Surgical Gloves Market By Material (Natural Rubber, Nitrile, Neoprene, Polyisoprene and Other Materials) By Sterility (Sterile Gloves and Non- Sterile Gloves) By Form (Powder and Powder-free) By Distribution Channel (Online and Offline) By End-User (Hospitals & Clinics, Diagnostic Centers and Other End-Users) by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2024

- Report ID: 16399

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

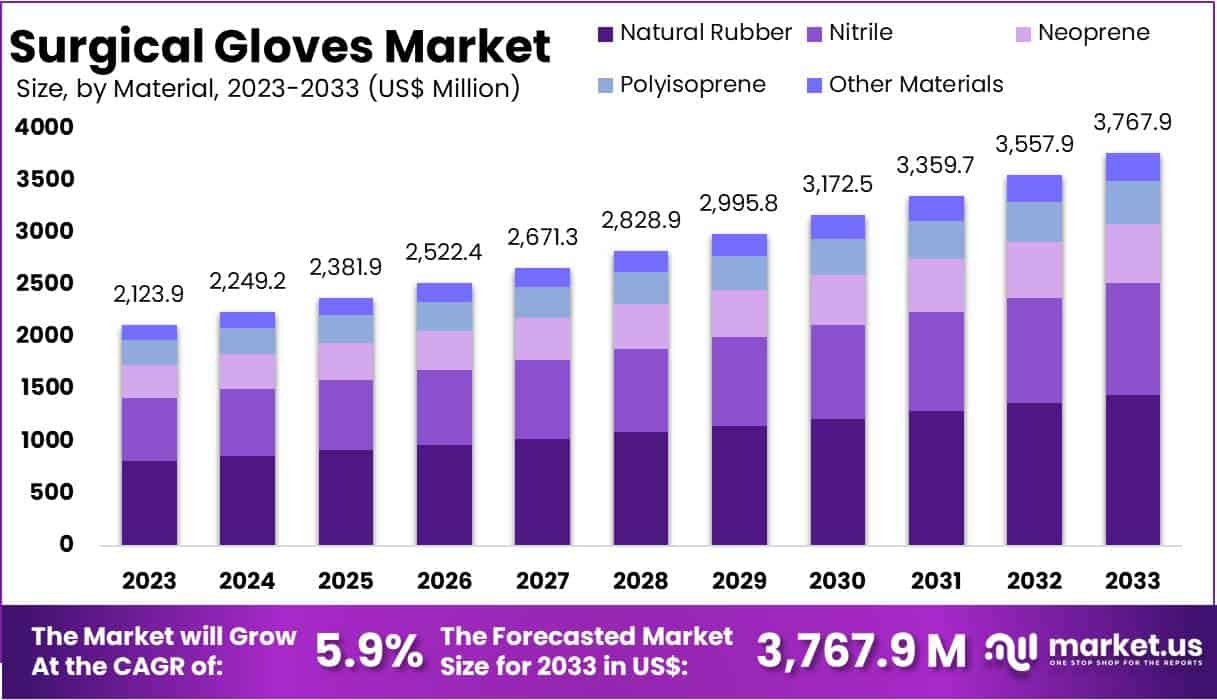

The Global Surgical Gloves Market size is expected to be worth around USD 3767.9 Million by 2032, from USD 2123.9 Million in 2023, growing at a CAGR of 5.9% during the forecast period from 2023 to 2033.

Surgical gloves are used during surgery and are usually prepared to a higher standard, and have better precision, more precise size, and sensitivity. Surgical gloves help protect doctors and patients from cross-contamination during medical examinations.

Surgical gloves are made of polymers, including polyisoprene, latex, neoprene, and nitrile. These products can be used as sterile gloves. From surgical purposes to dental applications, surgical gloves have many uses in the medical field. Surgical gloves are used in crime scene assessment due to their tight fit and thinness so that they can be conveniently used.

