Global Surgical Mask Market By Product Type (Basic Surgical Masks, Anti-Fog Surgical Masks, Fluid/Splash-Resistant Masks, Others) By Material Type (Polypropylene (PP), Polyurethane, Polyester, Cotton, Others) By Usage Type( Disposable Masks, Reusable Masks) By Distribution Channel (Online, Offline) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160727

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

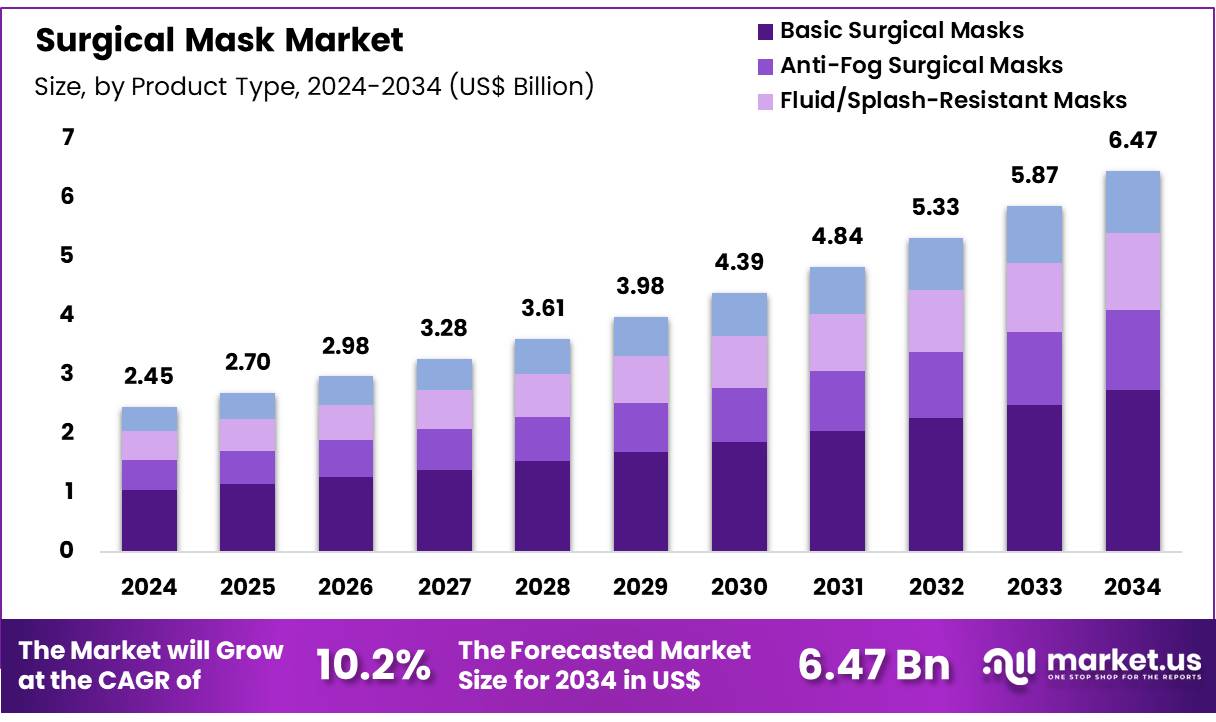

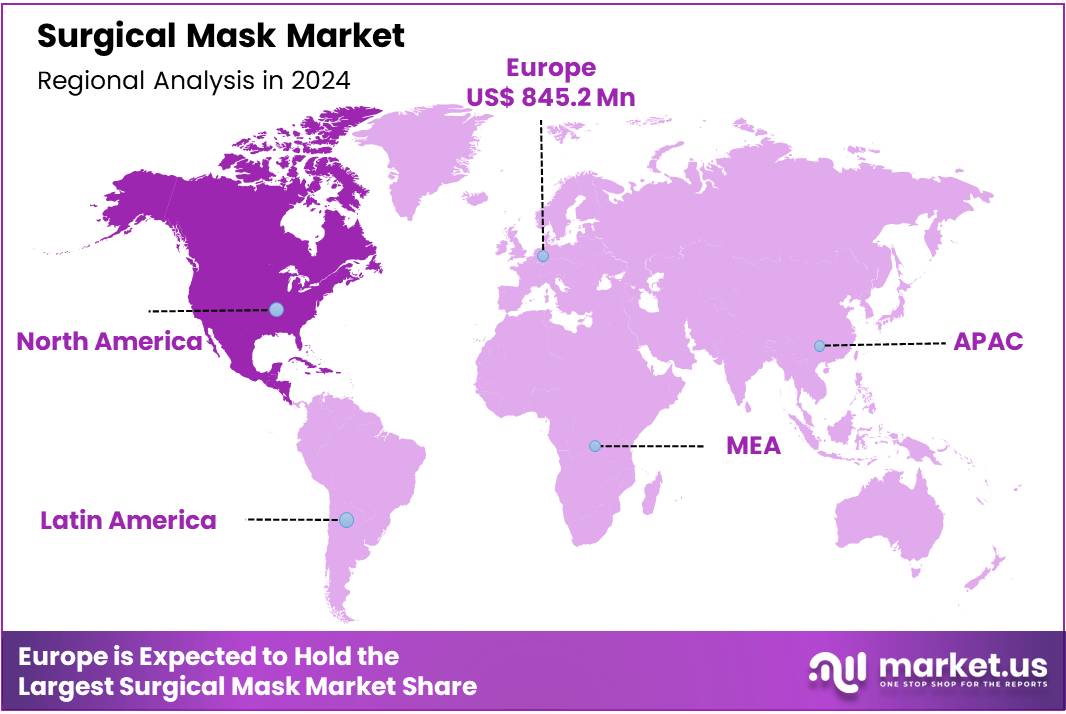

Global Surgical Mask Market size is expected to be worth around US$ 6.47 Billion by 2034 from US$ 2.45 Billion in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034. In 2024, Europe led the market, achieving over 34.5% share with a revenue of US$ 845.5 Million.

The demand for surgical masks has been sustained by multiple structural and regulatory factors, making their use an integral component of modern healthcare systems. Hospitals and clinics worldwide are bound by increasingly stringent infection-prevention rules.

The World Health Organization (WHO) reported in 2022 that effective infection-prevention and control programs can reduce healthcare-associated infections (HAIs) by up to 70%. Since HAIs remain a persistent burden in hospitals, the steady and routine use of medical masks during procedures and patient care continues to be essential. This ensures a consistent baseline demand even in non-outbreak years.

Public health guidance has reinforced this need. In 2023, WHO updated its recommendations, continuing to endorse medical masks for healthcare workers in specific clinical situations. Evidence-based recommendations from global health authorities have prompted hospitals to maintain adequate inventories of surgical masks, both for routine care and for emergency surges.

