria, Allergy, Atopic Dermatitis, Others), By Route of Administration (Oral, Parenteral, Others), By End-Users (Hospitals, Specialty Clinics, Homecare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 83756

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

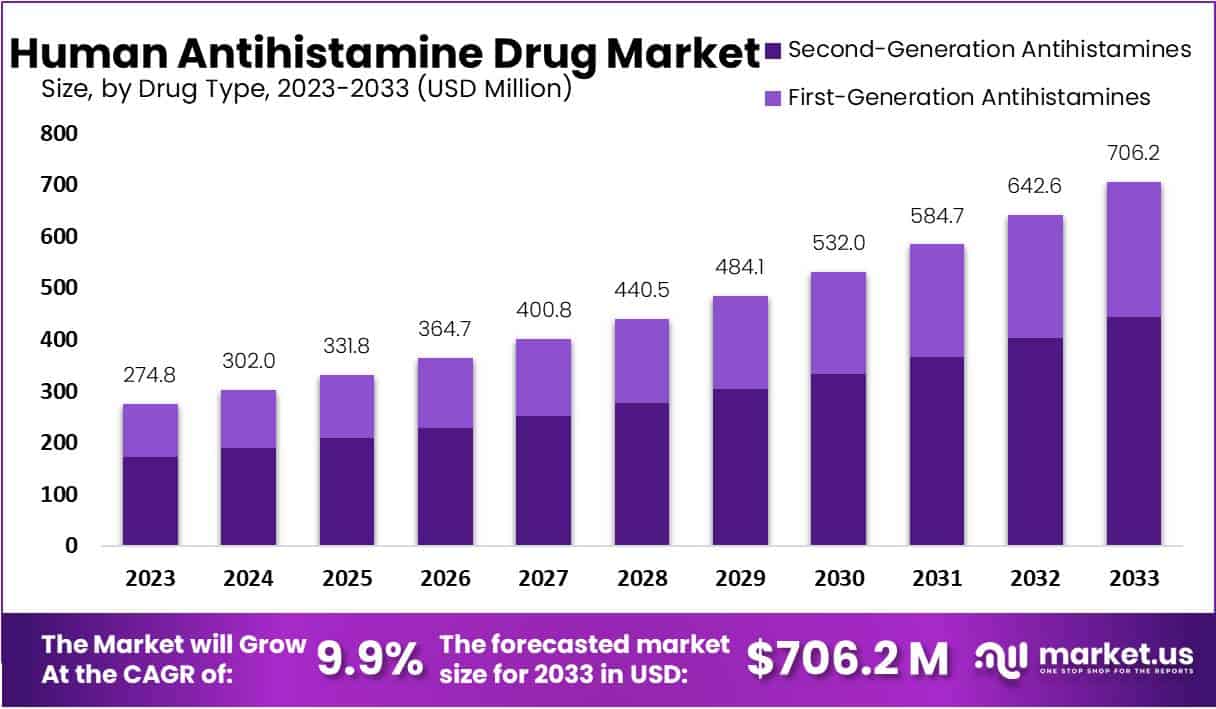

The Human Antihistamine Drugs Market Size is projected to reach approximately USD 706.2 million by 2033, showing a significant increase from the 2023 value of USD 274.8 million. This growth is anticipated to occur at a Compound Annual Growth Rate (CAGR) of 9.9% between 2024 and 2033.

*Note: Actual Numbers Might Vary In The Final Report

Antihistamine drug markets for humans represent an exciting, rapidly developing segment designed to combat allergic conditions. Antihistamines have proven an invaluable solution in terms of relieving symptoms such as sneezing, itching and congestion, leading to growing global allergy prevalence rates that drive increased demand. Major factors contributing to market expansion include innovations in drug research and development, expansions of healthcare infrastructure and increasing awareness about allergic disorders.

Additionally, this market features an intensely competitive landscape in which pharmaceutical companies strive to introduce novel formulations and increase treatment efficacy. As allergy rates continue to climb, research and development investments as well as innovative antihistamine drugs should fuel market expansion. With allergies becoming an ever more prevalent problem worldwide, human antihistamine drug sales will play a vital role in healthcare systems worldwide.

Key Takeaways

- Market Size Projection: The Human Antihistamine Drugs Market is set to reach USD 706.2 million by 2033, with a robust 9.9% CAGR from 2024 to 2033.

- Dominant Drug Type: Second-Generation Antihistamines hold over 62.7% market share in 2023, emphasizing improved safety profiles and reduced sedative effects.

- Preferred Medication Type: Over-the-Counter (OTC) drugs lead with 60.7% market share in 2023, reflecting consumer preference for accessible, non-prescription solutions.