The latex used to make these gloves is replaced by isoprene or nitrile, or neoprene is widely used because of the increase in allergies caused by latex in the general population. Latex is used as a raw material for manufacturing surgical gloves because it is cheap. Nowadays, the available high-Product Type nitrile gloves are more effective than latex.

This is one of the reasons; cost-effective latex has not been replaced by hospitals. In 2016, the FDA decided to ban the use of powdered surgical gloves due to its respiratory effect. In Germany and the UK, their healthcare systems have also banned the use of these products.

Key Takeaways

- Market Size Growth: The market is projected to grow from US$ 2123.9 million in 2023 to US$ 3767.9 million by 2032, at a CAGR of 5.9%.

- Natural Rubber Dominance: Natural rubber gloves held a 38.5% market share in 2023, valued for their elasticity and comfort during sensitive procedures.

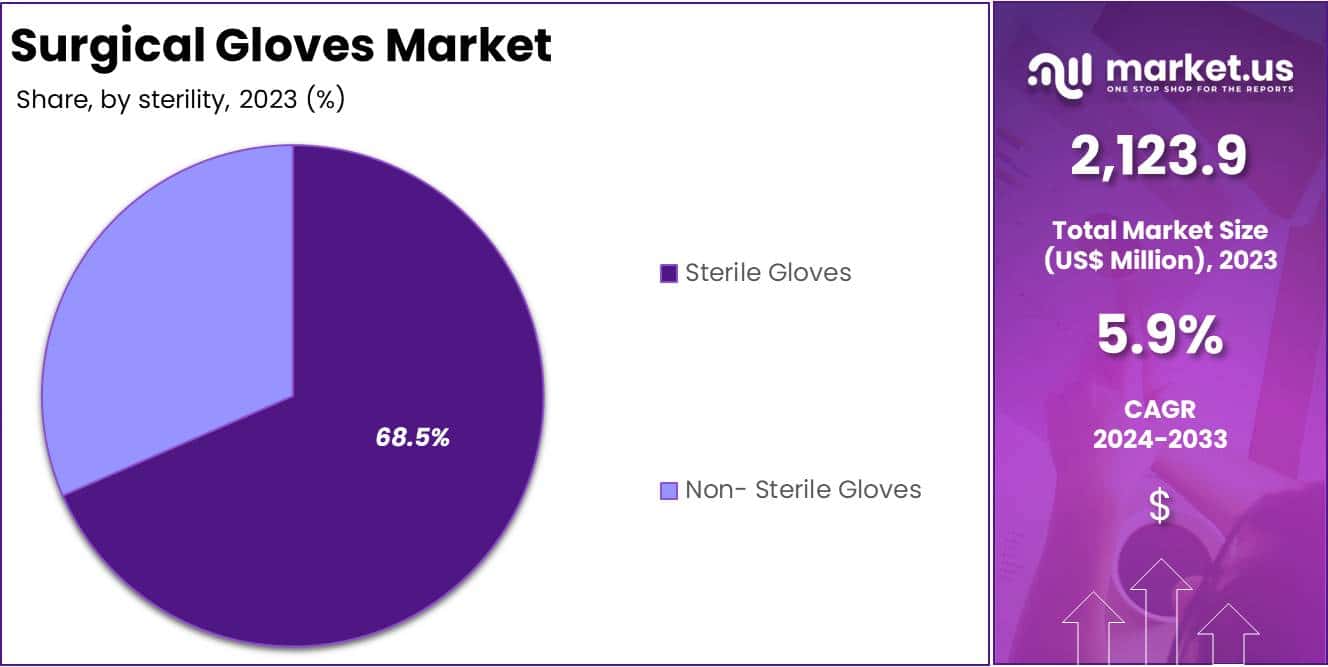

- Sterile Gloves: Sterile gloves captured 68.5% of the market in 2023, essential for preventing infections during surgical procedures.

- Powder-Free Gloves: In 2023, powder-free gloves held an 88.5% market share, preferred due to reduced allergy and respiratory risks.

- Offline Sales: Offline channels led the market with a 64.7% share in 2023, favored for immediate availability and quality assessment.

