Global Soybean Derivatives Market Size, Share, And Industry Analysis Report By Type (Soy Oil, Soy Milk, Soy Protein, Others), By Nature (Conventional, Organic), By Form (Liquid, Solid), By Application (Food and Beverage, Animal Feed, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175818

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

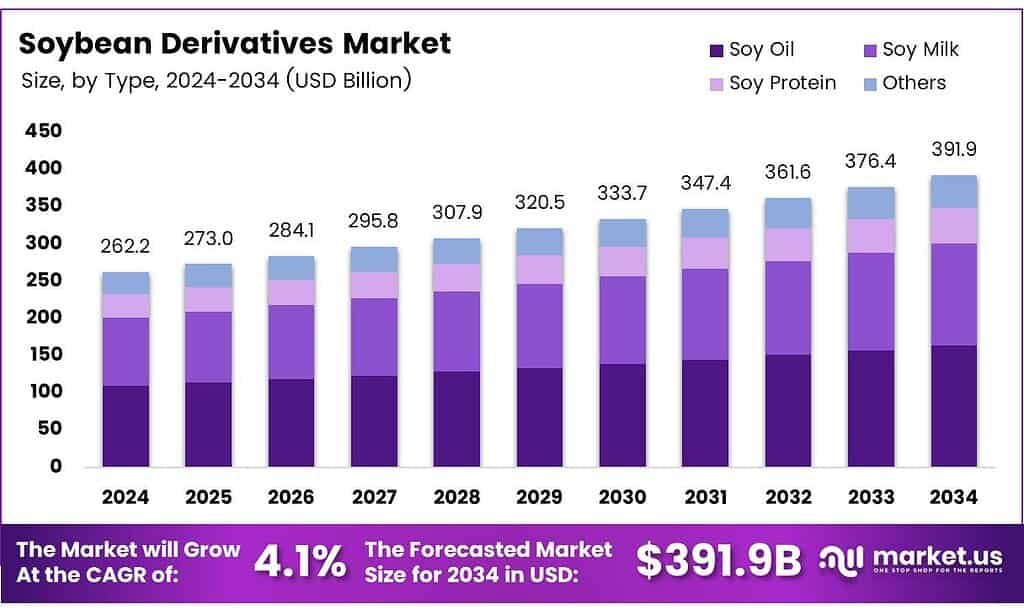

The Global Soybean Derivatives Market size is expected to be worth around USD 391.9 billion by 2034, from USD 262.2 billion in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034.

The Soybean Derivatives Market includes products such as soybean oil, soy meal, soy protein concentrates, lecithin, and bio-based industrial inputs used across food, feed, cosmetics, pharmaceuticals, and renewable energy applications. It reflects rising demand for high-protein ingredients, plant-based nutrition, sustainable oils, and versatile industrial derivatives supporting global manufacturing chains.

The soybean derivatives market continues to expand as consumers shift toward plant-based ingredients and high-protein feed solutions. Manufacturers increasingly favor soy derivatives for their nutritional density and cost efficiency. Meanwhile, broader supply chains rely on soy-based raw materials to stabilize production costs and improve sustainability outcomes across food, feed, and industrial markets worldwide.

- Nutritional strengths and global trade patterns keep boosting demand. Soybeans contain 36–40% protein, making them one of the richest plant-based proteins and a strong fit for wellness-focused food, supplements, and plant-based products. Soybean oil is the world’s second-most used edible oil, contributing 34% of the palm oil market value and reaching USD 19 billion in export earnings, with the U.S., Brazil, and Argentina supplying 90% of global exports.

Commodity-linked risks continue to shape the market’s overall structure. During the Ukraine–Russia conflict, spillovers between soybean oil, barley, and wheat intensified, with extreme-tail connectedness rising to 91–87%, even though median quantiles stayed below 49%. This shows how geopolitical shocks swiftly influence derivative pricing and supply-chain decisions across interconnected commodities.

Opportunities continue rising across food, nutraceuticals, and renewable energy sectors as manufacturers seek versatile, stable, and affordable raw materials. Soybean lecithin, soy fibers, and industrial-grade derivatives are increasingly relevant to pharma formulations, bakery applications, and biodegradable products. Meanwhile, the global shift toward circular bio-economy solutions further amplifies long-term market potential.

