Global Antibodies Market By Drug Type, Monoclonal antibodies, Polyclonal antibodies, Antibody-drug complexes (ADCs), By Disease Indication, CNS Disorders, Cardiovascular Diseases, Cancer , Autoimmune Disorders , By End User (Hospitals , Long-term Care Facilities, Research institutes) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: July 2024

- Report ID: 19180

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

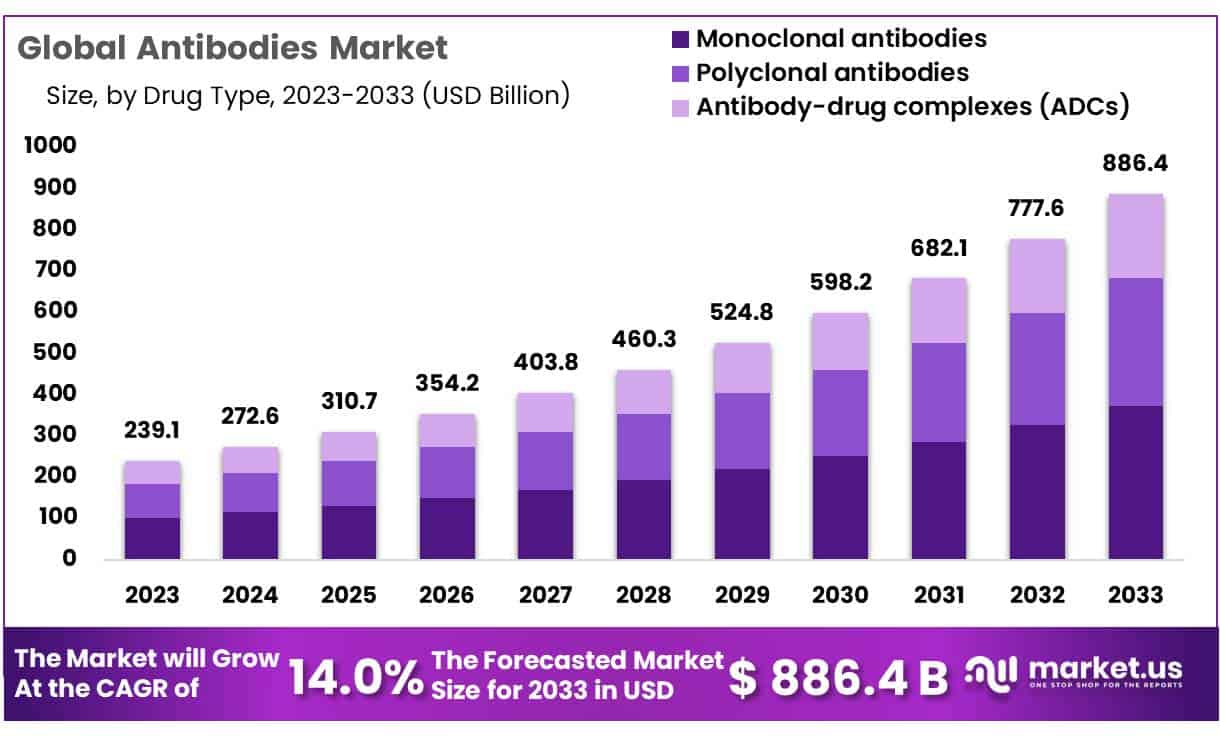

The Global Antibodies Market size is expected to be worth around USD 886.4 Billion by 2033 from USD 239.1 Billion in 2023, growing at a CAGR of 14.0% during the forecast period from 2024 to 2033.

Antibodies also referred to as immunoglobulins, are secreted through B cells to neutralize antigens such as bacteria and viruses. Generally, all antibodies are of the same Y-shaped molecular structure of four polypeptides, with two heavy chains and two light chains. Each Y tip consists of a paratope (a structure analogous to a lock) that is specific for one particular epitope (similarly analogous to a key) on an antigen allowing these structures to bind together with precision.

The ability of binding to an antigen has led to their abundant use in a variety of life sciences and medical science. These antibodies are classified into two types monoclonal and polyclonal, according to how they are created from lymphocytes. Each of them has an important role in the immune system, treatments and diagnostics exam.