- Hospital Demand: Hospitals and clinics accounted for 64.9% of the market in 2023, driven by high surgical procedure volumes.

- Disposable Gloves Demand: The shift towards disposable gloves is a key driver, with increasing preference for nitrile gloves to prevent contamination.

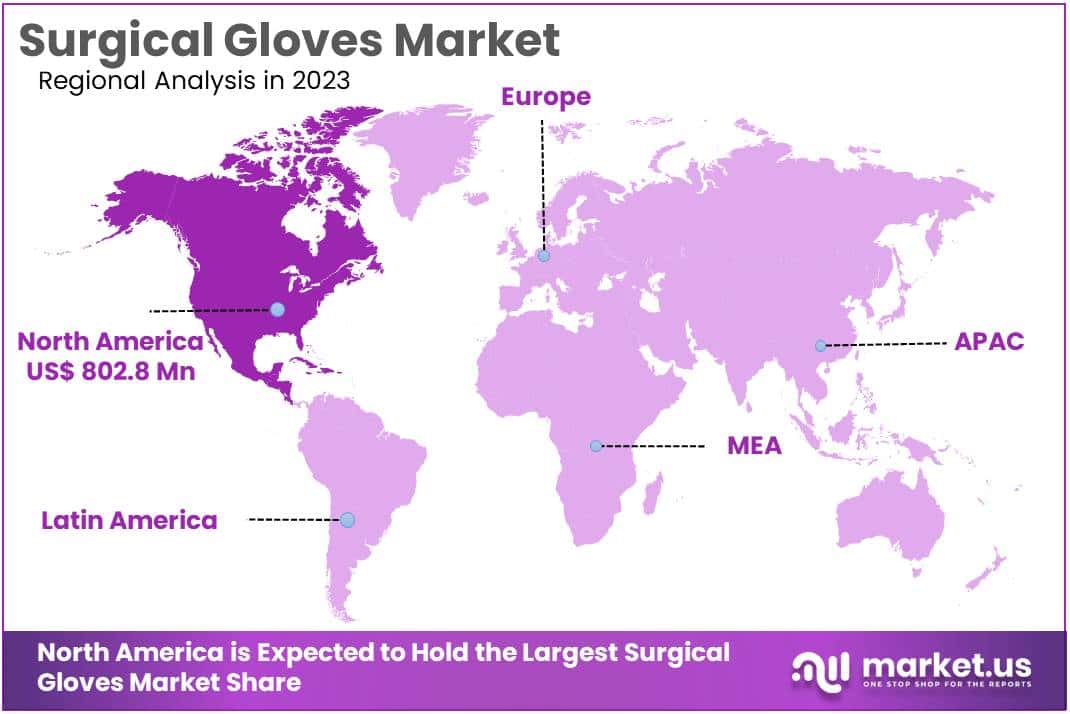

- North America Lead: North America led the market with a 37.8% share in 2023, supported by technological advancements and numerous surgical procedures.

- Asia Pacific Growth: The Asia Pacific region is expected to grow at a CAGR of 6.5%, driven by an aging population and healthcare investments.

- Key Players: Major companies include Hartalega Holdings, Sempermed, and Ansell Ltd., with significant investments in manufacturing and product innovations.

Material Analysis

In 2023, Natural Rubber held a dominant market position, capturing more than a 38.5% share in the surgical gloves market. This segment’s growth can be attributed to the material’s high elasticity and comfort, making it ideal for sensitive medical procedures. Natural rubber gloves are known for their superior tactile sensitivity, a critical factor for surgeons needing precise control during operations.

Nitrile gloves, another key segment, are gaining traction due to their strong resistance to chemicals and punctures. As of 2023, they represent a significant portion of the market, appealing to healthcare professionals who prioritize durability and safety. Nitrile gloves are also favored in environments where latex allergies are a concern, offering a hypoallergenic alternative to natural rubber.

