Global Healthcare Furniture Market By Product-Beds(ICU Beds, Fowler Beds, Plain Hospital Beds, Others) Patient Lift(Manual Lifts, Power Lifts, Stand up Lifts, Others) Tables(Examination Tables, Obstetric Tables, Surgical Tables, Others) Chairs, Medical Carts, Stretchers, Others, Application(Physician’s Furniture, Patient’s Furniture, Staff’s Furniture)By Distribution Channel(Offline, Online) Material Type(Metal, Plastic) End-use-(Hospitals & Specialty Clinics, Ambulatory Surgical Centers, Other) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 12870

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

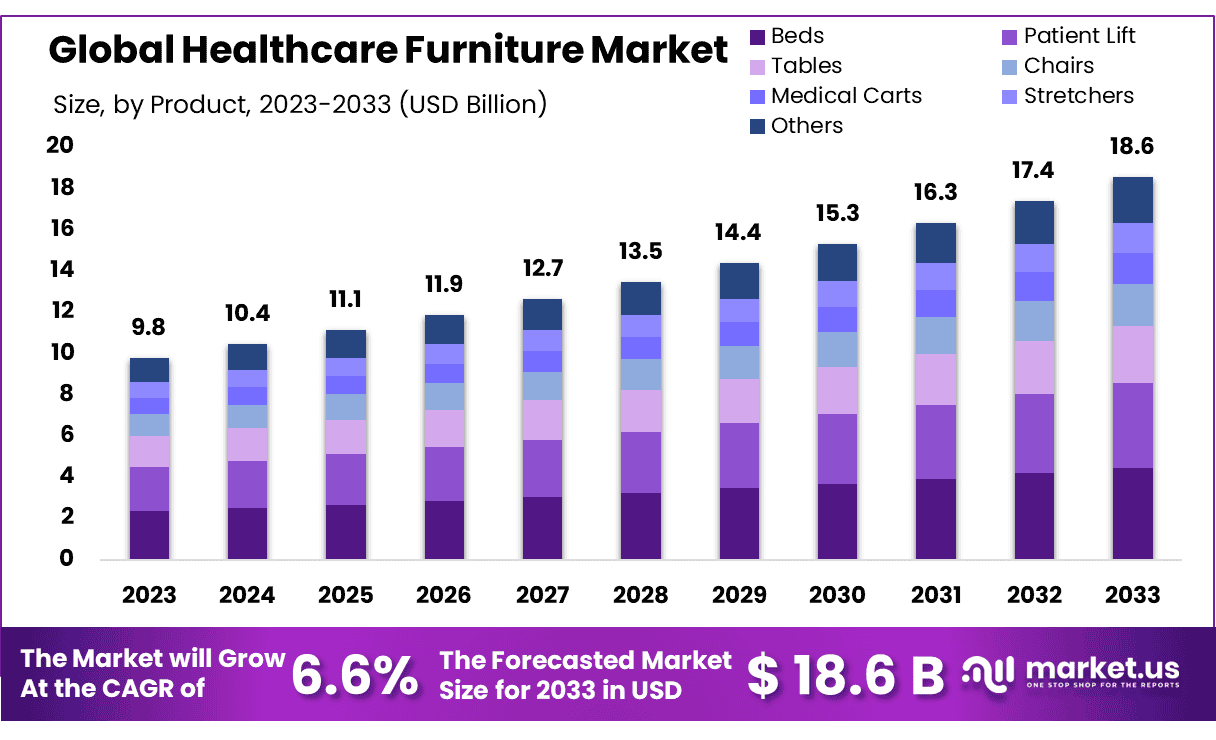

The Global Healthcare Furniture Market size is expected to be worth around USD 18.6 Billion by 2033 from USD 9.8 Billion in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

Healthcare furniture is an essential part of any healthcare infrastructure. Healthcare furniture includes all goods used in hospitals and clinics. These goods are basically moveable & stationery objects intended to support either patients or physicians. The healthcare facilities consider different factors before selecting the furniture such as ergonomics, bariatrics and aesthetics. These facilities are focusing firstly on the patient’s comfort. Secondly, the focus is on the reduction of hospital-acquired infections.