Similarly, European health agencies in 2023 advised facilities to strengthen infection-control measures due to the concurrent circulation of SARS-CoV-2, influenza, and RSV. This multi-pathogen preparedness has led to conservative procurement policies and regular replenishment cycles. Comparable monitoring efforts in the United States have supported similar precautionary practices.

Government initiatives also play a critical role in sustaining demand. In the United States, the Strategic National Stockpile (SNS) is being replenished to ensure readiness for future health emergencies. Federal investments have also been directed toward strengthening domestic PPE manufacturing, thereby ensuring stable purchasing patterns and replacement cycles. Such measures highlight how resilience planning has evolved into a structural growth driver for the surgical mask market.

Regulatory clarity further underpins demand. The U.S. Food and Drug Administration (FDA) has established guidance for premarket submissions of surgical masks while recognizing performance standards such as ASTM F2100-23. Clear benchmarks regarding filtration, breathability, and fluid resistance instill confidence among hospitals and purchasing groups, encouraging procurement from compliant suppliers. This regulatory environment favors high-quality products and supports market growth during competitive tender cycles.

Additionally, the growing health workforce and expansion of surgical services contribute to consistent demand. WHO has projected a global shortfall of health workers by 2030, which underscores the need for investment in protective equipment. The high volume of surgical procedures worldwide sustains constant procedural use of masks, even though access disparities remain in low-income regions. Collectively, these drivers regulatory frameworks, institutional needs, government stockpiles, and workforce expansion ensure steady and long-term consumption of surgical masks, independent of short-term epidemiological fluctuations.