Neoprene gloves have emerged as a preferred choice in specific surgical scenarios, especially where high chemical resistance and elasticity are required. These gloves offer a balance between sensitivity and protection, making them suitable for a variety of surgical procedures.

The Polyisoprene segment is noteworthy for its synthetic nature, providing a latex-like feel without the allergenic properties. This makes polyisoprene gloves an ideal choice for healthcare professionals with latex sensitivities. Their increasing adoption in surgical settings can be seen as a response to the growing need for hypoallergenic yet high-performance gloves.

Other materials, including various synthetic blends and innovations, are also part of this diverse market. These materials cater to niche requirements within the surgical glove market, offering specialized properties such as enhanced grip, temperature resistance, and extended wear comfort.

Sterility Analysis

In 2023, Sterile gloves held a dominant market position, capturing more than an 68.5% share in the surgical gloves market. This segment’s prominence is primarily due to the critical need for sterility in surgical and invasive procedures. Sterile gloves undergo rigorous sterilization processes, ensuring they are free from microorganisms, thereby reducing the risk of infections during surgeries. The high demand for these gloves is reflective of their indispensable role in maintaining aseptic conditions in operating rooms and other sterile environments.

Non-sterile gloves, while occupying a smaller market share, play a vital role in non-invasive medical procedures and examinations. These gloves are suitable for tasks where sterility is not a primary concern, such as in general patient care or routine medical examinations. The lower cost and broader application range make non-sterile gloves a practical choice in various healthcare settings.

The market dynamics of both sterile and non-sterile gloves are influenced by factors such as the rising awareness of hygiene in healthcare, the increasing number of surgical procedures, and the growing emphasis on infection control protocols. While sterile gloves lead the market due to their critical application in surgeries, non-sterile gloves maintain a steady demand in other medical and healthcare areas.

Form Analysis

Powder-Free gloves held a dominant market position, capturing more than an 88.5% share in the surgical gloves market in 2023. This segment’s strong market presence is largely due to increased awareness about the potential risks associated with powdered gloves, such as allergies and respiratory issues. Powder-free gloves are treated to be smooth and easy to put on, without the need for powder. Their rising popularity is also attributed to their reduced contamination risk, making them a safer choice in surgical and medical environments.

Powdered gloves, though occupying a lesser share of the market, are valued for their ease of donning, especially in high-paced environments where quick glove changes are necessary. However, the market share of powdered gloves has been declining due to mounting concerns over health risks and stricter regulations limiting their use.

The shift in preference towards powder-free gloves reflects the evolving industry standards and heightened safety protocols in healthcare settings. The market trend indicates a growing demand for safer, more user-friendly glove options, leading to increased innovation and improvement in powder-free glove technologies.

Distribution Channel Analysis

Offline distribution channels led market by capturing more than a 64.7% share in the surgical gloves market in 2023. This segment includes traditional brick-and-mortar establishments like medical supply stores, pharmacies, and direct sales from manufacturers to healthcare institutions. The preference for offline channels is largely due to the immediate availability of products, the ability to physically assess quality, and established relationships between suppliers and medical facilities. These factors are particularly important in the healthcare sector, where timely access to high-quality surgical gloves is crucial.

Online channels, while holding a smaller market share, are rapidly growing. This growth can be attributed to the convenience of online ordering, wider availability of product ranges, and competitive pricing. Online platforms are becoming increasingly popular among smaller healthcare providers and individual practitioners due to their ease of access and the ability to compare different products efficiently.

The surgical gloves market is experiencing a gradual shift as online platforms gain more traction, driven by technological advancements and changing purchasing behaviors. However, the offline segment continues to lead due to its established presence and reliability in supplying critical medical products.

End-User Analysis

In 2023, the surgical gloves market was predominantly led by Hospitals & Clinics, which accounted for over 64.9% of the market share. This segment’s leadership is attributed to the high volume of surgical and medical procedures performed in these settings. Hospitals and clinics have a continuous and substantial need for surgical gloves to maintain hygiene and prevent cross-contamination. The high demand in this segment is a direct reflection of the ongoing efforts to uphold patient safety and stringent infection control standards.