Both monoclonal and polyclonal antibodies have different advantages and disadvantages. Production time required for polyclonal antibodies is short; also they are low in cost. They are highly stable and tolerant of pH changes. Polyclonal antibodies have a high affinity. Also, they are less sensitive to antigen changes as compared to monoclonal antibodies. Monoclonal antibodies have highly specific recognition of only one epitope of an antigen. They have high consistency among experiments. Monoclonal antibodies are excellent for affinity purification.

The COVID-19 pandemic had an unprecedented surge in antibody sales. Biomed Central, an open access publisher, released data in January 2022 showing the rapid progress in developing and approving vaccines and neutralizing antibodies (nAbs) against COVID-19 thanks to global scientific collaboration. As soon as July 22, 2020, the U.S. government placed an initial pre-order of 100 million doses from Pfizer’s BNT162b2 mRNA vaccine at $1.95 billion with orders growing quickly year by year – evidence of significant demand and swift response during an outbreak.

Antibodies hold diverse applications since these are widely used in autoimmune disorders, oncology, CNS disorders, neurobiology, cardiovascular disease, and other research areas, resulting in the stable growth of the market worldwide. An increase in research funding and increasing investments by pharmaceuticals and biotechnology companies are further supporting the growth of the market. Rapid growth in developing countries and increasing demand for personalized therapeutics are expected to offer significant growth opportunities for market players over the forecast period.

Key Takeaways

- Market Size: Antibodies Market size is expected to be worth around USD 886.4 Billion by 2033 from USD 239.1 Billion in 2023.

- Market Growth: The market growing at a CAGR of 14.0% during the forecast period from 2024 to 2033.

- Drug Type Analysis: Monoclonal antibodies reign supreme with 42% market share.

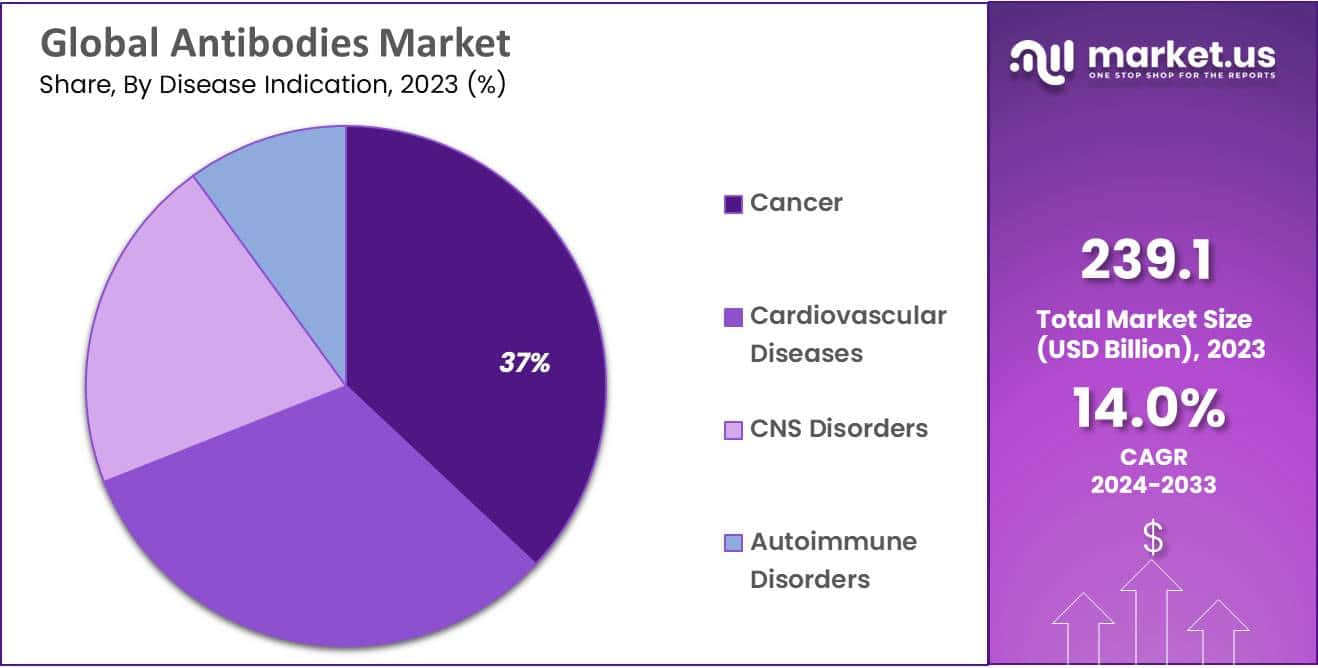

- Disease Indication Analysis: Antibody therapeutics market share for cancer stands at approximately 37% in 2023.

