Global Erectile Dysfunction Drugs Market By Product Type (Branded Drugs (Viagra, Cialis, Zydena, and Others) and Generic Drugs (Sildenafil, Tadalafil, Vardenafil, Alprostadil, and Others)), By Route of Administration (Oral, Injectable, Topical and Intraurethral Suppositories), By Distribution Channel (Hospital Pharmacies and Retail Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 98373

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

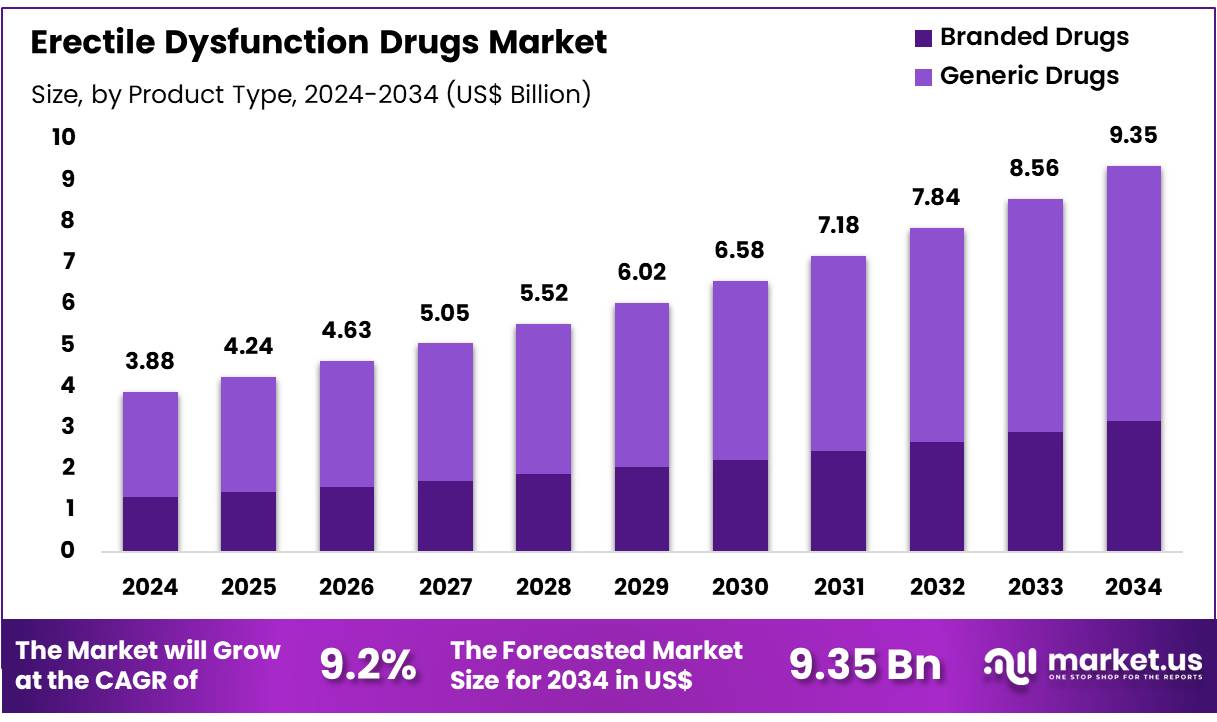

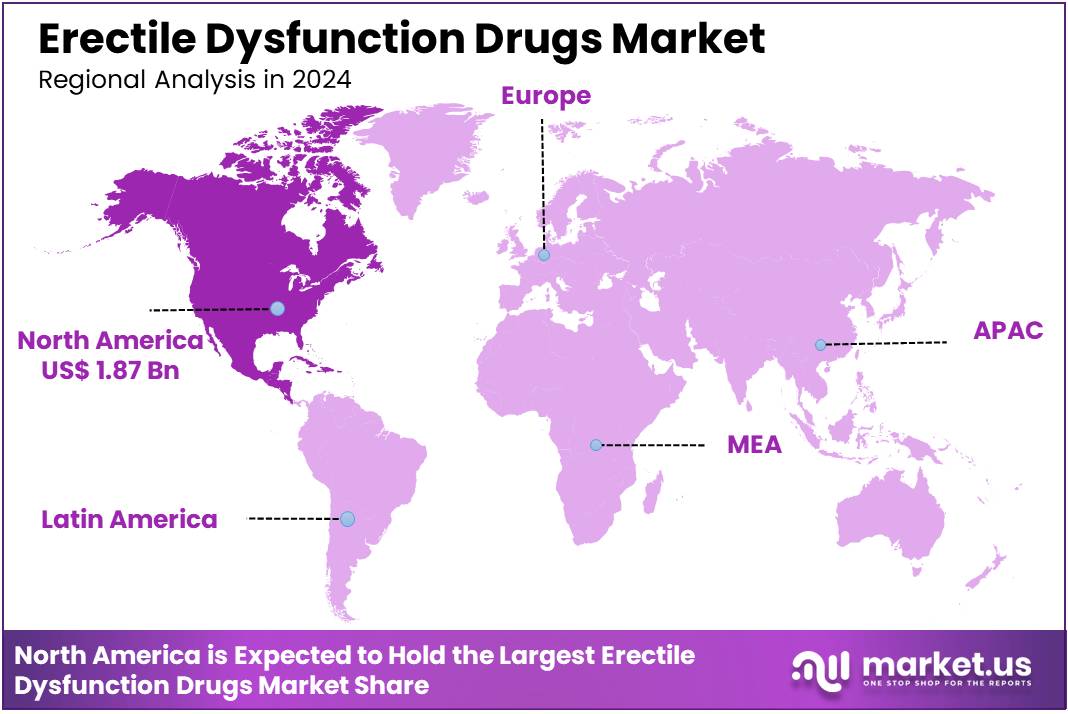

Global Erectile Dysfunction Drugs Market size is expected to be worth around US$ 9.34 billion by 2034 from US$ 3.88 billion in 2024, growing at a CAGR of 9.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.1% share with a revenue of US$ 1.87 Billion.

Erectile Dysfunction Drugs Market, Global Analysis, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 3.0 3.74 3.47 3.55 3.88 9.2% The erectile dysfunction drugs market is witnessing an expansion due to technological advancements and the integration of digital health platforms. Telemedicine and online pharmacies are playing a pivotal role in transforming the accessibility and delivery of ED medications, allowing for discreet and convenient options for patients seeking treatment. These digital avenues are not only enhancing patient engagement and compliance but are also facilitating a broader reach to underserved populations.

Moreover, the market is seeing a gradual shift towards personalized medicine, with research efforts focusing on understanding the genetic and molecular basis of erectile dysfunction. This approach aims at developing targeted therapies that offer improved efficacy and reduced side effects, catering to individual patient needs and conditions.

Key Takeaways

- In 2024, the market for Erectile Dysfunction Drugs generated a revenue of US$ 88 billion, with a CAGR of 9.2%, and is expected to reach US$ 9.34 billion by the year 2034.

- The Product Type segment is divided into Branded Drugs and Generic Drugs with branded Drugs taking the lead in 2024 with a market share of 57.3%