Key Takeaways

- The Global Soybean Derivatives Market is valued at USD 262.2 billion by 2024 and is projected to reach USD 391.9 billion by 2034, at a CAGR of 4.1% from 2025 to 2034.

- Soy Oil leads the Type segment with a 44.2% market share due to its wide industrial and food applications.

- The conventional nature category dominates with a 71.7% share supported by large-scale cultivation.

- Liquid forms such as soy oil and soy milk hold a strong 62.3% share in the Form segment.

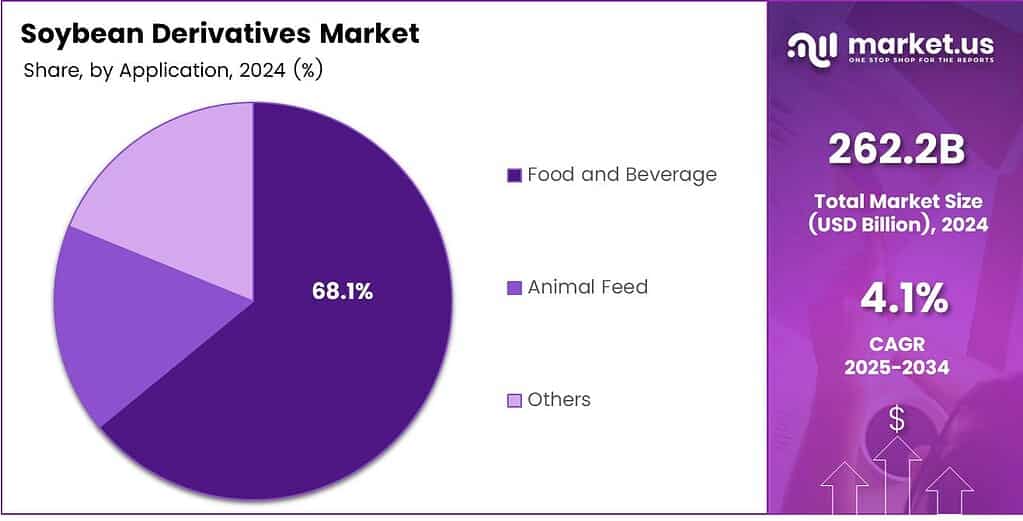

- Food & Beverage is the top application area, accounting for 68.1% of total demand.

- Offline distribution channels maintain dominance with a 59.6% share because of strong retail infrastructure.

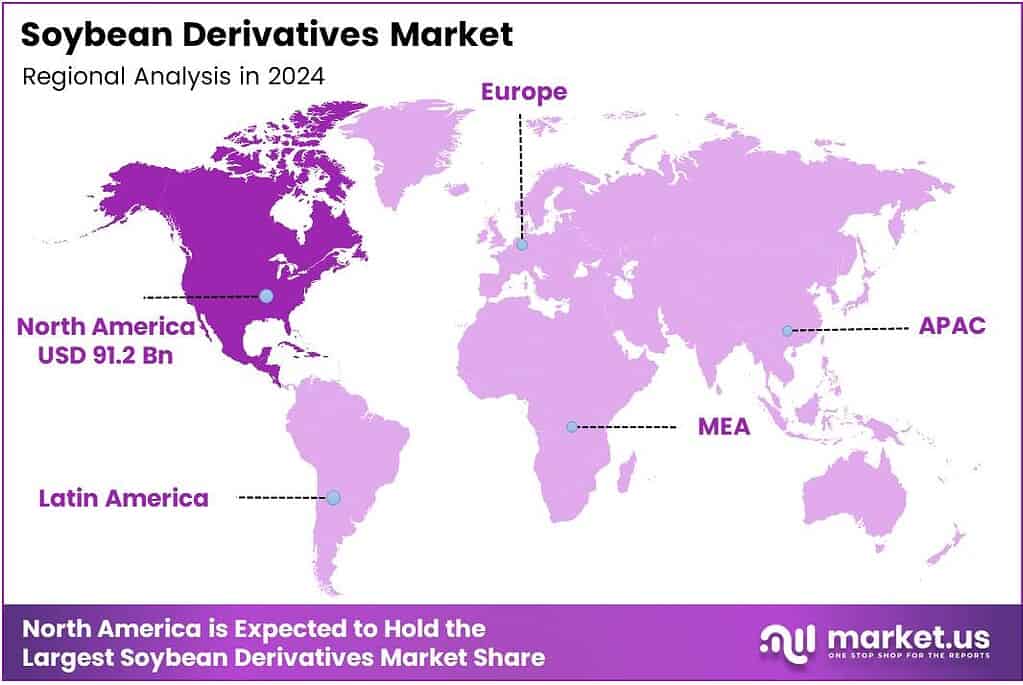

- North America leads regional performance with a 34.8% market share, valued at USD 91.2 billion.

