Global Hormonal Contraceptives Market By Product Type (Emergency Contraceptive Pills, Oral Contraceptive Pills, Injectable Birth Control), By Hormones Type (Combined Hormonal Contraceptive, and Progestin - Only Contraceptive), By User's Age Type (15-24 Years, 25-34 Years, 35-44 Years), By End User Type (Hospitals, Households, Gynecology Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast; 2023-2032

- Published date: July 2024

- Report ID: 95696

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

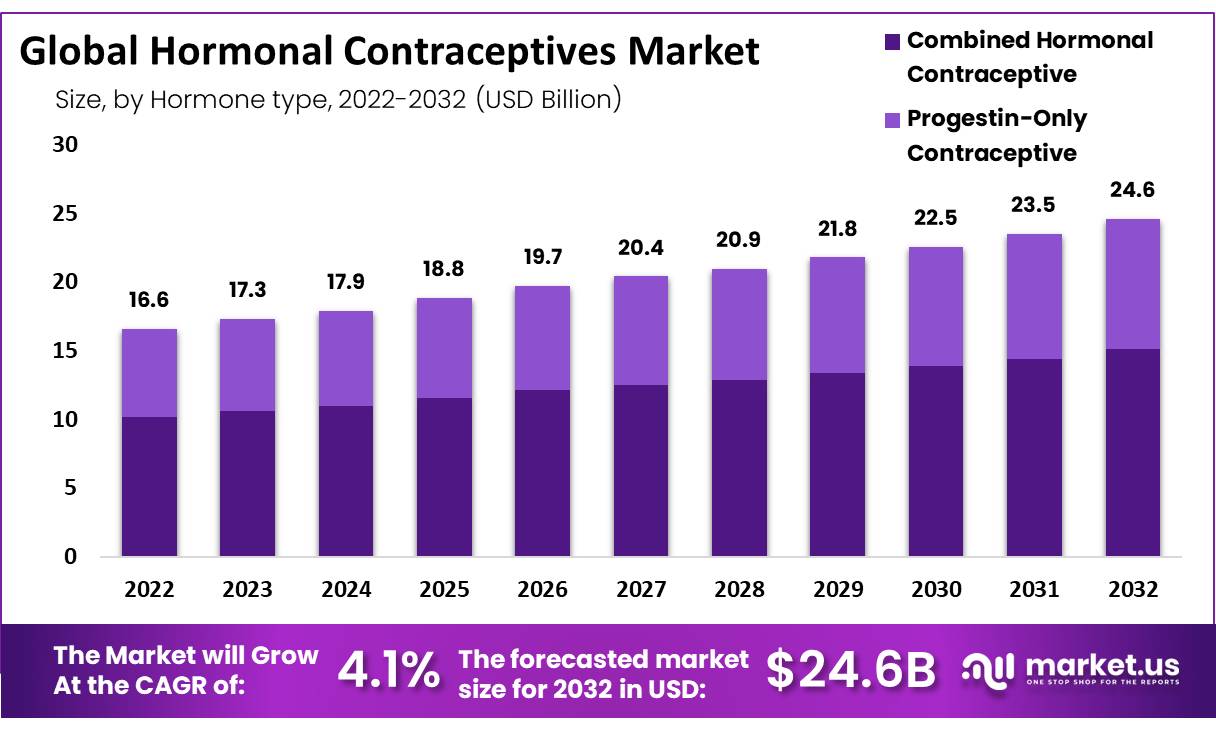

The Global Hormonal Contraceptives Market size is expected to be worth around USD 24.6 Billion by 2032 from USD 17.3 Billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2023 to 2032.

Hormonal contraceptives include progesterone and estrogen. It helps to stop pregnancy by stopping egg release from the ovaries, making the lining of the uterus very thin, or thickening the mucus in the cervix to keep sperm away from the egg.

There are four methods of hormonal contraceptives: the mini pill, the mill, the vaginal ring, and the contraceptive patch with that long-time reversible contraception methods. When hormonal contraceptives are used, they prevent more than 99% of unintended pregnancies. Uterine, ovarian, and colon cancer risks are precluded due to hormonal contraceptives.

Key Takeaways

- The Hormonal Contraceptives Market is expected to reach USD 24.6 billion by 2032.

- It’s estimated to grow at a CAGR of 4.1% from 2023 to 2032.

- Hormonal contraceptives help prevent pregnancy by stopping egg release, thinning uterine lining, or thickening cervical mucus.

- Oral contraceptive pills were the most popular in 2022.

- Combined hormonal contraceptives dominated the hormone type in 2022.

