Global Uninterruptible Power Supply (UPS) Market By Type (Online or Double Conversion, Line-Interactive, Offline or Standby), By Power Rating (Less than 5 kVA, 5–50 kVA, 51–200 kVA, Above 200 kVA), By Component, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134375

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- UPS Industry Latest Investments

- UPS Industry Partnerships & Acquisition

- Type Analysis

- Power Rating Analysis

- Component Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunity

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

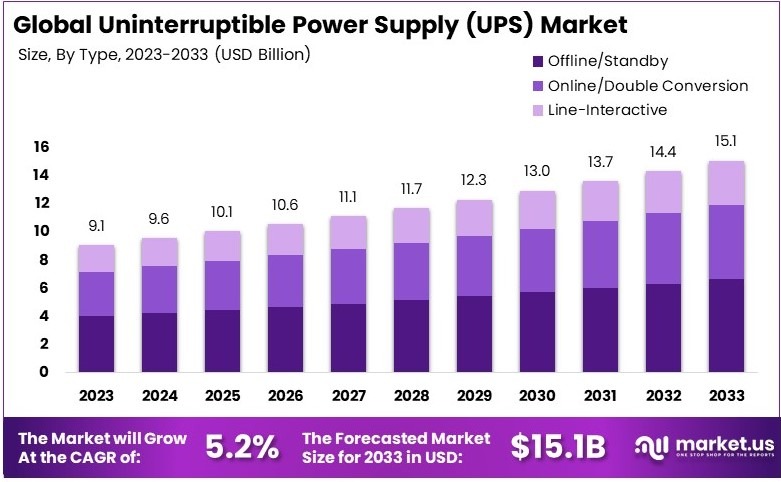

The Global Uninterruptible Power Supply (UPS) Market size is expected to be worth around USD 15.1 Billion by 2033, from USD 9.1 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

An Uninterruptible Power Supply (UPS) is a device that provides backup power during electrical outages or voltage fluctuations. It ensures continuous power supply to connected equipment, preventing data loss or hardware damage. UPS systems are commonly used in data centers, hospitals, and industries for critical power protection.

The Uninterruptible Power Supply (UPS) Market refers to the global industry focused on the production, sale, and distribution of UPS devices. This market includes various types of UPS systems, catering to industries like IT, healthcare, manufacturing, and residential sectors to ensure reliable power backup and protection.

The surge in AI applications and cloud computing has increased data center demand. A record 3,871.8 MW of construction was underway in North America in early 2024, a 69% year-over-year rise. This expansion fuels the UPS market, ensuring power stability for critical data operations and services.

Growing digital services have escalated the need for UPS solutions. Despite a 2.4% decline in PC shipments in 2024, data center development has surged. Intense market competition drives innovation, offering advanced UPS systems for various applications, ensuring customer satisfaction, and maintaining market growth.

On a global scale, the push for renewable energy has spurred demand for large-scale battery storage. Locally, power disruptions, like the 2024 New South Wales thunderstorm, highlight the need for reliable backup systems. UPS devices address these challenges, ensuring power continuity for remote and urban areas.

Governments worldwide are investing in critical infrastructure. For instance, $2.17 trillion was allocated to U.S. construction spending in October 2024, with data centers receiving significant funding. Policies supporting renewable energy and infrastructure projects indirectly boost UPS market growth, ensuring stable power solutions in emerging and developed regions.

Key Takeaways

- The Uninterruptible Power Supply (UPS) Market was valued at USD 9.1 billion in 2023 and is expected to reach USD 15.1 billion by 2033, with a CAGR of 5.2%.

- In 2023, 5–50 kVA led the market by power rating due to its wide adoption across commercial and industrial sectors.

- In 2023, the Offline/Standby segment dominated the product type category, offering cost-effective power backup for small-scale applications.

- In 2023, Batteries accounted for the largest share in the component segment, driven by their critical role in power storage and reliability.