Thirdly, the selection of furniture according to bariatric patients. And lastly, selecting furniture to make the environment family-friendly for visitors. The healthcare facilities are needed to be designed in a way that the examination room used for gynaecology on one day can be used for paediatrics on the next. Therefore, the interchangeability and movability of the furniture as a response to immediate changes is the prime impacting factor. Innovative technologies are adding useful components to healthcare furniture to make the furniture more comfortable for patients and to increase the ease of functional capabilities.

An increasing number of hospitals-rapid emergence of new hospitals across developing nations and a high number of hospitals in developed countries with a rising number of patients worldwide are expected to drive the market growth. Furthermore, the rising geriatric population worldwide is likely to increase the demand for healthcare furniture like riser recliners/lift chairs, tub chairs and profiling beds.

However, the long life span of the furniture restricts its repetitive purchasing, which may hamper the market growth. Nonetheless, technologically innovative products like motorised stretcher chairs are being introduced into the market. These chairs enhance the patient’s comfort and help to achieve superior clinical performance. This is likely to provide lucrative opportunities for market growth.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size & Growth: Healthcare Furniture Market size is expected to be worth around USD 18.6 Billion by 2033 from USD 9.8 Billion in 2023, growing at a CAGR of 6.6%.

- Product Analysis: Bed segment claimed the largest market share, accounting for 24.03% in 2023.

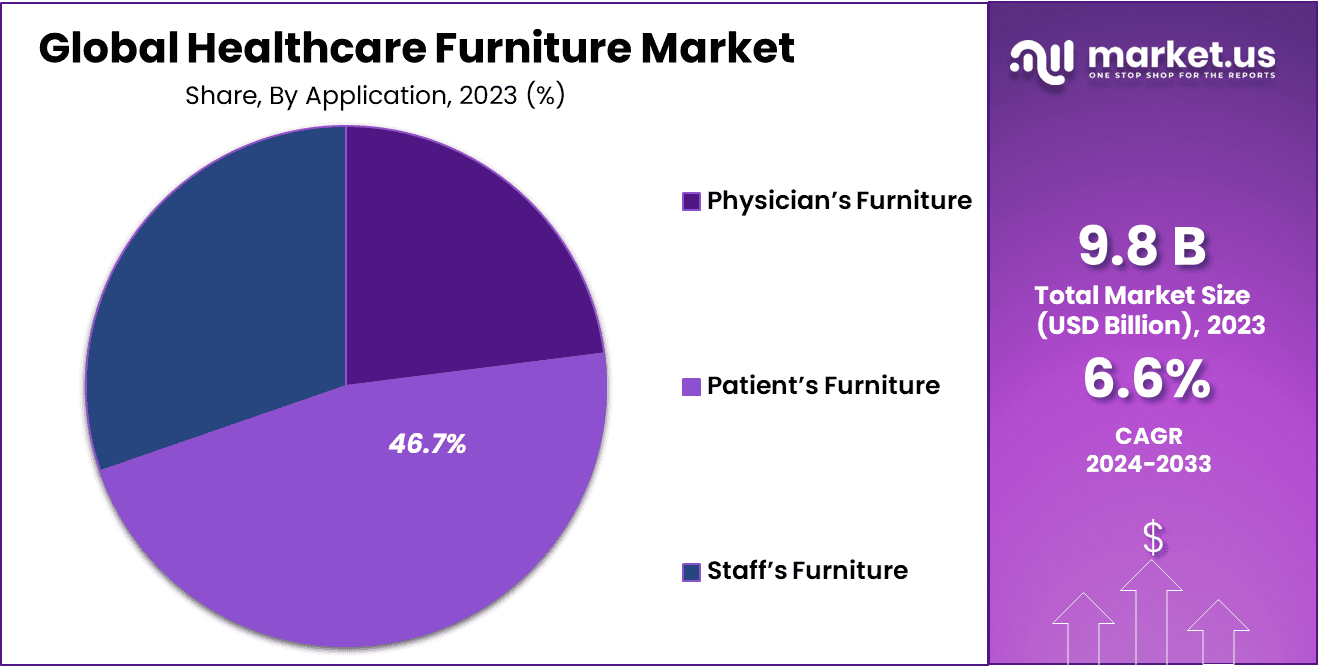

- Application Analysis: The patient furniture took the highest share in 2023 at over 46.7%.