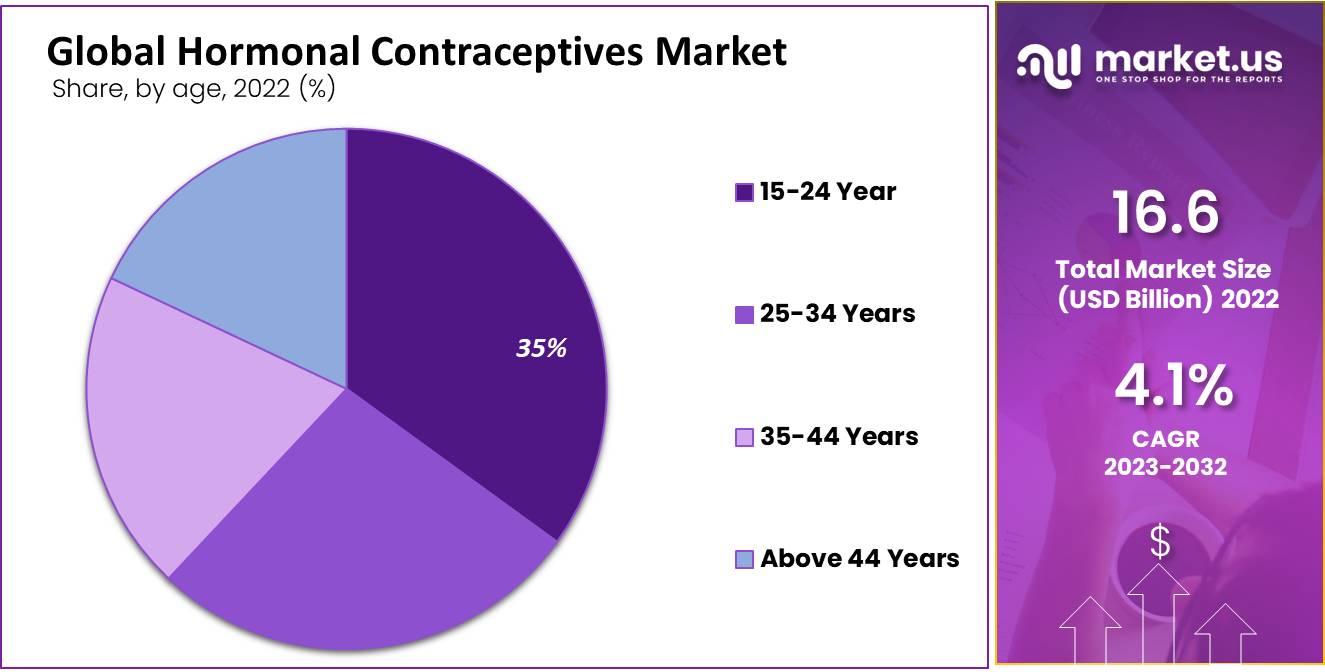

- Users aged 15 to 24 formed the majority.

- Household usage had the largest market share.