Diagnostic centers, another key end-user segment, also utilize surgical gloves, albeit to a lesser extent. These facilities primarily use gloves for sample collection and minor procedures, contributing to the market share. The role of surgical gloves in diagnostic centers is crucial for ensuring the safety of both patients and healthcare professionals during various diagnostic procedures.

Other end-users, including ambulatory surgery centers, nursing homes, and research laboratories, collectively form a significant portion of the market. These varied settings have specific requirements for surgical gloves, depending on the nature of care and procedures conducted. The demand in this segment is driven by the growing healthcare infrastructure and the expanding scope of medical and research applications.

Key Market Segments

By Material

- Natural Rubber

- Nitrile

- Neoprene

- Polyisoprene

- Other Materials

By Sterility

- Sterile Gloves

- Non- Sterile Gloves

By Form

- Powder

- Powder-free

By Distribution Channel

- Online

- Offline

By End-User

- Hospitals & Clinics

- Diagnostic Centers

- Other End-Users

Drivers

Rising Demand for Nitrile Gloves

Sterimax Global highlighted a significant market shift toward disposable nitrile gloves. These gloves are highly valued for their effectiveness in preventing contamination and reducing infection risks. The growing preference for nitrile gloves is primarily due to their superior protective properties compared to other materials, making them indispensable in various healthcare settings for ensuring hygiene and safety.

Impact of Global Health Emergencies

The COVID-19 pandemic has profoundly impacted the market by highlighting the urgent need for personal protective equipment such as surgical gloves. The pandemic emphasized the role of protective gear in controlling the spread of infections, leading to a sustained increase in demand across global healthcare systems. This trend is expected to continue as awareness and preparedness for health emergencies remain a priority.

Stringent Infection Control Regulations

Enhanced government regulations focusing on infection control within healthcare settings are pivotal in driving the demand for surgical gloves. These regulations mandate stringent hygiene practices, where the use of disposable gloves plays a crucial role in preventing the transmission of infectious agents. As healthcare providers strive to meet these standards, the demand for reliable and effective surgical gloves is expected to grow further.

Restraints

Trade Restrictions and Manufacturing Challenges

The surgical gloves market often faces significant hurdles due to disruptions in the supply chain. Trade restrictions can limit the availability of necessary raw materials, leading to shortages in glove production. Additionally, manufacturing challenges such as factory shutdowns, labor shortages, or logistical issues further exacerbate these shortages. This not only affects the market availability of surgical gloves but also places immense pressure on healthcare providers who rely heavily on a steady supply of these essential items to maintain safety and hygiene standards during medical procedures.

Latex Allergies Driving Material Innovation

A notable market constraint for surgical gloves is the increasing incidence of latex allergies among healthcare professionals and patients. This has spurred demand for gloves made from alternative materials such as nitrile and vinyl, which are hypoallergenic. The shift is driven by the need to reduce allergic reactions associated with latex gloves, which can range from mild skin irritations to severe anaphylactic reactions. As a result, manufacturers are investing in the development of new materials that ensure safety without compromising glove performance.

Opportunities

Global Awareness of Hygiene and Infection Control

The growing global focus on hygiene has significantly boosted the surgical gloves market, presenting new opportunities, particularly for non-latex gloves. This shift is primarily driven by increased health awareness among individuals and stringent regulations across healthcare settings to prevent infections. Non-latex gloves are gaining traction due to their hypoallergenic properties, catering to the needs of users with latex allergies. As a result, manufacturers are encouraged to innovate and expand their product lines to include non-latex options, tapping into a broader customer base seeking safer, more comfortable alternatives in infection control.

Innovative Material Development

There is a rising trend in the development of synthetic and biodegradable materials for surgical gloves, driven by environmental concerns and the need for high-performance alternatives to traditional materials. These innovations include materials that offer both durability in medical settings and the ability to break down safely after disposal. As consumers and regulatory bodies push for more sustainable healthcare products, manufacturers investing in these new materials are well-positioned to capture growth in a market increasingly influenced by ecological considerations.