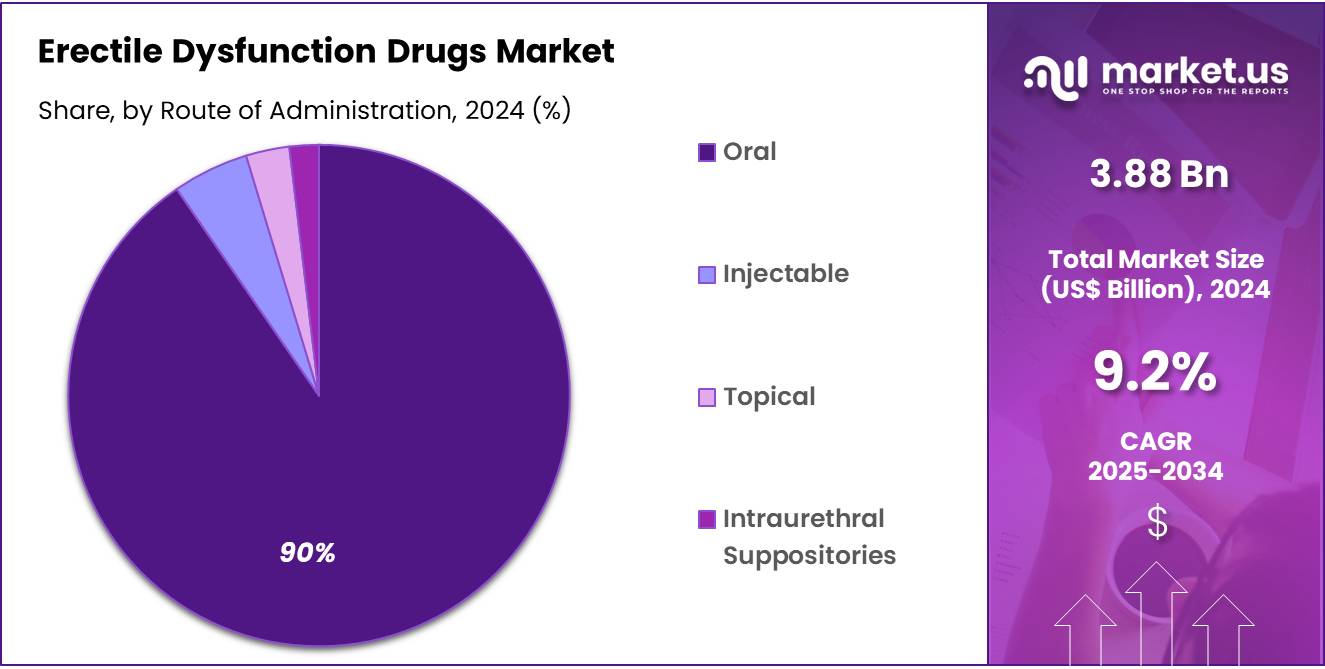

- Considering active Route of Administration, the market is divided into Oral, Injectable, Topical, and Intraurethral Suppositories. Among these, Oral held a significant share of 78.3%.

- Furthermore, concerning the Distribution Channel, the market is segregated into Hospital Pharmacies, Retail Pharmacies and Online Pharmacies. The Hospital Pharmacies stands out as the dominant segment, holding the largest revenue share of 48.3% in the Erectile Dysfunction Drugs market.

- North America led the market by securing a market share of 41.1% in 2024.

Product Type Analysis

The Erectile Dysfunction (ED) drugs market can be segmented by product type into branded drugs and generic drugs. Branded drugs held the major share of 57.3% in the market owing to the fact that generic drugs are typically much cheaper than branded counterparts, making them more accessible to a wider range of patients.

The affordability of generics is a significant driver, especially for those who need long-term or repeated treatments for ED. Generic ED drugs are formulated to have the same active ingredients and therapeutic effects as branded drugs, making them equally effective in treating ED. As a result, patients are more willing to opt for generics without sacrificing treatment quality.

In January 2020, Greenstone, Upjohn’s U.S.-based generics division and a wholly owned subsidiary of Pfizer Inc., partnered with Roman, a cutting-edge digital healthcare clinic for men, to provide Roman members with access to the only FDA-approved authorized generic version of Viagra (sildenafil citrate).

Erectile Dysfunction Drugs Market, Product Type Analysis, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 567.5 598.5 661.4 737.5 896.8 23.8% Route of Administration Analysis

In the Erectile Dysfunction (ED) Drugs Market, the oral segment dominates significantly with 78.3% market share, driven by the widespread use and convenience of oral medications like sildenafil (Viagra), tadalafil (Cialis), and vardenafil (Levitra). Oral administration remains the preferred choice due to its ease of use, effectiveness, and relatively fewer side effects compared to other routes.

