Global Medical Fiber Optics Market By Type (Single Mode Optical Fiber, and Fiber Bundles), By Application (Endoscopic Imaging, Biomedical Sensing, and Other Applications), By End-Users, By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 21388

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

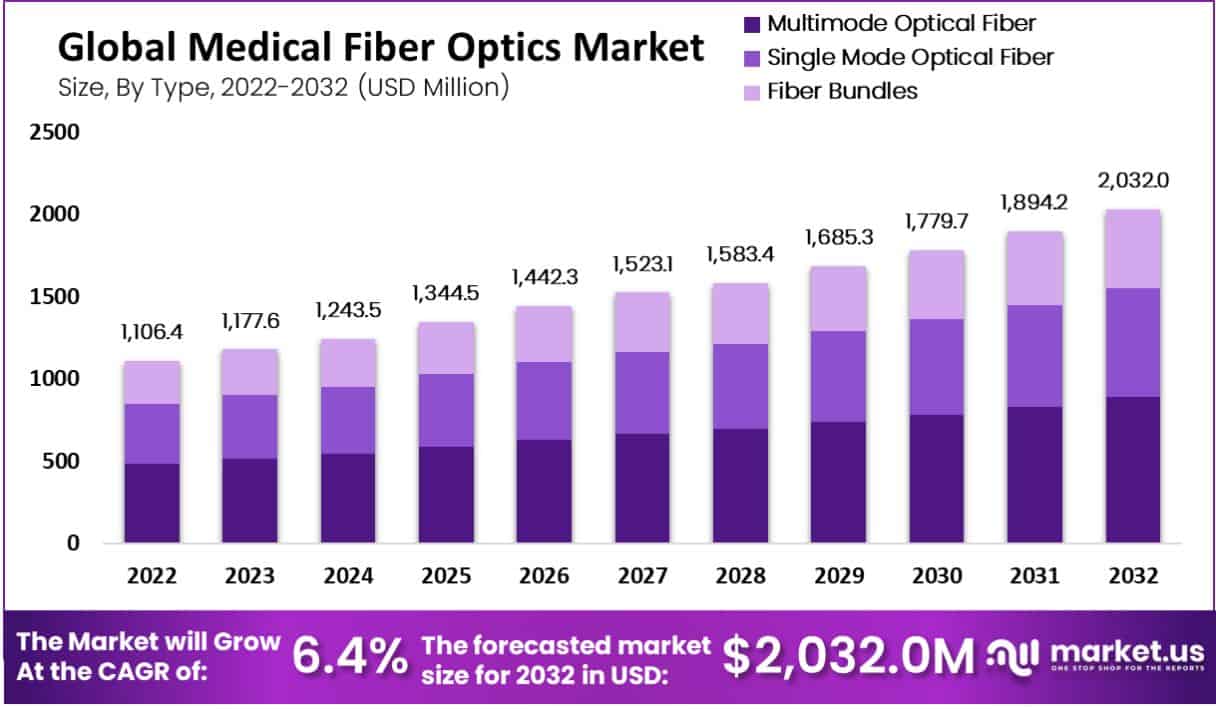

In 2022, the Global Medical Fiber Optics Market Size was valued at USD 1,106.4 Million. This market is estimated to reach USD 2032 Million the highest CAGR of 6.4% Between 2023 and 2032.

Optic fibers are transparent and flexible fibers that are made from plastic or glass and they are very smaller in diameter that they are slightly bigger than the diameter of human hair. Therefore, optic fibers are used in many applications for transmission and communication.

Similarly, optic fibers are used in the medical and healthcare sectors for various applications like biomedical sensing, endoscopic imaging, laser signal delivery, illumination, and many other applications. Optic fibers are flexible in handling and transmits data or light faster than other modes therefore they are used in high amount across the healthcare sector for different purposes.

The optic fibers allow the respective professionals to inspect and monitor all the inside activities of the body and help to diagnose the reason or cause of the diseases. Also, optic fibers allow the medical practitioner to perform the surgeries with minimal invasion. This helps the patient to heal quickly from minimal invasion through the cut. Due to this, optic fibers are used in many surgeries and inspections in the healthcare industry.

