Global Microwave Oven Market Size, Share, Growth Analysis By Product Type (Convection, Grill, Solo), By Structure (Built-in, Countertop, Over-the-Range), By Cooking Capacity, By Distribution Channel, By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 34093

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Microwave Oven Market Core Findings

- Product Type Analysis

- Structure Analysis

- Cooking Capacity Analysis

- Distribution Channel Analysis

- End-Use Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunity

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis of Microwave Oven Market

- Competitive Landscape of Microwave Oven Market

- Recent Advancements in Microwave Oven Market

- Report Scope

Report Overview

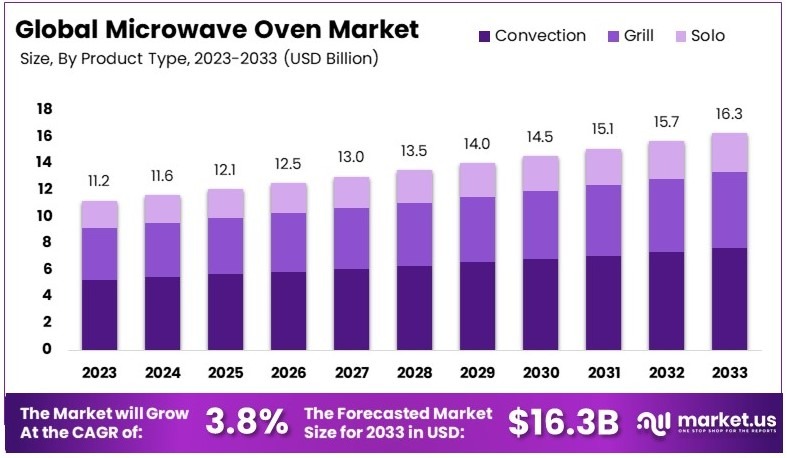

The Global Microwave Oven Market size is expected to be worth around USD 16.3 Billion by 2033, from USD 11.2 Billion in 2023, growing at a CAGR of 3.8% during the forecast period from 2024 to 2033.

A microwave oven is a kitchen appliance that uses electromagnetic radiation to heat and cook food quickly. It is commonly used in households and commercial settings to reheat, defrost, and prepare meals. Microwave ovens are designed for convenience, offering fast cooking times and ease of use, making them a popular choice for modern kitchens.

The microwave oven market includes the production and distribution of various types of microwave ovens, such as countertop, built-in, and over-the-range models. This market is growing due to increasing demand for convenient cooking solutions, rising urbanization, and changing consumer lifestyles.

Microwave ovens have evolved into essential appliances for a wide range of users, including homeowners, students, and professionals. The market offers various types, including countertop, over-the-range, and smart models, catering to different consumer needs.

For example, advanced over-the-range microwaves, such as those from Samsung, feature sensor cooking and Wi-Fi connectivity, which improve user convenience. These models often boast a capacity of 2.1 cu. ft., making them ideal for large dishes, particularly for families and commercial oven settings like restaurants. The versatility and growing sophistication of microwave ovens reflect their increasing importance in modern households and professional kitchens.

The microwave oven market is competitive, with well-established brands like Samsung, LG, and Panasonic dominating the space. In developed markets, such as North America and Europe, the market shows signs of maturity, particularly for basic microwave models. However, there is still room for growth in smart and energy-efficient models, which cater to tech-savvy consumers and those looking to reduce energy consumption.

On a broader scale, the shift toward smart and energy-efficient microwave ovens aligns with global efforts to reduce household energy consumption. Consumers are increasingly looking for electrical appliances that offer both convenience and energy savings.

For local markets, microwave ovens provide essential cooking solutions, particularly in urban areas where time constraints and space limitations make these appliances highly valuable. Moreover, the availability of advanced models with features such as 400 CFM ventilation power addresses local needs in commercial kitchens, where effective odor and steam management is critical.

Microwave Oven Market Core Findings

- The Microwave Oven Market was valued at USD 11.2 billion in 2023 and is expected to reach USD 16.3 billion by 2033, with a CAGR of 3.8%.

- In 2023, Convection Microwave Oven dominated the product type with 47%, owing to its versatility in cooking and baking.