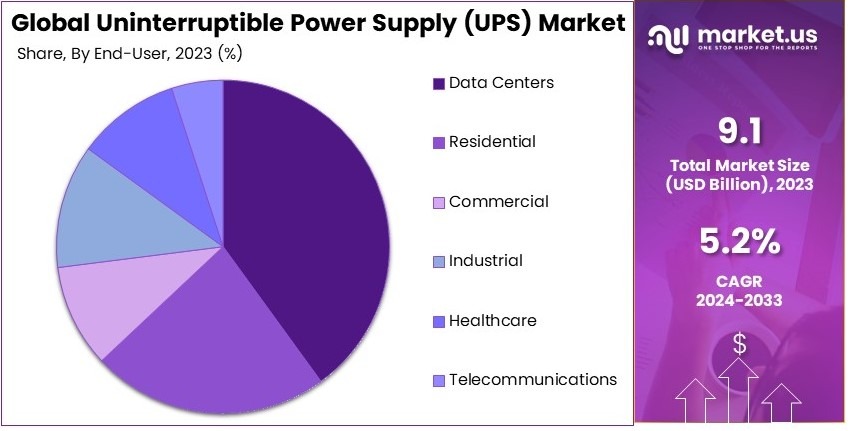

- In 2023, Data Centers dominated the end-user segment as they rely heavily on uninterrupted power to ensure seamless operations.

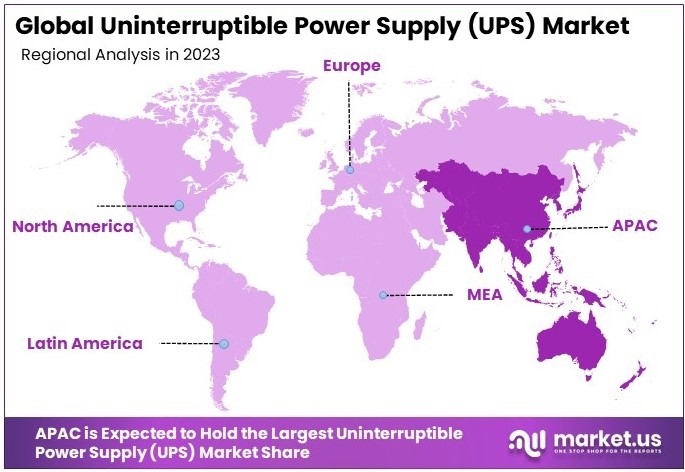

- In 2023, APAC was the leading region, supported by robust data center growth and significant government infrastructure investments.

UPS Industry Latest Investments

- CBAK Energy Technology and Shenzhen BAK Power Battery: In September 2023, CBAK Energy Technology, Inc. announced a strategic investment in Shenzhen BAK Power Battery Co., Ltd., acquiring a 5% stake for approximately $35.57 million. This partnership aims to synergize BAK Power’s development of model 46800 batteries with CBAK Energy’s models 46115 and 46157, enhancing product supply and establishing non-compete agreements for certain key customers.

- Eaton: In May 2024, Eaton inaugurated a state-of-the-art manufacturing campus in Helsinki, Finland, to expand its production of Uninterruptible Power Supply (UPS) systems, including the new Eaton 9395X. The 9395X model occupies up to 30% less space than comparable UPS models and incorporates silicon carbide converters for enhanced energy efficiency.

- Best Power Equipments (BPE): In February 2024, Best Power Equipments (BPE) unveiled its strategic plan for 2024, which includes significant investments and the launch of new products, particularly focusing on a new facility near Bhubaneswar, Odisha, sanctioned by the state government. This initiative underscores BPE’s commitment to innovation, sustainability, and global expansion, aligning with its ambitious targets set for 2025.

UPS Industry Partnerships & Acquisition

- Delta Electronics India and Savex Technologies: In September 2024, Delta Electronics India signed a Memorandum of Understanding with Savex Technologies, a prominent ICT distributor in India. This partnership aims to leverage Savex’s extensive distribution network to enhance Delta’s market presence, focusing on system integrators for data center solutions, small and medium-sized businesses, and government projects.

- Ballard Power Systems and Vertiv: In June 2024, Ballard Power Systems and Vertiv entered into a strategic technology partnership to develop hydrogen-powered fuel cell solutions for backup power in data centers and critical infrastructures. The collaboration successfully demonstrated a proof of concept at Vertiv’s Ohio facility, integrating Ballard’s fuel cell power modules with Vertiv’s Liebert EXL S1 uninterruptible power system.

- E2E Networks and Larsen & Toubro (L&T): In November 2024, E2E Networks, an Indian Cloud and AI Cloud provider, announced a strategic partnership with Larsen & Toubro (L&T), India’s leading tech conglomerate. This alliance focuses on accelerating the adoption of Generative AI solutions in India by integrating E2E Networks’ cloud platforms with L&T’s expertise in data center management and cloud solutions.

