Global Air Fryer Market By Product Type (Digital Air Fryers, Manual Air Fryers), By Application (Residential Segment, Commercial Segment), By Capacity (Less than 2L, 2L-5L, More than 5L), By Distribution Channel (Offline Stores, Online Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 56768

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

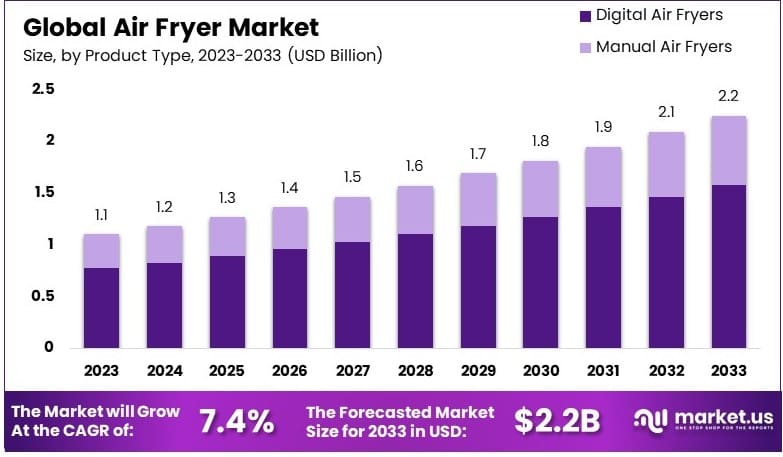

The Global Air Fryer Market size is expected to be worth around USD 2.2 Billion by 2033, from USD 1.1 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

An air fryer is a kitchen appliance that cooks food by circulating hot air around it. This device uses minimal oil, offering a healthier alternative to deep frying. Air fryers are popular for preparing crispy foods quickly, making them a convenient choice for health-conscious consumers.

The air fryer market involves the production, sale, and distribution of air fryers. It caters to consumers looking for healthier cooking options. This market includes various models, from basic to multifunctional air fryers, appealing to a wide range of household preferences and cooking needs.

Air fryers contribute to a healthier lifestyle by reducing oil consumption. Traditional frying methods can require up to 3 cups of oil, while air fryers use only 1 tablespoon, significantly cutting calorie and fat intake. Additionally, air frying can reduce harmful compounds like acrylamide by up to 90%, further boosting its appeal.

The air fryer market is experiencing significant growth, driven by health-conscious consumers and demand for convenient cooking appliances. In the United States, 36% of households owned an air fryer as of 2020, reflecting strong market penetration.

Social media platforms like TikTok have amplified interest, with over 2.5 billion views for #airfryer, as consumers seek quick and creative meal ideas. This high engagement underscores a sustained demand for air fryers, with users valuing their ease of use and health benefits.

Global demand for air fryers continues to rise, supported by international trade. In 2023, global shipments reached 114,500 units, involving 5,983 buyers and 5,889 suppliers, according to KMA. China leads in exports with 118,676 shipments, followed by the United States and Thailand, as reported by Volza.

Market competitiveness is strong, with manufacturers emphasizing energy efficiency, compact design, and additional features to differentiate their products. While some regions approach market saturation, emerging markets present growth opportunities as consumers increasingly prioritize health-focused appliances.

Key Takeaways

- The Air Fryer Market was valued at USD 1.1 Billion in 2023 and is projected to reach USD 2.2 Billion by 2033, with a CAGR of 7.4%.

- In 2023, Digital Air Fryer is the dominant product type, aligning with increasing user convenience.

- In 2023, 2L-5L capacity leads, supporting typical household cooking needs.

- In 2023, Residential use holds 69.7% of applications, reflecting popularity in home cooking.

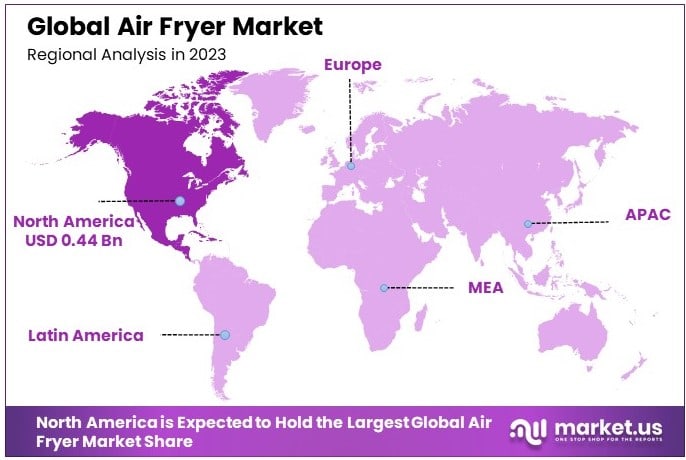

- In 2023, North America leads with 40.0%, driven by rising health-conscious consumer preferences.