Key Takeaways

- Market Growth: The global medical fiber optics market reached USD 1,106.4 million in 2022, projected to grow at 6.4% CAGR by 2032.

- Minimally Invasive Surgery: Optical fibers enable complex surgeries without extensive cuts, speeding patient recovery.

- Regulatory Hurdles: Stringent regulations and approval processes increase costs for optic fiber-based medical equipment.

- Multimode Domination: Multimode optical fibers lead the market with a 43.8% revenue share due to cost-effectiveness.

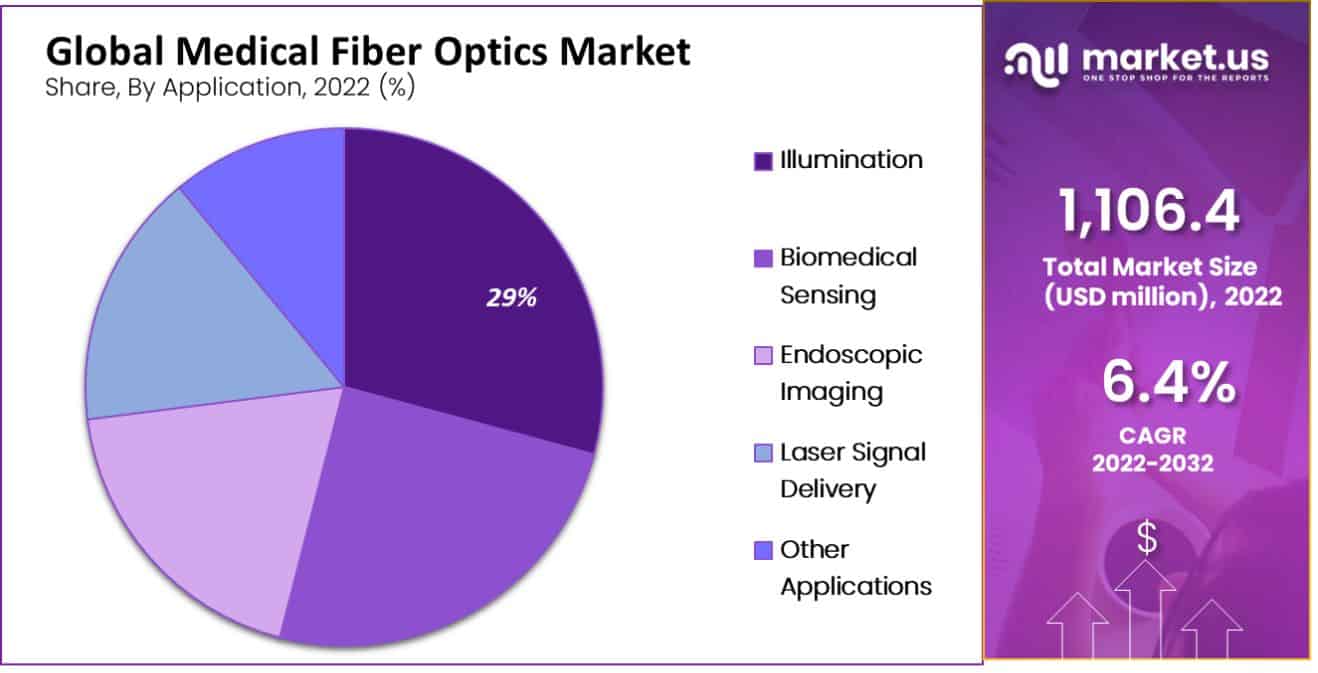

- Illumination Dominance: Illumination claims a 29.2% revenue share, widely used in surgical procedures and therapies.

- Hospital Usage: Hospitals hold a major share of 33.2% in the end-user segment due to various medical applications.

- Research Investments: Increased research investment in fiber optics for healthcare applications opens lucrative opportunities.