Key Takeaways

- Market Size: Global Surgical Mask Market size is expected to be worth around US$ 6.47 Billion by 2034 from US$ 2.45 Billion in 2024.

- Market Growth: The market growing at a CAGR of 10.2% during the forecast period from 2025 to 2034.

- Product Type Analysis: Basic surgical masks segment accounts for 42.5% of the total market share.

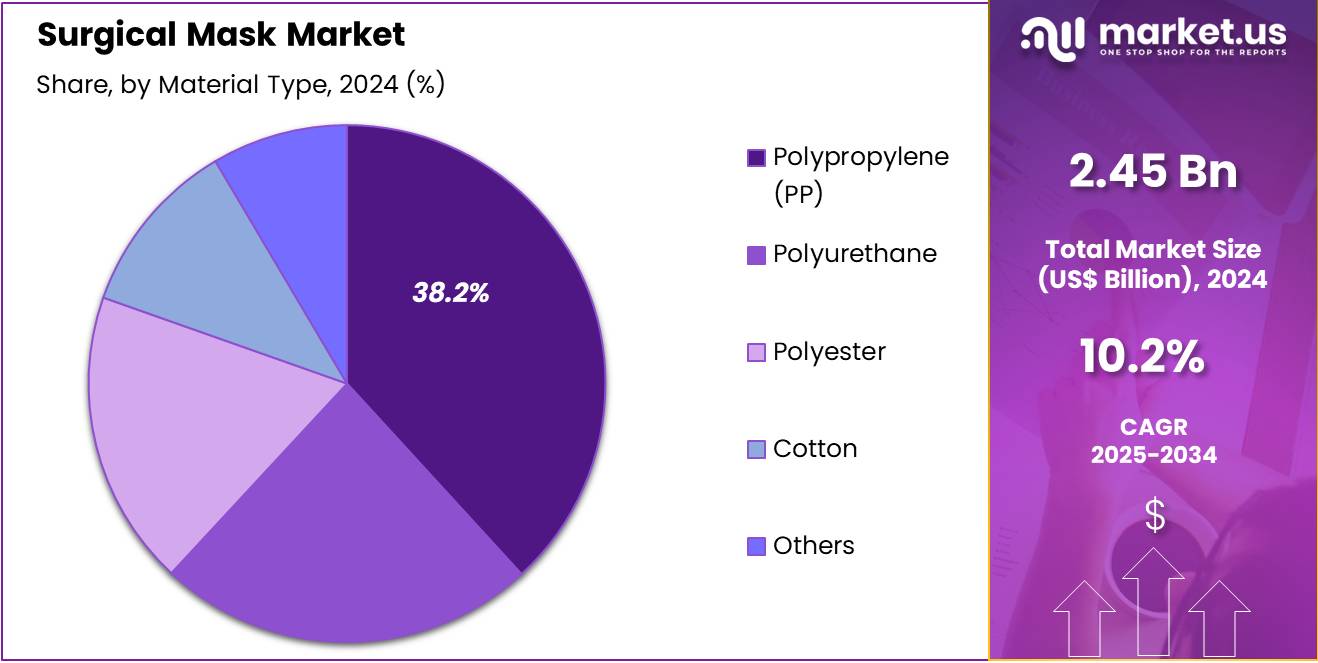

- Material Type Analysis: The surgical mask market in 2024 is primarily dominated by polypropylene (PP), which accounts for 38.2% of the total market share.

- Usage Type Analysis: The Usage Type are segmented into disposable masks and reusable masks, with disposable masks dominating at 38.2% of the total market share.

- Distribution Channel Analysis: The distribution of surgical masks is strongly shaped by the dominance of online channels, which account for 70.4% of the total market share.

- Regional Analysis: In 2024, Europe led the market, achieving over 34.5% share with a revenue of US$ 845.5 Million.

Product Type Analysis

The global surgical mask market in 2024 is primarily characterized by strong demand across key product categories, with basic surgical masks holding the dominant position. This segment accounts for 42.5% of the total market share, supported by their wide-scale adoption in hospitals, clinics, and general medical use due to cost-effectiveness and availability. The dominance of this category can be attributed to its role as a standard protective measure across both developed and developing healthcare systems.