- Distribution Channel Analysis: Offline sales claimed their place as industry leaders by contributing over 65.5% of total revenue in 2023.

- Material Type Analysis: Metal furniture took center stage in 2023’s industry by accounting for 40.5% of global revenue

- End-Use Analysis: Ambulatory Surgery Centers (ASCs) are projected to experience the highest CAGR during 2024-2033 at 7.8%

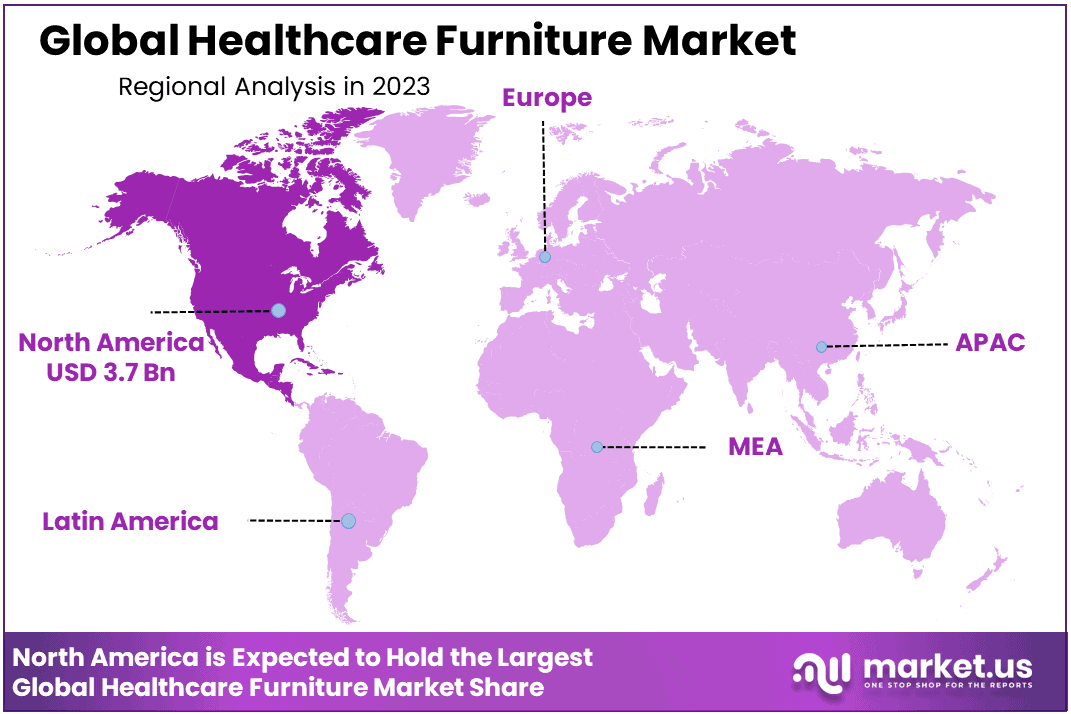

- Regional Analysis: North America held the largest market share at 38.02% and holding USD 3.7 Bn market revenue in 2023.

By Product

Based on product, the global Hospital Furniture market is subdivided into ICU Beds, Fowler Beds, Plain Hospital Beds, Pediatric Beds, Maternity Beds, Others. Notably, the Bed segment claimed the largest market share, accounting for 24.03% in 2023. Throughout the forecast period, the market growth of this segment is expected to be driven by several factors, including the escalating demand for beds in hospitals and healthcare institutions.