Product Type Analysis

Digital Air Fryers dominate due to their convenience and advanced features.

The Air Fryer Market, segmented by product type, includes Digital Air Fryers and Manual Air Fryers. Digital Air Fryers hold a dominant position in the market due to their enhanced functionality and ease of use.

These appliances are preferred for their precision in cooking times and temperatures, which can be critical for achieving the best cooking results. Digital models come equipped with touch screens or digital control panels that make it easier to select from a variety of cooking modes and functions, adding to their appeal.

Digital Air Fryers also often feature preset cooking programs, which simplify the preparation of common dishes such as fries, chicken, and bakery products. This functionality is especially attractive to consumers seeking convenience and consistency in their cooking.

Manual Air Fryers, while less technologically advanced, remain popular for their straightforwardness and typically lower cost. They require manual adjustment of cooking settings, which some users prefer for hands-on control. Both segments contribute to the market by catering to different consumer preferences regarding price and technological sophistication.

Application Analysis

Residential use dominates with 69.7% due to the increasing demand for convenient cooking appliances in homes.

The Air Fryer Market, segmented by application, includes Residential and Commercial segments. The Residential segment leads with a substantial 69.7% market share, driven by the growing consumer interest in healthier cooking methods and convenience appliances.

Air fryers have become popular in smart kitchen appliances due to their ability to cook food with significantly less oil than traditional frying methods, appealing to health-conscious consumers.

The rise in home cooking and the trend towards healthier eating habits have significantly contributed to the demand for air fryers in the residential sector. These devices are praised for their versatility and efficiency, capable of cooking a variety of dishes quickly and with less mess than conventional cooking methods.

The Commercial segment also utilizes air fryers, particularly in settings like small cafes and snack bars where space is limited, and healthier menu options are desired. However, the bulk of growth remains within the residential market as more consumers adopt air frying as part of a healthier lifestyle.

Capacity Analysis

2L-5L air fryers dominate due to their suitability for average-sized families.

The Air Fryer Market, segmented by capacity, includes models with less than 2L, 2L-5L, and more than 5L capacities. The 2L-5L range dominates the market, as these sizes are ideal for average-sized families, balancing capacity and countertop convenience. These air fryers are large enough to prepare meals for small families or couples without taking up as much space as larger models.

Air fryers within this capacity range are versatile enough to cook a significant amount of food while still being compact enough to fit in typical kitchen spaces. This size range meets the needs of the majority of households, making it the most popular choice among consumers.

Smaller models, less than 2L, are perfect for singles or couples without children, offering quick and efficient cooking for smaller meal portions. Larger models, more than 5L, cater to large families or occasions where cooking in bulk is required, though they require more storage space, limiting their appeal to those with ample kitchen space.

Distribution Channel Analysis

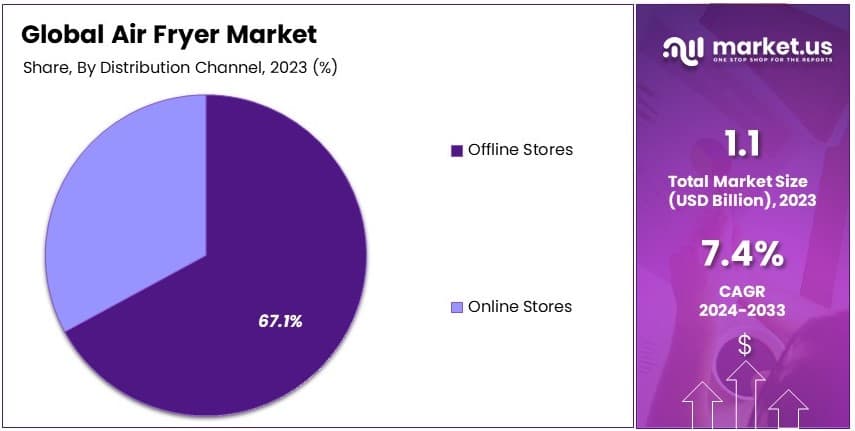

Offline distribution channels dominate with 67.1% due to consumer preference for physically evaluating products.

The Air Fryer Market, segmented by distribution channel, includes Supermarkets/Hypermarkets, Specialty Stores, Online Stores, and other channels. Offline channels lead the market with a 67.1% share. This dominance is attributed to consumer preferences for seeing and testing the product before purchase.