The anti-fog surgical masks segment has gained notable traction, particularly in surgical environments where clear visibility is essential. These masks are increasingly preferred by healthcare professionals using protective eyewear, as they reduce lens condensation and improve operational efficiency. Their growth is being supported by advancements in material technology and increasing awareness of occupational safety.

The fluid/splash-resistant surgical masks segment is expanding steadily, driven by rising concerns over exposure to bloodborne pathogens and infectious fluids during surgical procedures. These masks provide an enhanced barrier and are being adopted widely in specialized surgical practices. Increasing regulatory emphasis on healthcare worker protection is expected to further support this category’s expansion.

The others segment, comprising specialty masks with added functionalities such as odor resistance or environmentally sustainable designs, represents a smaller yet emerging share. Innovations in eco-friendly disposable masks and masks with enhanced comfort are gradually attracting attention, particularly in regions with strong sustainability initiatives.

Overall, product segmentation reveals that while basic surgical masks continue to dominate, niche categories such as anti-fog and fluid-resistant variants are gaining momentum, reflecting a shift toward enhanced safety and performance-driven preferences in surgical environments.

Material Type Analysis

The surgical mask market in 2024 is primarily dominated by polypropylene (PP), which accounts for 38.2% of the total market share. PP remains the most widely used material due to its superior filtration efficiency, lightweight structure, and cost-effectiveness. Its nonwoven properties provide effective bacterial filtration while ensuring breathability, making it the preferred choice for large-scale medical mask production. The material’s recyclability and widespread availability further strengthen its dominance in the global market.

The polyurethane (PU) segment has secured a significant position, largely due to its elastic and flexible properties. PU-based masks are often incorporated into specialized designs requiring comfort and durability. This material is particularly adopted in masks where higher adaptability and prolonged wear are essential, thereby driving its steady demand.

Polyester is another notable segment, valued for its strength, durability, and resistance to shrinkage. Polyester fibers are used either alone or blended with PP to enhance performance. Its utility in multi-layered surgical masks and reusable variants is gradually boosting its application.

Cotton masks represent a smaller portion of the market, primarily catering to the growing demand for reusable and eco-friendly alternatives. While cotton lacks the same filtration efficiency as PP, its comfort and sustainability appeal are supporting moderate adoption, especially in non-critical environments.

The others segment, including hybrid and innovative bio-based materials, is emerging as manufacturers explore sustainable alternatives. This segment is expected to gain traction in the coming years as healthcare institutions and governments emphasize greener solutions.

Usage Type Analysis

The Usage Type are segmented into disposable masks and reusable masks, with disposable masks dominating at 38.2% of the total market share. Disposable masks remain the most preferred choice in clinical and surgical environments due to their single-use design, which significantly reduces the risk of cross-contamination. Their affordability, ease of production, and compliance with stringent healthcare regulations have reinforced their widespread adoption across hospitals, outpatient centers, and emergency care facilities. Bulk procurement by healthcare institutions continues to drive the growth of this category.

Reusable masks, though smaller in share, are experiencing steady demand growth, largely driven by rising environmental concerns and the increasing emphasis on sustainability. These masks are designed for extended usage with proper sterilization and cleaning, reducing medical waste associated with disposables.

Cotton, polyester, and hybrid material-based reusable variants are gaining traction in both developed and developing markets, supported by government initiatives promoting eco-friendly medical products. Additionally, advancements in sterilization methods and durable filtration layers have improved their reliability, making them a viable alternative in non-critical care settings.

Overall, the usage type segmentation highlights the dominance of disposable masks, which are indispensable in high-risk medical environments. However, the reusable segment is anticipated to expand at a faster rate over the forecast period, reflecting a gradual shift toward sustainable healthcare practices without compromising on safety.

Distribution Channel Analysis

The distribution of surgical masks is strongly shaped by the dominance of online channels, which account for 70.4% of the total market share. The rapid adoption of e-commerce platforms and digital procurement solutions has transformed the way healthcare institutions and individual consumers purchase surgical masks.