- End-Use Analysis: Hospitals hold an essential place in antibody therapeutics, accounting for 58% of the market share.

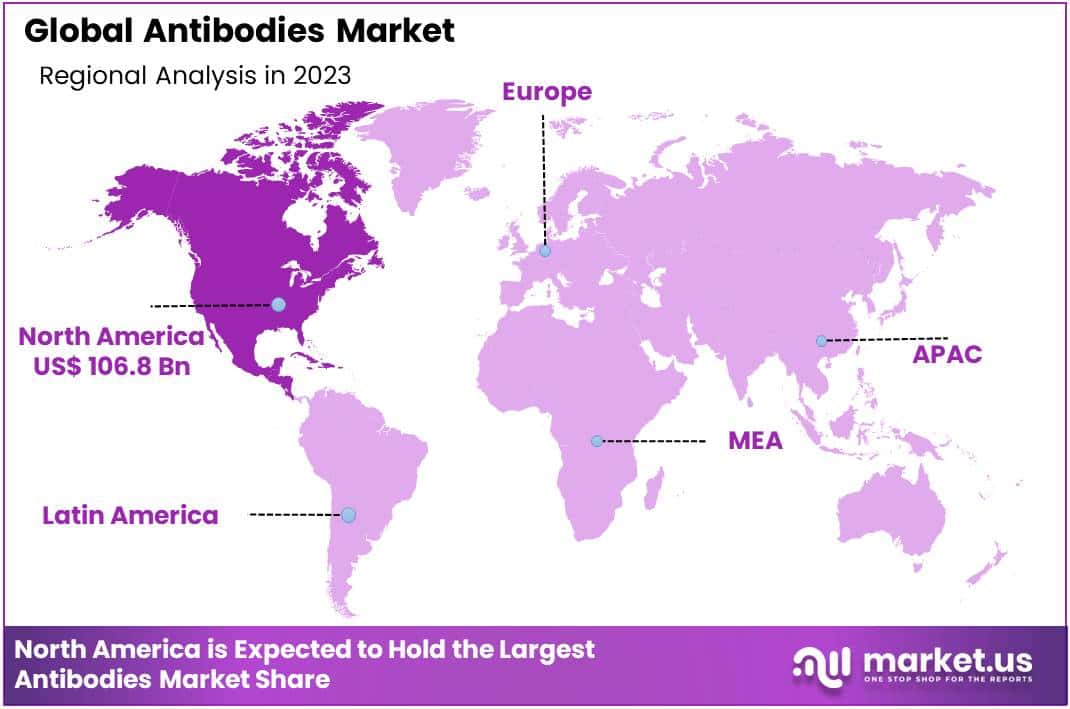

- Regional Analysis: In 2023, North America held a dominant market position, accounting for 44.7% of market shares.

- Innovations: The development of next-generation antibodies, such as bispecific antibodies and antibody-drug conjugates (ADCs), is revolutionizing the market. These innovations offer enhanced efficacy and reduced side effects, broadening therapeutic applications.

- Challenges: High costs associated with antibody production and stringent regulatory requirements are significant challenges. Additionally, the complex manufacturing processes and the need for cold chain logistics can hinder market growth.

- Future Outlook: The antibodies market is poised for continued expansion, driven by technological advancements, increasing approvals of new antibody-based therapies, and expanding applications in personalized medicine.

Drug Type Analysis

antibodies are among the most potent weapons in immunotherapy’s arsenal to fight disease. Of all antibody types available today, monoclonal antibodies reign supreme with 42% market share. Engineered to bind specifically designed targets, monoclonal antibodies exhibit great precision making them invaluable tools in diagnostics, therapeutics and research applications – specifically targeted towards diseased cells without harming healthy ones – making personalized medicine possible through personalized medicine applications.

Polyclonal antibodies provide versatility in recognizing multiple epitopes, making them useful in various assays and research settings. Though their market share may be smaller compared to that of monoclonal antibodies, polyclonal antibodies still play an integral role in identifying various biomolecules as well as uncovering complex biological pathways.

Antibody-drug complexs (ADCs) represent the combination of antibody technology and chemotherapy, offering targeted delivery of potency anticancer agents directly into cancer cells. This innovative approach minimizes off-target effects while improving therapeutic efficacy; garnering increasing investment into ADC development.