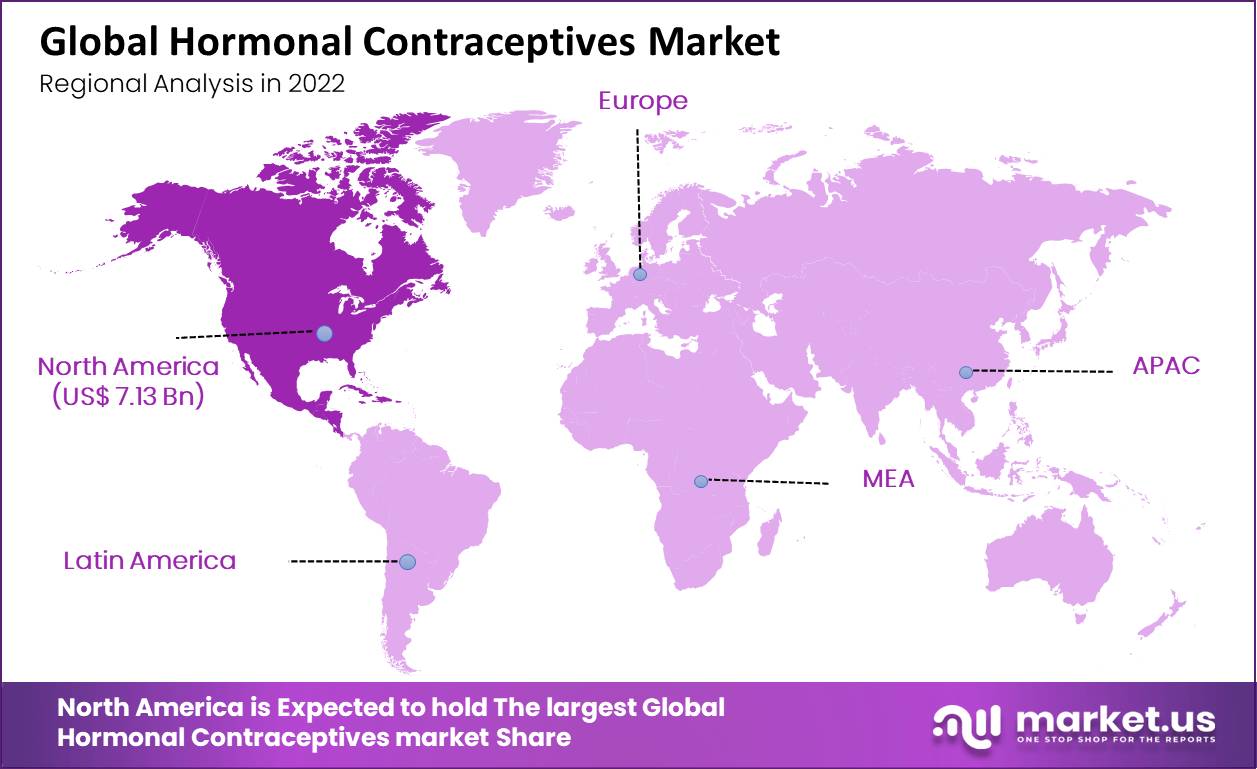

- North America led the market with a 37.5% share in 2022.

- Hormonal contraceptives are highly effective, preventing over 99% of unplanned pregnancies.

- Factors driving market growth include increased awareness, government initiatives, and accessibility.

- Major players invest in research and development and new product commercialization.

- Oral contraceptives containing estrogen and progesterone are widely used.

- They are expected to continue dominating due to their accessibility and convenience.

- The use of oral contraceptives is increasing worldwide.

- Market growth is fueled by family planning focus, health awareness, and improved contraceptive techniques.

- Europe’s market is expanding due to product releases, government initiatives, and awareness.

- Major market players include Abbvie, Bayer, Pfizer, and others.

By Product Type Analysis

The Oral Contraceptive Pills Segment Dominated the Largest Market Share in Other Product Types, Owing to its 99% Of Success Rate in Preventing Pregnancy.

Based on product type, the global hormonal contraceptive Market is segmented into oral contraceptive pills, emergency contraceptive pills, injectable birth control, vaginal rings, intrauterine devices (IUD), transdermal skin patches, and others. Among these products, oral contraceptive pills dominate the largest market share.

Oral contraceptives will also dominate in the forecast period due to the 99% of success rate in preventing pregnancy. The acceptance of hormonal contraceptives like vaginal rings has a fast market growth rate in the forecast period with lesser side effects and is simple to use.

Injectable contraceptives have harmful effects such as weight gain, bloating, and depression. The failure rate for female injectables is nearly 6%.

By Hormones Type Analysis

The Combined Hormonal Contraceptives Segment Dominated the Largest Market Share In Hormones Type Owing To its Increased Awareness

The global hormonal contraceptive Market is segmented based on hormone type into progestin-only and combined hormonal contraceptives. Combined hormonal contraceptives dependent on hormones increase these hormones’ overall annual growth rate.

As people are with increased awareness, government initiatives and programs can help grow overall sales of the hormonal contraceptive Market. Hormonal contraception is used as an endocrine system to prevent unplanned pregnancy.

By The Age Of The User Analysis

The 15-24 Years Age Segment Dominated the Largest Market Share In Age Of The User Type Owing To its Increased Awareness Of Hormonal Contraceptives

Based on age type, the global hormonal contraceptive Market is segmented into 15-24 years, 25-34 years, 35-44 years, and Above 44 Years. Among these users, 15 to 24 aged individuals dominate this sector and will stay dominant in the forecast period.

The 15 to 24 segment grows due to increased awareness of hormonal contraceptives, problems of unplanned, premarital, and unwanted pregnancy, which leads to abortion, known emergency contraceptive pills, and issues of adolescent-age sexual activity.

By End User Type Analysis

Household Segment Dominated the Largest Market Share In End User Type Owing To its Ease of Access

Based on end-user type, the global hormonal contraceptive market is segmented into hospitals, households, gynecology centers, ambulatory surgical centers, clinics, and others. Among these end-users, the hormonal contraceptive market depends on cost, obtainability, a combination of oral pills, and increased success. The household segment presently will dominate and also in the forecast period.