The injectable segment, although gaining traction, remains less popular due to its invasive nature, though it offers high efficacy, particularly for individuals who do not respond to oral medications. Topical treatments are emerging, but they are still in the early stages of adoption, primarily used for local effects with minimal systemic impact. Intraurethral suppositories provide a less invasive alternative to injectables, but their usage is limited, as the convenience and non-invasive appeal of oral medications continue to overshadow other routes.

Erectile Dysfunction Drugs Market, Route of Administration, 2020-2024 (US$ Billion)

Formulation 2020 2021 2022 2023 2024 Oral 2.71 3.38 3.14 3.21 3.51 Injectable 0.15 0.18 0.17 0.17 0.19 Topical 0.09 0.11 0.10 0.10 0.11 Intraurethral 0.06 0.07 0.07 0.07 0.07 Distribution Channel Analysis

Hospital pharmacies dominated the market with 48.3% share as these pharmacies are a critical distribution channel, offering direct access to pharmaceuticals within healthcare institutions. These pharmacies cater to both inpatients and outpatients, ensuring medications are easily accessible and managed in a hospital setting.

Due to the high volume of patients and the variety of treatments needed, hospital pharmacies experience steady demand. Retail pharmacies are among the most common and accessible distribution channels for consumers which is the reason for its fast growth.

Erectile Dysfunction Drugs Market, Distribution Channel Analysis, 2020-2024 (US$ Billion)

Distribution Channel 2020 2021 2022 2023 2024 Hospital Pharmacies 1.45 1.80 1.68 1.71 1.87 Retail Pharmacies 1.20 1.49 1.39 1.42 1.55 Online Pharmacies 0.35 0.44 0.41 0.42 0.46

Key Market Segments

Product Type

- Branded Drugs

- Viagra

- Cialis

- Zydena

- Others

- Generic Drugs

- Sildenafil

- Tadalafil

- Vardenafil

- Alprostadil

- Others

Route of Administration

- Oral

- Injectable

- Topical

- Intraurethral Suppositories

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Increasing Prevalence of Erectile Dysfunction

The rising prevalence of erectile dysfunction (ED) is a significant driver of the ED drugs market. Factors such as aging populations, sedentary lifestyles, obesity, diabetes, and cardiovascular diseases contribute to the growing incidence of ED. According to studies, ED affects approximately 30 million men in the U.S. alone, with global numbers increasing due to changing lifestyles and stress. This surge in cases has heightened awareness and diagnosis rates, leading to higher demand for effective treatments.

Pharmaceutical companies are capitalizing on this trend by investing in research and marketing campaigns to address the unmet needs of patients. Additionally, the destigmatization of ED has encouraged more men to seek medical help, further propelling market growth. As ED becomes more recognized as a common health issue, the demand for safe and effective drugs is expected to rise, driving innovation and expansion in the market.

For instance, Erectile dysfunction (ED) is a widespread condition affecting men globally, with prevalence increasing with age. Studies estimate that over 150 million men worldwide experience ED, and this number is projected to rise to 322 million by 2025 due to aging populations and lifestyle changes. In men aged 40-70, the prevalence ranges from 20% to 40%, with severe ED affecting approximately 5-15% of this age group.

Restraints

Side Effects and Contraindications

Despite the growing demand for ED drugs, side effects and contraindications pose significant restraints on market growth. Common side effects of ED medications, such as headaches, flushing, dizziness, and gastrointestinal issues, can deter patients from continued use.

Additionally, certain drugs are contraindicated for individuals with cardiovascular conditions or those taking nitrates, limiting their applicability. These safety concerns have led to cautious prescribing practices and patient hesitancy, impacting market penetration.

Furthermore, the availability of counterfeit drugs with severe side effects has raised safety alarms, eroding trust in some products. Regulatory bodies have imposed strict guidelines to ensure drug safety, but these measures can delay approvals and increase development costs. As a result, manufacturers face challenges in balancing efficacy and safety, which may hinder market expansion and patient adherence to treatment regimens.

