Global Stem Cell Manufacturing Market By Type (Products and Services), By Application (Drug Discovery & Development, Stem Cell Therapy, and Stem Cell Banking), By End-user (Pharmaceutical & Biotechnology Companies & CRO, Cell Banks & Tissue Banks, and Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 138158

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

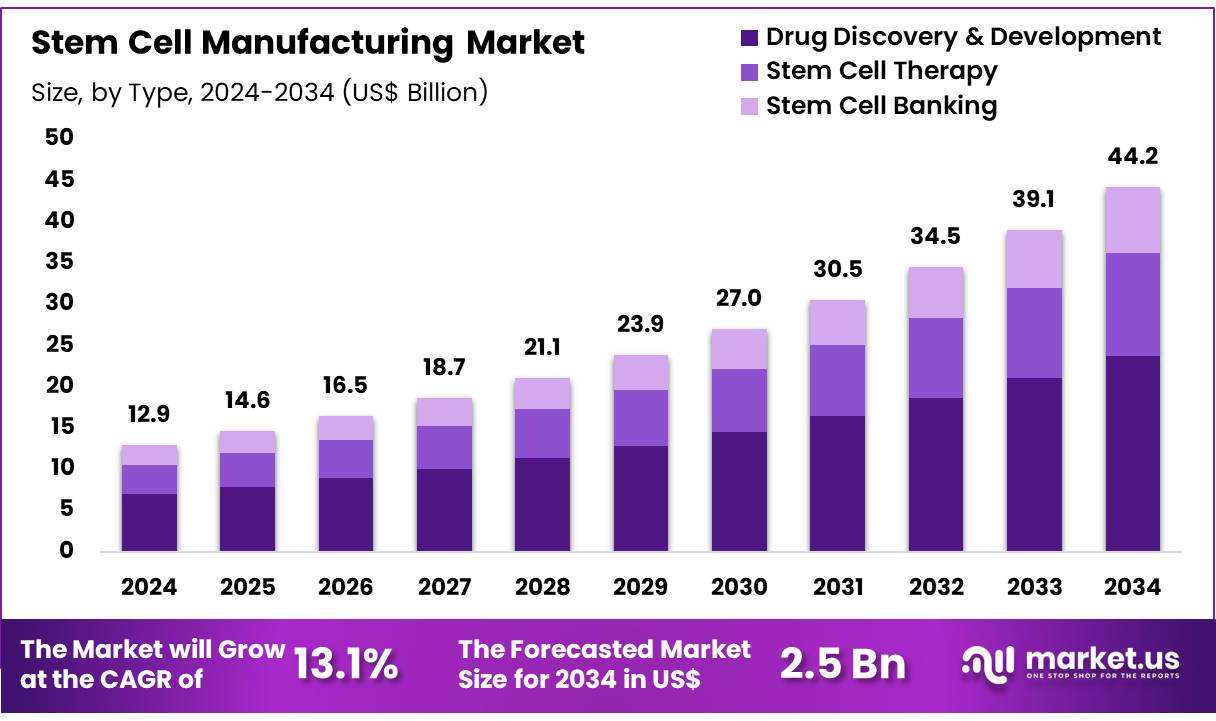

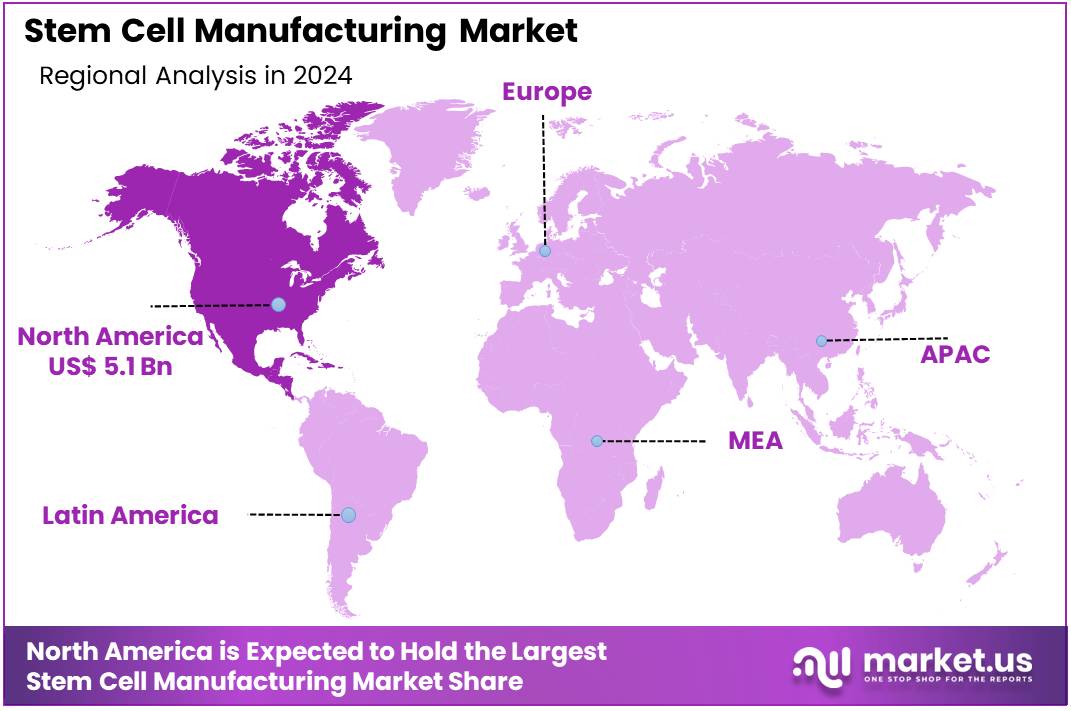

Global Stem Cell Manufacturing Market size is expected to be worth around US$ 44.2 Billion by 2034 from US$ 12.9 Billion in 2024, growing at a CAGR of 13.1% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 39.5% share with a revenue of US$ 5.1 Billion.

Rising demand for advanced cell-based therapies is driving the growth of the stem cell manufacturing market. Stem cells are increasingly used in regenerative medicine, drug development, and tissue engineering due to their unique ability to regenerate damaged tissues and organs. These applications offer significant potential in treating a variety of diseases, including neurodegenerative disorders, heart disease, and diabetes.

The growing interest in personalized medicine also fuels the demand for stem cell-based treatments tailored to individual patients. In January 2024, Pluri, an Israel-based developer of cell therapies, launched its Contract Development and Manufacturing Organization (CDMO) operations to assist other companies in the production of stem cell therapies. This move highlights the expanding role of CDMOs in providing essential manufacturing capabilities for stem cell-based products.

Recent trends show an increased focus on optimizing stem cell culture systems and improving scalability to meet the growing demand for these therapies. Additionally, advancements in gene editing technologies, such as CRISPR, offer opportunities to enhance stem cell therapies and address genetic disorders. As regulatory frameworks evolve and manufacturing technologies improve, the market for stem cell manufacturing is poised for continued growth, providing innovative solutions for a wide range of medical applications.

Key Takeaways

- In 2024, the market for stem cell manufacturing generated a revenue of US$ 12.9 billion, with a CAGR of 13.1%, and is expected to reach US$ 44.2 billion by the year 2034.

- The type segment is divided into products and services, with services taking the lead in 2024 with a market share of 64.5%.

- Considering application, the market is divided into drug discovery & development, stem cell therapy, and stem cell banking. Among these, drug discovery & development held a significant share of 53.8%.