As the growth of this segment increases, due to ease of access to contraceptives leads to increases in sexual health. Also, the use of contraceptives helped to improve the health of maternal and infants.

Key Market Segments

By Product Type

- Emergency Contraceptive Pills

- Oral Contraceptive Pills

- Vaginal Rings

- Injectable Birth Control

- Intrauterine Device (IUD)

- Transdermal Skin Patches

- Others

By Hormones Type

- Combined Hormonal Contraceptive

- Progestin-Only Contraceptive

By User’s Age Type

- 15-24 Year

- 25-34 Years

- 35-44 Years

- Above 44 Years

By End User Type

- Gynecology Centers

- Household

- Ambulatory Surgical Centers

- Hospitals

- Clinics

- Others

Drivers

Progesterone Injectables Such as Hormonal Contraceptives are Used to Boost Market

Prominent companies are trying with known celebrities to make people aware of hormonal contraceptives to help avoid unintended pregnancies. The “Women Who Know” campaign is done by celebrity Ashley Tisdale who collaborated with Allergen Plc. This campaign taught women about contraceptive methods such as the hormonal pill Loestrin Fe.

Restraints

Some Side Effects such as Headaches, Vaginal Infections, Decrease In Sexual Desire, Mood Swings

Hormonal contraceptive disadvantages are nausea, sore breasts, headaches, and vaginal yeast infections. There is a slight chance of forming blood clots called thrombosis. The use of hormonal contraceptives may develop mood swings and may decrease the sexual desire of women.

The more extended intake of oral contraceptives, the greater the risk of cervical-related cancer. If used for 5 years, oral contraceptives increase risk by up to 10%, and if consumed for further 5-9 years, there is an increase in the risk by up to 60%, whereas, after 10 years, it doubles the risk of using contraceptives.

Opportunity

Penetration of Untapped Market Of Developing Countries

Major players in the market are growing due to penetrating the untapped market in developed countries. Day by day, awareness of contraceptive pills is increasing, creating a new untapped market as people try to increase pregnancy age to boost careers or find life’s stability.

After the Start of The Supply Chain And Production In 2020 Substantial Increase In Sales

After 2020, some countries stopped the curb on the distribution of family planning services of hormonal contraceptives; after that industry tried to stabilize slowly, normalizing manufacturing and supply chains.

Regional Analysis

North America Dominated Hormonal Contraceptive Market Share Owing to Its Availability Of The Most Developed Pharmaceutical Sectors

North America has a revenue share of 37.5% of the global market. North America has the highest hormonal contraceptive market because of infrastructure, more awareness among people, and the massive pharmaceutical industry. North America has the most major growth of birth control methods because of the availability of the most developed pharmaceutical sectors.

Asia Pacific has countries such as India and Japan with developed pharmaceutical sectors; hence, they are the second most influential region in the hormonal contraceptive market. As high demand increases in the Asia Pacific sector in the forecast period, it gives a high CAGR to meet increased women’s needs to change their productive age.

An increasing number of product launches and government initiatives and improved people’s awareness have helped to increase Europe’s regional market. Southeast Asia is one of the best-developing areas with a very high CAGR.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

There are a lot of key players in the hormonal contraceptive market due to the presence of many generic drugs. To increase the share of each player, product strategies like commercialization, boost in area reach, approval of product, and increase in the application scope are used. In Feb 2020, companies such as Agile Therapeutics, Inc. for Twirla (patch with Ethinylestradiol and levonorgestrel) got US FDA approval.

Market Key Players

- Abbvie Inc.

- Afaxys, Inc.

- Bayer AG

- Pfizer, Inc

- Johnson & Johnson

- Janssen Pharmaceuticals Inc.

- Lupin Pharmaceuticals Inc.

- Pregna International Ltd.

- The Female Health Company

- Teva Pharmaceutical Industries Limited

- Mylan N.V.

- Ansell LTD

- Merck & Co. Inc.

- Church & Dwight, Co, Inc.

- Mayer Laboratories

- Novartis ag

- Agile Therapeutics

- Other Key Players

Recent Market Developments

- Abbvie Inc. (March 2024): Abbvie Inc. acquired Repros Therapeutics Inc., aiming to strengthen its portfolio in women’s health, particularly in hormonal contraceptives. This acquisition is expected to enhance Abbvie’s offerings and expand its market reach.