- Top Indication: Allergy drugs dominate, capturing 62.7% market share in 2023, indicating the acute need for effective antihistamine medications.

- Leading Route of Administration: Oral administration claims 46.1% market share in 2023, driven by its user-friendliness and widespread acceptance among patients.

- Primary End-User: Hospitals secure a commanding 46.8% market share in 2023, highlighting their crucial role in addressing diverse allergic conditions in patients.

- Challenges: High maintenance costs associated with AI applications and security concerns pose obstacles to market growth, impacting accessibility and adoption rates.

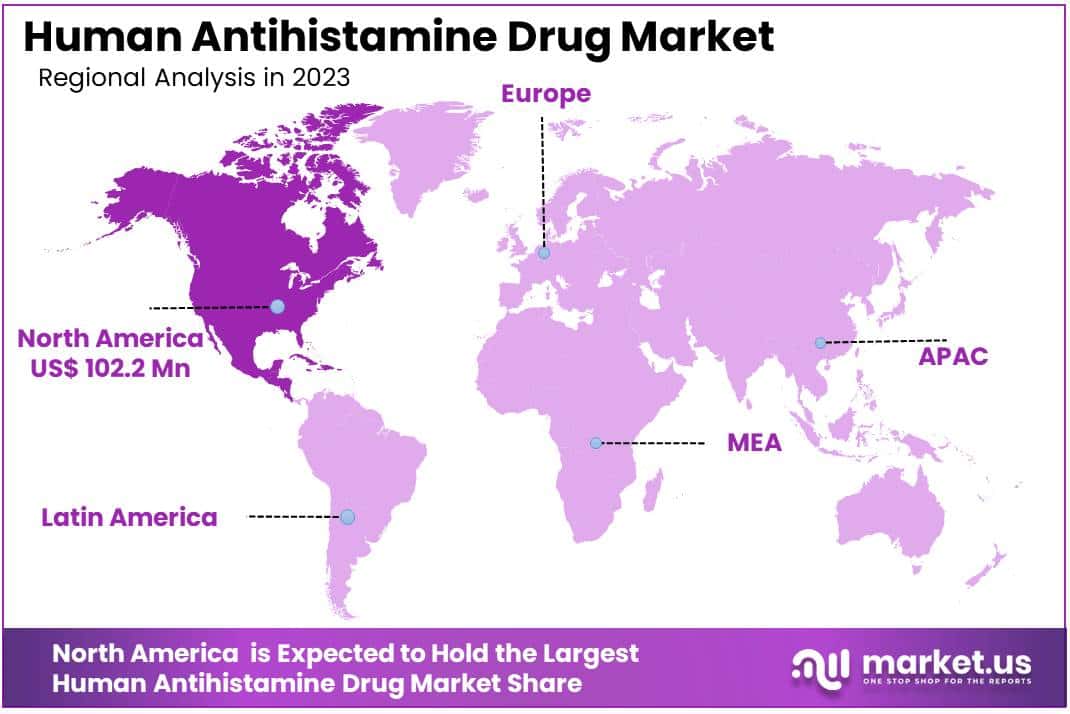

- Regional Dominance: North America holds a substantial 37.2% market share in 2023, driven by increased awareness, a high incidence of allergic conditions, and proactive healthcare approaches.

Drug Type Analysis

In 2023, Second-Generation Antihistamines dominate the Human Antihistamine Drug Market with over 62.7 % market share, reflecting both consumer demand and healthcare provider preferences for advanced antihistamines.

First-Generation Antihistamines, on the other hand, showcased a noticeable presence in the market. While retaining a significant share, they faced a moderate decline, capturing attention for specific use cases and preferences.

Second-Generation Antihistamines have proven their worth among both healthcare professionals and patients due to their improved safety profile and decreased sedative effects, earning their market leadership status.

This trend demonstrates a shift in consumer behaviors toward antihistamine drugs that not only address allergy symptoms effectively, but also meet modern healthcare expectations. Market dynamics suggest an emphasis on innovative solutions with reduced side effects; Second Generation Antihistamines being the more popular selection.

As time progresses, we anticipate sustained growth for Second Generation Antihistamines market segment due to continuing research and development initiatives to maximize efficacy while decreasing adverse reactions. This development underscores the necessity of remaining aware of changing consumer preferences and technological breakthroughs within Human Antihistamine Drug Market.

Type Analysis

In 2023, the human antihistamine drug market displayed significant segmentation based on types, most prominently prescriptive-based and OTC segments. Each segment played an essential part in shaping its respective market with unique characteristics and shares of sales.