By Type Analysis

Soy Oil dominates with 44.2% because of its versatile use and strong global demand.

In 2025, Soy Oil held a dominant market position in the By Type segment of the Soybean Derivatives Market, with a 44.2% share. Its wide use in cooking oils, processed foods, biodiesel production, and industrial uses continues to drive strong demand. The segment benefits from steady supply chains.

Soy Milk continues growing as consumers shift toward lactose-free and plant-based beverages. Its rising adoption in households and cafés supports consistent market expansion. Increasing vegan lifestyles and health awareness further enhance demand. Manufacturers are also improving texture and flavor, making it a competitive alternative to dairy milk.

Soy Protein remains essential across food, nutrition bars, sports supplements, and meat alternatives. Its functional properties and high protein density make it valuable for manufacturers. Demand increases as consumers seek clean, plant-based protein sources. The segment also gains traction from bakery, beverage, and infant nutrition applications.

The Others category includes soy flour, soy lecithin, and soy-based fibers used across food processing and industrial sectors. These derivatives support emulsification, texturizing, and stabilizing functions in packaged foods. Their broader functional value helps maintain steady usage, particularly in bakery, confectionery, and ready-to-eat meals.

By Nature Analysis

Conventional dominates with 71.7% due to large-scale cultivation and affordable pricing.

In 2025, Conventional held a dominant market position in the By Nature segment of the Soybean Derivatives Market, with a 71.7% share. This segment benefits from wide availability, strong farming networks, and cost-effective production. Its established supply chain supports significant usage across food, feed, and industrial applications.

Organic soybean derivatives continue expanding as consumers increasingly look for chemical-free, sustainable, and clean-label products. Growth is supported by rising awareness about health and environmentally friendly farming methods. Although volumes remain lower compared to conventional, demand increases steadily in premium food, baby nutrition, and personal care sectors.

By Form Analysis

Liquid dominates with 62.3% because of easy handling and wider industrial use.

In 2025, Liquid held a dominant market position in the By Form segment of the Soybean Derivatives Market, with a 62.3% share. Liquids such as soy oil and soy milk are widely used in food processing, beverages, and industrial applications. Their convenience and versatility support continuous demand.

Solid forms, including soy protein powders, soy flour, and textured soy, remain essential for food manufacturing and nutritional products. They offer longer shelf life and easier storage. Demand continues to rise from bakery, snacks, plant-based meats, and supplements. Their functional benefits help maintain stable market growth.

By Application Analysis

Food and beverage dominate with 68.1% due to rising plant-based product consumption.

In 2025, Food and Beverage held a dominant market position in the By Application segment of the Soybean Derivatives Market, with a 68.1% share. Soy-based ingredients are widely used in oils, drinks, snacks, tofu, and meat alternatives. Strong consumer preference for plant proteins supports sustained demand.

Animal Feed remains a crucial application, driven by soybean meal’s strong nutritional profile. Livestock producers rely on soy derivatives for protein-rich feed formulations. As poultry, dairy, and aquaculture industries grow, the segment continues expanding steadily with consistent global utilization.

The Others segment includes cosmetics, pharmaceuticals, and industrial uses such as biodiesel and lubricants. Functional attributes like emulsification and stability help broaden applications. These uses create additional value opportunities and support diverse market adoption across emerging and developed regions.

By Distribution Channel Analysis

Offline dominates with 59.6% because of strong retail presence and bulk purchasing.

In 2025, Offline held a dominant market position in the By Distribution Channel segment of the Soybean Derivatives Market, with a 59.6% share. Supermarkets, specialty stores, and wholesale outlets remain major purchasing points. Consumers prefer physical evaluation and immediate availability, supporting consistent sales.