Expanding Healthcare Industry

The expansion of healthcare infrastructures, especially in developing nations, is creating vast opportunities for the surgical gloves market. As these countries invest more in health services, the demand for medical supplies, including surgical gloves, is expected to rise. This growth is not only fueled by new hospital and clinic constructions but also by the global push towards improving healthcare accessibility and quality. Companies that can effectively supply to these emerging markets are likely to see significant growth, benefiting from the continuous global effort to enhance healthcare systems.

Challenges

Adverse Effects of Surgical Gloves

Choosing the right surgical gloves is crucial due to the risks of allergic reactions and dermatitis, particularly from latex varieties. Many healthcare professionals face these challenges, which can severely affect their comfort and performance. This issue underscores the need for manufacturers to innovate and develop safer, hypoallergenic glove materials. By focusing on product safety and wearer comfort, manufacturers can enhance user satisfaction and reduce the incidence of allergic reactions. Ensuring that gloves meet stringent safety standards not only supports health professionals but also advances overall patient care.

Counterfeit Medical Products

The surgical glove market faces significant challenges due to the proliferation of counterfeit products, especially in low- and middle-income countries (LMICs). These substandard gloves compromise market integrity and, more critically, patient safety. The presence of counterfeit medical gloves highlights the urgent need for stringent regulation and monitoring within the industry. Healthcare providers and regulators must collaborate to establish and enforce tougher standards to prevent the circulation of these hazardous products. By tackling this issue, the industry can protect patients and ensure that healthcare professionals are equipped with safe, effective protective gear.

Trends

Growth in the Disposable Gloves Segment

The disposable gloves segment is poised for significant expansion, primarily because of their distinct advantages over reusable gloves. Unlike their reusable counterparts, disposable gloves offer enhanced safety by reducing the risks of cross-contamination in medical settings. This factor alone greatly appeals to healthcare facilities prioritizing hygiene and patient safety. Moreover, disposable gloves are cost-effective when considering the logistics and expenses associated with cleaning and maintaining reusable gloves. As awareness of these benefits grows, so too does the adoption of disposable gloves across various healthcare applications, driving notable growth in this market segment.

Impact of Technological Advancements

Recent innovations in digitalization and automation have revolutionized the surgical gloves industry by enhancing manufacturing and distribution processes. These technological advancements have not only streamlined production but have also improved the consistency and quality of the final product. As manufacturers adopt these new technologies, they are able to meet the rising demand more efficiently and with higher standards. This transition is a key driver in the market’s expansion, as improved process efficiencies make it possible to scale operations effectively while maintaining high-quality outputs.

Influence of an Aging Population

The increasing number of elderly individuals, especially in the United States, is having a profound impact on healthcare services, including the market for surgical gloves. An aging population typically sees a higher incidence of medical conditions that require surgical interventions and ongoing medical care, thereby elevating the demand for surgical gloves. This demographic trend ensures a steady demand for medical supplies and supports the growth of the surgical gloves market as healthcare spending continues to rise to meet the needs of this growing patient segment.

Regional Analysis

In 2023, North America held a dominant market position in the Surgical Gloves Market, capturing more than a 37.8% share and holds a market value of USD 802.8 million for the year. This substantial market share can be attributed to several key factors.

Firstly, the region boasts a highly developed healthcare infrastructure. Hospitals and medical facilities are well-equipped and maintain rigorous standards for hygiene and patient care, which drive the demand for high-quality surgical gloves. Furthermore, stringent regulations by bodies such as the U.S. Food and Drug Administration (FDA) ensure that only the best products are used in medical settings, bolstering the market for premium surgical gloves.

Secondly, North America’s strong focus on healthcare research and development encourages continuous innovation in surgical gloves. Advances such as enhanced glove materials that offer better protection and comfort to healthcare professionals have become a priority. These innovations not only improve safety standards but also increase the efficiency of medical procedures, making advanced gloves a necessity.