Online platforms provide significant advantages, including wider product availability, transparent price comparisons, and bulk purchasing options. Additionally, the convenience of doorstep delivery and the ability to access a variety of brands and specifications have further accelerated this channel’s growth.

Hospitals, clinics, and individual consumers are increasingly shifting toward online procurement to streamline supply chains and reduce dependency on physical intermediaries. The COVID-19 pandemic created a strong behavioral shift toward digital purchasing, and this trend has continued, supported by growing investments in online healthcare marketplaces and B2B e-commerce platforms. The availability of subscription-based models and direct-from-manufacturer options has also strengthened the dominance of online sales.

While offline channels such as hospital pharmacies, retail outlets, and medical supply stores still maintain a presence, their market share is comparatively limited. These channels cater primarily to urgent, small-scale, or localized demand. However, their slower growth trajectory highlights the clear preference for digital platforms.

Key Market Segments

By Product Type

- Basic Surgical Masks

- Anti-Fog Surgical Masks

- Fluid/Splash-Resistant Masks

- Others

By Material Type

- Polypropylene (PP)

- Polyurethane

- Polyester

- Cotton

- Others

By Usage Type

- Disposable Masks

- Reusable Masks

By Distribution Channel

- Online

- Offline

Driving Factors

A principal driver of the surgical mask market is the sustained high incidence of infectious respiratory diseases (e.g. COVID-19, influenza, RSV), which strengthens demand for source control and protection in healthcare settings and the general public. Medical authorities such as the WHO have estimated monthly global requirements in the tens of millions (e.g. 89 million medical masks per month during COVID-19).

In addition, rising healthcare expenditure globally and stricter regulatory mandates in hospitals for PPE use further support demand. The ability of masks to reduce cross-infection in surgical and procedural environments underpins their standard use in clinical settings. Enhanced funding for public health and infection control programs also sustains procurement of surgical masks.

Trending Factors

One prevailing trend is the shift toward higher-performance and multifunctional masks – for example, fluid/splash-resistant or anti-fog variants particularly in settings with exposure risk. The fluid/splash-resistant sub-segment is projected to register faster growth.Another trend is the increasing penetration of direct-to-consumer sales via e-commerce, which allows end users (beyond institutions) to access surgical masks conveniently.

The emphasis on sustainability (e.g. recyclable materials or reduced environmental footprint) is also gaining traction, given concerns about disposal and plastic waste from mask use. Regulatory evolution, standard harmonization, and innovation in materials and comfort features (e.g. breathability, ergonomic design) further characterize current market dynamics.

Restraining Factors

A significant restraint is the environmental impact and regulatory scrutiny associated with disposal of single-use polypropylene masks. A lifecycle assessment found that the massive global use (e.g. 900 billion masks over 2020–22) led to substantial CO2 emissions and waste burdens. Moreover, stringent regulatory and certification requirements (e.g. ASTM, CE, FDA) pose barriers to new entrants and innovation, raising time and cost of compliance.

Supply chain bottlenecks especially for meltblown nonwoven fabric can impede scale-up. Also, mask fatigue (reduced public adherence over time) and potential substitution by respirators or advanced air purification systems limit growth. In low-resource settings, cost sensitivity may hinder large-scale adoption in nonclinical markets.

Opportunity

Opportunities lie in expansion into emerging economies where mask penetration is still low and healthcare infrastructure is developing. Governments and health agencies may subsidize mask procurement or include them in national stockpiles, creating stable institutional demand. Advances in biodegradable materials and reusable or sterilizable mask technologies create scope for differentiation and premium positioning.

Integration with digital health tools (e.g. sensor-embedded masks that monitor usage or filter degradation) represents a frontier. Further, partnerships with public health programs (for mass vaccination campaigns, outbreak response) offer recurring demand streams. The trend of increasing consumer awareness about hygiene and “everyday protection” beyond pandemics also opens potential for broader consumer adoption.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 34.5% share and holding a market value of US$ 845.5 million for the year. The strong position of North America can be attributed to its well-established healthcare infrastructure. High adoption rates of personal protective equipment (PPE) in hospitals, clinics, and outpatient facilities further supported demand. Strict regulatory frameworks also ensured consistent usage of surgical masks across medical practices.