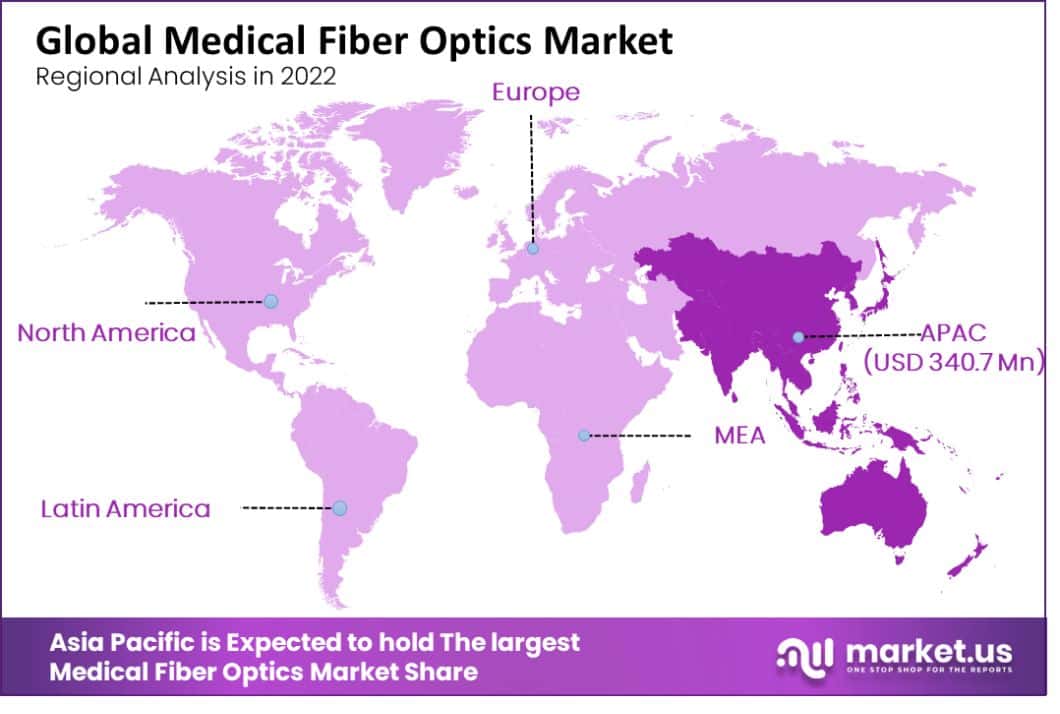

- Asia Pacific Dominance: Asia Pacific leads with a 30.8% revenue share, driven by improving healthcare infrastructure and government support.

Driving Factors

The benefits of Optic Fibers like Minimally Invasive Surgeries are Driving the Growth of the Global Medical Fiber Optics Market.

Rising awareness of optical fibers among individuals in reference to minimally invasive surgeries is primarily driving the growth of the global medical fiber optics market. Optic fibers help doctors to perform many complex surgeries without applying cuts on the individual’s body.

Doctors can perform the surgeries with minimal invasion through any entry point in the body. This helps the individual or patient to recover faster and also terminates the need for unnecessary cuts on the body. Optical fibers are used in many applications in the healthcare sector through various equipment like optic lines. Miniature cameras, and sensors.

Moreover, optic fiber-based lasers are widely used in dentistry and cosmetology for various applications. The research is going on biomedical sensors to improve their efficiency in application. This is expected to boost the growth of the global medical fiber optics market in the upcoming period.

Restraining Factors

The high Cost of Optic Fibers and Stringent Regulations from Regulatory Authorities are Restricting the Growth of the Global Medical Fiber Optics Market.

Optic fibers are used in the healthcare sector for their wide applications and benefits. However, the high cost of optic fibers-based equipment and instruments used in the medical and healthcare sector is restricting the growth of the global medical fiber optics market. Due to its high price, optic fibers based equipment is used in only limited applications in the medical sector.

Also, optic fiber-based instruments and equipment require approval from regulatory authorities to be sold in the market. The stringent rules and regulations from the regulatory authorities are obstructing the growth of this market. This as a result has increased the price for medical optic fiber-based equipment.

Type Analysis

The Multimode Optical Fiber Dominates the Type Segment by Holding Major Revenue Share in Account.

Based on Type, the global medical fiber optics market is classified into single-mode optical fiber, multimode optical fiber, and fiber bundles. From these types, the multimode optical fiber leads the segment with a major share of 43.8% revenue share in the account. This domination of the multimode optical fiber in the type segment is due to its wide range of applications in illumination and lighting solutions in surgical procedures.