- Schneider Electric, AVEVA, and IN-CORE Systèmes: In July 2024, Schneider Electric and AVEVA partnered with IN-CORE Systèmes to enhance efficiency in electric vehicle (EV) battery production. The collaboration aims to connect data from electrode manufacturing to final cell performance, providing comprehensive insights to improve processes.

Type Analysis

Online/Double Conversion UPS dominates the Type segment, providing comprehensive power protection.

The UPS market is segmented by type into three primary categories: Online/Double Conversion, Line-Interactive, and Offline/Standby. The Online/Double Conversion UPS stands out as the dominant sub-segment. This type of UPS provides continuous power protection by converting incoming AC power to DC to charge the batteries, then back to AC for running connected loads.

It is particularly valuable in environments where electrical isolation is necessary or where power fluctuations occur frequently. This system offers the most comprehensive protection against all forms of power problems, such as surges, brownouts, and blackouts, making it ideal for critical systems in data centers and medical facilities.

The Line-Interactive UPS, another key sub-segment, offers enhanced power filtering and is suitable for areas with frequent voltage fluctuations. It employs a multi-tap variable-voltage autotransformer to regulate voltage over a wide range without switching to battery, making it efficient and moderately priced.

The Offline/Standby UPS, the simplest and least expensive type, provides basic power protection and is best suited for less critical systems or consumer electronics where slight power inconsistencies are acceptable. Each of these sub-segments plays a crucial role in the broader market, catering to different levels of power protection needs and budget considerations.

Power Rating Analysis

5–50 kVA UPS segment leads due to its versatility in commercial and medium-sized data center applications.

In the Power Rating segment of the UPS market, capacities are categorized as Less than 5 kVA, 5–50 kVA, 51–200 kVA, and Above 200 kVA. The 5–50 kVA range is particularly dominant, offering a balance of capacity and affordability that is ideal for commercial buildings and medium-sized data centers.

This range is designed to handle higher power loads than the less than 5 kVA units, making it suitable for protecting clusters of servers or telecommunications equipment, which require robust power backup solutions to prevent data loss and maintain operations during power failures.

The Less than 5 kVA UPS are primarily used in residential settings or small offices, providing backup power for individual PCs, network equipment, or other critical electronics. The 51–200 kVA models are tailored for larger facilities, including industrial operations and larger data centers, where substantial power is needed to support extensive machinery and equipment.

The Above 200 kVA units are employed in very large applications such as full-scale data centers and manufacturing plants, offering the highest capacity to ensure uninterrupted power for all connected devices.

Component Analysis

Batteries are a critical component in UPS systems, storing energy for use during power interruptions.

Batteries are the backbone of any UPS system, holding the stored electrical energy that is critical during power interruptions. As a key component, they determine the runtime and reliability of the UPS, making them essential for any installation that requires a guarantee of uninterrupted power.

Innovations in battery technology, such as lithium-ion solutions, have enhanced the efficiency, lifecycle, and footprint of UPS systems, driving their increased adoption in various applications.

Other crucial components include the Rectifier, which converts AC to DC power to charge the UPS batteries and run loads on battery power. The Inverter plays the opposite role, converting stored DC power back to AC when mains power is unavailable.

The Static Bypass Switch allows the UPS to bypass the battery in cases of overload or fault conditions, ensuring continued power supply. Each component is vital for the UPS’s functionality and efficiency, contributing to the overall reliability and effectiveness of power backup solutions.

End-User Analysis

Data Centers are the predominant end-users of UPS systems, relying heavily on uninterrupted power for operational continuity.

Data Centers are the most significant end-users in the UPS market, requiring high-capacity, reliable UPS systems to maintain uninterrupted service and protect against data loss. The critical nature of data centers in hosting essential IT operations for businesses across all industries makes them particularly sensitive to power disruptions, which can cause operational failures and significant financial losses.

Other key end-user segments include Residential, where smaller UPS systems protect against data loss from personal computers and home networks. The Commercial sector uses UPS systems to maintain business operations, particularly in retail and banking, where transaction continuity is crucial.

Industrial facilities employ UPS systems to prevent machinery downtime and production losses, while Healthcare facilities rely on them to ensure the functionality of life-saving equipment. Telecommunications companies use UPS systems to maintain network operations and ensure communication continuity.