Online distribution grows rapidly with the expansion of e-commerce platforms, improved delivery networks, and broader product visibility. Digital purchasing appeals to consumers seeking convenience and wider product variety. The segment benefits from rising adoption of subscription models and direct-to-consumer brand strategies.

Key Market Segments

By Type

- Soy Oil

- Soy Milk

- Soy Protein

- Others

By Nature

- Conventional

- Organic

By Form

- Liquid

- Solid

By Application

- Food and Beverage

- Animal Feed

- Others

By Distribution Channel

- Offline

- Online

Emerging Trends

Growing Preference for Sustainable and Clean-Label Ingredients Shapes Market Trends

A major trend influencing the soybean derivatives market is the rising demand for clean-label, natural, and eco-friendly ingredients. Consumers prefer products made from simple and recognizable plant-based sources, and soybean derivatives fit well within this trend. This shift encourages food and cosmetic brands to adopt more soy-based formulations.

- The rapid growth of plant-based meat and dairy alternatives. Soy protein remains a leading ingredient in many of these products because of its ability to replicate texture and nutritional value. USDA FAS production data for 2024/2025 lists China at about 81.97 million metric tons of soybean meal production (around 29% of global production) and the United States at about 53.02 million metric tons (around 19%).

Sustainability initiatives also shape market behaviour. Companies are investing in traceability systems, responsible sourcing programs, and deforestation-free soybean supply chains. These efforts improve brand reputation and attract environmentally conscious consumers, making sustainability a key market trend.

Drivers

Growing Use of Plant-Based Ingredients Boosts Market Expansion

The soybean derivatives market is gaining strong momentum as more industries prefer plant-based ingredients. Food manufacturers increasingly use soybean oil, soy protein, and lecithin because they are affordable, versatile, and healthier alternatives to animal-derived options. This rising shift toward plant-based food boosts the demand for soybean derivatives globally.

- Biofuel makers were expected to use a record 15.5 billion pounds of U.S. soybean oil in the 2025/26 marketing year, which would be more than half of total domestic soyoil production. The U.S. soybean oil exports were projected to drop to 700 million pounds, down sharply from 2.6 billion pounds in the prior comparison, showing how domestic energy demand can crowd out export availability.

Industrial applications also play a major role in driving growth. Soybean derivatives are widely used in biodiesel, cosmetics, pharmaceuticals, and animal feed. Their functional qualities, such as high protein levels and natural emulsifying properties, make them important for product development in these sectors. This broad usage pattern supports long-term market expansion.

Restraints

Price Volatility of Raw Soybeans Limits Market Stability

One of the major restraints affecting the soybean derivatives market is the unstable price of raw soybeans. Prices often fluctuate due to weather changes, seasonal variations, and global supply disruptions. This volatility makes it difficult for manufacturers to plan production costs and maintain consistent pricing in the market.

Another challenge comes from increasing competition from alternative plant-based ingredients such as pea, almond, and sunflower derivatives. Many companies are exploring these substitutes due to allergies associated with soy or preferences for non-GMO options. This shift reduces the growth potential for soy-based ingredients in certain markets.

Environmental concerns also restrict market expansion. Soy cultivation requires large land areas, which sometimes leads to deforestation in key producing regions. This creates regulatory pressure and forces companies to follow stricter sustainability guidelines, increasing production costs and slowing adoption in some industries.

Growth Factors

Rising Adoption of Soy-Based Foods Creates New Market Pathways

The growing global demand for high-protein and plant-based foods creates strong opportunities for soybean derivatives. As consumers shift toward healthier diets, soy protein and soybean oil are increasingly used in snacks, beverages, and dairy alternatives. This trend opens new revenue channels for manufacturers developing innovative soy-based products.

Expanding applications in animal nutrition also offer promising growth prospects. Soybean meal remains one of the most preferred protein sources in livestock and poultry feed. Increasing meat and dairy consumption in developing economies drives continuous demand for high-quality feed ingredients, giving soy derivatives a competitive advantage.

The biofuel sector is another important opportunity. Governments across various regions are promoting biodiesel production to cut carbon emissions. Since soybean oil is a major raw material for biodiesel, its demand is expected to grow significantly. This policy-driven push strengthens long-term market opportunities.