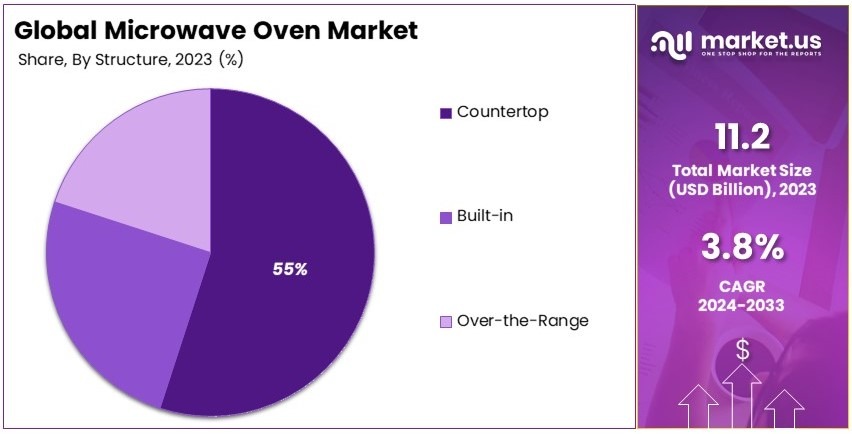

- In 2023, Countertop led the structure segment with 55%, being the most convenient option for households.

- In 2023, Large Microwaves were the dominant cooking capacity, meeting the growing demand for bigger appliances in households.

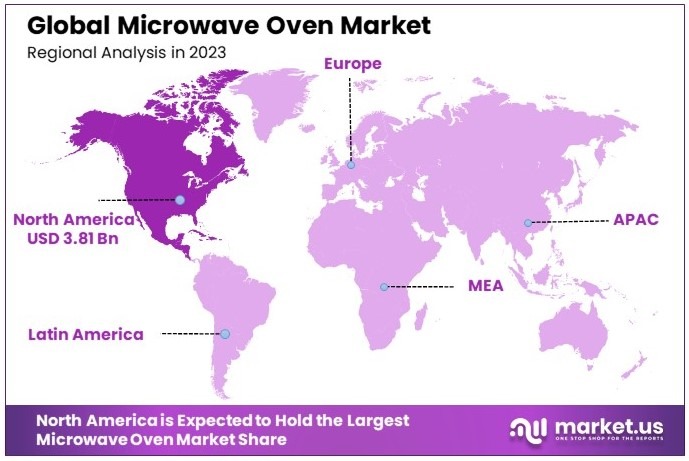

- In 2023, North America led the market with 34.0%, driven by high product penetration and innovation in the region.

Product Type Analysis

Convection microwave ovens dominate with 47% due to their advanced cooking capabilities and efficiency.

In the microwave oven market, the product types include convection, grill, and solo microwaves. Convection microwaves lead the segment significantly as they combine traditional microwave heating with a convection fan to circulate hot air around the food, resulting in evenly cooked dishes and a browned or crisped top.

This technology allows consumers to bake, roast, and grill, making these ovens particularly appealing to those looking for versatile cooking appliances. The popularity of convection microwave ovens is also fueled by the increasing consumer preference for quick yet healthy cooking methods.

Grill microwaves, another significant sub-segment, are equipped with heating coils and can be used to grill, toast, or roast food. They cater to consumers who prefer a crispy finish to their microwaved meals, enhancing the taste and texture of dishes.

Solo microwaves are the simplest form, primarily used for uniform reheating, cooking, and defrosting. Despite their lower price point, the limited functionality compared to convection and grill types restricts their appeal to budget-conscious consumers who need basic microwave features.

Structure Analysis

Countertop microwaves lead with 55% due to their portability, ease of installation, and affordability.

Regarding the structure of microwave ovens, the options include built-in, countertop, and over-the-range. Countertop microwaves are the most popular, favored for their ease of installation and versatility. They can be placed in any part of the kitchen and moved as needed, which appeals to renters and those frequently rearranging their cooking spaces. The affordability of countertop models also makes them a go-to choice for many households.

Built-in microwaves offer a seamless look and save counter space but are typically more expensive and require professional installation. They are preferred in new homes or during major kitchen renovations where custom fitting into cabinetry is possible.

Over-the-range microwaves save counter space and are equipped with integrated ventilation systems to remove smoke, steam, and cooking odors from the stovetop cooking area. Although they can be more complex to install, they are ideal for kitchens where space optimization is critical.

Cooking Capacity Analysis

Large microwave ovens are increasingly popular, catering to families and those who use the microwave for more substantial cooking tasks.

Microwave ovens are also categorized by their cooking capacity: small (up to 20 liters), medium (21-30 liters), and large (above 31 liters). Large microwaves dominate this segment as they meet the needs of larger households and those who frequently use microwaves for cooking and reheating larger quantities of food. The ability to accommodate bigger dishes and multiple items simultaneously makes large microwaves a preferred choice for families and individuals who entertain often or cook in bulk.