Additionally, the ongoing efforts to prevent hospital-acquired infections (HAIs) have led to increased awareness and implementation of safety practices among healthcare providers. This has further escalated the demand for disposable surgical gloves, seen as critical in infection control strategies.

Lastly, the presence of leading manufacturers who actively expand their product portfolios and improve distribution networks across the region solidifies North America’s leading position in the market. These companies often collaborate with healthcare organizations to ensure a steady supply and accessibility of their products, adapting quickly to the evolving needs of the healthcare sector.

Key Players Analysis

In the surgical gloves market, Hartalega Holdings stands out for its innovative approach, especially with its nitrile gloves that are appreciated for their robustness, comfort, and hypoallergenic qualities. Sempermed competes closely, offering a diverse range of latex and synthetic options known for their durability and adherence to international safety standards. Similarly, Globus Group tailors its offerings to meet the precise needs of healthcare professionals with gloves designed for maximum protection and comfort.

Kanam Latex Industries Pvt. Ltd. distinguishes itself by focusing on high-quality latex gloves prized for their elasticity and tactile sensitivity, crucial for surgical precision. Cardinal Health Inc. also plays a pivotal role with its reliable surgical gloves and a vast distribution network ensuring availability worldwide.

Additionally, other key market players continuously innovate to meet the dynamic demands of the healthcare sector, striving to maintain high hygiene and safety standards. Collectively, these companies drive innovation and quality across the global surgical gloves market, ensuring healthcare professionals have access to superior products.

Surgical Gloves Market Key Players are

- Hartalega Holdings

- Sempermed

- Globus Group

- Kanam Latex Industries Pvt. Ltd.

- Cardinal Health Inc.

- Ansell Ltd.

- Medline Industries, Inc.

- Leboo Healthcare Products Limited

- Berner International GmbH

- Sun Healthcare (M) Sdn. Bhd.

Recent Developments

- In October 2024: Hartalega Holdings Bhd is projected to benefit from the impending 50% import tariff by the United States on China-made gloves, effective January 2025. This development is anticipated to increase Hartalega’s revenue exposure to the U.S. market from the current 40%-50% to approximately 60%-70% starting January 2025.

- In May 2022: Alpha Solway, a subsidiary of Globus Group, inaugurated a £12 million manufacturing facility in Dumfries, Scotland. This state-of-the-art factory produces meltblown polypropylene, a critical component in FFP2 and IIR facemasks. The investment, supported by a £4.8 million partnership with South of Scotland Enterprise, led to the creation of over 300 jobs in the region.

- In April 2024: Ansell announced a major acquisition by entering into a binding agreement to purchase 100% of the assets of Kimberly-Clark’s Personal Protective Equipment business (KCPPE). This acquisition, valued at $640 million, is set to be completed by September 2024. It includes Kimberly-Clark’s portfolio of gloves, eyewear, and other safety apparel under the Kimtech and KleenGuard brands.

Report Scope

Report Features Description Market Value (2023) US$ 2123.9 Million Forecast Revenue (2033) US$ 3767.9 Million CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Trauma or Injury Treatment, Acute Illness Treatment, Physical Examinations, Immunization and Vaccination and Others) By Ownership (Hospital, Physicians, Corporation and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hartalega Holdings, Sempermed, Globus Group, Kanam Latex Industries Pvt. Ltd., Cardinal Health Inc., Ansell Ltd., Medline Industries, Inc., Leboo Healthcare Products Limited, Berner International GmbH, Sun Healthcare (M) Sdn. Bhd. And Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mölnlycke Health Care AB

- Medline Indust Ansell Limited ries, Inc.

- TOTAL S.A.

- Top Glove Corporation Bhd.

- Cardinal Health, Inc.

- Ansell Limited

- Asma Rubber Products Pvt. Ltd.

- Kossan Rubber Industries Bhd

- Shandong Yuyuan Latex Gloves Co., Ltd