The multimode optical fibers are used in the transmission of signals and light waves over a short distance. The multimode optical fibers cost less than the others in competition and they are also comparatively easy to manufacture. Therefore, many professionals choose multimode optical fiber over others in the competition. These all key factors are driving the growth of multimode optical fiber in the type segment of the global medical fiber optics market.

Application Analysis

High Usage of Fiber Optics in Illumination Helps the Illumination to Dominate the Segment in Global Medical Fiber Optics Market.

The global medical fiber optics market is classified into laser signal delivery, endoscopic imaging, illumination, biomedical sensing, and other applications based on the application. Out of these applications, illumination leads the application segment by holding a major revenue share of 29.2% in the global medical fiber optics market.

The growth of illumination is attributed to the increasing adoption of fiber optics in the medical sector for the purpose of guiding light in many surgical procedures and endoscopies. Also, illumination is used in high-power light healthcare therapies like light therapy, phototherapy, and many tattoo & hair removal procedures. These all key factors are propelling the growth of the illumination in global medical fiber optics market.

After illumination, biomedical sensing is anticipated to account for the largest revenue share during the forecast period. The high usage of fiber optics in sensors of wearables and other medical devices is driving the growth of biomedical sensing in the application segment of the global medical fiber optics market.

End-User Analysis

Hospitals lead the End-User Segment by Holding the Major Revenue Share of 33.2% Accounts.

Based on end-user, the global medical fiber optics market is classified into hospitals, ambulatory surgical centers, diagnostic laboratories, and other end-users. Among these end-users, the hospitals hold a major revenue share of 33.2% in the global medical fiber optics market in the end-user segment.

This growth of hospitals in the end-user segment is attributed to the wide applications of fiber optics in hospitals. Fiber optics are used in hospitals for minimally invasive surgeries, endoscopies, and many such applications. These factors are driving the growth of hospitals in the end-user segment of the global medical fiber optics market.

Key Market Segments

By Type

- Single Mode Optical Fiber

- Multimode Optical Fiber

- Fiber Bundles

By Application

- Laser Signal Delivery

- Endoscopic Imaging

- Biomedical Sensing

- Illumination

- Other Applications

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Other End-Users

Opportunity

High Investments in Research and the Benefits of Fiber Optics in Cancer Detection are Expected to Create Many Lucrative Opportunities During the Forecast Period.

Many key players in the global medical fiber optics market are focusing on the research and development of advanced technology for fiber optics-based medical equipment and instruments. Fiber optics has wide usage in the medical sector. Therefore, many companies are investing in the development of new products for medical sector that are based on fiber optics.

This is expected to create many lucrative opportunities in the global medical fiber optics market over the forecast period. Moreover, fiber optics are said to play an important role in the early detection of cancer in individuals. Most of the cancer types are unable to diagnose in the early stages of infection due to a lack of symptoms. But by the use of fiber optics, physicians can see the growth of infection inside the body. It can help to diagnose cancer in the early stages. This is expected to create many lucrative opportunities over the forecast period.

Trends

Use of Endoscopic Imaging is Expected to Propel the Growth of the Market in the Upcoming Period

The ongoing trend of using fiber optics for endoscopic imaging is expected to fuel the growth of the global medical fiber optics market during the forecast period. Endoscopic imaging involves the non-surgical examination of the patient’s internal part of the body by using fiber optics. The physicians insert the flexible tube inside the patient’s body through various entry points.

These flexible tubes carry optic fibers which have integrated camera and illuminating optic fibers for illumination. It helps the physician to examine the internal body properly and diagnose the reason accurately. This is expected to boost the growth of endoscopic imaging in the global medical fiber optics market over the forecast period.

Regional Analysis

Asia Pacific Dominates the Global Medical Fiber Optics Market by Holding Major Revenue Share in Account.

Asia Pacific leads the global medical fiber optics market by holding a major revenue share of 30.8%. This growth of the Asia Pacific region is attributed to the improving healthcare sector and supporting government initiatives within the region. Many key players in the Asia Pacific region are investing in the research and development of fiber optics-based applications for the healthcare sector. This is also supporting the growth of the medical fiber optics market within the Asia Pacific region.