Opportunities

New Drug Formulations and Delivery Methods

The ED drugs market presents significant opportunities for innovation through new drug formulations and delivery methods. Traditional oral medications, while effective, have limitations such as delayed onset and side effects. Companies are exploring alternative delivery systems, including sublingual tablets, topical creams, and injectable formulations, to enhance efficacy and patient convenience.

Additionally, advancements in nanotechnology and targeted drug delivery are paving the way for more precise and faster-acting treatments. The development of non-pharmacological solutions, such as wearable devices and shockwave therapy, also offers promising avenues for growth. Furthermore, the increasing focus on personalized medicine allows for tailored treatments based on individual patient profiles, improving outcomes.

These innovations not only address existing limitations but also expand the market by attracting new patient segments. As research and development efforts intensify, the ED drugs market is poised for transformative growth, driven by cutting-edge solutions that improve patient experiences and outcomes.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the erectile dysfunction (ED) drugs market. Economic stability and healthcare spending directly impact market growth; as higher disposable incomes enable greater access to ED treatments. Conversely, economic downturns or inflation can reduce affordability, limiting market expansion.

Geopolitical tensions, trade restrictions, and supply chain disruptions can affect the production and distribution of ED drugs, leading to shortages or price fluctuations. Regulatory changes, such as stricter drug approval processes or intellectual property laws, also shape market dynamics. Additionally, varying healthcare policies and reimbursement frameworks across regions influence drug accessibility and adoption.

Emerging markets, driven by improving healthcare infrastructure and rising awareness, present growth opportunities but are vulnerable to political instability and currency volatility. Overall, the ED drugs market is closely tied to global economic and geopolitical conditions, which can either foster growth or pose challenges for manufacturers and consumers alike.

Latest Trends

Integration of Lifestyle Modifications and Holistic Approaches

The integration of lifestyle modifications and holistic approaches is a growing trend in the erectile dysfunction (ED) drugs market, reflecting a shift toward comprehensive treatment strategies. While pharmaceutical interventions remain central, healthcare providers increasingly emphasize lifestyle changes such as weight management, regular exercise, smoking cessation, and stress reduction to address underlying causes of ED.

These modifications not only enhance the efficacy of ED drugs but also improve overall cardiovascular and metabolic health, which are often linked to ED. Additionally, holistic approaches, including mindfulness, yoga, and dietary supplements, are gaining traction as complementary therapies. This trend aligns with the broader movement toward personalized and preventive healthcare, appealing to patients seeking natural and sustainable solutions.

Pharmaceutical companies are responding by incorporating these insights into marketing campaigns and developing combination therapies that integrate drugs with lifestyle guidance. This holistic focus not only improves patient outcomes but also expands the market by attracting health-conscious consumers.

Regional Analysis

North America is leading the Erectile Dysfunction Drugs Market

North America dominates the ED drugs market, accounting for the largest share due to high prevalence rates, advanced healthcare systems, and widespread awareness. The region benefits from robust R&D activities, leading to innovative drug formulations and strong presence of key pharmaceutical players like Pfizer (Viagra) and Eli Lilly (Cialis). High disposable incomes and favorable reimbursement policies further drive market growth.

However, patent expirations and the rise of generic alternatives pose challenges. In February 2024, Oxford Academic published a data showing that in North America, the average prevalence rate was 20.7%, with a consistent increase in prevalence observed across countries as age and health comorbidities rose.

Europe follows closely, driven by increasing aging populations and growing acceptance of ED treatments. Government healthcare initiatives and rising awareness campaigns contribute to market expansion.