Disease Indication Analysis

Antibody therapeutics market share for cancer stands at approximately 37%. Antibodies have revolutionized cancer therapy with targeted therapies that disrupt tumor growth while strengthening immunity responses against malignant cells. Monoclonal antibodies in particular have emerged as essential tools in fighting this condition – numerous approved drugs targeting various molecular pathways associated with tumorigenesis can be found here.

However, antibody therapeutics go well beyond cancer to address multiple disease indications. Central Nervous System disorders offer significant opportunities for antibody intervention; antibodies have shown promise in targeting pathogenic proteins associated with neurodegenerative conditions like Alzheimer’s and Parkinson’s.

Antibodies have recently emerged as potential treatments for cardiovascular conditions. By modulating factors related to atherosclerosis, thrombosis, and myocardial infarction – including atherosclerotic plaque formation and myocardial infarction – antibodies offer new avenues for managing these prevalent ailments. Autoimmune disorders also offer great promise for antibody-based interventions, with therapies targeting the restoration of immune balance and mitigating aberrant immune reactions underlying conditions like rheumatoid arthritis, lupus, and multiple sclerosis.

End User Analysis

Hospitals hold an essential place in antibody therapeutics, accounting for 58% of market share. Hospitals serve as key hubs of patient care where antibodies-based treatments are administered across many medical specialties – from oncology wards to intensive care units – offering patients cutting-edge therapeutic options and precision and efficacy treatment plans.

Long-term care facilities represent a growing end-user segment in the antibodies market. As populations age and chronic diseases increase, these facilities increasingly incorporate antibody therapy therapies into their patient treatment programs in an attempt to increase patient outcomes while simultaneously improving quality of life.

Research institutes represent another key end-user group for antibody science innovation and discovery. These institutions play a critical role in understanding antibody mechanisms of action, designing new therapeutic approaches, conducting clinical trials to test safety and efficacy measures as well as conducting studies that examine safety.

Key Market Segments

Drug Type

- Monoclonal antibodies

- Polyclonal antibodies

- Antibody-drug complexes (ADCs)

Disease Indication

- CNS Disorders

- Cardiovascular Diseases

- Cancer

- Autoimmune Disorders

End User

- Hospitals

- Long-term Care Facilities

- Research institutes

Driver

Growth The growth of the antibodies market is propelled by both chronic diseases and advancement in therapeutic antibodies, both factors which increase with each passing year. First and foremost, the global epidemic of chronic conditions such as cancer, autoimmune diseases, and infectious diseases has necessitated more effective and targeted treatment options to be created for them. World Health Organization estimates chronic diseases will account for 73% of deaths worldwide by 2020; thus creating an urgent need for innovative therapies that can effectively treat such ailments.

Antibodies, specifically monoclonal antibodies (mAbs), have emerged as key treatments due to their unique ability to specifically target diseased cells while sparing healthy ones from being compromised; as such they significantly decrease side effects while improving patient outcomes.

Technological advances in antibody engineering and manufacturing have allowed for the creation of highly specific and potency antibodies. Next-generation sequencing and recombinant DNA technology have enabled the production of monoclonal and bispecific antibodies with improved efficacy and safety profiles.

As an example, in 2020 the global monoclonal antibodies market was estimated at USD 115.2 billion and is projected to experience compound annual compounded annual growth at 12%-15% through 2025. This growth can be attributed to advancements in antibody development technologies that have broadened applications beyond oncology to include asthma, arthritis, and psoriasis – thus expanding market scope.

Trend

One of the more noticeable developments in the antibodies market is their growing usage in personalized medicine. Customizing healthcare solutions based on patients’ personal characteristics and needs becomes ever more crucial in healthcare delivery systems. Antibodies have emerged as leaders of this revolution due to their unparalleled capability of binding to antigens found on cancer cells or pathogens’ surfaces.

Specificity allows for highly personalized treatments to be developed, improving efficacy and minimizing adverse side effects. Recently, FDA approvals of monoclonal antibodies targeting specific biomarkers has increased dramatically – signifying an industry trend toward personalized healthcare solutions.

One key trend in antibody research and development (R&D) is an increasing investment. R&D expenditure on novel antibody treatments worldwide has steadily increased since 2005; pharmaceutical and biotech companies dedicated significant resources towards exploring and creating antibody treatments for previously untreatable conditions as part of R&D spending across biopharmaceutical sector reached all-time high around USD 200 billion, of which an increasing portion went toward antibody research projects. Such investments may offer solutions previously untreatable conditions while providing significant returns for investors that successful drugs provide.