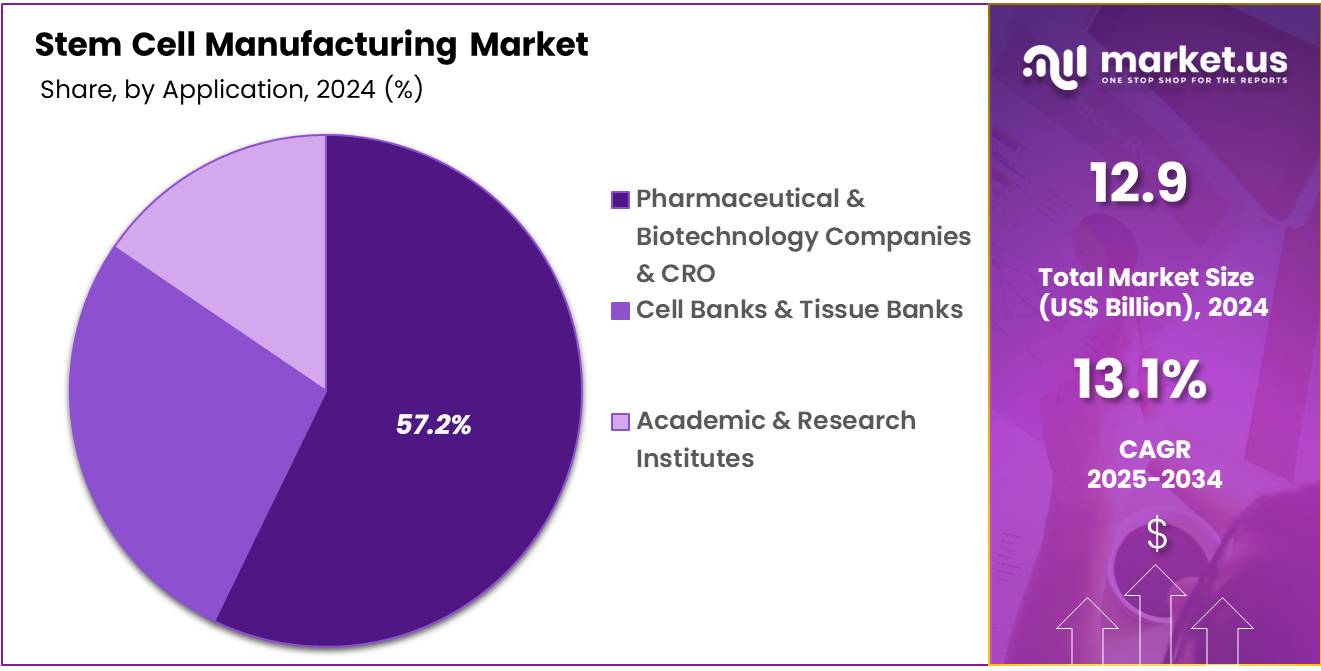

- Furthermore, concerning the end-user segment, the market is segregated into pharmaceutical & biotechnology companies & CRO, cell banks & tissue banks, and academic & research institutes. The pharmaceutical & biotechnology companies sector stands out as the dominant player, holding the largest revenue share of 57.2% in the stem cell manufacturing market.

- North America led the market by securing a market share of 39.5% in 2024.

Type Analysis

The services segment led in 2024, claiming a market share of 64.5% owing to the increasing demand for specialized services such as cell culture, cryopreservation, and quality control in stem cell production. These services are anticipated to become essential as stem cell therapies continue to advance and require stringent protocols to ensure safety, consistency, and scalability.

The increasing number of research and clinical trials focused on stem cell therapies is projected to fuel demand for specialized manufacturing services. Moreover, the complexity of stem cell production processes, which involves handling different stem cell types and maintaining sterile environments, is likely to drive the growth of outsourcing services to expert service providers.

Additionally, as the stem cell industry moves toward commercialization, the need for professional services related to GMP (Good Manufacturing Practice) and regulatory compliance is expected to further contribute to this segment’s expansion.

Application Analysis

The drug discovery & development held a significant share of 53.8% due to as stem cells offer valuable insights into disease modeling, drug screening, and therapeutic discovery. The ability to use stem cells to generate human-like models for testing drug efficacy and toxicity is expected to enhance pharmaceutical research and development processes. Stem cells are anticipated to become increasingly integral to personalized medicine, as they can be used to study disease mechanisms specific to individual patients or genetic conditions.

The demand for stem cells in drug discovery is likely to grow as companies seek more accurate and predictive in vitro models that can reduce the time and cost of clinical trials. Additionally, as regulatory agencies place more emphasis on human-relevant data, the use of stem cells in drug discovery is expected to expand, fueling the overall growth of this segment.

End-user Analysis

The pharmaceutical & biotechnology companies segment had a tremendous growth rate, with a revenue share of 57.2% as these industries increasingly adopt stem cells in drug discovery, therapeutic development, and tissue engineering. The pharmaceutical and biotechnology sectors are likely to drive the demand for stem cell manufacturing, particularly for the development of new treatments in regenerative medicine, cancer therapies, and genetic disorders.

As companies seek to integrate stem cells into their R&D pipelines, the need for reliable stem cell production systems, including cell banks and tissue banks, is anticipated to increase. Additionally, the growing interest in stem cell-based therapies, which offer the potential to repair or replace damaged tissues, is expected to further propel the demand for stem cell manufacturing.

As regulatory guidelines evolve and the commercial viability of stem cell therapies improves, pharmaceutical and biotechnology companies are projected to continue leading the way in stem cell-based product development.

Key Market Segments

By Type

- Products

- Services

By Application

- Drug Discovery & Development

- Stem Cell Therapy

- Stem Cell Banking

By End-user

- Pharmaceutical & Biotechnology Companies & CRO

- Cell Banks & Tissue Banks

- Academic & Research Institutes

Drivers

Growing Prevalence of Cancer Driving the Stem Cell Manufacturing Market

Growing prevalence of cancer is anticipated to drive the stem cell manufacturing market significantly. According to the National Institute of Health, approximately 2,001,140 new cancer cases are expected in the United States in 2024, with 611,720 projected deaths. This rising burden of cancer creates an urgent need for innovative treatment options, pushing demand for stem cell-based therapies.