Regional Analysis

North America Dominates the Soybean Derivatives Market with a Market Share of 34.8%, Valued at USD 91.2 Billion

North America stands as the leading region in the global Soybean Derivatives Market, driven by strong processing capacities, high adoption of soy-based food ingredients, and established biodiesel production. The region’s dominance, marked by its 34.8% share and a valuation of USD 91.2 billion, is supported by large-scale soybean cultivation and advanced supply chain infrastructure.

Europe exhibits steady growth, supported by rising interest in plant-based diets and clean-label food ingredients. The region benefits from stringent sustainability regulations that promote the use of bio-based chemicals and renewable feedstock, including soybean derivatives. Increased demand across food, pharmaceuticals, and industrial applications continues to enhance the region’s market position.

Asia Pacific is emerging as a high-growth region, fueled by expanding livestock feed consumption, rising urbanization, and increasing reliance on plant protein. China, India, and Southeast Asia contribute significantly due to large populations and expanding food manufacturing industries. The region also benefits from improved agricultural practices and rising soy-based product awareness.

The Middle East and Africa region is witnessing the gradual adoption of soybean derivatives, supported by growing food processing industries and rising demand for affordable protein alternatives. Despite lower production capacities, imports play a major role in meeting local needs. Expanding livestock feed applications also contribute to market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ag Processing Inc. is likely to keep benefiting in 2025 from steady demand for soybean meal, refined oils, and ingredient-grade derivatives used by feed, food, and industrial buyers. From an analyst lens, its co-op roots and U.S. crush footprint can support reliable supply programs, especially when customers prioritize continuity, traceability, and contract stability over spot-market buying.

AOS Products Pvt. Ltd. sits closer to the specialty end of soybean derivatives, where buyers often look for functional performance—such as emulsification, nutrition enhancement, or formulation support—rather than bulk commodity volume. In 2025, the key opportunity is moving up the value chain with differentiated specs and customer-aligned packaging, while managing raw material price swings and export-market compliance.

Archer Daniels Midland Co. remains a core bellwether for global soybean derivatives because it spans origination, crushing, refining, and ingredient solutions across multiple regions. In 2025, ADM’s scale can help it serve both high-volume industrial users and higher-margin food applications, but it will still be judged on execution: logistics efficiency, margin discipline, and the ability to pivot product mix when spreads tighten.

Arpadis Group is positioned more as a global distributor/trader, which matters in 2025 as buyers seek flexible sourcing across origins and a faster response to regional shortages. The company’s advantage is market connectivity—linking producers to end users—but it must keep sharpening risk management, quality consistency, and documentation to remain a preferred partner for regulated food and ingredient supply chains.

Top Key Players in the Market

- Ag Processing Inc.

- AOS Products Pvt. Ltd.

- Archer Daniels Midland Co.

- Arpadis Group

- BASF SE

- Bunge Global SA

- Cargill Inc.

- CHS Inc.

- Crown Soya Protein Group

- Gujarat Ambuja Exports Ltd.

Recent Developments

- In 2025, Ag Processing Inc (AGP), a major U.S. soybean processing cooperative, has focused on expanding its processing capacity in recent years. AGP’s 11th soybean processing location began commercial operations by the end of August 2025 and is expected to enhance soybean crushing capabilities for derivatives like meal and oil.

- In 2025, AOS Products Pvt. Ltd., an Indian manufacturer specializing in essential oils and carrier oils, continues to produce and market soybean oil as part of its portfolio, with certifications like BP/USP/EP/IP for pharmaceutical and food applications.

Report Scope

Report Features Description Market Value (2024) USD 262.2 Billion Forecast Revenue (2034) USD 391.9 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Soy Oil, Soy Milk, Soy Protein, Others), By Nature (Conventional, Organic), By Form (Liquid, Solid), By Application (Food and Beverage, Animal Feed, Others), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ag Processing Inc., AOS Products Pvt. Ltd., Archer Daniels Midland Co., Arpadis Group, BASF SE, Bunge Global SA, Cargill Inc., CHS Inc., Crown Soya Protein Group, Gujarat Ambuja Exports Ltd. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Soybean Derivatives MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Soybean Derivatives MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Ag Processing Inc.

- AOS Products Pvt. Ltd.

- Archer Daniels Midland Co.

- Arpadis Group

- BASF SE

- Bunge Global SA

- Cargill Inc.

- CHS Inc.

- Crown Soya Protein Group

- Gujarat Ambuja Exports Ltd.