Small microwave ovens are suited for individuals or small families with limited kitchen space. Their compact size is ideal for dorm rooms, offices, or small apartments.

Medium-sized microwaves strike a balance between space efficiency and capacity, suitable for average-sized households with moderate cooking needs. They represent a compromise between the versatility of large models and the space-saving design of small units.

Distribution Channel Analysis

Offline retail stores are the primary channel, holding 54% of the market due to personalized customer service and the ability to see and test products firsthand.

Distribution channels for microwave ovens include offline and online retail stores. Offline stores currently dominate the market because many consumers prefer to assess the size, design, and functionality of a microwave in person before making a purchase. Retail stores also offer the advantage of immediate gratification, as customers can take the product home immediately, along with the opportunity for personal interaction and professional advice from sales staff.

Online retail stores are growing in popularity due to the convenience of home shopping and often broader selections of products. However, the inability to physically interact with the product before purchase and concerns about the handling of such appliances during shipping are deterrents.

End-Use Analysis

Household applications lead with 62% as microwaves are considered essential home appliances in modern kitchens.

In terms of end-use, microwave ovens are predominantly used in households, making this the largest segment. The high penetration rate in residential settings can be attributed to the widespread reliance on microwaves for daily cooking and reheating tasks in modern homes. Microwaves offer a convenient and quick way to prepare meals, which is essential for busy families and professionals.

Commercial uses, although less significant, include offices, cafeterias, and catering services where microwaves are used for their speed and convenience, particularly in environments where quick service is crucial.

Key Market Segments

By Product Type

- Convection

- Grill

- Solo

By Structure

- Built-in

- Countertop

- Over-the-Range

By Cooking Capacity

- Small (up to 20 Liters)

- Medium (21-30 Liters)

- Large (Above 31 Liters)

By Distribution Channel

- Offline Retail Stores

- Online Retail Stores

By End-Use

- Commercial

- Household

Drivers

Increasing Consumer Demand for Convenient Cooking Drives Market Growth

The microwave oven market is driven by several key factors, including the rising demand for convenient cooking solutions, growing adoption of smart kitchen appliances, and increasing disposable income and urbanization. As consumers lead busier lifestyles, the demand for quick and easy meal preparation has surged. Microwave ovens provide a solution for fast cooking, making them an essential appliance in modern kitchens.

Additionally, the adoption of smart kitchen appliances is contributing to the market’s growth. Consumers are increasingly looking for appliances that integrate with smart home systems, offering features like remote control, automatic settings, and energy efficiency. This trend is pushing manufacturers to innovate and offer smart microwave ovens to meet evolving consumer preferences.

Urbanization and rising disposable income are also key drivers of the market. As more people move to urban areas, the demand for compact, efficient kitchen appliances grows, and microwave ovens are among the most popular choices for small spaces. The expansion of the food service industry, particularly in fast food and quick-service restaurants, further fuels the demand for microwave ovens to meet high-volume cooking needs.

Restraints

High Energy Consumption Restraints Market Growth

Several factors restrain the growth of the microwave oven market, including high energy consumption, concerns over microwave radiation, and the availability of alternative cooking solutions. One of the major concerns for consumers is the high energy consumption associated with microwave ovens, which can lead to increased electricity costs.

There are also concerns over the potential health risks associated with microwave radiation, which causes some consumers to hesitate in using microwave ovens regularly. Although scientific studies have largely proven them safe, this concern persists and impacts market growth.

The availability of alternative cooking solutions, such as air fryers and induction cooktops, also poses a challenge to the microwave oven market. These alternatives offer different cooking techniques that appeal to health-conscious consumers or those looking for more versatile cooking methods. Finally, the high initial cost of advanced microwave ovens with smart features can be a deterrent for budget-conscious buyers, further restraining market growth.

Opportunity

Technological Advancements in Microwave Ovens Provide Opportunities

Opportunities in the microwave oven market are driven by technological advancements, expanding demand in developing economies, and the growth of e-commerce sales channels. As microwave oven technology evolves, there are significant opportunities for manufacturers to introduce innovative products with enhanced features.

Developing economies present another area of opportunity for the microwave oven market. As disposable income rises and urbanization continues in these regions, there is increasing demand for affordable and efficient kitchen appliances, including microwave ovens. Companies that can offer cost-effective models tailored to these markets will see significant growth potential.

The expansion of e-commerce sales channels also creates opportunities for market growth. With more consumers shopping online, brands have the chance to reach wider audiences and offer a range of products, from budget-friendly models to high-end smart microwave ovens. Furthermore, the growing focus on energy-efficient appliances presents an opportunity for manufacturers to develop products that meet consumer demand for lower energy consumption while maintaining cooking performance.