Key Market Segments

By Type

- Online/Double Conversion

- Line-Interactive

- Offline/Standby

By Power Rating

- Less than 5 kVA

- 5–50 kVA

- 51–200 kVA

- Above 200 kVA

By Component

- Rectifier

- Inverter

- Static Bypass Switch

- Batteries

- Others

By End-User

- Residential

- Commercial

- Industrial

- Data Centers

- Healthcare

- Telecommunications

Drivers

Power Reliability Drives Market Growth

The increasing demand for power reliability in industrial applications has made UPS systems critical for ensuring uninterrupted operations in sectors such as manufacturing, healthcare, and telecommunications. Industries rely on continuous power to maintain productivity and prevent losses caused by sudden outages, which has fueled the adoption of reliable UPS solutions.

This demand is further amplified by the expanding data center industry, driven by the growing reliance on cloud computing, e-commerce, and digital services, necessitating high-capacity UPS installations to handle critical workloads. As data centers become the backbone of digital economies, they require advanced UPS systems to ensure operational continuity and manage critical IT infrastructure effectively.

The adoption of renewable energy sources such as solar and wind has created opportunities for integrating UPS systems as efficient energy storage solutions, addressing the intermittent nature of green power generation. This transition to cleaner energy requires reliable backup systems to stabilize power supply during fluctuations, further driving demand for UPS technologies.

Additionally, rapid urbanization, particularly in emerging economies, has increased electricity consumption, prompting the need for reliable backup systems to maintain energy continuity during grid failures or outages. Urban expansion places significant pressure on existing power grids, making UPS solutions essential for businesses and households alike to safeguard against power disruptions.

Restraints

High Initial Investment and Costs Restraints Market Growth

The high initial investment required for deploying UPS systems continues to be a significant challenge, especially for small and medium-sized enterprises with limited budgets. Many businesses struggle to justify the upfront costs, even though the long-term benefits of reliable power outweigh the initial expenditure.

Maintenance costs, including battery replacements and periodic upgrades, add to the operational expenses, deterring potential users from adopting the technology. For some organizations, these recurring costs create financial strain, limiting the widespread adoption of UPS solutions despite their benefits.

In emerging markets, a lack of awareness about the importance and functionality of UPS systems, coupled with inadequate infrastructure, restricts widespread adoption. Many organizations and households in these regions remain unaware of how UPS systems can safeguard against power outages, leading to untapped potential in these markets.

Moreover, rapid advancements in UPS technology lead to frequent obsolescence of older systems, making it difficult for organizations to justify ongoing upgrades, especially in cost-sensitive sectors. Businesses often face the dilemma of choosing between outdated but functional systems and investing in new, state-of-the-art solutions, slowing the market’s growth.

Opportunity

Renewable Integration Provides Opportunities

The integration of UPS systems with renewable energy sources allows for consistent power supply by mitigating the intermittent nature of solar and wind energy generation, opening significant market opportunities. This capability ensures that renewable energy systems can operate efficiently, even during low production periods, making them more viable for widespread adoption.

This compatibility is particularly beneficial for microgrids in remote or disaster-prone regions, where reliable and localized energy storage solutions are essential. In such areas, UPS systems act as a crucial component, ensuring power availability for critical infrastructure and services.

Smart grid initiatives worldwide emphasize enhanced energy storage and load management systems, directly benefiting the adoption of advanced UPS technologies. By enabling real-time energy monitoring and balancing, smart grids rely heavily on UPS systems to maintain grid stability and efficiency.

Additionally, government incentives and subsidies aimed at promoting energy resilience encourage businesses and households to invest in modern UPS systems, bolstering market growth potential. Supportive policies lower financial barriers for adopting UPS technologies, making them accessible to a broader audience and fostering innovation.

Challenges

Rising Cybersecurity Needs Challenges Market Growth

Modern UPS systems with IoT capabilities face growing cybersecurity risks, requiring manufacturers to implement robust security protocols, which increases costs and complexity. As systems become more connected, vulnerabilities to cyberattacks rise, potentially disrupting the very reliability these systems aim to provide.

Regulatory compliance adds another layer of challenge, as varying standards across regions demand significant resources to ensure adherence. Manufacturers must navigate a complex web of local, national, and international regulations, which can delay product launches and increase operational costs.

The scarcity of skilled professionals to manage advanced UPS technologies hampers proper implementation and maintenance, especially in developing regions. A limited talent pool creates operational inefficiencies, reducing the ability of organizations to leverage the full potential of modern UPS systems.