The surge in the number of patients undergoing surgical procedures and an increase in hospital stays due to delayed injury healing rates contribute significantly to the robust growth anticipated in the Hospital Bed segment. In response to the pandemic, many manufacturers are addressing the demand by producing cost-effective beds. For instance, Stryker, a leading global medical technology company, has unveiled a low-cost, limited-release emergency response bed designed to assist healthcare practitioners in delivering effective care during the ongoing COVID-19 pandemic.

By Application

Based on applications, the global industry can be divided into physician furniture, patient furniture and staff furniture. Of these categories, patient furniture took the highest share in 2023 at over 46.7% and is predicted to continue its dominance through the forecast period with its fast-growing rate driven largely by demand (examination couches, examination lights, drawers benches bedside tables over-bed tables chairs) as well as easy product maintenance requirements being key contributors.

Physician’s furniture is projected to experience the highest compound annual growth rate over its forecast period, driven by factors like increased patient admissions into larger hospitals, concerns surrounding patient safety and mobility concerns, as well as requirements for adequate support during medical exams. Its expected surge in growth further solidifies this industry’s role in supporting the evolving needs of healthcare facilities.

By Distribution Channel

Based on Distribution Channel, offline sales claimed their place as industry leaders by contributing over 65.5% of total revenue in 2023. Real-time experiences, increased purchase confidence, lower rejection rates, customizable options with immediate delivery service from sales personnel as well as comprehensive installation support with straightforward returns were among key contributors to its tremendous growth and dominance over time.

Online sales channels appear poised for rapid expansion over the forecast period. This growth could be spurred on by factors like product comparisons, wide product offerings, customer reviews that allow informed decisions, attractive offers and discounts, but delays in deliveries or quality concerns could potentially prevent widespread adoption within industry.

By Material Type

Based on Material Type, metal furniture took center stage in 2023’s industry by accounting for 40.5% of global revenue. Its growth is being propelled by increasing adoption rate and growing demand, due to exceptional durability that provides comfort. Over the forecast period, it is projected that metal will see further momentum driven by widespread usage within healthcare settings where stainless steel’s antimicrobial properties make it the choice in operating rooms.

The wood segment is projected to experience the fastest compound annual growth rate during its forecast period, attributing this development to the widespread use of wooden furniture for its warmth and aesthetic appeal. Wooden furniture offers its inherent organic qualities – thermal benefits as well as helping manage internal humidity balance – making them popular choices in homes worldwide. However, using abrasive cleaners may damage wooden furniture surfaces over time while moisture exposure may swell wood fibers causing swelling which promotes bacteria growth as well as makes porous wood susceptible to nicks and scratches allowing wood furniture makers to.

By End-use

Ambulatory Surgery Centers (ASCs) are projected to experience the highest CAGR during 2024-2033 at 7.8%. Driven largely by an increasing trend towards same-day surgeries that result in cost savings, shorter wait times and an upsurge in patient volume requiring surgical procedures. Furthermore, reimbursement policies tailored specifically for ASCs is expected to significantly expand their market presence; in 2023 alone hospitals & specialty clinics held the market’s dominant revenue share position.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

Product

Beds

- ICU Beds

- Fowler Beds

- Plain Hospital Beds

- Pediatric Beds

- Maternity Beds

- Others

Patient Lift

- Manual Lifts

- Power Lifts

- Stand up Lifts

- Heavy duty Lifts

- Overhead Track Lifts

- Others

Tables

- Examination Tables

- Obstetric Tables

- Surgical Tables

- Others

Chairs

Medical Carts

Stretchers

Others

Application

- Physician’s Furniture

- Patient’s Furniture

- Staff’s Furniture

Distribution Channel

Offline

Online

Material Type

- Metal

- Plastic

End-use

- Hospitals & Specialty Clinics

- Ambulatory Surgical Centers

- Other end-Uses

Drivers

Fuelling Demand for Healthcare Services

An increasing global population and aging demographics is driving an unprecedented demand for healthcare services, driving demand for healthcare furniture market expansion. As healthcare facilities expand to accommodate higher patient volumes, ergonomic and patient-friendly furniture becomes essential in creating healing environments and comfortable spaces for both patients and healthcare providers alike. This rise in healthcare furniture demand contributes significantly to growth of this specialized furniture segment.