After Asia Pacific, the North American region is also growing significantly in the global medical fiber optics market. Developed healthcare infrastructure in the North American region and the presence of many key players in the market are primarily driving the growth of the global medical fiber optics market. Increasing research and development activities from the key players in the North American region are anticipated to boost the growth of the North American region during the forecast period.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

The global medical fiber optics market is fragmented into many companies offering fiber optics for medical use. However, key players in the market are adopting various strategies like mergers, acquisitions, collaboration, and partnerships to expand their business share in the market across various regions and strengthen the position of the company in the global market.

Some of the key players in the global medical fiber optics market are Integra Lifesciences Corporation, Fiberoptics Technology Incorporated, AFL, Coherent Inc., Timbercon Inc., Gulf Fiberoptics, Smiths Interconnect, Newport Corporation, LEONI AG, Schott AG, Boston Scientific Corporation, and other key players.

Market Key Players

- Integra Lifesciences Corporation

- Fiberoptics Technology Incorporated

- AFL

- Coherent Inc.

- Timbercon Inc.

- Gulf Fiberoptics

- Newport Corporation

- Smiths Interconnect

- LEONI AG

- Schott AG

- Boston Scientific Corporation

- Other Key Players

Recent Developments

- In April 2022, Smiths Interconnect announced the launch of their HyperGrip disposable connectors. It helps to reduce the cost of single-use medical devices and they are also good options for the cycle receptacle.

- In April 2022, Honeywell expanded their Spectra Medical Grade Biofiber portfolio with a blue-hued fiber that helps to visually distinguish between many sutures in complex surgeries.

Report Scope:

Report Features Description Market Value (2022) USD 1,106.4 Mn Forecast Revenue (2032) USD 2,032 Mn CAGR (2023-2032) 6.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type – Single Mode Optical Fiber, Multimode Optical Fiber, and Fiber Bundles; By Application – Endoscopic Imaging, Laser Signal Delivery, Illumination, Biomedical Sensing, and Other Applications; By End-Users – Hospitals, Ambulatory Surgical Centers, Diagnostic Laboratories, And Other End-Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Integra Lifesciences Corporation, Fiberoptics Technology Incorporated, AFL, Coherent Inc., Timbercon Inc., Gulf Fiberoptics, Smiths Interconnect, Newport Corporation, LEONI AG, Schott AG, Boston Scientific Corporation, and other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the value of the global Medical Fiber Optics Market?In 2022, the global Medical Fiber Optics Market was valued at USD 1.106 billion.

What will be the market size for Medical Fiber Optics Market in 2032?In 2032, the Medical Fiber Optics Market will reach USD 2.032 billion.

What CAGR is projected for the Medical Fiber Optics Market?The Medical Fiber Optics Market is expected to grow at 9.7% CAGR (2023-2032).

List the segments encompassed in this report on the Medical Fiber Optics Market?Market.US has segmented the Medical Fiber Optics Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Type, market has been segmented into Single Mode Optical Fiber, Multimode Optical Fiber and Fiber Bundles. By Application, the market has been further divided into Laser Signal Delivery, Endoscopic Imaging, Biomedical Sensing, Illumination and Other Applications.

Which segment dominate the Medical Fiber Optics industry?With respect to the Medical Fiber Optics industry, vendors can expect to leverage greater prospective business opportunities through the Multimode Optical Fiber segment, as this dominate this industry.

Name the major industry players in the Medical Fiber Optics Market.Integra Lifesciences Corporation, Fiberoptics Technology Incorporated, AFL, Coherent Inc., Timbercon Inc., Gulf Fiberoptics and Other Key Players are the main vendors in this market.

Medical Fiber Optics MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Medical Fiber Optics MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Integra Lifesciences Corporation

- Fiberoptics Technology Incorporated

- AFL

- Coherent Inc.

- Timbercon Inc.

- Gulf Fiberoptics

- Newport Corporation

- Smiths Interconnect

- LEONI AG

- Schott AG

- Boston Scientific Corporation

- Other Key Players