OTC (Over-the-Counter) medications took the lead in 2023 by garnering more than 60.7% market share. This indicates an overwhelming consumer preference for nonprescription antihistamine drugs that are easily available and self administered remedies to address allergic conditions.

Prescription-Based Segment. While still serving an important purpose in meeting medical needs, Prescription-based segment accounted for the remaining market share, suggesting healthcare professionals continue prescribing antihistamine drugs based on individual patient requirements.

OTC antihistamine drugs have grown increasingly popular due to their convenient nature; allowing consumers to effectively treat mild allergy symptoms without needing a valid doctor’s prescription. This shift demonstrates a broader trend toward self-care and increased awareness about allergic conditions.

Attributes that contribute to the Over-the-Counter (OTC) segment’s dominance include its accessibility, affordability and consumers’ ability to make informed choices based on specific allergies. Furthermore, widespread availability makes the OTC market dominance all but assured.

This trend fits within a larger healthcare trend of consumers looking for accessible and user-friendly solutions for managing common health conditions. The surge in sales of antihistamine drugs over-the-counter (OTC) marks a substantial shift in how individuals approach and address allergic conditions versus traditional prescription-based solutions.

*Note: Actual Numbers Might Vary In The Final Report

Indication Analysis

In 2023, allergy drugs took the dominant position in the human antihistamine drug market by garnering 62.7 % market share signaling consumer preference towards antihistamine medications to address allergic conditions and adverse reactions caused by certain substances. Allergies made headlines across industries as people sought treatment solutions that addressed them effectively.

Urticaria was another key driver in driving sales of antihistamine medications to humans, commanding an impressive share of market revenue. Urticaria (more commonly referred to as “hives”) presented an ample market presence owing to the need for effective treatments to alleviate its itchy welts symptoms.

Atopic dermatitis, an itchy skin condition characterized by inflammation and discomfort, played a significant part in driving demand for antihistamine medications suited to this specific indication in human antihistamine drug sales. Consumers seeking relief contributed significantly to demand.

Other indications were also an integral segment of the market for human antihistamine drugs, showing their wide usage across medical conditions besides allergy, urticaria and atopic dermatitis.

2023 saw allergy solutions take the top position among consumer segments due to an acute need. Individuals continue to struggle with allergic reactions and the market’s focus is likely to remain on providing effective medications in this space for continued expansion and innovation in human antihistamine drug sales.

Route of Administration Analysis

In 2023, the Oral segment emerged as the frontrunner in the Human Antihistamine Drug Market, claiming a robust market share of over 46.1%. This dominance can be attributed to the convenience and widespread acceptance of oral administration among patients. Taking a pill is a common and user-friendly method, making it a preferred choice for many.

On the other hand, the Parenteral segment, which includes injections and other non-oral routes, secured a notable position in the market with a considerable share. These alternative administration methods cater to specific patient needs, providing effective relief in cases where oral intake might be challenging or less effective.

Additionally, the Others segment, comprising alternative routes of administration, saw significant growth and attracted much market interest. This dynamic category encompassed various modes of administering antihistamine medicines which demonstrated industry commitment towards finding innovative solutions meeting patient requirements.

As technological innovations and patient preferences shape the market landscape, market dynamics will likely shift accordingly. While Oral healthcare will likely retain its stronghold due to its user-friendliness and ease of use, both Parenteral and Other segments could experience growth with increased demands for personalized solutions as well as novel drug delivery mechanisms being created.

End-Users Analysis

In 2023, the Hospitals segment emerged as a frontrunner in the Human Antihistamine Drug Market, securing a commanding position with over 46.8% of the market share. This significant share can be attributed to the pivotal role hospitals play in catering to a diverse patient population with various allergic conditions.

Specialty Clinics also played a noteworthy role in the market landscape, contributing substantially to the overall market share. These clinics, specializing in specific medical areas, facilitated targeted treatment approaches, garnering a considerable portion of the market at a noteworthy percentage.

Moreover, the Homecare segment witnessed a steady rise, reflecting the growing preference for at-home treatment options. Convenience and comfort drove the demand for antihistamine drugs in a homecare setting, establishing it as a substantial player in the market.

In addition, other end-users, such as healthcare facilities beyond hospitals and clinics, collectively played a vital role, capturing a noteworthy share in the market. This diverse category encompasses various healthcare settings, each contributing uniquely to the distribution and accessibility of antihistamine drugs.