Challenges

Intense Market Competition Challenges Market Growth

The microwave oven market faces several challenges, including intense market competition, slow adoption of smart microwave ovens, and balancing cost with innovation. The market is highly competitive, with numerous global and regional players offering a wide range of products. This intense competition drives prices down, making it difficult for manufacturers to maintain margins while investing in innovation.

The adoption of smart microwave ovens has been slower than expected, particularly in certain regions where consumers are less familiar with or resistant to advanced features. Many consumers still prefer traditional microwave ovens with basic functionality, which presents a challenge for companies trying to promote newer, tech-driven models.

Balancing the cost of innovation is another significant challenge. Developing advanced microwave ovens with smart features, energy efficiency, and multi-functionality requires substantial investment in research and development. However, these features can lead to higher production costs, which may not align with consumer price expectations.

Growth Factors

Rising Demand for Ready-to-Eat Meals Is Growth Factor

Several growth factors are driving the expansion of the microwave oven market, including the rising demand for ready-to-eat meals, increased consumer focus on healthier cooking methods, and the growth of smart home devices. As more consumers lead busy lifestyles, the demand for convenient meal solutions has grown significantly. Ready-to-cook meals, which can be quickly prepared using microwave ovens, are becoming more popular, driving demand for these appliances.

There is also a growing focus on healthier cooking methods. Microwave ovens, especially those with steam cooking and low-oil frying features, are appealing to health-conscious consumers who want quick and nutritious meal preparation options.

The expansion of smart home ecosystems is another critical growth factor. As more consumers adopt smart home devices, the demand for smart kitchen appliances, including microwave ovens, is increasing. Additionally, the growth of urban nuclear families, where small households prioritize convenient cooking solutions, further fuels the demand for microwave ovens. These factors collectively contribute to the growth of the microwave oven market.

Emerging Trends

Integration of IoT in Microwave Ovens Is Latest Trending Factor

Several trends are shaping the microwave oven market, including the integration of IoT technology, increasing popularity of countertop models, and demand for compact, space-saving designs. The integration of IoT (Internet of Things) in microwave ovens allows consumers to control their appliances remotely, monitor cooking processes, and access preset cooking modes through smartphone apps.

Countertop microwave ovens are also gaining popularity, especially in urban areas where kitchen space is limited. Consumers are looking for appliances that are easy to use and don’t require built-in installation, which is driving demand for these models.

Compact and space-saving designs are another significant trend, as more consumers prioritize efficiency and functionality in smaller kitchens. Finally, the demand for multi-functional microwave ovens is rising. Consumers are increasingly interested in ovens that combine several cooking functions, such as grilling, convection, and air frying, all within a single appliance.

Regional Analysis of Microwave Oven Market

North America Dominates with 34.0% Market Share

North America leads the Microwave Oven Market with a 34.0% share, valued at USD 3.81 billion. This dominance is driven by high consumer demand for convenience appliances, a large middle-class population, and a fast-paced lifestyle. Advanced kitchen technologies and frequent product innovations by key players further support the market’s strong position.

The region’s high purchasing power and preference for time-saving appliances significantly boost microwave sales. Additionally, growing urbanization and the popularity of ready-to-eat meals increase the demand for microwave ovens in both residential and commercial sectors. The presence of established brands and continuous product advancements also fuel market growth.

North America’s leadership in the microwave oven market is expected to remain stable as consumers continue to prioritize convenience and technological advancements. As smart kitchen trends and energy-efficient appliances become more popular, the region is likely to experience steady market growth in the coming years.

Regional Mentions:

- Europe: Europe has a strong presence in the microwave oven market, driven by rising demand for energy-efficient appliances and growing urbanization. The region’s focus on reducing energy consumption is key to its market growth.

- Asia Pacific: Asia Pacific is witnessing rapid market growth, driven by increasing disposable income, urbanization, and the rising trend of convenience cooking. Countries like China and India are significant contributors to this expansion.

- Middle East & Africa: The Middle East and Africa are showing steady growth in the microwave oven market, supported by rising urbanization and growing demand for convenient home appliances in both residential and commercial sectors.

- Latin America: Latin America’s microwave oven market is growing due to increasing middle-class incomes and expanding retail sectors. The region’s focus on improving living standards and convenience appliances supports its steady market rise.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape of Microwave Oven Market

The Microwave Oven Market is highly competitive, with major players like LG Electronics, Samsung Electronics, Whirlpool Corporation, and Panasonic Corporation leading the industry. The market is driven by the growing demand for convenient kitchen appliances and the increasing popularity of smart kitchen solutions.