- Afaxys, Inc.(April 2024): Afaxys, Inc. launched a new low-dose oral contraceptive, Afaxys One, in April 2024. This product aims to provide effective birth control with fewer side effects, catering to women seeking safer and more convenient contraceptive options.

- Bayer AG (February 2024): Bayer AG acquired KaNDy Therapeutics, aiming to expand its women’s healthcare portfolio. This acquisition will enhance Bayer’s research capabilities and product offerings in the hormonal contraceptives market, focusing on innovative solutions.

- Pfizer, Inc.(January 2024): Pfizer, Inc. introduced a new contraceptive implant, PrevCon, in January 2024. PrevCon offers long-term birth control with a single implant, providing a convenient and effective option for women seeking extended protection.

- Johnson & Johnson (March 2024): Johnson & Johnson announced a merger with Agile Therapeutics in March 2024. This merger aims to combine Agile’s innovative contraceptive patch technology with Johnson & Johnson’s extensive market presence, enhancing their hormonal contraceptive product lineup.

Report Scope

Report Features Description Market Value (2023) USD 17.3 Billion Forecast Revenue (2032) USD 24.6 Billion CAGR (2023-2032) 4.1% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Emergency Contraceptive Pills, Oral Contraceptive Pills, Injectable Birth Control, Vaginal Rings, Intrauterine Device (IUD), and Transdermal Patches), By Hormones Type (Combined Hormonal Contraceptive and Progestin-Only Contraceptive), By User’s Age Type(15-24 years, 25-34 years, 35-44 years, and Above 44 Years), By End User Type (Hospitals, Household, Gynecology Centers, Ambulatory Surgical Centers, and Clinics) Regional Analysis North America – US, Canada, Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic; Eastern Europe – Russia, Poland, The Czech Republic, Greece; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates Competitive Landscape Abbvie, Inc.; Afaxys, Inc.; Teva Pharmaceuticals Industries Ltd; Merck & Co. Inc.; The Female Health Company; Bayer AG, Pfizer, Inc.; Mylan N.V.; Johnson & Johnson; Ansell LTD; Mayer Laboratories; Church & Dwight, Co, Inc., and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are hormonal contraceptives?Hormonal contraceptives are medications used to prevent pregnancy by regulating hormones. They include pills, patches, injections, implants, and intrauterine devices (IUDs) that release hormones such as estrogen and progestin.

How big is the Hormonal Contraceptives Market?The global Hormonal Contraceptives Market size was estimated at USD 17.3 Billion in 2023 and is expected to reach USD 24.6 Billion in 2033.

What is the Hormonal Contraceptives Market growth?The global Hormonal Contraceptives Market is expected to grow at a compound annual growth rate of 4.1%. From 2024 To 2033

Who are the key companies/players in the Hormonal Contraceptives Market?Some of the key players in the Hormonal Contraceptives Markets are Abbvie, Inc.; Afaxys, Inc.; Teva Pharmaceuticals Industries Ltd; Merck & Co. Inc.; The Female Health Company; Bayer AG, Pfizer, Inc.; Mylan N.V.; Johnson & Johnson; Ansell LTD; Mayer Laboratories; Church & Dwight, Co, Inc., and others

How do hormonal contraceptives work?Hormonal contraceptives prevent ovulation, thicken cervical mucus to block sperm, and thin the uterine lining to prevent implantation. These mechanisms collectively reduce the likelihood of pregnancy.

What are the benefits of using hormonal contraceptives?Benefits include effective pregnancy prevention, regulation of menstrual cycles, reduced menstrual cramps, and decreased risk of ovarian cysts and certain cancers. They can also manage symptoms of conditions like polycystic ovary syndrome (PCOS).

What factors are driving the growth of the hormonal contraceptives market?Factors driving growth include increased awareness of family planning, advancements in contraceptive technologies, a growing focus on women's health, and supportive government policies promoting contraceptive use.

What challenges does the hormonal contraceptives market face?Challenges include potential side effects, cultural and religious opposition, limited access in some regions, and the need for continuous research and development to improve efficacy and reduce adverse effects.

Hormonal Contraceptives MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Hormonal Contraceptives MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbvie Inc.

- Afaxys, Inc.

- Bayer AG

- Pfizer, Inc

- Johnson & Johnson

- Janssen Pharmaceuticals Inc.

- Lupin Pharmaceuticals Inc.

- Pregna International Ltd.

- The Female Health Company

- Teva Pharmaceutical Industries Limited

- Mylan N.V.

- Ansell LTD

- Merck & Co. Inc.

- Church & Dwight, Co, Inc.

- Mayer Laboratories

- Novartis ag

- Agile Therapeutics

- Other Key Players