Technological Advancements in Healthcare Furniture

Healthcare advances have led to the incorporation of smart and technologically advanced features into healthcare furniture, such as embedding sensors for monitoring patient vital signs into beds or beds that can be easily adjusted or reconfigured for different settings. Adopting technology not only enhances patient care but also contributes to overall efficiency of facilities, spurring the market for innovative healthcare furniture solutions.

Trends

Patient-Centric Care

Healthcare furniture industry trends reveal an increasing focus on patient-centric care. Healthcare providers increasingly recognize how physical environments influence patient outcomes, leading them to seek furniture that promotes comfort, mobility and normalcy in patients’ environments. Furniture designs now prioritize not just clinical functionality but aesthetics as well, creating more holistic healing environments.

Sustainable and Eco-Friendly Practices

Sustainability has become an emerging trend in healthcare furniture market. Both healthcare providers and consumers are placing greater value on sustainable furniture options such as eco-friendly materials, energy-efficient manufacturing processes and designs that promote recycling. Manufacturers have responded by including recycled material in their products as well as adopting sustainable practices throughout their supply chains to accommodate this growing trend.

Restraints

High Initial Costs

One of the primary restraints to healthcare furniture market growth is high initial costs associated with specialized healthcare furniture. Quality healthcare furniture designed specifically for clinical settings with features like infection control measures, adjustable functionality options and advanced technology integration can come at a significant premium price, creating financial difficulties for facilities operating with tight budgets or smaller facilities that need quality furniture for clinical settings.

Stiff Regulatory Compliance

The healthcare sector is subject to stringent regulations and standards intended to safeguard patient health and welfare, creating significant challenges in meeting regulations that need to be adhered to when purchasing furniture for healthcare environments. Keeping up with regulations adds complexity to manufacturing and procurement processes resulting in longer lead times and increased costs.

Opportunities

Expansion of Telehealth Services

As more healthcare is delivered remotely via telemedicine, demand for furniture to facilitate remote patient consultations and virtual care has skyrocketed – such as ergonomic chairs designed specifically to support them at home healthcare settings, as well as workstations used by healthcare professionals conducting virtual visits is on the rise. This presents healthcare furniture manufacturers with an opportunity to expand telehealth services in terms of furniture sales opportunities.

Ambulatory Care Centers

The rise of ambulatory care centers, which offer outpatient services in an easier and cost-effective way, offers new opportunities for the healthcare furniture market. Ambulatory care facilities often prioritize patient comfort and experience; thus creating demand for furniture specifically tailored to these settings that ensures flexibility, ease of movement, and an inviting atmosphere – features which align perfectly with ambulatory care facilities’ objectives.

Regional Analysis

North America held the largest market share at 38.02% and holding USD 3.7 Bn market revenue in 2023. This achievement can be attributed to the increasing prevalence of chronic health conditions like obesity, diabetes and cardiac arrest requiring hospitalization – such as obesity, diabetes and cardiac arrests which often necessitate hospital visits annually according to American Heart Association statistics; approximately 89% of Out-Hospital Cardiac Arrests (OHCAs) each year prove fatal requiring emergency hospital intervention as per American Heart Association data.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

This market displays fragmentation and intense global competition due to the presence of notable key players. These entities actively pursue growth via various strategies such as the launch of new products, collaborative initiatives, partnerships, operational expansions, mergers, and acquisitions as well as campaigns designed to raise patient awareness.

Market Key Players

- Stryker

- Invacare Corp.

- ARJO AB

- Steris Plc.

- Medline Industries, Inc.

- Hill-Rom Holdings, Inc.

- Drive DeVilbiss Healthcare

- GF Health Products, Inc.

- NAUSICAA Medical

- Sunrise Medical (US) LLC

- Herman Miller Furniture

- Kovonox

- Getinge AB

Recent Development

- January 2023 – Hill-Rom Holdings, Inc. has officially unveiled their Navigo bariatric bed system. Designed to offer outstanding patient comfort and safety for bariatric patients, its features include wider bed surfaces, increased weight capacities and enhanced bed exit assistance.