Key players offer a variety of microwave ovens, including solo, convection, and grill models. These products cater to both residential and commercial sectors, focusing on features like energy efficiency, speed, and multifunctionality. Smart ovens with IoT connectivity and sensor-based cooking are gaining popularity.

Leading companies position themselves through product diversification, innovative technology, and strategic partnerships. They collaborate with retailers and distributors to ensure a broad reach. Premium brands emphasize advanced features, while others target mass-market consumers with affordable models.

Pricing in the microwave oven market is diverse. Companies offer entry-level models at competitive prices, while premium models with smart features and higher wattage are priced accordingly. Promotions, discounts, and bundling with other kitchen appliances are common pricing tactics.

Key players have strong presences in North America, Europe, and Asia Pacific, with growing demand in emerging markets such as Latin America and the Middle East & Africa. Companies focus on expanding distribution networks in these regions.

Innovation is centered around smart technologies, energy efficiency, and compact designs. Companies invest in R&D to improve cooking speed, integrate voice control, and enhance safety features.

The competitive edge comes from continuous innovation, strong distribution networks, and a wide range of product offerings that cater to both premium and budget-conscious consumers. Leading brands leverage advanced technology and smart home integration to maintain market dominance.

Top Key Players in the Market

- LG Electronics

- Samsung Electronics

- Alto-Shaam Inc.

- Electrolux AB

- Sharp Corporation

- Whirlpool Corporation

- Panasonic Corporation

- Midea Group

- Haier Group Corporation

- Breville USA Inc.

- Robert Bosch GmbH

- Gorenje d.d.

- Daewoo Electronics

- SMEG S.p.A.

- Hisense Group

- Miele & Cie. KG

- Toshiba Corporation

- Candy Hoover Group

- BSH Home Appliances Corporation

- Galanz Group

- Sharp Corporation

- Black+Decker

- Maytag

- Cuisinart

- Other Key Players

Recent Advancements in Microwave Oven Market

- Samsung: In October 2024, Samsung launched a new line of smart all-in-one microwaves featuring an air fry function. These microwaves, equipped with Wi-Fi and SmartThings app integration, aim to provide versatile cooking options and streamline kitchen tasks.

- LG: In June 2024, LG launched a new range of microwaves equipped with Scan-to-Cook technology, which enables users to scan barcodes on food packaging to automatically set optimal cooking settings, enhancing convenience and promoting healthier cooking.

- Samsung Bespoke AI: In March 2024, Samsung expanded its smart appliance range with the Bespoke AI line, incorporating artificial intelligence to offer personalized recommendations and automation across devices like microwaves and washing machines.

- Toshiba: In March 2024, Toshiba unveiled its latest Air Fry Microwave Oven at the European Trade Conference. This multifunctional microwave, launching in June 2024, includes air fry, convection, grill, and microwave modes, designed for precise cooking using OriginInverter™ technology.

Report Scope

Report Features Description Market Value (2023) USD 11.2 Billion Forecast Revenue (2033) USD 16.3 Billion CAGR (2024-2033) 3.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Convection, Grill, Solo), By Structure (Built-in, Countertop, Over-the-Range), By Cooking Capacity (Small (up to 20 Liters), Medium (21-30 Liters), Large (Above 31 Liters)), By Distribution Channel (Offline Retail Stores, Online Retail Stores), By End-Use (Commercial, Household) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape LG Electronics, Samsung Electronics, Alto-Shaam Inc., Electrolux AB, Sharp Corporation, Whirlpool Corporation, Panasonic Corporation, Midea Group, Haier Group Corporation, Breville USA Inc., Robert Bosch GmbH, Gorenje d.d., Daewoo Electronics, SMEG S.p.A., Hisense Group, Miele & Cie. KG, Toshiba Corporation, Candy Hoover Group, BSH Home Appliances Corporation, Galanz Group, Sharp Corporation, Black+Decker, Maytag, Cuisinart, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LG Electronics

- Samsung Electronics

- Alto-Shaam Inc.

- Electrolux AB

- Sharp Corporation

- Whirlpool Corporation

- Panasonic Corporation

- Midea Group

- Haier Group Corporation

- Breville USA Inc.

- Robert Bosch GmbH

- Gorenje d.d.

- Daewoo Electronics

- SMEG S.p.A.

- Hisense Group

- Miele & Cie. KG

- Toshiba Corporation

- Candy Hoover Group

- BSH Home Appliances Corporation

- Galanz Group

- Sharp Corporation

- Black+Decker

- Maytag

- Cuisinart

- Other Key Players