Key Market Segments

Drug Type

- First-Generation Antihistamines

- Second-Generation Antihistamines

Type

- Prescription-based

- Over-the-counter (OTC)

Indication

- Urticaria

- Allergy

- Atopic Dermatitis

- Others

Route of Administration

- Oral

- Parenteral

- Others

End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

Drivers

Integrating AI Applications Into Healthcare

Artificial Intelligence (AI) applications within healthcare have emerged as one of the main forces propelling growth of human antihistamine drug markets, both traditional and emerging. AI helps practitioners perform patient assessments more quickly while offering valuable decision support. Additionally, it has also proven its worth as an accelerator of drug development, disease prediction capabilities and overall healthcare enhancement strategies – contributing significantly to market expansion and contributing significantly towards its expansion.

Accelerated Medication Development

Artificial intelligence has revolutionized drug discovery. AI algorithms analyze vast datasets, quickly identifying potential drug candidates and streamlining development. Not only has this technological development increased efficiency of drug discovery but it has also contributed to expanding human antihistamine drug markets by filling medical needs more effectively while offering improved treatment options.

Enhance Healthcare Outcomes

Artificial intelligence’s role in improving healthcare outcomes by aiding practitioners with decision-making and diagnosis is one of its driving forces. Through advanced analytics and predictive capabilities, AI assists physicians with creating tailored treatment plans, which reduce adverse reactions while increasing overall patient well-being. As this positive effect on healthcare outcomes becomes evident in patient care delivery systems, its adoption will likely spur demand for human antihistamine drugs as effective remedies become a cornerstone for improved healthcare services.

Restraints

High Maintenance Costs

The high maintenance costs associated with AI applications and healthcare technology is one of the main impediments to growth of the human antihistamine drug market. Their financial burden may impede accessibility and affordability for innovative healthcare solutions thereby slowing adoption rates of innovative healthcare solutions.

Security and Interoperability Issues

Security concerns and interoperability issues pose obstacles to the seamless integration of healthcare technologies, especially as AI becomes an ever-increasing part of healthcare delivery systems. Ensuring patient data privacy in AI healthcare remains of utmost importance as is attaining compatibility and smooth exchange among various healthcare systems – hindering efficiency and effectiveness within human antihistamine drug market operations.

Opportunities

Big Data and Cloud Utilization

Big data and cloud computing services offer significant growth opportunities to the human antihistamine drug market. Healthcare organizations that leverage huge datasets can tap their power for improved research, development and delivery of antihistamine medicines; streamlining processes further while making healthcare data more readily accessible, leading to breakthrough drug discoveries as well as patient care innovations. This trend could boost research capacity as organizations leverage vast datasets.

Exponential Growth in Healthcare IT Investments

With investments pouring into healthcare IT around the globe, an unprecedented opportunity exists for human antihistamine drug market growth. Backed by substantial financial backing, the healthcare IT sector should experience exponential expansion. In turn, this would foster breakthroughs in antihistamine drug research, development, distribution – aligned with healthcare sector growth trajectory overall.

Trends

Personalised Medicine

One notable trend in the human antihistamine drug market is AI’s increasing ability to facilitate personalized medicine; AI algorithms able to analyze individual patient data and tailor treatment plans accordingly have gained prominence within recent years, echoing industry developments towards precision medicine – where treatments are tailored according to each person’s specific characteristics, providing more targeted and effective antihistamine drug therapies.

Telehealth and Remote Patient Monitoring

Telehealth and remote patient monitoring is having an increasing effect on the human antihistamine drug market, providing patients with virtual consultations and remote health monitoring capabilities thanks to advances in technology. Not only has this increased accessibility of healthcare services; but this trend also provides opportunities for optimizing antihistamine drug prescriptions based on real-time patient data for improved overall management and care for each individual patient.

Regional Analysis

In 2023, North America emerged as a key player in the Human Antihistamine Drug Market, securing a leading position with a substantial 37.2% market share, boasting a market value of USD 102.2 million for the year. This signifies a strong market presence, indicating a significant preference for antihistamine drugs in the region.

The robust market standing in North America can be attributed to factors such as increased awareness about allergy management, a high incidence of allergic conditions, and a proactive approach to healthcare. This dominance suggests a noteworthy acceptance and reliance on antihistamine drugs among the population.

Furthermore, the ever-changing competitive environment in North America suggests a dynamic landscape, where major market participants are strategically aligning themselves to meet the increasing need for antihistamine solutions. This lively market situation reflects a flourishing industry characterized by ongoing progress and novel developments in the realm of allergy treatment.

As North America maintains its stronghold, other regions are also witnessing noteworthy developments in the Human Antihistamine Drug Market. However, the current market data underscores North America’s pivotal role, setting the tone for future trends and opportunities in the global landscape.