Stem cell technologies offer promising solutions for regenerating damaged tissues and improving patient outcomes in oncology. Increasing research into cancer immunotherapy enhances the adoption of stem cell applications in advanced therapeutic approaches. Pharmaceutical companies are prioritizing stem cell technologies for their ability to target cancer at the cellular level.

Expanding clinical trials for stem cell-based cancer therapies further reinforces their potential in addressing unmet medical needs. The market also benefits from the growing interest in precision medicine, which often incorporates stem cell-based treatments for tailored interventions. Government initiatives and funding for cancer research accelerate advancements in stem cell applications.

Collaboration between research institutions and industry players fosters innovation in stem cell production technologies. The need for scalable and efficient stem cell manufacturing processes drives investments in bioreactor technologies and automation. These trends underscore the integral role of stem cells in transforming cancer care and advancing the global stem cell manufacturing market.

Restraints

High Costs Are Restraining the Stem Cell Manufacturing Market

High costs associated with stem cell manufacturing are restraining the market. Producing stem cells involves expensive technologies, specialized equipment, and highly skilled personnel, which increase the overall cost of therapy. Manufacturing processes, particularly for personalized treatments, demand precise protocols and stringent quality control measures, driving up operational expenses.

The complexity of scaling production for commercial use adds further financial burdens, particularly for small and mid-sized companies. Regulatory hurdles, including rigorous testing and approval requirements, also contribute to prolonged timelines and increased costs. Limited insurance coverage for stem cell-based treatments restricts patient access, affecting market penetration.

In developing regions, where healthcare budgets are constrained, affordability becomes a significant barrier. Addressing these challenges requires innovation in cost-effective manufacturing processes and supportive policies to improve accessibility and affordability.

Opportunities

High Occurrence of Chronic Ailments as an Opportunity for the Stem Cell Manufacturing Market

High occurrence of chronic ailments presents a significant opportunity for the stem cell manufacturing market. The Centers for Disease Control and Prevention estimates that 129 million individuals in the United States will live with one or more chronic diseases in 2024. Conditions such as diabetes, hypertension, and cancer often result in tissue and cell damage, creating a demand for regenerative therapies.

Stem cells offer a unique potential to repair and replace damaged tissues, improving patient outcomes and quality of life. Pharmaceutical and biotech companies increasingly focus on developing stem cell-based solutions to address the complexities of chronic diseases. Advancements in cell therapy technologies support the scalability and efficacy of stem cell applications for widespread use.

Increasing adoption of personalized medicine encourages the integration of stem cell therapies in chronic disease management. Rising healthcare investments and government support further bolster research and development in stem cell technologies. Collaborative efforts among academia, industry, and regulatory bodies accelerate innovations in the stem cell space.

Expanding clinical trials for stem cell therapies targeting chronic conditions strengthen the pipeline of effective treatments. These trends position the stem cell manufacturing market to play a transformative role in managing chronic ailments and improving global healthcare outcomes.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the stem cell manufacturing market. On the positive side, rising global investments in biotechnology and regenerative medicine contribute to the expansion of stem cell-related research and production. Increasing demand for innovative therapies in various healthcare sectors, including personalized medicine, further accelerates market growth.

However, economic recessions or budget cuts may limit funding for research and slow the adoption of advanced manufacturing technologies. Geopolitical factors, such as regulatory differences between countries and potential trade barriers, can disrupt the supply of raw materials necessary for stem cell production.

Ethical concerns and regulatory hurdles also present challenges in certain regions, particularly regarding the use of human stem cells. Despite these obstacles, advancements in manufacturing technologies, coupled with the growing recognition of the potential of stem cells for treating a wide range of diseases, ensure continued growth in the sector.

Latest Trends

Increasing Popularity of Stem Cell Therapy Driving the Stem Cell Manufacturing Market:

Rising popularity of stem cell therapy is a key factor driving the growth of the stem cell manufacturing market. High interest in regenerative medicine and personalized healthcare treatments is expected to increase the demand for stem cell-based therapies. These therapies are likely to become more widely adopted as they prove to be effective in addressing various conditions, such as organ damage and congenital abnormalities.

In September 2022, an article on PubMed highlighted that stem cell therapy, supported by both in vitro and in vivo studies, has demonstrated safety and efficacy in treating a wide range of conditions. As stem cell treatments continue to advance, they are anticipated to revolutionize healthcare, driving the need for efficient and scalable manufacturing solutions. This trend is expected to expand the market for stem cell-based therapies and the related manufacturing infrastructure.