Restraint

One of the key hurdles facing antibody therapeutics markets is their high cost. Development, production and marketing require significant financial investments due to complex manufacturing processes as well as extensive clinical trials required to verify safety and efficacy; as a result this means high prices for end products which make them less accessible across broader patient populations – some monoclonal antibody therapies costing over USD 100,000 can place undue burden on healthcare systems as well as hinder accessing lifesaving therapies for many individuals.

Regulatory challenges also present significant obstacles for antibody markets. The approval process of antibody therapies is lengthy and stringent, necessitating extensive data regarding safety, efficacy, quality and complexity – with different regions having differing regulatory requirements that complicate global distribution and commercialization efforts of these therapeutics.

Opportunity

Biosimilars offer significant opportunities in the antibodies market. Biosimilars are highly similar products approved as biologic medicines that offer cost-efficient alternatives. As more blockbuster monoclonal antibodies go off patent in coming years, the biosimilar market is expected to expand significantly. This growth is propelled further by global efforts for more cost-effective healthcare and regulatory authorities’ acceptance of biosimilars as viable treatments.

By 2025, global sales of biosimilars are projected to hit USD 35 billion with compound annual compounded annual growth estimated at 24% from 2020-2025 – offering companies ample opportunity to invest in the development and commercialization of these antibodies.

Another opportunity lies with antibody-drug conjugates (ADCs). ADCs are targeted cancer therapies that combine specificity of antibodies with potency of cytotoxic drugs for effective cancer cell targeting while sparing healthy tissues from chemotherapy treatments. Their success in clinical trials and their approval to treat multiple cancer types have demonstrated their revolutionary nature – with ADC sales estimated at USD 350 Million globally by 2013.

Regional Analysis

In 2023, North America held a dominant market position, accounting for 44.7% of market shares. This dominance can be attributed to the extensive presence of leading biopharmaceutical and biotechnology firms within the region; an expectation which should continue throughout the forecast period. North American market growth is being propelled by an intensified focus on biomedical, stem cell, and cancer research.

Furthermore, chronic diseases such as cardiovascular and blood disorders should contribute to further market expansion in the coming years. Recent estimates by the American Cancer Society reveal that 1,735,350 people have been diagnosed with chronic diseases. With biotechnology and biopharmaceutical companies increasingly adopting advanced research antibodies and products specifically targeted towards stem cell examination, market expansion is likely to accelerate rapidly.

Asia Pacific region is predicted to become one of the fastest-growing research antibodies and reagents markets, having secured one of the largest market shares for research antibodies and reagents during 2019. This region saw a substantial spike in compound annual growth rate (CAGR) during 2019, thanks to improvements in healthcare infrastructure, reduced regulatory barriers, and an uptick in pharmaceutical investments which will continue to drive its market expansion going forward.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Player Analysis

This analysis highlights key activities within the antibodies market and classifies them according to organic and inorganic growth strategies. Companies are adopting increasingly organic strategies, including the launch of new products, product approval processes and engaging in activities like patenting and organizing events. Concurrently, the market has witnessed inorganic strategies of growth such as acquisitions and partnerships/collaborations agreements.

These moves have contributed to business expansion as well as customer base expansion for market participants. With increasing antibody demand worldwide, players should anticipate facing plenty of opportunities for future growth in future years.

Furthermore, this report features detailed profiles of key players in the antibodies market, providing in-depth SWOT analyses and marketing strategies of key companies within this space. Furthermore, it offers insight into leading industry firms by detailing their services, product offerings, financial performance over three years and recent achievements over five years – providing stakeholders with valuable data about competitive landscape and market dynamics.

Market Key Players

- Novartis AG

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson Services Inc.

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Biogen Inc.

- Bristol-Myers Squibb Company

- AbbVie Inc.

- Sanofi

- Eli Lilly and Co.

- Iovance Biotherapeutics Inc.

- Ultragenyx Pharmaceutical Inc.

- and Kyowa Kirin Co.Ltd.

Recent Developments

- Novartis AG (February 2024): Novartis announced the acquisition of MorphoSys AG for EUR 2.7 billion. This acquisition includes pelabresib, a BET inhibitor for myelofibrosis, and tulmimetostat, an investigational dual inhibitor for solid tumors and lymphomas. This move aims to strengthen Novartis’ oncology pipeline and expand its global footprint in hematology (Novartis).