The rise in elective surgeries and outpatient procedures in the United States and Canada increased consumption levels. Favorable reimbursement policies and the presence of leading healthcare providers further strengthened the regional share. Moreover, the heightened awareness of infection control practices among healthcare professionals and patients acted as a driver.

Government-led stockpiling initiatives following public health emergencies created stable procurement volumes. The region also benefitted from robust domestic manufacturing capacity, which reduced dependency on imports and improved supply security.

The presence of key distributors and advanced logistics systems allowed faster availability of products across hospitals, pharmacies, and online platforms. Consumer preference for certified and high-quality masks also reinforced regional growth.

North America is expected to retain its dominant position over the forecast period, supported by rising healthcare expenditure, strong regulatory compliance, and ongoing investments in hospital safety standards.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The surgical mask market is characterized by the presence of a diverse mix of global manufacturers, regional producers, and specialized suppliers. Competition is driven by continuous innovation in mask design, filtration efficiency, and material quality. Large-scale producers maintain dominance through advanced manufacturing facilities and strong distribution networks. Regional participants focus on cost-effectiveness and localized supply, particularly in emerging economies.

Strategic partnerships with healthcare providers, distributors, and government agencies play a critical role in securing long-term contracts. Investment in automation and sterile packaging technologies enhances production capacity and ensures compliance with regulatory standards. Many players emphasize research and development to introduce eco-friendly and reusable alternatives, addressing rising sustainability concerns.

Market growth is further influenced by expansion into digital sales channels, enabling direct access to consumers and healthcare institutions. The competitive landscape is expected to remain intense, with companies adopting strategies centered on product differentiation, capacity expansion, and global outreach.

Market Key Players

- 3M Company

- Honeywell International Inc.

- Kimberly-Clark Corporation

- Cardinal Health, Inc.

- Medline Industries, Inc.

- DuPont de Nemours, Inc.

- Ansell Ltd.

- Owens & Minor, Inc.

- Dynarex Corporation

- AlphaProTech

- Prestige Ameritech

- Makrite

- Mölnlycke Health Care AB

- Mediblue Health Care Pvt. Ltd.

- Kwalitex Healthcare Pvt. Ltd.

- Other key players

Recent Developments

- 3M Company: In March 2024, 3M appointed William “Bill” Brown as CEO (effective May 1, 2024), shifting leadership during evolving PPE and filtration demand.

- Ansell Ltd.: In April 2024, Ansell announced the acquisition of Kimberly-Clark PPE (KCPPE), expanding its PPE portfolio including surgical masks.

- Owens & Minor, Inc.: In 2024, Owens & Minor further consolidated its medical supply business by integrating Halyard Health (formerly Kimberly-Clark Health Care), which produces surgical masks, gowns, and drapes, bolstering its infection control portfolio.

Report Scope

Report Features Description Market Value (2024) US$ 2.45 Billion Forecast Revenue (2034) US$ 6.47 Billion CAGR (2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Basic Surgical Masks, Anti-Fog Surgical Masks, Fluid/Splash-Resistant Masks, Others) By Material Type (Polypropylene (PP), Polyurethane, Polyester, Cotton, Others) By Usage Type( Disposable Masks, Reusable Masks) By Distribution Channel (Online, Offline) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape 3M Company, Honeywell International Inc., Kimberly-Clark Corporation, Cardinal Health, Inc., Medline Industries, Inc., DuPont de Nemours, Inc., Ansell Ltd., Owens & Minor, Inc., Dynarex Corporation, AlphaProTech, Prestige Ameritech, Makrite, Mölnlycke Health Care AB, Mediblue Health Care Pvt. Ltd., Kwalitex Healthcare Pvt. Ltd., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M Company

- Honeywell International Inc.

- Kimberly-Clark Corporation

- Cardinal Health, Inc.

- Medline Industries, Inc.

- DuPont de Nemours, Inc.

- Ansell Ltd.

- Owens & Minor, Inc.

- Dynarex Corporation

- AlphaProTech

- Prestige Ameritech

- Makrite

- Mölnlycke Health Care AB

- Mediblue Health Care Pvt. Ltd.

- Kwalitex Healthcare Pvt. Ltd.

- Other key players