Erectile Dysfunction Drugs Market, Regional Analysis, 2020-2024 (US$ Billion)

Region 2020 2021 2022 2023 2024 North America 1.37 1.59 1.57 1.72 1.87 Europe 0.74 0.96 0.89 0.84 0.92 Asia Pacific 0.63 0.84 0.76 0.70 0.77  Key Regions and Countries

Key Regions and CountriesNorth America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Novartis AG, Eli Lilly and Company, Pfizer Inc., Viatris Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Aurobindo Pharma Limited, Glenmark Pharmaceuticals, Torrent Pharmaceuticals Ltd., Accord Healthcare Inc., CURE Pharmaceutical, Adamed, Aspargo Laboratories, Inc., Dong-A Pharmaceutical Co., Ltd, and Other Key Players.

Eli Lilly and Company is a key player in the Erectile Dysfunction Drugs Market, well-known for its leadership in the development and commercialization of ED drugs. Their flagship product, Cialis (tadalafil), has been one of the top-prescribed medications for treating erectile dysfunction. Pfizer Inc. is a major contender in the Erectile Dysfunction Drugs Market, with its well-known and widely prescribed medication, Viagra (sildenafil), which has been a staple in ED treatment since its approval.

Top Key Players

- Novartis AG

- Eli Lilly and Company

- Pfizer Inc.

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Aurobindo Pharma Limited

- Glenmark Pharmaceuticals

- Torrent Pharmaceuticals Ltd.

- Accord Healthcare Inc.

- CURE Pharmaceutical

- Adamed

- Aspargo Laboratories, Inc.

- Dong-A Pharmaceutical Co., Ltd

- Other Key Players

Recent Developments

- In January 2025, The US Food and Drug Administration (FDA) has lifted a clinical hold on its planned actual use trial (AUT) to support the transition of Cialis (tadalafil) from a prescription to an over-the-counter medication, allowing the AUT to begin and making Cialis the first PDE-5 inhibitor to reach this milestone, according to a statement released by Opella, Sanofi’s Consumer Healthcare business.

- In March 2024, Johnson & Johnson announced that the U.S. Food and Drug Administration (FDA) has approved OPSYNVI – a single-tablet combination of macitentan, an endothelin receptor antagonist (ERA), and tadalafil, a phosphodiesterase 5 (PDE5) inhibitor – for the chronic treatment of adults with pulmonary arterial hypertension (PAH, World Health Organization [WHO] Group I) and WHO functional class (FC) II-III.1 OPSYNVI® may be used in patients with PAH who are treatment-naïve or who are already on an ERA, PDE5 inhibitor or both.

- In July 2024, Aspargo Labs, Inc., a specialty pharmaceutical and MedTech company focused on transforming drug delivery with innovative oral sprays, today announced the release of a Phase 1 study demonstrating that ASP-001, an investigative sildenafil oral spray in development for erectile dysfunction (ED), achieves absorption starting within five minutes, twice as fast as traditional sildenafil tablets.

Report Scope

Report Features Description Market Value (2024) US$ 3.88 billion Forecast Revenue (2034) US$ 9.34 billion CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Branded Drugs (Viagra, Cialis, Zydena, and Others ) and Generic Drugs (Sildenafil, Tadalafil, Vardenafil, Alprostadil, and Others)), By Route of Administration (Oral, Injectable, Topical and Intraurethral Suppositories), By Distribution Channel (Hospital Pharmacies and Retail Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novartis AG, Eli Lilly and Company, Pfizer Inc., Viatris Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Aurobindo Pharma Limited, Glenmark Pharmaceuticals, Torrent Pharmaceuticals Ltd., Accord Healthcare Inc., CURE Pharmaceutical, Adamed, Aspargo Laboratories, Inc., Dong-A Pharmaceutical Co., Ltd, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Erectile Dysfunction Drugs MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Erectile Dysfunction Drugs MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Novartis AG

- Eli Lilly and Company

- Pfizer Inc.

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Aurobindo Pharma Limited

- Glenmark Pharmaceuticals

- Torrent Pharmaceuticals Ltd.

- Accord Healthcare Inc.

- CURE Pharmaceutical

- Adamed

- Aspargo Laboratories, Inc.

- Dong-A Pharmaceutical Co., Ltd

- Other Key Players