Specialty stores are also significant as they often provide expert advice and demonstrations, which can be influential in the purchasing decision. These stores typically offer a wider range of brands and models, including the latest releases.

Online Stores are growing in popularity due to the convenience of home shopping and often competitive pricing. They are particularly appealing to tech-savvy consumers who are comfortable making purchases based on online reviews and product information. The growth of e-commerce is expected to continue influencing this market segment, particularly as consumer confidence in online shopping strengthens.

Key Market Segments

By Product Type

- Digital Air Fryers

- Manual Air Fryers

By Application

- Residential Segment

- Commercial Segment

By Capacity

- Less than 2L

- 2L-5L

- More than 5L

By Distribution Channel

- Offline Stores

- Online Stores

Drivers

Growing Health Consciousness Among Consumers Drives Market Growth

The rising health consciousness among consumers drives the Air Fryer Market. People are increasingly opting for low-fat cooking methods, making air fryers a popular choice for healthier snacks and meal preparation.

The demand for home-cooked meals is also boosting sales. Consumers are turning to home cooking to ensure hygiene and quality, and air fryers offer a convenient and quick way to prepare meals.

The convenience factor is a major driver for air fryer adoption. Easy-to-use features, minimal oil usage, and quick cooking times make them appealing for busy households.

The increasing adoption of smart kitchen appliances contributes to market growth. Air fryers integrated with digital controls and smart features, such as programmable timers, attract tech-savvy consumers seeking innovative cooking solutions.

Restraints

High Initial Purchase Cost Restraints Market Growth

The high initial cost of air fryers restrains market growth. Advanced models with digital features can be expensive, making them less accessible to budget-conscious consumers.

Limited awareness in developing regions also impacts market penetration. In these areas, consumers may not be familiar with air fryers, leading to lower adoption rates.

Concerns over nutrient loss during air frying create further restraint. Some consumers worry that air fryers may reduce the nutritional value of food compared to traditional cooking methods, affecting purchase decisions.

Space constraints in small kitchens limit air fryer demand. Consumers living in compact urban homes may not have sufficient counter space to accommodate air fryers, which could restrict sales.

Opportunity

Expansion in Emerging Markets Provides Opportunities

Emerging markets offer significant growth opportunities for the Air Fryer Market. Rising urbanization and growing middle-class populations in regions like Asia-Pacific and Latin America increase demand for convenient cooking appliances.

The development of multi-functional air fryers supports market growth. Models that can bake, grill, and dehydrate in addition to frying attract consumers seeking versatile appliances.

Integration with IoT and smart home systems offers additional opportunities. Smart air fryers that connect with other home devices provide a seamless cooking experience, enhancing consumer interest.

Health-conscious restaurants are also driving demand. Eateries focusing on healthier menus are adopting air fryers to prepare low-fat dishes, expanding market reach beyond households.

Challenges

Intense Competition from Conventional Cooking Methods Challenges Market Growth

Intense competition from conventional cooking methods poses challenges for the Air Fryer Market. Consumers still rely on traditional cooking techniques, which can slow air fryer adoption.

Supply chain disruptions also challenge market stability. Delays in production and delivery of air fryers due to supply chain issues can impact sales and distribution.

Economic fluctuations affect consumer spending on non-essential appliances like air fryers. During downturns, households may delay purchases, affecting overall market growth.

Rapid technological changes require constant innovation. Manufacturers must continually develop new features and models to meet evolving consumer preferences, increasing operational costs.

Growth Factors

Government Campaigns Promoting Healthy Eating Are Growth Factors

Government campaigns promoting healthy eating boost the Air Fryer Market. Initiatives encouraging low-fat diets increase consumer interest in air fryers.

Increasing disposable income in urban areas supports market expansion. Higher income levels enable more households to invest in innovative cooking appliances like air fryers.

Expanding e-commerce channels contribute to market growth. Online platforms make it easier for consumers to browse, compare, and purchase air fryers, driving sales.

The growing number of single-person households drives demand. Single-person homes often prioritize quick, easy meal preparation, making air fryers an ideal kitchen solution.

Emerging Trends

Growing Popularity of Digital Air Fryers Is Latest Trending Factor

The growing popularity of digital air fryers is a key trend. Consumers prefer models with digital displays, touch controls, and preset cooking programs, enhancing user experience.

Demand for energy-efficient cooking appliances is on the rise. Energy-efficient air fryers align with consumer preferences for cost-saving and eco-friendly solutions.

Air fryers with dehydration features are also trending. These multi-functional models allow users to make dried fruits and vegetables, expanding usage beyond frying.

The preference for compact and portable designs supports market growth. Consumers, especially in urban areas, seek space-saving appliances that are easy to store and transport.