Moreover, global supply chain disruptions, including shortages of key components, delay manufacturing timelines and increase production costs, creating additional challenges for UPS providers. This issue is particularly acute in regions heavily reliant on imported components, where disruptions have a ripple effect on market availability.

Growth Factors

Data Center Growth Is Growth Factors

The rapid expansion of data centers, fueled by increasing digitalization and the proliferation of cloud services, has significantly boosted the demand for high-performance UPS systems to ensure uninterrupted operations. Data centers are mission-critical facilities that require seamless power management, making UPS systems an integral part of their infrastructure.

E-commerce growth, reliant on robust IT infrastructure, further increases the need for reliable backup power solutions, driving UPS market growth. The surge in online shopping and digital payment platforms places additional pressure on IT systems, necessitating uninterrupted power to maintain customer trust and operational efficiency.

In healthcare, where power reliability is critical for life-saving equipment, UPS systems have become indispensable, reinforcing their role in market expansion. Hospitals and diagnostic centers require continuous power to ensure the safety of patients and the accuracy of medical equipment, further driving demand.

The development of smart cities, which rely on interconnected systems and consistent energy supply, has created a strong demand for advanced UPS technologies to support their infrastructure. These cities depend on reliable power solutions to maintain the seamless operation of traffic systems, public services, and communication networks.

Emerging Trends

Automation and AI Are Latest Trending Factors

The integration of automation and AI in UPS systems enhances reliability by offering predictive maintenance and real-time performance monitoring, minimizing downtime and operational risks. These advanced features allow organizations to identify potential issues before they occur, reducing maintenance costs and improving system longevity.

Energy-efficient UPS solutions that align with sustainability goals are gaining popularity among businesses looking to reduce their carbon footprint and operational costs. These solutions address the growing demand for environmentally responsible technologies, making them attractive to modern organizations.

Modular UPS designs provide flexibility and scalability, allowing organizations to customize their power systems based on specific needs, which is particularly valuable in rapidly changing industries. This adaptability ensures that UPS systems can grow alongside organizational needs, reducing the risk of over-investment.

Hybrid UPS systems, combining traditional battery technologies with modern solutions, are becoming a preferred choice due to their enhanced performance and adaptability to diverse energy requirements. These systems offer the benefits of both legacy and emerging technologies, making them a compelling option for businesses transitioning to smarter energy management.

Regional Analysis

Asia Pacific Dominates with 35% Market Share

Asia Pacific leads the Uninterruptible Power Supply (UPS) Market with a 35% share, fueled by rapid industrial growth and extensive technological advancements across major economies such as China, Japan, and India. This region benefits from significant investments in infrastructure development and an expanding digital landscape.

The key factors driving the high market share in Asia Pacific include rapid urbanization, an increase in digitalization efforts across commercial sectors, and substantial investments in smart technology integration. Additionally, the rising number of data centers due to the region’s growing cloud services market is significantly boosting the demand for reliable UPS systems.

Asia Pacific is experiencing rapid urbanization, with its urban population projected to increase by 50%, adding 1.2 billion people by 2050. This significant urban growth is accompanied by a substantial rise in energy consumption. In 2023, the region’s primary energy consumption reached approximately 291.8 exajoules, marking a 4.7% increase from the previous year.

Market dynamics in Asia Pacific are influenced by the region’s focus on technological innovation and infrastructure resilience. The escalating need for data protection and energy efficiency in business operations supports the adoption of advanced UPS solutions, ensuring uninterrupted power supply and operational continuity.

Regional Mentions:

- North America: North America maintains a strong presence in the UPS market, driven by the necessity to support extensive digital infrastructures and maintain data integrity across various industries. The region’s advanced technological ecosystem and high standard for operational reliability continue to support its significant market share.

- Europe: Europe’s UPS market is characterized by its stringent regulations on energy efficiency and data security. The region’s commitment to sustainable development and high standards in technology deployment supports steady market growth and drives the adoption of sophisticated UPS systems.

- Middle East & Africa: The Middle East and Africa are gradually increasing their market presence in UPS systems, focusing on improving infrastructure resilience. Investments in sectors such as telecommunications and healthcare are pivotal in driving the UPS market forward in these regions.