*Note: Actual Numbers Might Vary In The Final Report

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Antihistamine drugs market competitive landscape includes various aspects of each competitor. This may include an overview, financial details, revenue generation and market potential as well as investment into research and development initiatives in new markets or global presence production sites and facilities production capacities strengths/weakness of each competitor, new product launch initiatives with their range and diversity as well as dominance across various applications pertaining to each one of them. It should be noted that all this data focuses solely on each company’s involvement or focus within this antihistamine drugs market space.

Market Key Players

- Sanofi

- Johnson & Johnson

- GlaxoSmithKline (GSK)

- Bayer AG

- Pfizer Inc.

- Novartis International AG

- Merck & Co. Inc.

- Boehringer Ingelheim

- Sun Pharmaceutical Industries Ltd.

- UCB S.A.

Recent Developments

- In September 2023, Novartis and Sun Pharma joined forces to collaborate in developing and commercializing biosimilar versions of levocetirizine – an antihistamine widely prescribed across many brand names – that may provide effective medication at more reasonable costs for developing countries. This partnership hopes to make effective medication more accessible at more reasonable costs than its brand-name equivalents.

- In October 2023, Sanofi announced their collaboration with ALX Therapeutics to develop ALX-370 as an antihistamine to treat allergic rhinitis and chronic idiopathic urticaria, using their expertise in drug delivery platform innovation to maximize this groundbreaking antihistamine’s development process. The collaboration utilizes Sanofi’s experience with antihistamine development while taking advantage of ALX Therapeutic’s advanced drug delivery system for drug delivery purposes.

- In November 2023, GSK announced positive findings of their Phase 3 trials of Xaraban (rivaroxaban), an already available blood thinner used for other conditions, that showed its effectiveness and safety when treating chronic urticaria, potentially broadening its applications as well as providing new hope to sufferers of this condition.

- In December 2023, Boehringer Ingelheim made an important move by acquiring global rights to ALTO-1366, an innovative next-generation antihistamine with an exciting mechanism of action. This acquisition expanded their allergy treatment market share significantly while offering potential breakthrough therapies.

Report Scope

Report Features Description Market Value (2023) USD 274.8 Mn Forecast Revenue (2033) USD 706.2 Mn CAGR (2024-2033) 9.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type (First-Generation Antihistamines, Second-Generation Antihistamines), By Type (Prescription-based, Over-the-counter (OTC)), By Indication (Urticaria, Allergy, Atopic Dermatitis, Others), By Route of Administration (Oral, Parenteral, Others), By End-Users (Hospitals, Specialty Clinics, Homecare, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sanofi, Johnson & Johnson, GlaxoSmithKline (GSK), Bayer AG, Pfizer Inc., Novartis International AG, Merck & Co. Inc., Boehringer Ingelheim, Sun Pharmaceutical Industries Ltd., UCB S.A., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Human Antihistamine Drug market in 2023?The Human Antihistamine Drug market size is USD 274.8 million in 2023.

What is the projected CAGR at which the Human Antihistamine Drug market is expected to grow at?The Human Antihistamine Drug market is expected to grow at a CAGR of 9.9% (2024-2033).

List the segments encompassed in this report on the Human Antihistamine Drug market?Market.US has segmented the Human Antihistamine Drug market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Drug Type the market has been segmented into First-Generation Antihistamines, Second-Generation Antihistamines. By Type the market has been segmented into Prescription-based, Over-the-counter (OTC). By Indication the market has been segmented into Urticaria, Allergy, Atopic Dermatitis, Others. By Route of Administration the market has been segmented into Oral, Parenteral, Others. By End-Users the market has been segmented into Hospitals, Specialty Clinics, Homecare, Others.

List the key industry players of the Human Antihistamine Drug market?Sanofi, Johnson & Johnson, GlaxoSmithKline (GSK), Bayer AG, Pfizer Inc., Novartis International AG, Merck & Co. Inc., Boehringer Ingelheim, Sun Pharmaceutical Industries Ltd., UCB S.A., and Other Key Players

Which region is more appealing for vendors employed in the Human Antihistamine Drug market?North America is expected to account for the highest revenue share of 37.2% and boasting an impressive market value of USD 102.2 million. Therefore, the Human Antihistamine Drug industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Human Antihistamine Drug?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Human Antihistamine Drug Market.

Human Antihistamine Drug MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Human Antihistamine Drug MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Sanofi

- Johnson & Johnson

- GlaxoSmithKline (GSK)

- Bayer AG

- Pfizer Inc.

- Novartis International AG

- Merck & Co. Inc.

- Boehringer Ingelheim

- Sun Pharmaceutical Industries Ltd.

- UCB S.A.