Regional Analysis

North America Dominates with 40.0% Market Share

North America leads the Air Fryer Market with a 40.0% share, totaling USD 0.44 billion. This dominance is driven by strong consumer demand for healthier cooking options, increased awareness of low-oil cooking, and higher disposable incomes. The U.S. remains the largest contributor, with Canada showing steady growth.

The region benefits from a health-conscious population, a preference for smart kitchen appliances, and widespread retail availability. High penetration of e-commerce platforms and regular product innovations also support market performance. Additionally, North America’s focus on convenience-oriented lifestyles accelerates the adoption of air fryers.

North America’s market presence is expected to remain strong, driven by ongoing product upgrades, expanding online retail channels, and rising interest in smart home cooking solutions.

Regional Mentions:

- Europe: Europe sees growing demand for air fryers, driven by rising health trends and a focus on sustainable, low-fat cooking solutions. Strong marketing of eco-friendly appliances supports market growth.

- Asia Pacific: Asia Pacific shows rapid growth, fueled by increasing urbanization, rising middle-class incomes, and growing adoption of modern cooking appliances in countries like China and India.

- Middle East & Africa: The region experiences steady growth, supported by rising awareness of healthy eating and expanding retail networks. Demand is growing in urban areas and among health-conscious consumers.

- Latin America: Latin America sees potential growth, driven by increased awareness of low-oil cooking and expanding retail presence. Key markets include Brazil and Mexico, where urban consumers show interest in new cooking technologies.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The air fryer market is highly competitive, driven by rising health consciousness and demand for convenient cooking appliances. The top four players in this sector are Philips, Newell Brands, Conair Corporation, and Ninja. These companies maintain strong positions due to their innovation, wide product range, and global distribution networks.

Philips is a leading player, known for pioneering air fryer technology with its patented Rapid Air Technology. Its focus on user-friendly designs, energy efficiency, and healthy cooking solutions has strengthened its market position. The company’s strong global presence and effective marketing strategies contribute to its dominance in both premium and mid-range segments.

Newell Brands, through its popular brand BLACK+DECKER, offers a variety of air fryers known for durability and affordability. The company targets a broad consumer base, emphasizing ease of use and value for money. Its strong retail network and competitive pricing strategy support its growth in the global air fryer market.

Conair Corporation, under its brand Cuisinart, offers high-quality air fryers with advanced features like digital controls and larger capacities. Its focus on innovation and strong brand reputation in kitchen appliances boosts its presence in the market.

Ninja is recognized for its versatility and multi-functional air fryer models, combining air frying with other cooking modes. The brand’s marketing strategy highlights performance, convenience, and healthy cooking, appealing to health-conscious consumers.

These companies lead the market through innovation, strategic product launches, and strong distribution channels, making them key players in the global air fryer market.

Top Key Players in the Market

- Philips

- Koninklijke Philips N.V.

- Newell Brands

- Conair Corporation

- Ninja

- COSORI

- GoWISE USA

- Instant Pot

- Cuisinart

- BLACK+DECKER

- Chefman

- T-fal

- Other Key Players

Recent Developments

- SharkNinja: On November 1, 2024, SharkNinja reported strong third-quarter earnings, exceeding Wall Street expectations. The company recorded an adjusted profit of $1.21 per share on $1.43 billion in sales, driven by a 27% increase in earnings and a 35% year-over-year rise in sales, attributed partly to the popularity of air fryers.

- Dreo: In July 2024, Dreo introduced the ChefMaker Combi Fryer, designed to combat meat dehydration with a unique water atomization system that sprays fine water particles on food during cooking, maintaining optimal hydration levels.

- Cosori: In October 2023, Cosori launched the 6-Quart TurboBlaze™ Air Fryer, engineered to cook meals 46% faster than previous models while using 95% less oil. The appliance includes nine cooking functions, appealing to health-conscious and time-sensitive consumers.

Report Scope

Report Features Description Market Value (2023) USD 1.1 Billion Forecast Revenue (2033) USD 2.2 Billion CAGR (2024-2033) 7.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Digital Air Fryers, Manual Air Fryers), By Application (Residential Segment, Commercial Segment), By Capacity (Less than 2L, 2L-5L, More than 5L), By Distribution Channel (Offline Stores, Online Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Philips, Koninklijke Philips N.V., Newell Brands, Conair Corporation, Ninja, COSORI, GoWISE USA, Instant Pot, Cuisinart, BLACK+DECKER, Chefman, T-fal, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Philips

- Ninja

- COSORI

- GoWISE USA

- Instant Pot

- Cuisinart

- BLACK+DECKER

- Chefman

- T-fal

- Other Key Players