- February 2023 – Stryker Corporation unveiled the ProCare XLT patient care bed today, designed to maximize both care and safety for its users. Features of this innovative product include low-height design for fall prevention, integrated patient monitoring capabilities and an ergonomic sleep surface – enhancing both care and safety for users alike.

- April 2023 – Getinge AB unveils its Flow-Care 5 mobile workstation to enhance healthcare worker efficiency and patient care, featuring features such as height adjustable work surface, integrated medical equipment storage space and mobile power source.

- May 2023 – Herman Miller, Inc. announces the introduction of its Embody chair designed specifically to meet the needs of healthcare workers who spend long hours sitting. Featuring ergonomic design elements such as an airy backrest and adjustable support zones, the chair promises support and comfort to healthcare employees who spend long periods sitting.

Report Scope

Report Features Description Market Value (2023) USD 9.8 Billion Forecast Revenue (2033) USD 18.6 Billion CAGR (2024-2033) 6.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product-Beds-(ICU Beds, Fowler Beds, Plain Hospital Beds, Pediatric Beds, Maternity Beds, Others);Patient Lift- (Manual Lifts, Power Lifts, Stand up Lifts, Heavy duty Lifts, Overhead Track Lifts, Others);Tables-(Examination Tables, Obstetric Tables, Surgical Tables, Others);Chairs, Medical Carts, Stretchers, Others, Application, -(Physician’s Furniture, Patient’s Furniture, Staff’s Furniture);By Distribution Channel-(Offline, Online);Material Type-(Metal, Plastic);End-use-(Hospitals & Specialty Clinics, Ambulatory Surgical Centers, Other end-Uses) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Stryker, Invacare Corp., ARJO AB, Steris Plc., Medline Industries, Inc., Hill-Rom Holdings, Inc., Drive DeVilbiss Healthcare, GF Health Products, Inc., NAUSICAA Medical, Sunrise Medical (US) LLC, Herman Miller Furniture, Kovonox, Getinge AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Healthcare Furniture Market?The Healthcare Furniture Market encompasses the production and distribution of furniture specifically designed for healthcare settings, including hospitals, clinics, and other medical facilities.

How big is the Healthcare Furniture Market?The global Healthcare Furniture Market size was estimated at USD 9.8 Billion in 2023 and is expected to reach USD 18.6 Billion in 2033.

What is the Healthcare Furniture Market growth?The global Healthcare Furniture Market is expected to grow at a compound annual growth rate of 6.6%. From 2024 To 2033

Who are the key companies/players in the Healthcare Furniture Market?Some of the key players in the Healthcare Furniture Markets are Stryker, Invacare Corp., ARJO AB, Steris Plc., Medline Industries, Inc., Hill-Rom Holdings, Inc., Drive DeVilbiss Healthcare, GF Health Products, Inc., NAUSICAA Medical, Sunrise Medical (US) LLC, Herman Miller Furniture, Kovonox, Getinge AB.

What Drives the Demand for Healthcare Furniture?The demand for healthcare furniture is primarily driven by factors such as the growing need for healthcare services, technological advancements in furniture design, and a focus on patient-centered care.

What Trends are Shaping the Healthcare Furniture Market?Key trends include a shift toward patient-centered care, the integration of technology in furniture design, a focus on sustainable and eco-friendly practices, and the rise of telehealth services influencing furniture needs.

What Challenges does the Healthcare Furniture Market Face?Challenges include the high initial costs associated with specialized healthcare furniture, stringent regulatory compliance, and the need for navigating a complex landscape of standards and regulations.

Healthcare Furniture MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Healthcare Furniture MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Stryker

- Invacare Corp.

- ARJO AB

- Steris Plc.

- Medline Industries, Inc.

- Hill-Rom Holdings, Inc.

- Drive DeVilbiss Healthcare

- GF Health Products, Inc.

- NAUSICAA Medical

- Sunrise Medical (US) LLC

- Herman Miller Furniture

- Kovonox

- Getinge AB