Regional Analysis

North America is leading the Stem cell manufacturing Market

North America dominated the market with the highest revenue share of 39.5% owing to advancements in regenerative medicine, increasing demand for stem cell-based therapies, and growing investments in biotechnology. As the region continues to prioritize the development of novel therapies for chronic conditions, stem cells are increasingly being recognized for their potential to treat a variety of diseases, including heart failure, diabetes, and neurological disorders.

In January 2024, a study published in the Journal of the American Heart Association found that heart failure has become increasingly prevalent, with a global total of 56.19 million cases. This growing burden of chronic cardiovascular diseases has spurred interest in stem cell therapies for heart regeneration and tissue repair.

Additionally, the rise in government funding and private sector investments has fueled innovation in stem cell research and manufacturing. Companies in North America are focusing on improving manufacturing processes and scaling up production to meet the growing demand for stem cell-based treatments. The increasing emphasis on personalized medicine, combined with advancements in cell culture technologies and regulatory support, is expected to continue driving growth in the stem cell manufacturing market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to a rising demand for advanced healthcare treatments, increasing investments in biotechnology, and the expansion of stem cell research initiatives. Countries like China, Japan, and South Korea are expected to see significant advancements in stem cell-based therapies, especially as the region’s healthcare systems improve and focus on more personalized and regenerative treatments.

The increasing prevalence of chronic diseases, such as cardiovascular disorders and diabetes, is likely to drive the demand for stem cell therapies to address unmet medical needs. In December 2023, Fujifilm announced a US$ 200 million investment to expand its two subsidiaries, aimed at enhancing its global capabilities in cell therapy contract development and manufacturing.

This investment highlights the growing interest in stem cell manufacturing and the increasing recognition of its potential in Asia Pacific. The market is expected to benefit from the region’s increasing focus on biopharmaceuticals, improved healthcare infrastructure, and government support for research and development. As the market continues to evolve, the demand for efficient and scalable stem cell manufacturing solutions is anticipated to grow substantially.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the stem cell manufacturing market focus on advancing automated production systems and scalable technologies to meet the growing demand for regenerative therapies and research. Companies enhance their capabilities by investing in R&D to optimize cell expansion and preservation techniques.

Collaborations with research institutions and biopharmaceutical firms help drive innovation and expand applications in disease treatment and drug discovery. Geographic expansion into regions with rising investments in biotechnology strengthens market reach. Many players also prioritize compliance with stringent regulatory standards to ensure product quality and reliability.

Lonza Group is a prominent player in this market, offering comprehensive solutions for stem cell production, including bioreactors and process optimization tools. The company leverages its expertise in cell and gene therapy to support scalable and efficient manufacturing. Lonza’s global presence and commitment to innovation make it a trusted partner in the field of regenerative medicine.

Top Key Players

- REPROCELL

- PromoCell GmbH

- Merck KGaA

- Lonza

- Cellular Engineering Technologies

- Bio-Techne

- BioCentriq

- ATCC

- AcceGen

Recent Developments

- In July 2024, BioCentriq strengthened its collaboration with Pluristyx, a leading developer of pluripotent stem cell products, to gain access to Pluristyx’s proprietary iPSC lines. These lines are designed to reduce entry barriers, facilitating seamless translation to clinical applications and ensuring an efficient path for the commercialization of next-generation iPSC-derived therapeutic treatments.

- In May 2024, REPROCELL announced the opening of a GMP manufacturing facility for human mesenchymal stem cells (hMSC) and human induced pluripotent stem cells (hiPSC). This facility aims to revolutionize stem cell therapy by leveraging closed-system technology.

Report Scope

Report Features Description Market Value (2024) US$ 12.9 billion Forecast Revenue (2034) US$ 44.2 billion CAGR (2025-2034) 13.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Products and Services), By Application (Drug Discovery & Development, Stem Cell Therapy, and Stem Cell Banking), By End-user (Pharmaceutical & Biotechnology Companies & CRO, Cell Banks & Tissue Banks, and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape REPROCELL, PromoCell GmbH, Merck KGaA, Lonza, Cellular Engineering Technologies, Bio-Techne, BioCentriq , ATCC, and AcceGen. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stem Cell Manufacturing MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Stem Cell Manufacturing MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- REPROCELL

- PromoCell GmbH

- Merck KGaA

- Lonza

- Cellular Engineering Technologies

- Bio-Techne

- BioCentriq

- ATCC

- AcceGen