- F. Hoffmann-La Roche Ltd. (April 2024): Roche launched a new monoclonal antibody therapy, targeted at treating a specific type of breast cancer. The new therapy, approved by the FDA, offers improved efficacy and a favorable safety profile, promising better outcomes for patients.

- Johnson & Johnson Services Inc. (May 2024): Johnson & Johnson received FDA approval for a new monoclonal antibody treatment for rheumatoid arthritis. This therapy, designed to target specific inflammatory pathways, aims to provide relief for patients with moderate to severe rheumatoid arthritis.

- Takeda Pharmaceutical Company Limited (January 2024): Takeda acquired a biotechnology firm specializing in antibody-drug conjugates (ADCs). This acquisition is expected to enhance Takeda’s pipeline of targeted cancer therapies and strengthen its position in the oncology market.

- Amgen Inc.(June 2024): Amgen launched a next-generation bispecific antibody for the treatment of multiple myeloma. This innovative therapy targets two different antigens, offering a novel approach to managing this challenging cancer and improving patient outcomes.

- Biogen Inc. (February 2024): Biogen entered into a strategic partnership with a leading biotech company to co-develop a new monoclonal antibody aimed at treating neurodegenerative diseases. This collaboration seeks to leverage both companies’ expertise to accelerate the development of innovative therapies for conditions such as Alzheimer’s disease.

Report Scope

Report Features Description Market Value (2023) USD 239.1 Billion Forecast Revenue (2033) USD 886.4 Billion CAGR (2024-2033) 14.0% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drug Type, Monoclonal antibodies, Polyclonal antibodies, Antibody-drug complexes (ADCs), By Disease Indication, CNS Disorders, Cardiovascular Diseases, Cancer , Autoimmune Disorders , By End User (Hospitals , Long-term Care Facilities, Research institutes) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Novartis AG, F. Hoffmann-La Roche Ltd., Johnson & Johnson Services, Inc., Takeda Pharmaceutical Company Limited, Amgen Inc., Biogen Inc., Bristol-Myers Squibb Company, AbbVie Inc., Sanofi, Eli Lilly and Co., Iovance Biotherapeutics, Inc., Ultragenyx Pharmaceutical Inc., and Kyowa Kirin Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are antibodies?Antibodies are proteins produced by the immune system to identify and neutralize foreign objects like bacteria and viruses. They are crucial in diagnostics and therapeutics for various diseases.

How big is the Antibodies Market?The global Antibodies Market size was estimated at USD 239.1 Billion in 2023 and is expected to reach USD 886.4 Billion in 2033.

What is the Antibodies Market growth?The global Antibodies Market is expected to grow at a compound annual growth rate of 14.0%. From 2024 To 2033

Who are the key companies/players in the Antibodies Market?Some of the key players in the Antibodies Markets are Novartis AG, F. Hoffmann-La Roche Ltd., Johnson & Johnson Services, Inc., Takeda Pharmaceutical Company Limited, Amgen Inc., Biogen Inc., Bristol-Myers Squibb Company, AbbVie Inc., Sanofi, Eli Lilly and Co., Iovance Biotherapeutics, Inc., Ultragenyx Pharmaceutical Inc., and Kyowa Kirin Co., Ltd.

What are monoclonal antibodies?Monoclonal antibodies (mAbs) are antibodies made by identical immune cells that are all clones of a unique parent cell. They can be designed to target specific cells or proteins and are used in the treatment of cancer, autoimmune diseases, and infectious diseases.

How has COVID-19 impacted the antibodies market?COVID-19 positively impacted the antibodies market by increasing the demand for therapeutic and diagnostic antibodies, including the rapid development and approval of monoclonal antibodies for treatment and vaccines.

What are the main challenges facing the antibodies market?Key challenges include the high cost of antibody production and treatment, regulatory hurdles, and the complexity of developing effective antibody therapies.

What are the major trends in the antibodies market?Significant trends include the rise of personalized medicine, increasing investment in R&D for novel antibody therapies, and the growing market for biosimilars and antibody-drug conjugates (ADCs).

-

-

- Novartis AG

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson Services Inc.

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Biogen Inc.

- Bristol-Myers Squibb Company

- AbbVie Inc.

- Sanofi

- Eli Lilly and Co.

- Iovance Biotherapeutics Inc.

- Ultragenyx Pharmaceutical Inc.

- and Kyowa Kirin Co.Ltd.