- Latin America: Latin America is witnessing a growing adoption of UPS systems, particularly driven by its needs to update and secure IT and manufacturing sectors. Efforts to stabilize power supply in response to frequent power outages are key drivers for the region’s UPS market growth.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Uninterruptible Power Supply (UPS) Market is competitive, with key players driving innovation and meeting diverse customer needs. Leading companies such as Schneider Electric SE, Eaton Corporation PLC, Vertiv Group Corp, and ABB Ltd hold significant market shares due to their strong portfolios, technological advancements, and global reach.

Schneider Electric is a global leader in energy management and automation solutions. Its UPS offerings focus on efficiency, scalability, and sustainability, serving industries like data centers, healthcare, and industrial automation. The company’s commitment to energy-efficient systems strengthens its position in a growing market.

Eaton is a prominent provider of UPS solutions, emphasizing high performance and reliability. Its products cater to both small businesses and large enterprises, with strong penetration in the data center and telecommunications sectors. Eaton’s global network and innovation in battery technologies enhance its competitive edge.

Vertiv specializes in critical infrastructure solutions, including UPS systems. Its products are designed for high availability and tailored to support the growing demands of cloud computing and edge applications. The company benefits from its extensive portfolio and a strong presence in emerging markets.

ABB offers a wide range of UPS systems with advanced power protection features. Its focus on industrial applications and renewable energy integration sets it apart. ABB’s investments in R&D and its expertise in electrification position it as a key player in the transition to sustainable energy solutions.

These companies leverage strong R&D capabilities, global distribution networks, and strategic partnerships to maintain market leadership and address the evolving needs of diverse industries.

Top Key Players in the Market

- Schneider Electric SE

- Eaton Corporation PLC

- Vertiv Group Corp

- ABB Ltd

- Toshiba Corporation

- Delta Electronics, Inc.

- Mitsubishi Electric Corporation

- Legrand

- Huawei Technologies Co., Ltd.

- AEG Power Solutions

- Riello Elettronica SpA

- Cyber Power Systems, Inc.

- Active Power (a division of Piller Power Systems)

- S&C Electric Company

- Socomec Group S.A.

Recent Developments

- Vertiv and Conapto: In March 2024, Vertiv announced the installation of its Liebert EXL S1, a grid-interactive Uninterruptible Power Supply (UPS), at Conapto’s data centers in Sweden. This system provides critical power protection while supporting grid stability by storing and releasing energy as needed, particularly from renewable sources.

- Schneider Electric: In June 2024, Schneider Electric announced the European availability of its APC Back-UPS Pro Gaming UPS, designed specifically for gamers, streamers, and influencers. Celebrating 40 years of reliability in critical power protection, this UPS safeguards gaming equipment from power outages and ensures a stable connection during energy spikes and failures.

- Schneider Electric: In March 2024, Schneider Electric introduced the Back-UPS BE Series – 900 and 1050 VA, expanding its uninterruptible power supply solutions for home use. These units offer increased power capacity and are designed to maintain seamless connectivity for home networks, essential for remote work and smart home devices.

Report Scope

Report Features Description Market Value (2023) USD 9.1 Billion Forecast Revenue (2033) USD 15.1 Billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Online or Double Conversion, Line-Interactive, Offline or Standby), By Power Rating (Less than 5 kVA, 5–50 kVA, 51–200 kVA, Above 200 kVA), By Component (Rectifier, Inverter, Static Bypass Switch, Batteries, Others), By End-User (Residential, Commercial, Industrial, Data Centers, Healthcare, Telecommunications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schneider Electric SE, Eaton Corporation PLC, Vertiv Group Corp, ABB Ltd, Toshiba Corporation, Delta Electronics, Inc., Mitsubishi Electric Corporation, Legrand, Huawei Technologies Co., Ltd., AEG Power Solutions, Riello Elettronica SpA, Cyber Power Systems, Inc., Active Power (a division of Piller Power Systems), S&C Electric Company, Socomec Group S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Uninterruptible Power Supply (UPS) MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Uninterruptible Power Supply (UPS) MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Schneider Electric SE

- Eaton Corporation PLC

- Vertiv Group Corp

- ABB Ltd

- Toshiba Corporation

- Delta Electronics, Inc.

- Mitsubishi Electric Corporation

- Legrand

- Huawei Technologies Co., Ltd.

- AEG Power Solutions

- Riello Elettronica SpA

- Cyber Power Systems, Inc.

- Active Power (a division of Piller Power Systems)

- S&C Electric Company

- Socomec Group S.A.